Global Automotive Parts Manufacturing Market Forecast

- The Automotive Parts Manufacturing Market is valued at USD 567.8 Bn in 2026 and is projected to reach USD 783.1 Bn, growing at a CAGR of 5% by 2033

Automotive Parts Manufacturing Market Insights

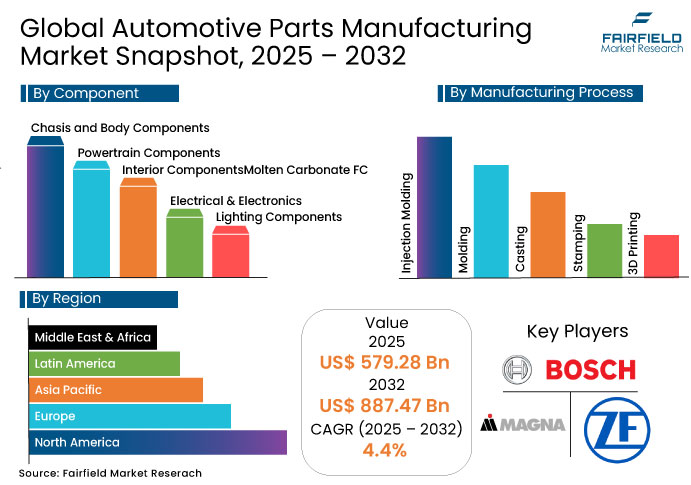

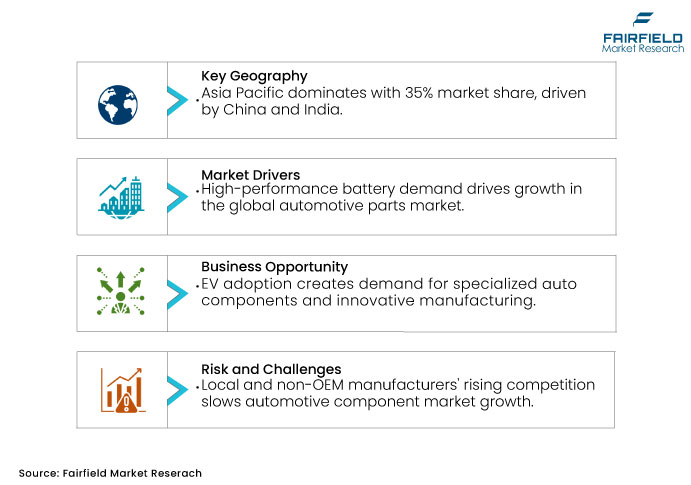

- Increasing demand for high-performance batteries boosts the global automotive parts manufacturing market demand.

- Rising competition from local and non-OEM manufacturers is hindering automotive component market growth.

- The shift towards EVs presents opportunities for component manufacturers to develop specialized parts.

- Technological innovation and affordability are driving growth in the automotive aftermarket.

- Powertrain components dominate the market due to their critical role in vehicle efficiency and performance, especially with increasing focus on fuel economy and electrification.

- Injection molding is increasingly used for interior parts, providing design flexibility and lightweight solutions.

- Passenger vehicles lead the market with around 55% market share, driven by high-volume production and innovations in comfort, safety, and performance.

- Asia Pacific leads globally, with more than 35% market share, due to high vehicle production in countries such as China, India, and Japan, and growing demand for commercial vehicles.

- Europe focuses heavily on premium vehicles, sustainability, and EV production, fostering high-tech and eco-friendly parts manufacturing.

- North America remains a major market, boosted by technological innovation and strong automotive aftermarket demand.

A Look Back and a Look Forward- Comparative Analysis

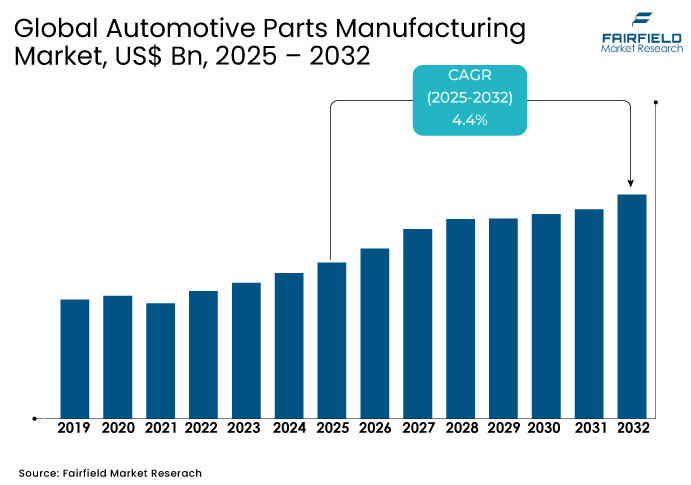

From 2019 to 2024, the global automotive parts manufacturing market experienced a slow growth of 0.8% CAGR, driven by rising vehicle production, aftermarket expansion, and evolving consumer preferences. Despite disruptions from the COVID-19 pandemic, including supply chain bottlenecks and labor shortages, the market quickly rebounded with increased investments in EV components, lightweight materials, and advanced manufacturing technologies. Manufacturers prioritized supply chain resilience and product diversification to adapt to changing industry demands.

Looking ahead, from 2025 to 2032, the market will continue to expand steadily with 4.4% CAGR, supported by the global shift toward electrification, autonomous technologies, and sustainability initiatives. Governments worldwide are introducing stricter emission regulations and offering incentives for EV and hybrid vehicle production, encouraging innovation in powertrains, thermal management, and electronic systems. Companies are investing heavily in smart manufacturing, digitalization, and remanufacturing solutions to enhance efficiency and environmental compliance. As vehicle lifespans extend, demand for durable, high-performance components will drive sustained market growth.

Key Growth Determinants

Expansion of product lines and electrified components fuels automotive parts market growth

The continuous expansion of product lines is driving the growth of the automotive parts manufacturing market by enhancing the availability of components across various vehicle segments. On January 16, 2024, ZF Aftermarket introduced 770 new parts for passenger cars in North America, covering an additional 158.2 million vehicles in operation. This expansion strengthens aftermarket support for internal combustion, hybrid, electric, and semi-automated vehicles, providing cost-effective solutions for vehicle owners. The introduction of TRW brake components, SACHS Ride Control CDC shocks, and LEMFÖRDER window regulators further reinforces the increasing demand for the components in critical vehicle systems.

Automakers and aftermarket companies are expanding their remanufactured product offerings, creating a more comprehensive remanufacturing ecosystem. By including advanced electronic components, drivetrain elements, and braking systems, they are achieving cost savings, enhancing supply chain resilience, and promoting environmental sustainability. As the demand for affordable, high-quality replacement parts grows, remanufacturing continues to gain momentum, benefiting manufacturers, vehicle owners, and the aftermarket industry.

Key Growth Barriers

Stringent Labor Regulations and Compliance Challenges Restraining Market Growth

The automotive parts manufacturing market faces growing constraints due to stringent labor regulations and increasing enforcement of labor rights. On the December 22, 2023, resolution of the USMCA Rapid Response Labor Mechanism (RRM) case at Tecnología Modificada, a Caterpillar subsidiary, underscores the evolving regulatory landscape. The case involved reinstating dismissed workers and addressing employer interference in union activities, highlighting the mounting pressure on companies to comply with strict labor laws.

The complexity of cross-border trade regulations under agreements like the USMCA can influence global trade dynamics in the manufacturing market. Stricter enforcement mechanisms may lead to export restrictions, supplier realignments, and market access challenges, particularly for companies dependent on international labor forces. As regulatory bodies continue to scrutinize labor practices, manufacturers must allocate resources toward workforce training, compliance monitoring, and policy adjustments, adding to overall business costs. The need for enhanced labor rights protections, while essential for ethical business practices, creates barriers to entry and operational complexities that may hinder the growth of the automotive parts manufacturing industry in certain regions.

Automotive Parts Manufacturing Market Trends and Opportunities

Regional Shifts in Manufacturing and Supply Chains

The global automotive parts manufacturing industry is undergoing significant regional shifts in its manufacturing and supply chain strategies. These changes are primarily driven by geopolitical factors, trade policies, and the need for supply chain resilience amid global disruptions.

Governments worldwide are implementing trade policies and tariffs that are reshaping the global automotive supply chain. For instance, the United States’ 25% tariff on imported vehicles from Canada and Mexico has compelled automakers to reconsider their production locations. These tariffs could increase vehicle costs by up to US$7,000 for imports and US$3,000 for domestically manufactured vehicles, prompting companies to shift operations to the U.S. to mitigate financial impacts.

Furthermore, Japanese automotive companies, with substantial investments in Mexico's auto industry, face uncertainties due to proposed U.S. tariffs. These tariffs threaten the viability of their US$18 billion investments in Mexico, leading companies like Nissan, Mazda, and Honda to reevaluate their manufacturing strategies, including potential shifts in production locations.

To counteract these challenges, automotive companies are embracing localization and regionalization strategies. The United States-Mexico-Canada Agreement (USMCA) has encouraged automakers to source more components locally and establish regional manufacturing hubs.

The Shift Towards EVs Presents Opportunities for Component Manufacturers to Develop Specialized Parts

The global shift toward EVs presents significant opportunities for automotive component manufacturers to develop specialized parts that cater to the evolving demands of the industry. As automakers transition to electrification, suppliers are increasingly innovating to provide advanced solutions in areas such as power electronics, energy efficiency, and sustainable mobility.

FORVIA HELLA’s recent announcement regarding the full availability of its revolutionary SlimLine Series on January 13, 2025. This cutting-edge vehicle lighting technology is designed to meet the demands of modern EV lighting, offering enhanced functionality, durability, and sleek aesthetics. As EVs require more efficient and lightweight lighting solutions to optimize energy consumption, innovations like the SlimLine Series play a crucial role in improving vehicle efficiency and driving experience.

Leading Segment Overview

Chassis and Body Parts Leads the Market due to its Structural Advances

Chassis and Body parts are leading the automotive parts manufacturing market, with around 28% market share, due to the increasing demand for lightweight materials and modular vehicle platforms. Chassis and body components form the structural backbone of a vehicle, playing a critical role in safety, durability, and overall vehicle performance. Manufacturers such as Gestamp and Magna International are investing in hot stamping and advanced forming techniques to produce high-strength, lightweight components that improve fuel efficiency and crash safety.

Furthermore, regulatory bodies in Europe and North America are enforcing stricter safety and emission standards, encouraging OEMs to innovate in chassis and body design. The integration of smart sensors and adaptive structures is also expanding, particularly in vehicles equipped with ADAS. The shift toward EVs further fuels this segment, as EVs require redesigned platforms with reinforced structures to support battery systems, prompting manufacturers to diversify their product offerings across combustion, hybrid, and electric vehicle models.

Casting Innovations Powering the Future of Automotive Components

Casting is a fundamental manufacturing process in the automotive industry, widely used for producing complex components such as engine blocks, gearbox housings, and suspension parts. It offers cost-efficiency and high-volume production capabilities, making it a preferred method for both traditional and electric vehicle components.

The shift towards aluminum and magnesium alloys is driving advancements in lightweight casting technologies, aligning with global emission reduction goals. Companies like Nemak and Ryobi have expanded their operations to include high-pressure die casting and vacuum-assisted techniques that enhance precision and reduce porosity.

Governments are supporting cleaner production practices through environmental regulations, prompting foundries to adopt sand reclamation systems and low-emission furnaces. In the EV segment, casting is increasingly used for battery enclosures and structural components, reflecting the method’s adaptability. As OEMs seek more efficient production methods, innovations in casting continue to support cost-effective scalability and design flexibility in automotive component manufacturing.

Passenger Vehicles Leading Demand in Automotive Parts Manufacturing Market

Passenger vehicles represent the largest share of the global automotive parts manufacturing market, driven by rising urbanization, disposable income, and evolving consumer preferences. It includes sedans, SUVs, hatchbacks, and crossovers, all of which require a wide range of high-performance components. OEMs such as Toyota, Hyundai, and Volkswagen are increasing investments in modular vehicle architectures that streamline component compatibility across multiple models.

Government initiatives promoting EV adoption such as subsidies, tax incentives, and stricter fuel efficiency standards are accelerating innovation in thermal management, electronic control units, and battery components. Furthermore, consumer demand for enhanced safety and connectivity features is boosting the integration of sensors, infotainment systems, and ADAS components. These trends collectively position passenger vehicles as a key driver of volume, innovation, and revenue in the automotive component manufacturing industry.

Regional Analysis

- Technological Growth and Policy Support Drive North America's Automotive Parts Manufacturing Market

North America remains a crucial market for automotive components manufacturing, driven by technological innovation, strong aftermarket growth, and supportive government policies. Major companies like ZF Aftermarket and BorgWarner are expanding their portfolios to meet rising demand for hybrid and electric vehicle parts. The U.S. government’s Inflation Reduction Act encourages domestic production of critical automotive components, including EV batteries and electronic systems, strengthening supply chain resilience.

Furthermore, the USMCA agreement enforces stricter rules of origin, prompting manufacturers to invest in local sourcing and assembly operations. Investments in advanced manufacturing technologies, such as additive manufacturing and AI-driven production processes, are reshaping the region’s competitiveness. Demand for lightweight, energy-efficient components continues to grow, driven by regulatory pressures to improve fuel economy and reduce emissions. With strong R&D capabilities and a maturing EV market, North America remains a strategic hub for innovation, particularly in powertrain, electronic, and chassis systems development.

- Green Innovation and Premium Technologies Propel Europe’s Automotive Market

Europe leads the automotive parts manufacturing market through its focus on sustainability, electrification, and premium vehicle production. Leading suppliers such as Bosch, Valeo, and Continental are investing heavily in electric drive technologies, lightweight structures, and smart mobility solutions.

The European Union’s "Fit for 55" package and stricter CO₂ emission standards are pushing manufacturers toward greener production methods and expanded recycling initiatives. Significant growth in the EV segment, particularly in Germany, France, and Scandinavia, is boosting demand for advanced battery management systems, electric drive units, and chassis components optimized for electric vehicles.

Furthermore, initiatives like the European Battery Alliance aim to localize battery production and secure the supply chain for future vehicle technologies. Investments in circular economy practices and green manufacturing are reshaping the European market, positioning it at the forefront of global automotive innovation. Europe’s strong regulatory environment and emphasis on premium quality continue to drive market transformation.

- Asia Pacific Dominates with Scalable Production and Emerging Technology in Auto Parts Market

Asia Pacific dominates the global automotive parts manufacturing market, fueled by rapid industrialization, expanding vehicle ownership, and strong government support. China, India, Japan, and South Korea are major contributors, with companies like Denso, Aisin Seiki, and Hyundai Mobis aggressively expanding production capacities and product innovation.

China's NEV (New Energy Vehicle) policy and India’s Production Linked Incentive (PLI) scheme for auto components are strengthening the region’s focus on electric and hybrid vehicle parts. Manufacturers are increasingly investing in lightweight materials, smart electronics, and energy-efficient components to meet evolving consumer preferences and regulatory demands.

Furthermore, the strong growth of passenger and commercial vehicles in emerging markets is creating robust demand for both OEM and aftermarket components. Asia Pacific’s cost-effective manufacturing capabilities, along with advancements in automation and supply chain management, continue to attract global investments. The region’s dynamic market environment positions it as a manufacturing powerhouse for both traditional and next-generation automotive parts.

Competitive Landscape

The Automotive Parts Manufacturing market is characterized by significant involvement from both global automotive manufacturer giants and specialized technology providers. Companies are investing heavily to innovate new customized technologies to improve the vehicle efficiency. The manufacturers are also expanding their reach with acquisitions and partnering with the other players. This development is in response to geopolitical supply chain disruptions. The market is observing a shift towards geographical expansion with technological advancements.

- On September 9, 2024, DENSO CORPORATION announced that it will build a new plant by expanding the site of the Zenmyo Plant in Nishio City, Aichi Prefecture. Construction will start in the first half of FY2025 and will be completed in January 2027, with production slated to start in the first half of FY2028.

- On Jan 30, 2025, Global automotive supplier Magna International Inc. has launched a manufacturing facility in Chakan, Maharashtra, India focused on producing latches and mirrors for car manufacturers in western India.

- On July 31, 2024, AISIN Corporation and the BMW Group have agreed on a strategic partnership. The aim of this partnership is a cooperation in the field of build-to-print e-axle production by AISIN based on a BMW Group design.

Key Market Companies

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Magna International Inc.

- Denso Corporation

- Hyundai Mobis

- Aisin Corporation

- Continental AG

- Valeo

- ACDelco

- Aptiv PLC

- Tenneco Inc.

- Toyota Boshoku Corp.

- BorgWarner Inc.

- Forvia (Hella)

- Akebono Brake Industry Co. Ltd.

Global Automotive Parts Manufacturing Market Segmentation -

By Component

- Powertrain Components

- Chasis and Body Components

- Interior Components

- Electrical & Electronics

- Lighting Components

By Manufacturing Process

- Forging

- Casting

- Injection Molding

- Stamping

- 3D Printing

- Other

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

- Executive Summary

- Global Automotive Parts Manufacturing Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Automotive Parts Manufacturing Market Outlook, 2020 - 2033

- Global Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Powertrain Components

- Chasis and Body Components

- Interior Components

- Electrical & Electronics

- Lighting Components

- Global Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, Value (US$ Mn), 2020-2033

- Forging

- Casting

- Injection Molding

- 3D Printing

- Stamping

- Other

- Global Automotive Parts Manufacturing Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

- Global Automotive Parts Manufacturing Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- North America Automotive Parts Manufacturing Market Outlook, 2020 - 2033

- North America Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Powertrain Components

- Chasis and Body Components

- Interior Components

- Electrical & Electronics

- Lighting Components

- North America Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, Value (US$ Mn), 2020-2033

- Forging

- Casting

- Injection Molding

- 3D Printing

- Stamping

- Other

- North America Automotive Parts Manufacturing Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

- North America Automotive Parts Manufacturing Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- S. Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- S. Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Canada Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Canada Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Canada Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Europe Automotive Parts Manufacturing Market Outlook, 2020 - 2033

- Europe Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Powertrain Components

- Chasis and Body Components

- Interior Components

- Electrical & Electronics

- Lighting Components

- Europe Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, Value (US$ Mn), 2020-2033

- Forging

- Casting

- Injection Molding

- 3D Printing

- Stamping

- Other

- Europe Automotive Parts Manufacturing Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

- Europe Automotive Parts Manufacturing Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Germany Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Germany Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Italy Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Italy Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Italy Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- France Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- France Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- France Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- K. Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- K. Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- K. Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Spain Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Spain Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Spain Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Russia Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Russia Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Russia Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Rest of Europe Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Rest of Europe Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Asia Pacific Automotive Parts Manufacturing Market Outlook, 2020 - 2033

- Asia Pacific Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Powertrain Components

- Chasis and Body Components

- Interior Components

- Electrical & Electronics

- Lighting Components

- Asia Pacific Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, Value (US$ Mn), 2020-2033

- Forging

- Casting

- Injection Molding

- 3D Printing

- Stamping

- Other

- Asia Pacific Automotive Parts Manufacturing Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

- Asia Pacific Automotive Parts Manufacturing Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- China Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- China Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Japan Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Japan Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Japan Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- South Korea Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- South Korea Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- South Korea Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- India Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- India Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- India Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Southeast Asia Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Southeast Asia Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Rest of SAO Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Rest of SAO Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Latin America Automotive Parts Manufacturing Market Outlook, 2020 - 2033

- Latin America Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Powertrain Components

- Chasis and Body Components

- Interior Components

- Electrical & Electronics

- Lighting Components

- Latin America Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, Value (US$ Mn), 2020-2033

- Forging

- Casting

- Injection Molding

- 3D Printing

- Stamping

- Other

- Latin America Automotive Parts Manufacturing Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

- Latin America Automotive Parts Manufacturing Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Brazil Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Brazil Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Mexico Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Mexico Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Mexico Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Argentina Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Argentina Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Argentina Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Rest of LATAM Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Rest of LATAM Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Middle East & Africa Automotive Parts Manufacturing Market Outlook, 2020 - 2033

- Middle East & Africa Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Powertrain Components

- Chasis and Body Components

- Interior Components

- Electrical & Electronics

- Lighting Components

- Middle East & Africa Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, Value (US$ Mn), 2020-2033

- Forging

- Casting

- Injection Molding

- 3D Printing

- Stamping

- Other

- Middle East & Africa Automotive Parts Manufacturing Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

- Middle East & Africa Automotive Parts Manufacturing Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- GCC Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- GCC Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- South Africa Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- South Africa Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- South Africa Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Egypt Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Egypt Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Egypt Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Nigeria Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Nigeria Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Nigeria Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East Automotive Parts Manufacturing Market Outlook, by Component, 2020-2033

- Rest of Middle East Automotive Parts Manufacturing Market Outlook, by Manufacturing Process, 2020-2033

- Rest of Middle East Automotive Parts Manufacturing Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Automotive Parts Manufacturing Market Outlook, by Component, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Robert Bosch GmbH

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- ZF Friedrichshafen AG

- Magna International Inc.

- Denso Corporation

- Hyundai Mobis

- Aisin Corporation

- Continental AG

- Valeo

- ACDelco

- Aptiv PLC

- Robert Bosch GmbH

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Manufacturing Process Coverage |

|

|

Vehicle Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |