Global Bio-butanol Market Forecast

- The Bio-butanol Market is valued at USD 2.8 Bn in 2026 and is projected to reach USD 4.9 Bn, growing at a CAGR of 8% by 2033.

Quick Report Digest

- Due to its increased energy density and molecular similarity to petrol, which makes it easier to utilize in today's fuel engines, biobutanol is regarded as a suitable replacement for traditional petroleum-based fuels.

- The agricultural industry makes extensive use of bio-butanol, using it as food-grade solvents for the manufacturing and extraction of food products, particularly for processed foods like cheese and meat products.

- Given that bio-butanol-based resins are used in the textile industry to give materials wrinkle resistance, the rising consumption of textile products, such as clothes and apparel, will present growth prospects for the industry.

- In 2022, the raw material market for cereal crops was dominant. Wheat, corn feedstock, sugar, and other cereal crops are widely employed in the formulation of bio-based butanol, which eventually improves cereal output and supports the growth of the biobutanol production business.

- During the projected period, the global acrylates application segment is expected to keep a dominating role. Across the end-use industries such as paints and coatings, textiles, and lubricants, acrylate has many uses.

- The end-use market for transportation is in a strong position. The rising need for ecologically friendly and sustainable transportation fuels as well as the rising demand for energy security and independence are both expected to drive the growth of the transportation segment.

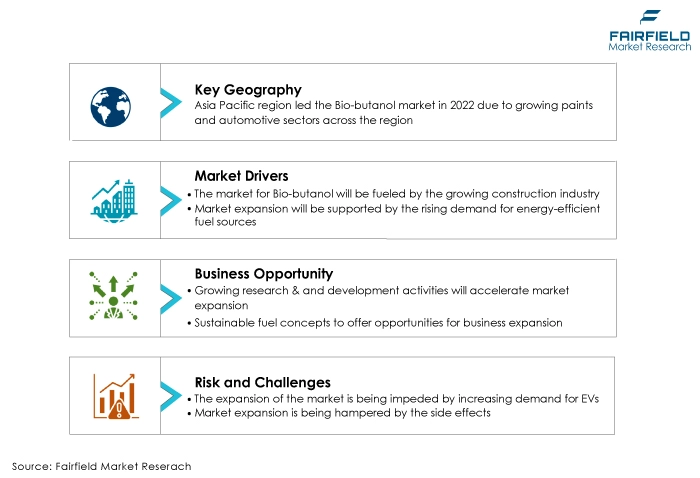

- Asia Pacific region dominates the bio-butanol market since it is home to significant economies like China, which is the world's top manufacturer of paints and automobiles and the primary consumer of bio-butanol.

- Due to the cold climate in most of its nations, North America maintains the second-largest market share.

A Look Back and a Look Forward - Comparative Analysis

The auto manufacturing business has benefited from a growth in logistics and transportation activity as well as a rise in well-established manufacturing facilities. The Indian auto components aftermarket, for instance, is predicted to increase at a rate of 10.5% to reach US$13 Bn by 2019–20, up from US$8.4 Bn in 2016–17, according to a September 2022 article.

Additionally, bio-based butanol is widely employed. These elements have increased the sales of bio-butanol in several end-use industries, opening attractive market potential. Throughout the historical period of 2018 to 2022, the market had uneven growth. This is because it has a wide range of uses in many different end-use industries, including oil and gas, transportation, consumer goods, and automobile.

The market has previously been driven by the accessibility of raw materials and the applicability of bio-butanol for a variety of end-use industries. The use of bio-based butanol, which has important features as petrol, is being driven by key factors such as an increase in the population, rising demand for automobiles, and increased awareness regarding carbon dioxide emissions. For instance, because it is corrosive and has low vapour pressure, it can be transported and stored using the same infrastructure as petrol.

Key Growth Determinants

- Growing Construction Industry

Due to the widespread usage of acrylates and plasticizers made from bio-butanol in the construction industry, this substance has a lot of applications in this industry. Plasticizers are utilised to increase the quality of cement, whereas acrylates are employed in making window panels instead of glass since they are lightweight and shatter resistant.

The size of building operations has increased because of economies' growth and the population's ongoing growth. For instance, the Federal Statistical Office of Germany reports that in January 2022, 29,951 residential construction permits were granted in Germany, an increase of 8.3% from the same month in 2021. The industry for bio-butanol will grow favourably because of an increase in construction activity.

- Rising Government Support

Globally, governments are concentrating on growing their economies. To do this, their nations' infrastructures must be improved to draw foreign investment and tourism. These expenditures could raise the demand for paints in the biotech industry, among other things.

The government's plans will make it possible for foreign firms to invest in the building industry, increasing demand for construction and boosting demand for bio-butanol.

The Renewable Fuel Standard (RFS), for instance, which requires the blending of renewable biofuels with petrol and diesel in the United States, has increased the demand for biobutanol there.

- Rise in Demand for Energy-efficient Fuel Sources

In spark-ignition engines, biobutanol can be used with petrol as fuel and an oxygenate. As a result, biobutanol fuel produces fewer pollutants since it is less explosive and caustic than ethanol, has a lower vapour pressure, a high energy content, and a low volatility.

Additionally, because it is made from the fermentation of lignocellulosic biomass, bio-butanol is a renewable fuel with a high-octane number, adaptable fuel blends, and no igniting issues.

The rise in demand for renewable fuel in the transportation sector due to rising oil costs and government regulations to minimise greenhouse gas emissions would favourably affect the use of bio-butanol as a transportation fuel.

Major Growth Barriers

- Potential Side Effects on Exposure

The effects of solvent-based systems on human and environmental health are one of the main restraining factors affecting the market growth. Headaches, dizziness, and light-headedness are acute health hazards connected with solvent-based systems; these symptoms can progress to unconsciousness and seizures.

Working with this system might also cause nasal and throat irritation. In addition to hurting the body, volatile organic compounds may also impose stress on vital organs like the heart and lungs. The development of the bio-butanol market may be impacted by awareness of the negative consequences of bio-butanol products.

- Rising Adoption of EVs

Due to increased environmental concerns, buyers have begun to switch from buying gasoline-powered cars to buying electric hybrids. As a result, the share of electric car consumption has increased.

According to the European Automobile Manufacturer Association, for example, electric vehicles saw a significant increase in sales, accounting for 18.0% of all new car registrations in 2021, up from a share of 10.5% in 2020.

Hybrid electric vehicles also saw a significant increase in sales, accounting for 19.6% of all new passenger cars registered across the EU in 2021, compared to 11.9% in 2020. The use of bio-butanol as fuel will be negatively impacted by such a rise in electric car sales, which will also negatively affect the development of the bio-butanol sector.

Key Trends and Opportunities to Look at

- Growing Emphasis on R&D

The market growth is being driven by a focus on R&D operations to improve the production process and reduce the cost of biobutanol. The development of new, better, more efficient, and less expensive production procedures is a result of technological advancement. It is expected that these enhancements will reduce the cost of manufacturing biobutanol and raise its parity with traditional fossil fuels.

- Sustainable Fuel Adoption

Growing environmental concerns are driving demand for biobutanol as a cleaner and more sustainable fuel, which is functioning as a significant trend for the market. Only a few of the environmental issues that traditional fossil fuel consumption has been linked to include climate change, and air pollution.

Biobutanol emits far fewer greenhouse gases than traditional fossil fuels. This has led to the usage of biobutanol in numerous industries, such as transportation, aviation, and power production.

- Lignocellulosic Biomass is Becoming Popular

Due to its sustainable supply and lack of competition with food, biobutanol production from lignocellulosic biomass through acetone-butanol-ethanol (ABE) fermentation has attracted considerable interest globally. Since lignocellulosic biomass is the most plentiful, economical, and sustainable type of biomass, turning it into biofuel could have significant advantages.

However, using lignocellulosic materials might also dramatically lessen environmental contamination brought on by the buildup of agricultural and forestry wastes, making it a viable alternative method for producing biobutanol on a wide scale.

How Does the Regulatory Scenario Shape this Industry?

Over the last few years, the use of biofuels has been encouraged by governments all over the world as a means of reducing their reliance on fossil fuels and reducing greenhouse gas emissions.

The adoption of laws and regulations requiring the use of biofuels in numerous industries is driving demand for biobutanol. For instance, The Renewable Energy Directive, which was introduced by the European Commission, establishes goals for the use and development of renewable energy sources like biobutanol.

The use of butanol as an additive in fuels, such as petrol and diesel mixes, is governed by regulations set forth by the US Environmental Protection Agency (EPA). In addition, Regulations have been implemented by the California Air Resources Board (CARB) to minimise emissions from automobiles using alternative fuels, including butanol mixes up to 15%.

Fairfield’s Ranking Board

Top Segments

- Cereal Crops Preferred Raw Material

The cereal crops segment led the market in 2022. Numerous agricultural wastes and some energy crops can be used to make butanol. The production method calls for pre-treating the serial stars with diluted sulfuric acid to increase cellulose's accessibility to hydrolytic enzymes.

Cereals are thus the primary raw material used in the manufacturing of biobutanol. As a result of the rising demand for these raw materials, the market for bio-butanol may rise as a result.

Furthermore, the waste biomass category is projected to experience the fastest market growth. Due to the raw materials' lack of competition with food sources, biobutanol production from the fermentation of biogenic wastes has recently attracted a lot of attention.

- Acrylates at the Forefront

In 2022, the acrylates category dominated the industry. Over the course of the projection period, growth is anticipated to be stimulated by increasing demand for the product from a variety of coatings sector applications, such as paper coatings, leather coatings, and water-based coatings.

In addition, more research and development on bio-butanol as a motor fuel to replace petrol is anticipated to create new market prospects shortly due to its better physical characteristics and affordability.

The glycol ethers category is anticipated to grow substantially throughout the projected period. In addition to being a crucial raw material in the creation of glycol ethers, biobutanol is a second-generation alcoholic fuel that has a lower volatility and higher energy density than ethanol.

- Transportation Segment Leads

The transport sector is predicted to experience the quickest revenue growth throughout the course of the projection period. Autos, lorries, and buses are among the vehicles that can use biobutanol as a biofuel. Air quality can be improved, and greenhouse gas emissions can be significantly reduced by using biobutanol as fuel.

The construction category is expected to experience the fastest growth within the forecast time frame. Rapid urbanisation in developing nations like China and India is fuelling demand from the construction sector, which is helping the sector flourish.

Regional Frontrunners

Asia Pacific Largest in the Play

The region with the biggest market share for bio-butanol was Asia Pacific. key end customers of bio-butanol like the automotive and construction industries, are found in the area, which includes key manufacturing nations like China, India, Japan, and South Korea.

The industrial production output of these nations has expanded because of the accelerated economic expansion and rising investments in industrial sectors. For instance, the International Organisation of Motor Vehicle Manufacturers estimates that in 2021, Asia-Pacific accounted for 50% of the 80 million automobiles produced worldwide, with major producers including China (26 million), India (4.4 million), and South Korea (3.4 million).

North America Grows Stronger

Throughout the predicted period, North America is also expected to continue to dominate. The expansion of the bio-butanol market in the area has been considerably aided by nations like US, and Canada.

The expanding population, the expansion of the chemical manufacturing sector, and government initiatives and investments in renewable energy sources—all of which have paved the way for the expansion of the bio-butanol market—are crucial drivers of development in the North American region.

Fairfield’s Competitive Landscape Analysis

The global bio-butanol market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Bio-butanol Space?

- Abengoa

- Biocleave Limited

- Bioenergy International

- Butalco GmBH (Lesaffre)

- Butamax Advanced Biofuels LLC (BP and Corteva)

- Celtic Renewables

- Cathay Industrial Biotech

- Eastman Chemical Company

- Gevo Inc.

- Green Biologics

- Metabolic Explorer SA

- Phytonix

- Solvay S.A.

- W2 Energy Inc.

- PetroChina

Global Bio-butanol Market is Segmented as Below:

By Raw Material:

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Miscellaneous

By Application:

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Miscellaneous

By End-use Industry:

- Transportation

- Construction

- Medical

- Power Generation

- Miscellaneous

By Geographic Coverage:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Bio-butanol Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Five Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Bio-butanol Market Outlook, 2020 - 2033

- Global Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Miscellaneous

- Global Bio-butanol Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Miscellaneous

- Global Bio-butanol Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Transportation

- Construction

- Medical

- Power Generation

- Miscellaneous

- Global Bio-butanol Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- North America Bio-butanol Market Outlook, 2020 - 2033

- North America Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Miscellaneous

- North America Bio-butanol Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Miscellaneous

- North America Bio-butanol Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Transportation

- Construction

- Medical

- Power Generation

- Miscellaneous

- North America Bio-butanol Market Outlook, by Country, Value (US$ Mn), 2020-2033

- U.S. Bio-butanol Market Outlook, by Raw Material, 2020-2033

- U.S. Bio-butanol Market Outlook, by Application, 2020-2033

- U.S. Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Canada Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Canada Bio-butanol Market Outlook, by Application, 2020-2033

- Canada Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Europe Bio-butanol Market Outlook, 2020 - 2033

- Europe Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Miscellaneous

- Europe Bio-butanol Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Miscellaneous

- Europe Bio-butanol Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Transportation

- Construction

- Medical

- Power Generation

- Miscellaneous

- Europe Bio-butanol Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Germany Bio-butanol Market Outlook, by Application, 2020-2033

- Germany Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Italy Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Italy Bio-butanol Market Outlook, by Application, 2020-2033

- Italy Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- France Bio-butanol Market Outlook, by Raw Material, 2020-2033

- France Bio-butanol Market Outlook, by Application, 2020-2033

- France Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- U.K. Bio-butanol Market Outlook, by Raw Material, 2020-2033

- U.K. Bio-butanol Market Outlook, by Application, 2020-2033

- U.K. Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Spain Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Spain Bio-butanol Market Outlook, by Application, 2020-2033

- Spain Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Russia Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Russia Bio-butanol Market Outlook, by Application, 2020-2033

- Russia Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Rest of Europe Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Rest of Europe Bio-butanol Market Outlook, by Application, 2020-2033

- Rest of Europe Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Asia Pacific Bio-butanol Market Outlook, 2020 - 2033

- Asia Pacific Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Miscellaneous

- Asia Pacific Bio-butanol Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Miscellaneous

- Asia Pacific Bio-butanol Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Transportation

- Construction

- Medical

- Power Generation

- Miscellaneous

- Asia Pacific Bio-butanol Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Bio-butanol Market Outlook, by Raw Material, 2020-2033

- China Bio-butanol Market Outlook, by Application, 2020-2033

- China Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Japan Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Japan Bio-butanol Market Outlook, by Application, 2020-2033

- Japan Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- South Korea Bio-butanol Market Outlook, by Raw Material, 2020-2033

- South Korea Bio-butanol Market Outlook, by Application, 2020-2033

- South Korea Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- India Bio-butanol Market Outlook, by Raw Material, 2020-2033

- India Bio-butanol Market Outlook, by Application, 2020-2033

- India Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Southeast Asia Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Southeast Asia Bio-butanol Market Outlook, by Application, 2020-2033

- Southeast Asia Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Rest of SAO Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Rest of SAO Bio-butanol Market Outlook, by Application, 2020-2033

- Rest of SAO Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Latin America Bio-butanol Market Outlook, 2020 - 2033

- Latin America Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Miscellaneous

- Latin America Bio-butanol Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Miscellaneous

- Latin America Bio-butanol Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Transportation

- Construction

- Medical

- Power Generation

- Miscellaneous

- Latin America Bio-butanol Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Brazil Bio-butanol Market Outlook, by Application, 2020-2033

- Brazil Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Mexico Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Mexico Bio-butanol Market Outlook, by Application, 2020-2033

- Mexico Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Argentina Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Argentina Bio-butanol Market Outlook, by Application, 2020-2033

- Argentina Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Rest of LATAM Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Rest of LATAM Bio-butanol Market Outlook, by Application, 2020-2033

- Rest of LATAM Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Middle East & Africa Bio-butanol Market Outlook, 2020 - 2033

- Middle East & Africa Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Miscellaneous

- Middle East & Africa Bio-butanol Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Miscellaneous

- Middle East & Africa Bio-butanol Market Outlook, by End-use Industry, Value (US$ Mn), 2020-2033

- Transportation

- Construction

- Medical

- Power Generation

- Miscellaneous

- Middle East & Africa Bio-butanol Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Bio-butanol Market Outlook, by Raw Material, 2020-2033

- GCC Bio-butanol Market Outlook, by Application, 2020-2033

- GCC Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- South Africa Bio-butanol Market Outlook, by Raw Material, 2020-2033

- South Africa Bio-butanol Market Outlook, by Application, 2020-2033

- South Africa Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Egypt Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Egypt Bio-butanol Market Outlook, by Application, 2020-2033

- Egypt Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Nigeria Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Nigeria Bio-butanol Market Outlook, by Application, 2020-2033

- Nigeria Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- Rest of Middle East Bio-butanol Market Outlook, by Raw Material, 2020-2033

- Rest of Middle East Bio-butanol Market Outlook, by Application, 2020-2033

- Rest of Middle East Bio-butanol Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Bio-butanol Market Outlook, by Raw Material, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Abengoa

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Biocleave Limited

- Bioenergy International

- Butalco GmBH (Lesaffre)

- Celtic Renewables

- Cathay Industrial Biotech

- Eastman Chemical Company

- Gevo Inc.

- Green Biologics

- Metabolic Explorer SA

- Abengoa

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Raw Material Coverage |

|

|

Application Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |