Global Botulinum Toxin Market Forecast

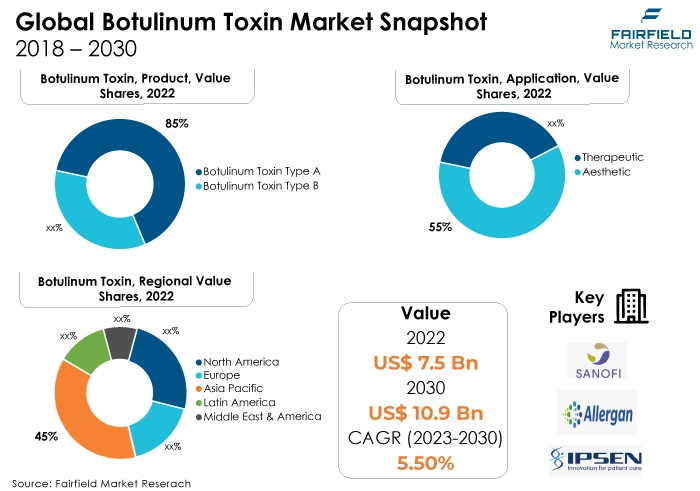

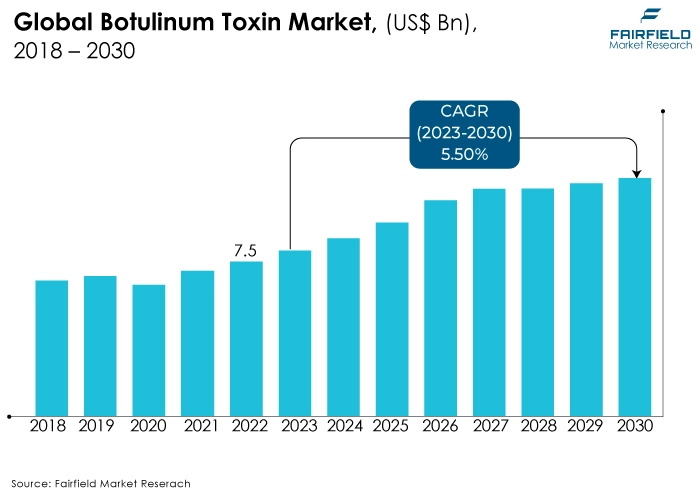

- The approximately US$7.5 Bn market for botulinum toxin likely to reach US$10.9 Bn in 2030

- Botulinum toxin market size predicted to witness a CAGR of 5.5% during 2023 - 2030

Major Report Findings - Fairfield's Perspective

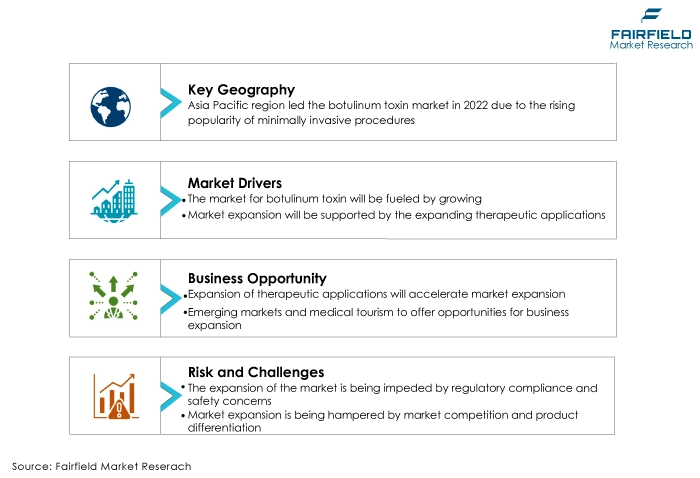

- The key trend anticipated to fuel the botulinum toxin market growth is the increasing preference for minimally invasive aesthetic and therapeutic procedures, which is a significant driver. Patients seek treatments with minimal downtime, boosting the demand for botulinum toxin products.

- Another major market trend expected to fuel botulinum toxin's applications in treating various medical conditions such as migraines, muscle spasms, and hyperhidrosis is driving its adoption in therapeutic settings. Ongoing research expands its therapeutic applications, creating new opportunities.

- In 2022, continuous advancements in botulinum toxin formulations, ensuring longer-lasting effects and improved safety profiles, drive market growth. Innovations in manufacturing processes enhance product efficacy and safety.

- Botulinum toxin type A accounts for most of the share due to its widespread use in both aesthetic and therapeutic applications, supported by extensive research and established safety records.

- In 2022, aesthetic applications dominated the market, fueled by the growing demand for facial rejuvenation and cosmetic enhancements.

- Specialty and dermatology clinics are dominant end users due to their specialized focus on aesthetics and treatments, offering comprehensive services to patients.

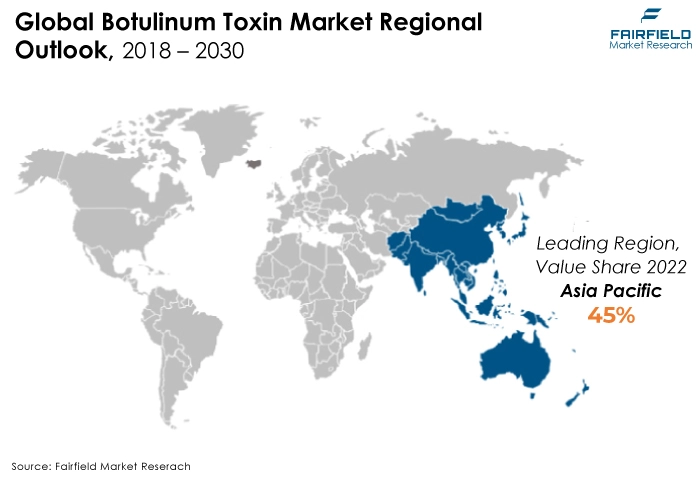

- Asia Pacific leads the market due to the rising middle-class population, increasing disposable incomes, and a growing focus on aesthetic enhancements across countries like China, South Korea, and India.

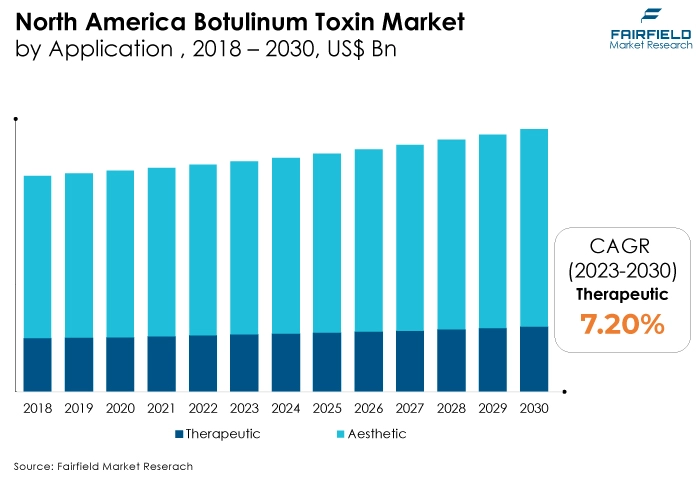

- North America exhibits the fastest growth, primarily attributed to the high healthcare expenditure, well-established healthcare infrastructure, and widespread awareness of aesthetic procedures in the region.

A Look Back and a Look Forward - Comparative Analysis

The global botulinum toxin market is currently witnessing robust growth due to the increasing demand for minimally invasive cosmetic and therapeutic procedures. The market is driven by advancements in toxin formulations, expanding applications in various medical conditions, and a growing aging population seeking aesthetic enhancements. Aesthetic treatments, such as wrinkle reduction and facial contouring, dominate the current market, with rising awareness and acceptance among consumers.

The market witnessed staggered growth during the historical period 2018 - 2022. the botulinum toxin market experienced significant expansion. Technological advancements led to the development of safer and more effective toxin formulations. The market saw a surge in therapeutic applications, including the treatment of neurological disorders and chronic pain conditions. Aesthetic procedures became increasingly popular, driven by social media influence and the desire for youthful appearances. Market players focused on research and development, leading to the introduction of novel products and applications, fueling market growth during this period.

The botulinum toxin market is poised for continuous growth. Future trends indicate a broader range of therapeutic applications, including migraine management and bladder disorders. Advancements in biotechnology and genetic engineering may lead to the development of personalized toxin therapies. The market is anticipated to witness substantial investments in research, with a focus on expanding applications and improving patient outcomes. Moreover, emerging markets in the Asia Pacific, and Latin America are expected to drive market expansion, supported by increasing healthcare infrastructure and a rising emphasis on aesthetics and treatments.

Key Growth Determinants

- Rising Demand for Minimally Invasive Aesthetic Procedures

The botulinum toxin market is the increasing demand for minimally invasive aesthetic procedures. Botulinum toxin, commonly known as botox, is widely used for cosmetic purposes such as reducing facial wrinkles and fine lines. With advancements in injection techniques and the development of precise dosing, more individuals are opting for botox treatments to achieve a youthful appearance without undergoing invasive surgical procedures. The convenience, safety, and effectiveness of botox injections contribute significantly to the growing preference for aesthetic enhancements, driving market expansion.

- Expanding Therapeutic Applications

Beyond cosmetic use, botox has found diverse therapeutic applications, which is a key driver of market growth. The toxin is utilized to treat various medical conditions, including neurological disorders such as migraine, cervical dystonia, and spasticity. Additionally, botox is employed in managing conditions like hyperhidrosis (excessive sweating), and temporomandibular joint disorders (TMJ).

The expanding therapeutic landscape showcases the versatility of botulinum toxin, making it a preferred choice for both physicians and patients seeking effective non-surgical treatments. This broadening scope of applications is driving the market forward.

- Technological Advancements, and Product Innovations

Technological advancements and continuous product innovations in botulinum toxin formulations are driving market growth. Researchers and pharmaceutical companies are focusing on enhancing the efficacy and safety profiles of botulinum toxin products. Novel formulations with longer-lasting effects and reduced side effects are being developed, increasing patient satisfaction, and encouraging repeat treatments.

Additionally, research efforts are directed toward exploring new therapeutic uses and delivery methods, expanding the market potential. These advancements not only cater to the growing demand but also attract healthcare professionals and patients, fostering the market's progression.

Major Growth Barriers

- Regulatory Challenges, and Safety Concerns

The stringent regulatory framework surrounding botulinum toxin products. Regulatory authorities closely monitor the production, distribution, and administration of these products to ensure patient safety. Any changes in regulations, labelling requirements, or approval processes can create challenges for manufacturers and healthcare providers. Safety concerns, especially related to improper administration or dosage miscalculations, also pose a restraint. Adverse events or complications can impact the market’s reputation and deter potential patients and practitioners from opting for botulinum toxin treatments.

- Pricing Pressure

Intense market competition, and pricing pressures present challenges for botulinum toxin manufacturers. The market is saturated with several established players and new entrants, leading to competitive pricing strategies to gain market share. Price wars can reduce profit margins, affecting the revenue potential for companies.

Additionally, the availability of alternative treatments and therapies, both invasive and non-invasive, creates options for patients. Healthcare providers and consumers weigh the cost-effectiveness of botulinum toxin treatments against other available procedures, influencing market demand and revenue streams for manufacturers.

Opportunities

- Rising Popularity of Minimally Invasive Procedures

The market sees a growing trend toward minimally invasive aesthetic treatments, with botulinum toxin injections being at the forefront. This trend is prominent globally, reflecting a preference for non-surgical procedures. Key companies are investing in innovative technologies and formulations to enhance the precision and effectiveness of these injections, catering to the demand for subtle and natural-looking results.

- Increasing Therapeutic Applications

Botulinum toxin's applications extend beyond aesthetics into various therapeutic areas, such as neurology and urology. Its efficacy in treating chronic migraines, muscle disorders, and overactive bladder issues is driving demand. Companies are investing in research to expand these therapeutic applications, aiming to gain regulatory approvals in different regions. This trend is especially pronounced in North America, and Europe, where medical professionals are increasingly adopting botulinum toxin therapies for diverse medical conditions.

- Collaborations, and Partnerships

Companies operating in the botulinum toxin market are forming strategic collaborations and partnerships to expand their market presence and technological capabilities. Alliances between pharmaceutical companies, research institutions, and healthcare providers are facilitating the development of innovative formulations and delivery methods. These collaborations, notably in the Asia Pacific region, are fostering a competitive landscape and enabling brands to leverage shared expertise, leading to enhanced product offerings and market penetration.

How Does the Regulatory Scenario Shape this Industry?

The botulinum toxin market is heavily influenced by stringent regulatory frameworks aimed at ensuring the safety and efficacy of these products. Regulatory bodies such as the Food and Drug Administration (FDA) in the United States, the European Medicines Agency (EMA) in Europe, and the Therapeutic Goods Administration (TGA) in Australia play pivotal roles. These entities assess the clinical trials, manufacturing processes, and labeling of Botulinum Toxin products, ensuring they meet strict quality standards before entering the market.

Region-specific regulations also impact the industry. For instance, in the European Union, the Biologicals Regulation (E.C.) No. 1394/2007 governs the authorization and supervision of these products. In the United States, the Biosimilar User Fee Act (BsUFA) and The Public Health Service Act are essential legislations affecting market entry. Moreover, regulatory changes, such as labeling requirements and safety protocols, directly influence product development strategies, market access, and competitive positioning.

Fairfield’s Ranking Board

Top Segments

Botulinum Toxin Type A Category to Uphold Dominance Through 2030

Botulinum toxin type A dominated the global landscape in 2022. Type A is widely recognized for its versatile applications in both therapeutic and aesthetic treatments. Its effectiveness in reducing wrinkles and treating various medical conditions, such as migraines, sac muscle spasms, and hyperhidrosis, has made it the preferred choice among healthcare professionals and patients. Due to its extensive use and proven efficacy, botulinum toxin type A commands a substantial market share, estimated at around 85%.

Furthermore, botulinum toxin type B represents the fastest-growing category. While type A dominates the market, Type B is gaining traction, especially in therapeutic applications. Recent research and development efforts have led to the introduction of novel formulations of type B botulinum toxin, which offer advantages in specific medical conditions. Its growth can be attributed to the expanding research into new therapeutic uses and an increasing number of patients seeking alternatives or complementary treatments. The market share for botulinum toxin type B is expected to witness a significant uptick, potentially reaching 15% in the coming years.

Aesthetic Applications Surge Ahead of Therapeutic Application Areas

In 2022, in the botulinum toxin market, aesthetic applications dominate the industry landscape. Aesthetic treatments, such as wrinkle reduction and facial rejuvenation, have gained immense popularity among consumers seeking non-invasive cosmetic procedures. The demand for aesthetic botulinum toxin treatments continues to soar due to the growing emphasis on youthful appearances and the rising acceptance of minimally invasive procedures. Aesthetic applications hold a substantial market share, estimated at approximately 70%.

Therapeutic applications represent the fastest-growing category in the botulinum toxin market. Therapeutic uses, including the treatment of various medical conditions like muscle spasms, migraines, and hyperhidrosis, are expanding. Ongoing research and clinical trials are uncovering new therapeutic applications, leading to increased adoption among healthcare professionals. The therapeutic segment is witnessing rapid growth, and its market share is anticipated to reach around 30%, reflecting the rising demand for botulinum toxin in medical treatments.

- Specialty and Dermatology Clinics Lead the Botox Way

Specialty and dermatology clinics dominate the landscape, serving as the primary hub for botulinum toxin treatments. These clinics specialize in aesthetic and dermatological procedures, including botox treatments, making them a focal point for consumers seeking these services. The specialized expertise and advanced equipment available at these clinics make them highly preferred among patients, contributing to their dominance in the market. Specialty and dermatology clinics currently hold a substantial market share, estimated at approximately 60%.

The hospitals segment represents the fastest-growing category in the botulinum toxin market. Hospitals are increasingly incorporating botulinum toxin treatments into their services, catering to a broader patient base. The trust associated with hospital settings, coupled with the availability of comprehensive healthcare services, makes hospitals an attractive choice for consumers seeking botulinum toxin treatments. The hospital segment is witnessing rapid growth, and its market share is anticipated to reach around 40%, reflecting the expanding adoption of botulinum toxin in hospital-based settings.

Regional Frontrunners

Asia Pacific Reigns Supreme as Global Revenue Leader

Asia Pacific stands as the largest revenue-contributing region in the global botulinum toxin market, capturing approximately 45% of the market share. This dominance can be attributed to several key factors. The rising demand for cosmetic procedures, including botox treatments, among the burgeoning middle-class population in countries like China, India, and South Korea is significantly fuelling the market. Increasing disposable incomes and the rising awareness of aesthetic enhancements are driving the adoption of botulinum toxin therapies in the region.

The region is witnessing substantial advancements in the healthcare and cosmetic surgery sectors. The availability of skilled practitioners and advanced medical facilities, coupled with a proactive approach toward aesthetic procedures, contributes to the region's market leadership.

Momentum Builds in North America

North America is poised to witness significant growth in botulinum toxin sales, accounting for approximately 40% of the global market share. Several factors contribute to the region's robust market expansion. The US, being one of the major economies in North America, has a well-established healthcare infrastructure and a high acceptance rate for aesthetic procedures, including botox treatments. The region has a large aging population, which drives the demand for anti-aging solutions.

Moreover, the cultural emphasis on youthful appearance and the availability of advanced medical technologies further boost the adoption of botulinum toxin therapies. North America experiences a high level of research and development activities in the field of cosmetics and aesthetics. Pharmaceutical companies in the region invest significantly in developing innovative botulinum toxin products, catering to the evolving needs of consumers.

Fairfield’s Competitive Landscape Analysis

In the competitive landscape, companies are expected to focus on research and development to introduce innovative products that cater to specific market segments. Moreover, strategic collaborations and partnerships might become more prevalent, enabling companies to leverage each other's strengths and expand their market presence. Opportunities lie in diversifying applications; beyond aesthetic treatments, botulinum toxin's therapeutic potential in addressing various medical conditions offers a vast, untapped market.

Who are the Leaders in Global Botulinum Toxin Space?

- Merz Pharma GmbH and Co. KGaA

- Allergan plc

- Ipsen Group

- Sanofi S.A.

- Salix

- HUGEL Inc.

- Medytox Inc.

- Galderma S.A.

- Smith and Nephew plc

- S. Worldwide

- EVOLUS INC.

- DAEWOONG PHARMACEUTICAL

- Abbvie Inc

- REVANCE THERAPEUTICS INC

Significant Company Developments

New Product Launch

- October 2022: Hugel recently declared that the USFDA has accepted its Biologics License Application for letibotulinumtoxinA. The FDA has categorized the resubmission as a Class 2 response and has set an action date of April 6, 2023, in accordance with the Prescription Drug User Fee Act (PDUFA).

- July 2022: Fastox Pharma launched the long-lasting botulinum toxin LAST technology at the 'Toxins 2022 International Conference'. Fastox discovered that combining botulinum toxin type A (BoNT/A) with fast-acting myorelaxant drugs is anticipated to accelerate the BoNT/A onset of action.

- October 2022: Evolus, Inc. commenced its commercial operations in Great Britain and has successfully delivered the initial customer orders for Nuceiva (type A).

Distribution Agreement

- October 2022: During Breast Cancer Awareness Month, Galderma maintained its collaboration with the National Breast Cancer Foundation Inc. (NBCF). Through a campaign on Galderma's social media platforms, they showcased the experiences and treatment paths of individuals who have overcome breast cancer and had received Restylane, Dysport (abobotulinumtoxinA), and/or Sculptra.

- August 2022: Medytox's partnership with Bloomage Biotechnology is terminated. Bloomage Biotechnology stated that Medytox has never provided Medybloom China BTX products for sale since the joint venture agreement was signed.

An Expert’s Eye

Demand and Future Growth

The botulinum toxin market is set to witness sustained demand and future growth, primarily driven by the rising awareness about minimally invasive cosmetic procedures and their effectiveness in addressing various medical conditions. The increasing emphasis on aesthetics, especially in regions like North America and Asia Pacific, will continue to fuel demand. As the aging population grows globally, the demand for botulinum toxin treatments, both therapeutic and aesthetic, is expected to soar.

Supply Side of the Market

According to our analysis, on the supply side, ensuring a consistent, high-quality supply of botulinum toxin is imperative. The production process demands precision, and any deviation could result in compromised product quality. Manufacturers need to invest in robust supply chain management, ensuring a smooth flow from production to distribution. Additionally, securing a stable supply of the raw materials required for botulinum toxin production is crucial. Shortages might result from any interruption in the supply chain, which would affect patients as well as healthcare professionals.

Manufacturers should build trusting relationships with suppliers and have backup plans in place to reduce the risk of supply chain interruptions. These plans should include alternative sourcing options and regular monitoring of inventory levels to prevent stockouts. By prioritizing supply chain resilience, manufacturers can maintain a consistent supply of botulinum toxin and meet the demands of patients and healthcare providers effectively.

Global Botulinum Toxin Market is Segmented as Below:

By Product:

- Botulinum Toxin Type A

- Botulinum Toxin Type B

By Application:

- Aesthetic

- Therapeutic

By End User:

- Hospitals

- Specialty and Dermatology Clinics

- Cosmetic Centres

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Botulinum Toxin Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Botulinum Toxin Market Outlook, 2018 - 2030

3.1. Global Botulinum Toxin Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Botulinum Toxin Type A

3.1.1.2. Botulinum Toxin Type B

3.2. Global Botulinum Toxin Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Aesthetic

3.2.1.2. Therapeutic

3.3. Global Botulinum Toxin Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Specialty and Dermatology Clinics

3.3.1.3. Cosmetic Centers

3.3.1.4. Others

3.4. Global Botulinum Toxin Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Botulinum Toxin Market Outlook, 2018 - 2030

4.1. North America Botulinum Toxin Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Botulinum Toxin Type A

4.1.1.2. Botulinum Toxin Type B

4.2. North America Botulinum Toxin Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Aesthetic

4.2.1.2. Therapeutic

4.3. North America Botulinum Toxin Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Specialty and Dermatology Clinics

4.3.1.3. Cosmetic Centers

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Botulinum Toxin Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Botulinum Toxin Market Outlook, 2018 - 2030

5.1. Europe Botulinum Toxin Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Botulinum Toxin Type A

5.1.1.2. Botulinum Toxin Type B

5.2. Europe Botulinum Toxin Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Aesthetic

5.2.1.2. Therapeutic

5.3. Europe Botulinum Toxin Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Specialty and Dermatology Clinics

5.3.1.3. Cosmetic Centers

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Botulinum Toxin Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K .Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Botulinum Toxin Market Outlook, 2018 - 2030

6.1. Asia Pacific Botulinum Toxin Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Botulinum Toxin Type A

6.1.1.2. Botulinum Toxin Type B

6.2. Asia Pacific Botulinum Toxin Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Aesthetic

6.2.1.2. Therapeutic

6.3. Asia Pacific Botulinum Toxin Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Specialty and Dermatology Clinics

6.3.1.3. Cosmetic Centers

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Botulinum Toxin Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Botulinum Toxin Market Outlook, 2018 - 2030

7.1. Latin America Botulinum Toxin Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Botulinum Toxin Type A

7.1.1.2. Botulinum Toxin Type B

7.2. Latin America Botulinum Toxin Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Aesthetic

7.2.1.2. Therapeutic

7.3. Latin America Botulinum Toxin Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Specialty and Dermatology Clinics

7.3.1.3. Cosmetic Centers

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Botulinum Toxin Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Botulinum Toxin Market Outlook, 2018 - 2030

8.1. Middle East & Africa Botulinum Toxin Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Botulinum Toxin Type A

8.1.1.2. Botulinum Toxin Type B

8.2. Middle East & Africa Botulinum Toxin Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Aesthetic

8.2.1.2. Therapeutic

8.3. Middle East & Africa Botulinum Toxin Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Specialty and Dermatology Clinics

8.3.1.3. Cosmetic Centers

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Botulinum Toxin Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Botulinum Toxin Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Botulinum Toxin Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Botulinum Toxin Market End User, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Merz Pharma GmbH and Co. KGaA

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Allergan plc

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Ipsen Group

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Sanofi S.A.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Salix

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. HUGEL Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Medytox Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Galderma S.A.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Business Strategies and Development

9.4.9. Smith and Nephew plc

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. US Worldmed

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. EVOLUS INC.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. DAEWOONG PHARMACEUTICAL

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Abbvie, Inc.

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. REVANCE THERAPEUTICS, INC.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |