Global Amphibious Excavator Market Forecast

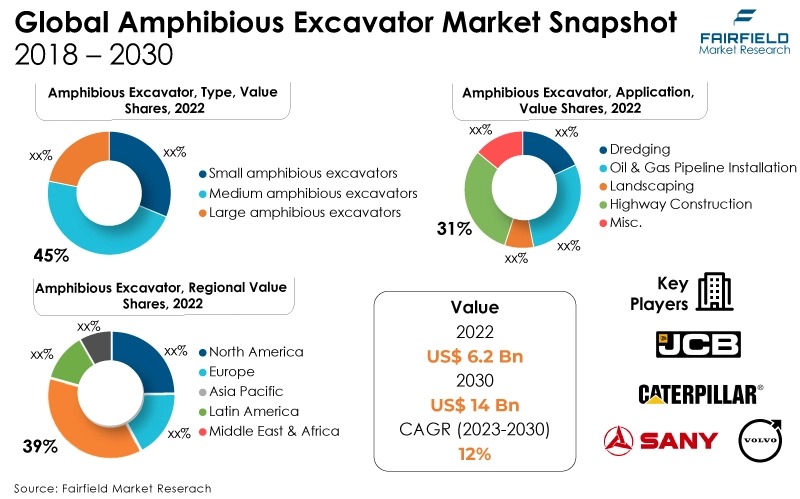

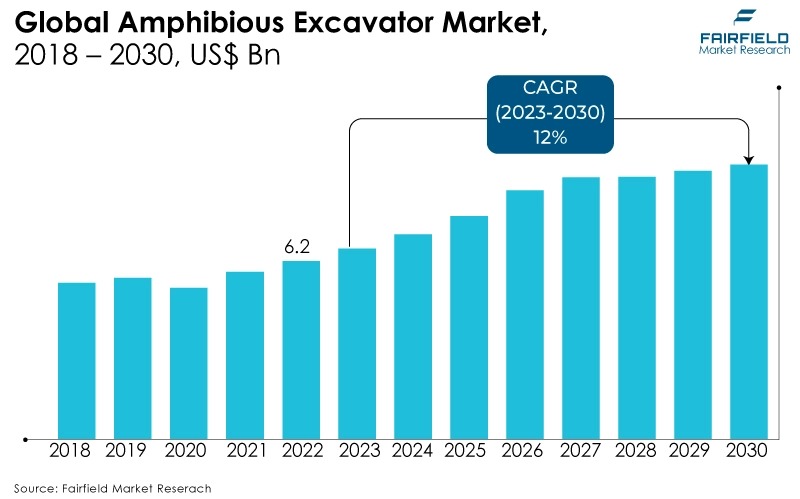

- Global market for amphibious excavators to reach nearly US$14 Bn in 2030, from US$6.2 Bn attained in 2022

- Market valuation anticipated to expand at a value CAGR of 12% during 2023 - 2030

Quick Report Digest

- The increased use of amphibious excavators for dredging is removing these elements from the bottom of various bodies of water and shifting them to new sites. In recent years, there has been increase in demand for waterborne trade, driven by economic growth and rise in demand for food and technological products. The rise in waterborne trade will drive the requirement for dredging significantly.

- Renting amphibious excavators rather than purchasing them is becoming more popular. This is due to the high cost of these machines, which not all construction companies can afford. Construction companies can save money by renting this equipment while still having access to them when needed.

- Amphibious excavators are used for a range of tasks, including dredging, pile driving, earthmoving, and other tasks. Manufacturers are always innovating and developing new applications for these machines to expand their usability and customer base.

- Amphibious excavators increasingly utilize new technologies such as GPS, remote control, etc. This allows operators to manage these devices and complete various duties more effectively.

- In terms of market share, medium amphibious excavator was the most preferred type globally. Medium amphibious excavators are typically employed by contractors working on huge projects such as dam construction or road construction where dredging works must be conducted alongside levee construction activities.

- In 2022, the highway construction was the most leading application category in the market. This device is highly beneficial in both marshes and wetlands. The usage of this equipment simplifies all construction activities. The employment of amphibious excavators has expanded for projects operating near riverbeds, oceanic shores, and areas where there have recently been floods.

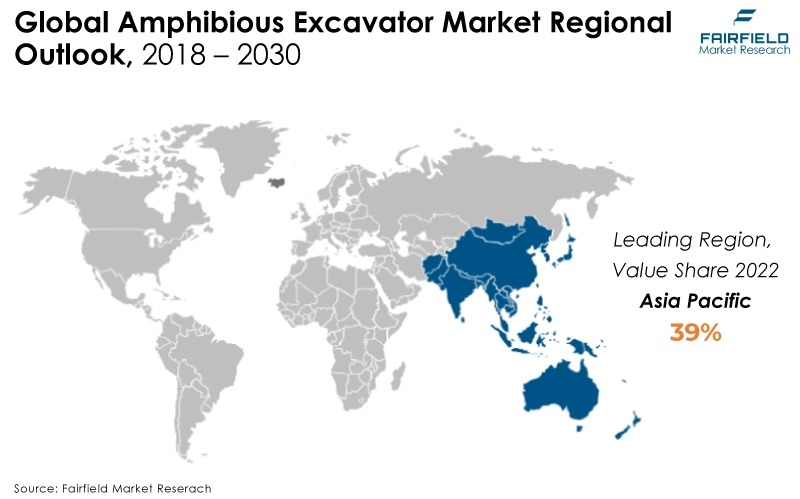

- Asia Pacific region held the largest share in the global amphibious excavator market, and it is predicted to grow rapidly throughout the forecast period. This is huge investment in infrastructure development operations, particularly in China and India.

- North America is also likely to experience the significant growth. Due to increased demand for land reclamation and infrastructure construction, such as golf courses, motorways, and airports, the region is predicted to grow.

A Look Back and a Look Forward - Comparative Analysis

The fact that these machines are getting more popular in developing countries aids the growth of the amphibious excavator market. However, the high cost of these excavators prevents this market from expanding as much as it could.

The construction business is expanding rapidly, which is propelling the market forward. This spread is being driven by population growth and economic development, particularly in Asia Pacific and Middle East & Africa. Amphibious excavators are in high demand due to the rising need for offshore oil and gas exploration, as well as other marine activities such as underwater building and maintenance.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the construction industry and the increased use of amphibious excavators due to their exceptional features.

The expansion of marine trade will present significant chances for this market's growth in the next years. The construction of seaports will further enhance demand for this excavator. Along with the construction of new seaports, the rehabilitation of existing ones will aid in market expansion. These excavators are also used to clean the water in wires and bodies of water.

Key Growth Determinants

- Rising Dredging Activities

Dredging is the process of excavating silt from the bottom of a body of water and transporting it to a new place. The increase in water-borne trade in shallow waters around the world is driving up demand for dredging.

Dredging is essential so that water-borne traffic can pass freely through the body of water. Dredging is a common application for amphibious excavators around the world. As a result, an increase in dredging activity around the world stimulates the sale of amphibious excavators.

- Rapid Expansion of Construction Industry

Rapid urbanisation, as well as industrialisation, are also projected to play an important influence on market expansion throughout the forecast period. Dredging is particularly significant in regulating traffic in water bodies that are used for transportation.

As dredging activities expand around the world, the demand for amphibious excavators will rise, and sales of this equipment will contribute to a significant growth in revenue during the projection period.

- Rising Sea Trades to Drive Market Growth

Increased dredging efforts in shallow water bodies around the world will drive product sales in the future years. Increased maritime traffic and the development of new seaports, as well as the refurbishment of existing seaports, will drive market expansion.

According to reports, the requirement for cleaning water reservoirs and increasing water flow has prompted governments around the world to engage in dredging activities, resulting in a high demand for amphibious excavators.

A significant increase in water-borne commerce operations in shallow waters would increase the demand for dredging, driving market trends. Furthermore, the growing construction sector has significantly contributed to the amphibious excavator market share.

Major Growth Barriers

- High Cost of Amphibious Excavators

Ordinary excavators can only utilize certain cheaper welding wires due to price and cost, however, using more expensive and pricey quality welding wires can provide a longer service life for the excavator under varied difficult situations. However, the buying price of some of the higher-quality amphibious excavators is usually quite high.

If expensive excavators must be used for a building project, the cost can be much higher for projects. This has an impact on the overall project-building goals. This impedes the market growth.

- Lack of Awareness

A lack of knowledge and the high cost of ownership are impeding the growth of the amphibious excavator market. There is little to no understanding of the advantages these devices provide and how they can be employed in a variety of applications. As a result, these products have a small customer base.

Furthermore, amphibious excavators are expensive to buy and maintain. Because of the high cost, the number of potential clients who can afford to invest in these items is limited.

Key Trends and Opportunities to Look at

- Availability of Rental Services

One of the important trends that the amphibious excavator market foresees is the growing popularity of rental services. Renting rather than purchasing amphibious excavators is now an option. This is because not all construction companies have the financial means to purchase such expensive equipment. Thus, this trend will expedite the market’s expansion in the anticipated period.

- Increasing Adoption of New Technologies

Eco-friendly packaging options are created to reduce the environmental effects of packaging components and operations during their useful lives. These solutions seek to decrease resource consumption, encourage sustainability, and reduce waste.

Using packaging materials effectively and streamlining the packaging procedure to meet environmental objectives are the main concerns when discussing amphibious excavators.

- Rampant Population Growth, and Urbanisation

The focus on environmental remediation services is expected to be a key element in the global amphibious excavator market. In addition, the market growth is attributed to the increasing construction activities in various applications such as dredging and pipeline building increase.

The market for amphibious excavators will increase due to governments all over the world showing an interest in a clean environment and their various uses. Additionally, several companies in this area offer these services to the military and government. This is projected to have a beneficial impact on the market's growth in the future years.

How Does the Regulatory Scenario Shape this Industry?

The building and mining industries require more amphibious excavators, which is the primary factor driving the amphibious excavator market growth. In addition, programs to build infrastructure such as seaports, airports, and bridges in developing economies help the industry flourish.

In Japan, for example, the Ministry of Land, Infrastructure, Transport, and Tourism has initiated several projects targeted at strengthening public transport systems around the country. As part of these projects, the private sector will invest US$ 56 Bn on transit networks between 2022 and 2027.

Furthermore, several new train lines have been built or are being built across Japan to relieve congestion on current routes. This will drive up demand for amphibious excavators in China.

Fairfield’s Ranking Board

Top Segments

- Medium Amphibious Excavators Bestselling

Medium amphibious excavators will have the biggest market share in the future years. Even in recent years, this segment has dominated the market. The demand for medium-sized excavators will rise in the next years, as this size excavator is chosen for a variety of jobs that require excavators. These medium-sized excavators are widely utilised in the construction industry, including residential and commercial structures.

Furthermore, the small excavator category is projected to experience the fastest market growth. These mini excavators have more horsepower and weigh around 6 metric tonnes. These excavators are used for digging. Small-sized excavators will be in high demand in the next years since repairs are relatively inexpensive and depreciation is minimal.

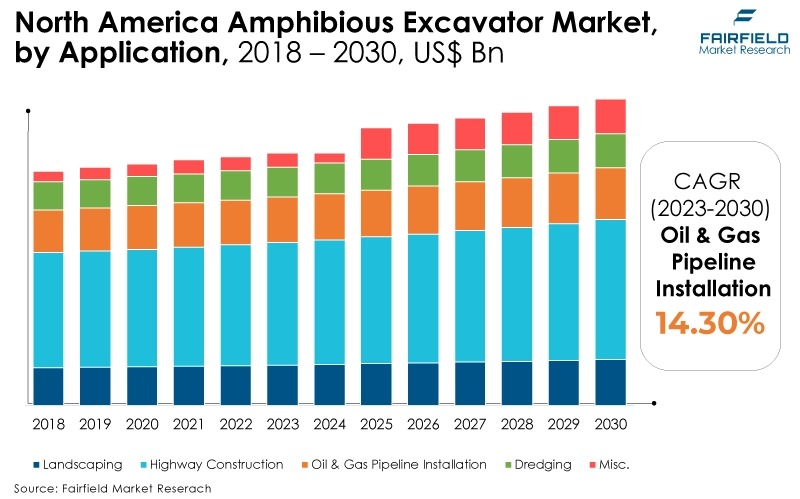

- Highway Construction Category Leads

In 2022, the highway construction category dominated the industry. Construction companies favour amphibious excavators for highway projects because they require continuous mobility between two points (either side). This equipment is ranked as the finest available alternative because it reduces the amount of time required to complete the procedure while also saving money.

In cases where there has recently been a calamity, such as a flood, the usage of amphibious excavators will give an efficient application. The oil and gas pipeline installation category is anticipated to grow substantially throughout the projected period.

Amphibious excavators are also employed in oil and pipeline installation to dig or dredge trenches and then place each pipe inside its trench with accuracy to avoid damage. They can conduct important jobs like this underwater because they have pontoons that provide buoyancy over water.

Regional Frontrunners

Asia Pacific at the Forefront

During the projection period, Asia Pacific region will dominate the amphibious excavator market. During the projected period, this region will experience tremendous growth and the greatest compound annual growth rate. Increasing global population, and industrialisation are among the factors that will drive market expansion throughout the forecast period.

As the construction sector grows in Asia Pacific region, these are the drivers that will drive significant growth. Additionally, in the next years, there will be an increasing demand for goods & and services related to the building industry. Due to population development, the Asia Pacific region will see an increase in the need for industrial and commercial construction.

North America Expects Significant Developments

North America region is expected to develop at a significant pace due to rising demand for land reclamation and infrastructure projects, such as golf courses, highways, and airports. Furthermore, the increase might be ascribed to rising demand for dredging activities in North America, owing to increased government investments in infrastructure development activities throughout the region.

Fairfield’s Competitive Landscape Analysis

The global amphibious excavator market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Amphibious Excavator Space?

- Volvo Construction Equipment

- Caterpillar, Inc.

- Liebherr Group

- JCB

- Sany Group

- XCMG

- Deere & Co.

- Hitachi Construction Machinery

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Kobelco Construction Machinery

- HD Hyundai Construction Equipment

- Komatsu Ltd.

- Doosan Group

- Sinoway Industrial (Shanghai) Co., Ltd.

- Ultratrex Machinery Sdn Bhd

Significant Company Developments

Purchase Agreement

- December 2022: The Agriculture Sector Development Unit (ASDU) of the Ministry of Agriculture organised a simple exercise to test and examine three freshly bought amphibious excavators as part of the government's continuing flood risk management program. The pieces of equipment were purchased for US$438,654,750.

Product Launches

- June 2021: Waterking BV has announced that their amphibious excavator models WK 95, WK 55, and WK 20 are now ES-TRIN certified. The WK 20 and WK 55 are the company's smallest models and are zone 4 ES-TRIN certified. According to the company, the WK 95 is ES-TRIN zone 3 and 4 certified.

- April 2019: REMU, the Finnish manufacturer of earthmoving products, said that the Big Float E15, built for 10-15-ton excavators, will be available in May, bringing the total number of Big Float models in the REMU E-Series to three.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s analysis, the focus on environmental remediation services is expected to be a key element in the global amphibious excavators market. Furthermore, this market is predicted to expand as construction activities in various applications such as dredging and pipeline building increase.

With governments around the world demonstrating interest in a clean environment, demand for amphibious excavators in a variety of applications will rise. Furthermore, several businesses in this market supply these services to the government and military sectors. This is projected to have a beneficial impact on the market growth in the future years.

Supply Side of the Market

Demand for this equipment is predicted to increase in the coming years due to its use on land and in water. Because of the large number of hydraulic motors in this equipment, it may also be employed in marshy areas and shallow water. The presence of a few leading players is making this market quite competitive.

Most of the market participants are working on better innovations with the help of new technologies, because of which they are delivering better output through their present items. Increased mergers and alliances between these organisations or corporations will also aid in business development.

Global Amphibious Excavator Market is Segmented as Below:

By Type:

- Small Amphibious Excavators

- Medium Amphibious Excavators

- Large Amphibious Excavators

By Application:

- Dredging

- Oil and gas pipeline Installation

- Landscaping

- Highway Construction

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & and Africa

1. Executive Summary

1.1. Global Amphibious Excavator Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Amphibious Excavator Market Outlook, 2018 - 2030

3.1. Global Amphibious Excavator Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Small amphibious excavators

3.1.1.2. Medium amphibious excavators

3.1.1.3. Large amphibious excavators

3.2. Global Amphibious Excavator Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Dredging

3.2.1.2. Oil and gas pipeline installation

3.2.1.3. Landscaping

3.2.1.4. Highway Construction

3.2.1.5. Misc.

3.2.2. Key Highlights

3.2.2.1. North America

3.2.2.2. Europe

3.2.2.3. Asia Pacific

3.2.2.4. Latin America

3.2.2.5. Middle East & Africa

4. North America Amphibious Excavator Market Outlook, 2018 - 2030

4.1. North America Amphibious Excavator Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Small amphibious excavators

4.1.1.2. Medium amphibious excavators

4.1.1.3. Large amphibious excavators

4.2. North America Amphibious Excavator Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Dredging

4.2.1.2. Oil and gas pipeline installation

4.2.1.3. Landscaping

4.2.1.4. Highway Construction

4.2.1.5. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Amphibious Excavator Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Amphibious Excavator Market Outlook, 2018 - 2030

5.1. Europe Amphibious Excavator Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Small amphibious excavators

5.1.1.2. Medium amphibious excavators

5.1.1.3. Large amphibious excavators

5.2. Europe Amphibious Excavator Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Dredging

5.2.1.2. Oil and gas pipeline installation

5.2.1.3. Landscaping

5.2.1.4. Highway Construction

5.2.1.5. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Amphibious Excavator Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Russia Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Russia Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Rest of Europe Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Rest of Europe Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Amphibious Excavator Market Outlook, 2018 - 2030

6.1. Asia Pacific Amphibious Excavator Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Small amphibious excavators

6.1.1.2. Medium amphibious excavators

6.1.1.3. Large amphibious excavators

6.1.1.4. Unmanned aerial vehicles

6.2. Asia Pacific Amphibious Excavator Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Dredging

6.2.1.2. Oil and gas pipeline installation

6.2.1.3. Landscaping

6.2.1.4. Highway Construction

6.2.1.5. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Amphibious Excavator Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Amphibious Excavator Market Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Amphibious Excavator Market Outlook, 2018 - 2030

7.1. Latin America Amphibious Excavator Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Small amphibious excavators

7.1.1.2. Medium amphibious excavators

7.1.1.3. Large amphibious excavators

7.2. Latin America Amphibious Excavator Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Dredging

7.2.1.2. Oil and gas pipeline installation

7.2.1.3. Landscaping

7.2.1.4. Highway Construction

7.2.1.5. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Amphibious Excavator Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Rest of Latin America Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Rest of Latin America Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Amphibious Excavator Market Outlook, 2018 - 2030

8.1. Middle East & Africa Amphibious Excavator Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Small amphibious excavators

8.1.1.2. Medium amphibious excavators

8.1.1.3. Large amphibious excavators

8.2. Middle East & Africa Amphibious Excavator Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Dredging

8.2.1.2. Oil and gas pipeline installation

8.2.1.3. Landscaping

8.2.1.4. Highway Construction

8.2.1.5. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Amphibious Excavator Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Rest of Middle East & Africa Amphibious Excavator Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Rest of Middle East & Africa Amphibious Excavator Market by Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Type vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Volvo Construction Equipment

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Caterpillar, Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Liebherr Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. JCB

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Sany Group

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Deere & Co.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Hitachi Construction Machinery

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Zoomlion Heavy Industry Science and Technology Co., Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Kobelco Construction Machinery

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Kobelco Construction Machinery

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. HD Hyundai Construction Equipment

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Komatsu Ltd.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Doosan Group

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Sinoway Industrial (Shanghai) Co., Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Ultratrex Machinery Sdn Bhd

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |