Global Agritech Market Forecast

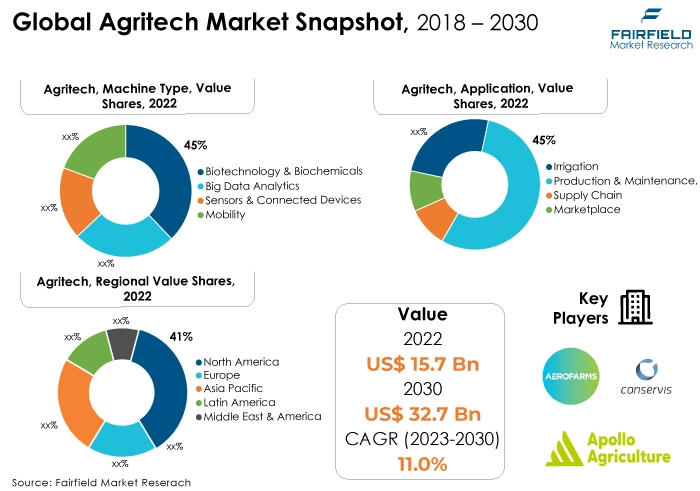

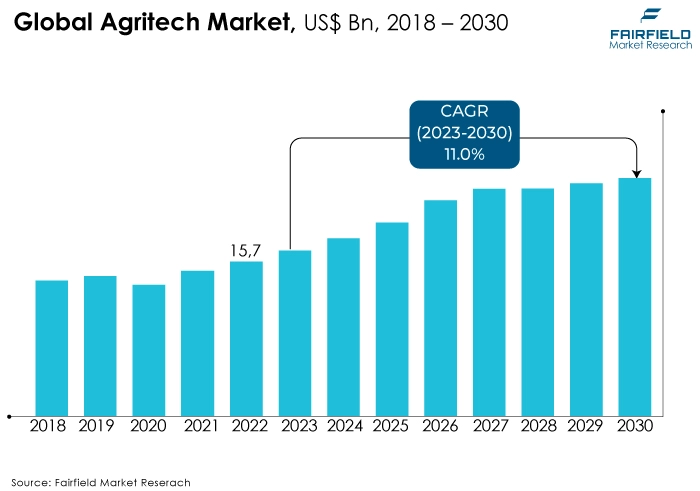

- Agritech market revenue likely to reach US$32.7 Bn by 2030, up from US$15.7 Bn recored in 2023

- Agritech market size likely to expand at a CAGR of 11% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the agritech market growth is global investments in agriculture technology solutions, which have been rising with the increased demand for agricultural products brought on by population growth. Numerous services are offered to farmers by agritech platforms, such as soil analysis, weather forecasting, crop monitoring, precision farming, and farm management tools.

- Another major market trend expected to fuel the agritech market growth is farmers' implementation of modern technologies to boost crop yields, reduce resource waste, and enhance agricultural practices. For example, drones and GPS-guided tractors make accurate planting and harvesting possible and have a lower input cost and environmental impact.

- In 2022, the biotechnology & biochemicals category dominated the industry. Genetically modified crops and innovative biochemical treatments are examples of biotechnology and biochemical advancements revolutionising agriculture.

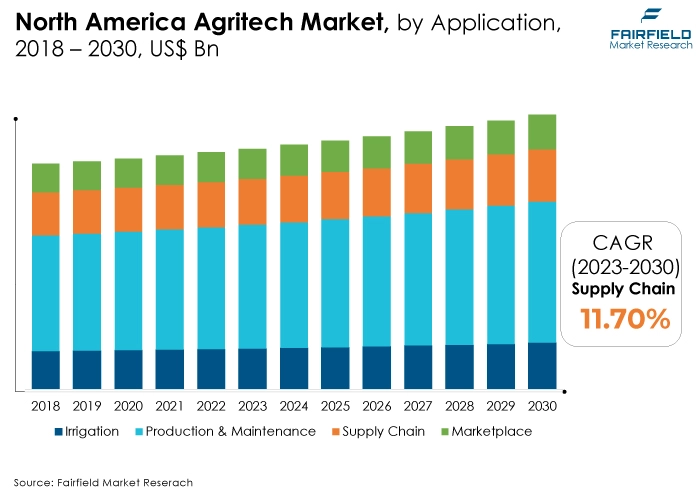

- In terms of market share for agritech globally, the production & maintenance segment is anticipated to dominate. Irrigation systems are crucial for optimising water use, ensuring efficient crop hydration, and reducing water waste, especially in nations with limited water resources. These technologies are essential for sustainable agriculture as climate patterns shift.

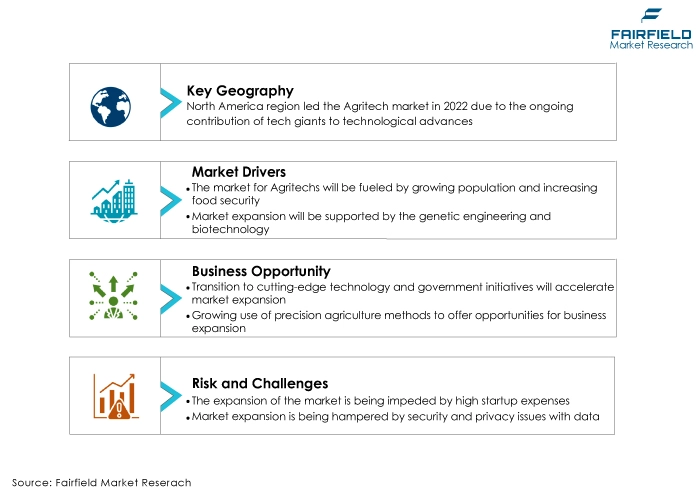

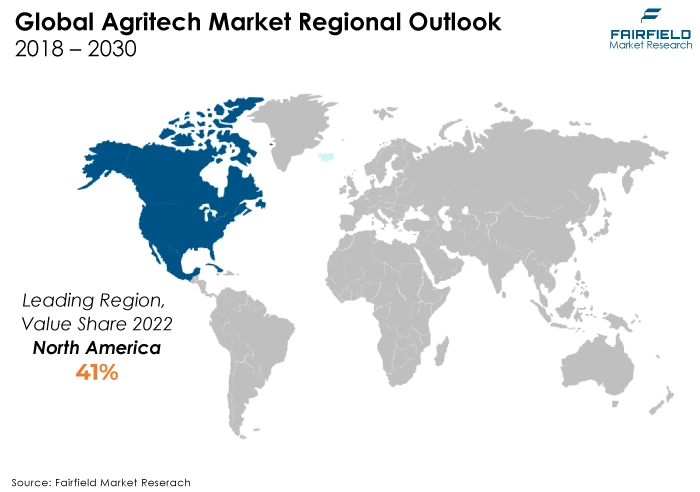

- The North American region is anticipated to account for the largest share of the global agritech market, owing to the ongoing contribution of tech giants to technological advances and the growing tendency of market competitors to engage in mergers and acquisitions.

- The market for agritech is expanding in Asia Pacific due to the potential for investments in agricultural technologies by nations like China, and India. The region's market is expanding due to these countries' growing use of agritech solutions such as smart irrigation management, precision farming, and others.

A Look Back and a Look Forward - Comprative Analysis

The market for agritech has grown in popularity due to factors such as the world's rise in investments in agricultural technology solutions due to the growing demand for agricultural products brought on by population growth. Crop monitoring, precision farming, soil analysis, weather forecasting, and farm management tools are just a few services agritech platforms offer farmers.

The market witnessed staggered growth during the historical period 2018 – 2022. The widespread use of smartphones and high internet penetration rates in rural regions have enabled farmers to monitor field conditions and apply cutting-edge scientific methods to increase agricultural productivity. Farmers can gain much from agritech platforms, including higher yields, better crop quality, lower expenses, and more profitability.

Additionally, the use of agritech platforms helps farmers maximise their yield, cut down on waste, and lessen the environmental impact of farming practices. According to market research, the global agritech market is anticipated to grow significantly over the next several years due to rising food prices, increased productivity, and the adoption of precision farming techniques. The market is also anticipated to grow as more farmers adopt technological solutions to enhance their farming practices.

Key Growth Determinants

- Exploding Global Population, and Rising Food Security Concerns

Two major drivers propelling the agritech market are population growth and food security. This demographic development is putting enormous pressure on the global food supply network. Providing for the nutritional needs of this growing population is one of the most significant issues that agritech aims to address.

Ensuring individuals have access to sufficient, wholesome food is a top priority. The increasing demand for food may be more than traditional farming techniques can supply. Agritech enters the picture by offering innovative ways to boost agricultural output while minimising the damaging consequences of farming on the environment.

Agritech employs cutting-edge technologies, including biotechnology, data analytics, and precision agriculture, to feed the world's population. Farmers may increase crop yields, reduce waste, and improve how they manage resources like water, land, and fertilizer by using these technologies. They also support supply chain management and oversight to guarantee efficient food delivery to customers.

- Genetic Engineering, and Biotechnology

Genetic engineering and biotechnology are major forces behind the agritech industry. The primary objective of this driver is to enhance agricultural productivity and adaptation by utilising biological approaches and procedures. Genetic engineering is an excellent method for producing genetically modified organisms (GMOs) with improved traits beneficial for agriculture.

Genetically modified crops are engineered to possess beneficial characteristics such as resilience to pests, diseases, or herbicides and increased tolerance to extreme weather conditions like drought or high heat. These genetic changes have the potential to significantly boost agricultural yields, reduce the need for chemical inputs, and improve agriculture's overall sustainability.

- Rise in the Demand for Food Worldwide

Over the next few decades, as the world's population continues to climb, food requirements will likely significantly increase. This is a fantastic opportunity for agritech to step in and bridge the gap between the increasing demand for food and agricultural productivity. Agritech solutions that incorporate techniques like precision agriculture, biotechnology, and data-driven farming, assist farmers in raising crop yields, allocating resources more effectively, and decreasing waste.

Agritech solutions can ensure that farming operations are sustainable and kind to the environment, all while meeting the increasing demand for food products. Diversifying and increasing the amount of protein in meals is one way that changing dietary habits might lead to new opportunities for agritech innovation.

Major Growth Barriers

- High Start-up Expenses

The high upfront expenditures of implementing agritech solutions considerably impede the agriculture industry's efforts to modernise and become more sustainable. While agritech developments could lead to long-term advantages like increased productivity and resource efficiency, many farmers-particularly small-scale operators with limited resources-face financial difficulties when adopting new technologies.

Investments in agritech frequently involve a wide variety of expenses, including purchasing specialised machinery, IoT sensors, data analytics software, and equipment for precision farming. Expenses for educating agricultural laborers on properly using these technologies are also covered. These upfront costs may be unaffordable for smaller farms with limited financial resources, such as credit or money.

- Security and Privacy Issues with Data

One of the main causes of issues with data privacy is ownership and control of data related to agriculture. Farmers can worry that data produced by their operations-such as crop yields, soil conditions, and resource utilisation-could be utilised or shared without their consent, costing them a competitive advantage or violating their privacy. Data security is another important issue.

The digitisation of agriculture has made farms more vulnerable to cyberattacks and data breaches. Unauthorised access to agricultural data may compromise intellectual property, disrupt farming processes, and damage the food distribution chain. Regarding the genetic composition of crops and livestock, the appropriate use of agricultural data presents more general ethical questions.

Key Trends and Opportunities to Look at

- Transition to Cutting-edge Technology, and Supportive Government Initiatives

Traditional approaches have given way to cutting-edge technical technologies in the agriculture industry. This change is anticipated to accelerate the agritech platform market's expansion. Continuous advancements in digital technologies and data and partnerships between farmers and academics in the public and commercial sectors are the driving forces behind modern agriculture.

Farmers can monitor crop growth and manage crop irrigation systems through advanced technology, which improves yields and maximises resource efficiency. Crop irrigation system control and monitoring have benefited greatly from mobile technology. Thanks to smartphones and tablets, farmers can now remotely monitor the weather, soil moisture content, and crops.

- Precision Agriculture

Precision farming is a cutting-edge agricultural method that monitors and manages crops using technologies like GPS, sensors, and drones. Farmers may minimise waste, maximise resource utilisation, and make data-driven decisions with this method. Because precision farming techniques can increase crop yields, lower expenses, and boost profitability, farmers worldwide are adopting them.

Agritech platforms play a major role in precision farming by collecting and analysing crop, soil, and weather data. These technologies give farmers access to real-time data, empowering them to decide on crucial tasks like fertilisation and irrigation with knowledge. The need for agritech platforms is driven by the increasing use of precision farming methods, and the industry is anticipated to expand rapidly.

- Smart Farming, and IoT

Real-time data collection, monitoring, and control of agricultural activities are made possible by connecting various farm equipment, sensors, and devices to the Internet. In agriculture, this is referred to as IoT. The agricultural technology industry has many benefits and opportunities due to this revolutionary technology.

IoT improves data-driven decision-making. Precise information about the soil's temperature, moisture level, and nutrient content can be obtained from field-based sensors. Real-time data can optimise and remotely manage connected irrigation systems and tractors.

How Does the Regulatory Scenario Shape this Industry?

Agritech regulations have a complicated and dynamic regulatory environment. While some governments are more cautious, others encourage agritech innovation. Large volumes of data are frequently gathered from farms using agritech solutions. Although this data may have value, it is crucial to ensure that it is shielded from unwanted access. GMO use in agriculture is a contentious topic. While some nations have more lax rules regarding GMOs, others have more stringent laws.

The environment and human health may suffer as a result of the use of pesticides and herbicides. Certain pesticides and herbicides are prohibited or subject to use restrictions in some countries. The agritech regulatory environment is gradually improving despite these obstacles. Many nations are seeing how agritech can enhance sustainability and food security. They are trying to create rules to safeguard the environment and public health while encouraging innovation.

Fairfield’s Ranking Board

Top Segments

- Prominence of Biotechnology and Biochemical Category Prevails

The biotechnology and biochemical segment dominated the market in 2022. Biotechnology and biochemical advancements are revolutionising agriculture by introducing genetically modified crops and innovative biochemical therapies. By enhancing crop resistance, productivity, and nutritional value, these advances address concerns related to global food security.

Furthermore, the big data analytics category is projected to experience the fastest market growth. Another important field is big data and analytics, which offer data-driven insights for precision agriculture. Through data collection, analysis, and predictive modeling, farmers may enhance supply chain operations, crop management, and resource use, ultimately increasing productivity and sustainability.

- Production and Maintenance Remain the Key Areas

In 2022, the production and maintenance category dominated the industry. Irrigation systems are crucial for optimising water use, ensuring efficient crop hydration, and reducing water waste, especially in nations with limited water resources. These technologies are essential for sustainable agriculture as climate patterns shift.

Production and maintenance are two key areas where farming methods must be improved. Various technological advancements, including precision agricultural instruments, biotechnology applications, and automated machinery, fall under this category.

The supply chain category is anticipated to grow substantially throughout the projected period. They enable efficient tracking and management of agricultural products from farm to table. This department ensures that food is provided to clients in a timely, fresh, and minimally wasted manner.

Regional Frontrunners

North America Continues to Present the Most Favourable Environment for Market Expansion

Tech hubs, and agritech incubators that foster innovation and attract talent and funding to the sector, are especially prominent in Silicon Valley, and the Midwest. Large-scale commercial farming operations were among the first to deploy agritech in the region. These companies combine precision agriculture technologies, big data analytics, and sophisticated machinery to increase crop output, reduce expenses, and improve sustainability.

Because of North America's commitment to biotechnology research and development, significant progress is being achieved. The development and application of genetically modified crops that have improved traits like insect resistance, and drought tolerance have increased crop yields and resilience.

Asia Pacific Benefits from Rapid Penetration of Precision Farming

Due to massive contribution of tech giants to technical breakthroughs, and the growing trend of M&A among market competitors, Asia Pacific is one of the leading areas in the agritech platform market. The region's farmers are gearing up in terms of adopting precision farming, and farm management systems, which is further stimulating the market's expansion.

The ongoing customer focus on diversified and novel products stimulates the demand for new product launches. However, supply chains are under pressure from Mainland China's Zero-COVID-19 regulations in the near run. In China, and other Asian markets, the medium- to long-term projection is still optimistic.

Fairfield’s Competitive Landscape Analysis

The global agritech market is a consolidated market with fewer major players present across the globe. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Agritech Space?

- ARSR Tech

- AeroFarms

- Apollo Agriculture

- Crofarm Agriproducts Pvt Ltd.

- Conservis

- Indigo AG Inc.

- LettUs Grow Ltd.

- Pivot Bio

- AgBiome Inc

- Ceres Imaging

Significant Company Developments

Partnerships, Agreements, and Expansions

- March 2023: Mahindra buys all of AgriTech M.I.T.R.A.'s shares. As per the arrangement, Omnivore's stake in the startup MITRA-backed by that business-was acquired by M&M. MITRA plans to expand its network and scale its product portfolio in India and other foreign countries.

- In 2020: In Abu Dhabi, UAE, AeroFarms plans to construct the largest indoor vertical farm in the world, spanning 90,000 square feet. To construct facilities in Abu Dhabi, the Abu Dhabi Investment Office (ADIO) invested $100 million in AeroFarms.

- In 2020, AgBiome announced the issuance of a new patent in the US about the Connate product line, enhancing the company's intellectual property protection for innovative product offerings.

An Expert’s Eye

Demand and Future Growth

Fairfield’s Analysis shows that a growing use of digital technologies is driving the market. Growing population and increasing food security, genetic engineering and biotechnology, and a rise in the demand for food worldwide, increasing the need for agritech.

Furthermore, the transition to cutting-edge technology and government initiatives, growing use of precision agriculture methods, smart farming, and the Internet of Things. However, high start-up expenses, and security and privacy issues with data hinder market expansion.

Supply Side of the Market

According to our analysis, The urgent need to address the issues brought on by a growing world population, shifting climatic patterns, and resource limits lies at the core of these dynamics. The increasing use of digital technology is propelling the agritech market. Farmers use artificial intelligence, IoT devices, and data analytics to optimise operations. Precision agriculture, which increases yields and decreases waste by accurately allocating resources, is made feasible by these technologies.

Environmental sustainability is another key factor influencing the dynamics of the agritech business. Scientific advancements in organic farming, water management, and renewable energy technologies have been spurred by a growing emphasis on ecologically sustainable farming techniques. The need for climate change adaptation and food security has spurred research and development in biotechnology.

High-yielding, disease-tolerant, and drought-resistant plant varieties are being developed through new breeding techniques and genetically engineered crops. Thanks to start-ups and venture capital backing, entrepreneurs are developing creative solutions for large-scale and smallholder farmers. This financial inflow is driving the market's rapid expansion. Regulatory and policy frameworks are crucial in helping governments balance innovation, safety, and sustainability. Tariffs and trade agreements can significantly impact the dynamics of the global agritech business.

Global Agritech Market is Segmented as Below:

By Type:

- Biotechnology & Biochemicals

- Big Data Analytics

- Sensors & Connected Devices

- Mobility

By Application:

- Irrigation

- Production & Maintenance

- Supply Chain

- Marketplace

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Agritech Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Agritech Market Outlook, 2018 - 2030

3.1. Global Agritech Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Biotechnology & Biochemicals

3.1.1.2. Big Data Analytics

3.1.1.3. Sensors & Connected Devices

3.1.1.4. Mobility

3.2. Global Agritech Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Irrigation

3.2.1.2. Production & Maintenance

3.2.1.3. Supply Chain

3.2.1.4. Marketplace

3.3. Global Agritech Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Agritech Market Outlook, 2018 - 2030

4.1. North America Agritech Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Biotechnology & Biochemicals

4.1.1.2. Big Data Analytics

4.1.1.3. Sensors & Connected Devices

4.1.1.4. Mobility

4.2. North America Agritech Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Irrigation

4.2.1.2. Production & Maintenance

4.2.1.3. Supply Chain

4.2.1.4. Marketplace

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Agritech Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Agritech Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Agritech Market Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Agritech Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Agritech Market Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Agritech Market Outlook, 2018 - 2030

5.1. Europe Agritech Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Biotechnology & Biochemicals

5.1.1.2. Big Data Analytics

5.1.1.3. Sensors & Connected Devices

5.1.1.4. Mobility

5.2. Europe Agritech Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Irrigation

5.2.1.2. Production & Maintenance

5.2.1.3. Supply Chain

5.2.1.4. Marketplace

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Agritech Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Agritech Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Agritech Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Agritech Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Agritech Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Agritech Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Agritech Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Agritech Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Agritech Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Agritech Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Agritech Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Agritech Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Agritech Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Agritech Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Agritech Market Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Agritech Market Outlook, 2018 - 2030

6.1. Asia Pacific Agritech Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Biotechnology & Biochemicals

6.1.1.2. Big Data Analytics

6.1.1.3. Sensors & Connected Devices

6.1.1.4. Mobility

6.2. Asia Pacific Agritech Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Irrigation

6.2.1.2. Production & Maintenance

6.2.1.3. Supply Chain

6.2.1.4. Marketplace

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Agritech Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Agritech Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Agritech Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Agritech Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Agritech Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Agritech Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Agritech Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Agritech Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Agritech Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Agritech Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Agritech Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Agritech Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Agritech Market Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Agritech Market Outlook, 2018 - 2030

7.1. Latin America Agritech Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Biotechnology & Biochemicals

7.1.1.2. Big Data Analytics

7.1.1.3. Sensors & Connected Devices

7.1.1.4. Mobility

7.2. Latin America Agritech Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Irrigation

7.2.1.2. Production & Maintenance

7.2.1.3. Supply Chain

7.2.1.4. Marketplace

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Agritech Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Agritech Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Agritech Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Agritech Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Agritech Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Agritech Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Agritech Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Agritech Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Agritech Market Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Agritech Market Outlook, 2018 - 2030

8.1. Middle East & Africa Agritech Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Biotechnology & Biochemicals

8.1.1.2. Big Data Analytics

8.1.1.3. Sensors & Connected Devices

8.1.1.4. Mobility

8.2. Middle East & Africa Agritech Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Irrigation

8.2.1.2. Production & Maintenance

8.2.1.3. Supply Chain

8.2.1.4. Marketplace

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Agritech Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Agritech Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Agritech Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Agritech Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Agritech Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Agritech Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Agritech Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Agritech Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Agritech Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Agritech Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Agritech Market Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. ARSR Tech

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. AeroFarms

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Apollo Agriculture

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Crofarm Agriproducts Pvt Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Conservis

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Indigo AG Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. LettUs Grow Ltd.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Pivot Bio

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. AgBiome Inc

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Ceres imaging

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |