AUV & ROV Market Growth and Industry Forecast

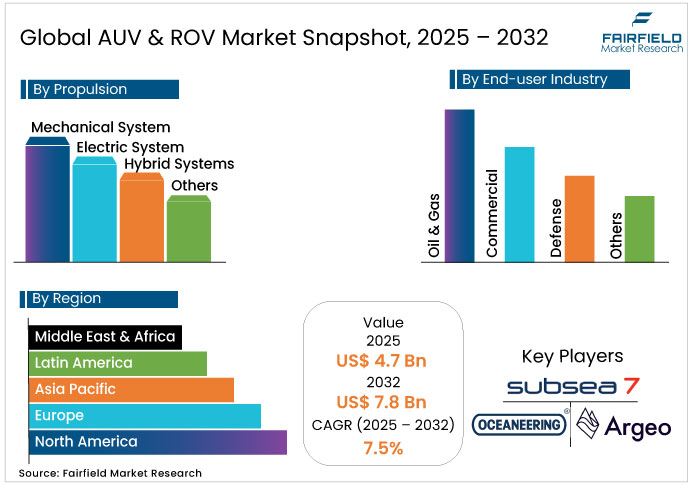

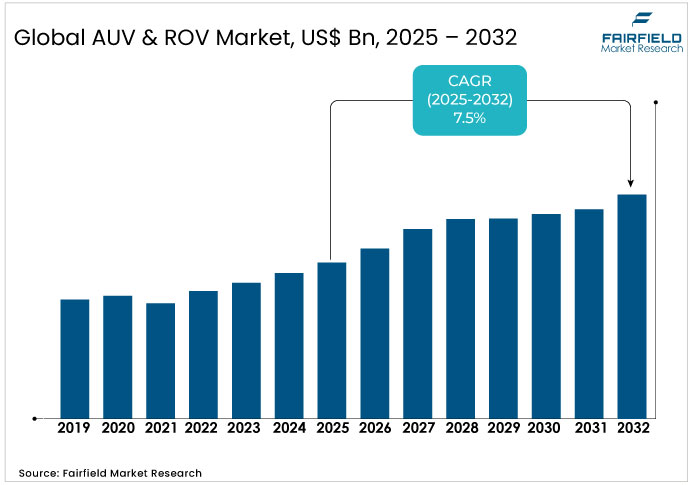

The AUV & ROV Market is valued at USD 4.7 billion in 2025 and is projected to reach USD 7.8 billion growing at a CAGR of 7.5% by 2032.

AUV & ROV Market Summary: Key Insights & Trends

- ROVs dominate the AUV & ROV market with over 80% share, driven by their reliability in complex subsea operations across oil and gas infrastructure.

- AUVs are the fastest-growing type segment, gaining momentum through autonomous deep-sea exploration and defense applications.

- Electric propulsion systems lead with around 50% share, favored for their efficiency and alignment with low-emission operational standards.

- Hybrid propulsion systems show the fastest growth, combining electric precision and mechanical power for deepwater and long-endurance missions.

- The oil and gas sector holds over 55% share, remaining the largest end user due to high demand for subsea inspection and maintenance.

- The defense segment expands fastest, fueled by increasing naval modernization and the adoption of autonomous underwater surveillance systems.

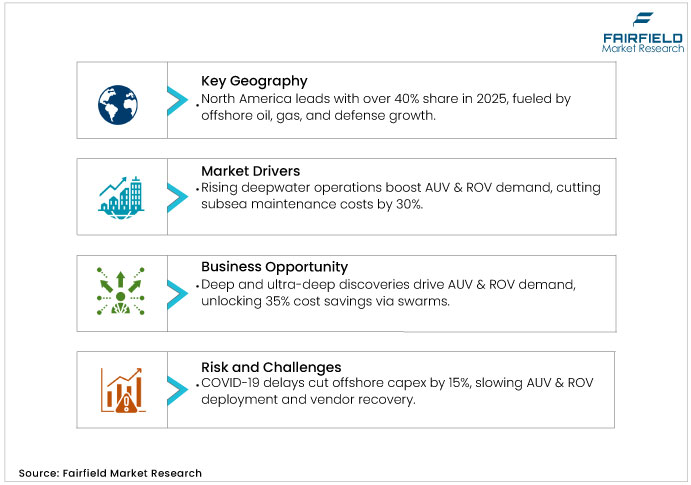

- North America leads with over 40% market share, supported by mature offshore energy infrastructure and strong defense investments.

- Asia Pacific emerges as the fastest-growing region, driven by offshore exploration expansion and defense procurement programs.

Key Growth Drivers

- Predictive Subsea Maintenance Drives AUV & ROV Adoption in Deepwater Operations

The AUV & ROV Market benefits significantly from the growing need for efficient subsea maintenance, as oil and gas operations migrate to deeper waters. Theoretical models in reliability engineering show that ROVs and AUVs minimize downtime through real-time inspections, reducing operational costs by up to 30% in simulations based on industry benchmarks from the International Association of Oil & Gas Producers (IOGP). This propels the growth by enabling predictive maintenance paradigms, where sensor-fusion theories enable anomaly detection in pipelines and structures. Justifications stem from the inherent challenges of subsea access, where traditional diver interventions prove inefficient.

- Stringent Environmental Regulations Accelerate Adoption of AUVs and ROVs Worldwide

Regulatory pressures drive the market by mandating precise environmental monitoring, grounded in sustainability theories that integrate ecological impact assessments. The International Maritime Organization (IMO) enforces standards requiring zero-discharge operations, theoretically boosting AUV & ROV industry penetration through non-intrusive data collection that cuts compliance costs by 25%. This is justified by the precautionary principle in environmental law, where AUVs' acoustic and visual sensors enable biodiversity tracking without habitat disruption.

Key Restraints

- COVID-19 Aftereffects Disrupt Offshore Projects, Slowing AUV & ROV Deployments

The AUV & ROV Market faces headwinds from lingering COVID-19 effects on the oil and gas sectors, where project delays disrupt deployment schedules. Theoretical disruption models from the World Bank highlight supply chain vulnerabilities, leading to a 15% dip in offshore capex as per their energy outlooks. This restraint limits the momentum, as deferred explorations strain vendor financing.

- Operational Barriers in Deepwater Conditions Restrict AUV & ROV Performance

Operational constraints at extreme depths continue to challenge both Autonomous Underwater Vehicles (AUVs) and Remotely Operated Vehicles (ROVs), as high-pressure environments and limited communication bandwidth significantly restrict performance and mission duration. Battery endurance remains a critical bottleneck, with current energy storage technologies unable to sustain extended deep-sea missions.

According to industry analyses by the Society of Underwater Technology (SUT), failure rates can reach as high as 20% in ultra-deep operations, often due to navigation inaccuracies, communication loss, and system malfunctions. These challenges have led to cautious adoption across the subsea exploration and inspection sectors, where reliability, redundancy, and real-time data transmission are paramount for operational safety and economic viability.

AUV & ROV Market Trends and Opportunities

- Frontier Deep-Sea Discoveries Create New Growth Avenues for AUV & ROV Sectors

Emerging deep and ultra-deep ocean discoveries present vast opportunities rooted in resource exploration theories that predict exponential value from untapped hydrocarbons. The U.S. Geological Survey (USGS) estimates over 30% of global undiscovered oil in such frontiers, theoretically expanding AUV & ROV Market applications in high-resolution mapping. This is justified by prospecting models showing cost savings of 35% via AUV swarms.

- Rising Demand for Mini-ROVs Drives Efficiency and Agility in Operations

The preference for smaller ROVs signals a transformative opportunity driven by manoeuvrability theories that prioritize agility over bulk. SUT reports indicate mini-ROVs capturing 25% growth in niche inspections, theoretically reducing logistics by 50% through portable designs. Justifications lie in lean manufacturing principles, enabling rapid deployment in confined spaces such as subsea wells. This trend in the AUV & ROV promotes modular architectures, blending AI theories for autonomous adjustments. With decommissioning activities rising, the AUV & ROV industry benefits from scalable solutions, fostering market entry for innovators in precision engineering.

Segment-wise Trends & Analysis

- ROVs Dominate Market Operations While AUVs Gain Momentum Through Autonomous Expansion

ROVs command over 80% market share, valued at approximately USD 3.76 billion, driven by their reliability in real-time interventions for oil & gas infrastructure. This leadership stems from tether-based control, enabling precise manipulations in construction and repair tasks where latency is critical. Competitive positioning favors incumbents such as Oceaneering, who leverage extensive fleets for 24/7 operations, outpacing AUVs in high-stakes commercial settings.

AUVs emerge as the fast-growing segment, projected to expand at double the overall CAGR due to autonomy in data collection for research and defense. Underlying drivers include AI integration for untethered surveys, reducing operational costs by 30% in remote areas.

- Electric Systems Lead Efficiency Race as Hybrid Technologies Reshape Deepwater Exploration

Electric systems hold approximately 50% market share in the AUV & ROV market in 2025, equating to USD 2.35 billion, owing to their efficiency in precision tasks such as pipeline mapping. Leadership arises from battery advancements, aligning with emission regulations, and extending mission durations without refueling. Competitors such as Kongsberg Maritime dominate via integrated electric drives, ensuring 20% energy savings in electric-dominant fleets.

Hybrid systems represent the emerging powerhouse, with growth fueled by combining electric agility and mechanical power for versatile deep-water ops. Drivers include regulatory incentives for green tech, potentially unlocking USD 1 billion in retrofits by 2030. This trajectory strengthens positioning for firms such as TechnipFMC, which emphasize hybrid modularity to bridge legacy and future needs in the AUV & ROV industry.

- Oil & Gas Sector Retains Leadership While Defense Accelerates with Strategic Investments

Oil & gas leads with over 55% share in the market in 2025, surpassing USD 2.59 billion, anchored by deep-water exploration demands. Current dominance reflects 40% of global rigs requiring subsea support, per International Association of Drilling Contractors data. Positioning favors service giants such as Subsea 7, which secure long-term contracts through specialized ROV tooling.

Defense emerges rapidly, propelled by geopolitical tensions necessitating underwater surveillance. Growth drivers encompass unmanned threat detection, with budgets rising 15% annually via U.S. Department of Defense allocations.

Regional Trends & Analysis

North America Leads Global AUV & ROV Adoption with Offshore Energy Strength

North America holds over 40% share in 2025, establishing itself as the leading regional market driven by extensive offshore oil and gas reserves in the Gulf of Mexico and significant defense investments. The region benefits from mature offshore infrastructure requiring continuous maintenance and inspection services, creating consistent demand for underwater vehicles. The United States dominates regional market share through major energy companies' investments in deepwater exploration and the U.S. Navy's substantial procurement programs for autonomous underwater systems.

U.S. AUV & ROV Market – 2025 Snapshot & Outlook

The U.S. maintains market leadership through extensive Gulf of Mexico offshore operations requiring sophisticated ROV support for drilling, production, and infrastructure maintenance activities. Major energy companies, including ExxonMobil, Chevron, and ConocoPhillips, continue investing in deepwater exploration programs that necessitate advanced underwater vehicle technologies. The U.S. Navy's Unmanned Undersea Vehicle Master Plan drives substantial procurement spending for autonomous systems designed for mine countermeasures, intelligence gathering, and anti-submarine warfare operations.

Government initiatives supporting offshore wind development along the East Coast, including the Biden Administration's goal of 30 gigawatts of offshore wind capacity by 2030, are creating new market opportunities for specialized inspection and maintenance services. Recent regulatory frameworks requiring enhanced subsea monitoring and environmental compliance are further driving demand for autonomous underwater systems capable of continuous data collection and real-time reporting.

Asia Pacific Emerges as Fastest-Growing Hub for AUV & ROV Technologies

Asia Pacific represents the fastest-growing region in the AUV & ROV Market with a projected CAGR exceeding 6.1% during the forecast period, driven by rapid industrialization, increasing energy demands, and substantial defense modernization programs. The region's extensive coastlines, offshore energy reserves, and growing maritime security concerns are fueling investments in underwater robotics technologies across multiple applications.

Japan AUV & ROV Market – 2025 Snapshot & Outlook

Japan's market expansion is driven by advanced maritime technology development and substantial defense investments in underwater surveillance capabilities. The Japan Maritime Self-Defense Force is investing heavily in autonomous underwater systems for intelligence gathering and mine countermeasures in response to regional security challenges. Japanese technology companies are developing innovative AUV solutions incorporating artificial intelligence and advanced sensor integration for both civilian and military applications.

The country's extensive offshore infrastructure, including underwater communication cables and energy transmission systems, requires sophisticated inspection and maintenance services that drive consistent demand for ROV operations. Japan's leadership in advanced manufacturing and robotics technology positions the country as a key innovation hub for next-generation underwater vehicle development.

India AUV & ROV Market – 2025 Snapshot & Outlook

India's growing market is fueled by expanding offshore oil and gas exploration activities along the eastern and western coastlines, particularly in the Krishna Godavari and Cauvery basins. The Indian Navy's modernization programs emphasize underwater surveillance capabilities and maritime domain awareness, driving procurement of autonomous underwater systems for border security and intelligence operations. Recent partnerships between Indian oil explorers and global petroleum companies are expected to accelerate the deployment of AUV technologies for deepwater exploration activities.

Government initiatives promoting indigenous defense manufacturing under the "Make in India" program are encouraging domestic development of underwater robotics technologies, creating opportunities for technology transfer and local manufacturing partnerships with international AUV & ROV suppliers.

Europe Strengthens AUV & ROV Industry Through Offshore Wind and Maintenance Demand

Europe maintains a significant market position driven by leadership in offshore renewable energy development and mature oil and gas infrastructure requiring continuous maintenance. The region's extensive offshore wind installations across the North Sea, Baltic Sea, and Atlantic coastal areas create substantial demand for specialized underwater vehicles supporting turbine installation, cable maintenance, and routine inspection operations.

Germany AUV & ROV Market – 2025 Snapshot & Outlook

Germany's market growth is primarily driven by the country's extensive offshore wind energy program and advanced maritime technology development capabilities. German companies are leading innovation in electric propulsion systems and autonomous navigation technologies for underwater vehicles. The country's position as a major offshore wind developer creates continuous demand for ROV services supporting turbine foundation installation and maintenance operations.

German engineering expertise in precision manufacturing and advanced sensor integration is contributing to the development of next-generation underwater robotics systems designed for renewable energy applications and environmental monitoring operations.

U.K. AUV & ROV Market – 2025 Snapshot & Outlook

The U.K. maintains a strong market position through its leadership in offshore oil and gas operations in the North Sea and growing offshore wind development programs. British companies are pioneering innovative ROV applications for decommissioning aging offshore platforms, creating new market opportunities for specialized underwater services. The U.K.'s advanced regulatory framework for offshore operations ensures high safety and environmental standards that drive demand for sophisticated monitoring and inspection technologies.

Recent investments in floating offshore wind platforms and deep-water renewable energy projects are creating new applications for autonomous underwater vehicles capable of operating in challenging marine environments while supporting the energy transition objectives.

Competitive Landscape Analysis

The players in the AUV & ROV market are focusing on strategic collaborations to enhance technological autonomy. This approach counters fragmentation by pooling R&D resources, as evidenced by a 2022 joint venture between Oceaneering and Argeo that accelerated hybrid ROV prototypes, capturing 15% more deep-water contracts. Such partnerships mitigate solo innovation risks, with the top 10 firms holding over 50% revenue share. Moreover, emphasis on electric propulsion upgrades stems from regulatory tailwinds, exemplified by Kongsberg Maritime's 2020 LARS system deal, which expanded unmanned vessel compatibility and boosted order backlogs by 20%.

Emerging regulations on subsea emissions and M&A activity will reshape costs, with potential consolidations such as TechnipFMC's integrations trimming supply chain expenses by 10-15%. Capacity strains from raw material volatility could inflate prices, yet proactive filings for green certifications offer offsets. Early movers will benefit from first-mover premiums in hybrid niches, while latecomers may face squeezed margins in saturated oil & gas bids.

Key Companies

- SUBSEA7

- Oceaneering International, Inc.

- Argeo

- Fugro

- Saab AB

- Atlas Elektronik Gmbh

- BIRNS, Inc.

- Technip fmc

- Stapem Offshore

- Kongsberg Maritime

Recent Developments:

- July 2025, the company delivered a strong Q2 performance with adjusted EBITDA up 23% to US$360 million and a margin of 21%, supported by solid results in both Subsea and Renewables. It reaffirmed its 2025 guidance, backed by a robust US$11.8 billion backlog providing over 90% revenue visibility. Additionally, it announced a merger of equals with Saipem to form a global energy services leader.

- October 2024, Oceaneering International won a multi-million-dollar U.S. DoD contract to build a Freedom™ Autonomous Underwater Vehicle and set up a Remote Operations Center for the U.S. Navy. The deal leverages its offshore robotics expertise for defense use, with manufacturing in Louisiana and support from its global supply chain.

- August 2025, Saab has secured a SEK 60 million contract from the Swedish Defence Materiel Administration to develop a Large Uncrewed Undersea Vehicle (LUUV) equipped with its Autonomous Ocean Core system. The project aims to enhance Sweden’s underwater surveillance and mapping capabilities, with sea trials scheduled for summer 2026.

Global AUV & ROV Market Segmentation-

By Type

- ROV

- AUV

By Propulsion

- Mechanical System

- Electric System

- Hybrid Systems

- Others

By End-user Industry

- Oil & Gas

- Commercial

- Defense

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global AUV & ROV Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact

2.5.1. Supply Chain

2.5.2. End-user Industry Customer Impact Analysis

3. Price Trends Analysis

4. Global AUV & ROV Market Outlook, 2019 - 2032

4.1. Global AUV & ROV Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. ROVs

4.1.1.2. AUVs

4.1.2. BPS Analysis/Market Attractiveness Analysis, by Type

4.2. Global AUV & ROV Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Mechanical System

4.2.1.2. Electric System

4.2.1.3. Hybrid System

4.2.1.4. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis, by Propulsion

4.3. Global AUV & ROV Market Outlook, by End-user Industry, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Oil & Gas

4.3.1.2. Commercial

4.3.1.3. Defense

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis, by End-user Industry

4.4. Global AUV & ROV Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

4.4.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America AUV & ROV Market Outlook, 2019 - 2032

5.1. North America AUV & ROV Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. ROVs

5.1.1.2. AUVs

5.2. North America AUV & ROV Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Mechanical System

5.2.1.2. Electric System

5.2.1.3. Hybrid System

5.2.1.4. Others

5.3. North America AUV & ROV Market Outlook, by End-user Industry, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Oil & Gas

5.3.1.2. Commercial

5.3.1.3. Defense

5.3.1.4. Others

5.4. North America AUV & ROV Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. U.S. AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

5.4.1.2. Canada AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

6. Europe AUV & ROV Market Outlook, 2019 - 2032

6.1. Europe AUV & ROV Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. ROVs

6.1.1.2. AUVs

6.2. Europe AUV & ROV Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Mechanical System

6.2.1.2. Electric System

6.2.1.3. Hybrid System

6.2.1.4. Others

6.3. Europe AUV & ROV Market Outlook, by End-user Industry, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Oil & Gas

6.3.1.2. Commercial

6.3.1.3. Defense

6.3.1.4. Others

6.4. Europe AUV & ROV Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Germany AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

6.4.1.2. France AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

6.4.1.3. U.K. AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

6.4.1.4. Italy AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

6.4.1.5. Rest of Europe AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

7. Asia Pacific AUV & ROV Market Outlook, 2019 - 2032

7.1. Asia Pacific AUV & ROV Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. ROVs

7.1.1.2. AUVs

7.2. Asia Pacific AUV & ROV Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Mechanical System

7.2.1.2. Electric System

7.2.1.3. Hybrid System

7.2.1.4. Others

7.3. Asia Pacific AUV & ROV Market Outlook, by End-user Industry, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Oil & Gas

7.3.1.2. Commercial

7.3.1.3. Defense

7.3.1.4. Others

7.4. Asia Pacific AUV & ROV Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. China AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

7.4.1.2. Japan AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

7.4.1.3. India AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

7.4.1.4. ASEAN AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

7.4.1.5. Rest of Asia Pacific AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

8. Latin America AUV & ROV Market Outlook, 2019 - 2032

8.1. Latin America AUV & ROV Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. ROVs

8.1.1.2. AUVs

8.2. Latin America AUV & ROV Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Mechanical System

8.2.1.2. Electric System

8.2.1.3. Hybrid System

8.2.1.4. Others

8.3. Latin America AUV & ROV Market Outlook, by End-user Industry, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Oil & Gas

8.3.1.2. Commercial

8.3.1.3. Defense

8.3.1.4. Others

8.4. Latin America AUV & ROV Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Brazil AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

8.4.1.2. Mexico AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

8.4.1.3. Rest of Latin America AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

9. Middle East & Africa AUV & ROV Market Outlook, 2019 - 2032

9.1. Middle East & Africa AUV & ROV Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. ROVs

9.1.1.2. AUVs

9.2. Middle East & Africa AUV & ROV Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Mechanical System

9.2.1.2. Electric System

9.2.1.3. Hybrid System

9.2.1.4. Others

9.3. Middle East & Africa AUV & ROV Market Outlook, by End-user Industry, Value (US$ Bn), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Oil & Gas

9.3.1.2. Commercial

9.3.1.3. Defense

9.3.1.4. Others

9.4. Middle East & Africa AUV & ROV Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. GCC AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

9.4.1.2. South Africa AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

9.4.1.3. Rest of Middle East & Africa AUV & ROV Market, Value (US$ Bn), by Type, Propulsion, End-user Industry, 2019 - 2032

10. Competitive Landscape

10.1. Company Market Share Analysis, 2022

10.2. Strategic Collaborations

10.3. Company Profiles

10.3.1. SUBSEA7

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Oceaneering International, Inc.

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Argeo

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Fugro

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Saab AB

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Atlas Elektronik Gmbh

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. BIRNS, Inc.

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Technip fmc

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Stapem Offshore

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Kongsberg Maritime

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Propulsion Coverage |

|

|

End-user Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Price Trend Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |