Global Clinical Nutrition Market Forecast

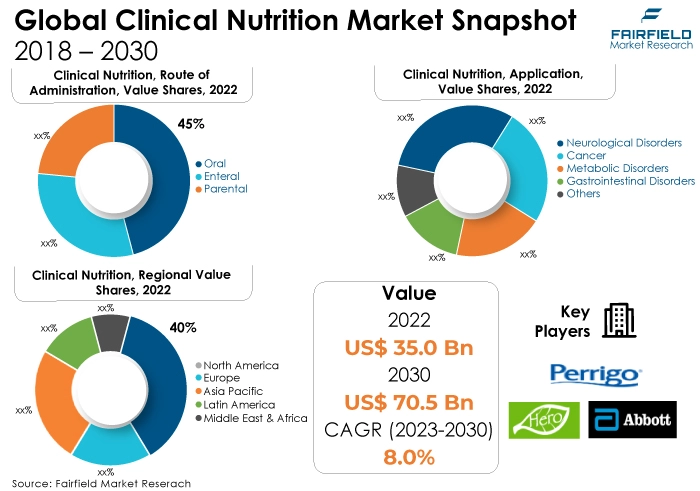

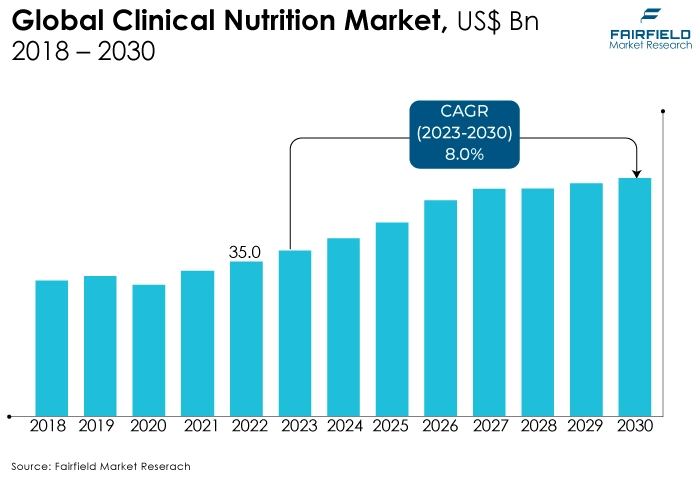

- The approximately US$35 Bn market for clinical nutrition all set to see double expansion, exceeding US$70 Bn by 2030

- Market revenue poised to witness robust expansion at a CAGR of 8% during 2023 - 2030

Quick Report Digest

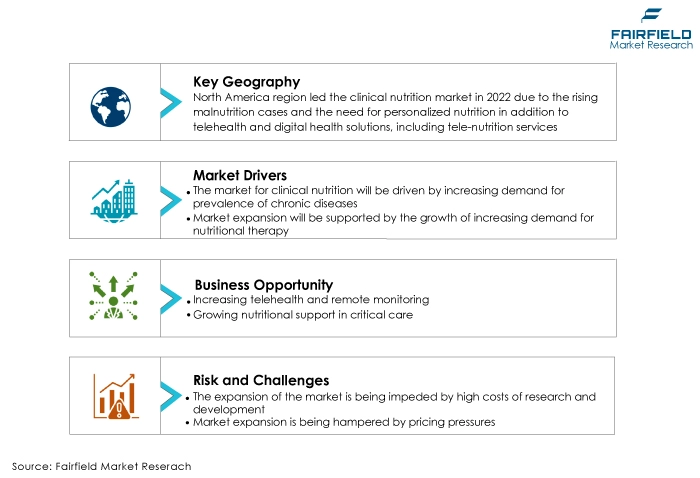

- The key trend anticipated to drive the clinical nutrition market growth is advancements in clinical nutrition science. Furthermore, clinical nutrition protocols can now be customised to each patient's unique genetic profile and dietary requirements due to developments in nutritional genomics and personalised medicine. Due to its increased ability to make clinical nutrition interventions more effective, personalised nutrition is a significant market growth driver.

- Another major market trend expected to drive the clinical nutrition market growth is the rapidly expanding rising incidence of malnutrition. Malnutrition affects hospitalised people regularly, frequently as a result of disease, surgery, or the inability to eat regular meals. To meet the nutritional needs of patients and aid in their recovery, clinical nutrition is crucial in hospitals.

- The development of the industry may need to be improved by a lack of knowledge about the advantages of clinical nutrition among consumers and healthcare professionals. For the proper use of therapeutic nutrition products to be promoted, better education and training are required.

- In 2022, the oral category dominated the industry. Providing a concentrated source of calories, protein, and nutrients, nutritional bars are dependable, transportable snacks. They are practical for on-the-go nutrition and frequently used by athletes, people with higher calorie requirements, or anyone in need of an immediate nutritional boost.

- In 2022, the neurological disorders category dominated the industry. A customised nutrition plan may be necessary for people undergoing neurological rehabilitation, such as those recovering from traumatic brain injury (TBI) or spinal cord injury (SCI).

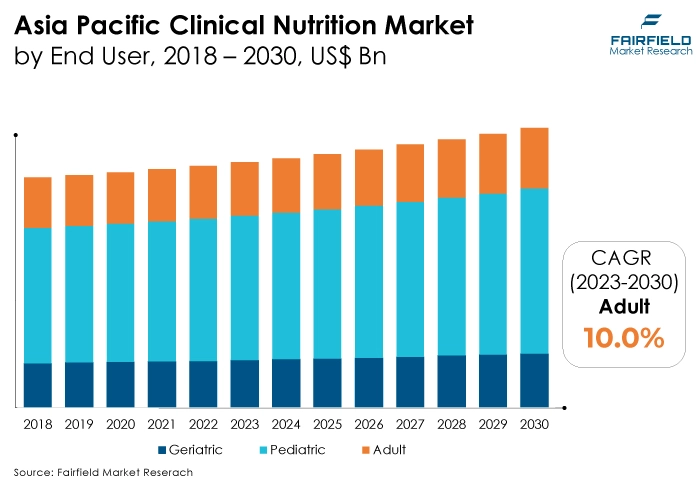

- During the forecast period, the adult category is expected to grow significantly. To support the health and development of both the mother and baby, pregnant and nursing women need specialised nutritional advice. In order to ensure appropriate nutrient intake during different life stages, clinical nutrition is essential.

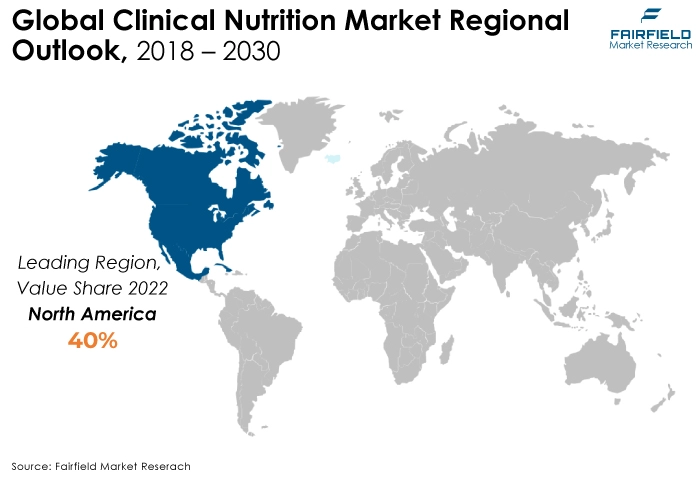

- The North America region is expected to dominate the clinical nutrition market during the forecast period. Telehealth and digital health solutions, including tele-nutrition services, have been significantly adopted in North America. This pattern makes clinical nutrition services easier to get, which fosters market expansion.

- Asia Pacific is expected to be the fastest-growing clinical nutrition market region. Both international and regional businesses are offering innovative clinical nutrition products, and they are specifically designed to meet the nutritional and cultural demands of Asian people.

A Look Back and a Look Forward - Comparative Analysis

The rising popularity of low-carb and ketogenic diets, therapeutic nutrition products with lower carbohydrate contents have been developed to meet the needs of those consuming these diets. Protein-rich diets have become more popular among people looking to grow muscle, control their weight, or feel fuller faster. Higher protein content clinical nutrition solutions are now available to suit this requirement.

The need for clinical nutrition solutions created with natural additives and clean-label substances is rising. The appeal of products that fit these tastes is greater. The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the clinical nutrition solutions with optimised nutritional profiles and delivery strategies customised to individuals' genetic differences were created using information from nutrigenomic research.

Individuals can now get personalised nutritional advice based on their genetic makeup due to the growing accessibility of genetic testing services. Clinical nutrition products that complied with these genetic recommendations became very popular as a result. Clinical nutrition has included nanotechnology to enhance nutrient delivery. Certain nutrients' solubility and absorption can be improved by nanoemulsions and nanocarriers, ensuring they are more effectively absorbed and reach their intended target in the coming years.

Additionally, Customised oral supplements and enteral nutrition formulations have been made using 3D printing technology to cater to the individual demands of patients. Furthermore, The consistency and safety of clinical nutrition products have been enhanced by technological developments in production and quality control procedures. Systems for quality control and automation aid in ensuring that products adhere to tight regulatory criteria during the next five years.

Key Growth Determinants

- Rising Prevalence of Chronic Diseases

The number of patients in need of specialised nutritional support has increased as chronic disease prevalence has increased. Products for clinical nutrition are frequently crucial for maintaining chronic condition patients' health and enhancing their outcomes. Different chronic illnesses call for different dietary strategies.

Products for clinical nutrition are highly sought-after because they are designed to meet the special dietary requirements of patients with particular diseases. For instance, nutritional supplements for diabetics or enteral nutrition formulae that are heart-healthy. The importance of nutrition in preventing & treating chronic diseases is becoming better understood. To lower their chance of developing these disorders, many patients use therapeutic nutrition products as part of a preventive health approach.

- Increasing Demand for Nutritional Therapy

Nutritional treatment is in greater demand as people become more aware of its significance for maintaining overall health and treating diseases. To address their unique health concerns, people are becoming more and more interested in personalised dietary counseling and therapies.

Dietary regimens made specifically for a person's health requirements are frequently used in nutritional medicine. As a result, specialised therapeutic nutrition solutions created to address particular medical disorders have been created.

Patients with acute or long-term medical issues frequently receive nutritional therapy in hospitals and clinics. These therapy programs must include clinical nutrition products, such as enteral and parenteral nutrition.

- Growing Healthcare Expenditure

Healthcare organisations devote more funds to patient care, including nutrition treatment and clinical nutrition products, as healthcare spending rises. As a result, clinical nutrition solutions are bought and used more frequently. Better funding enables healthcare institutions to modernise and broaden their offerings, including clinical nutrition services.

Modern healthcare facilities are more prepared to offer patients specialised clinical nutrition support. Investments in advanced medical technologies frequently follow increases in healthcare costs. This includes enhanced diagnostic tools that make it easier to spot nutritional deficiencies and, more precisely, target nutritional therapy.

Major Growth Barriers

- High R&D Costs

Smaller businesses and startups may need help to enter the clinical nutrition market due to the significant investment necessary for R&D. This restricts market innovation and competitiveness.

The process of creating clinical nutrition products requires extensive testing, clinical trials, and regulatory clearances. As a result, the time needed to produce the product may be extended. This slows the release of new goods onto the market.

Businesses may be less willing to invest in cutting-edge clinical nutrition solutions due to high R&D expenditures. This could limit the market's potential for growth by resulting in a lack of novel goods and a reliance on current formulas.

- Constant Pricing Pressure

Healthcare providers and systems are frequently under pressure to reduce costs. They may look for less expensive substitutes for clinical nutrition items, which may result in price negotiations and decreased reimbursement rates for these goods. Insurance companies may not fully cover clinical nutrition items.

The fact that patients could have to cover a sizable percentage of the expense out of pocket can discourage them from using these goods. Price wars between manufacturers can result from intense competition in the clinical nutrition sector. Price cuts used by businesses to increase market share may affect profit margins and their capacity to make R&D investments.

Key Trends and Opportunities to Look at

- Rising Plant-based Clinical Nutrition

Increased consumer demand for plant-based clinical nutrition products is a result of increased consumer awareness of the health advantages of plant-based diets, such as decreased risk of chronic diseases and improved general well-being.

As a result of their growing numbers, vegetarians and vegans frequently look for therapeutic nutrition products made from plants that complement their dietary preferences and moral principles. Products with plant-based clinical nutrition are often free of common allergens like dairy and eggs, making them ideal for people with dietary intolerances or allergies.

- Increasing Adoption Telehealth and Remote Monitoring

Telehealth platforms enable consumers, particularly those in underprivileged or remote areas, to receive clinical nutrition consultations and guidance from registered dietitians and healthcare experts without the need for in-person visits.

Patients can seek dietary advice and assistance more easily with the help of telehealth. By making clinical nutrition programs more accessible, this convenience can improve patient involvement in their healthcare and result in higher adherence.

Using digital tools and apps, healthcare professionals can track their patients' nutritional compliance and development from a distance. This enhances the efficiency of clinical nutrition interventions by enabling real-time modifications to nutrition programs based on patient data.

- Growing Nutritional Support in Critical Care

Critical care patients, especially those in intensive care units (ICUs), may have specialised nutritional needs due to the severity of their illness or damage. Appropriate clinical nutrition support can hasten healing, minimise issues, and improve patient outcomes overall.

Rapid dietary deficits and muscular atrophy can result from critical illness. For the purpose of preventing malnutrition in critically sick patients, clinical nutrition products, such as enteral and parenteral nutrition, are crucial.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the clinical nutrition market has been governed by strict regulatory frameworks and is closely monitored by numerous regulatory bodies in various nations and regions. These regulatory authorities set rules and criteria to guarantee the security, effectiveness, and quality of therapeutic nutrition products. Clinical nutrition products, such as enteral and parenteral nutrition, are governed by the Food and Drug Administration (FDA) as medical foods or dietary supplements.

Clinical nutrition products must adhere to strict quality and safety criteria set by the Food and Drug Administration (FDA). Any novel medicine or medical device used for clinical nutrition reasons must first receive Food and Drug Administration (FDA) approval. This procedure might have an impact on market entry and product development. EMA uses the centralised authorisation process to regulate clinical nutrition products in the European Union (EU).

While some European Union (EU) nations classify clinical nutrition products as medicines that need marketing permission, others may regulate them as foods or dietary supplements. Regulations from the European Medicines Agency (EMA) have an impact on marketing tactics, product labeling, and safety requirements in the European Union (EU) market.

Fairfield’s Ranking Board

Top Segments

- Oral Category Dominant over Enteral Segments

The oral segment dominated the market in 2022. These include macronutrient-balanced ready-to-drink or powdered formulations (carbohydrates, proteins, and fats), as well as vitamin and mineral supplements.

People with malnutrition, chronic illnesses, or those who are at risk for nutritional deficiencies frequently use ONS. They can be ingested orally as a beverage and are available in a variety of flavors. Some oral clinical nutrition solutions are designed to meet the particular nutritional needs of illnesses, including diabetes, kidney disease, or gastrointestinal issues.

Furthermore, the enteral category is projected to experience the fastest market growth. Patients who are unable to satisfy their nutritional needs through routine oral intake frequently need to get enteral nourishment. This includes people who are recovering from surgery, those who are severely malnourished, and those who have conditions including dysphagia, gastrointestinal problems, or dysphagia.

- Neurological Disorders Prominent

The neurological disorders segment dominated the market in 2022. Due to a variety of variables, including reduced mobility, higher energy expenditure, and difficulties swallowing (dysphagia), many neurological disorders can result in malnutrition.

The signs and problems associated with these illnesses can be made worse by malnutrition. Malnutrition in people with neurological diseases must be prevented or treated using clinical nutrition therapy.

The cancer category is anticipated to grow substantially throughout the projected period. Cancer and its treatments, such as chemotherapy and radiation therapy, can cause a number of side effects that impair a patient's ability to eat, including nausea, vomiting, appetite loss, taste alterations, and mouth sores.

Malnutrition puts many cancer patients at risk for weakened immune systems, decreased muscle mass, and slowed healing after therapy.

- Pediatric Category Remains the Prime Consumer

The pediatric segment dominated the market in 2022. Infant formula is frequently the topic of pediatric clinical nutrition infancy, with a focus on infants who cannot be breastfed or who require additional nourishment. For premature infants who have allergies or have diseases that impede digestion, there are specialised formula products available.

Diets for children with food allergies or intolerances must be carefully controlled to avoid allergic reactions and guarantee healthy growth. The use of nutritional formulae and advice on preventing allergens is crucial.

The adult segment is anticipated to experience significant growth during the projection period. Adults of all ages can benefit from clinical nutrition, which is intended to maintain and improve general health. Dietary recommendations, calorie management, and ensuring daily nutrient requirements are all possible nutritional interventions.

Regional Frontrunners

North America Holds the Highest Prospects

North America is anticipated to lead the clinical nutrition market throughout the projection period. Chronic diseases like diabetes, obesity, and cardiovascular disorders are very common in North America. The management and prevention of many health problems depend heavily on clinical nutrition, which raises the need for associated items.

The region comprises a number of hospitals and healthcare facilities. Because these facilities are well-equipped to offer clinical nutrition therapy, prospects for market expansion arise. In North America, preventive healthcare is receiving more attention.

Clinical nutrition plays a big part in preventative care plans, which encourages people to use linked goods and services. Consumers in North America are becoming more health-conscious and knowledgeable about the value of good nutrition. This awareness increases the demand for clinical nutrition products and supplements.

The Fastest Growth Potential Identified in Asia Pacific

The region with the fastest-growing market for clinical nutrition is expected to be Asia Pacific. A significant portion of the world's population resides in the Asia Pacific region. The demand for clinical nutrition goods and services is rising as a result of rapid urbanisation and increasing disposable incomes in nations like China, and India.

Asia Pacific is witnessing an ageing population, similar to many other regions. Because of this demographic shift, there is an increased demand for clinical nutrition products to meet the specific dietary requirements of older persons.

The Asian consumer is becoming more aware of the role that diet plays in preserving health and preventing chronic diseases. This awareness sparks consumer interest in clinical nutrition products and dietary supplements.

Fairfield’s Competitive Landscape Analysis

The global clinical nutrition market, which has been consolidated, includes a small number of well-known businesses as competitors. The big companies are introducing new items and enhancing their distribution systems in an effort to gain market share. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Clinical Nutrition Space?

- Perrigo Company Plc

- Hero Nutritionals Inc.

- Abbott Laboratories

- Danone Nutricia

- bbraun

- Baxter International Inc.

- Fresenius Se & Co. Kgaa

- Pfizer Inc.

- Lonza Ltd.

- Nestlé S.A.

- Meiji Holdings Co., Ltd.

- Mead Johnson Nutrition

- Vivify Health

- Ketogenic

- FMC Corporation

Significant Company Developments

New Product Launches

- April 2022: TechVantage, a functionally optimised nutrient technology platform that offers customers nutrient solutions, was launched by Glanbia Nutritionals.

- May 2022: Culina Health, launched by registered dietitians Steven Kuyan and Vanessa Rissetto, received US$$4.75 Mn in first funding after 18 months of bootstrapping expansion in the practices of 20 clinicians who have already held more than 18,000 sessions.

- November 2021: A special blend of five HMO prebiotics called Similac 360 Total Care was launched by American global healthcare corporation Abbott Laboratories to enhance newborns' immune function, cognitive development, and digestive health. With this introduction, the business was able to increase sales while expanding its line of products.

Distribution Agreements

- October 2022: A strategic agreement was formed between Hologram Sciences and Maeil Health Nutrition to provide the Korean market with personalised nutrition solutions.

- October 2019: The Food and Agriculture Organisation of the United Nations and Groupe Danone partnered to advance understanding of global nutrition and food safety and to promote ethical agricultural value chains for more sustainable food systems.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, foods that are functional and fortified are easily accessible to customers because they are easily found in grocery stores and supermarkets. This ease of use motivates more people to include clinical nutrition in their regular meals.

Furthermore, Every stage of life has particular nutritional needs. Therefore, fortified meals are available for youngsters, pregnant women, and the elderly. However, the clinical nutrition market is expected to face considerable challenges because of the high costs of research and development.

Supply Side of the Market

According to our analysis, the United States is the main supplier of clinical nutrition products, holding more than 50% of the market share in North America. Significant makers of clinical nutrition products in the US include a number of businesses, including Abbott Laboratories, Baxter International, Fresenius Kabi, and Nestlé Health Science. These companies are well-established in the US market and provide patients and medical professionals with a wide selection of clinical nutrition products.

With over 30% of the global market, Europe is the second-largest supplier of clinical nutrition products worldwide. With approximately 25% of the regional market, Germany is the largest supplier of clinical nutrition products in Europe. With almost 50% of the regional market in 2022, the United States will be the largest consumer of clinical nutrition products in North America.

The high prevalence of chronic diseases like obesity, diabetes, and cancer, as well as the ageing population and growing public awareness of the role that nutrition plays in overall health and wellbeing, all contribute to the high consumption of clinical nutrition products in the United States. Canada, and Mexico are two additional significant clinical nutrition product customers in North America.

Global Clinical Nutrition Market is Segmented as Below:

By Route of Administration:

- Oral

- Enteral

- Parental

By Application:

- Cancer

- Metabolic Disorders

- Gastrointestinal Disorders

- Neurological Disorders

- Malnutrition

- Others

By End User:

- Pediatric

- Adult

- Geriatric

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Clinical Nutrition Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Clinical Nutrition Market Outlook, 2018 - 2030

3.1. Global Clinical Nutrition Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Oral

3.1.1.2. Enteral

3.1.1.3. Parental

3.2. Global Clinical Nutrition Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cancer

3.2.1.2. Metabolic Disorders

3.2.1.3. Gastrointestinal Disorders

3.2.1.4. Neurological Disorders

3.2.1.5. Malnutrition

3.2.1.6. Others

3.3. Global Clinical Nutrition Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Pediatric

3.3.1.2. Adult

3.3.1.3. Geriatric

3.4. Global Clinical Nutrition Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Clinical Nutrition Market Outlook, 2018 - 2030

4.1. North America Clinical Nutrition Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Oral

4.1.1.2. Enteral

4.1.1.3. Parental

4.2. North America Clinical Nutrition Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Cancer

4.2.1.2. Metabolic Disorders

4.2.1.3. Gastrointestinal Disorders

4.2.1.4. Neurological Disorders

4.2.1.5. Malnutrition

4.2.1.6. Others

4.3. North America Clinical Nutrition Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Pediatric

4.3.1.2. Adult

4.3.1.3. Geriatric

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Clinical Nutrition Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Clinical Nutrition Market Outlook, 2018 - 2030

5.1. Europe Clinical Nutrition Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Oral

5.1.1.2. Enteral

5.1.1.3. Parental

5.2. Europe Clinical Nutrition Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Cancer

5.2.1.2. Metabolic Disorders

5.2.1.3. Gastrointestinal Disorders

5.2.1.4. Neurological Disorders

5.2.1.5. Malnutrition

5.2.1.6. Others

5.3. Europe Clinical Nutrition Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Pediatric

5.3.1.2. Adult

5.3.1.3. Geriatric

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Clinical Nutrition Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Clinical Nutrition Market Outlook, 2018 - 2030

6.1. Asia Pacific Clinical Nutrition Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Oral

6.1.1.2. Enteral

6.1.1.3. Parental

6.2. Asia Pacific Clinical Nutrition Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Cancer

6.2.1.2. Metabolic Disorders

6.2.1.3. Gastrointestinal Disorders

6.2.1.4. Neurological Disorders

6.2.1.5. Malnutrition

6.2.1.6. Others

6.3. Asia Pacific Clinical Nutrition Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Pediatric

6.3.1.2. Adult

6.3.1.3. Geriatric

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Clinical Nutrition Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Clinical Nutrition Market Outlook, 2018 - 2030

7.1. Latin America Clinical Nutrition Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Oral

7.1.1.2. Enteral

7.1.1.3. Parental

7.2. Latin America Clinical Nutrition Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Cancer

7.2.1.2. Metabolic Disorders

7.2.1.3. Gastrointestinal Disorders

7.2.1.4. Neurological Disorders

7.2.1.5. Malnutrition

7.2.1.6. Others

7.3. Latin America Clinical Nutrition Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Pediatric

7.3.1.2. Adult

7.3.1.3. Geriatric

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Clinical Nutrition Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Clinical Nutrition Market Outlook, 2018 - 2030

8.1. Middle East & Africa Clinical Nutrition Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Oral

8.1.1.2. Enteral

8.1.1.3. Parental

8.2. Middle East & Africa Clinical Nutrition Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Cancer

8.2.1.2. Metabolic Disorders

8.2.1.3. Gastrointestinal Disorders

8.2.1.4. Neurological Disorders

8.2.1.5. Malnutrition

8.2.1.6. Others

8.3. Middle East & Africa Clinical Nutrition Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Pediatric

8.3.1.2. Adult

8.3.1.3. Geriatric

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Clinical Nutrition Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Clinical Nutrition Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Clinical Nutrition Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Clinical Nutrition Market, by End user, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Hero Nutritionals Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Abbott Laboratories

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Danone Nutricia

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. B. Braun Melsungen Ag

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Baxter International Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Fresenius Se & Co. Kgaa

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Pfizer Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Lonza Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Nestlé S.A.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Meiji Holdings Co., Ltd.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Mead Johnson Nutrition

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Vivify Health

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Ketogen

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. FMC Corporation

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Route of Administration Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |