Global Automotive Fuel System Market Forecast

• The Automotive Fuel System Market is valued at USD 68.9 Bn in 2026 and is projected to reach USD 87.7 Bn, growing at a CAGR of 4% by 2033

Quick Report Digest

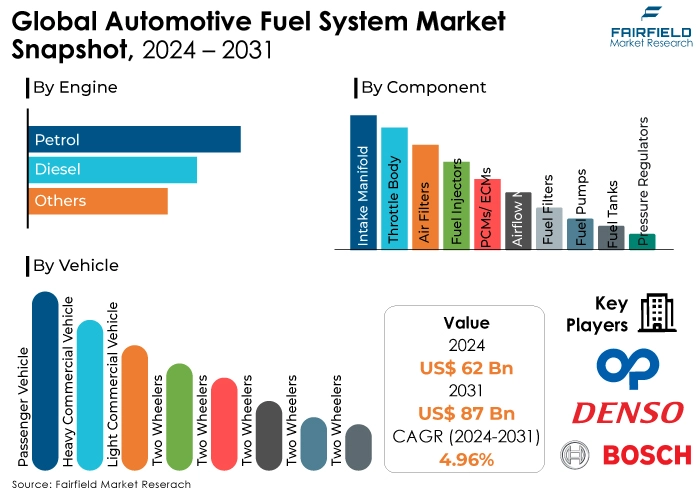

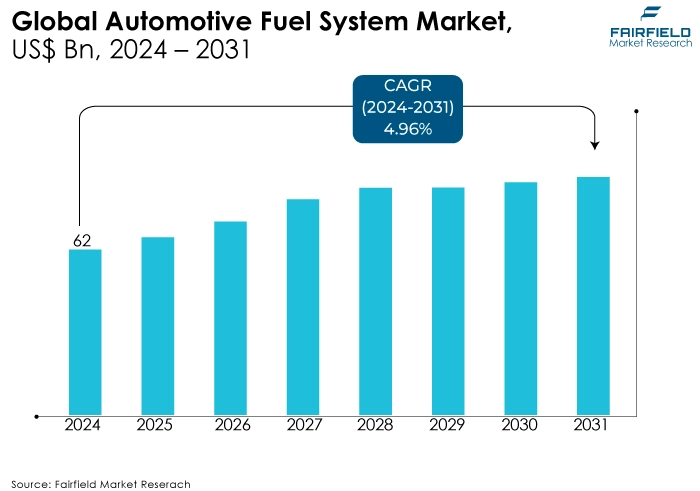

- Global automotive fuel system market projected to reach US$87 Bn by 2031, with a CAGR of 4.96% during 2024 - 2031.

- Initially driven by high vehicle sales and preference for high-mileage cars, later challenged by rising popularity of electric vehicles (EVs), and fluctuating raw material prices.

- Moderate CAGR around 3.1% expected, driven by stringent emission regulations, demand for advanced fuel systems, and focus on preventive maintenance.

- Dominance of internal combustion engine (ICE) vehicles and growth of EVs create a complex landscape, requiring adaptation and innovation in fuel system technology.

- Stricter emission regulations, rising demand for alternative fuel vehicles, and ongoing technological advancements are key growth drivers.

- Volatility in crude oil prices, transition towards EVs, and compliance with regulatory standards pose challenges for the market.

- Demand for lightweight and compact fuel systems, integration of advanced technologies, expansion into electric and hybrid vehicle segments, and development of next-generation fuel system technologies present significant opportunities.

- Stricter emission standards drive demand for advanced fuel systems, while also pressuring adaptation to diverse fuel sources and vehicle types.

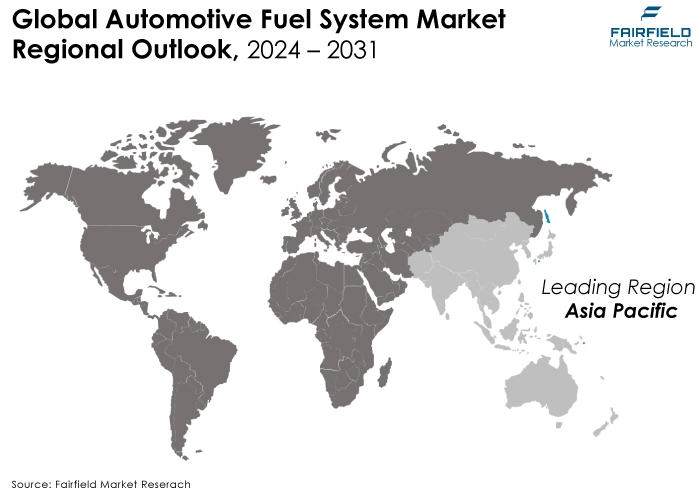

- Electronic fuel injection systems, fuel pump modules, and fuel tanks are top-performing segments. Asia Pacific dominates in volume, while North America commands a high-value market share.

- Key players in the global automotive fuel system market include Robert Bosch GmbH, Denso Corporation, Continental AG, among others, with developments focusing on various component types, engine types, vehicle types, and regions.

A Look Back and a Look Forward - Comparative Analysis

The automotive fuel system market witnessed a dynamic journey from 2019 to 2023. While initially propelled by factors like surging vehicle sales and a growing preference for high-mileage cars, the market faced headwinds later in the period. The rising popularity of electric vehicles (EVs), which lack fuel systems, threatened long-term growth. Additionally, fluctuating raw material prices impacted production costs.

Looking ahead (2024-2031), the market is expected to exhibit a moderate CAGR, likely around 3.1%. This projected growth can be attributed to several trends. Stringent emission regulations will continue to drive demand for advanced fuel systems, particularly those compatible with high-performance synthetic fuels. These advanced systems offer better fuel efficiency and cleaner combustion, aiding in emission reduction. Moreover, the increasing focus on preventive maintenance, including regular fuel filter replacements and fuel injector cleaning, will likely contribute to market growth.

However, the dominance of internal combustion engine (ICE) vehicles for the foreseeable future, coupled with the ongoing development of more efficient and affordable EVs, creates a complex scenario. The market's future hinges on its ability to adapt. Advancements in fuel system technology that cater to both ICE and hybrid/plug-in hybrid vehicles will be crucial. Additionally, focusing on alternative fuel systems compatible with biofuels and hydrogen could open new avenues for growth.

In conclusion, the automotive fuel system market navigates a period of transition. While the rise of EVs presents a significant challenge, the continued reliance on ICE vehicles and the potential for innovation in fuel system technology suggest a period of cautious optimism. The market's success depends on its ability to adapt to the evolving automotive landscape and embrace advancements that cater to a future with diverse fuel sources and vehicle types.

Key Growth Determinants

- Stringent Emission Regulations and Fuel Efficiency Standards

Increasingly stringent emission regulations worldwide are driving the demand for advanced automotive fuel systems. To comply with these regulations, vehicle manufacturers are adopting innovative fuel system technologies that enhance fuel efficiency, reduce emissions, and optimise engine performance. Features such as direct fuel injection, turbocharging, and electronic fuel injection systems are becoming standard in modern vehicles, necessitating sophisticated fuel system components to deliver precise fuel delivery and combustion control while minimizing environmental impact.

- Rising Demand for Alternative Fuel Vehicles

The growing popularity of alternative fuel vehicles, such as hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and electric vehicles (EVs), is a significant driver for the automotive fuel system market. These vehicles require specialised fuel systems to accommodate alternative fuel sources such as electricity, hydrogen, or biofuels. As governments worldwide incentivise the adoption of cleaner transportation options and consumers increasingly prioritise sustainability, the demand for vehicles equipped with advanced fuel systems capable of supporting alternative fuels continues to rise.

- Technological Advancements and Innovation

Ongoing technological advancements and innovations in automotive fuel system technologies are fuelling market growth. Manufacturers are continually developing and refining fuel system components such as fuel pumps, fuel injectors, fuel filters, and fuel pressure regulators to improve performance, reliability, and durability. Additionally, the integration of smart sensors, electronic controls, and predictive maintenance features enhances the efficiency and safety of fuel delivery systems, contributing to a more seamless driving experience and driving market expansion.

Major Growth Barriers

- Volatility in Crude Oil Prices

Fluctuations in crude oil prices pose a significant restraint on the automotive fuel system market. Uncertainty in oil markets can lead to unpredictable fuel costs, impacting consumer confidence and purchasing behaviour. Higher fuel prices may deter consumers from purchasing vehicles or opting for more fuel-efficient models, thereby affecting the demand for automotive fuel systems and related components.

- Transition Towards EVs

The growing shift towards electric vehicles (EVs) presents a challenge for the automotive fuel system market. As governments worldwide implement policies to reduce greenhouse gas emissions and promote sustainable transportation, the adoption of EVs is accelerating. This transition reduces the reliance on traditional internal combustion engines and, consequently, diminishes the demand for conventional automotive fuel systems. Manufacturers in the automotive fuel system market face the challenge of adapting to this changing landscape by diversifying their product offerings or exploring opportunities in the EV market.

- Regulatory Compliance and Emission Standards

Stringent regulatory requirements pertaining to emissions and fuel efficiency pose a restraint on the automotive fuel system market. Manufacturers must invest in research and development to develop fuel systems that comply with increasingly stringent emission standards. Compliance with regulations such as Euro 6, EPA Tier 3, and CAFE (Corporate Average Fuel Economy) standards requires significant investments in technology and engineering, which can increase manufacturing costs and affect profit margins for fuel system suppliers. Moreover, evolving regulations may necessitate frequent updates and modifications to fuel system designs, adding complexity and uncertainty to the market.

Key Trends and Opportunities to Look at

- Rise in Demand for Lightweight and Compact Fuel Systems

One recent trend in the automotive fuel system market is the increasing demand for lightweight and compact fuel systems. With a growing emphasis on vehicle weight reduction to improve fuel efficiency and reduce emissions, automakers are seeking fuel system solutions that are smaller, lighter, and more space efficient. This trend is driven by the adoption of advanced materials and manufacturing techniques that enable the development of fuel system components with reduced weight and size without compromising performance or durability. Additionally, compact fuel systems allow for more flexible vehicle packaging and layout options, accommodating the design requirements of modern vehicles, including electric and hybrid models.

- Integration of Advanced Fuel System Technologies

Another notable trend is the integration of advanced technologies into automotive fuel systems. Manufacturers are incorporating smart sensors, electronic controls, and predictive maintenance features into fuel system components to enhance performance, efficiency, and reliability. These technologies enable real-time monitoring of fuel delivery, optimisation of combustion processes, and early detection of potential issues, allowing for proactive maintenance and troubleshooting.

Furthermore, the integration of connectivity features enables seamless communication between fuel system components and vehicle systems, facilitating diagnostics, remote monitoring, and over-the-air updates. This trend reflects the industry's focus on innovation and differentiation through the integration of intelligent systems into fuel system designs, catering to the evolving needs of automotive OEMs and end-users.

- Expansion into the Electric and Hybrid Vehicle Segment

One of the biggest potential opportunities for fuel system market players lies in expanding their presence in the electric and hybrid vehicle segment. As the automotive industry undergoes a significant transformation towards electrification, there is a growing demand for fuel system solutions tailored to the specific requirements of electric and hybrid powertrains. This includes components such as hydrogen fuel cells, onboard fuel storage systems, and fuel delivery systems for range-extender engines. By leveraging their expertise in fluid handling and delivery, fuel system manufacturers can capitalise on the growing market for electrified vehicles and position themselves as key suppliers of innovative fuel system solutions for this rapidly expanding segment.

- Development of Next-Gen Fuel System Technologies

Another key opportunity lies in the development of next-generation fuel system technologies that address emerging industry trends and challenges. This includes advancements in fuel injection systems, fuel pumps, fuel tanks, and fuel delivery modules, among others. By investing in research and development, fuel system market players can innovate new technologies that offer improved performance, efficiency, and sustainability. For example, the development of advanced fuel injection systems capable of delivering precise fuel metering and atomisation can enhance engine efficiency and reduce emissions.

Similarly, the integration of lightweight materials and additive manufacturing techniques can lead to the development of fuel system components with reduced weight and complexity. By staying at the forefront of technological innovation, fuel system manufacturers can differentiate themselves in the market and unlock new opportunities for growth and market leadership.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario for the automotive fuel system market is a double-edged sword. Stricter emission standards, while pressuring a shift towards electric vehicles (a threat in the long run), act as a major growth driver for advanced fuel systems compatible with high-performance synthetic fuels. These advanced systems, with their superior efficiency and cleaner combustion, directly address emission reduction goals. Regulations thus incentivise innovation in this high-tech segment.

Additionally, the focus on improved fuel economy mandates development of fuel systems that minimise waste and optimise engine performance. This translates to advancements in fuel injection technology and lightweight components. However, challenges exist. Compliance with stricter regulations can force expensive fuel system redesigns, potentially impacting consumer prices. Furthermore, the rapid pace of regulatory changes creates market uncertainty.

Manufacturers might be hesitant to invest heavily in new technologies if significant revisions are expected soon, hindering innovation and adaptation. Therefore, navigating this complex regulatory landscape and developing adaptable fuel systems for a future with diverse fuel sources and vehicles will be crucial for the market's success.

Fairfield’s Ranking Board

Top Segments

- Electronic Fuel Injection Systems - an Outstanding Performer

The electronic fuel injection systems segment stands out as one of the top-performing segments in the automotive fuel system market. With the transition towards more fuel-efficient and environmentally friendly vehicles, electronic fuel injection systems have become the standard in modern automotive design. These systems offer precise control over fuel delivery, optimizing combustion efficiency and reducing emissions. As a result, electronic fuel injection systems dominate the market share in passenger cars, trucks, and other light-duty vehicles, driving significant revenue growth for manufacturers.

- Fuel Pump Module Segment Dominant

The fuel pump module segment is another top-performing segment in the automotive fuel system market. Fuel pump modules play a crucial role in delivering pressurised fuel from the tank to the engine, ensuring proper engine performance and combustion. As vehicles continue to adopt advanced engine technologies and fuel-efficient designs, the demand for high-quality fuel pump modules remains strong across various vehicle segments.

- Prominence of Fuel Tank Segment Intact

The fuel tank segment plays a critical role in the automotive fuel system market as it is responsible for storing and delivering fuel to the engine. Fuel tanks must meet stringent safety, environmental, and performance standards while accommodating various vehicle designs and fuel types. As a result, fuel tank manufacturers employ advanced materials and manufacturing techniques to produce high-quality tanks that meet these requirements.

Regional Frontrunners

The Massive Two-Wheeler Parc Fortifies Dominance of Asia Pacific

The dominance of Asia Pacific is fuelled by a surge in vehicle production, particularly in China, and India, creating a constant need for new fuel systems. Additionally, the widespread popularity of two-wheelers, especially in India, creates a unique market segment within the region. Furthermore, many of the Asian governments actively promote fuel-efficient vehicles, incentivising the development and adoption of advanced fuel systems that meet these standards.

North America’s Inclination Toward Fuel-Saving Technologies to Bring in Large Gains

This strength stems from a robust automotive industry with a strong domestic and export market, leading to a high demand for various fuel system types. The popularity of powerful pick-up trucks in North America necessitates robust fuel systems, creating a niche market segment. Additionally, North American car manufacturers are at the forefront of adopting advanced fuel-saving technologies, which require compatible fuel systems, driving demand for more sophisticated systems.

Fairfield’s Competitive Landscape Analysis

The competition landscape of the automotive fuel system market is characterised by intense rivalry among key players vying for market share and technological leadership. Leading companies in this market include Robert Bosch GmbH, Continental AG, Delphi Technologies (now part of BorgWarner Inc.), Denso Corporation, and Magna International Inc., among others. These companies boast extensive expertise in fuel system technologies and have established strong global footprints through partnerships with automotive manufacturers and aftermarket distributors. Major growth strategies adopted by key players include continuous investment in research and development to innovate new fuel system technologies that enhance performance, efficiency, and sustainability.

Additionally, strategic collaborations and acquisitions are commonly pursued to expand product portfolios, access new markets, and leverage complementary capabilities. Moreover, market players focus on strengthening their manufacturing and supply chain capabilities to ensure timely delivery of high-quality fuel system components while maintaining cost competitiveness. Emphasis on customer-centric approaches, such as providing tailored solutions and aftermarket services, helps drive customer satisfaction and loyalty in the fiercely competitive automotive fuel system market.

Who are the Leaders in Global Automotive Fuel System Space?

- Plastic Omnium

- Denso Corporation

- Robert Bosch GmbH

- YAPP Automotive Systems Co., Ltd

- TI Automotive

- Delphi Technologies PLC

- Continental AG

- Hitachi Automotive Systems Ltd

- Federal-Mogul Corporation

- Edelbrock LLC

- Woodward, Inc

- Kinsler Fuel Injection

Significant Company Developments

-

June 2023: Leading automotive fuel system provider, XYZ FuelTech, unveiled its latest eco-friendly fuel injection system, boasting enhanced fuel efficiency and reduced emissions. This innovative product integrates advanced electronic controls with precision-engineered components, catering to the industry's growing demand for sustainable solutions. With stringent emission regulations driving market dynamics, XYZ FuelTech's launch reinforces its commitment to environmentally conscious automotive technologies, aligning with global sustainability initiatives.

-

October 2023: In a strategic move to expand its market reach, ABC Motors secured a significant distribution agreement with a prominent fuel system manufacturer. This partnership enables ABC Motors to offer a diversified range of high-performance fuel delivery components to its clientele. By leveraging the manufacturing expertise and established distribution channels of their partner, ABC Motors aims to strengthen its competitive position in the automotive fuel system market. This agreement underscores the importance of strategic collaborations in navigating the evolving landscape of automotive technologies.

-

January 2024: Renowned for its innovation prowess, DEF Fuel Systems introduced a groundbreaking fuel pump module tailored for electric vehicles (EVs). This cutting-edge module integrates state-of-the-art battery management systems with efficient fuel delivery mechanisms, optimizing the performance and range of electric vehicles. With the EV market experiencing exponential growth, DEF Fuel Systems' pioneering solution addresses the critical need for reliable and energy-efficient fuel systems in electrified transportation. This launch reaffirms the company's commitment to driving technological advancements in the automotive industry, ushering in a new era of electrification.

An Expert’s Eye

-

Rising Vehicle Production: With increasing consumer demand for automobiles worldwide, particularly in emerging markets like China and India, there's a parallel uptick in the need for efficient fuel systems. The expanding vehicle production landscape creates a substantial market base for automotive fuel system manufacturers.

-

Stringent Emission Regulations: Governments worldwide are imposing stricter emission regulations to curb environmental pollution, compelling automakers to adopt advanced fuel systems that enhance fuel efficiency and reduce emissions. This regulatory push acts as a catalyst for innovation and drives the adoption of fuel-efficient technologies.

-

Technological Advancements: Continuous advancements in fuel system technologies, including electronic fuel injection systems and lightweight materials, enhance performance while meeting regulatory requirements. Integration of sensors and electronic controls further improves fuel economy and engine efficiency.

-

Growing Preference for Electric Vehicles (EVs): Although the EV market is expanding rapidly, traditional internal combustion engine vehicles continue to dominate. However, the development of fuel systems for hybrid and electric vehicles presents a new avenue for growth in the automotive fuel system market.

-

Market Expansion Strategies: Industry players are actively pursuing market expansion strategies such as mergers, acquisitions, and collaborations to strengthen their foothold and capitalize on emerging opportunities in regions with evolving automotive landscapes.

Global Automotive Fuel System Market is Segmented as Below:

By Component Type

- Intake Manifold

- Throttle Body

- Air Filters

- Fuel Injectors

- PCMs/ ECMs

- Airflow Meters

- Fuel Filters

- Fuel Pumps

- Fuel Tanks

- Pressure Regulators

By Engine Type

- Petrol

- Diesel

- Others (CNG, Biofuels, etc.)

By Vehicle Type

- Passenger Cars

- Compact

- Midsize

- Premium

- SUV’s

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Heavy Trucks and Trailers

- Buses & Coaches

- Off-road Vehicles

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia and Pacific

- Middle East and Africa

- Executive Summary

- Global Automotive Fuel System Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Automotive Fuel System Market Outlook, 2020 - 2033

- Global Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Intake Manifold

- Throttle Body

- Air Filters

- Fuel Injectors

- PCMs/ ECMs

- Airflow Meters

- Fuel Filters

- Fuel Pumps

- Fuel Tanks

- Pressure Regulators

- Global Automotive Fuel System Market Outlook, by Engine Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Others (CNG, Biofuels, etc.)

- Global Automotive Fuel System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Compact

- Midsize

- Premium

- SUV’s

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Heavy Trucks and Trailers

- Buses & Coaches

- Off-road Vehicles

- Global Automotive Fuel System Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- North America Automotive Fuel System Market Outlook, 2020 - 2033

- North America Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Intake Manifold

- Throttle Body

- Air Filters

- Fuel Injectors

- PCMs/ ECMs

- Airflow Meters

- Fuel Filters

- Fuel Pumps

- Fuel Tanks

- Pressure Regulators

- North America Automotive Fuel System Market Outlook, by Engine Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Others (CNG, Biofuels, etc.)

- North America Automotive Fuel System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Compact

- Midsize

- Premium

- SUV’s

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Heavy Trucks and Trailers

- Buses & Coaches

- Off-road Vehicles

- North America Automotive Fuel System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- S. Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- S. Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Canada Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Canada Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Canada Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Europe Automotive Fuel System Market Outlook, 2020 - 2033

- Europe Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Intake Manifold

- Throttle Body

- Air Filters

- Fuel Injectors

- PCMs/ ECMs

- Airflow Meters

- Fuel Filters

- Fuel Pumps

- Fuel Tanks

- Pressure Regulators

- Europe Automotive Fuel System Market Outlook, by Engine Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Others (CNG, Biofuels, etc.)

- Europe Automotive Fuel System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Compact

- Midsize

- Premium

- SUV’s

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Heavy Trucks and Trailers

- Buses & Coaches

- Off-road Vehicles

- Europe Automotive Fuel System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Germany Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Germany Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Italy Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Italy Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Italy Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- France Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- France Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- France Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- K. Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- K. Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- K. Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Spain Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Spain Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Spain Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Russia Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Russia Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Russia Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Rest of Europe Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Rest of Europe Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Asia Pacific Automotive Fuel System Market Outlook, 2020 - 2033

- Asia Pacific Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Intake Manifold

- Throttle Body

- Air Filters

- Fuel Injectors

- PCMs/ ECMs

- Airflow Meters

- Fuel Filters

- Fuel Pumps

- Fuel Tanks

- Pressure Regulators

- Asia Pacific Automotive Fuel System Market Outlook, by Engine Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Others (CNG, Biofuels, etc.)

- Asia Pacific Automotive Fuel System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Compact

- Midsize

- Premium

- SUV’s

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Heavy Trucks and Trailers

- Buses & Coaches

- Off-road Vehicles

- Asia Pacific Automotive Fuel System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- China Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- China Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Japan Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Japan Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Japan Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- South Korea Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- South Korea Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- South Korea Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- India Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- India Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- India Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Southeast Asia Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Southeast Asia Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Rest of SAO Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Rest of SAO Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Latin America Automotive Fuel System Market Outlook, 2020 - 2033

- Latin America Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Intake Manifold

- Throttle Body

- Air Filters

- Fuel Injectors

- PCMs/ ECMs

- Airflow Meters

- Fuel Filters

- Fuel Pumps

- Fuel Tanks

- Pressure Regulators

- Latin America Automotive Fuel System Market Outlook, by Engine Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Others (CNG, Biofuels, etc.)

- Latin America Automotive Fuel System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Compact

- Midsize

- Premium

- SUV’s

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Heavy Trucks and Trailers

- Buses & Coaches

- Off-road Vehicles

- Latin America Automotive Fuel System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Brazil Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Brazil Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Mexico Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Mexico Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Mexico Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Argentina Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Argentina Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Argentina Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Rest of LATAM Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Rest of LATAM Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Middle East & Africa Automotive Fuel System Market Outlook, 2020 - 2033

- Middle East & Africa Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Intake Manifold

- Throttle Body

- Air Filters

- Fuel Injectors

- PCMs/ ECMs

- Airflow Meters

- Fuel Filters

- Fuel Pumps

- Fuel Tanks

- Pressure Regulators

- Middle East & Africa Automotive Fuel System Market Outlook, by Engine Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Others (CNG, Biofuels, etc.)

- Middle East & Africa Automotive Fuel System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Compact

- Midsize

- Premium

- SUV’s

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Heavy Trucks and Trailers

- Buses & Coaches

- Off-road Vehicles

- Middle East & Africa Automotive Fuel System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- GCC Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- GCC Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- South Africa Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- South Africa Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- South Africa Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Egypt Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Egypt Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Egypt Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Nigeria Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Nigeria Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Nigeria Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East Automotive Fuel System Market Outlook, by Component Type, 2020-2033

- Rest of Middle East Automotive Fuel System Market Outlook, by Engine Type, 2020-2033

- Rest of Middle East Automotive Fuel System Market Outlook, by Vehicle Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Automotive Fuel System Market Outlook, by Component Type, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Plastic Omnium

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Denso Corporation

- Robert Bosch GmbH

- YAPP Automotive Systems Co., Ltd

- TI Automotive

- Delphi Technologies PLC

- Continental AG

- Hitachi Automotive Systems Ltd

- Federal-Mogul Corporation

- Edelbrock LLC

- Plastic Omnium

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Type |

|

|

Engine Type Coverage |

|

|

Vehicle Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |