Global Tantalum Capacitors Market Forecast

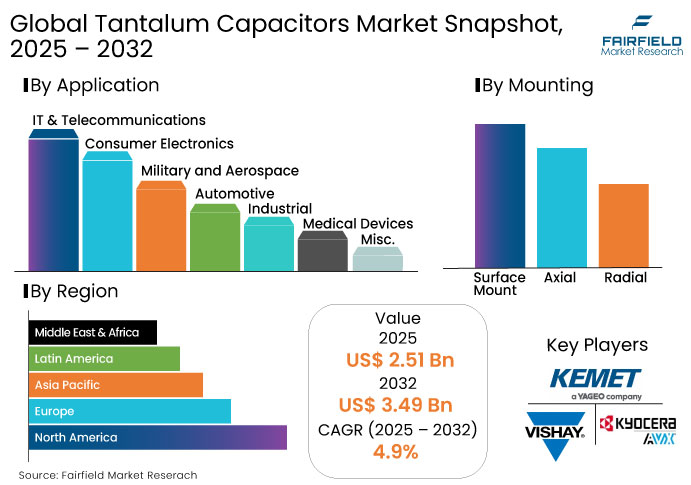

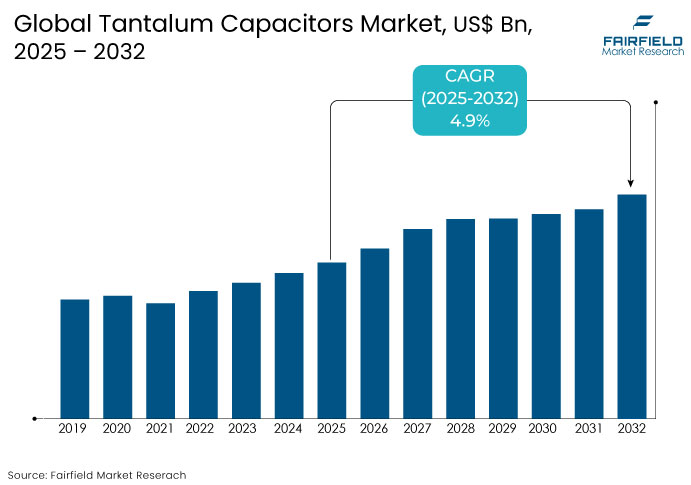

- The global tantalum capacitors market is expected to reach a market size of US$ 3.49 Bn by 2032, up from an estimated market size of US$ 2.51 Bn in 2025, resembling strong growth with 4.9% CAGR during this period.

- The tantalum capacitor market is anticipated to benefit from strong demand due to the growing need for high-performance, compact, and reliable components.

Tantalum Capacitors Market Insights

- The rise of compact, high-performance devices in consumer and industrial electronics has driven demand for capacitors with superior charge retention and volumetric efficiency.

- Automotive electronics, including advanced driver-assistance systems (ADAS) and infotainment, are increasingly using tantalum capacitors for their reliability and high-performance characteristics.

- Solid tantalum capacitors dominate the market due to their superior stability, better performance at high temperatures, and lower leakage current.

- Medical devices like hearing aids, pacemakers, and imaging equipment, where stability and reliability are paramount, are driving market growth in this sector.

- With the expansion of 5G networks, the demand for high-performance capacitors is expected to rise significantly in telecommunications equipment.

- The growing emphasis on energy-efficient electronic products, including low-power devices, is fostering the demand for tantalum capacitors, which provide stable performance with low leakage.

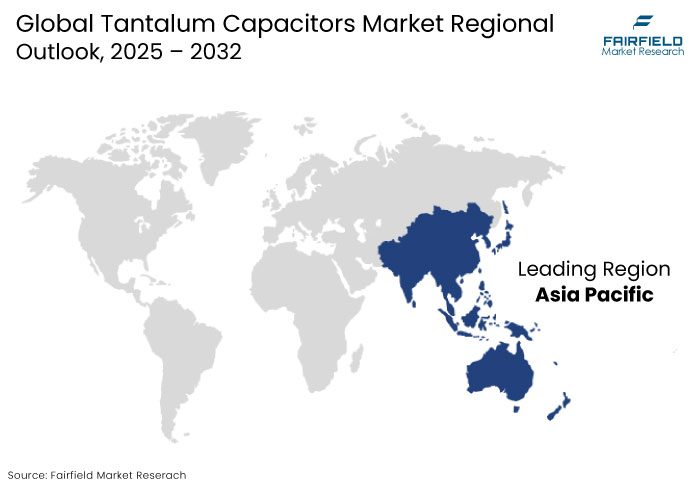

- Asia-Pacific plays a vital role in the manufacturing and export of tantalum capacitors. The region’s strong electronics manufacturing base, along with a growing automotive market, fuels demand.

- The rise of Industry 4.0, automation, and robotics has increased the need for reliable and efficient capacitors in industrial electronics

A Look Back and a Look Forward - Comparative Analysis

The historical growth of the tantalum capacitors market has been primarily driven by the increasing demand for electronic devices, especially in the consumer electronics sector. The rise of mobile devices, automotive electronics, and medical equipment has played a crucial role in the market's expansion. The growth of the Internet of Things (IoT) and the integration of advanced technologies into various sectors, along with the adoption of more sophisticated power management systems in electronic devices, further boosted demand. Volatility in the tantalum supply, due to its reliance on limited mining regions, has posed challenges during this period.

Looking ahead, the tantalum capacitors market is expected to experience robust year-over-year growth due to increasing demand for more efficient and miniaturized electronic components. As 5G networks, autonomous vehicles, and wearable devices proliferate, the need for high-performance capacitors will continue to grow. These components are expected to remain essential due to their superior stability and compact form factor. The rising focus on renewable energy systems and energy-efficient devices is anticipated to further boost the demand for specialized capacitors in these applications.

Key Growth Determinants

- Miniaturization of Electronic Devices

The growing demand for smaller, more powerful, and efficient electronic products drives the need for advanced components that can fit into compact spaces without compromising performance. Consumer electronics, particularly smartphones, wearables, and tablets, are shrinking in size, requiring smaller components such as tantalum capacitors to power features such as high-resolution cameras, fast processors, and 5G connectivity. Tantalum capacitors are well-suited for these designs due to their stability, reliability, and high energy density, making them ideal for high-performance applications in slim, lightweight devices.

The medical sector also benefits from miniaturization, with devices such as hearing aids, pacemakers, and portable medical monitors requiring small, reliable capacitors. Tantalum capacitors meet these demands, offering consistent performance and handling fluctuating power requirements. In addition, the Indian government's initiatives, such as the US$2.7 billion production-linked incentive (PLI) scheme approved in March 2025 to boost electronics manufacturing, are expected to further drive the demand for tantalum capacitors, generating approximately 92,000 jobs and reducing dependency on imports.

Key Growth Barriers

- Impact of Tantalum Ore Supply Issues and Price Instability on Capacitor Production

The tantalum capacitors market faces several restraints, primarily due to the fluctuating prices of tantalum, which are influenced by geopolitical tensions, supply-demand oscillations, and disruptions in extraction and refining processes. In 2021, the average monthly price of tantalum ore was stable at around USD 158 per kilogram of Ta2O5 content. However, the prices witnessed a significant increase in 2023, with the mean price of tantalum imports reaching USD 412K per ton in August, down by 8.7% from the previous month. The average price in 2022 was USD 150 per kilogram, reflecting a 5% decrease from 2021. These price shifts can significantly affect production costs for tantalum capacitors, influencing overall cost structures and product prices.

The limited availability of tantalum ore, largely concentrated in a few countries, presents a significant risk to the market. The Democratic Republic of Congo, a leading producer, faces political instability and poor infrastructure, making supply highly unpredictable. As countries and industries compete for supplies, manufacturers, particularly smaller ones, face difficulty securing raw materials, leading to supply chain disruptions. With a low recycling rate for tantalum and inefficient recycling processes, the long-term stability of the tantalum capacitors market remains uncertain, pushing companies to explore alternatives like aluminum or ceramic capacitors.

Tantalum Capacitors Market Trends and Opportunities

- Rising Electric and Autonomous Vehicle Growth

Autonomous driving systems and electric powertrains are transforming the automotive industry, driving increased demand for high-performance electronic components. These technologies rely on real-time data processing, energy efficiency, and component reliability, which are supported by advanced capacitors like tantalum. Tantalum capacitors, known for their high capacitance-to-volume ratio, tantalum capacitors are vital in power management systems, regulating voltage fluctuations, ensuring stable power delivery, and improving overall energy efficiency in electric vehicles (EVs).

This integration has also spurred demand for semiconductors, microcontrollers, and other devices that depend on advanced capacitors. Governments worldwide are encouraging EV and autonomous tech adoption through supportive policies. According to the IEA, electric light-duty vehicle sales are expected to hit 40% by 2030 and nearly 55% by 2035. Canada and the UK aim for 60% and 80% zero-emission vehicle sales by 2030, respectively. In India, although FAME II ended in March 2024, a follow-up scheme from April to July 2024 allocated over INR 4.9 billion (USD 60 million) to subsidize electric two- and three-wheelers.

- Expansion of Renewable Energy Infrastructure

Modern photovoltaic (PV) inverters, smart modules, and wind turbine electronics require capacitors that offer high reliability, thermal stability, and long operational life under dynamic environmental conditions. Tantalum capacitors with their compact size, low ESR, and superior endurance meet these demands, making them ideal for space-constrained applications such as micro-inverters and sensor systems. As offshore and onshore wind farms expand globally, the need for robust components in power control and conversion systems continues to grow.

In energy storage systems (ESS) and IoT-enabled smart grids, capacitors are gaining prominence due to their stable performance, high energy density, and ability to support long charge-discharge cycles. These qualities are crucial in hybrid systems integrating renewables with traditional sources. According to the IEA, global renewable electricity generation is set to exceed 17,000 TWh by 2030, an almost 90% increase from 2023, driven largely by solar PV and wind, which will account for 95% of new capacity growth. In India, solar capacity surged to 97.86 GW in 2024, up 33.47% year-on-year, further underlining the growing market potential for tantalum capacitors in renewable infrastructure.

Leading Segment Overview

- Solid Tantalum Capacitors Lead the Market in Reliability and Efficiency

Solid tantalum capacitors are expected to account for more than 35% share in 2025, due to their superior performance, reliability, and smaller size. It offers low ESR (equivalent series resistance) and high capacitance values, making them ideal for high-frequency and high-performance circuits. They are known for their long lifespan and consistent performance under varying temperatures and conditions. Their increased usage in consumer electronics and compact devices further boosts their market dominance. Ease of integration into surface-mount technology (SMT) contributes to their widespread adoption in modern electronic devices.

The solid polymer electrolyte in polymer tantalum capacitors provides superior efficiency compared to traditional liquid-electrolyte tantalum capacitors. This results in higher energy density and improved heat management, making them ideal for compact, power-intensive applications. Polymer tantalum capacitors exhibit greater resistance to shock and vibration, ensuring stable performance in harsh environments. Their low failure rates and consistent characteristics enhance overall reliability and longevity of electronic systems.

- Rise of Surface-Mount Type in Modern Electronic Devices

Surface-mount is expected to hold a 58.9% share of the tantalum capacitors market in 2025, driven by their compact size, reliability, and suitability for automated assembly processes. Their small form factor allows for higher component density, making them ideal for modern, space-constrained electronic devices such as smartphones, laptops, and automotive electronics. Surface-mount technology (SMT) aligns with mass production requirements, reducing manufacturing costs and time. These mounting-type capacitors are also known for their stable electrical performance and long lifespan, critical for applications requiring consistent power delivery.

Radial segment is expected to grow at a significant rate due to its cost-effectiveness and versatile applications across various consumer electronics and industrial devices. Their simple design and reliability make them ideal for high-demand environments, offering ease of integration and long-term performance. The advancements in miniaturization and the increasing demand for efficient energy solutions further boost their adoption.

Regional Analysis

- Asia Pacific is the Largest Market for Tantalum Capacitors

China continues to dominate electronics manufacturing, driving robust demand for reliable and compact tantalum capacitors. The country’s push towards electric vehicles and 5G infrastructure has further intensified demand, as these capacitors are widely used in ECUs, power electronics, and telecom base stations. In 2024, the electronic information manufacturing sector, the added value of major enterprises rose by 11.8% year-on-year, with revenues hitting 16.19 trillion yuan (approximately US$2.26 trillion) and profits reaching 640.8 billion yuan. Mobile phone production reached 1.67 billion units, a 7.8% increase, underscoring the need for essential components like tantalum capacitors.

Japan’s demand is fueled by its strong automotive and industrial automation sectors, where high-performance and durable capacitors are critical. Automotive electronics, robotics, and precision instruments benefit from the reliability and stability of tantalum capacitors. South Korea sees rising demand due to its semiconductor and consumer electronics sectors, with Samsung and LG leading the charge. India’s "Make in India" initiative is expanding domestic electronics and semiconductor manufacturing, with increasing use of tantalum capacitors in smartphones, automotive, defense electronics, and renewable energy infrastructure.

- Europe's Tech Industries Fueling Advanced Capacitor Demand

Germany, as Europe’s industrial powerhouse, shows the strongest demand, particularly in its automotive sector, transitioning to electric vehicles (EVs). These components are crucial in battery management systems, inverters, and infotainment units. Despite a 3.0% drop in new manufacturing orders in 2024, a 6.9% month-on-month rise in December, driven by a 55.5% surge in the manufacture of other transport equipment sectors, indicates a potential rebound, especially in high-tech industries relying on advanced electronics.

In France, demand is primarily driven by the aerospace, defense, and telecom sectors, where capacitors must perform reliably under extreme conditions. The preference stems from their compact size and high reliability, aligning with the country’s investments in satellite technology and aerospace avionics. In the U.K., defense modernization and tech startups fuel demand, especially for rugged and high-performance designs. The manufacturing sector contributed £217 billion in 2024, with £38.8 billion in investment, strengthening local production and subtly boosting component demand through reshoring trends.

- Strategic Investments and Reshoring Drive Surge in Passive Component Demand in North America

In the United States, strong demand is driven by the robust defense and aerospace industries, where components are integrated into radar, missile guidance, satellite communication, and avionics systems. Continued government investment in military modernization sustains this need, with companies like Raytheon Technologies and Lockheed Martin relying on these components for their resilience to stress, shock, and vibration. The expansion in medical electronics sector is driven by applications in ICDs, pacemakers, and neurostimulators, where long-lasting and biocompatible solutions are crucial amid an aging population and the rise in wearable health devices.

Canada is advancing its position in the critical minerals space with a US$10 million investment announced in June 2024 to support mining and processing in Northern Ontario. This is part of a national strategy aimed at enhancing supply chain security and reducing environmental impacts. North America, reshoring efforts, and acts like the U.S. CHIPS and Science Act are revitalizing semiconductor manufacturing, increasing demand for passive components. Growing emphasis on conflict-free sourcing, in line with Dodd-Frank Section 1502, is influencing procurement choices, favoring certified and ethically sourced products for high-performance technologies.

Fairfield's Competitive Landscape Analysis

Key players are focusing on enhancing performance through miniaturization, high capacitance, and efficiency. By partnering with OEMs and distributors, they access new markets and secure long-term contracts in industries such as telecommunications, automotive, and healthcare. These collaborations foster the joint development of advanced technologies. They are optimizing production processes, reducing costs, and leveraging economies of scale to offer competitive pricing while maintaining quality, targeting price-sensitive customers.

- In March 2024, KEMET introduced the T581 series, the first polymer tantalum surface mount capacitors qualified to MIL-PRF-32700/2 for military and aerospace applications. This series offers higher power, lower ESR capacitance, and superior reliability, making it ideal for high-reliability power management in fast-switching DC/DC converters.

- In February 2024, KYOCERA AVX released the TCD Series DLA 04051 and COTS-Plus conductive polymer capacitors, designed for military, aerospace, defense, and industrial applications. These capacitors offer high reliability, low ESR, and long life (2,000 hours at 125°C) with various testing options and compliant with DLA 04051 specifications.

- In July 2024, Vishay launched surface-mount solid moulded tantalum chip capacitors for electronic detonation systems, featuring robust mechanical design, low leakage current, and rigorous testing. Each part is 100% surge current tested and undergoes additional screenings to ensure consistency in electrical characteristics.

Key Companies

- Vishay Intertechnology, Inc.

- KEMET Corporation

- AVX Corporation

- ROHM Co., Ltd.

- Samsung Electro-Mechanics

- NIC Components Corp.

- Exxelia

- Hitachi AIC

- Panasonic

- Xiangyee

Expert Opinion

- Solid tantalum capacitors offer high capacitance values, excellent reliability, and low leakage current, making them ideal for high-density applications.

- Tantalum is a rare metal, and its price fluctuates due to supply-demand dynamics, mining conditions, and geopolitical factors in regions where the metal is mined. This volatility impacts the cost structure for tantalum capacitor manufacturers.

- Tantalum’s thermal stability and reliability under harsh conditions make it ideal for military-grade applications, despite rising competition from advanced ceramics and polymers.

- Advanced Driver Assistance Systems (ADAS), infotainment, and powertrain electrification demand highly reliable components capable of operating in extreme environments. In such applications, tantalum capacitors offer superior performance compared to aluminum and ceramic alternatives.

Global Tantalum Capacitors Market is Segmented as-

By Type

- Solid Tantalum Capacitors

- Wet Tantalum Capacitors

- Polymer Tantalum Capacitors

By Mounting Type

- Surface-Mount

- Axial

- Radial

By Application

- IT & Telecommunications

- Consumer Electronics

- Military and Aerospace

- Automotive

- Industrial

- Medical Devices

- Misc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Tantalum Capacitors Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Five Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Tantalum Capacitors Market Outlook, 2019 - 2032

3.1. Global Tantalum Capacitors Market Outlook, by Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.1.1. Solid Tantalum Capacitors

3.1.2. Wet Tantalum Capacitors

3.1.3. Polymer Tantalum Capacitors

3.2. Global Tantalum Capacitors Market Outlook, by Mounting Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.2.1. Surface-Mount

3.2.2. Axial

3.2.3. Radial

3.3. Global Tantalum Capacitors Market Outlook, by Application, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.3.1. IT & Telecommunications

3.3.2. Consumer Electronics

3.3.3. Military and Aerospace

3.3.4. Automotive

3.3.5. Industrial

3.3.6. Medical Devices

3.3.7. Misc.

3.4. Global Tantalum Capacitors Market Outlook, by Region, Value (US$ Mn) & Volume (Units), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Tantalum Capacitors Market Outlook, 2019 - 2032

4.1. North America Tantalum Capacitors Market Outlook, by Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.1.1. Solid Tantalum Capacitors

4.1.2. Wet Tantalum Capacitors

4.1.3. Polymer Tantalum Capacitors

4.2. North America Tantalum Capacitors Market Outlook, by Mounting Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.2.1. Surface-Mount

4.2.2. Axial

4.2.3. Radial

4.3. North America Tantalum Capacitors Market Outlook, by Application, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.3.1. IT & Telecommunications

4.3.2. Consumer Electronics

4.3.3. Military and Aerospace

4.3.4. Automotive

4.3.5. Industrial

4.3.6. Medical Devices

4.3.7. Misc.

4.4. North America Tantalum Capacitors Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

4.4.1. U.S. Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

4.4.2. U.S. Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

4.4.3. U.S. Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

4.4.4. Canada Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

4.4.5. Canada Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

4.4.6. Canada Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Tantalum Capacitors Market Outlook, 2019 - 2032

5.1. Europe Tantalum Capacitors Market Outlook, by Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.1.1. Solid Tantalum Capacitors

5.1.2. Wet Tantalum Capacitors

5.1.3. Polymer Tantalum Capacitors

5.2. Europe Tantalum Capacitors Market Outlook, by Mounting Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.2.1. Surface-Mount

5.2.2. Axial

5.2.3. Radial

5.3. Europe Tantalum Capacitors Market Outlook, by Application, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.3.1. IT & Telecommunications

5.3.2. Consumer Electronics

5.3.3. Military and Aerospace

5.3.4. Automotive

5.3.5. Industrial

5.3.6. Medical Devices

5.3.7. Misc.

5.4. Europe Tantalum Capacitors Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

5.4.1. Germany Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

5.4.2. Germany Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

5.4.3. Germany Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

5.4.4. Italy Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

5.4.5. Italy Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

5.4.6. Italy Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

5.4.7. France Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

5.4.8. France Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

5.4.9. France Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

5.4.10. U.K. Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

5.4.11. U.K. Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

5.4.12. U.K. Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

5.4.13. Spain Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

5.4.14. Spain Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

5.4.15. Spain Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

5.4.16. Russia Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

5.4.17. Russia Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

5.4.18. Russia Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

5.4.19. Rest of Europe Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

5.4.20. Rest of Europe Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

5.4.21. Rest of Europe Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Tantalum Capacitors Market Outlook, 2019 - 2032

6.1. Asia Pacific Tantalum Capacitors Market Outlook, by Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.1.1. Solid Tantalum Capacitors

6.1.2. Wet Tantalum Capacitors

6.1.3. Polymer Tantalum Capacitors

6.2. Asia Pacific Tantalum Capacitors Market Outlook, by Mounting Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.2.1. Surface-Mount

6.2.2. Axial

6.2.3. Radial

6.3. Asia Pacific Tantalum Capacitors Market Outlook, by Application, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.3.1. IT & Telecommunications

6.3.2. Consumer Electronics

6.3.3. Military and Aerospace

6.3.4. Automotive

6.3.5. Industrial

6.3.6. Medical Devices

6.3.7. Misc.

6.4. Asia Pacific Tantalum Capacitors Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

6.4.1. China Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

6.4.2. China Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

6.4.3. China Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

6.4.4. Japan Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

6.4.5. Japan Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

6.4.6. Japan Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

6.4.7. South Korea Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

6.4.8. South Korea Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

6.4.9. South Korea Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

6.4.10. India Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

6.4.11. India Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

6.4.12. India Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

6.4.13. Southeast Asia Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

6.4.14. Southeast Asia Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

6.4.15. Southeast Asia Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

6.4.16. Rest of SAO Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

6.4.17. Rest of SAO Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

6.4.18. Rest of SAO Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Tantalum Capacitors Market Outlook, 2019 - 2032

7.1. Latin America Tantalum Capacitors Market Outlook, by Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.1.1. Solid Tantalum Capacitors

7.1.2. Wet Tantalum Capacitors

7.1.3. Polymer Tantalum Capacitors

7.2. Latin America Tantalum Capacitors Market Outlook, by Mounting Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.2.1. Surface-Mount

7.2.2. Axial

7.2.3. Radial

7.3. Latin America Tantalum Capacitors Market Outlook, by Application, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.3.1. IT & Telecommunications

7.3.2. Consumer Electronics

7.3.3. Military and Aerospace

7.3.4. Automotive

7.3.5. Industrial

7.3.6. Medical Devices

7.3.7. Misc.

7.4. Latin America Tantalum Capacitors Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

7.4.1. Brazil Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

7.4.2. Brazil Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

7.4.3. Brazil Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

7.4.4. Mexico Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

7.4.5. Mexico Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

7.4.6. Mexico Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

7.4.7. Argentina Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

7.4.8. Argentina Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

7.4.9. Argentina Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

7.4.10. Rest of LATAM Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

7.4.11. Rest of LATAM Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

7.4.12. Rest of LATAM Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Tantalum Capacitors Market Outlook, 2019 - 2032

8.1. Middle East & Africa Tantalum Capacitors Market Outlook, by Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.1.1. Solid Tantalum Capacitors

8.1.2. Wet Tantalum Capacitors

8.1.3. Polymer Tantalum Capacitors

8.2. Middle East & Africa Tantalum Capacitors Market Outlook, by Mounting Type, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.2.1. Surface-Mount

8.2.2. Axial

8.2.3. Radial

8.3. Middle East & Africa Tantalum Capacitors Market Outlook, by Application, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.3.1. IT & Telecommunications

8.3.2. Consumer Electronics

8.3.3. Military and Aerospace

8.3.4. Automotive

8.3.5. Industrial

8.3.6. Medical Devices

8.3.7. Misc.

8.4. Middle East & Africa Tantalum Capacitors Market Outlook, by Country, Value (US$ Mn) & Volume (Units), 2019 - 2032

8.4.1. GCC Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

8.4.2. GCC Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

8.4.3. GCC Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

8.4.4. South Africa Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

8.4.5. South Africa Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

8.4.6. South Africa Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

8.4.7. Egypt Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

8.4.8. Egypt Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

8.4.9. Egypt Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

8.4.10. Nigeria Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

8.4.11. Nigeria Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

8.4.12. Nigeria Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

8.4.13. Rest of Middle East Tantalum Capacitors Market Outlook, by Type, 2019 - 2032

8.4.14. Rest of Middle East Tantalum Capacitors Market Outlook, by Mounting Type, 2019 - 2032

8.4.15. Rest of Middle East Tantalum Capacitors Market Outlook, by Application, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Vishay Intertechnology, Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. KEMET Corporation

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. AVX Corporation

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. ROHM Co., Ltd.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Samsung Electro-Mechanics

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. NIC Components Corp.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Exxelia

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Hitachi AIC

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Panasonic

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Xiangyee

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Mounting Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |