Global Anti-rheumatics Market Forecast

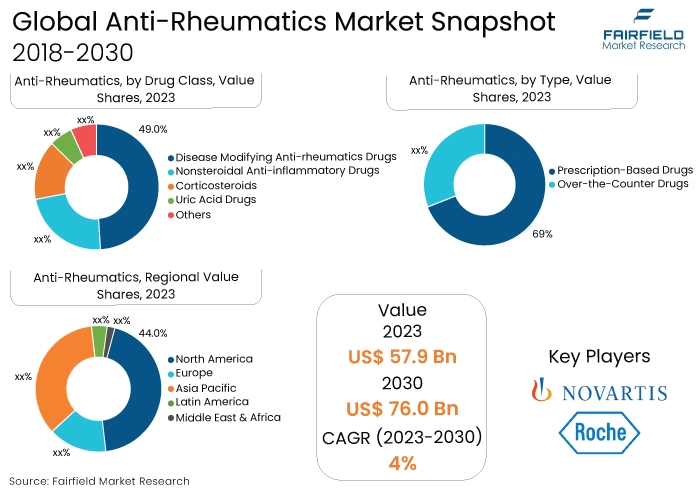

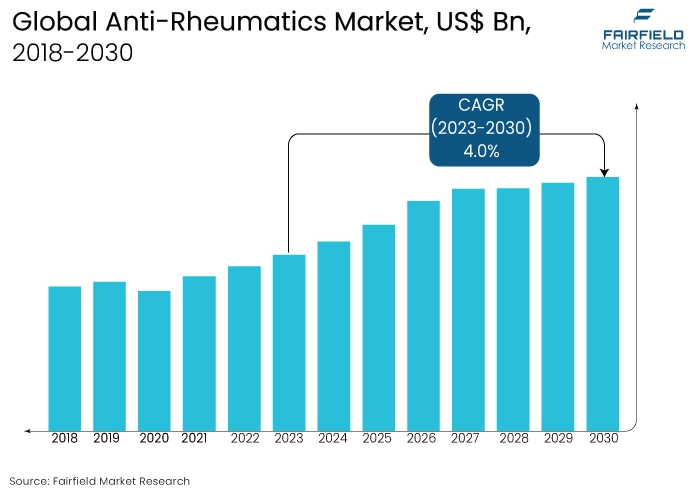

- Global anti-rheumatics market size to jump from US$57.9 Bn in 2023 to US$76.0 Bn in 2030

- Anti-rheumatics market revenue likely to see expansion at a CAGR of 4% between 2023 and 2030

Quick Report Digest

- The growing use of biologic treatments, such as TNF-alpha inhibitors and interleukin inhibitors, for the focused treatment of autoimmune disorders like rheumatoid arthritis is one trend in the worldwide anti-rheumatics industry.

- Combination therapy approaches, which involve using various anti-rheumatic medicines concurrently to improve disease control and symptom management in patients with rheumatic illnesses, are becoming more and more popular.

- The trend towards better efficacy, safety, and patient compliance in anti-rheumatic treatment regimens is being driven by ongoing developments in drug delivery technology, such as sustained-release formulations and innovative modes of administration.

- An increasing emphasis on precision therapeutics and personalised medicine is influencing the development of customised anti-rheumatic medicines. These approaches use patient-specific variables, genetic profiling, and biomarker testing to maximise therapeutic benefits and reduce side effects.

- Disease Modifying Anti-rheumatic Drugs (DMARDs) are anticipated to hold the largest market share among the sectors in 2023. Because of their capacity to delay the progression of the disease and their ability to modify it, DMARDs are regarded as the cornerstone of treatment for rheumatoid arthritis and other autoimmune disorders.

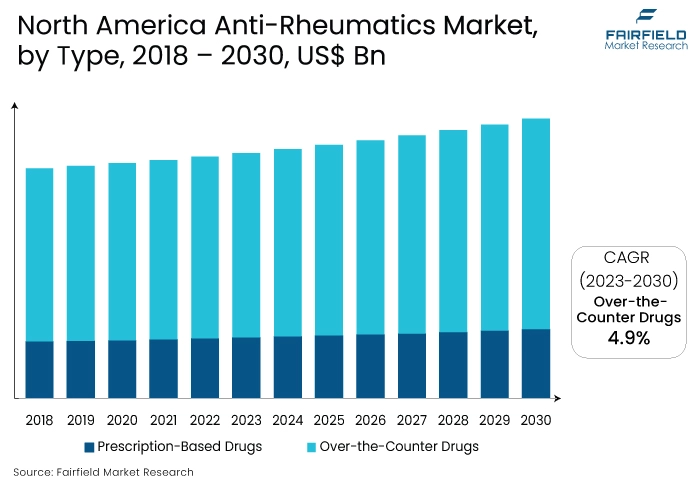

- In 2023, prescription drugs are anticipated to hold a dominant market share because rheumatic disorders are complex and require customised treatment strategies from medical specialists. Prescription anti-rheumatic drugs are used more often than over-the-counter alternatives.

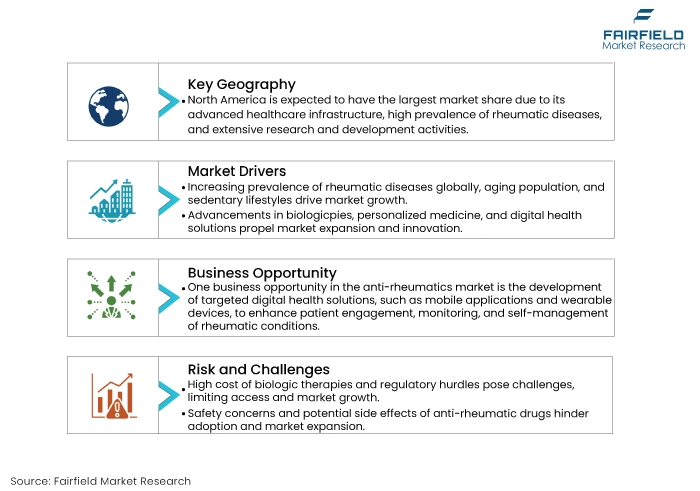

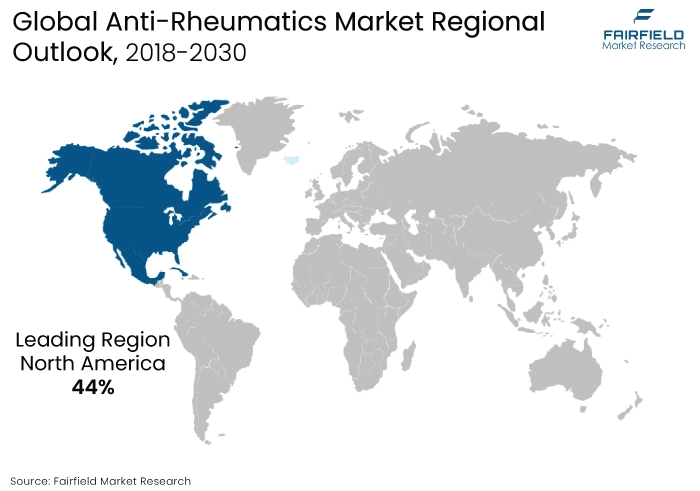

- Globally, North America is expected to have the highest market penetration. Anti-rheumatic drugs are frequently used in the area to treat lupus, osteoarthritis, rheumatoid arthritis, and other inflammatory diseases with an emphasis on lowering pain, swelling, and joint damage.

- It is anticipated that market penetration will rise at the quickest rate in Asia Pacific. Rising healthcare costs, an increase in the prevalence of rheumatic disorders, and better access to healthcare facilities drive the demand for anti-rheumatic drugs in the region. These drugs are especially important for managing osteoarthritis and rheumatoid arthritis.

A Look Back and a Look Forward - Comparative Analysis

Presently, the worldwide anti-rheumatics market is experiencing consistent expansion, propelled by the escalating incidence of rheumatic diseases, the expanding geriatric demographic, and developments in therapeutic alternatives. A wide range of drugs, such as biologics, DMARDs, NSAIDs, and corticosteroids, are available in the market to meet the different needs of patients. Targeted therapies and personalised medication are also receiving more attention, which is helping the industry grow.

Historically, the introduction of biologic medicines and the increase of treatment options for autoimmune disorders such as lupus and rheumatoid arthritis have driven significant growth in the anti-rheumatics industry. The market has grown over time due in large part to the use of combination therapies and improvements in drug delivery methods.

Antirheumatic drugs have a bright future ahead of them as long as research and development efforts continue to yield novel therapeutic approaches. It is projected that new medication delivery technologies, precision medicine strategies, and emerging biologic agents will change the industry by providing better patient outcomes, safety, and efficacy. Furthermore, rising healthcare costs, a larger patient base, and rising public awareness of rheumatic illnesses are probably going to fuel consistent market expansion in the years to come.

Key Growth Determinants

- Advancements in Biologic Therapies

The ongoing developments in biologic medicines significantly drive the anti-rheumatics market. Biologics offers tailored therapy techniques for autoimmune disorders such as psoriatic arthritis, ankylosing spondylitis, and rheumatoid arthritis.

Examples of these include B-cell-focused treatments, TNF-alpha inhibitors, and interleukin inhibitors. When compared to traditional disease-modifying drugs, these therapies show higher efficacy in lowering inflammation, managing disease activity, and delaying the course of the illness.

The creation of biosimilars has also improved treatment affordability and accessibility, which is propelling market expansion even more. Biologic therapies are expected to continue as a mainstay of the management of rheumatic diseases, propelling market expansion in the years to come, with research and development efforts concentrated on new biologic agents and customised medicine techniques.

- Increasing Prevalence of Rheumatic Diseases

One major factor propelling the anti-rheumatics industry is the increasing global prevalence of rheumatic disorders. Numerous causes, including sedentary lifestyles, ageing population demographics, and environmental variables, are contributing to the rising prevalence of illnesses like lupus, osteoarthritis, and rheumatoid arthritis.

There is an increasing need for efficient treatment alternatives because chronic illnesses have a major negative influence on patients' quality of life and come with high healthcare expenses.

The need for anti-rheumatic drugs is fuelled by this demographic trend, which also contributes to increased disease awareness and diagnostic rates, propelling market expansion. In addition, the development of treatment accessibility and healthcare infrastructure in developing nations supports market expansion.

- Focus on Early Diagnosis, and Intervention

The growing emphasis on early diagnosis and intervention represents a key driver for the anti-rheumatics market. Early detection and treatment initiation are crucial for preventing irreversible joint damage, deformities, and disability in rheumatic diseases. Consequently, healthcare providers and policymakers are increasingly promoting strategies for early screening, diagnosis, and referral of patients with symptoms suggestive of rheumatic conditions.

This proactive approach not only improves patient outcomes but also drives the demand for anti-rheumatic drugs, including DMARDs, NSAIDs, and corticosteroids. As a result, there is a shift towards aggressive treatment strategies aimed at achieving disease remission or low disease activity, further propelling market growth.

Major Growth Barriers

- High Expense of Biological Treatments

The high cost of biologic therapy severely constrains the market for anti-rheumatoid arthritis drugs. The high cost of developing, producing, and delivering these drugs places a significant financial strain on payers, healthcare systems, and patients. Biologics are frequently out of reach due to cost concerns, which impedes market expansion, especially in healthcare settings with limited resources.

- Potential Safety Concerns, and Side Effects

Side effects and safety issues associated with anti-rheumatic drugs are a hindrance to market expansion. Although biological medicines provide focused treatment modalities, there is a chance of severe infections, immune suppression, and unfavourable responses.

Furthermore, prolonged use of corticosteroids and NSAIDs is linked to renal, cardiovascular, and gastrointestinal problems, which restricts their general usage and acceptance. Because of these safety concerns, market dynamics are impacted by the need for rigorous risk-benefit analysis and monitoring.

Key Trends and Opportunities to Look at

- Rise in Demand for Biosimilars

In the anti-rheumatics sector, biosimilars are becoming more and more popular since they provide affordable substitutes for branded biologic treatments. Driven by the goal to lower healthcare costs and increase treatment accessibility, this movement is widespread.

Important companies like Novartis, and Pfizer are putting money into the development of biosimilars, increasing market share and rivalry. Brands will probably use biosimilars to increase their competitiveness in the market, provide more accessible treatment alternatives, and take advantage of the rising demand around the world.

- Personalised Medicines

In the anti-rheumatics industry, there is a shift towards personalised medicine with a growing emphasis on patient-specific treatment regimens, biomarker testing, and genetic profiling. Growing awareness of disease heterogeneity and improvements in precision medicine technologies are the main causes behind the increasing popularity of this approach in North America, and Europe.

Offering individualised treatment plans, businesses like Roche, and AbbVie are driving advancements in companion diagnostics and targeted therapies. Companies are expected to use personalised medicine to improve patient outcomes, increase treatment efficacy, and set themselves apart from competitors.

- Digital Health Solutions

The anti-rheumatics market is changing thanks to digital health tools that allow for remote monitoring, patient involvement, and therapy optimisation. Global telemedicine and wearable device use are the main drivers of this trend.

To improve disease management, businesses like Johnson & Johnson, and Eli Lilly are investing in digital health platforms that integrate data analytics and artificial intelligence. Brands will probably utilise digital health solutions to enhance patient adherence, gather real-time data, and provide value-added services that meet the changing demands and preferences of patients.

How Does the Regulatory Scenario Shape this Industry?

Regulatory frameworks are essential in the anti-rheumatoid arthritis industry because they guarantee the efficacy, safety, and quality of pharmaceutical goods. Important regulatory bodies are the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan, the European Medicines Agency (EMA) in Europe, and the Food and Drug Administration (FDA) in the United States.

Based on clinical trial results and compliance with regulatory standards, including Good Manufacturing Practice (GMP) and Good Clinical Practice (GCP), these agencies assess drug applications. By facilitating the approval and market access of biosimilar anti-rheumatic drugs, region-specific regulatory changes—like the US's Biologics Price Competition and Innovation Act (BPCIA) and the European Medicines Agency's biosimilar medicine guidelines—have an impact on market dynamics. Market participants must adhere to regulatory criteria in order to guarantee product approval and commercial success in various geographic areas.

Fairfield’s Ranking Board

Top Segments

- Disease Modifying Anti-rheumatic Drugs (DMARDs) to be Dominant in Sales

Disease modifying anti-rheumatic drugs (DMARDs) are anticipated to hold the biggest market share among the segments above. Because of their capacity to delay the progression of the disease and their ability to modify it, DMARDs are regarded as the cornerstone of treatment for rheumatoid arthritis and other autoimmune disorders. They are frequently given by medical professionals throughout the world, which greatly boosts the anti-rheumatics market's overall earnings.

The fastest-growing category is predicted to be uric acid drugs. This increase is ascribed to higher knowledge and diagnostic rates, as well as the growing prevalence of diseases like gout and hyperuricemia. In order to meet the unmet medical needs of patients with these disorders, the launch of innovative therapeutics targeting uric acid metabolism and urate-lowering drugs is anticipated to propel market expansion in this category.

- Prescription-based Drugs to Garner Higher Traction

Prescription-based drugs are anticipated to hold the most market share among the previously stated sectors. Healthcare practitioners frequently administer prescription-based drugs to treat rheumatic disorders like lupus, osteoarthritis, and rheumatoid arthritis. The fact that these drugs frequently need close observation and dosage modifications makes patients more dependent on the advice and prescriptions of healthcare professionals, which helps explain the segment's market dominance.

Over-the-counter (OTC) pharmaceuticals are expected to grow at the fastest rate. OTC anti-rheumatic drug availability in pharmacies and retail stores, along with rising consumer knowledge and self-care habits, are driving this growth. OTC medicine uptake is fuelled by price, accessibility, and ease of prescription-free shopping. This is especially true for mild to severe rheumatic symptoms. The demand for over-the-counter anti-rheumatic drugs is anticipated to increase gradually as customers want greater control over their healthcare choices; this will fuel the segment's quick market expansion.

Regional Frontrunners

North America to Occupy the Largest Market Share

In the worldwide anti-rheumatics market, North America is positioned to hold the largest share. The high frequency of rheumatic disorders, the sophisticated healthcare system, and the region's intensive R&D efforts are all contributing causes to this supremacy.

Strong regulatory frameworks and advantageous reimbursement policies also contribute to the growth of the market in North America. The region's leadership in the anti-rheumatics industry is being cemented by the research and product development driven by major pharmaceutical companies based in the US, and Canada.

Asia Pacific to be Highly Assertive in Compound Growth During Forecast

The anti-rheumatics market is predicted to develop at the quickest rate in Asia Pacific. The region's growing patient base, rising healthcare costs, and quick economic growth all support market expansion. The demand for anti-rheumatic medications is driven in Asia Pacific by increased knowledge of rheumatic disorders, better access to healthcare facilities, and the adoption of cutting-edge treatment methods.

Additionally, partnerships between pharmaceutical firms and government programs to improve the region's healthcare system and encourage illness management help to drive market expansion. Because of this, market participants in Asia Pacific have a lot of chances to build their businesses and take advantage of the rising demand for anti-rheumatic drugs.

Fairfield’s Competitive Landscape Analysis

Personalised medicine, digital health solutions, and a growing emphasis on biosimilars are the key factors propelling the market in terms of competition. Because biosimilars are more affordable than branded biologic medicines, manufacturer competition has increased.

Furthermore, personalised medicine techniques like genetic profiling and biomarker testing enable businesses to create customised treatments and set themselves apart from competitors.

Competition is further increased by the incorporation of digital health solutions, such as wearable technology and telemedicine, which improve patient outcomes and involvement during treatment. In general, businesses in the anti-rheumatoid drugs industry that innovate and adjust to these changes will have a competitive advantage.

Who are the Leaders in the Global Anti-rheumatics Space?

- Pfizer Inc.

- Novartis AG

- HOFFMANN LA ROCHE LTD

- Johnson & Johnson

- Eli Lilly And Company

- Abbvie Inc.

- Amgen Inc.

- BRISTOL - MYERS SQUIBB Company

- Merck & Co. Inc.

- UCB S.A.

- Celgene Corporations

- MedImmune, LLC

- Takeda Pharmaceutical Company Ltd.

- Biogen Inc.

- Celltrion Inc.

- Galapagos NV

- Mitsubishi Tanabe Pharma

- Boehringer Ingelheim Pharmaceuticals

- Gilead Sciences Inc.

Significant Company Developments

New Product Launch

- June 2023: In a Phase I study, Dr. Reddy's Laboratories Ltd. reported that DRL_TC, a tocilizumab biosimilar candidate, fulfilled both its primary and secondary endpoints effectively. The pharmacokinetic equivalency, safety, and immunogenicity of Dr. Reddy's tocilizumab biosimilar candidate were assessed in this Phase I research using an intravenous (IV) formulation in contrast to reference products.

- September 2022: The European Medicines Agency (EMA) has accepted the Marketing Authorization Application (MAA) for BIIB800, a biosimilar candidate that references RoACTEMRA, an anti-interleukin-6 receptor monoclonal antibody, according to a statement released by Biogen Inc. Additionally, patients with active systemic juvenile idiopathic arthritis who have not responded well to prior therapy with NSAIDs and systemic corticosteroids, as well as those with juvenile idiopathic polyarthritis who have not yet reached the age of two years old.

An Expert’s Eye

Demand and Future Growth

Several variables will persist in propelling the anti-rheumatics industry over time. First of all, as the world's population ages, rheumatic diseases will become more common, increasing the need for anti-rheumatic drugs. Furthermore, developments in customised medicine and biologic medicines will provide more focused and efficient treatment alternatives, which will accelerate market expansion.

In addition, there will be a greater need for anti-rheumatic medications due to increased patient awareness and diagnosis rates of rheumatic illnesses, particularly in developing nations. In general, the long-term market demand will be sustained by the rising prevalence of rheumatic disorders and the requirement for creative treatment approaches.

Supply Side of the Market

It is critical to conduct a comprehensive supply chain analysis in order to maximise cost reduction, streamline manufacturing procedures, and guarantee punctual delivery of anti-rheumatic medications. Purchasing raw materials, production productivity, logistics of distribution, and regulatory compliance are important factors to consider.

For improving the flexibility and resilience of the supply chain, distributors, contract manufacturers, and suppliers should form strong partnerships. Furthermore, supply chain visibility and responsiveness to market dynamics can be increased by utilising technology and data analytics. Industry participants can streamline operations, cut costs, and better meet changing market demands by improving the supply chain.

Global Anti-rheumatics Market is Segmented as Below:

By Drug Class:

- Disease Modifying Anti-rheumatics Drugs (DMARDs)

- Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

- Corticosteroids

- Uric Acid Drugs

- Others

By Type:

- Prescription-Based Drugs

- Over-the-Counter Drugs

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Anti-rheumatics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Anti-rheumatics Market Outlook, 2018 - 2030

3.1. Global Anti-rheumatics Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Disease Modifying Anti-rheumatics Drugs (DMARD's)

3.1.1.2. Nonsteroidal Anti-inflammatory Drugs (NSAID's)

3.1.1.3. Corticosteroids

3.1.1.4. Uric Acid Drugs

3.1.1.5. Others

3.2. Global Anti-rheumatics Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Prescription-Based Drugs

3.2.1.2. Over-the-Counter Drugs

3.3. Global Anti-rheumatics Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Anti-rheumatics Market Outlook, 2018 - 2030

4.1. North America Anti-rheumatics Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Disease Modifying Anti-rheumatics Drugs (DMARD's)

4.1.1.2. Nonsteroidal Anti-inflammatory Drugs (NSAID's)

4.1.1.3. Corticosteroids

4.1.1.4. Uric Acid Drugs

4.1.1.5. Others

4.2. North America Anti-rheumatics Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Prescription-Based Drugs

4.2.1.2. Over-the-Counter Drugs

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Anti-rheumatics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Anti-rheumatics Market Outlook, 2018 - 2030

5.1. Europe Anti-rheumatics Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Disease Modifying Anti-rheumatics Drugs (DMARD's)

5.1.1.2. Nonsteroidal Anti-inflammatory Drugs (NSAID's)

5.1.1.3. Corticosteroids

5.1.1.4. Uric Acid Drugs

5.1.1.5. Others

5.2. Europe Anti-rheumatics Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Prescription-Based Drugs

5.2.1.2. Over-the-Counter Drugs

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Anti-rheumatics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Anti-rheumatics Market Outlook, 2018 - 2030

6.1. Asia Pacific Anti-rheumatics Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Disease Modifying Anti-rheumatics Drugs (DMARD's)

6.1.1.2. Nonsteroidal Anti-inflammatory Drugs (NSAID's)

6.1.1.3. Corticosteroids

6.1.1.4. Uric Acid Drugs

6.1.1.5. Others

6.2. Asia Pacific Anti-rheumatics Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Prescription-Based Drugs

6.2.1.2. Over-the-Counter Drugs

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Anti-rheumatics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Anti-rheumatics Market Outlook, 2018 - 2030

7.1. Latin America Anti-rheumatics Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Disease Modifying Anti-rheumatics Drugs (DMARD's)

7.1.1.2. Nonsteroidal Anti-inflammatory Drugs (NSAID's)

7.1.1.3. Corticosteroids

7.1.1.4. Uric Acid Drugs

7.1.1.5. Others

7.2. Latin America Anti-rheumatics Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Prescription-Based Drugs

7.2.1.2. Over-the-Counter Drugs

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Anti-rheumatics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Anti-rheumatics Market Outlook, 2018 - 2030

8.1. Middle East & Africa Anti-rheumatics Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Disease Modifying Anti-rheumatics Drugs (DMARD's)

8.1.1.2. Nonsteroidal Anti-inflammatory Drugs (NSAID's)

8.1.1.3. Corticosteroids

8.1.1.4. Uric Acid Drugs

8.1.1.5. Others

8.2. Middle East & Africa Anti-rheumatics Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Prescription-Based Drugs

8.2.1.2. Over-the-Counter Drugs

8.2.2. Middle East & Africa Anti-rheumatics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.2.3. Key Highlights

8.2.3.1. GCC Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.2.3.2. GCC Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

8.2.3.3. South Africa Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.2.3.4. South Africa Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

8.2.3.5. Egypt Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.2.3.6. Egypt Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

8.2.3.7. Nigeria Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.2.3.8. Nigeria Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

8.2.3.9. Rest of Middle East & Africa Anti-rheumatics Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.2.3.10. Rest of Middle East & Africa Anti-rheumatics Market Type, Value (US$ Mn), 2018 - 2030

8.2.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Type Heatmap

9.2. Manufacturer vs Type Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Pfizer Inc.

9.5.1.1. Company Overview

9.5.1.2. Drug Class Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Novartis AG

9.5.2.1. Company Overview

9.5.2.2. Drug Class Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. HOFFMANN LA ROCHE LTD

9.5.3.1. Company Overview

9.5.3.2. Drug Class Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Johnson & Johnson

9.5.4.1. Company Overview

9.5.4.2. Drug Class Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Eli Lilly And Company

9.5.5.1. Company Overview

9.5.5.2. Drug Class Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Abbvie Inc.

9.5.6.1. Company Overview

9.5.6.2. Drug Class Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Amgen Inc.

9.5.7.1. Company Overview

9.5.7.2. Drug Class Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. BRISTOL - MYERS SQUIBB Company

9.5.8.1. Company Overview

9.5.8.2. Drug Class Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Merck & Co. Inc.

9.5.9.1. Company Overview

9.5.9.2. Drug Class Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. UCB S.A.

9.5.10.1. Company Overview

9.5.10.2. Drug Class Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Celegene Corporations

9.5.11.1. Company Overview

9.5.11.2. Drug Class Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. MedImmune, LLC

9.5.12.1. Company Overview

9.5.12.2. Drug Class Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Takeda Pharmaceutical Company Ltd.

9.5.13.1. Company Overview

9.5.13.2. Drug Class Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Biogen Inc.

9.5.14.1. Company Overview

9.5.14.2. Drug Class Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Celltrion Inc.

9.5.15.1. Company Overview

9.5.15.2. Drug Class Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Galapagos NV

9.5.16.1. Company Overview

9.5.16.2. Drug Class Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. Mitsubishi Tanabe Pharma

9.5.17.1. Company Overview

9.5.17.2. Drug Class Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

9.5.18. Boehringer Ingelheim Pharmaceuticals

9.5.18.1. Company Overview

9.5.18.2. Drug Class Portfolio

9.5.18.3. Financial Overview

9.5.18.4. Business Strategies and Development

9.5.19. Gilead Sciences Inc.

9.5.19.1. Company Overview

9.5.19.2. Drug Class Portfolio

9.5.19.3. Financial Overview

9.5.19.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Class Coverage |

|

|

Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |