Global Automotive Radiator Market Forecast

- The Automotive Radiator Market is valued at USD 11 Bn in 2026 and is projected to reach USD 15.8 Bn, growing at a CAGR of 5% by 2033.

Quick Report Digest

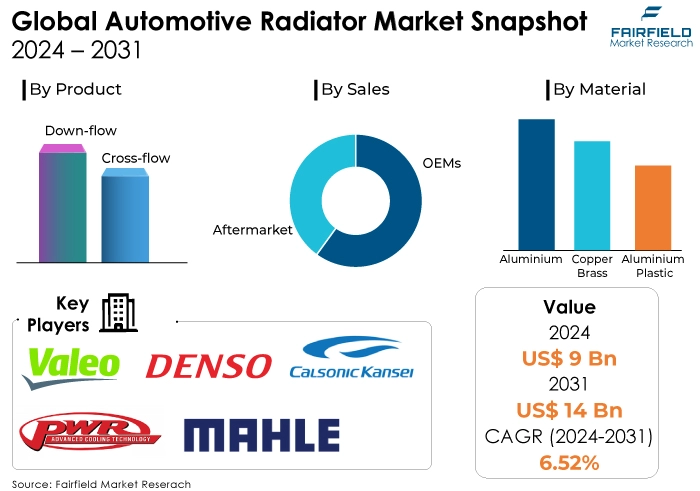

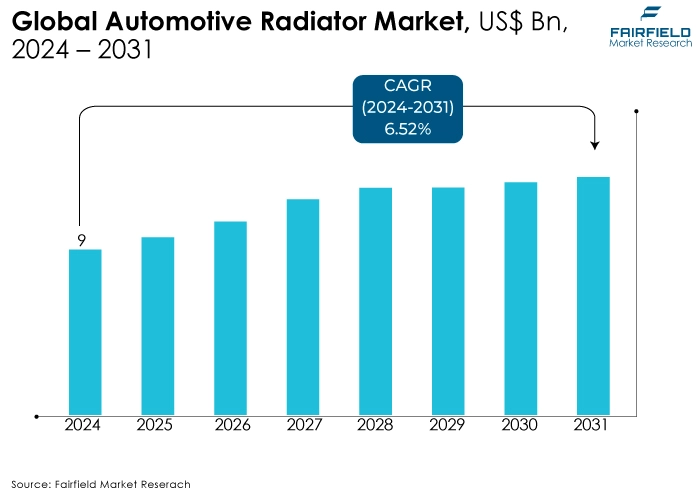

- Global automotive radiator market projected to reach US$14 Bn by 2031, with a CAGR of 6.52% from 2024 to 2031.

- Past growth attributed to rising global vehicle production and demand for higher-end radiators.

- Future growth driven by expansion of electric vehicle market and shift towards lightweight materials.

- Challenges include stringent emissions regulations and supply chain disruptions.

- Key growth determinants include the increasing vehicle production, stringent emission regulations, and technological advancements.

- Major growth barriers include regulatory compliance, rapid technological advancements favouring alternative cooling systems, and market saturation.

- Key industry trends include dominance of electric vehicles, emphasis on lightweight and efficient radiators, and integration of advanced cooling technologies.

- Regulatory landscape shapes market, driving innovation towards efficient and eco-friendly radiator solutions.

- Top segments of this market include electric vehicle radiators, performance and sports cars radiators, and radiators for commercial vehicles.

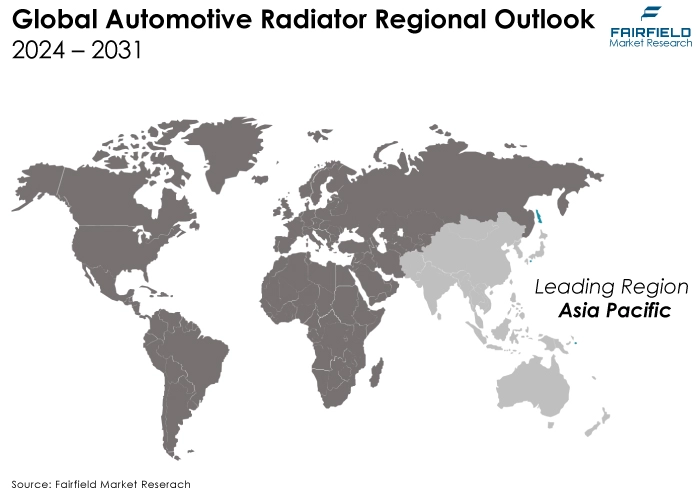

- Asia Pacific currently leads market due to rapid automotive industry expansion, followed by North America, further followed by Europe.

- Some of the key players include Valeo SA, Denso Corporation, and Mahle GmbH, with recent developments driving innovation.

A Look Back and a Look Forward - Comparative Analysis

The automotive radiator market experienced a positive trajectory from 2019 to 2023. While specific figures depend on the source, market size likely grew steadily. This growth can be attributed to factors like rising global vehicle production, particularly in emerging economies. Additionally, the increasing popularity of performance and luxury cars, which often require more sophisticated cooling systems, fuelled demand for higher-end radiators.

The market is expected to continue expanding at a healthy CAGR. Key drivers include the ongoing growth of the electric vehicle (EV) market. Though EVs do not require traditional radiators, they do possess thermal management systems that utilise components like radiators, creating a new demand area. Furthermore, stricter fuel efficiency regulations worldwide will push car manufacturers towards lightweight materials like aluminum, a trend that benefits the aluminum radiator segment.

However, the market also faces challenges. Stringent government regulations on emissions might limit the production of gasoline-powered cars, potentially impacting traditional radiator demand. Additionally, supply chain disruptions and fluctuating raw material prices could pose hurdles for manufacturers.

Overall, the automotive radiator market outlook is promising. The rise of EVs and aluminum radiators, coupled with continued global vehicle production, presents significant growth opportunities. However, navigating potential roadblocks like stricter regulations and supply chain issues will be crucial for market success.

Key Growth Determinants

- Increasing Vehicle Production

The automotive radiator market is driven by the continuous growth in global vehicle production. As the automotive industry expands, there is a corresponding rise in the demand for radiators to cool engines efficiently. Emerging markets such as China, India, and Brazil have witnessed significant growth in vehicle production, contributing substantially to the demand for radiators.

- Stringent Emission Regulations

With a growing emphasis on reducing vehicle emissions to meet environmental standards, automakers are increasingly adopting technologies that enhance engine efficiency. Radiators play a crucial role in maintaining optimal engine temperatures, thereby supporting the implementation of advanced engine designs and emission control systems. Compliance with stringent emission regulations worldwide is propelling the adoption of high-performance radiators.

- Technological Advancements

Ongoing technological advancements in radiator design and materials are fuelling market growth. Innovations such as aluminum-core radiators, which offer improved heat dissipation and lightweight construction, are gaining prominence. Additionally, the integration of smart sensors and advanced cooling systems enhances radiator efficiency and prolongs engine life, driving demand further. Continuous research and development efforts aimed at enhancing radiator performance and durability are key drivers shaping the automotive radiator market's growth trajectory.

Major Growth Barriers

- Regulatory Compliance

Stringent emission norms and safety regulations imposed by governments worldwide pose a significant challenge for the automotive radiator market. Compliance with these regulations necessitates costly modifications to radiator designs and materials, impacting profitability and market growth.

- Technological Advancements

The rapid evolution of automotive technology, including the emergence of electric vehicles (EVs) and hybrid vehicles, presents a restraint for traditional automotive radiator manufacturers. These newer vehicle types often employ alternative cooling systems or have different thermal management requirements, reducing the demand for conventional radiators.

- Market Saturation

In mature markets like North America, and Europe, the automotive radiator market faces saturation due to high market penetration and slower replacement rates. Additionally, the increasing durability and reliability of modern radiators have extended their lifespan, resulting in decreased aftermarket demand. This saturation limits growth opportunities for radiator manufacturers, compelling them to explore new markets or diversify their product offerings to sustain growth.

Key Trends and Opportunities to Look at

- Rapid Expansion of EVs

The automotive industry is witnessing a significant shift towards electric vehicles (EVs) driven by environmental concerns, government regulations, and technological advancements. With increasing awareness about climate change and the need to reduce greenhouse gas emissions, consumers are showing more interest in electric vehicles. This trend is prompting automotive radiator market players to innovate and develop radiators tailored for electric vehicles, which may require different cooling mechanisms compared to traditional internal combustion engine vehicles.

- Lightweight and Efficient Radiators

Another prominent trend in the automotive radiator market is the emphasis on lightweight and efficient radiators. Manufacturers are investing in research and development to create radiators that are lighter in weight while maintaining optimal cooling efficiency. This trend is fuelled by the automotive industry's pursuit of improved fuel efficiency and reduced emissions. Lightweight radiators not only contribute to better fuel economy but also enhance overall vehicle performance. Additionally, advancements in materials and manufacturing processes are enabling the production of radiators with better heat transfer capabilities, contributing to improved vehicle performance and longevity.

- Integration of Advanced Cooling Technologies

One significant opportunity for automotive radiator market players lies in the integration of advanced cooling technologies into radiator systems. With the increasing complexity of vehicle designs and the demand for higher performance, there is a growing need for innovative cooling solutions. Radiator manufacturers can capitalize on this opportunity by incorporating technologies such as variable airflow control, active grille shutters, and thermal management systems into their products. These advanced features not only enhance cooling efficiency but also contribute to overall vehicle efficiency and performance, presenting a competitive advantage in the market.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape plays a significant role in shaping the automotive radiator market. Stringent emission norms and regulations on fuel efficiency are pushing car manufacturers towards developing cleaner and more efficient engines. This translates to a demand for radiators that can manage thermal performance effectively. For instance, the growing popularity of hybrid vehicles necessitates not just traditional radiators but also additional low-temperature heat exchangers for dedicated battery cooling. These regulations also indirectly promote the development of advanced radiator materials that offer superior heat transfer capabilities while being lightweight to improve fuel efficiency.

Furthermore, regulations pertaining to material safety and recyclability are influencing radiator design and manufacturing processes. Manufacturers are increasingly exploring eco-friendly materials like aluminum alloys and high-performance plastics that comply with environmental regulations. Additionally, regulations mandating stricter safety standards for vehicles often have a ripple effect on radiator design, prompting the development of radiators that can withstand higher pressures and offer better corrosion resistance.

In essence, the regulatory scenario acts as a guiding force for the automotive radiator market, pushing innovation towards radiators that are not only efficient in heat management but also meet environmental and safety requirements. This creates a dynamic market environment where manufacturers constantly adapt and develop new radiator technologies to comply with evolving regulations.

Fairfield’s Ranking Board

Top Segments

Aluminium/Plastic Material to Dominate the Market Growth

Conventional copper and non-coated metal aluminium radiator have a lower propensity to rust and corrosion. Compared to brass and copper, it is less expensive and simpler to fix. Plastic/aluminium radiators are a less costly option as compared to other radiators. Aluminium/plastic material radiator are lighter which results in a car that uses less gasoline by the virtue of their light weight and aluminium radiators. These radiators are better heat conductors and heat absorbers that other materials, they speed up the cooling of heated coolant flowing through tubes.

Regional Frontrunners

- Automotive Radiator Market Shines the Brightest in Asia Pacific

Asia Pacific dominates the automotive radiator market due to the rapid expansion of the automotive industry in countries like China, India, Japan, and South Korea. The region's growing population, increasing disposable income, and urbanisation are driving the demand for automobiles, consequently boosting the need for radiators. Additionally, the presence of major automotive manufacturers and suppliers in this region contributes to its market dominance.

- Developed Western Regions Represent Sizeable Markets

North America holds a significant share in the automotive radiator market owing to the presence of established automotive manufacturers and a mature automotive industry. Stringent regulations regarding vehicle emissions and fuel efficiency further drive the demand for technologically advanced radiators in this region.

Europe is another prominent market for automotive radiators due to the presence of leading automotive manufacturers and the adoption of advanced technologies in the automotive sector. Additionally, strict emission norms and government initiatives promoting eco-friendly vehicles contribute to the growth of the radiator market in this region.

Fairfield’s Competitive Landscape Analysis

The automotive radiator market is highly competitive, characterised by the presence of several key players striving to enhance their market share. Leading companies include Valeo SA, Denso Corporation, Mahle GmbH, Modine Manufacturing Company, and Behr GmbH & Co. KG. These companies employ various growth strategies to maintain their competitive edge, including product innovations, strategic partnerships, mergers and acquisitions, and geographical expansion. Product innovation is a primary focus, with companies investing in research and development to introduce advanced radiator technologies that improve efficiency, durability, and performance.

Strategic partnerships and collaborations enable companies to leverage complementary strengths and expand their market reach. Mergers and acquisitions facilitate market consolidation and access to new technologies or customer segments. Geographical expansion allows companies to tap into emerging markets and diversify their revenue streams. Overall, these growth strategies contribute to the dynamic and competitive landscape of the automotive radiator market.

Who are the Leaders in the Automotive Radiator Market Space?

- Valeo S.A.

- PWR Advanced Cooling Technology

- Calsonic Kansei Corporation

- Denso Corporation

- MAHLE GmbH

- Zhejiang Yinlun Machinery Co.

- Ltd, Sanden Holdings Corporation

- T.RAD Co., Ltd

- TYC Brothers Industrial Co. Ltd.

- Nissens A/S

- Modine Manufacturing Company

- Keihin Corporation and Banco Products (I) Ltd.

Significant Company Developments

New Product Launch

- March 2024: In March 2024, Radiant Cooling Systems unveiled their revolutionary graphene-enhanced automotive radiator. This radiator promises superior heat dissipation and durability, improving vehicle performance while maintaining efficient cooling. Its innovative design is expected to set new standards in the automotive cooling industry, catering to the increasing demand for high-performance cooling solutions.

- February 2024: February 2024 witnessed the debut of CoolFlow's next-generation smart radiators. Equipped with advanced sensors and AI algorithms, these radiators autonomously regulate coolant flow, optimising engine temperature and fuel efficiency. CoolFlow's cutting-edge technology represents a significant leap forward in automotive cooling systems, offering drivers enhanced reliability and reduced maintenance costs.

Distribution Agreement

- January 2024: January 2024 marked a strategic partnership between Titan Automotive and a leading aftermarket parts distributor. This agreement enables Titan to expand its reach across key markets, ensuring broader accessibility to its premium radiators. With streamlined distribution channels, Titan aims to strengthen its market presence and provide customers with top-notch cooling solutions for various vehicle makes and models.

An Expert’s Eye

- Increasing Vehicle Production

With the automotive industry witnessing steady growth in vehicle production globally, the demand for automotive radiators is expected to rise correspondingly. Emerging markets, particularly in Asia-Pacific regions, are contributing significantly to this growth due to increasing urbanisation and rising disposable incomes.

- Technological Advancements

Continuous advancements in automotive radiator technologies, such as lightweight materials, improved heat dissipation capabilities, and enhanced durability, are driving market expansion. Manufacturers are focusing on developing innovative solutions to meet stringent emission regulations and improve fuel efficiency, further stimulating market growth.

- Ascending EV Adoption

The rising adoption of electric vehicles presents a new growth avenue for the automotive radiator market. EVs still require cooling systems, albeit of different designs, to manage battery temperatures and maintain optimal performance, creating additional demand for specialised radiators.

- Aftermarket Demand:

The aftermarket segment is expected to witness substantial growth due to the need for radiator replacements and maintenance services. As vehicles age and require servicing, the aftermarket for automotive radiators is projected to expand steadily.

The Global Automotive Radiator Market is Segmented as Below:

By Product Type

- Down-flow

- Cross-flow

By Sales Channel

- OEMs

- Aftermarket

By Vehicle

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

By Material

- Aluminium

- Copper / Brass

- Aluminium / Plastic

By Region

- North America

- Latin America

- Europe

- South Asia and Pacific

- East Asia

- Middle East and Africa

- Executive Summary

- Global Automotive Radiator Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Automotive Radiator Market Outlook, 2020 - 2033

- Global Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Down-flow

- Cross-flow

- Global Automotive Radiator Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- OEMs

- Aftermarket

- Global Automotive Radiator Market Outlook, by Vehicle, Value (US$ Mn), 2020-2033

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

- Global Automotive Radiator Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Aluminium

- Copper / Brass

- Aluminium / Plastic

- Global Automotive Radiator Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- North America Automotive Radiator Market Outlook, 2020 - 2033

- North America Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Down-flow

- Cross-flow

- North America Automotive Radiator Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- OEMs

- Aftermarket

- North America Automotive Radiator Market Outlook, by Vehicle, Value (US$ Mn), 2020-2033

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

- North America Automotive Radiator Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Aluminium

- Copper / Brass

- Aluminium / Plastic

- North America Automotive Radiator Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Automotive Radiator Market Outlook, by Product Type, 2020-2033

- S. Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- S. Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- S. Automotive Radiator Market Outlook, by Material, 2020-2033

- Canada Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Canada Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Canada Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Canada Automotive Radiator Market Outlook, by Material, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Europe Automotive Radiator Market Outlook, 2020 - 2033

- Europe Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Down-flow

- Cross-flow

- Europe Automotive Radiator Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- OEMs

- Aftermarket

- Europe Automotive Radiator Market Outlook, by Vehicle, Value (US$ Mn), 2020-2033

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

- Europe Automotive Radiator Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Aluminium

- Copper / Brass

- Aluminium / Plastic

- Europe Automotive Radiator Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Germany Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Germany Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Germany Automotive Radiator Market Outlook, by Material, 2020-2033

- Italy Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Italy Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Italy Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Italy Automotive Radiator Market Outlook, by Material, 2020-2033

- France Automotive Radiator Market Outlook, by Product Type, 2020-2033

- France Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- France Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- France Automotive Radiator Market Outlook, by Material, 2020-2033

- K. Automotive Radiator Market Outlook, by Product Type, 2020-2033

- K. Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- K. Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- K. Automotive Radiator Market Outlook, by Material, 2020-2033

- Spain Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Spain Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Spain Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Spain Automotive Radiator Market Outlook, by Material, 2020-2033

- Russia Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Russia Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Russia Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Russia Automotive Radiator Market Outlook, by Material, 2020-2033

- Rest of Europe Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Rest of Europe Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Rest of Europe Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Rest of Europe Automotive Radiator Market Outlook, by Material, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Asia Pacific Automotive Radiator Market Outlook, 2020 - 2033

- Asia Pacific Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Down-flow

- Cross-flow

- Asia Pacific Automotive Radiator Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- OEMs

- Aftermarket

- Asia Pacific Automotive Radiator Market Outlook, by Vehicle, Value (US$ Mn), 2020-2033

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

- Asia Pacific Automotive Radiator Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Aluminium

- Copper / Brass

- Aluminium / Plastic

- Asia Pacific Automotive Radiator Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Automotive Radiator Market Outlook, by Product Type, 2020-2033

- China Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- China Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- China Automotive Radiator Market Outlook, by Material, 2020-2033

- Japan Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Japan Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Japan Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Japan Automotive Radiator Market Outlook, by Material, 2020-2033

- South Korea Automotive Radiator Market Outlook, by Product Type, 2020-2033

- South Korea Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- South Korea Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- South Korea Automotive Radiator Market Outlook, by Material, 2020-2033

- India Automotive Radiator Market Outlook, by Product Type, 2020-2033

- India Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- India Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- India Automotive Radiator Market Outlook, by Material, 2020-2033

- Southeast Asia Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Southeast Asia Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Southeast Asia Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Southeast Asia Automotive Radiator Market Outlook, by Material, 2020-2033

- Rest of SAO Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Rest of SAO Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Rest of SAO Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Rest of SAO Automotive Radiator Market Outlook, by Material, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Latin America Automotive Radiator Market Outlook, 2020 - 2033

- Latin America Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Down-flow

- Cross-flow

- Latin America Automotive Radiator Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- OEMs

- Aftermarket

- Latin America Automotive Radiator Market Outlook, by Vehicle, Value (US$ Mn), 2020-2033

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

- Latin America Automotive Radiator Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Aluminium

- Copper / Brass

- Aluminium / Plastic

- Latin America Automotive Radiator Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Brazil Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Brazil Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Brazil Automotive Radiator Market Outlook, by Material, 2020-2033

- Mexico Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Mexico Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Mexico Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Mexico Automotive Radiator Market Outlook, by Material, 2020-2033

- Argentina Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Argentina Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Argentina Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Argentina Automotive Radiator Market Outlook, by Material, 2020-2033

- Rest of LATAM Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Rest of LATAM Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Rest of LATAM Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Rest of LATAM Automotive Radiator Market Outlook, by Material, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Automotive Radiator Market Outlook, 2020 - 2033

- Middle East & Africa Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Down-flow

- Cross-flow

- Middle East & Africa Automotive Radiator Market Outlook, by Sales Channel, Value (US$ Mn), 2020-2033

- OEMs

- Aftermarket

- Middle East & Africa Automotive Radiator Market Outlook, by Vehicle, Value (US$ Mn), 2020-2033

- Compact

- Sub-compact

- Mid-size

- Sedans

- Luxury

- Vans

- Middle East & Africa Automotive Radiator Market Outlook, by Material, Value (US$ Mn), 2020-2033

- Aluminium

- Copper / Brass

- Aluminium / Plastic

- Middle East & Africa Automotive Radiator Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Automotive Radiator Market Outlook, by Product Type, 2020-2033

- GCC Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- GCC Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- GCC Automotive Radiator Market Outlook, by Material, 2020-2033

- South Africa Automotive Radiator Market Outlook, by Product Type, 2020-2033

- South Africa Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- South Africa Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- South Africa Automotive Radiator Market Outlook, by Material, 2020-2033

- Egypt Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Egypt Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Egypt Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Egypt Automotive Radiator Market Outlook, by Material, 2020-2033

- Nigeria Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Nigeria Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Nigeria Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Nigeria Automotive Radiator Market Outlook, by Material, 2020-2033

- Rest of Middle East Automotive Radiator Market Outlook, by Product Type, 2020-2033

- Rest of Middle East Automotive Radiator Market Outlook, by Sales Channel, 2020-2033

- Rest of Middle East Automotive Radiator Market Outlook, by Vehicle, 2020-2033

- Rest of Middle East Automotive Radiator Market Outlook, by Material, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Automotive Radiator Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Valeo S.A.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- PWR Advanced Cooling Technology

- Calsonic Kansei Corporation

- Denso Corporation

- MAHLE GmbH

- Zhejiang Yinlun Machinery Co.

- Ltd, Sanden Holdings Corporation

- RAD Co., Ltd

- TYC Brothers Industrial Co. Ltd.

- Nissens A/S

- Valeo S.A.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Sales Coverage |

|

|

Vehicle Coverage |

|

|

Material Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |