Global Automotive Remanufactured Parts Market Forecast

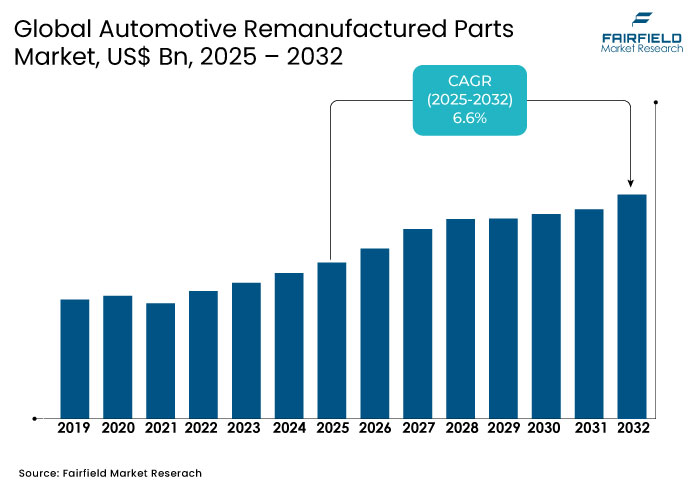

- The Automotive Remanufactured Parts Market is valued at USD 70.3 Bn in 2026 and is projected to reach USD 110.7 Bn, growing at a CAGR of 7% by 2033

Automotive Remanufactured Parts Market Insights

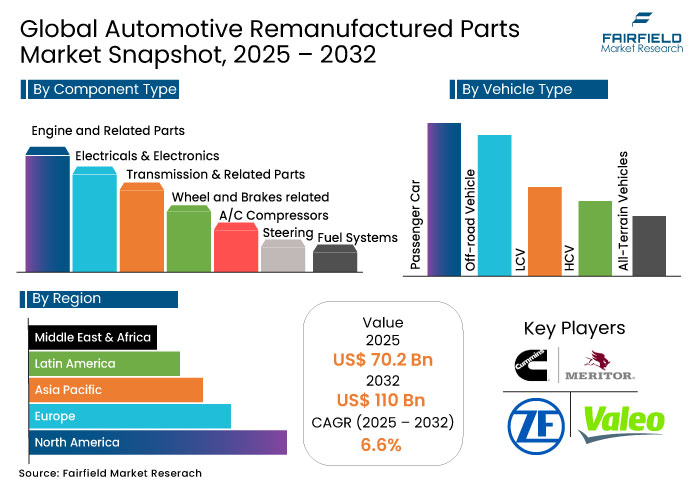

- The expected CAGR of 6.4% for 2025–2032 reflects a rising demand for cost-effective, sustainable aftermarket solutions.

- Electrification trends are boosting the adoption of remanufactured EV parts, including powertrains, batteries, and electronic drive systems.

- Companies such as ZF and Stellantis are launching EV-specific remanufactured solutions and expanding ADAS remain portfolios.

- Electronic components such as ECUs and ADAS systems are becoming central to new remanufacturing strategies.

- Misconceptions about remanufactured parts’ quality and reliability still hinder broader consumer adoption.

- EV battery remanufacturing is emerging as a high-value segment, attracting OEMs, investors, and startups.

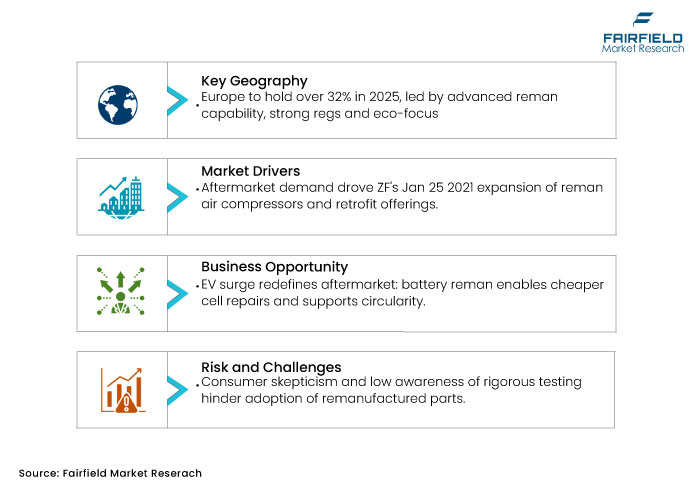

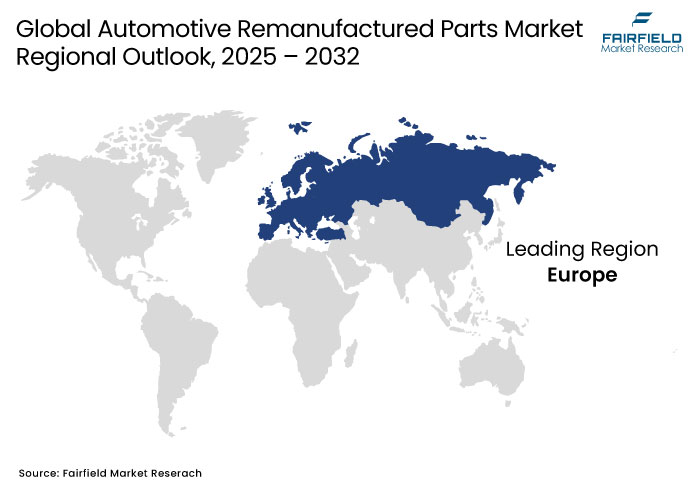

- Europe holds the largest market share due to mature infrastructure, regulation, and environmental awareness.

- Passenger cars account for 7% of demand, driven by their large, aging global fleet base.

- Engine-related parts lead the component segment with 34.6% value share due to high cost and demand.

A Look Back and a Look Forward - Comparative Analysis

The global automotive remanufactured parts market has steadily progressed from a cost-centric aftermarket alternative to a critical enabler of sustainable vehicle lifecycle management. Between 2019 and 2024, the market experienced moderate growth at a CAGR of 1.5%, driven by increasing demand for affordable, resource-efficient maintenance solutions. Industry leaders such as ZF and Stellantis expanded their remanufacturing capabilities across internal combustion engine (ICE), hybrid, and semi-autonomous vehicle platforms, strengthening the market’s foundation. However, widespread adoption was hindered by persistent consumer skepticism regarding quality and durability, compounded by limited awareness and a lack of standardized industry advocacy.

Looking ahead, the market is poised for accelerated growth, with projections indicating a rise to US$ 107.6 billion by 2032, registering a robust CAGR of 6.4% from 2025 onward. This momentum will be fueled by the electrification of global vehicle fleets, a stronger emphasis on sustainability, and increased integration of circular economy principles. The remanufacturing of EV-specific components—such as battery packs, e-axles, and power electronics-presents significant growth potential. Strategic investments, including Poen’s EV battery remanufacturing initiatives and Stellantis’ ADAS component reuse programs, highlight the sector’s evolution. With Europe and North America leading through advanced infrastructure and regulatory alignment, the industry is transitioning toward a more innovative, resilient, and environmentally sustainable remanufacturing ecosystem.

Key Growth Determinants

- Expanding Remanufactured Solutions Driving Automotive Remanufactured Parts Market Growth

The demand for cost-effective and sustainable aftermarket solutions is driving growth in the automotive parts remanufacturing market. On January 25, 2021, ZF expanded its remanufactured air compressor and collision mitigation retrofit portfolios for commercial vehicles, strengthening its commitment to fleet owners. By increasing the availability of remanufactured air compressors, ZF is addressing the need for lower-cost maintenance solutions that extend vehicle lifespan and reduce downtime. This expansion aligns with the industry’s push toward sustainability, reducing material waste and lowering emissions. Electrification is further fueling the adoption of remanufactured components, especially for electric and hybrid vehicles.

On August 8, 2024, ZF Aftermarket introduced Electric Axle Drive Repair Kits in the U.S. and Canada, covering 25 different repair tasks for electric axle drives. These kits allow independent workshops to service EVs without removing the electric drive, reducing labor time and complexity. As EV adoption accelerates, such solutions are crucial for minimizing repair costs and ensuring the long-term reliability of electric powertrains. ZF’s introduction of 45 new aftermarket products demonstrates the growing focus on remanufactured solutions for both the ICE and EV segments.

The integration of remanufactured components into both traditional and electric vehicle maintenance is positioning remanufacturing as a key enabler of cost-efficient and sustainable fleet management. As leading companies like ZF invest in expanding remanufactured product offerings, the market is expected to witness increased innovation in product development and servicing capabilities. The availability of specialized repair solutions for EVs and hybrids, coupled with remanufactured components for internal combustion engine (ICE) vehicles, underscores the broadening scope of remanufacturing in the global automotive industry. This trend will continue to shape the market, providing economic and environmental benefits while enhancing long-term vehicle operability.

Key Growth Barriers

- Inadequate Charging Infrastructure Challenges Automotive Remanufactured Parts Market

Despite advancements in technology and quality assurance, many consumers and businesses still perceive remanufactured parts as inferior to new components. This negative perception stems from outdated notions about reliability, durability, and performance. While remanufacturing restores components to meet or exceed OEM specifications, skepticism among customers remains. This hesitation poses a significant barrier to market expansion.

One of the key reasons for this perception issue is the lack of awareness and education among end-users. Many vehicle owners are unfamiliar with the rigorous testing and quality control processes that remanufactured parts undergo. independent mechanics and repair shops hesitate to recommend remanufactured components, fearing customer complaints or warranty concerns. Without proper industry-wide advocacy, misinformation continues to impact consumer confidence.

OEMs and aftermarket suppliers must actively invest in branding and awareness campaigns to highlight the benefits of remanufacturing. By showcasing real-world case studies, customer testimonials, and performance comparisons, companies can build trust in the market. Highlighting cost savings, sustainability benefits, and performance guarantees will help shift consumer perception in favor of remanufactured products. Offering warranties comparable to new components can further reassure customers and boost adoption rates.

Collaboration with automotive service providers, fleet operators, and insurance companies can also drive acceptance of remanufactured parts. When these industry stakeholders endorse remanufactured components, end-users are more likely to perceive them as high-quality alternatives. Without addressing this perception issue, the remanufacturing market will continue to face resistance, limiting its growth potential despite the evident benefits of cost-effectiveness and sustainability.

Automotive Remanufactured Parts Market Trends and Opportunities

- EV Parts Remanufacturing Presents a Lucrative Opportunity for OEMs and Strategic Investors

The rapid expansion of electric vehicles (EVs) is fundamentally altering the dynamics of the global automotive market and, with it, unlocking a major opportunity in EV parts remanufacturing. As over 70% of EV components differ from those in traditional internal combustion engine (ICE) vehicles, the aftermarket landscape is being redefined. In particular, the high cost and complexity of EV batteries make remanufacturing a commercially and strategically critical segment for automakers, investors, and sustainability-focused enterprises.

Battery degradation driven by both calendar and usage-based (cyclical) aging has long posed challenges to EV lifespan and resale value. However, advancements in diagnostic and predictive technologies now enable precision repair at the cell and module level. This allows restoration of battery performance at a fraction of the cost of replacement while significantly reducing waste. For OEMs, integrating remanufacturing capabilities offers a strategic path to lower warranty liabilities, enhance brand equity, and support circular business models.

The market’s momentum is further validated by recent developments. In July 2024, Korean startup Poen raised USD 28 million in Series B funding to scale its proprietary EV battery remanufacturing technology. Beyond automotive, remanufactured EV components are gaining traction in energy storage, industrial machinery, and aerospace positioning, this segment as a high-margin, scalable, and future-proof growth engine for both established players and new entrants.

Segments Covered in the Report

- Engine and Related Parts Take the Lead in the Global Market

Based on the component types, the market is segmented as Engine and Related Parts, Electricals & Electronics, Transmission & Related Parts, Wheel and Brakes related, A/C Compressors, Steering, Fuel Systems, and Others (pumps, injectors, etc). According to a recent analysis, the Engine and Related Parts segment is set to dominate the global Automotive Remanufactured Parts (EV) market in 2025, capturing 34.6% value share in 2025.

Engine-related parts such as turbochargers, engines, and carburetors dominate the automotive remanufacturing market due to their high replacement costs and critical role in vehicle performance. Remanufactured engine components offer a cost-effective solution, providing durability and efficiency comparable to new parts at significantly lower prices. As vehicle customization trends grow, demand for crate engines and remanufactured components continues to rise. These engines undergo comprehensive disassembly, inspection, and precision machining, with critical parts like pistons, cylinder heads, and camshafts either reconditioned or replaced to meet OEM standards. This process ensures high performance, extended service life, and sustainability, making remanufactured engines an attractive choice for both consumers and commercial operators.

- Passenger Electric Vehicles Lead the Vehicle Type Segment

Based on vehicle types, the market is segmented as Off-road vehicles, LCV, HCV, Passenger cars, and All-Terrain Vehicles. The Passenger Car vehicle type is set to dominate the global Automotive Remanufactured Parts (EV) market in 2025, capturing 42.7% value share in 2025.

Passenger cars dominate the global remanufactured parts market primarily due to their large and aging vehicle population, which creates a consistent and recurring demand for cost-effective replacement components. According to the European Automobile Manufacturers Association (ACEA), global passenger car sales reached approximately 75.9 million units in 2023, with Asia accounting for more than half of these sales. This substantial vehicle base, particularly in cost-sensitive regions, fuels the demand for remanufactured parts as a reliable and economical alternative to new components. Remanufactured parts offer similar performance at a significantly lower price, making them an attractive solution for passenger car owners focused on affordable maintenance and long-term vehicle use.

Regional Analysis

- Europe to Maintain Strong Market Share of 32.0% in the Global Automotive Remanufactured Parts Market by 2025

Europe will continue to lead the global Automotive Remanufactured Parts (EV) market, holding 32.0% of the total market share in 2025. This dominance is driven by its advanced remanufacturing infrastructure, strong regulatory frameworks, and heightened environmental consciousness. Countries like Germany and the UK are at the forefront, with Germany exhibiting particularly strong remanufacturing capabilities. The region demonstrates a high penetration rate of remanufactured parts, significantly surpassing that of emerging markets such as India and China. This is primarily due to greater customer awareness of the environmental and cost-saving benefits of remanufactured components, as well as a more favorable price differential compared to new parts.

In Europe, commonly remanufactured components include starters, turbochargers, transmissions, compressors, ECUs, and other electronic parts used in internal combustion engine (ICE) vehicles. With the ongoing shift toward electrification, the region is also seeing increased remanufacturing of EV-specific parts such as batteries, e-motors, inverters, e-compressors, and DC-DC converters. Supporting this market dominance, Europe produced around 12.2 million passenger cars in 2023, accounting for approximately 16% of global car production, according to ACEA. This substantial vehicle base creates a strong aftermarket demand for remanufactured parts, positioning Europe as a global hub for sustainable automotive component reuse.

- North America ranks second in the Demand for Automotive Remanufactured parts

North America remains the second-largest Automotive Remanufactured Parts market globally, with a 24.8% value market share in the Global Market.

The North American automotive remanufacturing market is bolstered by a mature aftermarket infrastructure, a large and aging vehicle population, and robust technical capabilities. The United States remains a frontrunner, driven by well-developed core collection networks and active support from organizations such as the Automotive Parts Remanufacturers Association (APRA) and leading industry players like Cardone and BBB Industries. High-demand remanufactured components include engine control modules (ECMs), starters, and alternators, many of which are produced under ISO-certified quality standards. Some of the key remanufacturers operating in the U.S. include Caterpillar, BorgWarner Inc., Meritor Inc. (a Cummins Inc. company), ATC Drivetrain, and BBB Industries.

Canada’s market growth is underpinned by increasing environmental consciousness and efficient cross-border trade with the U.S. Electrification is emerging as a key growth driver, with rising demand for remanufactured hybrid vehicle components. Remarkably, in August 2023, BBB Industries expanded its footprint by launching a new remanufacturing facility in Mexico dedicated to brake calipers and steering gears.

Competitive Landscape

The global Automotive Remanufactured Parts Market is characterized by a highly fragmented competitive landscape, with the top players collectively holding an estimated 20–25% share. This fragmentation is primarily due to the presence of a large number of independent and regional remanufacturers operating across various vehicle and component categories. Despite this, leading players are strengthening their positions through strategic collaborations and partnerships.

A notable trend is the rise in contracted remanufacturing agreements between Tier 1 suppliers and OEMs, as well as between independent remanufacturers and OEMs. These partnerships have become increasingly critical due to the growing complexity and digitalization of vehicle components, which requires OEM support for software integration and legacy part access. Independent remanufacturers, particularly in the commercial vehicle segment, are leveraging such collaborations to mitigate risks associated with the rapid pace of technological advancements in passenger cars.

Key market players set themselves apart by adopting rigorous quality control and advanced testing processes to ensure remanufactured parts meet or exceed OEM standards. Offering warranties equivalent to or longer than those of new parts further enhances consumer trust. Companies with broad product portfolios across multiple vehicle types and component categories, such as engines, transmissions, and brake systems, are better positioned to gain market share.

The automotive remanufacturing market is evolving with a strong focus on sustainability and electrification. Key players such as TERREPOWER, ZF, and Stellantis are expanding into EVs, while others pursue battery reuse, acquisitions, and OEM collaborations, driving circular economy goals, lower emissions, and enhanced digital integration across the global value chain.

Key Companies

- Caterpillar Inc.

- AB Volvo

- ZF Friedrichshafen AG

- VEGE Group

- Remy Power Products, LLC

- ATSCO Remanufacturing Inc.

- Andre Niermann

- Marshall Engines

- Detroit Diesel Corporation

- Jasper Engines and Transmissions

- Motorcar Parts of America, Inc.

- Teamec BVBA

- American Axle & Manufacturing

- Cooper Tire & Rubber Company

- Maval Manufacturing Inc.

- Genuine Parts Company

- AER Manufacturing, LP.

- Borg Automotive AS

- Standard Motor Products Inc.

- Other Market Players

Recent Industry Developments

- On February 4, 2025, BBB Industries rebranded to TERREPOWER, signalling a strategic shift from traditional remanufacturing to sustainable solutions across EVs, renewables, and industrial sectors, leveraging circular economy practices.

- In July 2024, Korean startup Poen raised $28 million in Series B funding to scale its EV battery remanufacturing tech, partnering with Hyundai, Kia, LG Energy Solution, SK ON, and CATL to commercialize eco-friendly battery reuse.

- On September 10, 2024, ZF Aftermarket launched the ZF REMAN label and CorExpedia digital tool at Automechanika Frankfurt to boost visibility of remanufactured parts and improve reverse logistics in support of sustainability goals.

- On August 8, 2024, ZF introduced Electric Axle Drive Repair Kits in the U.S. and Canada, simplifying EV and hybrid repairs for 25 different tasks and enabling workshops to service vehicles without removing electric drives.

- On August 20, 2024, BBB Industries acquired All Star Auto Parts to expand its remanufactured offerings, especially in collision replacement parts like lights and wheels, and strengthen its U.S. electronics remanufacturing capabilities.

- On January 21, 2024, ZF Aftermarket partnered with HDA Truck Pride to distribute WABCO parts to the commercial aftermarket, increasing access to remanufactured components like air compressors, ABS, and trailer systems.

- In April 2023, Rivian announced a $10 million investment to open a remanufacturing facility in Shepherdsville, Kentucky, creating 218 jobs and reinforcing the state’s growing EV and manufacturing sectors.

- On December 14, 2023, ZEISS partnered with BORG Automotive to co-develop advanced visual and automation technologies for remanufacturing, aiming to improve quality, service life, and efficiency across reman processes.

Expert Opinion

- Remanufactured parts reduce emissions and waste, aligning with global circular economy goals and fleet sustainability strategies.

- Electric vehicle adoption boosts the need for remanufactured powertrains, batteries, and electronics, creating new aftermarket opportunities.

- Industry leaders are expanding reman portfolios across ICE and EV platforms to lower costs and improve vehicle uptime.

- ZF’s Electric Axle Drive Repair Kits empower independent workshops to service EVs with greater speed and precision.

- Remanufactured engines and related parts lead the market due to high replacement costs and critical performance needs.

- Misconceptions about reman quality persist, requiring awareness campaigns, warranties, and endorsements from trusted industry players.

- Advanced electronics such as ADAS cameras are now being remanufactured, signaling deeper integration of tech in circular models.

- With mature infrastructure and green policies, Europe dominates globally in both ICE and EV parts remanufacturing.

- The U.S. boasts advanced collection systems, OEM support, and growing demand for reman hybrid and EV components.

- Capital flow into EV reman startups like Poen signals high-growth potential and strategic relevance in future mobility.

Global Automotive Remanufactured Parts Market is Segmented as-

By Component Type

- Engine and Related Parts

- Turbochargers

- Engine

- Carburetors & Others

- Electricals & Electronics

- Starters

- Alternators

- Others

- Transmission & Related Parts

- Gearbox

- Clutches

- Other Transmission Components

- Wheel and Brakes related

- Hub Assemblies

- Master Cylinders

- Brake Calipers

- Bearings

- A/C Compressors

- Steering

- Fuel Systems

- Others (pumps, injectors, etc.)

By Vehicle Type

- Off-road Vehicle

- LCV

- HCV

- Passenger Car

- All-Terrain Vehicles

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

- Executive Summary

- Global Automotive Remanufactured Parts Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Automotive Remanufactured Parts Market Outlook, 2020 - 2033

- Global Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Engine and Related Parts

- Turbochargers

- Engine

- Carburetors & Others

- Electricals & Electronics

- Starters

- Alternators

- Others

- Transmission & Related Parts

- Gearbox

- Clutches

- Other Transmission Components

- Wheel and Brakes related

- Hub Assemblies

- Master Cylinders

- Brake Calipers

- Bearings

- A/C Compressors

- Steering

- Fuel Systems

- Others (pumps, injectors, etc.)

- Engine and Related Parts

- Global Automotive Remanufactured Parts Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Off-road Vehicle

- LCV

- HCV

- Passenger Car

- All-Terrain Vehicles

- Global Automotive Remanufactured Parts Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- North America Automotive Remanufactured Parts Market Outlook, 2020 - 2033

- North America Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Engine and Related Parts

- Turbochargers

- Engine

- Carburetors & Others

- Electricals & Electronics

- Starters

- Alternators

- Others

- Transmission & Related Parts

- Gearbox

- Clutches

- Other Transmission Components

- Wheel and Brakes related

- Hub Assemblies

- Master Cylinders

- Brake Calipers

- Bearings

- A/C Compressors

- Steering

- Fuel Systems

- Others (pumps, injectors, etc.)

- Engine and Related Parts

- North America Automotive Remanufactured Parts Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Off-road Vehicle

- LCV

- HCV

- Passenger Car

- All-Terrain Vehicles

- North America Automotive Remanufactured Parts Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- S. Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Canada Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Canada Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Europe Automotive Remanufactured Parts Market Outlook, 2020 - 2033

- Europe Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Engine and Related Parts

- Turbochargers

- Engine

- Carburetors & Others

- Electricals & Electronics

- Starters

- Alternators

- Others

- Transmission & Related Parts

- Gearbox

- Clutches

- Other Transmission Components

- Wheel and Brakes related

- Hub Assemblies

- Master Cylinders

- Brake Calipers

- Bearings

- A/C Compressors

- Steering

- Fuel Systems

- Others (pumps, injectors, etc.)

- Engine and Related Parts

- Europe Automotive Remanufactured Parts Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Off-road Vehicle

- LCV

- HCV

- Passenger Car

- All-Terrain Vehicles

- Europe Automotive Remanufactured Parts Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Germany Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Italy Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Italy Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- France Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- France Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- K. Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- K. Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Spain Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Spain Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Russia Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Russia Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Rest of Europe Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Asia Pacific Automotive Remanufactured Parts Market Outlook, 2020 - 2033

- Asia Pacific Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Engine and Related Parts

- Turbochargers

- Engine

- Carburetors & Others

- Electricals & Electronics

- Starters

- Alternators

- Others

- Transmission & Related Parts

- Gearbox

- Clutches

- Other Transmission Components

- Wheel and Brakes related

- Hub Assemblies

- Master Cylinders

- Brake Calipers

- Bearings

- A/C Compressors

- Steering

- Fuel Systems

- Others (pumps, injectors, etc.)

- Engine and Related Parts

- Asia Pacific Automotive Remanufactured Parts Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Off-road Vehicle

- LCV

- HCV

- Passenger Car

- All-Terrain Vehicles

- Asia Pacific Automotive Remanufactured Parts Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- China Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Japan Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Japan Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- South Korea Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- South Korea Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- India Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- India Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Southeast Asia Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Rest of SAO Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Latin America Automotive Remanufactured Parts Market Outlook, 2020 - 2033

- Latin America Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Engine and Related Parts

- Turbochargers

- Engine

- Carburetors & Others

- Electricals & Electronics

- Starters

- Alternators

- Others

- Transmission & Related Parts

- Gearbox

- Clutches

- Other Transmission Components

- Wheel and Brakes related

- Hub Assemblies

- Master Cylinders

- Brake Calipers

- Bearings

- A/C Compressors

- Steering

- Fuel Systems

- Others (pumps, injectors, etc.)

- Engine and Related Parts

- Latin America Automotive Remanufactured Parts Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Off-road Vehicle

- LCV

- HCV

- Passenger Car

- All-Terrain Vehicles

- Latin America Automotive Remanufactured Parts Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Brazil Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Mexico Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Mexico Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Argentina Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Argentina Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Rest of LATAM Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Automotive Remanufactured Parts Market Outlook, 2020 - 2033

- Middle East & Africa Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Engine and Related Parts

- Turbochargers

- Engine

- Carburetors & Others

- Electricals & Electronics

- Starters

- Alternators

- Others

- Transmission & Related Parts

- Gearbox

- Clutches

- Other Transmission Components

- Wheel and Brakes related

- Hub Assemblies

- Master Cylinders

- Brake Calipers

- Bearings

- A/C Compressors

- Steering

- Fuel Systems

- Others (pumps, injectors, etc.)

- Engine and Related Parts

- Middle East & Africa Automotive Remanufactured Parts Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Off-road Vehicle

- LCV

- HCV

- Passenger Car

- All-Terrain Vehicles

- Middle East & Africa Automotive Remanufactured Parts Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- GCC Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- South Africa Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- South Africa Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Egypt Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Egypt Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Nigeria Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Nigeria Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East Automotive Remanufactured Parts Market Outlook, by Component Type, 2020-2033

- Rest of Middle East Automotive Remanufactured Parts Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Automotive Remanufactured Parts Market Outlook, by Component Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Caterpillar Inc.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- AB Volvo

- ZF Friedrichshafen AG

- VEGE Group

- Remy Power Products, LLC

- ATSCO Remanufacturing Inc.

- Andre Niermann

- Marshall Engines

- Detroit Diesel Corporation

- Jasper Engines and Transmissions

- Caterpillar Inc.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Type Coverage |

|

|

Vehicle Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |