Global ATV and UTV Market Forecast

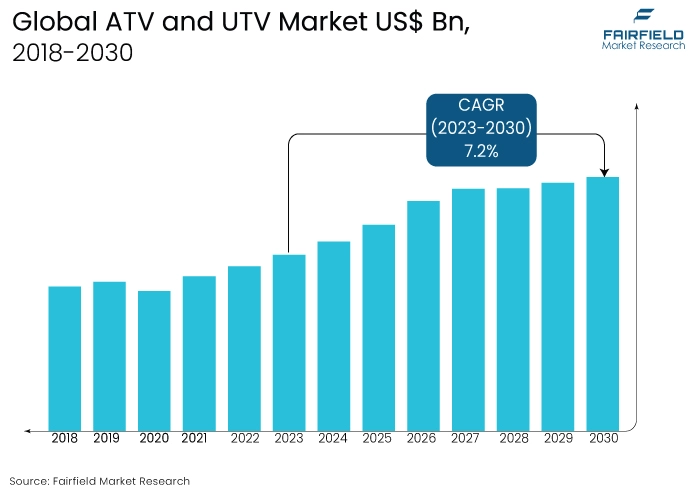

- The ATV and UTV Market is valued at USD 7.8 Bn in 2026 and is projected to reach USD 12.5 Bn, growing at a CAGR of 7% by 2033

Quick Report Digest

- The all-terrain vehicle (ATV), and utility task vehicle (UTV) market comprises off-road vehicles designed for diverse applications. ATVs are versatile, compact vehicles, while UTVs offer utility with seating for multiple occupants, emphasizing functionality in challenging terrains.

- The ATV and UTV market is propelled by increasing recreational activities, demand for efficient agricultural and industrial solutions, technological advancements enhancing vehicle capabilities, and a growing emphasis on off-road mobility for both leisure and commercial purposes.

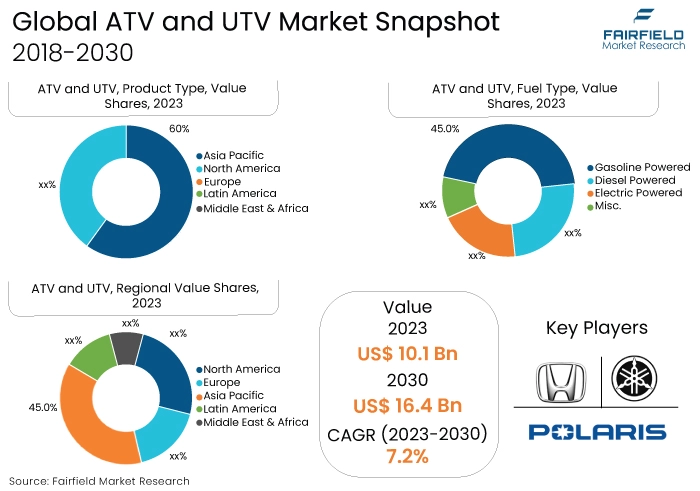

- Currently, the UTV segment dominates the market due to its versatility, and utility. UTVs' multi-passenger capacity, cargo capabilities, and adaptability across various applications contribute to their prominence over the more compact and sport-oriented ATV counterparts.

- Gasoline-powered vehicles remain the dominant choice in the ATV and UTV market, owing to their widespread availability and convenience. However, with increasing environmental concerns and advancements in technology, electric-powered options are gaining traction, especially in regions prioritising sustainability.

- Agriculture emerges as the largest end-use industry, with the demand for UTVs soaring for tasks like farming, livestock management, and crop monitoring. The military, construction, and forestry sectors also contribute significantly, utilising both ATV and UTV models for their specialised off-road capabilities.

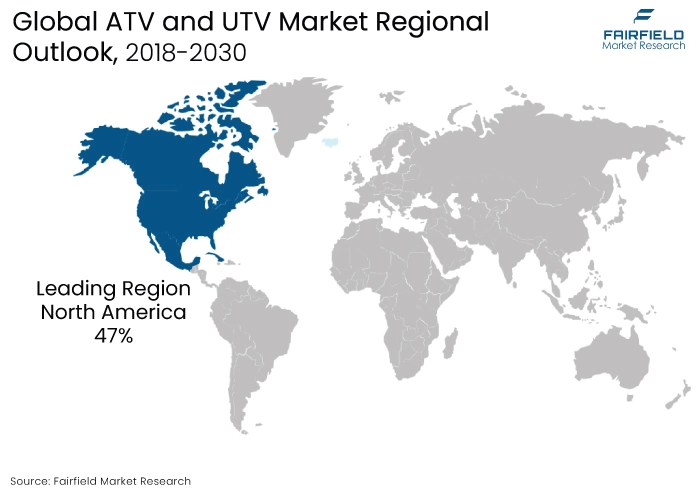

- North America leads the ATV and UTV market, fuelled by a strong recreational culture, expansive agricultural activities, and a robust industrial sector. Europe, and Asia Pacific follow closely, with varied applications in agriculture and industry driving demand. Latin America, the Middle East, and Africa exhibit potential growth, influenced by increasing off-road exploration and industrial expansion.

A Look Back and a Look Forward - Comparative Analysis

The ATV and UTV market is thriving, driven by diverse applications in recreation, agriculture, and industry. Robust demand for off-road mobility, technological advancements, safety features, and a focus on sustainability are shaping the current landscape, with UTVs leading due to their versatile utility.

Over the years, the ATV and UTV markets have witnessed significant evolution. Originating as recreational vehicles, their utility expanded into agriculture, construction, and military sectors. Technological advancements, safety enhancements, and market diversification mark the historical trajectory, reflecting the industry's adaptability.

The future of the ATV and UTV market envisions continued growth propelled by electric-powered innovations, autonomous capabilities, and increased connectivity. Sustainability will play a pivotal role in influencing product development. Integration of advanced safety features and expanding applications across emerging industries will define the industry's dynamic evolution.

Key Growth Determinants

- Rise in Demand for ATVs and UTVs in Military Activities

The ATV and UTV market are experiencing a remarkable surge in demand within military activities globally. Recognised for their agility, versatility, and adaptability to challenging terrains, ATVs and UTVs have become integral components of military operations. Armed forces worldwide are increasingly leveraging these vehicles for tasks such as surveillance, troop transport, and special missions.

The off-road capabilities of ATVs and the utility and capacity of UTVs make them indispensable in diverse military scenarios. This rise in demand underscores their strategic value in enhancing mobility and operational effectiveness, contributing significantly to the expansion and diversification of the ATV and UTV market within the defense sector.

- Government Rules in Favour of Driving ATVs and UTVs on Road

Governments globally are implementing regulations to support the on-road use of ATVs and UTVs, marking a significant development in the ATV and UTV market. Recognising the practical applications and recreational value of these vehicles, these rules aim to broaden market access and enhance safety standards for road usage.

By providing a regulatory framework, governments are encouraging responsible driving practices and integrating these versatile vehicles into daily transportation. This support not only expands the market's reach but also contributes to the normalisation of ATVs and UTVs as legitimate, road-legal modes of transport, fostering a positive environment for manufacturers and consumers in the ATV and UTV market.

- Increase in Recreational Activities, and Adventure Sports

The ATV and UTV markets are witnessing a robust expansion propelled by a significant increase in the trend of recreational activities and adventure sports. Enthusiasts are increasingly drawn to these vehicles for off-road exploration, trail riding, and participation in extreme sports. This surge in demand reflects a growing consumer preference for outdoor recreational pursuits, driving manufacturers to respond with innovative designs.

These vehicles offer not only exhilarating off-road experiences but also safety features tailored for adventure sports. The upward trajectory of recreational use and adventure sports participation significantly contributes to the diversification and sustained growth of the ATV and UTV markets.

Major Growth Barriers

- Ban on Driving ATVs and UTVs in Wildlife Areas Due to Terrain Damage

Environmental concerns have led to regulatory restrictions on ATV and UTV driving in wildlife areas, acknowledging the potential terrain damage caused by these off-road vehicles. The ban reflects a delicate balance between promoting recreational activities and preserving sensitive ecosystems. Manufacturers are adapting with eco-friendly designs and promoting responsible off-road practices to mitigate environmental impact, addressing this restraint while maintaining the appeal of ATV and UTV usage.

- High Maintenance Cost of ATVs and UTVs

A notable restraint in the ATV and UTV market is the high maintenance cost associated with these vehicles. Owners often face substantial expenses for specialised parts, repairs, and routine upkeep. This challenge impacts the overall ownership experience and may deter potential buyers. Manufacturers are actively addressing this concern by focusing on designing more durable and cost-effective models, aiming to enhance the vehicles' affordability and attract a wider consumer base

Key Trends and Opportunities to Look at

- Electric Power Adoption

The trend towards electric-powered ATVs and UTVs is rapidly growing, fuelled by environmental consciousness. Globally, regions like Europe and North America are leading this shift. Key players, including Polaris and Can-Am, are investing in electric models, anticipating heightened consumer demand and favourable regulatory environments, leveraging sustainability as a market differentiator.

- Connectivity, and Smart Features

The integration of connectivity and smart features in ATVs and UTVs is on the rise, enhancing user experience. This trend is gaining popularity across North America, and Asia Pacific. Companies like Yamaha and Honda are focusing on IoT integration, GPS navigation, and mobile app connectivity, foreseeing increased consumer demand for tech-enhanced off-road experiences.

- Versatility for Work and Recreation

There is a notable trend towards ATVs and UTVs designed for both work and recreation, offering versatility across diverse applications. This trend is prevalent globally, with brands like Kawasaki, and Arctic Cat emphasizing multi-purpose models. Companies are strategically developing models that cater to agricultural, industrial, and recreational needs, aiming to capture a broader market share.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a pivotal role in shaping the ATV and UTV industry. Government regulations influence vehicle design, safety standards, and permissible usage, significantly impacting market dynamics. Regulations supporting on-road usage contribute to increased market accessibility and a broader consumer base. Conversely, bans or restrictions in environmentally sensitive areas, such as wildlife habitats, address ecological concerns but may limit off-road opportunities.

The push towards electric-powered vehicles aligns with global environmental regulations, fostering innovation and sustainability within the industry. Stricter safety standards can lead to advancements in vehicle design. Overall, the regulatory landscape acts as a guiding force, influencing manufacturers to align with environmental, safety, and usage norms, ensuring a harmonious balance between industry growth and responsible practices.

Fairfield’s Ranking Board

Top Segments

- UTV Bestselling Product Type Category

The UTV product type commands the largest segment in the ATV and UTV market due to its unparalleled versatility, and utilitarian design. UTVs offer multi-passenger seating, robust cargo capacity, and adaptability across a spectrum of applications, from agricultural tasks to industrial use and recreational pursuits. Their ability to seamlessly transition between work and play, coupled with enhanced safety features, has elevated UTVs to a dominant position.

This product type's broad appeal and practicality across diverse industries contribute to its sustained popularity, making UTVs the go-to choice for consumers seeking a versatile, all-in-one off-road solution. The fastest-growing segment in the ATV and UTV market is the electric-powered UTV category. Fuelled by increasing environmental awareness and advancements in electric vehicle technology, this segment addresses sustainability concerns.

With a surge in demand for eco-friendly alternatives, electric-powered UTVs offer a clean, quiet, and efficient off-road solution. Stringent emission regulations and a global shift toward green mobility contribute to the rapid growth of electric UTVs. Manufacturers are investing heavily in research and development to capitalise on this trend, making electric-powered UTVs the forefront of innovation and expansion within the ATV and UTV market.

- Gasoline-Powered ATVs and UTVs Maintain Dominance Despite Popularity of Electric Counterparts

Gasoline-powered ATVs and UTVs dominate due to their widespread availability, convenience, and robust performance. This fuel type has long been the preferred choice for off-road enthusiasts, offering a balance of power and efficiency. Gasoline's accessibility, coupled with the versatility of these vehicles, has solidified its leading position in the market. While electric-powered models are gaining traction, the established infrastructure and consumer preference for gasoline-powered vehicles make it the prevailing and largest segment in the ATV and UTV market.

The fastest-growing fuel type in the ATV and UTV market is electric powered. As environmental consciousness intensifies, there's a notable shift towards cleaner, sustainable alternatives. Electric-powered ATV and UTV models offer reduced emissions, lower operational costs, and quieter performance, aligning with global trends favouring eco-friendly mobility solutions.

Governments' emphasis on green initiatives and the escalating demand for cleaner off-road vehicles propel the rapid growth of the electric-powered segment. Manufacturers are increasingly investing in electric technology, marking it as the forefront of innovation and a key driver of expansion in the ATV and UTV market.

- Demand Remains Strongest in Agriculture

The largest end-use industry segment in the ATV and UTV market is Agriculture. ATVs and UTVs play a pivotal role in modern farming practices, offering farmers versatile solutions for tasks such as crop monitoring, transportation, and livestock management. Their agility and off-road capabilities make them indispensable on agricultural terrains. As global agriculture embraces mechanisation and efficiency, the demand for ATVs and UTVs in the agricultural sector continues to surge, contributing significantly to their dominant position in the market.

Construction fastest-growing end-use industry segment in the ATV and UTV market. With increased construction and infrastructure projects globally, the demand for versatile, off-road vehicles has surged. ATVs and UTVs in the construction sector are utilised for tasks such as material transport, site surveying, and personnel movement, driving their accelerated growth. The industry's recognition of the efficiency and adaptability of these vehicles in diverse construction environments contributes to the fastest CAGR in this segment, making it a key focus for manufacturers and investors in the ATV and UTV market.

Regional Frontrunners

North America Retains Dominance on the Back of a Robust Off-road Culture

North America stands as the largest regional market in the ATV and UTV industry, accounting for a substantial market share. This dominance is attributed to a robust off-road culture, increasing recreational activities, and a strong demand from diverse sectors like agriculture, and construction.

Performance analysis reveals a consistent growth trajectory, propelled by evolving consumer preferences and technological advancements. Market share contribution from leading manufacturers like Polaris, Yamaha, and Honda underscores North America's pivotal role. Trends such as electric-powered models, and connectivity features are gaining traction, shaping the region's dynamic ATV and UTV market landscape.

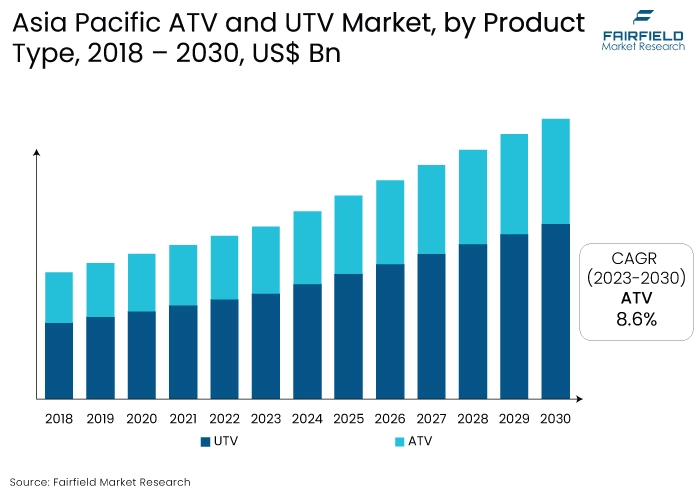

Momentum Builds Across Asia Pacific

Asia Pacific emerges as the fastest-growing regional market in the ATV and UTV industry. Fuelled by rising disposable incomes, growing interest in recreational activities, and expanding agricultural and industrial sectors, the region witnesses a robust uptick in demand. Performance analysis indicates a flourishing market, with trends like electric-powered vehicles gaining momentum.

Consumer analysis reveals a heightened enthusiasm for off-road experiences. Market share contributions from key players like Suzuki, and Kawasaki underscore the region's ascent. With increasing urbanisation and a burgeoning middle class, Asia Pacific represents a dynamic and lucrative market for ATV and UTV manufacturers, showcasing substantial growth potential.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the ATV and UTV market is intense, characterised by key players such as Polaris, Yamaha, and Honda. These industry leaders continually innovate, offering a wide array of models tailored for diverse consumer needs. Electric-powered vehicles and advanced connectivity features are emerging as focal points for differentiation.

Strategic partnerships, global expansions, and a focus on sustainability mark the competitive strategies. The market's dynamism is evident through constant technological advancements and a keen emphasis on consumer preferences, ensuring a vibrant and competitive environment where companies vie for market share by delivering cutting-edge solutions in the ever-evolving ATV and UTV market.

Who are the Leaders in the Global ATV and UTV Space?

- Polaris Inc.

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BRP Inc.

- Textron Inc.

- Suzuki Motor Corporation

- Kubota Corporation

- John Deere

- Can-Am

Significant Industry Developments

New Product Launch

- July 2023: RJWC Powersports, a leading manufacturer of high-performance ATV and UTV accessories, announced a new distribution partnership with Kimpex, a reputed distributor of aftermarket parts for ATV and UTV. This strategic collaboration will facilitate RJWC Powersport's expansion into the Canadian market.

- April 2023: Indian Manufacturer Powerland Tachyon developed a powerful new ATV for the United States and European markets. The developed product contains an all-wheel drive using four in-wheel motors. They offer 50 HP of peak power and 210 Nm Output torque. The product price in the US is estimated to be USD 15,000 before taxes.

An Expert’s Eye

Demand and Future Growth

The ATV and UTV market exhibit strong market demand and promising future growth. Increasing recreational activities, a surge in off-road adventures, and rising applications in agriculture, construction, and military sectors are driving this demand. As consumer preferences evolve, there is a growing emphasis on eco-friendly electric models.

The industry's future growth is propelled by technological advancements, connectivity features, and expanding market reach in regions like Asia Pacific. With a focus on sustainability and versatile applications, the ATV and UTV market is poised for continuous expansion, presenting manufacturers with opportunities for innovation and capturing a broader consumer base.

Supply Side of the Market

The supply side of the ATV and UTV market is robust, with manufacturers consistently meeting the demand for these off-road vehicles. Key industry players like Polaris, Yamaha, and Honda lead the market, offering a diverse range of models catering to various consumer needs. Production innovations, including electric-powered models, contribute to a dynamic supply landscape.

Manufacturers focus on enhancing durability, safety features, and technological advancements to maintain a competitive edge. With a global presence, the supply side is characterised by strategic partnerships, efficient distribution networks, and a continuous commitment to meeting the evolving demands of both recreational and industrial users in the ATV and UTV market.

Global ATV and UTV Market is Segmented as Below:

By Product Type:

- ATV

- UTV

By Fuel Type:

- Gasoline Powered

- Diesel Powered

- Electric Powered

- Misc

By End-use Industry:

- Agriculture

- Military

- Construction

- Forestry

- Misc

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

- Executive Summary

- Global ATV and UTV Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global ATV and UTV Market Outlook, 2020 - 2033

- Global ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- ATV

- UTV

- Global ATV and UTV Market Outlook, by Fuel Type, Value (US$ Mn), 2020-2033

- Gasoline Powered

- Diesel Powered

- Electric Powered

- Misc

- Global ATV and UTV Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Agriculture

- Military

- Construction

- Forestry

- Misc

- Global ATV and UTV Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- North America ATV and UTV Market Outlook, 2020 - 2033

- North America ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- ATV

- UTV

- North America ATV and UTV Market Outlook, by Fuel Type, Value (US$ Mn), 2020-2033

- Gasoline Powered

- Diesel Powered

- Electric Powered

- Misc

- North America ATV and UTV Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Agriculture

- Military

- Construction

- Forestry

- Misc

- North America ATV and UTV Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. ATV and UTV Market Outlook, by Product Type, 2020-2033

- S. ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- S. ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Canada ATV and UTV Market Outlook, by Product Type, 2020-2033

- Canada ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Canada ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Europe ATV and UTV Market Outlook, 2020 - 2033

- Europe ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- ATV

- UTV

- Europe ATV and UTV Market Outlook, by Fuel Type, Value (US$ Mn), 2020-2033

- Gasoline Powered

- Diesel Powered

- Electric Powered

- Misc

- Europe ATV and UTV Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Agriculture

- Military

- Construction

- Forestry

- Misc

- Europe ATV and UTV Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany ATV and UTV Market Outlook, by Product Type, 2020-2033

- Germany ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Germany ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Italy ATV and UTV Market Outlook, by Product Type, 2020-2033

- Italy ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Italy ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- France ATV and UTV Market Outlook, by Product Type, 2020-2033

- France ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- France ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- K. ATV and UTV Market Outlook, by Product Type, 2020-2033

- K. ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- K. ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Spain ATV and UTV Market Outlook, by Product Type, 2020-2033

- Spain ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Spain ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Russia ATV and UTV Market Outlook, by Product Type, 2020-2033

- Russia ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Russia ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Rest of Europe ATV and UTV Market Outlook, by Product Type, 2020-2033

- Rest of Europe ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Rest of Europe ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Asia Pacific ATV and UTV Market Outlook, 2020 - 2033

- Asia Pacific ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- ATV

- UTV

- Asia Pacific ATV and UTV Market Outlook, by Fuel Type, Value (US$ Mn), 2020-2033

- Gasoline Powered

- Diesel Powered

- Electric Powered

- Misc

- Asia Pacific ATV and UTV Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Agriculture

- Military

- Construction

- Forestry

- Misc

- Asia Pacific ATV and UTV Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China ATV and UTV Market Outlook, by Product Type, 2020-2033

- China ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- China ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Japan ATV and UTV Market Outlook, by Product Type, 2020-2033

- Japan ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Japan ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- South Korea ATV and UTV Market Outlook, by Product Type, 2020-2033

- South Korea ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- South Korea ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- India ATV and UTV Market Outlook, by Product Type, 2020-2033

- India ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- India ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Southeast Asia ATV and UTV Market Outlook, by Product Type, 2020-2033

- Southeast Asia ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Southeast Asia ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Rest of SAO ATV and UTV Market Outlook, by Product Type, 2020-2033

- Rest of SAO ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Rest of SAO ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Latin America ATV and UTV Market Outlook, 2020 - 2033

- Latin America ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- ATV

- UTV

- Latin America ATV and UTV Market Outlook, by Fuel Type, Value (US$ Mn), 2020-2033

- Gasoline Powered

- Diesel Powered

- Electric Powered

- Misc

- Latin America ATV and UTV Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Agriculture

- Military

- Construction

- Forestry

- Misc

- Latin America ATV and UTV Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil ATV and UTV Market Outlook, by Product Type, 2020-2033

- Brazil ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Brazil ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Mexico ATV and UTV Market Outlook, by Product Type, 2020-2033

- Mexico ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Mexico ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Argentina ATV and UTV Market Outlook, by Product Type, 2020-2033

- Argentina ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Argentina ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Rest of LATAM ATV and UTV Market Outlook, by Product Type, 2020-2033

- Rest of LATAM ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Rest of LATAM ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Middle East & Africa ATV and UTV Market Outlook, 2020 - 2033

- Middle East & Africa ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- ATV

- UTV

- Middle East & Africa ATV and UTV Market Outlook, by Fuel Type, Value (US$ Mn), 2020-2033

- Gasoline Powered

- Diesel Powered

- Electric Powered

- Misc

- Middle East & Africa ATV and UTV Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Agriculture

- Military

- Construction

- Forestry

- Misc

- Middle East & Africa ATV and UTV Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC ATV and UTV Market Outlook, by Product Type, 2020-2033

- GCC ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- GCC ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- South Africa ATV and UTV Market Outlook, by Product Type, 2020-2033

- South Africa ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- South Africa ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Egypt ATV and UTV Market Outlook, by Product Type, 2020-2033

- Egypt ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Egypt ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Nigeria ATV and UTV Market Outlook, by Product Type, 2020-2033

- Nigeria ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Nigeria ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- Rest of Middle East ATV and UTV Market Outlook, by Product Type, 2020-2033

- Rest of Middle East ATV and UTV Market Outlook, by Fuel Type, 2020-2033

- Rest of Middle East ATV and UTV Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa ATV and UTV Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Polaris Inc.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BRP Inc.

- Textron Inc.

- Suzuki Motor Corporation

- Kubota Corporation

- John Deere

- Can-Am

- Polaris Inc.

- 4.11.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Fuel Type Coverage |

|

|

End-Use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |