Global CGRP Inhibitors Market Forecast

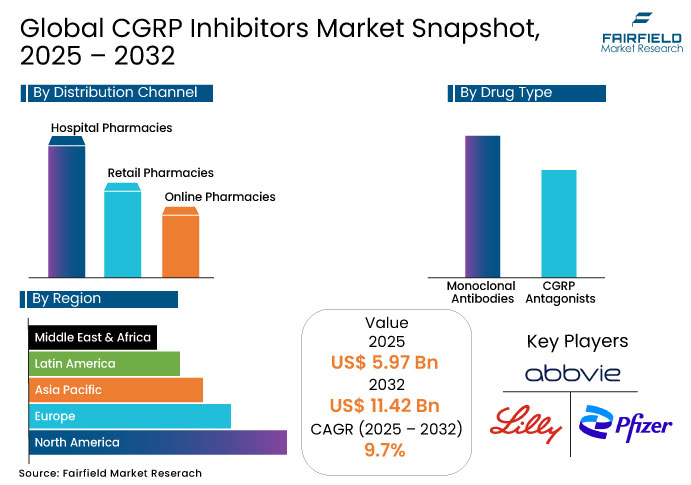

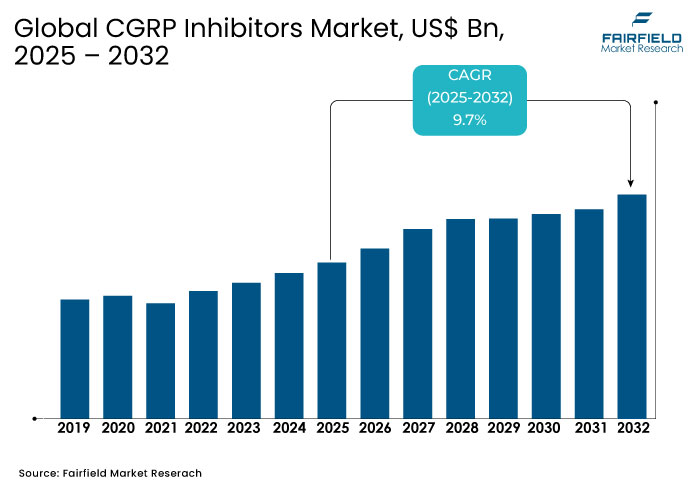

- The global CGRP Inhibitors Market size is expected to reach US$ 11.4 Bn, currently at US$ 5.9 Bn in 2025, resembling strong growth with 9.7% CAGR by 2032.

- The market is anticipated to benefit from strong demand for effective, targeted migraine treatments, particularly CGRP antagonists and monoclonal antibodies, as patients and healthcare providers seek safer and more reliable alternatives to traditional therapies.

CGRP Inhibitors Market Insights

- CGRP inhibitors market are gaining popularity due to their targeted action, offering a safer and more effective alternative to traditional migraine treatments.

- The North American market remains the largest for CGRP inhibitors, driven by high patient awareness, advanced healthcare infrastructure, and strong demand for new migraine therapies.

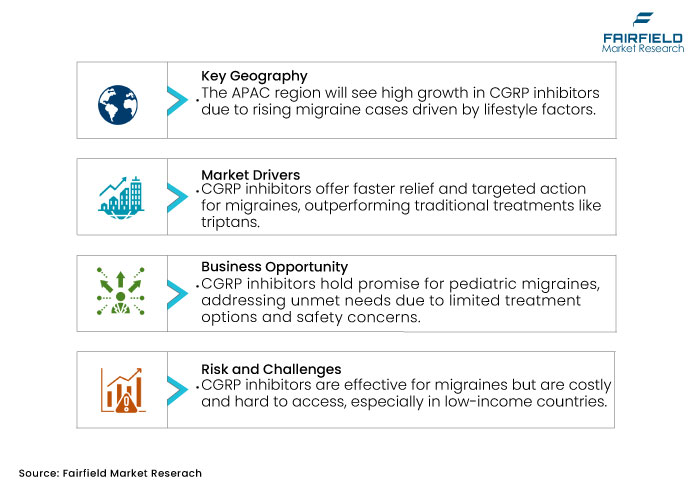

- Asia Pacific is expected to experience the highest growth rate for CGRP inhibitors, fueled by increasing migraine prevalence linked to stress, lifestyle changes, and environmental factors.

- Expanding indications to include pediatric and adolescent populations represents a major opportunity, as clinical trials continue to show positive results for pediatric patients.

- Faster regulatory approvals in key markets such as the U.S. and Europe are driving the availability of CGRP inhibitors, improving access for patients.

- New oral CGRP inhibitors are emerging, offering patients an easier-to-administer alternative to injectables, further expanding treatment options.

- The potential introduction of CGRP biosimilars could help lower costs and increase accessibility, opening up new opportunities for market growth.

A Look Back and a Look Forward - Comparative Analysis

CGRP inhibitors have transformed migraine treatment since their introduction, offering targeted therapy with fewer side effects compared to traditional options such as triptans or antiepileptics. Initially approved for adults with episodic and chronic migraines, drugs such as erenumab, fremanezumab, and galcanezumab demonstrated strong efficacy in reducing migraine frequency and improving quality of life. However, high costs and insurance limitations have restricted access for many patients.

Looking ahead, the CGRP inhibitors market is poised for growth through expanded indications, including pediatric use, and the development of oral CGRP receptor antagonists, which offer more convenient dosing. Clinical trials continue to evaluate safety and effectiveness in younger populations and those with treatment-resistant migraines. Additionally, the potential introduction of biosimilars or lower-cost alternatives could broaden accessibility. As awareness increases and payer policies evolve, CGRP inhibitors are likely to become a more widely used solution for migraine management, offering long-term relief and reducing the overall burden of the disease.

Key Growth Determinants

- Superior Efficacy and Faster Onset of Action Boosting CGRP Inhibitor Adoption

CGRP inhibitors market have emerged as a promising advancement in migraine treatment due to their superior efficacy and quicker onset of action compared to traditional therapies. Conventional treatments, such as triptans and analgesics, often take longer to alleviate symptoms and may require repeated dosing. These medications also carry risks like medication overuse headaches, making them less suitable for long-term use. In contrast, CGRP inhibitors provide a targeted approach by blocking the activity of calcitonin gene-related peptide (CGRP), a molecule that plays a central role in migraine-related pain. This targeted mechanism helps relieve symptoms more quickly and addresses the root biological causes of migraines.

Clinical studies show that CGRP inhibitors, including monoclonal antibodies and receptor antagonists, can reduce migraine frequency and intensity, often within the first month of use. Their rapid and sustained effects make them especially beneficial for patients with chronic migraines who require ongoing symptom control. As awareness of their benefits increases among patients and healthcare providers, the use of CGRP inhibitors is expanding. Their ability to offer immediate relief and long-term prevention positions them as a valuable option in the evolving landscape of migraine management.

Key Growth Barriers

- Cost and Accessibility-related Constraints

CGRP inhibitors are effective treatments for migraines, but they are very expensive and hard to access for many people. Injectable drugs like erenumab, fremanezumab, and galcanezumab often cost over $500–$600 a month without insurance. This makes them too costly for many patients, especially in low- and middle-income countries. Even in developed countries, people face high co-pays, insurance rejections, and rules that require trying cheaper treatments first. A 2022 article on Migraine.com shared stories of patients being denied these drugs by their insurance or struggling to afford them.

In Europe, government health plans usually only cover CGRP inhibitors for people with very severe migraines. In emerging CGRP inhibitors markets, the situation is more pronounced, as many public health systems do not include CGRP inhibitors in their essential drug lists, forcing patients to rely on out-of-pocket payments or less effective alternatives. Until costs go down or insurance improves, many people will struggle to get the treatment they need.

CGRP Inhibitors Market Trends and Opportunities

- Pediatric and Adolescent Migraine Treatment

The pediatric and adolescent migraine segment presents a significant growth opportunity within the CGRP inhibitor market. Although current approvals for CGRP-targeting therapies mainly cover adults, migraines affect roughly 8–10% of children and adolescents, with prevalence rising during teenage years, especially among girls. Traditional migraine treatments like triptans and antiepileptics often have poor tolerability and safety concerns in younger populations, leaving a substantial unmet need for more suitable options.

CGRP inhibitors market, known for their targeted action and favorable safety profiles, are emerging as promising alternatives. Recent clinical trials are exploring their use in younger patients. For example, a Phase 3 study of fremanezumab in adolescents with episodic migraine showed that 47.2% of treated participants experienced a 50% or greater reduction in monthly migraine days, compared to just 27% in the placebo group. Side effects were comparable between both groups, indicating good tolerability.

Securing regulatory approval for pediatric use could not only extend product lifecycles but also introduce these therapies to a largely untapped patient population. Early treatment may also help prevent the progression to chronic migraine, reducing long-term healthcare burdens. Addressing this need offers both clinical value and strong commercial potential, making the pediatric segment a compelling area for market expansion.

Leading Segment Overview

- Demand from the CGRP Antagonists dominates the Market.

The CGRP inhibitors market is mainly driven by strong demand for CGRP antagonists, especially oral options like rimegepant and ubrogepant. These drugs are popular because they are easy to take and work quickly to relieve migraine pain. Many patients prefer them over older treatments, which often have more side effects. This rising demand has helped oral CGRP drugs gain a large share of the market.

Meanwhile, monoclonal antibodies such as erenumab, fremanezumab, and galcanezumab also play a key role in the market. These are usually given by injection and are used for migraine prevention rather than immediate relief. They are effective in reducing the number of migraine days each month and are well-tolerated by most patients. Although they are more expensive and less convenient than pills, they are a good option for people with frequent or severe migraines. Together, CGRP antagonists and monoclonal antibodies are shaping the future of migraine treatment.

Regional Analysis

- North America is the largest market for CGRP Inhibitors

North America is currently the largest market for CGRP inhibitors. This is mainly because of the high number of people diagnosed with migraines, better awareness about new treatments, and strong healthcare infrastructure. In the United States, many patients have access to specialists and advanced therapies, which have helped increase the use of CGRP inhibitors like erenumab, fremanezumab, and rimegepant. Insurance coverage, although sometimes challenging, is more widespread than in many other regions, making these treatments more accessible.

Pharmaceutical companies also focus heavily on the North American CGRP inhibitors market for launching new drugs and conducting clinical trials. The region’s strong presence of key market players and faster regulatory approvals help in quicker product availability. In addition, growing efforts to improve insurance coverage and include younger patients, like adolescents, are expected to further boost demand. Overall, North America is set to remain a leading region in the CGRP inhibitor market in the near future.

- Growth Opportunities for CGRP Inhibitors in the Asia Pacific Market

The Asia Pacific (APAC) region is projected to experience the highest compound annual growth rate (CAGR) for CGRP inhibitors during the forecast period. This growth is largely driven by the increasing prevalence of migraines, influenced by a mix of cultural, lifestyle, and environmental factors like stress, sleep deprivation, and other regional challenges. As the demand for effective migraine treatments rises, CGRP inhibitors are expected to play a key role in addressing the needs of the population.

For example, a study published in the Journal of Population Therapeutics and Clinical Pharmacology in January 2024 highlighted common migraine triggers in India, including emotional stress (97.5%), weather changes (69%), physical exertion (64.5%), missed meals (63.5%), travel (55.5%), and sleep deprivation (55%). These factors are contributing to the increasing demand for migraine treatments, which is anticipated to drive the regional market's growth, positioning APAC as a key area for the expansion of CGRP inhibitors market.

Competitive Landscape

The CGRP inhibitors market is highly competitive, with major pharmaceutical companies focusing on innovation and strategic partnerships. Key players include Amgen, Eli Lilly, Teva Pharmaceuticals, and AbbVie, each offering FDA-approved therapies targeting migraine prevention and treatment. Companies are investing heavily in research and development to expand therapeutic indications and enhance drug efficacy.

The market is witnessing increasing biosimilar development and regional expansion efforts. Mergers, acquisitions, and collaborations are common strategies to strengthen market presence and access new patient populations. Continuous clinical trials and regulatory approvals are expected to shape future dynamics, ensuring sustained growth and heightened competition in the industry.

- In April 2024, AbbVie announced an interim analysis of an ongoing Phase 3, open-label 156-week extension study evaluating the long-term safety and tolerability of oral atogepant for the prevention of migraine in participants with chronic or episodic migraine.

- In August 2024, Organon healthcare company with a focus on women’s health, announced it has expanded its agreement with Eli Lilly and Company to become the sole distributor and promoter for the migraine medicine Emgality ® (galcanezumab) in Canada, Colombia, Israel, South Korea, Kuwait, Mexico, Qatar, Saudi Arabia, Taiwan, Turkey and the United Arab Emirates.

- In March 2023, the FDA approved Pfizer’s ZAVZPRET™ (zavegepant), a nasal spray treatment for migraines.

Key Companies

- Pfizer Inc.

- AbbVie Inc.

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- Lundbeck A/S

- Amgen Inc.

Expert Opinion

- Increasing awareness of CGRP inhibitors' effectiveness in preventing and treating migraines, the demand for these targeted therapies is growing. This trend is expected to continue as more patients seek safer, more efficient alternatives to traditional medications.

- Oral CGRP inhibitors, such as rimegepant and ubrogepant, are gaining popularity due to their convenience and quick action. The shift towards more patient-friendly, oral options is expected to drive further market growth, offering a competitive edge over injectable treatments.

- As clinical trials show promising results for pediatric patients, the market is likely to expand with new approvals for pediatric and adolescent use.

Global CGRP Inhibitors Market is Segmented as-

By Drug Type

- Monoclonal Antibodies

- CGRP Antagonists

By Treatment Type

- Acute (Abortive)

- Preventative

By Route of Administration

- Oral

- Injectable

- Nasal

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Patient Demographics

- Adult

- Geriatric

- Pediatric

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global CGRP Inhibitors Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. List of Recent FDA-Approved CGRP Inhibitors

2.5. Pipeline Assessment

2.6. Prevalence of Migraine by Key Countries

2.7. Reimbursement Scenario

2.8. Porter’s Five Forces Analysis

2.9. COVID-19 Impact Analysis

2.9.1. Supply

2.9.2. Demand

2.10. Impact of Ukraine-Russia Conflict

2.11. Economic Overview

2.11.1. World Economic Projections

2.12. PESTLE Analysis

3. Global CGRP Inhibitors Market Outlook, 2019 - 2032

3.1. Global CGRP Inhibitors Market Outlook, by Drug Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Monoclonal Antibodies

3.1.1.2. CGRP Antagonists

3.2. Global CGRP Inhibitors Market Outlook, by Treatment Type, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Acute (Abortive)

3.2.1.2. Preventative

3.3. Global CGRP Inhibitors Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Oral

3.3.1.2. Injectable

3.3.1.3. Nasal

3.4. Global CGRP Inhibitors Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Hospital Pharmacies

3.4.1.2. Retail Pharmacies

3.4.1.3. Online Pharmacies

3.5. Global CGRP Inhibitors Market Outlook, by Patient Demographics, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. Adult

3.5.1.2. Geriatric

3.5.1.3. Paediatric

3.6. Global CGRP Inhibitors Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America CGRP Inhibitors Market Outlook, 2019 - 2032

4.1. North America CGRP Inhibitors Market Outlook, by Drug Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Monoclonal Antibodies

4.1.1.2. CGRP Antagonists

4.2. North America CGRP Inhibitors Market Outlook, by Treatment Type, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Acute (Abortive)

4.2.1.2. Preventative

4.3. North America CGRP Inhibitors Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Oral

4.3.1.2. Injectable

4.3.1.3. Nasal

4.4. North America CGRP Inhibitors Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Hospital Pharmacies

4.4.1.2. Retail Pharmacies

4.4.1.3. Online Pharmacies

4.5. North America CGRP Inhibitors Market Outlook, by Patient Demographics, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. Adult

4.5.1.2. Geriatric

4.5.1.3. Paediatric

4.5.2. BPS Analysis/Market Attractiveness Analysis

4.6. North America CGRP Inhibitors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.6.1. Key Highlights

4.6.1.1. U.S. CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

4.6.1.2. U.S. CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

4.6.1.3. U.S. CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

4.6.1.4. U.S. CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.6.1.5. U.S. CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

4.6.1.6. Canada CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

4.6.1.7. Canada CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

4.6.1.8. Canada CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

4.6.1.9. Canada CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.6.1.10. Canada CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe CGRP Inhibitors Market Outlook, 2019 - 2032

5.1. Europe CGRP Inhibitors Market Outlook, by Drug Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Monoclonal Antibodies

5.1.1.2. CGRP Antagonists

5.2. Europe CGRP Inhibitors Market Outlook, by Treatment Type, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Acute (Abortive)

5.2.1.2. Preventative

5.3. Europe CGRP Inhibitors Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Oral

5.3.1.2. Injectable

5.3.1.3. Nasal

5.4. Europe CGRP Inhibitors Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Hospital Pharmacies

5.4.1.2. Retail Pharmacies

5.4.1.3. Online Pharmacies

5.5. Europe CGRP Inhibitors Market Outlook, by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Adult

5.5.1.2. Geriatric

5.5.1.3. Paediatric

5.5.2. BPS Analysis/Market Attractiveness Analysis

5.6. Europe CGRP Inhibitors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.6.1. Key Highlights

5.6.1.1. Germany CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

5.6.1.2. Germany CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

5.6.1.3. Germany CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.4. Germany CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.6.1.5. Germany CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.6.1.6. U.K. CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

5.6.1.7. U.K. CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

5.6.1.8. U.K. CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.9. U.K. CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.6.1.10. U.K. CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.6.1.11. France CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

5.6.1.12. France CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

5.6.1.13. France CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.14. France CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.6.1.15. France CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.6.1.16. Italy CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

5.6.1.17. Italy CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

5.6.1.18. Italy CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.19. Italy CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.6.1.20. Italy CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.6.1.21. Turkey CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

5.6.1.22. Turkey CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

5.6.1.23. Turkey CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.24. Turkey CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.6.1.25. Turkey CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.6.1.26. Russia CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

5.6.1.27. Russia CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

5.6.1.28. Russia CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.29. Russia CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.6.1.30. Russia CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.6.1.31. Rest of Europe CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

5.6.1.32. Rest of Europe CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

5.6.1.33. Rest of Europe CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.34. Rest of Europe CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.6.1.35. Rest of Europe CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific CGRP Inhibitors Market Outlook, 2019 - 2032

6.1. Asia Pacific CGRP Inhibitors Market Outlook, by Drug Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Monoclonal Antibodies

6.1.1.2. CGRP Antagonists

6.2. Asia Pacific CGRP Inhibitors Market Outlook, by Treatment Type, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Acute (Abortive)

6.2.1.2. Preventative

6.3. Asia Pacific CGRP Inhibitors Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Oral

6.3.1.2. Injectable

6.3.1.3. Nasal

6.4. Asia Pacific CGRP Inhibitors Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Hospital Pharmacies

6.4.1.2. Retail Pharmacies

6.4.1.3. Online Pharmacies

6.5. Asia Pacific CGRP Inhibitors Market Outlook, by Patient Demographics, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. Adult

6.5.1.2. Geriatric

6.5.1.3. Paediatric

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Asia Pacific CGRP Inhibitors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.6.1. Key Highlights

6.6.1.1. China CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

6.6.1.2. China CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

6.6.1.3. China CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.4. China CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.6.1.5. China CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

6.6.1.6. Japan CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

6.6.1.7. Japan CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

6.6.1.8. Japan CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.9. Japan CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.6.1.10. Japan CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

6.6.1.11. South Korea CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

6.6.1.12. South Korea CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

6.6.1.13. South Korea CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.14. South Korea CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.6.1.15. South Korea CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

6.6.1.16. India CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

6.6.1.17. India CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

6.6.1.18. India CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.19. India CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.6.1.20. India CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

6.6.1.21. Southeast Asia CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

6.6.1.22. Southeast Asia CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

6.6.1.23. Southeast Asia CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.24. Southeast Asia CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.6.1.25. Southeast Asia CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

6.6.1.26. Rest of Asia Pacific CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

6.6.1.27. Rest of Asia Pacific CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

6.6.1.28. Rest of Asia Pacific CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.29. Rest of Asia Pacific CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.6.1.30. Rest of Asia Pacific CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America CGRP Inhibitors Market Outlook, 2019 - 2032

7.1. Latin America CGRP Inhibitors Market Outlook, by Drug Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Monoclonal Antibodies

7.1.1.2. CGRP Antagonists

7.2. Latin America CGRP Inhibitors Market Outlook, by Treatment Type, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Acute (Abortive)

7.2.1.2. Preventative

7.3. Latin America CGRP Inhibitors Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Oral

7.3.1.2. Injectable

7.3.1.3. Nasal

7.4. Latin America CGRP Inhibitors Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Hospital Pharmacies

7.4.1.2. Retail Pharmacies

7.4.1.3. Online Pharmacies

7.5. Latin America CGRP Inhibitors Market Outlook, by Patient Demographics, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Adult

7.5.1.2. Geriatric

7.5.1.3. Paediatric

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Latin America CGRP Inhibitors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.6.1. Key Highlights

7.6.1.1. Brazil CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

7.6.1.2. Brazil CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

7.6.1.3. Brazil CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.6.1.4. Brazil CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.6.1.5. Brazil CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

7.6.1.6. Mexico CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

7.6.1.7. Mexico CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

7.6.1.8. Mexico CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.6.1.9. Mexico CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.6.1.10. Mexico CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

7.6.1.11. Argentina CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

7.6.1.12. Argentina CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

7.6.1.13. Argentina CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.6.1.14. Argentina CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.6.1.15. Argentina CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

7.6.1.16. Rest of Latin America CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

7.6.1.17. Rest of Latin America CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

7.6.1.18. Rest of Latin America CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.6.1.19. Rest of Latin America CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.6.1.20. Rest of Latin America CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa CGRP Inhibitors Market Outlook, 2019 - 2032

8.1. Middle East & Africa CGRP Inhibitors Market Outlook, by Drug Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Monoclonal Antibodies

8.1.1.2. CGRP Antagonists

8.2. Middle East & Africa CGRP Inhibitors Market Outlook, by Treatment Type, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Acute (Abortive)

8.2.1.2. Preventative

8.3. Middle East & Africa CGRP Inhibitors Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Oral

8.3.1.2. Injectable

8.3.1.3. Nasal

8.4. Middle East & Africa CGRP Inhibitors Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Hospital Pharmacies

8.4.1.2. Retail Pharmacies

8.4.1.3. Online Pharmacies

8.5. Middle East & Africa CGRP Inhibitors Market Outlook, by Patient Demographics, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. Adult

8.5.1.2. Geriatric

8.5.1.3. Paediatric

8.5.2. BPS Analysis/Market Attractiveness Analysis

8.6. Middle East & Africa CGRP Inhibitors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.6.1. Key Highlights

8.6.1.1. GCC CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

8.6.1.2. GCC CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

8.6.1.3. GCC CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.4. GCC CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.6.1.5. GCC CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

8.6.1.6. South Africa CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

8.6.1.7. South Africa CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

8.6.1.8. South Africa CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.9. South Africa CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.6.1.10. South Africa CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

8.6.1.11. Egypt CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

8.6.1.12. Egypt CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

8.6.1.13. Egypt CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.14. Egypt CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.6.1.15. Egypt CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

8.6.1.16. Nigeria CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

8.6.1.17. Nigeria CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

8.6.1.18. Nigeria CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.19. Nigeria CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.6.1.20. Nigeria CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

8.6.1.21. Rest of Middle East & Africa CGRP Inhibitors Market by Drug Type, Value (US$ Bn), 2019 - 2032

8.6.1.22. Rest of Middle East & Africa CGRP Inhibitors Market by Treatment Type, Value (US$ Bn), 2019 - 2032

8.6.1.23. Rest of Middle East & Africa CGRP Inhibitors Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.24. Rest of Middle East & Africa CGRP Inhibitors Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.6.1.25. Rest of Middle East & Africa CGRP Inhibitors Market by Patient Demographics, Value (US$ Bn), 2019 - 2032

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2023

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Pfizer Inc.

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. AbbVie Inc.

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Eli Lilly and Company

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Teva Pharmaceutical Industries Ltd.

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Lundbeck A/S

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Amgen Inc.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Type Coverage |

|

|

Treatment Type Coverage |

|

|

Route of Administration Coverage |

|

|

Distribution Channel Coverage |

|

|

Patient Demographics Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |