Global Alternative Fuel and Hybrid Vehicle Market Forecast

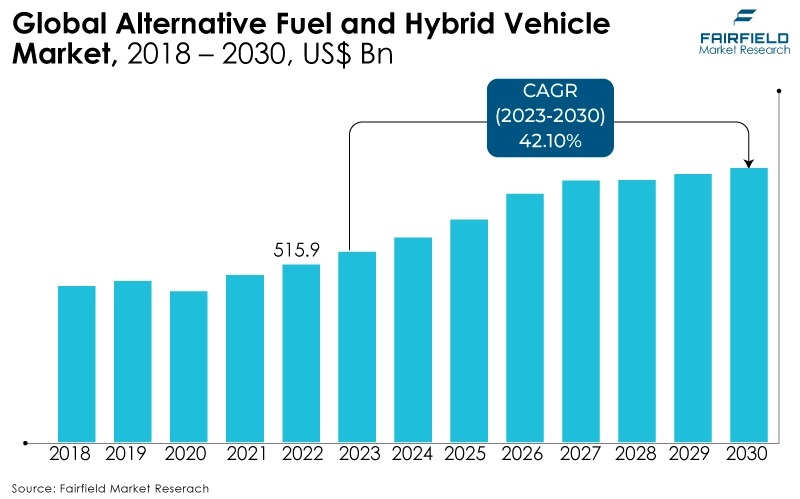

- The Alternative Fuel and Hybrid Vehicle Market is valued at USD 450.3 Bn in 2026 and is projected to reach USD 2590.9 Bn, growing at a CAGR of 28% by 2033.

Quick Report Digest

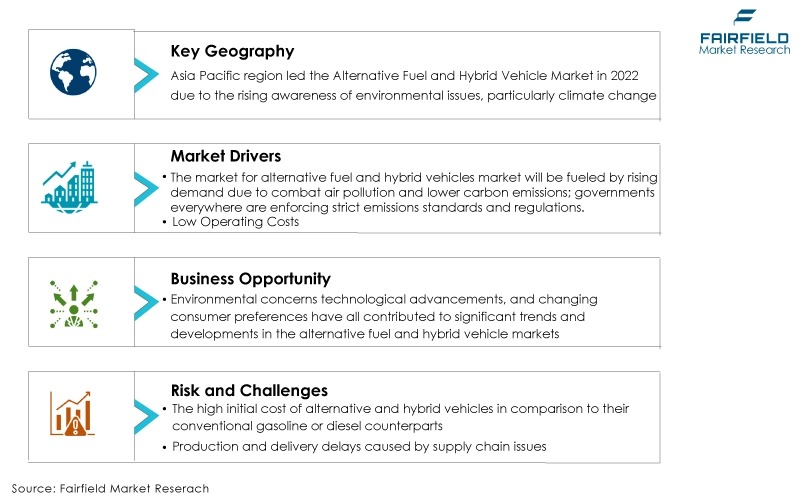

- The key trend anticipated to fuel the alternative fuel and hybrid vehicle market growth is the rising awareness of environmental issues, particularly climate change, which is one of the main forces behind the development of alternative fuel and hybrid vehicles.

- Consumers and governments are looking for cleaner transportation options as traditional internal combustion engine (ICE) vehicles significantly increase greenhouse gas emissions. This concern has prompted the creation and use of vehicles running on alternative fuels, such as electricity, hydrogen, and natural gas, emitting very little or no emissions.

- Another major market trend expected is to combat air pollution and lower carbon emissions; governments everywhere are enforcing strict emissions standards and regulations.

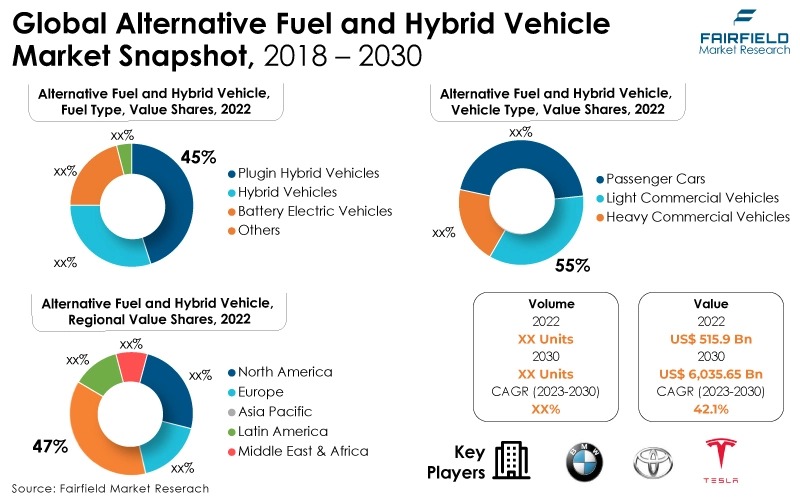

- In 2022, the plug-in hybrid vehicle category dominated the industry. Fuel consumption may be drastically decreased when PHEVs are compared to conventional petrol or diesel automobiles. Using just electricity, they can cover shorter distances, conserving fuel and reducing greenhouse gas emissions.

- Regarding market share for alternative fuel and hybrid vehicles globally, the passenger vehicles segment is anticipated to dominate. Diesel-electric or gasoline-electric hybrid vehicles are renowned for their higher fuel efficiency. The overall cost of ownership and reliance on fossil fuels is decreased because they can achieve higher miles per gallon (MPG) or equivalent, which is responsible for this segment's significant market share.

- In 2022, the economic vehicles category controlled the market. Many consumers prioritise and meet the needs of affordable vehicles, which is why consumers tend to frequently choose them for various reasons.

- Governments enforce strict emissions standards and regulations everywhere to combat air pollution and lower carbon emissions. These rules encourage automakers to create greener vehicles or risk fines. Manufacturers are, therefore, spending more money on hybrid and alternative fuel technologies to satisfy these legal requirements.

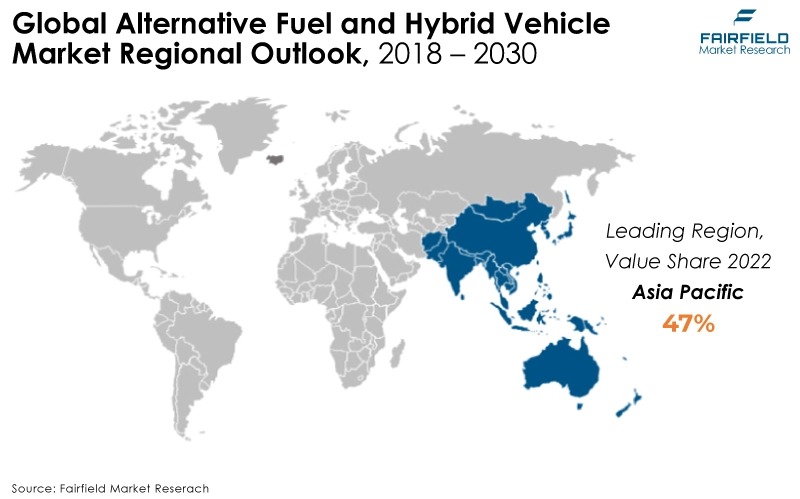

- Asia Pacific region is anticipated to account for the largest share of the global market for alternative fuel and hybrid vehicle; many countries in the Asia Pacific region offer generous incentives and subsidies to promote the adoption of alternative and hybrid fuel vehicles. These incentives can include tax breaks, rebates, and reduced registration fees, making these vehicles more affordable.

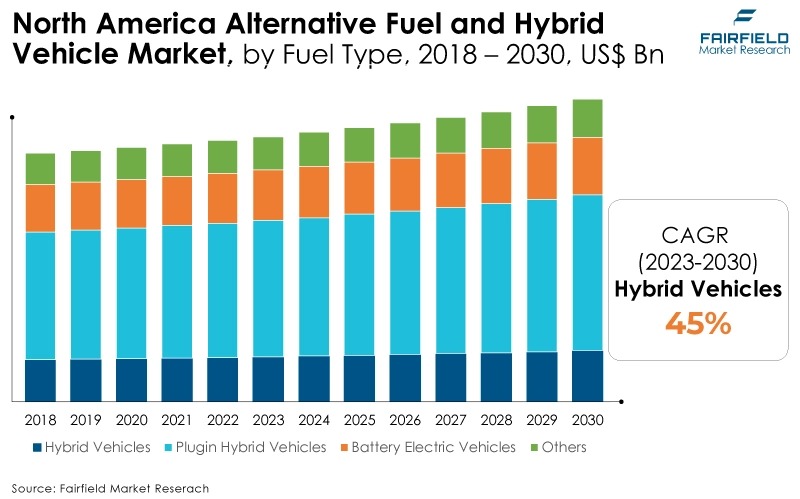

- The alternative fuel and hybrid vehicles market is expanding in North America because various federal and state governments offer tax credits, rebates, and other incentives to encourage the purchase of alternative fuel and hybrid vehicles. These incentives help reduce the initial cost for consumers.

A Look Back and a Look Forward - Comparative Analysis

The alternative fuel and hybrid vehicles market has grown in popularity due to factors such as advancements in battery technology. Lithium-ion batteries have improved efficiency and cost, allowing the creation of electric vehicles (EVs) with longer ranges and faster charging times. Additionally, hydrogen fuel cell technology improvements have made hydrogen-powered cars a practical choice.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of Consumers heavily weighing fuel efficiency, particularly in light of fluctuating fuel prices. Hybrid and electric vehicles typically have lower operating costs than conventional internal combustion engine (ICE) vehicles.

A strong financial incentive for consumers to use alternative fuel vehicles is that electricity and other alternative fuels are frequently less expensive than gasoline and diesel. Infrastructure investment is being made by public and commercial entities to assist the expansion of electric and hydrogen cars.

New hydrogen refuelling stations and a larger network of EV charging stations are being created as part of this. The availability of convenient refueling options and improved infrastructure encourages consumers to purchase alternative fuel vehicles.

Key Growth Determinants

- Rapid EV Sales

The rapid growth of electric vehicles is due to advancements in battery technology and their zero-emission status, EVs have gained widespread acceptance. There is an expanding selection of electric models available to consumers thanks to significant investments by major automakers in EV production.

The expansion of the driving range of EVs is a crucial trend in the industry. As a result of technological advancements, batteries now have a higher energy density, enabling EVs to go farther on a single charge.

- Expanding Fast-charging Infrastructure

Adding fast-charging infrastructure is a significant trend. Governments and private companies are spending money to increase accessibility, shorten charging times, and expand charging networks. This trend improves the practicality and convenience of electric vehicles.

Hybrid technology is now available in vehicles other than compact cars, or "hybridization across segments." Including SUVs, trucks, and luxury cars, automakers are incorporating hybrid systems into various vehicle segments.

More options for consumers to lessen their carbon footprint are made available by this trend. This always worries about "range anxiety" and makes EVs more usable for a wider range of consumers.

- Increased Consumer Awareness, and Government Initiatives

Environmental concerns and the advantages of alternative fuel and hybrid vehicles are becoming increasingly well-known to consumers. This pattern is increasing interest in and demand for greener transportation options.

Across the globe, numerous governments are implementing incentives and rules to encourage using alternative fuel and hybrid vehicles. These may include mandates for the sale of electric vehicles, tax credits, rebates, and even emissions standards.

Automakers are forming alliances and collaborations to pool resources and hasten the advancement of alternative fuel technologies. Through these partnerships, cutting-edge solutions are developed more quickly and cheaply.

Major Growth Barriers

- Competition, and Innovations

Traditional automakers and upstarts alike have invested significantly in alternative fuel technologies, escalating the level of competition in the automotive sector. Hybrid and electric cars are improving in efficiency and cost-effectiveness due to this rivalry.

Environmentally friendly transit solutions are increasingly and more crucial as cities grow in population. Hybrid and electric cars are perfect for cities since they produce less emissions and may reduce traffic congestion.

- High Initial Costs

One of the greatest obstacles to adoption is the high initial cost of alternative and hybrid cars in comparison to their traditional petrol or diesel counterparts. As a result of their frequent usage of expensive technology like fuel cells or lithium-ion batteries, many buyers feel these vehicles to be out of their price range.

One of the greatest obstacles to adoption is the high initial cost of alternative and hybrid cars in comparison to their traditional petrol or diesel counterparts.

Key Trends and Opportunities to Look at

- Eco-friendly Packaging Solutions

As urbanisation rises, eco-friendly transportation options are becoming more and more important. Hybrid and electric vehicles are good for urban areas since they generate minimal pollutants and have the potential to reduce traffic congestion.

A further factor accelerating the use of alternative fuel vehicles in urban areas is the growth of shared mobility services like ride-sharing and electric scooters.

- Infrastructural Developments

Infrastructure is being built by governments and private companies to enable the adoption of electric and hydrogen cars. New hydrogen refuelling stations and an extended network of EV charging stations are being created as part of this. Convenient refuelling options and improved infrastructure encourage consumers to purchase alternative fuel vehicles.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, strict emissions laws, particularly in Asia Pacific, Europe, and North America, have forced automakers to create and produce cleaner vehicles. Manufacturers have invested in hybrid technology and low-emission alternative fuel vehicles, such as electric cars, hydrogen fuel cells, and compressed natural gas (CNG) vehicles, to meet these standards.

Government regulations to increase fuel efficiency have propelled automakers to investigate hybrid technology. Corporate Average Fuel Economy (CAFE) standards are frequently included in these regulations, forcing automakers to produce more fuel-efficient vehicles to meet a set fuel efficiency standard across their fleets. Zero-Emission Vehicle (ZEV) Mandates: Some areas, like California in the US, have enacted ZEV mandates that call for automakers to produce a specific number of zero-emission vehicles, such as electric cars.

Electric vehicles (EVs) and hybrids have been developed and produced due to these regulations. Numerous governments provide tax credits and incentives to people who buy alternative and hybrid fuel vehicles. These monetary rewards lower the cost of ownership and have significantly boosted consumer adoption.

Fairfield’s Ranking Board

Top Segments

- Plugin Hybrid Vehicles Win over Hybrid Counterparts

The plugin hybrid vehicles dominated the market in 2022. Comparing PHEVs to traditional gasoline or diesel vehicles, fuel consumption can be significantly reduced. They can go longer distances on electricity alone, conserving gasoline and lowering greenhouse gas emissions.

Over time, operating a PHEV may be more economical. Drivers can reduce fuel costs by using electricity for local commutes and shorter distances. Additionally, electricity is typically less expensive than gasoline and diesel fuel. Benefits to the Environment: PHEVs are less harmful to the environment than conventional vehicles because they run on electricity rather than gasoline. This lowers air pollution and helps improve local air quality, particularly in cities.

Moreover, the hybrid vehicles battery category is expected to grow fastest in the alternative fuel and hybrid vehicle market during the forecast period. A common feature of hybrid vehicles is an idle stop-start system, which shuts off the internal combustion engine when the car is stationary, like at a stop sign or traffic light. To save fuel and lessen emissions, the electric motor takes over.

- Passenger Vehicles Will Surge Ahead

In 2022, the passenger vehicles category dominated the industry. Hybrid cars that run on diesel or petrol are recognised for having improved fuel economy. The overall cost of ownership and reliance on fossil fuels is decreased because they can achieve higher miles per gallon (MPG) or equivalent.

Compared to conventional gasoline or diesel engines, alternative fuel options like hydrogen, compressed natural gas (CNG), and propane emit significantly less greenhouse gas. This lessens the carbon footprint of personal vehicles and slows climate change.

Regenerative braking and less wear and tear on the internal combustion engine result in lower maintenance costs for hybrid vehicles. Alternative fuels may also be more economical, depending on local fuel costs. Alternative fuel vehicles produce fewer harmful pollutants, which improves the air quality in urban areas.

The semi-automatic category is anticipated to grow substantially throughout the projected period. Between entirely manual and fully automated packaging operations is a transitional stage represented by the semi-automatic alternative fuel and hybrid vehicles category. It offers the right amount of productivity, adaptability, and human control, making it an excellent option for various sectors with varying packaging requirements and production volumes.

- Economical Vehicles Prominent

The economical vehicles segment dominated the market in 2022. Many consumers are becoming more aware of their environmental impact and carbon footprint. By selecting a cost-effective vehicle, they can match their mode of transportation with their values and support sustainability initiatives.

The government has set stricter emissions and fuel economy standards in some places. Economical vehicles assist automakers in adhering to these regulations and avoiding fines, which can result in a greater supply of such vehicles on the market.

Moreover, the mid-priced vehicles category is expected to grow fastest in the alternative fuel and hybrid vehicle market during the forecast period. The convenience and adaptability of frozen foods have helped them become more popular. The category of frozen foods is always evolving and providing new goods to satisfy consumer expectations for time-saving solutions and a larger variety of meal options.

Regional Frontrunners

Asia Pacific Contributes the Largest Share

In the alternative fuel and hybrid vehicle industries, increasing air pollution and concerns about climate change have led to a growing interest in cleaner transportation options, and adoption is anticipated to dominate in the Asia Pacific region.

Many countries in the Asia Pacific region offer generous incentives and subsidies to promote the adoption of alternative and hybrid fuel vehicles. These incentives, which might include tax reductions, rebates, and lower registration costs, lower the cost of these automobiles.

Moreover, the demand for alternative fuel and hybrid vehicles in Asia is projected to increase due to a growing professional base.

North America Expects Strong Growth, Backed by Favourable Regulatory Structure

In North America, various federal and state governments offer tax credits, rebates, and other incentives to encourage the purchase of alternative fuel and hybrid vehicles. All this helps in reducing the cost for consumers.

The North American consumer is increasingly aware of environmental issues and more inclined to choose vehicles that have a smaller carbon footprint. This awareness drives demand for cleaner transportation options.

Advances in battery technology have improved the range and performance of electric vehicles, making them more attractive to consumers. This has led to increased adoption of electric cars in North America. Stricter emissions regulations and fuel efficiency standards at both federal and state levels have pushed automakers to invest in alternative and hybrid technologies to meet these requirements.

Fairfield’s Competitive Landscape Analysis

The global market is a consolidated alternative fuel and hybrid vehicle market with fewer major global players. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in Global Alternative Fuel and Hybrid Vehicle Space?

- BMW Group

- Tesla, Inc.

- Volkswagen AG

- Toyota Motor Corporation

- Mitsubishi Motors Corporation

- Honda Motor Co.Ltd

- BYD Company Ltd

- Ford Motor Company

- Mercedes-Benz Group AG

- Nissan Motor Co., Ltd

- Ampere Vehicles

- Maruti Suzuki

- Mahindra

- Audi AG

- Renault Group

Significant Company Developments

New Product Launches

- July 2023: An FFV-SHEV has a flex-fuel engine and an electric powertrain, which offers the dual benefits of higher ethanol use and greater fuel efficiency because it can run for a long time in its EV mode, in which the engine is turned off. Vehicles that are flex-fuel compatible can run on a combination of different fuel types. Usually, a mixture of gasoline and ethanol or methanol is employed.

- July 2023: After a three-year hiatus, the Indian Auto Expo is back in New Delhi and Greater Noida with 75 launches and 5 global launches. One to keep an eye on is the automaker Ashok Leyland, the second-most successful producer of commercial vehicles in India. A battery electric vehicle (EV), a fuel cell EV, a hydrogen internal combustion engine (ICE) vehicle, a liquefied natural gas (LNG) vehicle, an intercity CNG bus, a mini passenger bus, and an ambulance were among the seven new vehicles on display by the company.

Distribution Agreements

- May 2023: Research potential well-established distributors in your target markets and identify them as partners. Negotiate terms, such as pricing, payment schedules, geographic restrictions, and exclusivity agreements.

- February 2022: Maintain transparency regarding obligations, guarantees, and support. Ascertain that your goods abide by all statutory and regulatory requirements in the countries where they will be sold. Implement quality control measures to keep your products at a certain standard during distribution.

- February 2022: For your distributors to effectively represent and market your products, you should provide them with training and support. Support your distributors' marketing initiatives by promoting hybrid and alternative fuel vehicles.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the rising awareness of environmental issues, particularly climate change, is one of the main forces behind developing alternative fuel and hybrid vehicles.

Consumers and governments alike seek cleaner transportation options as traditional internal combustion engine (ICE) vehicles significantly increase greenhouse gas emissions. This worry has prompted the creation and use of vehicles running on alternative fuels, such as electricity, hydrogen, and natural gas, which emit either very little or no emission.

Supply Side of the Market

According to our analysis, monitoring and evaluation are important, keeping a close eye on distributor performance, customer feedback, and sales. The distribution agreement should be modified on a regular basis to reflect changing market needs or conditions.

To avoid legal problems, the agreement should contain procedures for resolving disputes. To ensure all terms are legitimate and safeguard your interests, speak with lawyers specializing in distribution agreements.

Global Alternative Fuel and Hybrid Vehicle Market is Segmented as Below:

By Fuel Type:

- Hybrid Vehicles

- Plugin Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Miscellaneous

By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Vehicle Class:

- Economical Vehicles

- Mid-priced Vehicles

- Luxury Vehicles

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

- Executive Summary

- Global Alternative Fuel and Hybrid Vehicle Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Alternative Fuel and Hybrid Vehicle Market Outlook, 2020 - 2033

- Global Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Hybrid Vehicles

- Plugin Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Miscellaneous

- Global Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Global Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, Value (US$ Bn), 2020-2033

- Economical Vehicles

- Mid-priced Vehicles

- Luxury Vehicles

- Global Alternative Fuel and Hybrid Vehicle Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- North America Alternative Fuel and Hybrid Vehicle Market Outlook, 2020 - 2033

- North America Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Hybrid Vehicles

- Plugin Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Miscellaneous

- North America Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- North America Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, Value (US$ Bn), 2020-2033

- Economical Vehicles

- Mid-priced Vehicles

- Luxury Vehicles

- North America Alternative Fuel and Hybrid Vehicle Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- S. Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- S. Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Canada Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Canada Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Canada Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Europe Alternative Fuel and Hybrid Vehicle Market Outlook, 2020 - 2033

- Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Hybrid Vehicles

- Plugin Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Miscellaneous

- Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, Value (US$ Bn), 2020-2033

- Economical Vehicles

- Mid-priced Vehicles

- Luxury Vehicles

- Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Germany Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Germany Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Italy Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Italy Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Italy Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- France Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- France Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- France Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- K. Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- K. Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- K. Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Spain Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Spain Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Spain Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Russia Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Russia Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Russia Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Rest of Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Rest of Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Asia Pacific Alternative Fuel and Hybrid Vehicle Market Outlook, 2020 - 2033

- Asia Pacific Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Hybrid Vehicles

- Plugin Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Miscellaneous

- Asia Pacific Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Asia Pacific Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, Value (US$ Bn), 2020-2033

- Economical Vehicles

- Mid-priced Vehicles

- Luxury Vehicles

- Asia Pacific Alternative Fuel and Hybrid Vehicle Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- China Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- China Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Japan Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Japan Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Japan Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- South Korea Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- South Korea Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- South Korea Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- India Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- India Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- India Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Southeast Asia Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Southeast Asia Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Rest of SAO Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Rest of SAO Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Latin America Alternative Fuel and Hybrid Vehicle Market Outlook, 2020 - 2033

- Latin America Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Hybrid Vehicles

- Plugin Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Miscellaneous

- Latin America Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Latin America Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, Value (US$ Bn), 2020-2033

- Economical Vehicles

- Mid-priced Vehicles

- Luxury Vehicles

- Latin America Alternative Fuel and Hybrid Vehicle Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Brazil Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Brazil Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Mexico Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Mexico Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Mexico Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Argentina Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Argentina Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Argentina Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Rest of LATAM Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Rest of LATAM Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Middle East & Africa Alternative Fuel and Hybrid Vehicle Market Outlook, 2020 - 2033

- Middle East & Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Hybrid Vehicles

- Plugin Hybrid Vehicles

- Battery Electric Vehicles

- Fuel Cell Electric Vehicles

- Miscellaneous

- Middle East & Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Middle East & Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, Value (US$ Bn), 2020-2033

- Economical Vehicles

- Mid-priced Vehicles

- Luxury Vehicles

- Middle East & Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- GCC Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- GCC Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- South Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- South Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- South Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Egypt Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Egypt Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Egypt Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Nigeria Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Nigeria Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Nigeria Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- Rest of Middle East Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, 2020-2033

- Rest of Middle East Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East Alternative Fuel and Hybrid Vehicle Market Outlook, by Vehicle Class, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Alternative Fuel and Hybrid Vehicle Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- BMW Group

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Tesla, Inc.

- Volkswagen AG

- Toyota Motor Corporation

- Mitsubishi Motors Corporation

- Honda Motor Co.Ltd

- BYD Company Ltd

- Ford Motor Company

- Mercedes-Benz Group AG

- Nissan Motor Co., Ltd

- BMW Group

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Fuel Type Coverage |

|

|

Vehicle Type Coverage |

|

|

Vehicle Class Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |