Market Growth Forecast

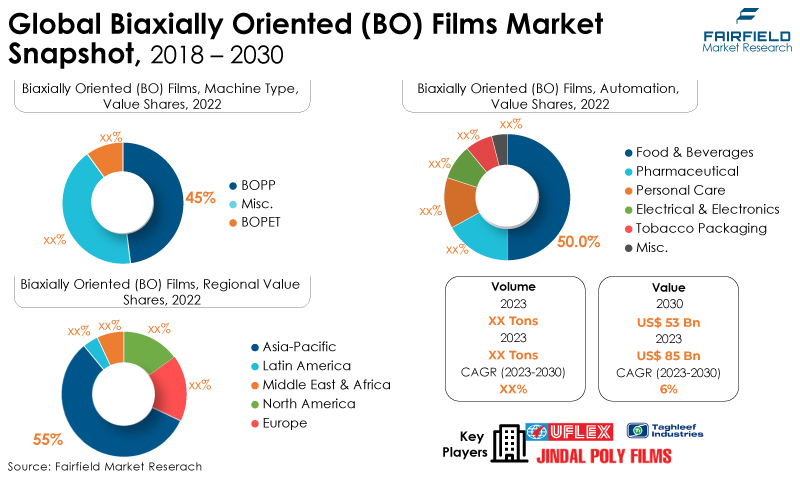

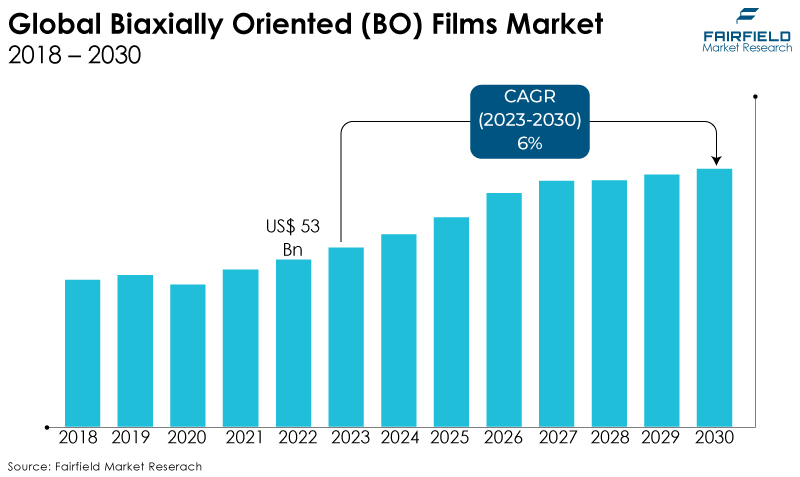

- In 2022, the market for biaxially oriented films was estimated to be worth US$53 Bn, and by 2030, it is expected to increase to US$85 Bn

- Between 2023 and 2030, the market is anticipated to expand at a CAGR of 6%

Quick Report Digest

- The key trend anticipated to fuel the biaxially oriented films market growth is increased demand for folding carton-board packaging across numerous industries and manufacturer upgrades. Furthermore, due to its total biodegradability, carton-board packaging is often favoured over all other alternatives for secondary packaging.

- Another major market trend expected to fuel the BO films market growth is the rapidly expanding global FMCG industry. The market is also predicted to profit from the expanding worldwide pharmaceutical and food and beverage industries.

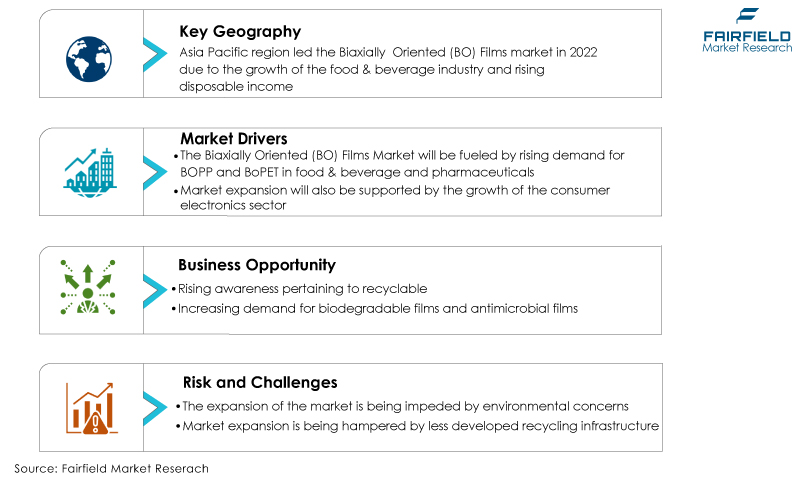

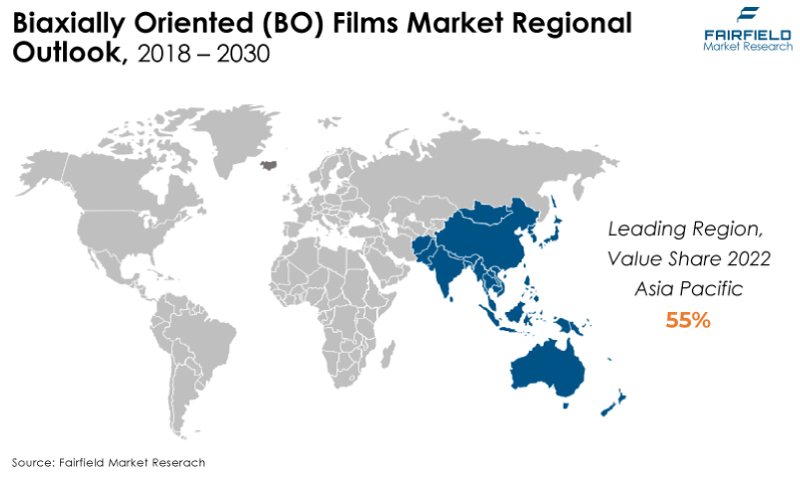

- China holds the lighest share the global biaxially oriented films market. The demand is expanding in Asia Pacific due to the rise in packaging needs in the food and beverage, pharmaceutical, and cosmetics industries. Additionally, consumers of packaged goods prioritised convenience and packaging that complemented their lifestyles and provided value.

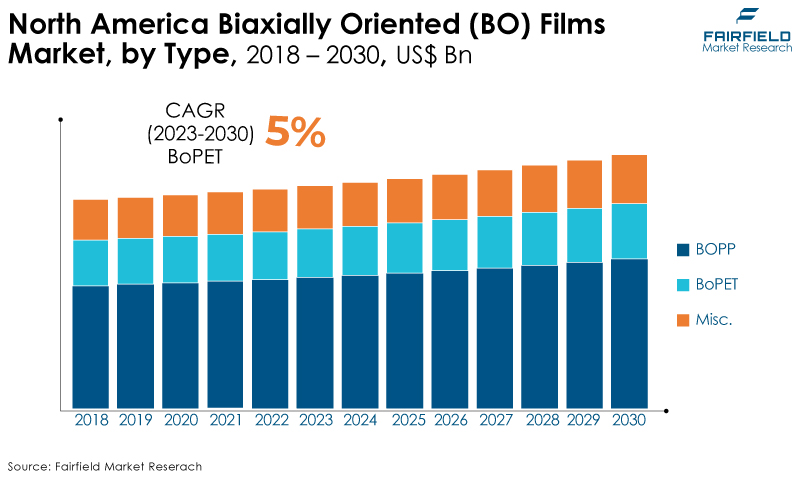

- North America holds substantial share in the global BO films market, owing to various factors such as expansion in the food industry, government initiatives to encourage environmentally sustainable packaging use, and consistent packaging technology advancements by industry leaders.

- Oversupply and sustainability are amongst the key challenges in the global BO films market. There has been excess supply of BO films in the market. The oversupply is likely to create a supply-demand imbalance resulting in lowering the profitability of the market players.

- The biaxially oriented films market faces challenges from less developed recycling infrastructure, as these films are often difficult to recycle efficiently. Limited recycling facilities hinder the recovery and reuse of BO films, contributing to environmental concerns and potentially impacting market growth as sustainability becomes a greater priority.

A Look Back and a Look Forward - Comparative Analysis

The market for biaxially oriented Films has grown in popularity due to factors such as an increase in its applications across various industries, including food and beverage, with an increase in usage generally in line with the global economy.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as food & beverages, pharamacetuical and personal care. In food & beverages applications, the demand for biaxially oriented films has increased, including frozen biscuits/bakery, confectionery, and snacks/dried food products.

The increased need for quick delivery and high consumer expectations have motivated e-retailers to implement operational innovations for speedy order fulfillment and to stay competitive in the market. This offers biaxially oriented Films a significant chance to experience quick acceptance in the e-commerce sector in the coming years.

Additionally, technological developments in factory automation have substantially contributed to the growth and development of various biaxially oriented films. Furthermore, due to their rising popularity, various conventional biaxially oriented films are anticipated to lose ground to robotic packaging during the next five years.

Major Growth Determinants

- Increased Demand for BO Films from Multiple Industries

The growing demand for flexible packaging is a significant driving force behind the expansion of the biaxially oriented films market. Flexible packaging offers convenience to consumers, including easy resealing, portability, and portion control. It aligns with modern lifestyles and on-the-go consumption patterns.

BO films provide excellent barrier properties, protecting products from moisture, oxygen, and UV radiation. This extends the shelf-life of perishable goods, reducing food waste and enhancing product freshness.

Manufacturers increasingly use BO films to create sustainable, eco-friendly, flexible packaging options, meeting consumer demands for greener alternatives.

BO films are cost-effective due to their lightweight nature, reducing transportation costs and material usage. This cost-efficiency appeals to manufacturers looking to optimise their supply chains.

BO films allow for high-quality printing and branding opportunities, helping products stand out on store shelves and attract consumer attention.

- Expanding F&B Industry, Coupled with Lower Carbon Footprint of BO Films

The expanding food and beverages industry is a primary driver of the biaxially oriented films market. As the global population grows and consumer preferences evolve, the demand for packaged foods and beverages is heightened.

BO Films, known for their excellent barrier properties and flexibility, are crucial for preserving product freshness, extending shelf life, and ensuring food safety. They are extensively used in various packaging formats, such as pouches, wrappers, and labels.

As the food and beverage industry expands, BO Films plays a pivotal role in meeting packaging requirements, making them an integral component of this thriving sector.

One of the primary reason behind the growth of BO films is its lower carbon footprint as compared to other plastic films. Consumption of BOPP films has benefitted from green and sustainability drive at the expense of other packaging films.

- Rising Consumer Awareness, and Quality Standards

The biaxially oriented films market is experiencing growth due to rising consumer awareness and stringent quality standards.

Consumers are increasingly conscious of product safety, hygiene, and sustainability, driving demand for BO Films, known for their barrier properties and compliance with quality regulations. These films are vital in preserving various products' integrity and shelf-life, aligning with evolving consumer expectations.

Additionally, BO Films meets industry-specific quality standards, making them a preferred choice in food packaging, pharmaceuticals, and electronics sectors.

The market expansion is a direct response to consumers' and regulatory bodies' heightened focus on product quality and safety.

Major Growth Barriers

- Environmental Concerns are Limiting Market Expansion

Environmental concerns significantly challenge the biaxially oriented films market. Increasing awareness of plastic pollution and its impact on ecosystems and marine life has led to calls for reduced plastic usage and more sustainable packaging solutions.

BO Films, primarily derived from petroleum-based plastics, must address these concerns by developing eco-friendly alternatives, optimising recycling processes, and enhancing sustainability to meet evolving consumer and regulatory expectations.

- Less Developed Recycling Infrastructure

The limited development of recycling infrastructure presents a considerable challenge to the biaxially oriented films market. BO Films, predominantly made of polypropylene (PP), are theoretically recyclable, but the lack of robust recycling facilities and collection systems makes it difficult to realise this potential.

Without efficient recycling channels, the industry faces difficulties in reducing plastic waste, complying with sustainability goals, and meeting the demands of eco-conscious consumers.

Investments in recycling infrastructure, awareness campaigns, and collaborations with stakeholders are vital to address this challenge and promote a more circular approach to BO Films.

Key Trends and Opportunities to Look at

- Recyclable and Sustainable Films

Growing environmental consciousness among consumers and stricter regulations regarding plastic waste and pollution have spurred the demand for recyclable and sustainable packaging materials.

BO films that are recyclable and made from eco-friendly materials are favoured in this context. Consumers are increasingly seeking products packaged in environmentally friendly materials.

BO films that are recyclable and sustainable align with these preferences, enhancing the marketability of packaged goods.

- Biodegradable Films

Biodegradable films are derived from renewable resources like plant-based polymers (e.g., PLA, PHA) or compostable plastics. Their production typically has a lower carbon footprint than conventional plastic films, reducing the environmental impact.

Growing regulations on plastic waste and single-use plastics in various regions necessitate using biodegradable alternatives. BO film manufacturers must adapt to these regulations to remain compliant.

- Antimicrobial Films

Antimicrobial BO films help inhibit the growth of bacteria and pathogens on the surface of packaged food products. This added layer of protection contributes to improved food safety and reduces the risk of foodborne illnesses.

By preventing microbial contamination, these films can extend the shelf life of perishable foods. This is particularly valuable in the food industry, reducing food waste and ensuring product quality over an extended period.

Heightened awareness of health and hygiene, particularly in the wake of global health crises, has led to increased demand for products with antimicrobial.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape is pivotal in shaping the Biaxially oriented Film industry, influencing various aspects from product development to market accessibility.

Stringent regulations govern the safety and quality of BO films, particularly those used in food packaging and pharmaceuticals. Compliance with these regulations is mandatory, ensuring BO films are safe for direct contact with consumable goods.

Increasing environmental concerns have led to regulations promoting sustainability. This has pushed manufacturers to develop recyclable and biodegradable BO films, aligning with sustainability goals and meeting regulatory requirements.

Product labeling and branding regulations influence BO films' design and printing. Requirements for clear and accurate labeling affect the choice of materials and printing technologies. Waste disposal and recycling regulations impact BO films' end-of-life considerations.

Compliance with recycling mandates and initiatives like extended producer responsibility (EPR) is crucial for manufacturers. Regulations on using certain chemicals and additives in BO films, such as plasticizers or colorants, may influence the composition and manufacturing processes.

International trade agreements and tariffs can affect BO films' global supply chain and market dynamics, influencing pricing and market access.

Fairfield’s Ranking Board

Top Segments

- BOPP Films Continue to Dominate over Other BO Films

Biaxially oriented polypropylene (BOPP) films have secured the largest market share in the biaxially oriented films market due to their exceptional versatility, cost-effectiveness, and wide range of applications.

BOPP films offer excellent clarity, high tensile strength, moisture resistance, and superior printability. They are extensively used in flexible packaging for food, beverages, personal care products, and more.

Additionally, BOPP films' popularity is driven by their suitability for lamination, labels, and adhesive tapes. Their combination of favourable properties and compatibility with diverse industries has solidified their dominant position in the BO Films market.

Other BO films such as BOPLA and BOPA are amogst the fastest-growing type in the biaxially oriented films market due to its exceptional properties.

These films offer high tensile strength, excellent thermal stability, and remarkable barrier properties against moisture, gases, and UV radiation. These qualities make them highly sought-after in applications like flexible packaging, electronics, and solar panels.

Additionally, the growing demand for sustainable and recyclable materials has further accelerated the adoption of these films, driving their rapid growth in the market.

- Food & Beverages Industry Accounts for the Largest Share

Growing awareness regarding food and nutrition packaging has been te key driving force behind the growth of BO films in food & beverage segment. Biaxially oriented films act as an excellent moisture barrier.

The metalized variant of these films provides excellent oxygen barrier characteristics, playing a crucial role in extending the shelf-life of food products, thereby reducing the waste.

Bakery is one of the major subsegment on food & beverage industry opting BO films for packaging. These films are extensively used in packaging biscuits and bakery products to maintain product freshness and extend shelf life.

Additionally, BO films offer excellent moisture and gas barrier properties, crucial for preserving the quality of these products, further solidifying their dominance in this application segment.

Due to evolving consumer habits favouring convenience foods, the snacks/dried food applications are expected to be fastest-growing in the BO films market.

BO films provide excellent moisture and oxygen barrier properties, ensuring the extended shelf life and freshness of snacks and dried foods.

As on-the-go and ready-to-eat snacks gain popularity globally, the demand for BO films in this sector surges, making it the fastest-growing segment in the market.

Regional Frontrunners

North America Lucrative

Due to several factors, North America is considered amongst one of the most lucrative region in the biaxially oriented films market. Firstly, a robust and diverse industrial base in the region, particularly in the US, has driven demand across various sectors, including packaging, labeling, and industrial applications.

Additionally, a strong focus on product innovation, sustainability, and compliance with stringent quality and safety standards has bolstered North America's position in the BO films market.

Furthermore, a well-established distribution network and a large consumer base with a preference for high-quality and visually appealing packaging have contributed to the region's market dominance.

North America's economic stability and favourable regulatory environment have also significantly attracted investments and fostered market growth.

Asia Pacific Witnesses Significant Growth in Sales

For several compelling reasons, Asia Pacific stands out as the fastest-growing region in the biaxially oriented films market.

The region's burgeoning population and rapid urbanisation have increased the demand for packaged goods, thereby driving the need for BO films in applications ranging from food packaging to consumer electronics.

Secondly, lower manufacturing and labour costs in countries like China, and India have made it a cost-effective hub for BO film production.

Additionally, Asia Pacific benefits from a thriving manufacturing ecosystem and a burgeoning middle class with rising disposable incomes, fostering sustained demand for BO films.

Furthermore, the region's focus on sustainability and eco-friendly packaging aligns with global trends, further propelling the growth of BO films in the Asia Pacific market.

Fairfield’s Competitive Landscape Analysis

The global biaxially oriented films market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Biaxially Oriented Films Space?

- Zhejiang Kinlead Innovative Materials Co., Ltd.

- Jindal Poly Films Limited (JPFL)

- Taghleef Industries

- Treofan Group

- Uflex Ltd

- Anhui Guofeng Plastic Industry Co., Ltd.

- Cosmo Films Ltd

- Polyplex Corporation Ltd.

- Sibur Internation GmbH

- Toray Plastics (America) Ltd.

- Qingdao Kingchuan Packaging

- Vibac Group S.p.A.

- FlexFilms Inc.

- SRF Limited

- Borealis AG

- Garware Polyester Ltd.

- Copol International Limited

Significant Company Developments

New Product Launches

- August 2022: SRF Limited has unveiled plans to construct a second BOPP film line and a metallizer in Indore, India. This move was given the green light to meet the burgeoning demand in both the Indian and international BOPP markets while ensuring comprehensive product offerings for their customers.

- May 2022: Innovia Films has disclosed plans for a substantial investment of US$70 Mn in expanding its film production capacity in Germany. The investment is directed towards establishing an advanced 8-meter wide multi-layer co-extrusion line. This cutting-edge facility is poised to manufacture specialised thin gauge label films, catering to the escalating demand for sustainable, resin-reduced materials. This strategic move is set to bolster the company's production capabilities and effectively meet the surging market demand.

- March 2022: The Oben Holding Group and Bruckner Maschinenbau have entered a new phase of their longstanding partnership. Oben Holding Group recently expanded its state-of-the-art 10.5-meter high-speed BOPET line. It concurrently inked a deal for its second high-speed BOPP line, reinforcing its commitment to a mutually beneficial collaboration.

Distribution Agreement

- July 2022: Krones reported that the global consumption of packaged water had exceeded 472 billion liters, establishing it as one of the most popular packaged beverage categories worldwide. Following closely, packed alcoholic beverages secured the second position with a consumption of 272 billion liters, while milk and dairy products ranked third, with 258.5 billion liters.

An Expert’s Eye

Present Demand and Future Growth

As per Fairfield’s Analysis, an increase in consumer demand for food safety and hygiene standards is driving the usage of BO films in food and beverages segment.

The rising demand for beverages may result in a growth in secondary packaging, where biaxially oriented films can be used which would increase the need for biaxially oriented films.

Furthermore, technological developments have greatly aided the growth and development of various biaxially oriented films in factory automation.

However, the biaxially oriented films market is expected to face considerable challenges because of high initial expenses.

Supply Side of the Market

China and India are amongst the largest manufacturer of BO films, especially BOPP and BoPET films. The production of BO films involves stretching a polypropylene (PP) film in two perpendicular directions (bi-axially) to enhance its mechanical properties. This stretching process imparts strength, transparency, and gas barrier properties to the film.

Manufacturers typically use the tenter frame process, which involves heating the PP film until it becomes amorphous and then stretching it mechanically.

Another common method is the bubble process, where the film is extruded into a bubble and then stretched. Manufacturers source PP resin from petrochemical companies or produce it in-house through polymerization.

The availability and price of PP resin can significantly impact the supply-side dynamics, as it constitutes a substantial portion of production costs.

The supply side of the biaxially oriented film market is a complex landscape influenced by factors such as production processes, key players, raw materials, technology, regulations, sustainability initiatives, and supply chain management.

Understanding these dynamics is crucial for manufacturers and stakeholders in the industry to navigate the evolving market, meet customer demands, and contribute to the growth and innovation of BO films in various applications worldwide.

Global Biaxially Oriented Films Market is Segmented as Below:

By Type:

- BOPP

- BoPET

- Miscellaneous

By End-user:

- Food & Beverages

- Pharmaceutical

- Personal Care

- Electrical & Electronics

- Tobacco Packaging

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Biaxially Oriented (BO) Films Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume/Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output Analysis, 2018 - 2022

3.1. Key Highlights

3.2. Production Output, by Region, 2018 - 2022

3.3. Installed Capacity, by Region

4. Price Trend Analysis, 2018 - 2030

4.1. Key Highlights

4.2. Factors Affecting the BO Films Market

4.3. Prices by Type

4.4. Prices by Region

5. Global Biaxially Oriented (BO) Films Market Outlook, 2018 - 2030

5.1. Global Biaxially Oriented (BO) Films Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. BOPP

5.1.1.2. BoPET

5.1.1.3. Misc.

5.2. Global Biaxially Oriented (BO) Films Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Food & Beverages

5.2.1.2. Pharmaceutical

5.2.1.3. Personal Care

5.2.1.4. Electrical & Electronics

5.2.1.5. Tobacco Packaging

5.2.1.6. Misc.

5.3. Global Biaxially Oriented (BO) Films Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Biaxially Oriented (BO) Films Market Outlook, 2018 - 2030

6.1. North America Biaxially Oriented (BO) Films Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. BOPP

6.1.1.2. BoPET

6.1.1.3. Misc.

6.2. North America Biaxially Oriented (BO) Films Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Food & Beverages

6.2.1.2. Pharmaceutical

6.2.1.3. Personal Care

6.2.1.4. Electrical & Electronics

6.2.1.5. Tobacco Packaging

6.2.1.6. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Biaxially Oriented (BO) Films Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. U.S. Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. U.S. Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Canada Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Canada Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Biaxially Oriented (BO) Films Market Outlook, 2018 - 2030

7.1. Europe Biaxially Oriented (BO) Films Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. BOPP

7.1.1.2. BoPET

7.1.1.3. Misc.

7.2. Europe Biaxially Oriented (BO) Films Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Food & Beverages

7.2.1.2. Pharmaceutical

7.2.1.3. Personal Care

7.2.1.4. Electrical & Electronics

7.2.1.5. Tobacco Packaging

7.2.1.6. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Biaxially Oriented (BO) Films Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Germany Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Germany Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. U.K. Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. U.K. Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. France Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. France Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.7. Italy Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Italy Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.9. Russia Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.10. Russia Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.11. Rest of Europe Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

7.3.1.12. Rest of Europe Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Biaxially Oriented (BO) Films Market Outlook, 2018 - 2030

8.1. Asia Pacific Biaxially Oriented (BO) Films Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. BOPP

8.1.1.2. BoPET

8.1.1.3. Misc.

8.2. Asia Pacific Biaxially Oriented (BO) Films Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Food & Beverages

8.2.1.2. Pharmaceutical

8.2.1.3. Personal Care

8.2.1.4. Electrical & Electronics

8.2.1.5. Tobacco Packaging

8.2.1.6. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Biaxially Oriented (BO) Films Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. China Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. China Biaxially Oriented (BO) Films Market by End User, Value (US$ Mn), 2018 - 2030

8.3.1.3. Japan Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. Japan Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. South Korea Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. South Korea Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.7. India Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. India Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.9. Southeast Asia Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Southeast Asia Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.11. Rest of Asia Pacific Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

8.3.1.12. Rest of Asia Pacific Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Biaxially Oriented (BO) Films Market Outlook, 2018 - 2030

9.1. Latin America Biaxially Oriented (BO) Films Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. BOPP

9.1.1.2. BoPET

9.1.1.3. Misc.

9.2. Latin America Biaxially Oriented (BO) Films Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

9.1.2. Key Highlights

9.2.1.1. Food & Beverages

9.2.1.2. Pharmaceutical

9.2.1.3. Personal Care

9.2.1.4. Electrical & Electronics

9.2.1.5. Tobacco Packaging

9.2.1.6. Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Biaxially Oriented (BO) Films Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Brazil Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

9.3.1.2. Brazil Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

9.3.1.3. Mexico Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

9.3.1.4. Mexico Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

9.3.1.5. Rest of Latin America Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

9.3.1.6. Rest of Latin America Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Biaxially Oriented (BO) Films Market Outlook, 2018 - 2030

10.1. Middle East & Africa Biaxially Oriented (BO) Films Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. BOPP

10.1.1.2. BoPET

10.1.1.3. Misc.

10.2. Middle East & Africa Biaxially Oriented (BO) Films Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Food & Beverages

10.2.1.2. Pharmaceutical

10.2.1.3. Personal Care

10.2.1.4. Electrical & Electronics

10.2.1.5. Tobacco Packaging

10.2.1.6. Misc.

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Biaxially Oriented (BO) Films Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. GCC Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

10.3.1.2. GCC Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

10.3.1.3. South Africa Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

10.3.1.4. South Africa Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

10.3.1.5. Rest of Middle East & Africa Biaxially Oriented (BO) Films Market Type, Value (US$ Mn), 2018 - 2030

10.3.1.6. Rest of Middle East & Africa Biaxially Oriented (BO) Films Market Application, Value (US$ Mn), 2018 - 2030

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Type vs Application Heatmap

11.2. Manufacturer vs Type Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Zhejiang Kinlead Innovative Materials Co., Ltd.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Jindal Poly Films Limited (JPFL)

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Taghleef Industries

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Treofan Group

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Uflex Ltd.

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Anhui Guofeng Plastic Industry Co., Ltd.

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Cosmo Films Ltd.

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Polyplex Corporation Limited

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Sibur International GmbH

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Toray Plastics (America), Inc.

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Business Strategies and Development

11.5.11. Qingdao Kingchuan Packaging

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Vibac Group S.p.a

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. FlexFilms (USA) Inc

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. FuRong Group Co., Ltd.

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Ti Plastic Film Limited

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

11.5.16. Garware Polyester Ltd.

11.5.16.1. Company Overview

11.5.16.2. Product Portfolio

11.5.16.3. Financial Overview

11.5.16.4. Business Strategies and Development

11.5.17. Copol International Ltd.

11.5.17.1. Company Overview

11.5.17.2. Product Portfolio

11.5.17.3. Financial Overview

11.5.17.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |