Global System Integration Market: Comprehensive Strategic Analysis

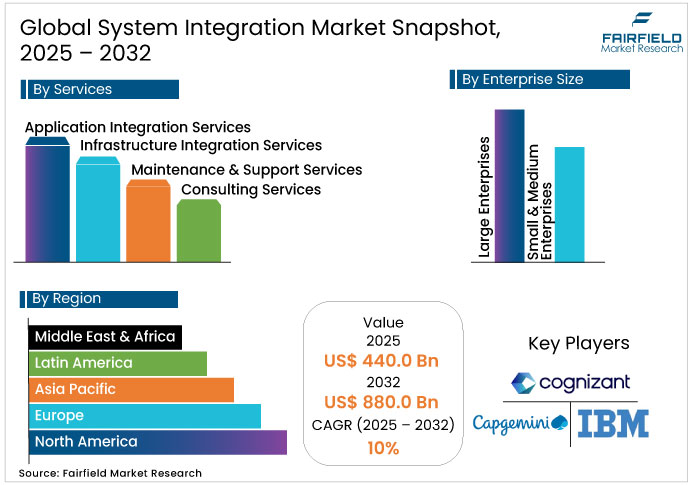

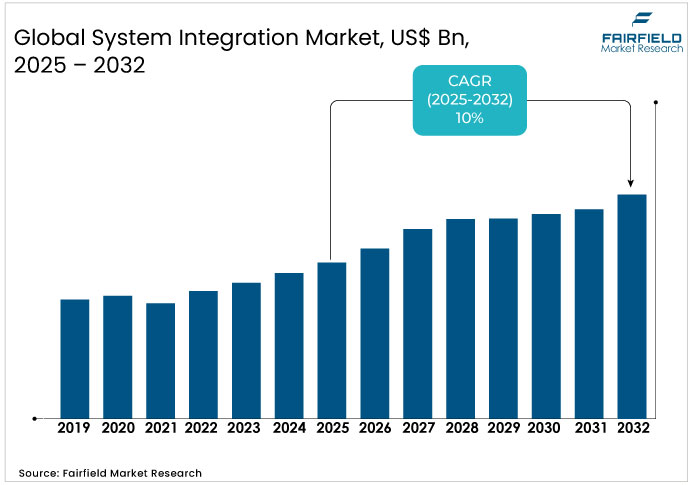

- The global System Integration Market is valued at around US$440 billion in 2025 and is projected to reach US$880 billion by 2032, growing at a 10% CAGR, driven by rapid digital transformation and system unification needs.

- Infrastructure Integration Services lead with over 33% share in 2025, powered by hybrid and multi-cloud connectivity demands and the rise of API-led and low-code platforms enabling faster deployment.

- Large enterprises dominate with 60-70% market share in 2025 due to large-scale modernization investments, while SMEs are expanding rapidly as cloud and low-code tools lower integration barriers.

- The IT & Telecom sector holds about 25% market share in 2025, driven by 5G, network virtualization, and edge computing, while healthcare and manufacturing emerge as the fastest-growing verticals.

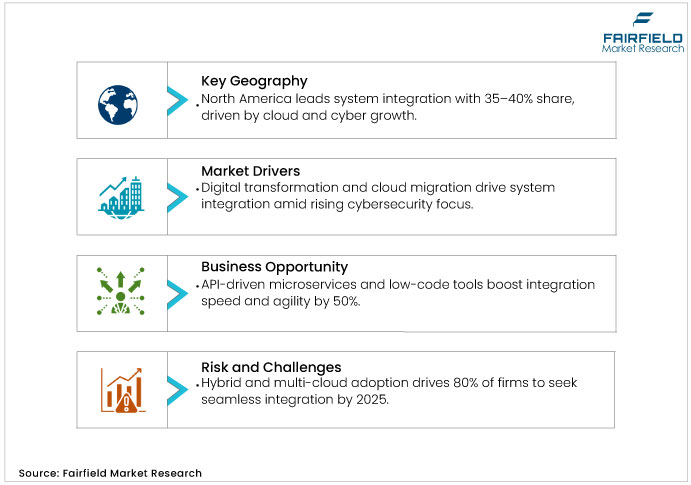

- North America leads with 35-40 % share in 2025, reflecting mature digital ecosystems and regulatory mandates, whereas Asia-Pacific grows fastest (13-15% CAGR) led by China, India, and Japan.

- Technology convergence including cloud computing, AI, and IoT remains the core structural growth driver, enabling real-time data flow, predictive analytics, and autonomous decision-making across enterprises.

Market Dynamics: Drivers, Restraints, and Opportunities Analysis

Market Drivers

Digital Transformation Imperatives and Cloud Migration Acceleration

Digital transformation and accelerated cloud migration are key growth drivers for the system integration market. Enterprises are modernizing IT ecosystems, transitioning from legacy systems to cloud-native and distributed architectures that demand advanced interoperability. According to CISA’s assessments of control systems and asset environments, identity compromise remains a leading entry vector for attackers in converged IT/OT settings. This growing focus on operational resilience and cybersecurity is fueling investments in integration infrastructure across defense, healthcare, and utilities.

Hybrid and Multi-Cloud Environment Proliferation

The widespread adoption of hybrid and multi-cloud environments is reshaping enterprise integration priorities. According to study by 2025, ~ 80% of organizations will adopt cloud-first strategies, with over 50% embracing multi-cloud models to enhance flexibility and reduce vendor lock-in. This evolution intensifies demand for integration services that ensure seamless data exchange, workload portability, and compliance across diverse platforms. As organizations pursue operational agility and governance consistency, multi-cloud integration has become a strategic cornerstone of modern digital transformation initiatives.

Market Restraints

Implementation Complexity and Integration Risk

System integration projects often face execution hurdles due to high technical complexity, legacy system constraints, and organizational readiness gaps. Integrating decades-old applications with modern cloud-native environments demands advanced expertise and precise project governance. Many legacy systems lack proper documentation, depend on obsolete protocols, and require custom connector development, creating hidden risks. Mapping outdated PLC architectures to cloud systems while maintaining operational continuity further complicates execution. Consequently, project delays and cost overruns are frequent, often resulting from underestimated complexity and vendor lock-in during implementation.

Regulatory Compliance Complexity and Data Security Requirements

Evolving data protection and privacy laws pose another major restraint for the system integration market. Regulations such as GDPR in Europe and HIPAA in healthcare mandate stringent standards for encryption, data residency, and access control across multiple jurisdictions. Enterprises must design compliance architectures that enforce data localization, audit trails, and security governance, adding significant implementation burden. Failure to meet these obligations can lead to financial penalties and reputational damage, discouraging cross-border integration efforts. This regulatory challenge is estimated to reduce overall market growth by 1-2 percentage points, especially in tightly regulated sectors such as healthcare and finance.

Market Opportunities

API-Driven Microservices Architecture and Low-Code Integration Platforms

The rise of API-driven microservices and low-code integration platforms presents a major opportunity for system integration market to enhance agility and reduce deployment timelines. These technologies enable faster, more modular integration development while empowering non-technical users to build workflows without extensive coding. According to study low-code solutions will account for over 60% of all application development by 2024, marking a shift toward accessible and scalable integration frameworks. Organizations adopting API-first microservices have achieved over 50% faster time-to-market, strengthening competitiveness. Integrators offering platforms with API management, service orchestration, and visual design tools are well-positioned to outpace traditional enterprise service bus vendors.

Industry 4.0 Digital Twin Implementation and Predictive Maintenance

Industry 4.0 transformation is unlocking new integration opportunities through digital twin deployment and predictive maintenance applications. Digital twins virtual replicas of physical systems require deep integration across IoT devices, sensors, analytics, and ERP systems. Manufacturers leveraging these solutions report significant gains in uptime, efficiency, and product quality. System integrators capable of linking industrial IoT, edge computing, and analytics frameworks can capture strong value in this domain. Moreover, sustainability-driven use cases such as energy optimization and waste reduction further expand the scope for integrated IoT-to-analytics ecosystems enabling real-time operational intelligence.

Dynamics Impact Analysis Table

|

Factor Category |

Specific Factor |

Impact Magnitude and Timeline for Impact |

Affected Market Segments |

Geographic Concentration |

Strategic Implications |

|

Driver |

Digital transformation and cloud migration |

High and Medium term (2-4 years) |

BFSI, IT & Telecom, Healthcare, Manufacturing |

Global, concentrated in developed markets |

Sustained capital allocation toward integration modernization; market share concentration among vendors with cloud integration expertise |

|

Driver |

Hybrid and multi-cloud adoption |

High and Short term (≤2 years) |

Large enterprises, IT & Telecom, Manufacturing |

North America, Europe, Asia-Pacific |

Increased demand for sophisticated orchestration and API management; differentiation opportunity for platform vendors |

|

Driver |

Edge computing and IoT integration |

Medium-High and Short term (≤2 years) |

Manufacturing, Telecom, Healthcare, Retail |

North America lead, APAC expansion |

Emerging specialization in edge architecture design; talent scarcity in edge computing expertise |

|

Restraint |

Implementation complexity and risk |

Medium and Long term (≥4 years) |

SMEs, complex legacy environments |

Global |

Low-code platform adoption accelerating; pressure on traditional services vendors |

|

Restraint |

Regulatory compliance complexity |

Medium and Medium term (2-4 years) |

Healthcare, BFSI, Government |

Europe, North America, Asia-Pacific |

Compliance consulting expansion; integration platform certification requirements increasing |

|

Opportunity |

API microservices and low-code platforms |

High and Short term (≤2 years) |

SMEs, digital-native enterprises |

Global |

Market democratization; addressable market expansion in SME segment estimated at 15-20% |

|

Opportunity |

5G integration and edge computing |

High and Medium term (2-4 years) |

Telecom, Manufacturing, Automotive, Healthcare |

North America lead, APAC rapid expansion |

Premium valuation for specialized 5G integrators; sustained 28%+ growth in 5G-specific services |

|

Opportunity |

Industry 4.0 and digital twins |

High and Medium term (2-4 years) |

Manufacturing, Automotive |

Europe, North America, Asia-Pacific |

Differentiation for IoT-to-analytics integration specialists; predictive maintenance as high-margin service offering |

Regional Market Assessment: Strategic Geography Analysis

North America Strategic Assessment

North America, led by the United States, holds the largest share of the global system integration market approximately 35-40% in 2025, valued at around US$154-176 billion. The region’s dominance stems from advanced technology adoption, high enterprise IT spending, and competitive innovation. Growth is primarily fueled by accelerated digital transformation, widespread hybrid and multi-cloud strategies, and surging cybersecurity investments amid escalating cyber threats.

Regulatory frameworks such as SOX, HIPAA, and evolving cybersecurity mandates necessitate integrated compliance and audit-ready architectures. North America’s innovation ecosystem, anchored in Silicon Valley and industrial Midwest hubs, continues to drive next-generation capabilities including API management, low-code integration platforms, and edge computing infrastructure that underpin its global leadership position.

Europe: Regulatory Harmonization and Differentiated Market Dynamics

Europe’s system integration market exhibits diverse growth patterns shaped by varying regulatory and industrial landscapes. Germany and the United Kingdom together contribute nearly half of the regional market value. Germany’s manufacturing base drives robust demand from automotive, chemicals, and industrial automation sectors pursuing Industry 4.0 adoption, while the U.K. focuses heavily on BFSI modernization and compliance initiatives.

The region’s regulatory environment anchored by GDPR and NIS2 directives creates opportunities for integrators skilled in data localization, encryption, and privacy-by-design solutions. Furthermore, sustainability policies under the European Green Deal and digital sovereignty initiatives are promoting energy-efficient and localized integration architectures, enhancing demand for European vendors emphasizing responsible innovation and regional resilience.

Asia-Pacific: Differential Growth and Competitive Positioning

Asia-Pacific is the fastest-growing regional system integration market, expanding at an impressive 13-15% CAGR. China dominates with roughly 40-50% of regional share, supported by large-scale industrial digitalization, government-led innovation, and AI integration in manufacturing.

India and ASEAN economies are witnessing exceptional growth, driven by digital infrastructure expansion, manufacturing sector modernization, and thriving domestic technology ecosystems. Japan, though technologically advanced, faces slower growth due to legacy infrastructure and demographic workforce challenges. Across the region, national initiatives promoting technology self-sufficiency, smart infrastructure, and industrial automation are fueling strong demand for integration solutions connecting IoT, AI, and cloud platforms positioning Asia-Pacific as the next frontier for global system integration innovation

Segmentation Analysis: Category-Wise Strategic Assessment

Services/Product-Type Analysis

Infrastructure integration services remain the backbone of the global system integration market, commanding approximately 33-37% market share in 2025, valued between US$145-163 billion. Their dominance reflects enterprises’ foundational need to unify heterogeneous infrastructure components supporting digital transformation.

Meanwhile, application integration services currently at about 25% share are growing rapidly at an estimated 14% CAGR, outpacing overall market growth. This surge is driven by widespread adoption of API-first, microservices, and event-driven architectures that enable modular, agile, and scalable operations. As a result, application integration is evolving from a technical function into a core business transformation enabler, enhancing vendor margins and service differentiation.

Enterprise Scale Analysis

Large enterprises hold a commanding 60-70% share of the global system integration market in 2025, valued at approximately US$264-308 billion. Their dominance stems from complex multi-system environments, extensive IT budgets, and ongoing modernization programs spanning legacy upgrades, cloud migration, and process automation. These large-scale transformation initiatives demand deep integration expertise and long-term service partnerships.

However, the SME segment holding around 26-40% share is witnessing accelerated growth, fueled by the rise of affordable cloud-based integration tools and low-code/no-code platforms. These innovations lower entry barriers and empower smaller firms to adopt integration capabilities once reserved for large corporations, enabling competitive digital transformation.

End-User Industry Analysis

The IT & Telecom sector leads global system integration market with roughly 25% share in 2025, driven by large-scale 5G rollouts, network virtualization, and IT-telecom infrastructure convergence. Telecom operators are modernizing legacy networks and deploying cloud-native systems to enable flexible, software-defined architectures and network slicing.

Concurrently, healthcare emerges as a high-growth vertical outpacing the overall market average, propelled by digital health initiatives, EHR modernization, and stringent interoperability standards. Healthcare providers are investing in integrated systems connecting EHRs, diagnostic devices, labs, and pharmacy networks to achieve unified data management, improved patient outcomes, and enhanced clinical decision-making.

Competitive Landscape: Market Structure and Strategic Positioning

The global system integration market remains moderately fragmented, with top players Accenture, Infosys, TCS, Cognizant, Deloitte, Capgemini, IBM, and HCL Technologies holding nearly 40-50% of total share. Developed markets, especially North America, show higher concentration due to entrenched vendor relationships and infrastructure barriers. In contrast, Asia-Pacific is more fragmented, led by Indian service providers offering cost-efficient integration solutions. Competitive differentiation spans strategic advisory and global delivery (multinationals), cost-effectiveness and technical depth (Indian firms), and low-code innovation (emerging vendors). High entry barriers stem from the need for specialized expertise and long-term client infrastructure. Consolidation is intensifying as large firms acquire niche players and platform vendors, while boutique firms gain traction in vertical-specific and emerging technology domains such as edge computing and 5G.

Key Players

- Cognizant

- IBM Corporation

- Capgemini

- Deloitte

- Accenture

- Tata Consultancy Services (TCS)

- Infosys Limited

- HCL Technologies

- Wipro Limited

- Microsoft Corporation

- Oracle Corporation

- Atos SE

- CGI Inc.

- DXC Technology

- Fujitsu Limited

Recent Developments

- November 2025, ManageWare Solutions has introduced the industry’s first Single-Technology Ecosystem integrating Claims Administration, Bill Review, Utilization Review, Case Management, and Provider Network Management on a unified platform. The system uses real-time web-services integration to eliminate traditional EDI processes, reducing costs and enhancing efficiency for small to mid-size payers and administrators in the workers’ compensation industry.

- In September 2025, nCino, Inc. launched Integration Gateway, a purpose-built Integration Platform as a Service (iPaaS) that streamlines connectivity across banking, fintech, and core systems. The platform enables seamless API-driven integration, eliminates data silos, and accelerates digital transformation while ensuring compliance with financial regulations. It is already adopted by over 100 North American financial institutions ranging from $500M to $200B+ in assets.

- In March 2025, PwC launched agent OS, an enterprise AI orchestration platform that connects and scales intelligent agents across diverse systems such as AWS, Microsoft Azure, Salesforce, Oracle, and SAP. The platform acts as a unified integration layer, enabling seamless workflow automation, cross-platform interoperability, and enterprise-wide AI adoption. Its cloud-agnostic, low-code framework allows organizations to accelerate digital transformation by integrating AI agents and data systems efficiently.

Global System Integration Market Segmentation-

By Services

- Application Integration Services

- Infrastructure Integration Services

- Maintenance & Support Services

- Consulting Services

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Industry

- IT & Telecom

- Retail & e-Commerce

- BFSI

- Government & Defense

- Healthcare

- Manufacturing

- Transportation & Logistics

- Media & Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global System Integration Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global System Integration Market Outlook, 2019 - 2032

3.1. Global System Integration Market Outlook, by By Services, Value (US$ Bn), 2019-2032

3.1.1. Application Integration Services

3.1.2. Infrastructure Integration Services

3.1.3. Maintenance & Support Services

3.1.4. Consulting Services

3.1.5. Others

3.2. Global System Integration Market Outlook, by By Enterprise Size, Value (US$ Bn), 2019-2032

3.2.1. Large Enterprises

3.2.2. Small & Medium Enterprises

3.3. Global System Integration Market Outlook, by By Industry, Value (US$ Bn), 2019-2032

3.3.1. IT & Telecom

3.3.2. Retail & e-Commerce

3.3.3. BFSI

3.3.4. Government & Defense

3.3.5. Healthcare

3.3.6. Manufacturing

3.3.7. Transportation & Logistics

3.3.8. Media & Entertainment

3.3.9. Others

3.4. Global System Integration Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America System Integration Market Outlook, 2019 - 2032

4.1. North America System Integration Market Outlook, by By Services, Value (US$ Bn), 2019-2032

4.1.1. Application Integration Services

4.1.2. Infrastructure Integration Services

4.1.3. Maintenance & Support Services

4.1.4. Consulting Services

4.1.5. Others

4.2. North America System Integration Market Outlook, by By Enterprise Size, Value (US$ Bn), 2019-2032

4.2.1. Large Enterprises

4.2.2. Small & Medium Enterprises

4.3. North America System Integration Market Outlook, by By Industry, Value (US$ Bn), 2019-2032

4.3.1. IT & Telecom

4.3.2. Retail & e-Commerce

4.3.3. BFSI

4.3.4. Government & Defense

4.3.5. Healthcare

4.3.6. Manufacturing

4.3.7. Transportation & Logistics

4.3.8. Media & Entertainment

4.3.9. Others

4.4. North America System Integration Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.4.1. U.S. System Integration Market Outlook, by By Services, 2019-2032

4.4.2. U.S. System Integration Market Outlook, by By Enterprise Size, 2019-2032

4.4.3. U.S. System Integration Market Outlook, by By Industry, 2019-2032

4.4.4. Canada System Integration Market Outlook, by By Services, 2019-2032

4.4.5. Canada System Integration Market Outlook, by By Enterprise Size, 2019-2032

4.4.6. Canada System Integration Market Outlook, by By Industry, 2019-2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe System Integration Market Outlook, 2019 - 2032

5.1. Europe System Integration Market Outlook, by By Services, Value (US$ Bn), 2019-2032

5.1.1. Application Integration Services

5.1.2. Infrastructure Integration Services

5.1.3. Maintenance & Support Services

5.1.4. Consulting Services

5.1.5. Others

5.2. Europe System Integration Market Outlook, by By Enterprise Size, Value (US$ Bn), 2019-2032

5.2.1. Large Enterprises

5.2.2. Small & Medium Enterprises

5.3. Europe System Integration Market Outlook, by By Industry, Value (US$ Bn), 2019-2032

5.3.1. IT & Telecom

5.3.2. Retail & e-Commerce

5.3.3. BFSI

5.3.4. Government & Defense

5.3.5. Healthcare

5.3.6. Manufacturing

5.3.7. Transportation & Logistics

5.3.8. Media & Entertainment

5.3.9. Others

5.4. Europe System Integration Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.4.1. Germany System Integration Market Outlook, by By Services, 2019-2032

5.4.2. Germany System Integration Market Outlook, by By Enterprise Size, 2019-2032

5.4.3. Germany System Integration Market Outlook, by By Industry, 2019-2032

5.4.4. Italy System Integration Market Outlook, by By Services, 2019-2032

5.4.5. Italy System Integration Market Outlook, by By Enterprise Size, 2019-2032

5.4.6. Italy System Integration Market Outlook, by By Industry, 2019-2032

5.4.7. France System Integration Market Outlook, by By Services, 2019-2032

5.4.8. France System Integration Market Outlook, by By Enterprise Size, 2019-2032

5.4.9. France System Integration Market Outlook, by By Industry, 2019-2032

5.4.10. U.K. System Integration Market Outlook, by By Services, 2019-2032

5.4.11. U.K. System Integration Market Outlook, by By Enterprise Size, 2019-2032

5.4.12. U.K. System Integration Market Outlook, by By Industry, 2019-2032

5.4.13. Spain System Integration Market Outlook, by By Services, 2019-2032

5.4.14. Spain System Integration Market Outlook, by By Enterprise Size, 2019-2032

5.4.15. Spain System Integration Market Outlook, by By Industry, 2019-2032

5.4.16. Russia System Integration Market Outlook, by By Services, 2019-2032

5.4.17. Russia System Integration Market Outlook, by By Enterprise Size, 2019-2032

5.4.18. Russia System Integration Market Outlook, by By Industry, 2019-2032

5.4.19. Rest of Europe System Integration Market Outlook, by By Services, 2019-2032

5.4.20. Rest of Europe System Integration Market Outlook, by By Enterprise Size, 2019-2032

5.4.21. Rest of Europe System Integration Market Outlook, by By Industry, 2019-2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific System Integration Market Outlook, 2019 - 2032

6.1. Asia Pacific System Integration Market Outlook, by By Services, Value (US$ Bn), 2019-2032

6.1.1. Application Integration Services

6.1.2. Infrastructure Integration Services

6.1.3. Maintenance & Support Services

6.1.4. Consulting Services

6.1.5. Others

6.2. Asia Pacific System Integration Market Outlook, by By Enterprise Size, Value (US$ Bn), 2019-2032

6.2.1. Large Enterprises

6.2.2. Small & Medium Enterprises

6.3. Asia Pacific System Integration Market Outlook, by By Industry, Value (US$ Bn), 2019-2032

6.3.1. IT & Telecom

6.3.2. Retail & e-Commerce

6.3.3. BFSI

6.3.4. Government & Defense

6.3.5. Healthcare

6.3.6. Manufacturing

6.3.7. Transportation & Logistics

6.3.8. Media & Entertainment

6.3.9. Others

6.4. Asia Pacific System Integration Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.4.1. China System Integration Market Outlook, by By Services, 2019-2032

6.4.2. China System Integration Market Outlook, by By Enterprise Size, 2019-2032

6.4.3. China System Integration Market Outlook, by By Industry, 2019-2032

6.4.4. Japan System Integration Market Outlook, by By Services, 2019-2032

6.4.5. Japan System Integration Market Outlook, by By Enterprise Size, 2019-2032

6.4.6. Japan System Integration Market Outlook, by By Industry, 2019-2032

6.4.7. South Korea System Integration Market Outlook, by By Services, 2019-2032

6.4.8. South Korea System Integration Market Outlook, by By Enterprise Size, 2019-2032

6.4.9. South Korea System Integration Market Outlook, by By Industry, 2019-2032

6.4.10. India System Integration Market Outlook, by By Services, 2019-2032

6.4.11. India System Integration Market Outlook, by By Enterprise Size, 2019-2032

6.4.12. India System Integration Market Outlook, by By Industry, 2019-2032

6.4.13. Southeast Asia System Integration Market Outlook, by By Services, 2019-2032

6.4.14. Southeast Asia System Integration Market Outlook, by By Enterprise Size, 2019-2032

6.4.15. Southeast Asia System Integration Market Outlook, by By Industry, 2019-2032

6.4.16. Rest of SAO System Integration Market Outlook, by By Services, 2019-2032

6.4.17. Rest of SAO System Integration Market Outlook, by By Enterprise Size, 2019-2032

6.4.18. Rest of SAO System Integration Market Outlook, by By Industry, 2019-2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America System Integration Market Outlook, 2019 - 2032

7.1. Latin America System Integration Market Outlook, by By Services, Value (US$ Bn), 2019-2032

7.1.1. Application Integration Services

7.1.2. Infrastructure Integration Services

7.1.3. Maintenance & Support Services

7.1.4. Consulting Services

7.1.5. Others

7.2. Latin America System Integration Market Outlook, by By Enterprise Size, Value (US$ Bn), 2019-2032

7.2.1. Large Enterprises

7.2.2. Small & Medium Enterprises

7.3. Latin America System Integration Market Outlook, by By Industry, Value (US$ Bn), 2019-2032

7.3.1. IT & Telecom

7.3.2. Retail & e-Commerce

7.3.3. BFSI

7.3.4. Government & Defense

7.3.5. Healthcare

7.3.6. Manufacturing

7.3.7. Transportation & Logistics

7.3.8. Media & Entertainment

7.3.9. Others

7.4. Latin America System Integration Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.4.1. Brazil System Integration Market Outlook, by By Services, 2019-2032

7.4.2. Brazil System Integration Market Outlook, by By Enterprise Size, 2019-2032

7.4.3. Brazil System Integration Market Outlook, by By Industry, 2019-2032

7.4.4. Mexico System Integration Market Outlook, by By Services, 2019-2032

7.4.5. Mexico System Integration Market Outlook, by By Enterprise Size, 2019-2032

7.4.6. Mexico System Integration Market Outlook, by By Industry, 2019-2032

7.4.7. Argentina System Integration Market Outlook, by By Services, 2019-2032

7.4.8. Argentina System Integration Market Outlook, by By Enterprise Size, 2019-2032

7.4.9. Argentina System Integration Market Outlook, by By Industry, 2019-2032

7.4.10. Rest of LATAM System Integration Market Outlook, by By Services, 2019-2032

7.4.11. Rest of LATAM System Integration Market Outlook, by By Enterprise Size, 2019-2032

7.4.12. Rest of LATAM System Integration Market Outlook, by By Industry, 2019-2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa System Integration Market Outlook, 2019 - 2032

8.1. Middle East & Africa System Integration Market Outlook, by By Services, Value (US$ Bn), 2019-2032

8.1.1. Application Integration Services

8.1.2. Infrastructure Integration Services

8.1.3. Maintenance & Support Services

8.1.4. Consulting Services

8.1.5. Others

8.2. Middle East & Africa System Integration Market Outlook, by By Enterprise Size, Value (US$ Bn), 2019-2032

8.2.1. Large Enterprises

8.2.2. Small & Medium Enterprises

8.3. Middle East & Africa System Integration Market Outlook, by By Industry, Value (US$ Bn), 2019-2032

8.3.1. IT & Telecom

8.3.2. Retail & e-Commerce

8.3.3. BFSI

8.3.4. Government & Defense

8.3.5. Healthcare

8.3.6. Manufacturing

8.3.7. Transportation & Logistics

8.3.8. Media & Entertainment

8.3.9. Others

8.4. Middle East & Africa System Integration Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.4.1. GCC System Integration Market Outlook, by By Services, 2019-2032

8.4.2. GCC System Integration Market Outlook, by By Enterprise Size, 2019-2032

8.4.3. GCC System Integration Market Outlook, by By Industry, 2019-2032

8.4.4. South Africa System Integration Market Outlook, by By Services, 2019-2032

8.4.5. South Africa System Integration Market Outlook, by By Enterprise Size, 2019-2032

8.4.6. South Africa System Integration Market Outlook, by By Industry, 2019-2032

8.4.7. Egypt System Integration Market Outlook, by By Services, 2019-2032

8.4.8. Egypt System Integration Market Outlook, by By Enterprise Size, 2019-2032

8.4.9. Egypt System Integration Market Outlook, by By Industry, 2019-2032

8.4.10. Nigeria System Integration Market Outlook, by By Services, 2019-2032

8.4.11. Nigeria System Integration Market Outlook, by By Enterprise Size, 2019-2032

8.4.12. Nigeria System Integration Market Outlook, by By Industry, 2019-2032

8.4.13. Rest of Middle East System Integration Market Outlook, by By Services, 2019-2032

8.4.14. Rest of Middle East System Integration Market Outlook, by By Enterprise Size, 2019-2032

8.4.15. Rest of Middle East System Integration Market Outlook, by By Industry, 2019-2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Cognizant

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. IBM Corporation

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Capgemini

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Deloitte

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Accenture

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Tata Consultancy Services (TCS)

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Infosys Limited

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. HCL Technologies

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Wipro Limited

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Microsoft Corporation

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Services Coverage |

|

|

By Enterprise Size Coverage |

|

|

By Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |