Alumina Market Growth and Industry Forecast

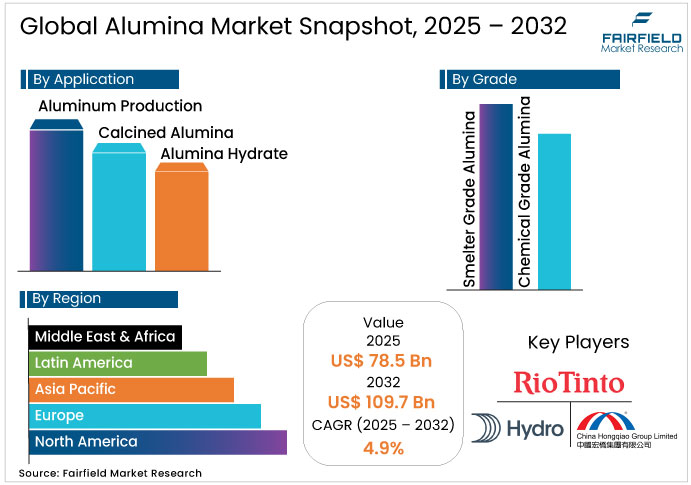

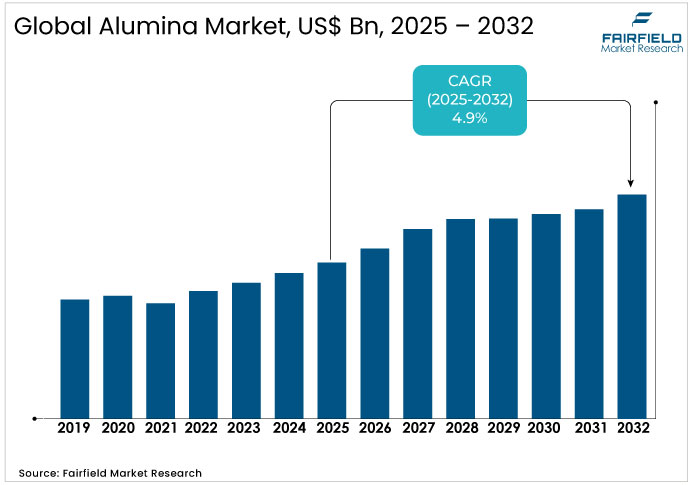

The alumina market is valued at USD 78.5 Bn in 2025 and is projected to reach USD 109.7 Bn by 2032, growing at a CAGR of 4.9%.

Alumina Market Summary: Key Insights & Trends

- Smelter Grade Alumina dominates the market with nearly 90% share, driven by its indispensable role in aluminum production across automotive and packaging sectors.

- Chemical Grade Alumina is the fast-expanding segment, gaining prominence in specialty applications such as ceramics, refractories, and advanced electronics.

- Aluminum Production accounts for about 85% of total alumina demand, supported by growing lightweight material adoption in transportation, aerospace, and infrastructure.

- Calcined Alumina strengthens its industrial presence through rising use in abrasives, refractories, and high-performance manufacturing applications.

- Rising demand for lightweight aluminum components continues to be a key driver, aligning alumina use with global decarbonization and circular economy goals.

- Southeast Asia, particularly Indonesia, emerges as a major growth hub as domestic refining mandates and joint ventures enhance regional alumina output.

- Asia Pacific not only dominates but also remains the fastest-growing region, led by China’s self-sufficiency push, Japan’s R&D focus, and India’s refining expansion initiatives.

Key Growth Drivers

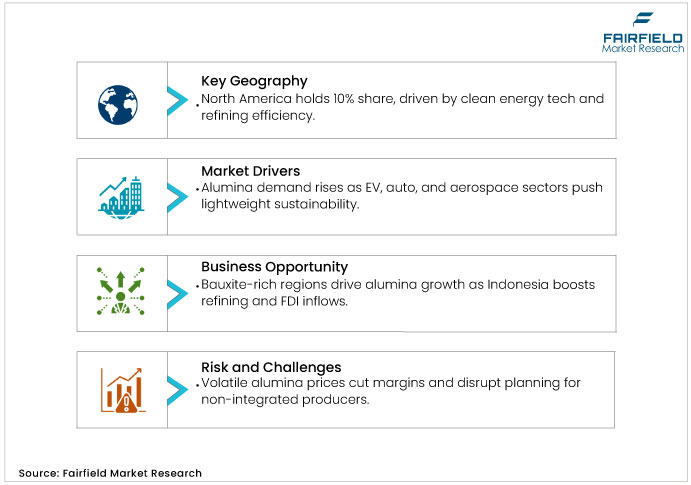

- Rising Alumina Demand Driven by Lightweight Aluminum Adoption in Key Industries

The Alumina Market thrives as industries prioritize lightweight materials to enhance efficiency and sustainability. Automotive and aerospace sectors lead this shift, integrating aluminum to reduce vehicle weight and improve fuel economy, thereby lowering emissions. This theoretical framework underscores how alumina, as the core precursor to aluminum, supports broader environmental goals without compromising structural integrity. Investments in electric vehicles amplify this demand, where alumina-derived components enable longer battery life and better performance. According to data from the International Aluminium Institute, global aluminum demand in transportation is expected to rise significantly, driven by policy mandates for greener technologies. Justification lies in alumina's role in enabling scalable production, fostering innovation in material science. As manufacturers adopt circular economy principles, alumina's recyclability becomes a key advantage, reducing dependency on primary resources and aligning with global net-zero ambitions.

- Expanding Infrastructure Projects Fuel Alumina Use in Durable Construction Materials

Infrastructure development propels the Alumina Market forward, with aluminum's durability and corrosion resistance making it ideal for building applications. Theoretical analysis reveals how urbanization in developing regions necessitates robust materials that withstand environmental stresses while minimizing maintenance costs. Governments worldwide invest in smart cities and renewable energy projects, where alumina-based aluminum facilitates efficient structures such as solar frames and high-speed rail systems. Statistics from the U.S. Geological Survey indicate that construction accounts for a substantial portion of aluminum consumption, justified by alumina's efficient refining processes that ensure high-quality output. This driver is further supported by economic recovery post-disruptions, encouraging theoretical supply chain optimizations for faster delivery. Alumina's versatility in alloys enhances theoretical performance metrics, such as tensile strength, making it indispensable. As theoretical frameworks such as sustainable development goals gain traction, alumina's low-carbon variants emerge, justifying increased R&D investments and market expansion.

Key Restraints

- Alumina Price Swings Undermine Profitability and Challenge Long-Term Market Stability

Price fluctuations in the market challenge profitability, as energy-intensive refining processes amplify cost sensitivities. Historical data from the London Metal Exchange indicates alumina spot prices swung 40% in 2022 due to supply disruptions, squeezing smelter margins to below 5%. Theoretically, real options theory explains how uncertainty deters hedging, leading to production curtailments when prices dip below US$400 per ton. This restraint hampers long-term planning, particularly for non-integrated players reliant on spot markets.

- Global Geopolitical Conflicts Reshape Alumina Trade Routes and Escalate Supply Costs

Geopolitical conflicts impede the Alumina Market by altering trade patterns and escalating logistics expenses. Sanctions on key producers such as Russia, which supplied 40% of European alumina in 2022 per USGS, reroute shipments, inflating freight costs by 20-30%. Agency theory highlights principal-agent misalignments in global chains, where policy shifts exacerbate shortages, delaying deliveries and inflating premiums.

Alumina Market Trends and Opportunities

- Rising Alumina Production in Southeast Asia Strengthens Global Supply Resilience

The Alumina Market unlocks substantial potential through regional production shifts in bauxite-rich areas, fostering export-oriented growth. Indonesia's processing mandates from 2023 compel domestic refining, potentially doubling output to 20 million tons by 2028, as outlined in national mining policies. Theoretically, comparative advantage theory supports this relocation, where lower labor and energy costs yield a 15% margin uplift over traditional hubs. This opportunity extends to joint ventures, attracting foreign direct investment (FDI) valued at US$10 billion annually per World Bank data, diversifying supply and buffering against Western disruptions. For stakeholders, it implies strategic alliances to capture 10-15% market share gains, emphasizing localization's role in resilience.

- Green Refining Innovations Propel Alumina Industry Toward Low-Carbon Transformation

Sustainability imperatives present a transformative opportunity as low-carbon processes align with global decarbonization agendas. Innovations such as residue neutralization reduce environmental footprints by 25%, enabling premium pricing for green alumina. Resource-based view theory posits that proprietary tech confers competitive moats, with early adopters achieving 20% efficiency gains. This pathway not only complies with regulations such as the EU's Carbon Border Adjustment Mechanism but also taps into ESG-driven financing, projected at US$50 billion by 2030 via International Finance Corporation estimates. Decision-makers can leverage this for portfolio diversification, mitigating regulatory risks while enhancing brand equity in eco-conscious segments.

Segment-wise Trends & Analysis

- Smelter Grade Alumina Dominates Market While Chemical Grade Gains Specialty Momentum

Smelter Grade Alumina commands current market leadership with approximately 90% share in 2025, valued at a dominant position due to its essential role in aluminum smelting. Its growth trajectory remains steady, driven by expanding aluminum demand in transportation and packaging, with underlying drivers including efficient electrolytic processes and global production ramps. Competitive positioning favors integrated players who control bauxite supplies, enabling cost advantages and supply chain resilience.

Chemical Grade Alumina emerges as the fast-growing segment, propelled by specialty applications in ceramics and refractories. Its trajectory accelerates with innovations in high-tech industries, driven by sustainability trends and material advancements. Positioning analysis reveals opportunities for niche suppliers to differentiate through purity enhancements, challenging dominant firms while capitalizing on premium markets.

- Aluminum Production Leads Demand While Calcined Alumina Rises in Industrial Uses

Aluminum Production leads with about 85% market share in 2025, underpinning the Alumina Market's core value through high-volume smelting operations. Growth follows aluminum's expansion in lightweight sectors, driven by efficiency demands and infrastructure investments. Competitively, vertically integrated companies hold strong positions, leveraging economies of scale for market dominance.

Calcined Alumina stands out as the emerging segment, growing via applications in abrasives and refractories. Its trajectory benefits from industrial modernization, with drivers such as enhanced durability needs. Positioning favors innovators focusing on customized formulations, eroding traditional boundaries, and opening new revenue streams.

Regional Trends & Analysis

North America Leads the Alumina Industry with Energy Efficiency and Recycling Integration

North America holds about 10% share in 2025, primarily through advanced refining capabilities in the U.S. Trends revolve around energy-efficient technologies and recycling integration, addressing environmental concerns. Drivers include automotive sector expansion, where lightweight materials reduce emissions. Supportive policies such as tax incentives for clean energy bolster margins, enhancing competitiveness.

U.S. Alumina Market – 2025 Snapshot & Outlook

Top trends in the U.S. market involve increased adoption of renewable energy in refining, driven by federal incentives under the Inflation Reduction Act, which offers tax credits up to 30% for sustainable projects. Government policies support margin advantages through reduced energy costs, positively impacting profitability by 15-20%. A consumer trend toward eco-friendly products is evident, with a U.S. Department of Energy survey indicating 65% of manufacturers prioritizing low-carbon alumina. This shift encourages innovation in process optimization.

The outlook for the U.S. market projects steady growth, fuelled by infrastructure investments that demand more aluminum. Supportive tax policies, including accelerated depreciation for mining equipment, enhance operational efficiency. Retail shifts toward sustainable sourcing, backed by regulator data from the EPA, show a 25% increase in certified green suppliers. These factors position the market for resilient expansion amid global uncertainties.

Asia Pacific Dominates Alumina Through Expanding Production and Urbanization Demand

Asia Pacific leads and drives the Alumina Market through massive production scales in China, Japan, and South Korea, with trends focusing on capacity expansions and import substitutions. China leads with policy-driven self-sufficiency, while Japan emphasizes high-tech applications. South Korea benefits from electronics demand, propelling innovation. Drivers include rapid urbanization and EV adoption, fostering integrated value chains.

Japan Alumina Market – 2025 Snapshot & Outlook

In Japan, the market trends toward precision engineering for electronics, driven by government subsidies for R&D in advanced materials. Margin advantages arise from efficient supply chains, reducing costs by 10-15% via localized sourcing. Supportive policies such as the Green Growth Strategy offer tax breaks for low-emission tech. A consumer trend, per METI survey, shows 70% preference for sustainable components in gadgets.

The outlook highlights growth from semiconductor demand, with policies enabling faster permitting for expansions. Retail shifts to high-purity alumina, supported by regulator data indicating a 20% rise in exports. These elements ensure competitive positioning, with mitigation against supply risks through diversification.

India Alumina Market – 2025 Snapshot & Outlook

India's market sees trends in domestic refining boosts, driven by the Production Linked Incentive scheme, offering up to 15% rebates on investments. Government policies enhance margins via duty exemptions on equipment imports. A consumer trend toward infrastructure materials is noted, with NITI Aayog data showing 55% growth in construction demand. This supports export-oriented strategies.

Future outlook involves capacity doublings, aided by tax policies for mineral exploration. Retail shifts emphasize affordable aluminum products, per regulator reports on a 30% increase in local consumption. Risk mitigation includes hedging against bauxite volatility through contracts.

Europe Accelerates Alumina Growth Through Sustainability and Circular Economy Goals

Europe emerges as a fast-growing region, with Germany and the U.K. leading through sustainability-focused trends. High energy costs drive efficiency innovations, while EU regulations promote circular models. Drivers encompass green transition goals, integrating alumina into renewable supply chains for broader adoption.

Germany Alumina Market – 2025 Snapshot & Outlook

Germany's market trends include decarbonization efforts, driven by the Energiewende policy, providing subsidies for renewable integration in refining. Margin advantages stem from efficient logistics, cutting costs by 12%. Tax policies support R&D credits up to 25%. A Bundesministerium survey reveals 60% industrial shift to low-carbon alumina.

Outlook anticipates expansion via EU funding, with policies easing permits for upgrades. Retail trends favor sustainable sourcing, per regulator data showing 22% demand rise. Mitigation strategies involve energy hedging to counter volatility.

U.K. Alumina Market – 2025 Snapshot & Outlook

The U.K. market emphasizes recycling trends, driven by Net Zero commitments offering grants for circular tech. Government policies enhance margins through VAT reductions on green materials. A BEIS survey indicates 68% consumer preference for eco-aluminum. This fosters innovation in waste recovery.

Projections show growth from aerospace demand, with tax incentives accelerating investments. Retail shifts to premium products, backed by regulator reports on 18% market increase. Risks such as supply disruptions are mitigated via diversified imports.

Competitive Landscape

Players in the Alumina Market focus on sustainability strategies to achieve cost reductions and regulatory compliance. This approach stems from global pressure for lower emissions, backed by investments in residue management technologies that cut waste by 20%. A notable event includes industry-wide commitments to carbon neutrality by 2050, enhancing brand value. Theoretical models show how such strategies build long-term resilience against policy changes.

M&A activities consolidate supply chains, impacting capacity by adding 10% output in key regions, while new regulations on emissions raise compliance costs. Early movers benefit from first-mover advantages in green markets, while latecomers may face higher entry barriers.

Key Companies

- China Hongqiao Group Co. Ltd.

- Rio Tinto Group

- Norsk Hydro ASA

- South32 Limited

- Aluminum Corporation of China Limited (Chalco)

- Alcoa Corporation

- United Company Rusal IPJSC

- Shandong Xinfa Aluminium Group

- Alumina Limited

- Jinjiang Group

- Hindalco Industries Limited

- Vedanta Limited

Recent Developments:

- August 2025: China Hongqiao Group reported a 35% year-on-year rise in H1 2025 net profit to RMB 12.36 billion, supported by firm aluminium prices and continued cost optimization. The company expanded its renewable and recycled-aluminium initiatives, reinforcing its leadership in low-carbon and sustainable metal production.

- October 2025: Rio Tinto Group introduced a new operating model structured around three core divisions — Iron Ore, Aluminium & Lithium, and Copper — to streamline operations and enhance shareholder value. The move supports its strategic focus on decarbonization and portfolio optimization across its global mining and materials business.

- February 2025: Norsk Hydro ASA partnered with Siemens Mobility and a European rail operator to launch Europe’s first train-to-train closed-loop aluminium recycling initiative. Hydro also achieved its 2025 CO₂ reduction target ahead of schedule and advanced projects in carbon capture and hydrogen to support sustainable metals production.

Global Alumina Market Segmentation -

By Grade

- Smelter Grade Alumina

- Chemical Grade Alumina

By Application

- Aluminum Production

- Calcined Alumina

- Alumina Hydrate

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Alumina Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Government Policies to Encourage Alumina Sustainability

2.7. Impact of Ukraine-Russia Conflict

2.8. Economic Overview

2.8.1. World Economic Projections

2.8.2. Electric Car Registrations and Market Share, 2019 - 2024

2.8.3. Per Capita Alumina Consumption, by Major Countries, 2025

2.9. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Global Bauxite Reserves, by Country, 2025

3.2. Global Bauxite Production, by Region, 2025

3.3. Global Smelter Grade Alumina Installed Capacity, by Region, 2019 - 2024

3.4. Global Alumina Production, by Region, 2025

3.5. Global Smelter Grade Alumina, Production, 2019 - 2024

3.6. Global Smelter Grade Alumina Production, 2019 - 2024

3.7. Smelter Grade Alumina Import Statistics, 2019 - 2024

3.8. Smelter Grade Alumina Export Statistics, 2019 - 2024

4. Price Trends Analysis and Future Projects, 2019 - 2032

4.1. Global Average Price Analysis, by Grade, US$ per Kg

4.2. Prominent Factors Affecting Alumina Prices

4.3. Global Average Price Analysis, by Region, US$ per Kg

5. Global Alumina Market Outlook, 2019 - 2032

5.1. Global Alumina Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Smelter Grade Alumina

5.1.1.2. Chemical Grade Alumina

5.2. Global Alumina Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Aluminum Production

5.2.1.2. Calcined Alumina

5.2.1.3. Alumina Hydrate

5.3. Global Alumina Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Alumina Market Outlook, 2019 - 2032

6.1. North America Alumina Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Smelter Grade Alumina

6.1.1.2. Chemical Grade Alumina

6.2. North America Alumina Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Aluminum Production

6.2.1.2. Calcined Alumina

6.2.1.3. Alumina Hydrate

6.3. North America Alumina Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. U.S. Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1.2. U.S. Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1.3. Canada Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1.4. Canada Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Alumina Market Outlook, 2019 - 2032

7.1. Europe Alumina Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Smelter Grade Alumina

7.1.1.2. Chemical Grade Alumina

7.2. Europe Alumina Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Aluminum Production

7.2.1.2. Calcined Alumina

7.2.1.3. Alumina Hydrate

7.3. Europe Alumina Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Germany Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.2. Germany Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.3. France Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.4. France Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.5. Norway Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.6. Norway Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.7. Iceland Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.8. Iceland Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.9. Sweden Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.10. Sweden Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.11. Slovakia Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.12. Slovakia Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.13. Russia Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.14. Russia Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.15. Rest of Europe Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1.16. Rest of Europe Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Alumina Market Outlook, 2019 - 2032

8.1. Asia Pacific Alumina Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Smelter Grade Alumina

8.1.1.2. Chemical Grade Alumina

8.2. Asia Pacific Alumina Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Aluminum Production

8.2.1.2. Calcined Alumina

8.2.1.3. Alumina Hydrate

8.3. Asia Pacific Alumina Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. China Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.2. China Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.3. Australia Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.4. Australia Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.5. India Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.6. India Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.7. Kazakhstan Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.8. Kazakhstan Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.9. Southeast Asia Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.10. Southeast Asia Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.11. Rest of Asia Pacific Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.12. Rest of Asia Pacific Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Alumina Market Outlook, 2019 - 2032

9.1. Latin America Alumina Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Smelter Grade Alumina

9.1.1.2. Chemical Grade Alumina

9.2. Latin America Alumina Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Aluminum Production

9.2.1.2. Calcined Alumina

9.2.1.3. Alumina Hydrate

9.3. Latin America Alumina Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Brazil Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.2. Brazil Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.3. Argentina Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.4. Argentina Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.5. Rest of Latin America Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.6. Rest of Latin America Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Alumina Market Outlook, 2019 - 2032

10.1. Middle East & Africa Alumina Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.1.1. Key Highlights

10.1.1.1. Smelter Grade Alumina

10.1.1.2. Chemical Grade Alumina

10.2. Middle East & Africa Alumina Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.2.1. Key Highlights

10.2.1.1. Aluminum Production

10.2.1.2. Calcined Alumina

10.2.1.3. Alumina Hydrate

10.3. Middle East & Africa Alumina Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1. Key Highlights

10.3.1.1. GCC Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.2. GCC Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.3. South Africa Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.4. South Africa Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.5. Iran Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.6. Iran Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.7. Egypt Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.8. Egypt Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.9. Mozambique Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.10. Mozambique Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.11. Rest of Middle East & Africa Alumina Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.12. Rest of Middle East & Africa Alumina Market by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Alumina Corporation of China Limited (Chalco)

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. China Hongqiao Group Co. Ltd.

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Shandong Xinfa Aluminium Group

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Rio Tinto Alcan

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Alcoa Corporation

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. United Company Rusal IPJSC

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Norsk Hydro ASA

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Alumina Limited

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. South32 Limited

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Hindalco Industries Limited

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Jinjiang Group

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Vedanta Limited

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Bn Volume: Kilo Tons |

||

|

REPORT FEATURES |

DETAILS |

|

Grade Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Production Output, Trade Statistics, Price Trend Analysis, Competition Landscape, Grade-, Application-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply), Key Market Trends |