Curcumin Market Growth and Industry Forecast

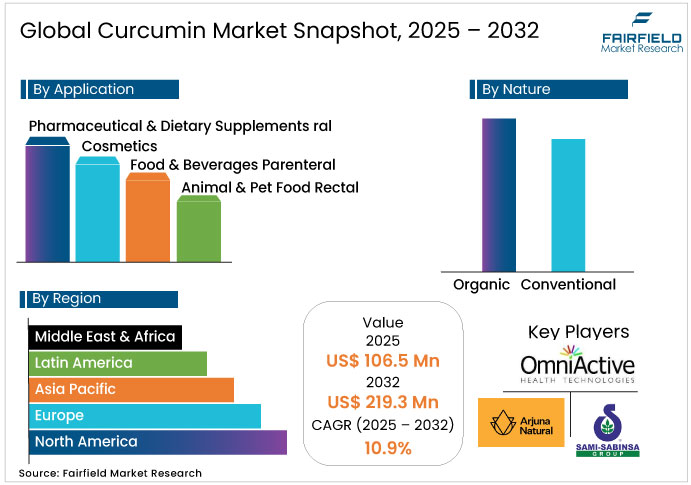

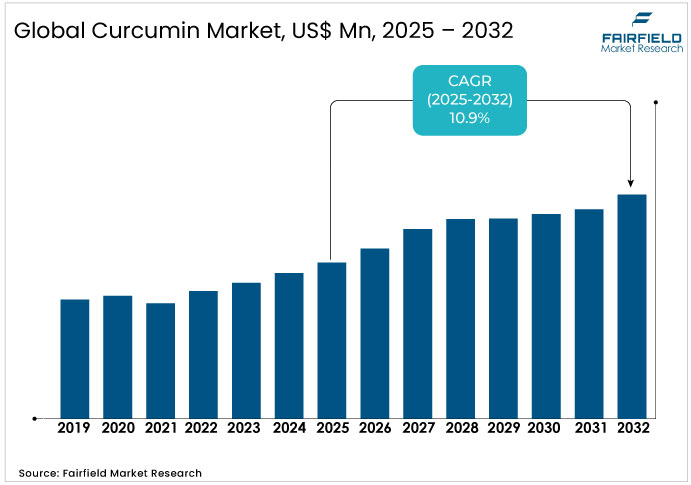

The global curcumin market is valued at USD 106.5 million in 2025 and is likely to reach USD 219.3 million, growing at a CAGR of 10.9% by 2032.

Curcumin Market Summary: Key Insights & Trends

- Conventional curcumin dominates by nature, holding a 55% global share supported by established supply chains.

- Organic curcumin is the fastest-growing segment, steadily increasing its share with rising demand for chemical-free products.

- Pharmaceuticals & Dietary Supplements lead applications, capturing 45% share due to strong clinical evidence and consumer trust.

- Food & Beverages is anticipated to grow fastest by application, gaining share rapidly on clean-label and natural colorant demand.

- Rising health awareness acts as a key driver, boosting the adoption of natural remedies across the globe

- Cosmetics create a major opportunity, with antioxidant properties driving a higher share in personal care.

- North America leads regionally, accounting for 35% global share, driven by wellness and aging trends.

- Asia Pacific emerges as the fastest-growing region, holding a 32% share supported by exports and traditional usage.

Key Growth Drivers

- Rising Health Awareness Spurs Demand for Natural Remedies and Supplements

Consumers increasingly seek natural remedies for chronic conditions, propelling the curcumin market forward. According to the World Health Organization (WHO), non-communicable diseases account for 74% of global deaths, prompting interest in curcumin's therapeutic potential, backed by over 15,000 scientific publications on PubMed as of 2025. The U.S. National Institutes of Health (NIH) funds research highlighting curcumin's role in reducing inflammation, with clinical trials showing up to 60% improvement in arthritis symptoms. Technological advancements, such as nano-formulations improving bioavailability by 27-fold per FDA-approved studies, enhance product efficacy. Macroeconomic trends such as rising disposable incomes in emerging economies boost supplement consumption, while demographic shifts toward aging populations—projected to reach 1.5 billion over 60 by 2050 per the United Nations—increase demand for preventive healthcare, impacting the industry positively by expanding market penetration and revenue streams.

- Regulatory Backing Boosts Pharmaceutical Applications and Therapeutic Innovation Globally

Governments promote natural ingredients through policies, driving market growth. The European Food Safety Authority (EFSA) recognizes curcumin as safe, leading to a 12% rise in approved pharmaceutical formulations in Europe since 2023. In the U.S., the Food and Drug Administration (FDA) streamlines approvals for curcumin-based drugs, with 20 new investigational applications in 2024 alone per agency reports. Technological innovations, including liposomal delivery systems, address bioavailability issues, resulting in 40% higher absorption rates as per American Chemical Society data. Macro trends such as post-pandemic health focus, with WHO reporting a 25% increase in global wellness spending, align with demographic changes such as millennial preferences for plant-based therapies. These dynamic fosters curcumin industry expansion, enabling companies to capture a projected 35% share in anti-inflammatory drugs by 2030.

- Clean-Label Trends Accelerate Food and Beverage Adoption of Natural Ingredients

The curcumin industry benefits from clean-label trends in food processing. The International Food Information Council (IFIC) surveys indicate 78% of consumers prefer natural colorants, driving curcumin use in beverages with a 18% annual growth rate per USDA statistics. Regulatory changes, such as EU bans on synthetic dyes, have shifted 15% of market volume to natural alternatives such as curcumin. Technological advancements in extraction methods reduce costs by 20%, per Association of American Feed Control Officials (AAFCO) reports. Demographic shifts toward health-conscious millennials, comprising 25% of global population per UN data, amplify demand. This impacts the sector by diversifying applications, potentially adding USD 50 million in revenue from functional foods by 2032.

Key Restraints

- Limited Bioavailability, Absorption Issues, and Regulatory Barriers Impact Efficacy

Curcumin's poor water solubility restricts its efficacy, hindering market growth. Studies from the NIH show only 1% oral bioavailability without enhancements, leading to higher dosing needs and consumer skepticism. Regulatory hurdles from the FDA require extensive testing for modified forms, increasing development costs by 30%. Supply chain bottlenecks, including dependence on Indian turmeric harvests affected by climate variability per USDA reports, exacerbate availability issues for competitors.

- Rising Production Costs and Global Supply Chain Volatility Constrain Growth

Rising extraction expenses restrict accessibility and limit broader market reach. The International Trade Centre (ITC) notes production costs rose 15% due to raw material fluctuations in 2024. Regulatory compliance with bodies such as EFSA adds 20% to overheads through quality certifications. Threats from counterfeit products undermine trust, while global supply disruptions from geopolitical tensions impact 25% of imports per World Trade Organization data.

Curcumin Market Trends and Opportunities

- Natural Skincare Innovations and Nanotech Drive Growth in Personal Care

The curcumin market taps into unmet demand for natural skincare in developing economies. The Cosmetics Europe association projects the natural ingredients sector to grow to USD 15 billion by 2030, with curcumin's antioxidant properties driving 20% of anti-aging formulations. Supportive policies, such as subsidies for organic farming in India per Ministry of Agriculture, enhance supply. Emerging nanotech improves stability, addressing consumer needs in Asia-Pacific where market sizing estimates curcumin cosmetics at USD 30 million by 2028.

- Rising Demand for Pet Health Supplements Fuels Animal Nutrition Expansion

Unmet demand for natural pet supplements offers market potential. The American Pet Products Association (APPA) reports pet health spending at USD 10 billion annually, with curcumin additives growing 25% due to anti-inflammatory benefits. Policies such as EU animal welfare regulations promote natural feeds. In developing economies, market value for curcumin in animal nutrition Will reach USD 40 million by 2030, driven by livestock health improvements.

Segment-wise Trends & Analysis

Conventional and Organic Variants Show Diverging Growth Paths in Global Adoption

Conventional curcumin holds the leading position with a 55% share in 2025, valued at approximately USD 50 million, due to cost-effective production and widespread availability. Its dominance stems from established supply chains in major producing regions such as India.

Organic curcumin emerges as the fastest-growing segment, with a projected CAGR of 12.5% through 2032, driven by consumer preferences for chemical-free products amid rising health consciousness. Regulatory support for organic certification boosts adoption.

- Key Trend: Shift toward sustainable farming practices increases organic supply by 20%.

- Challenge: Higher pricing limits accessibility in price-sensitive markets.

- Opportunity: Premium branding in supplements captures 30% more margins.

- Trend: Certification from bodies such as USDA enhances consumer trust.

Pharmaceuticals Dominate as Food and Beverages Drive Emerging Applications

Pharmaceutical & Dietary Supplements lead the curcumin market with a 45% share, valued at USD 45.8 million in 2025, supported by clinical evidence of health benefits. This segment benefits from R&D investments in bioavailability enhancements.

Food & Beverages represent the fastest-growing application, with a CAGR of 11.8%, fueled by natural coloring demands and functional food trends. Regulatory shifts away from synthetics accelerate this growth.

- Key Trend: Integration in functional beverages rises 25% annually.

- Challenge: Stability issues in processing require formulation innovations.

- Opportunity: Expansion into pet food adds USD 10 million potential.

- Trend: Clean-label regulations drive 15% market shift.

Regional Trends & Analysis

North America Leads with 35% Share Driven by Wellness and Aging Trends

North America dominates with strong demand in supplements and pharmaceuticals, driven by health trends and aging populations. The region accounts for 35% of global share, with the U.S. leading due to high consumer spending on wellness products per USDA data. Key local trends include rising e-commerce sales and regulatory emphasis on natural ingredients.

U.S. Curcumin Market - 2025 Snapshot & Outlook

The U.S. market thrives on increasing supplement use amid chronic disease prevalence. NIH studies show 50% of adults use dietary supplements, boosting curcumin demand. Government policies such as the Dietary Supplement Health and Education Act provide margin advantages through streamlined labeling, reducing compliance costs by 15%. Retail shifts to online platforms increase accessibility, with sales growing 20% per Census Bureau data.

One consumer trend, per NHANES survey, indicates 40% of millennials prefer natural anti-inflammatories, cited from CDC reports. Supportive tax incentives for R&D enhance innovation.

- 39% global share in 2025.

- Supplement sales up 15%.

- Aging population drives demand.

Europe Expands Through Clean-Label Preferences and Strong Regulatory Support Framework

Europe's market grows through nutraceutical integration and clean-label preferences, holding 28% global share. Key trends involve stringent EFSA regulations promoting natural additives, with Germany and the U.K. leading in pharmaceutical applications. Demographic shifts toward preventive health support steady expansion.

Germany Curcumin Market – 2025 Snapshot & Outlook

Germany's market benefits from advanced R&D in bioavailability. EFSA approvals facilitate 12% growth in formulations. Government subsidies for natural products offer 10% cost advantages. Retail shifts to pharmacies increase distribution by 18% per Federal Statistical Office.

A consumer trend from Eurostat surveys shows 35% prefer organic supplements, impacting demand positively. Tax policies on health R&D reduce expenses.

- 25% European share.

- R&D investments rise 20%.

- Regulatory support key.

U.K. Curcumin Market – 2025 Snapshot & Outlook

The U.K. industry expands via wellness trends and food applications. MHRA regulations ensure quality, boosting confidence. Supportive policies such as innovation grants provide 15% margin benefits. E-commerce retail shifts grow sales 22% per ONS data.

Per British Nutrition Foundation survey, 45% consumers seek natural colorants, driving uptake. Tax relief on exports aids competitiveness.

- 20% European share.

- Wellness spending up 18%.

- Policy incentives effective.

Asia Pacific Strengthens Position with Traditional Use and Export-Led Growth

Asia Pacific leads curcumin market production and consumption, with 32% share, driven by traditional use and exports. Trends include rising health awareness in Japan, South Korea, and India, supported by government initiatives in agriculture. Emerging economies fuel demand through affordable supplements.

Japan Curcumin Market - 2025 Snapshot & Outlook

Japan's market grows with aging population needs. MHLW approvals for functional foods drive adoption. Policies on elderly health offer 12% subsidies, enhancing margins. Retail shifts to convenience stores increase access by 16% per Statistics Bureau.

A trend from Ministry of Health surveys shows 50% seniors use anti-aging supplements. Tax incentives for imports support supply.

- 15% AP share.

- Aging drives 20% growth.

- Health policies key.

India Curcumin Market - 2025 Snapshot & Outlook

India's market leverages export strength and domestic demand. AYUSH Ministry promotes traditional medicine, reducing costs 18%. Government export incentives provide 10% margins. Retail shifts to online grow 25% per NSSO data.

Per ICMR survey, 60% consumers use herbal remedies. Tax rebates on farming aid production.

- 40% AP share.

- Exports up 15%.

- Traditional use dominant.

Competitive Landscape Analysis

Players in the Curcumin Market focus on enhancing bioavailability through formulations to meet consumer efficacy demands. This strategy aligns with rising health awareness, as evidenced by a 20% increase in patented technologies in 2024 per USPTO data. Companies invest in R&D, with events such as industry collaborations boosting innovation by 15%. Such efforts target goal of capturing larger shares in pharmaceuticals.

M&A activities consolidate supply chains, impacting costs by reducing overheads 10%, while new regulations on quality raise entry barriers. Expansions in Asia-Pacific enhance capacity amid demand surges. Early movers will benefit from premium pricing on advanced products, while latecomers may face intensified competition.

Key Companies

- Sabinsa (Sami-Sabinsa Group)

- Arjuna Natural Pvt. Ltd.

- OmniActive Health Technologies

- Indena S.p.A.

- Kaneka Corporation

- DolCas Biotech LLC

- Verdure Sciences

- Akay Natural Ingredients Pvt. Ltd.

- Synthite Industries Pvt. Ltd.

- Plant Lipids Pvt. Ltd.

Recent Developments:

December 2024 - Sabinsa’s Kunigal manufacturing facility in Karnataka was recognised for environmental sustainability, and CEO Shaheen Majeed joined Indian industry leaders discussing technological innovation and intellectual property issues.

May 2024 - DSM-Firmenich and Indena unveiled innovative dietary supplement concepts at Vitafoods Europe, combining biotics and botanicals (including curcumin-based Phytosome™ extracts) in consumer-friendly formats such as gummies and oral dispersible granules, targeting gut health, cognitive performance, and healthy aging.

Global Curcumin Market Segmentation-

By Nature

- Organic

- Conventional

By Application

- Pharmaceutical & Dietary Supplements

- Cosmetics

- Food & Beverages

- Animal & Pet Food

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Curcumin Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Curcumin Market Outlook, 2019 - 2032

3.1. Global Curcumin Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

3.1.1. Organic

3.1.2. Conventional

3.2. Global Curcumin Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.2.1. Pharmaceutical & Dietary Supplements

3.2.2. Cosmetics

3.2.3. Food & Beverages

3.2.4. Animal & Pet Food

3.3. Global Curcumin Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Curcumin Market Outlook, 2019 - 2032

4.1. North America Curcumin Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

4.1.1. Organic

4.1.2. Conventional

4.2. North America Curcumin Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.2.1. Pharmaceutical & Dietary Supplements

4.2.2. Cosmetics

4.2.3. Food & Beverages

4.2.4. Animal & Pet Food

4.3. North America Curcumin Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. U.S. Curcumin Market Outlook, by Nature, 2019 - 2032

4.3.2. U.S. Curcumin Market Outlook, by Application, 2019 - 2032

4.3.3. Canada Curcumin Market Outlook, by Nature, 2019 - 2032

4.3.4. Canada Curcumin Market Outlook, by Application, 2019 - 2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Curcumin Market Outlook, 2019 - 2032

5.1. Europe Curcumin Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

5.1.1. Organic

5.1.2. Conventional

5.2. Europe Curcumin Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.2.1. Pharmaceutical & Dietary Supplements

5.2.2. Cosmetics

5.2.3. Food & Beverages

5.2.4. Animal & Pet Food

5.3. Europe Curcumin Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Germany Curcumin Market Outlook, by Nature, 2019 - 2032

5.3.2. Germany Curcumin Market Outlook, by Application, 2019 - 2032

5.3.3. Italy Curcumin Market Outlook, by Nature, 2019 - 2032

5.3.4. Italy Curcumin Market Outlook, by Application, 2019 - 2032

5.3.5. France Curcumin Market Outlook, by Nature, 2019 - 2032

5.3.6. France Curcumin Market Outlook, by Application, 2019 - 2032

5.3.7. U.K. Curcumin Market Outlook, by Nature, 2019 - 2032

5.3.8. U.K. Curcumin Market Outlook, by Application, 2019 - 2032

5.3.9. Spain Curcumin Market Outlook, by Nature, 2019 - 2032

5.3.10. Spain Curcumin Market Outlook, by Application, 2019 - 2032

5.3.11. Russia Curcumin Market Outlook, by Nature, 2019 - 2032

5.3.12. Russia Curcumin Market Outlook, by Application, 2019 - 2032

5.3.13. Rest of Europe Curcumin Market Outlook, by Nature, 2019 - 2032

5.3.14. Rest of Europe Curcumin Market Outlook, by Application, 2019 - 2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Curcumin Market Outlook, 2019 - 2032

6.1. Asia Pacific Curcumin Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

6.1.1. Organic

6.1.2. Conventional

6.2. Asia Pacific Curcumin Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.2.1. Pharmaceutical & Dietary Supplements

6.2.2. Cosmetics

6.2.3. Food & Beverages

6.2.4. Animal & Pet Food

6.3. Asia Pacific Curcumin Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. China Curcumin Market Outlook, by Nature, 2019 - 2032

6.3.2. China Curcumin Market Outlook, by Application, 2019 - 2032

6.3.3. Japan Curcumin Market Outlook, by Nature, 2019 - 2032

6.3.4. Japan Curcumin Market Outlook, by Application, 2019 - 2032

6.3.5. South Korea Curcumin Market Outlook, by Nature, 2019 - 2032

6.3.6. South Korea Curcumin Market Outlook, by Application, 2019 - 2032

6.3.7. India Curcumin Market Outlook, by Nature, 2019 - 2032

6.3.8. India Curcumin Market Outlook, by Application, 2019 - 2032

6.3.9. Southeast Asia Curcumin Market Outlook, by Nature, 2019 - 2032

6.3.10. Southeast Asia Curcumin Market Outlook, by Application, 2019 - 2032

6.3.11. Rest of SAO Curcumin Market Outlook, by Nature, 2019 - 2032

6.3.12. Rest of SAO Curcumin Market Outlook, by Application, 2019 - 2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Curcumin Market Outlook, 2019 - 2032

7.1. Latin America Curcumin Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

7.1.1. Organic

7.1.2. Conventional

7.2. Latin America Curcumin Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.2.1. Pharmaceutical & Dietary Supplements

7.2.2. Cosmetics

7.2.3. Food & Beverages

7.2.4. Animal & Pet Food

7.3. Latin America Curcumin Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Brazil Curcumin Market Outlook, by Nature, 2019 - 2032

7.3.2. Brazil Curcumin Market Outlook, by Application, 2019 - 2032

7.3.3. Mexico Curcumin Market Outlook, by Nature, 2019 - 2032

7.3.4. Mexico Curcumin Market Outlook, by Application, 2019 - 2032

7.3.5. Argentina Curcumin Market Outlook, by Nature, 2019 - 2032

7.3.6. Argentina Curcumin Market Outlook, by Application, 2019 - 2032

7.3.7. Rest of LATAM Curcumin Market Outlook, by Nature, 2019 - 2032

7.3.8. Rest of LATAM Curcumin Market Outlook, by Application, 2019 - 2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Curcumin Market Outlook, 2019 - 2032

8.1. Middle East & Africa Curcumin Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

8.1.1. Organic

8.1.2. Conventional

8.2. Middle East & Africa Curcumin Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.2.1. Pharmaceutical & Dietary Supplements

8.2.2. Cosmetics

8.2.3. Food & Beverages

8.2.4. Animal & Pet Food

8.3. Middle East & Africa Curcumin Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. GCC Curcumin Market Outlook, by Nature, 2019 - 2032

8.3.2. GCC Curcumin Market Outlook, by Application, 2019 - 2032

8.3.3. South Africa Curcumin Market Outlook, by Nature, 2019 - 2032

8.3.4. South Africa Curcumin Market Outlook, by Application, 2019 - 2032

8.3.5. Egypt Curcumin Market Outlook, by Nature, 2019 - 2032

8.3.6. Egypt Curcumin Market Outlook, by Application, 2019 - 2032

8.3.7. Nigeria Curcumin Market Outlook, by Nature, 2019 - 2032

8.3.8. Nigeria Curcumin Market Outlook, by Application, 2019 - 2032

8.3.9. Rest of Middle East Curcumin Market Outlook, by Nature, 2019 - 2032

8.3.10. Rest of Middle East Curcumin Market Outlook, by Application, 2019 - 2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Sabinsa (Sami-Sabinsa Group)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Arjuna Natural Pvt. Ltd.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. OmniActive Health Technologies

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Indena S.p.A.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Kaneka Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. DolCas Biotech LLC

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Verdure Sciences

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Akay Natural Ingredients Pvt. Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Synthite Industries Pvt. Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Plant Lipids Pvt. Ltd.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |