Global Body Armor Market Forecast

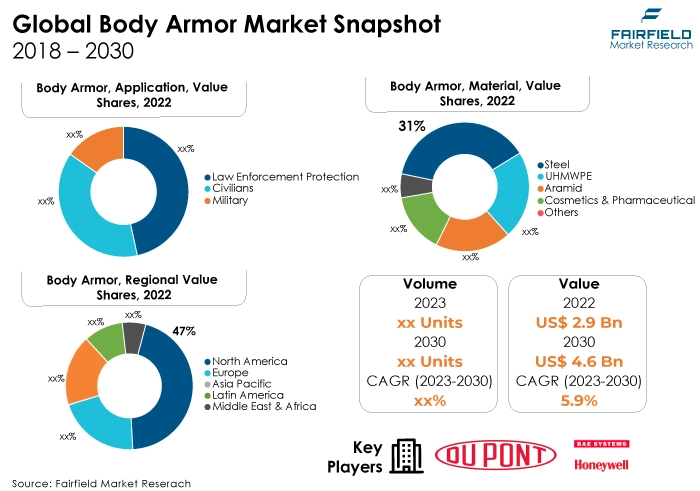

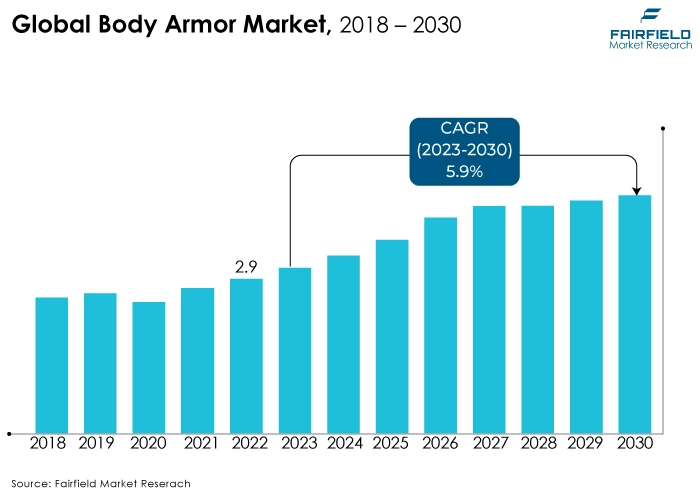

- Global body armor market worth around US$2.9 Bn in 2022 projected to reach US$4.6 Bn in 2030

- Global market size poised to expand at a CAGR of 5.9% during 2023 - 2030

Quick Report Digest

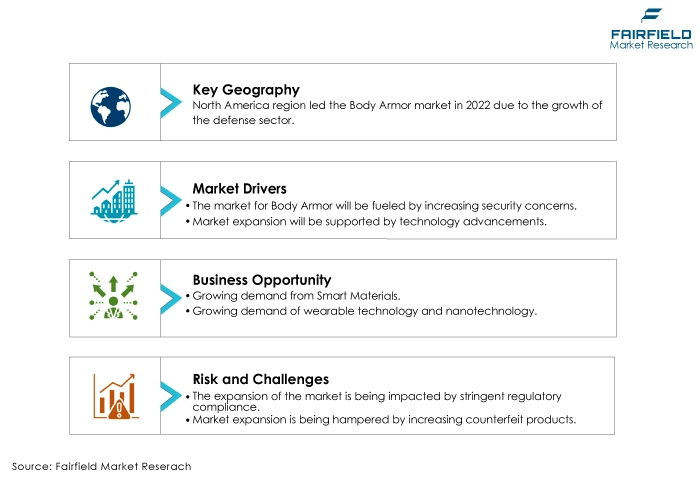

- The body armor market is growing due to increased security concerns worldwide, rising military and defense budgets, technological advancements in protective gear, and growing civilian demand for personal safety solutions in a world where threats to personal security are on the rise.

- Level I body armor, typically used for protecting against low-level threats, captures the largest market share due to its lightweight and discreet design. It provides basic protection, making it suitable for various applications, including civilian use, where comfort and concealment are essential considerations.

- The law enforcement protection application has captured the largest market share in the body armor market due to the substantial demand from law enforcement agencies worldwide. These agencies prioritise officer safety and require high-quality, customised body armor solutions to protect personnel during critical and routine operations, contributing significantly to the market's growth.

- Steel material has captured the largest market share in the body armor market because of its affordability and durability. It is commonly used for entry-level and budget-friendly armor, making it a choice for law enforcement agencies, security personnel, and civilian buyers who seek cost-effective protection without compromising on safety.

- Increasing security concerns, including terrorist threats and urban violence, are driving the body armor market. Law enforcement, military, and civilian users seek effective protection against various threats, propelling the demand for advanced body armor solutions that offer enhanced security and personal safety.

- North America has captured the largest share in the body armor market due to its substantial defense budget, advanced military and law enforcement sectors, and high demand for protective gear. The region's focus on enhancing security and safety measures has driven the adoption of body armor, contributing to its dominance in the market.

- The Asia region is growing at the highest CAGR in the body armor market due to increasing military modernised efforts, rising security concerns, and expanding law enforcement agencies. Rapid economic growth and a growing awareness of the importance of personal protection are driving the demand for body armor in this region.

- Stringent regulatory compliance is challenging the body armor market as manufacturers must meet rigorous standards to ensure product safety and performance. Complying with evolving regulations adds complexity and cost to the production process, which can hinder market growth.

A Look Back and a Look Forward - Comparative Analysis

The body armor market is experiencing growth primarily due to increasing concerns for personal safety and the rising instances of armed conflicts and violent crimes worldwide. Law enforcement agencies, military forces, and civilians are adopting body armor for protection.

Technological advancements, such as lightweight and high-performance materials, are making body armor more comfortable and effective. Additionally, the ongoing development of advanced military and police forces further drives the demand for modern body armor solutions, fueling market growth.

The market has witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors, such as Law Enforcement Protection and civilians. The Law Enforcement Protection market is growing due to increasing security concerns and threats, necessitating enhanced protection for law enforcement officers. Rising crime rates, domestic security issues, and the need for effective defense against firearms drive the demand for advanced protective solutions in this sector.

The future of the body armor market looks promising as the need for enhanced personal protection continues to grow. Technological advancements, including the development of lighter and more flexible materials, are expected to make body armor more comfortable and effective. Rising security concerns, particularly in law enforcement and military sectors, will drive demand. Additionally, innovations in ballistic protection and the integration of smart technologies may further shape the market's future.

Key Growth Determinants

- Increasing Security Concerns Worldwide

Increasing security concerns stemming from the rising instances of armed conflicts, terrorism, and violent crimes are major drivers of the body armor market. Law enforcement agencies, military forces, and civilians alike are seeking effective protection against these threats.

The need for modern, advanced body armor solutions has surged, leading to a growing demand for lightweight, high-performance protective gear. This trend is expected to persist as security remains a top priority in various sectors, further propelling the body armor market's growth.

- Advances in Technology

Technology plays an important role in the growth of the body armor market. Ongoing research and development efforts have resulted in innovative materials and designs, making body armor lighter, more comfortable, and highly effective in offering ballistic protection.

Such advancements have increased the adoption of body armor among law enforcement agencies and military personnel, as they now have access to state-of-the-art protective gear.

Additionally, technological integration, including smart fabrics and sensor technologies, further enhances the functionality and safety features of body armor, driving market growth.

- Augmenting Government Investments

Government investments are a key driver of the body armor market as nations prioritise the modernised of their military and law enforcement agencies. These investments facilitate the procurement of advanced protective gear, including body armor, for personnel.

Governments allocate budgets to enhance the safety and operational capabilities of their security forces, spurring demand for innovative and effective protective solutions. This ongoing commitment to improving security infrastructure and equipment sustains the growth of the body armor market on a global scale.

Major Growth Barriers

- Stringent Regulatory Compliance

Regulatory compliance presents significant challenges to the body armor market. Manufacturers must adhere to stringent standards and undergo extensive testing to ensure their products meet safety and performance requirements. These regulations can vary by region and evolve, requiring constant monitoring and adaptation.

Compliance delays can hinder product launches, and maintaining consistent quality is essential. Moreover, the market faces the issue of counterfeit and non-compliant products, undermining consumer safety and trust. Navigating this complex regulatory landscape is resource-intensive and crucial for the industry's integrity.

- Increasing Ubiquity of Counterfeiting

Counterfeit products pose a substantial challenge to the body armor market. These unauthorised and often substandard imitations can endanger users' lives by providing inadequate protection. Counterfeits erode consumer confidence, damage brand reputations, and result in financial losses for legitimate manufacturers.

Moreover, detecting counterfeit body armor can be difficult, putting law enforcement and military personnel at risk. Addressing this issue requires robust anti-counterfeiting measures, stricter regulatory enforcement, and public awareness campaigns to educate consumers about the risks associated with fake body armor.

Key Trends and Opportunities to Look at

- Smart Materials

Smart materials in the body armor market are designed to respond dynamically to threats. Impact, temperature, and other outside variables can cause certain materials to alter their characteristics.

For instance, liquid armor can become rigid upon impact, while shape-memory alloys can return to their original shape after deformation. Smart materials offer enhanced protection and adaptability, making them a crucial technology trend in body armor development.

- Nanotechnology

Nanotechnology is revolutionising the body armor market by introducing advanced materials and manufacturing techniques. Nanomaterials, like carbon nanotubes and graphene, are used to enhance the strength and lightweight properties of armor.

Nano-coatings provide improved protection against chemical and biological threats. This technology makes it possible to create body armor for military, law enforcement, and civilian purposes that is incredibly effective, light, and flexible.

- Wearable Devices

Wearable devices in the body armor market include smart helmets, vests, and suits integrated with sensors and communication technology. These devices provide real-time data on the wearer's vital signs, environmental conditions, and situational awareness.

These devices enhance the safety and effectiveness of military personnel and law enforcement officers by enabling better decision-making and communication in the field.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly shapes the body armor market. Government agencies and standards organiseds, such as the National Institute of Justice (NIJ) in the United States, set stringent requirements for body armor performance and safety.

Compliance with these regulations is mandatory for manufacturers to ensure the quality of their products. Testing and certification processes are crucial for obtaining approval, which, in turn, instills confidence in law enforcement, military, and civilian users.

The regulatory environment is dynamic, with standards continually evolving to address emerging threats and technologies. Manufacturers must stay updated on these changes, invest in research and development, and adapt their designs to meet the latest requirements.

Additionally, international markets may have different regulations, necessitating Compliance with multiple sets of standards for global sales. Ensuring regulatory Compliance is a complex but essential aspect of the body armor market, as it directly impacts user safety and market acceptance.

Fairfield’s Ranking Board

Top Segments

- Level I Continues to Dominate

Level I body armor captures the largest market share due to its versatility and lightweight design. It offers basic protection against small-caliber firearms and is often preferred by law enforcement and civilians for daily wear. Its inconspicuous profile and comfort make it a popular choice for everyday use.

While higher-level armor provides greater protection, Level I meets the needs of many users without the bulk or discomfort associated with heavier options, contributing to its dominant market presence.

Level II body armor will however exhibit the fastest CAGR in the body armor market due to its ability to provide enhanced protection against a wider range of threats. It offers defense against more powerful handguns, making it suitable for law enforcement, security personnel, and civilians seeking increased safety.

As the threat landscape evolves, the demand for Level IIIA armor has risen, driving its growth in the market, especially in regions where firearm-related risks are a concern.

- Application in Law Enforcement Protection will be the Maximum

Law enforcement protection commands the largest market share in the body armor market due to the extensive use of body armor by police forces globally. Law enforcement agencies prioritise officer safety, and body armor is considered standard-issue equipment.

The increasing threat of firearms and other weapons necessitates advanced protection, driving the adoption of higher-level armor solutions. Additionally, government budgets allocated for law enforcement further support the procurement of body armor, making this segment dominant in the market.

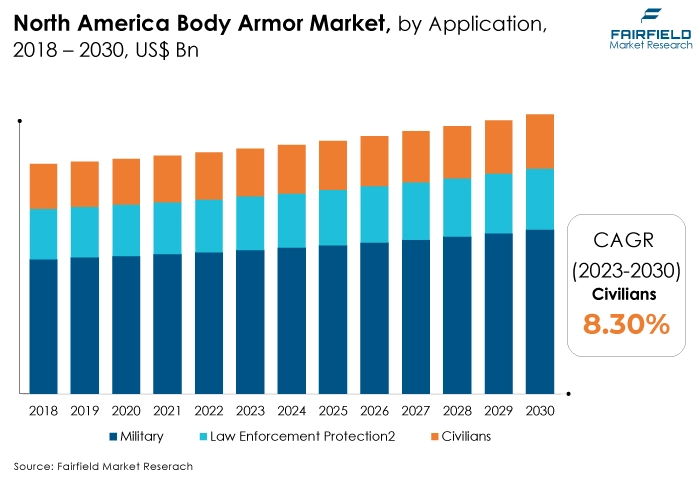

The civilian segment on the other hand is expected to display the fastest growth during the years of projection. Rising concerns about personal safety and an increase in firearm ownership among civilians have driven the demand for body armor.

Moreover, advancements in lightweight and concealable armor designs have made them more accessible and comfortable for everyday use. Additionally, events like mass shootings and civil unrest have further heightened awareness and interest in personal protection, contributing to the growth of the civilian segment.

- Steel Remains the Most Preferred Material

Steel material has captured the largest market share in the body armor market due to its proven durability and cost-effectiveness. Steel plates provide reliable protection against various ballistic threats, making them a preferred choice for military and law enforcement applications.

Additionally, their relatively lower cost compared to alternatives like ceramic or composite materials makes them attractive for budget-conscious buyers. While they may be heavier, steel plates offer a balance between performance and affordability, contributing to their dominant market presence.

Aramid materials such as Kevlar, and Twaron, are experiencing the highest CAGR in the body armor market due to their exceptional combination of strength and lightness. Aramid fibers offer superior ballistic protection while being significantly lighter than traditional steel or ceramic plates.

Such a characteristic enhances the user comfort and maneuverability, making aramid-based body armor increasingly popular, especially among military and law enforcement personnel who require agility and extended wear. The growth in the adoption of aramid-based armor reflects its ability to provide advanced protection without sacrificing mobility.

Regional Frontrunners

North America Jumps in the Bandwagon

North America has captured the largest market share in the body armor market due to several key factors. The region has a robust and well-funded law enforcement sector, which consistently invests in modern body armor solutions for its officers.

The civilian market in North America has seen significant growth, driven by rising concerns about personal safety and increased firearm ownership, further boosting demand for body armor among civilians. In addition, military expenditures and modernised efforts contribute to a strong need for advanced body armor in North America.

Moreover, stringent regulatory standards and testing requirements in the region ensure the reliability and quality of body armor products, instilling confidence in both domestic and international customers. These factors collectively establish North America as a dominant player in the global body armor market.

Asia Pacific will Grow Highly Lucrative Through 2030

Rising security concerns, territorial conflicts, and increasing defense budgets have led to heightened demand for advanced protective gear in the region. Additionally, economic growth, urbanised, and a burgeoning middle class have resulted in greater spending on personal security, driving civilian demand for body armor.

Furthermore, the Asia Pacific region is witnessing advancements in manufacturing capabilities and technology, making body armor more accessible and affordable. These factors combined contribute to the rapid growth of the body armor market here.

Fairfield’s Competitive Landscape Analysis

The global body armor market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Body Armor Space?

- DuPont de Nemours, Inc.

- BAE Systems Inc.

- Point Blank Enterprises

- Honeywell International

- 3M Company

- SafariLand LLC

- Condor Outdoor Products

- Armor Express

- S. Armor Corporation

- EnGrade Body Armor

- Sarkar Defense Solutions

- MKU Limited

- Ballistic Body Armour

- Protech Tactical

- Revision Military Inc.

Key Company Developments

New Product Launch

- March 2022: The United Kingdom Military has unveiled enhanced body armor enhancements designed specifically for female personnel in its armed forces. This upgraded protective gear, referred to as the Virtus Scalable Tactical Vest (STV), is the product of a partnership involving various Ministry of Defence entities and industry organiseds, including the Defence Science and Technology Laboratory (DSTL), Defence Equipment and Support (DE&S), and Source Tactical Gear.

Distribution Agreement

- February 2022: India has introduced the "Veer" helmets designed for the soldiers of the Indian Army. These helmets were created in collaboration with the Global Defense and Homeland Security Company MKU. They are equipped with compatibility for the MCAS (Modular Accessory Connector System), facilitating multi-accessory mounting.

An Expert’s Eye

Demand and Future Growth

An increase in demand for quality weapons is driving the market. The body armor market is experiencing robust demand driven by increasing security concerns globally. Future growth is expected due to technological advancements, rising defense budgets, and heightened threats to military and law enforcement personnel.

The civilian sector is also contributing significantly as personal safety awareness grows. Additionally, the market is evolving with lighter and more ergonomic designs, expanding its applications. These factors collectively indicate a promising future with sustained growth in the body armor market.

Supply Side of the Market

The leading countries in the body armor market include the United States, which has a substantial defense budget and a well-equipped military and law enforcement sector. Other prominent countries include China, with a growing focus on modernising its armed forces, and India, which is investing in protective gear for its military personnel.

Europe, particularly countries like the United Kingdom, Germany, and France, also contribute significantly to the global body armor market, driven by their strong defense capabilities and law enforcement agencies.

The primary raw materials used in the body armor market include high-strength synthetic fibers like aramid (e.g., Kevlar), ballistic ceramics, and specialised coatings. Major suppliers of these raw materials retain companies such as DuPont, known for producing Kevlar fibers, and various ceramics manufacturers that provide materials like boron carbide and silicon carbide. These suppliers play a crucial role in the production of advanced body armor materials, ensuring the quality and performance of the final products.

Global Body Armor Market is Segmented as Below:

By Level:

- Level I

- Level II A

- Level II

- Level IIIA

- Level III

- Level IV

By Application:

- Military & Defense

- Law Enforcement Protection

- Civilians

By Material:

- Steel

- UHMWPE

- Aramid

- Composite Ceramic

- Others

By Geographic Coverage:

- North America

- The U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Body Armor Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Body Armor Market Outlook, 2018 - 2030

3.1. Global Body Armor Market Outlook, by Level, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Level I

3.1.1.2. Level II A

3.1.1.3. Level II

3.1.1.4. Level IIIA

3.1.1.5. Level III

3.1.1.6. Level IV

3.2. Global Body Armor Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Military & Defense

3.2.1.2. Law Enforcement Protection

3.2.1.3. Civilians

3.3. Global Body Armor Market Outlook, by Material, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Steel

3.3.1.2. UHMWPE

3.3.1.3. Aramid

3.3.1.4. Composite Ceramic

3.3.1.5. Others

3.4. Global Body Armor Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Body Armor Market Outlook, 2018 - 2030

4.1. North America Body Armor Market Outlook, by Level, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Level I

4.1.1.2. Level II A

4.1.1.3. Level II

4.1.1.4. Level IIIA

4.1.1.5. Level III

4.1.1.6. Level IV

4.2. North America Body Armor Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Military & Defense

4.2.1.2. Law Enforcement Protection

4.2.1.3. Civilians

4.3. North America Body Armor Market Outlook, by Material, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Steel

4.3.1.2. UHMWPE

4.3.1.3. Aramid

4.3.1.4. Composite Ceramic

4.3.1.5. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Body Armor Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Body Armor Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Body Armor Market Material, Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. Body Armor Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Body Armor Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada Body Armor Market Material, Value (US$ Bn), 2018 - 2030

4.4.1.8. Canada Body Armor Market End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Body Armor Market Outlook, 2018 - 2030

5.1. Europe Body Armor Market Outlook, by Level, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Level I

5.1.1.2. Level II A

5.1.1.3. Level II

5.1.1.4. Level IIIA

5.1.1.5. Level III

5.1.1.6. Level IV

5.2. Europe Body Armor Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Military & Defense

5.2.1.2. Law Enforcement Protection

5.2.1.3. Civilians

5.3. Europe Body Armor Market Outlook, by Material, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Steel

5.3.1.2. UHMWPE

5.3.1.3. Aramid

5.3.1.4. Composite Ceramic

5.3.1.5. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Body Armor Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Body Armor Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Body Armor Market Material, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Body Armor Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Body Armor Market Material, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Body Armor Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Body Armor Market Material, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Body Armor Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Body Armor Market Material, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Body Armor Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Body Armor Market Material, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Body Armor Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Body Armor Market Material, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Body Armor Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Body Armor Market Material, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Body Armor Market Outlook, 2018 - 2030

6.1. Asia Pacific Body Armor Market Outlook, by Level, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Level I

6.1.1.2. Level II A

6.1.1.3. Level II

6.1.1.4. Level IIIA

6.1.1.5. Level III

6.1.1.6. Level IV

6.2. Asia Pacific Body Armor Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Military & Defense

6.2.1.2. Law Enforcement Protection

6.2.1.3. Civilians

6.3. Asia Pacific Body Armor Market Outlook, by Material, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Steel

6.3.1.2. UHMWPE

6.3.1.3. Aramid

6.3.1.4. Composite Ceramic

6.3.1.5. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Body Armor Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Body Armor Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Body Armor Market Material, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Body Armor Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Body Armor Market Material, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Body Armor Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Body Armor Market Material, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Body Armor Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Body Armor Market Material, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Body Armor Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Body Armor Market Material, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Body Armor Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Body Armor Market Material, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Body Armor Market Outlook, 2018 - 2030

7.1. Latin America Body Armor Market Outlook, by Level, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Level I

7.1.1.2. Level II A

7.1.1.3. Level II

7.1.1.4. Level IIIA

7.1.1.5. Level III

7.1.1.6. Level IV

7.2. Latin America Body Armor Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Military & Defense

7.2.1.2. Law Enforcement Protection

7.2.1.3. Civilians

7.3. Latin America Body Armor Market Outlook, by Material, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Steel

7.3.1.2. UHMWPE

7.3.1.3. Aramid

7.3.1.4. Composite Ceramic

7.3.1.5. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Body Armor Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Body Armor Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Body Armor Market Material, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Body Armor Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Body Armor Market Material, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Body Armor Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Body Armor Market Material, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Body Armor Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Body Armor Market Material, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Body Armor Market Outlook, 2018 - 2030

8.1. Middle East & Africa Body Armor Market Outlook, by Level, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Level I

8.1.1.2. Level II A

8.1.1.3. Level II

8.1.1.4. Level IIIA

8.1.1.5. Level III

8.1.1.6. Level IV

8.2. Middle East & Africa Body Armor Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Military & Defense

8.2.1.2. Law Enforcement Protection

8.2.1.3. Civilians

8.3. Middle East & Africa Body Armor Market Outlook, by Material, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Steel

8.3.1.2. UHMWPE

8.3.1.3. Aramid

8.3.1.4. Composite Ceramic

8.3.1.5. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Body Armor Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Body Armor Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Body Armor Market Material, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Body Armor Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Body Armor Market Material, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Body Armor Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Body Armor Market Material, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Body Armor Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Body Armor Market Material, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Body Armor Market by Level, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Body Armor Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Body Armor Market Material, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. DuPont de Nemours, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. BAE Systems plc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Point Blank Enterprises, Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Honeywell International Inc

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. 3M Company

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Safariland, LLC

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Condor Outdoor Products, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Armor Express

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. U.S. Armor Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Ballistic Body Armour (Pty) Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. EnGarde Body Armor

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Sarkar Defense Solutions

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. MKU Limited

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Protech Tactical

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Revision Military, Inc.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Level Coverage |

|

|

Application Coverage |

|

|

Material Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |