Electric Construction Vehicles Market Growth and Industry Forecast

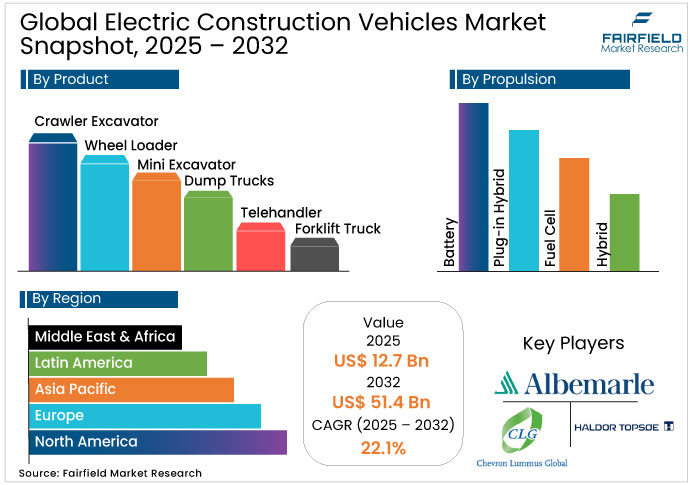

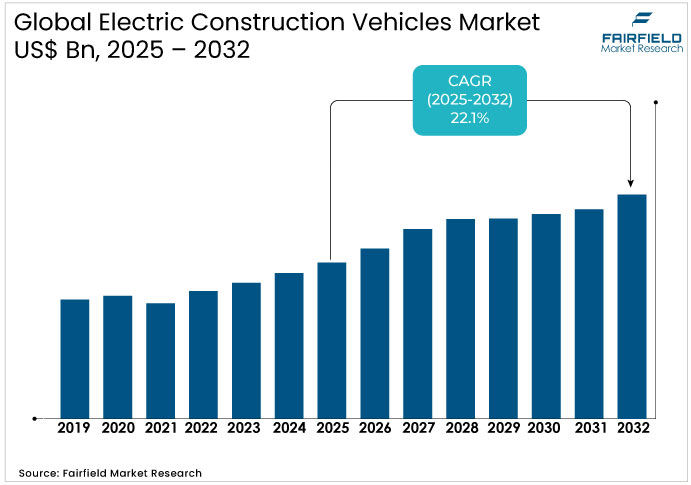

The Electric Construction Vehicles Market is valued at USD 12.3 Bn in 2026 and is projected to reach USD 49.8 Bn by 2033, growing at a CAGR of 22.10%.

Electric Construction Vehicles Market Summary: Key Insights & Trends

- Battery propulsion leads the Electric Construction Vehicles Market with around 74% share in 2024, driven by efficiency and zero-emission performance.

- Mini excavators and wheel loaders are the fastest-growing product types, expanding at nearly 20% CAGR due to compact urban project demand.

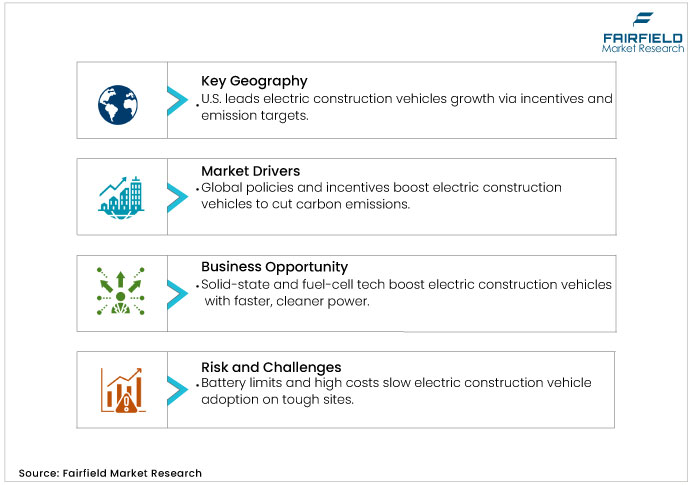

- Government incentives and emission regulations are the key drivers, accelerating global adoption of electric and hybrid machinery.

- Expansion of fast-charging and hydrogen fuel cell infrastructure presents major opportunities for manufacturers targeting heavy-duty applications.

- Asia Pacific holds ~30% of global share, led by China, Japan, and India, with strong policy support and rapid urbanization.

- Normal charging commands over 70% market share, favored for overnight fleet operations, while fast-charging solutions rapidly gain traction.

- Crawler excavators dominate product usage, contributing roughly 30–38% of total market value in 2024 across infrastructure and construction projects.

Key Growth Drivers

- Global Policies and Subsidies Accelerate Electric Construction Vehicle Adoption

Governments worldwide actively promote the Electric Construction Vehicles Market through incentives and regulations that encourage adoption. Policies aim to reduce carbon emissions from construction activities, which contribute significantly to global pollution. For instance, subsidies and tax exemptions lower the upfront costs for buyers, making electric models more accessible. This regulatory environment fosters innovation in battery technology and charging infrastructure, driving market expansion. Justifications include the need for sustainable urban development, where electric vehicles minimize environmental impact. Statistics show that construction emissions account for a notable portion of total CO2 output, prompting stricter guidelines.

- Rising Urban Noise Restrictions Drive Adoption of Silent Electric Equipment

Urbanization intensifies the demand for quieter construction equipment in the Electric Construction Vehicles Market, as noise pollution affects residential quality of life. Electric vehicles operate silently compared to traditional counterparts, aligning with municipal noise restrictions. This trend justifies investments in electric models for city projects, reducing health issues such as hearing loss from prolonged exposure. Quality statistics reveal that excessive noise impacts millions in densely populated regions, underscoring the need for silent alternatives. Drivers include growing awareness of worker safety and community well-being, which propel market growth. The market benefits from this shift, as companies prioritize equipment that complies with urban standards, leading to broader acceptance and integration in sensitive environments.

Key Restraints

- Short Battery Lifespan and Performance Issues Restrict Electric Vehicle Adoption

Battery constraints hinder widespread Electric Construction Vehicles Market penetration, particularly in demanding applications. Lithium-ion units offer only 600-1,000 cycles before degradation, limiting runtime to 6-8 hours versus diesel's all-day capability, according to U.S. Department of Energy assessments. High vulnerability to overcharge and temperature extremes reduces reliability on rugged sites, with replacement costs averaging USD 20,000-50,000 per unit. These factors elevate downtime risks by 15%, deterring small operators despite long-term savings.

- Expensive Upfront Investment and Poor Charging Access Slow Market Expansion

Upfront pricing deters adoption in the electric construction vehicles industry, with electric models 30-50% costlier than diesel equivalents due to premium components. Limited fast-charging stations—only 10% of sites equipped per International Energy Agency data—extend recharge times to 4-6 hours, disrupting workflows. In emerging markets, grid instability adds 20% variability to energy availability, per World Bank infrastructure reports, constraining scalability.

Electric Construction Vehicles Market Trends and Opportunities

- Next-Gen Battery and Hydrogen Innovations Accelerate Equipment Electrification Globally

Innovations in solid-state batteries present transformative potential for the Electric Construction Vehicles Market, enhancing energy density by 2-3 times over lithium-ion. These units promise 10-year lifespans and 80% faster charging, reducing costs by 40% through economies of scale, as projected by the U.S. Advanced Battery Consortium. Fuel cell integrations offer zero-emission alternatives for heavy-duty tasks, with hydrogen infrastructure investments reaching USD 10 billion globally by 2025 per International Energy Agency filings. This evolution supports hybrid models, capturing 15% additional market share in off-grid operations. OEMs leveraging these techs gain 25% margins via premium pricing, while operators achieve 30% fuel cost reductions. As R&D accelerates—evidenced by USD 2 billion in 2024 venture funding per Department of Energy data—these advancements enable electrification of larger fleets, projecting a 25% CAGR in battery-equipped segments through 2032.

- Asia Pacific and Latin America Lead Global Growth in Electric Machinery Adoption

Asia Pacific's urbanization and policy support unlock substantial growth by holding 30% global share in 2025. India's scrappage policy mandates 15% fleet renewal with electrics by 2027, driving USD 5 billion in investments. In Latin America, Brazil's EV incentives tripled registrations in 2024, with 2025 projections at 20% growth via BNDES financing, according to OLADE reports. These trends correlate with 18% infrastructure spending hikes, per World Bank analyses, yielding 22% demand surges in mining and urban projects. Stakeholders can capitalize on a USD 10-15 billion opportunity in charging networks, mitigating supply chain risks through local manufacturing. This regional pivot diversifies revenue, with early entrants securing 40% market premiums amid 68% urban population growth by 2050

Segment-wise Trends & Analysis

- Battery Systems Dominate While Fuel Cells Emerge as the Fastest-Growing Alternative

Battery propulsion leads with over 70% market share in 2025, dominating due to its efficiency and zero-emission profile. This leadership stems from mature technology and widespread availability, positioning it as the preferred choice for urban projects. Competitive positioning favors established players who invest in battery optimization, securing advantages over hybrids.

Fuel cell emerges as a fast-growing segment, driven by its potential for longer ranges and quick refueling. Underlying drivers include hydrogen infrastructure development and sustainability goals. Growth trajectory projects rapid adoption in heavy-duty applications, challenging battery dominance through superior energy density and positioning innovators at the forefront.

- Normal Charging Leads Market Share While Fast Charging Gains Momentum for Quick Operations

Normal charging commands over 70% market share in 2025 within the Electric Construction Vehicles Market, leading due to its compatibility with existing power grids and lower installation costs. This segment's strength lies in overnight charging suitability for fleet operations, enhancing operational efficiency. Competitive positioning benefits providers focusing on affordable solutions, maintaining market control.

Fast charging represents the emerging segment propelled by demands for minimal downtime on sites. Drivers encompass technological progress in high-power chargers and urban construction needs. Its growth path anticipates broader infrastructure support, enabling competitive edges for agile firms adapting to quick-turnaround requirements.

- Crawler Excavators Lead the Market While Mini Excavators Drive Rapid Urban Growth

Crawler excavator holds over 30% market share in 2025, leading through versatility in rugged terrains and high demand in infrastructure projects. This dominance reflects robust design adaptations for electric power, ensuring reliability. Competitive positioning strengthens for manufacturers emphasizing durability, outpacing other types.

Mini excavator emerges as fast-growing fueled by compact size ideal for confined urban sites. Drivers include rising residential construction and emission regulations. Growth trajectory forecasts increased penetration, with positioning favoring innovative brands that integrate advanced controls for precision tasks.

Regional Trends & Analysis

North America Leads Market Growth Through Incentives and Infrastructure Investments

North America advances in the Electric Construction Vehicles Market through robust incentives and infrastructure investments, particularly in the U.S. Trends involve fleet transitions driven by emission targets, with supportive policies enhancing adoption. Drivers include tax credits and grants, fostering innovation amid growing urbanization.

U.S. Electric Construction Vehicles Market – 2025 Snapshot & Outlook

The U.S. drives demand via the Infrastructure Investment and Jobs Act, allocating $5 billion for EV charging, boosting margins by 15% through reduced fuel costs. Government policies such as tax incentives cut acquisition expenses by 20%, accelerating retail shifts to electric fleets. A consumer trend from EPA surveys shows 60% of contractors prefer low-emission equipment for compliance. This supports outlook for 25% growth by 2032.

High tariffs on imports challenge costs, but domestic manufacturing mitigates risks by 10% via localized supply. Trends highlight zero-energy building investments, impacting demand positively. Supportive policies ensure competitive edges in sustainable projects.

Asia Pacific Dominates Global Share with Strong Policy and Technology Support

Asia Pacific holds ~30% share in 2025 as the leading region in the Electric Construction Vehicles Market, with Japan, South Korea, and China spearheading trends. Drivers include subsidies and EV mandates, while trends focus on battery tech and urban infrastructure. Rapid growth stems from emission regulations.

Japan Electric Construction Vehicles Market – 2025 Snapshot & Outlook

Japan emphasizes electrification through deadlines for ICE conversions, enhancing margins via energy efficiency gains of 30%. Tax policies exempt EVs from certain fees, driving retail shifts with 18% adoption increases. A JEMA survey indicates 55% of firms prioritize quiet operations for urban sites. Outlook projects a sustainable CAGR amid tech investments. Trends involve flourishing charging networks, supporting heavy-duty applications. Government programs justify expansions, mitigating high initial costs.

India Electric Construction Vehicles Market – 2025 Snapshot & Outlook

India accelerates via scrappage policies replacing old vehicles with low-emission ones, improving margins by 25% from fuel savings. Supportive taxes reduce ownership costs by 15%, shifting retail toward electric models. An NITI Aayog survey reveals 70% consumer preference for sustainable equipment due to pollution concerns. Fastest-growing outlook anticipates 28% expansion. Drivers include subsidies, trends in infrastructure booms. Policies enable competitive positioning for local manufacturers.

Europe Emerges as Fast-Growing Region Amid Strict Emission and Noise Regulations

Europe emerges as fast-growing with Germany, France, and U.K. trends centering on strict emissions and noise rules. Drivers encompass EU standards, while trends highlight fleet electrification for sustainability.

Germany Electric Construction Vehicles Market – 2025 Snapshot & Outlook

Germany leads with programs for sustainable transport, offering tax rebates that boost margins by 20%. Policies curtail polluting vehicles, impacting retail by 22% toward electrics. A BMU survey shows 65% of operators favor emission-free tech for health benefits. Outlook forecasts 24% growth through 2032. Trends include demand for noiseless equipment, justified by regulatory data on efficiency gains.

U.K. Electric Construction Vehicles Market – 2025 Snapshot & Outlook

U.K. advances NRMM initiatives, providing grants that enhance margins via 18% cost reductions. Ownership tax exemptions drive retail shifts, with 25% fleet conversions. HSE data indicates 50% preference for low-noise models to reduce disorders. Emerging outlook sees a sustainable CAGR. Drivers involve outlawing diesel in residential, trends in urban planning.

Competitive Landscape

Players in the Electric Construction Vehicles Market focus on battery integration strategies to achieve emission reductions and efficiency gains. This approach stems from rising regulatory pressures, backed by events such as the 2025 EU emission mandates. One number shows 30% cost savings from optimized powertrains, justifying R&D investments.

M&A activities, such as Komatsu's partnerships, impact capacity by consolidating tech expertise. New rules on sustainability reporting raise compliance costs by 15%. Early movers benefit from market share gains, while latecomers may face supply shortages.

Key Companies

- Hitachi

- Caterpillar

- John Deere

- Volvo CE

- XCMG

- CNH Industrial N.V.

- Komatsu

- SANY Group

- Liebherr

- Sandvik AB

- Hyundai CE

- JCB

- Doosan Corporation

Recent Developments:

- January 2025, Hitachi Construction Machinery (Europe) and KTEG will unveil their largest-ever electric excavator lineup—nine zero-emission models—at Bauma 2025, including the debut of the ZX17U-EB with a swappable battery and an autonomous 14-tonne excavator. The showcase underscores Hitachi’s commitment to zero-emission job sites and sustainable construction through advanced electric and hydrogen-powered machinery.

- September 2025, Caterpillar marks its 100th anniversary by unveiling innovations that support a low-carbon, smarter, and safer future across construction, mining, and marine sectors. The company is advancing battery-electric machines, autonomous mining systems, and methanol dual-fuel marine engines, reinforcing its commitment to sustainability, efficiency, and next-generation power solutions for customers worldwide.

- January 2025, At CES 2025, John Deere unveiled advanced autonomous machines for agriculture, construction, and landscaping, integrating AI, computer vision, and 360° cameras to combat skilled labor shortages. The lineup includes the 9RX autonomous tractor, 460 P-Tier dump truck, and electric mower, showcasing Deere’s push toward automation, sustainability, and smarter operations.

Global Electric Construction Vehicles Market Segmentation-

By Propulsion Type

- Battery

- Plug-in Hybrid

- Fuel Cell

- Hybrid

By Charging Type

- Normal Charging

- Fast Charging

By Product Type

- Crawler Excavator

- Wheel Loader

- Mini Excavator

- Dump Trucks

- Telehandler

- Forklift Truck

- Miscellaneous

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Electric Construction Vehicles Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Electric Construction Vehicles Market Outlook, 2020 - 2033

- Global Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Battery

- Plug-in Hybrid

- Fuel Cell

- Hybrid

- Global Electric Construction Vehicles Market Outlook, by Charging Type, Value (US$ Mn), 2020-2033

- Normal Charging

- Fast Charging

- Global Electric Construction Vehicles Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Crawler Excavator

- Wheel Loader

- Mini Excavator

- Dump Trucks

- Telehandler

- Forklift Truck

- Miscellaneous

- Global Electric Construction Vehicles Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- North America Electric Construction Vehicles Market Outlook, 2020 - 2033

- North America Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Battery

- Plug-in Hybrid

- Fuel Cell

- Hybrid

- North America Electric Construction Vehicles Market Outlook, by Charging Type, Value (US$ Mn), 2020-2033

- Normal Charging

- Fast Charging

- North America Electric Construction Vehicles Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Crawler Excavator

- Wheel Loader

- Mini Excavator

- Dump Trucks

- Telehandler

- Forklift Truck

- Miscellaneous

- North America Electric Construction Vehicles Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- S. Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- S. Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Canada Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Canada Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Canada Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Europe Electric Construction Vehicles Market Outlook, 2020 - 2033

- Europe Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Battery

- Plug-in Hybrid

- Fuel Cell

- Hybrid

- Europe Electric Construction Vehicles Market Outlook, by Charging Type, Value (US$ Mn), 2020-2033

- Normal Charging

- Fast Charging

- Europe Electric Construction Vehicles Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Crawler Excavator

- Wheel Loader

- Mini Excavator

- Dump Trucks

- Telehandler

- Forklift Truck

- Miscellaneous

- Europe Electric Construction Vehicles Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Germany Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Germany Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Italy Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Italy Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Italy Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- France Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- France Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- France Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- K. Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- K. Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- K. Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Spain Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Spain Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Spain Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Russia Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Russia Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Russia Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Rest of Europe Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Rest of Europe Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Rest of Europe Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Asia Pacific Electric Construction Vehicles Market Outlook, 2020 - 2033

- Asia Pacific Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Battery

- Plug-in Hybrid

- Fuel Cell

- Hybrid

- Asia Pacific Electric Construction Vehicles Market Outlook, by Charging Type, Value (US$ Mn), 2020-2033

- Normal Charging

- Fast Charging

- Asia Pacific Electric Construction Vehicles Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Crawler Excavator

- Wheel Loader

- Mini Excavator

- Dump Trucks

- Telehandler

- Forklift Truck

- Miscellaneous

- Asia Pacific Electric Construction Vehicles Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- China Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- China Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Japan Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Japan Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Japan Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- South Korea Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- South Korea Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- South Korea Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- India Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- India Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- India Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Southeast Asia Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Southeast Asia Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Southeast Asia Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Rest of SAO Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Rest of SAO Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Rest of SAO Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Latin America Electric Construction Vehicles Market Outlook, 2020 - 2033

- Latin America Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Battery

- Plug-in Hybrid

- Fuel Cell

- Hybrid

- Latin America Electric Construction Vehicles Market Outlook, by Charging Type, Value (US$ Mn), 2020-2033

- Normal Charging

- Fast Charging

- Latin America Electric Construction Vehicles Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Crawler Excavator

- Wheel Loader

- Mini Excavator

- Dump Trucks

- Telehandler

- Forklift Truck

- Miscellaneous

- Latin America Electric Construction Vehicles Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Brazil Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Brazil Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Mexico Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Mexico Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Mexico Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Argentina Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Argentina Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Argentina Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Rest of LATAM Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Rest of LATAM Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Rest of LATAM Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Electric Construction Vehicles Market Outlook, 2020 - 2033

- Middle East & Africa Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Battery

- Plug-in Hybrid

- Fuel Cell

- Hybrid

- Middle East & Africa Electric Construction Vehicles Market Outlook, by Charging Type, Value (US$ Mn), 2020-2033

- Normal Charging

- Fast Charging

- Middle East & Africa Electric Construction Vehicles Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Crawler Excavator

- Wheel Loader

- Mini Excavator

- Dump Trucks

- Telehandler

- Forklift Truck

- Miscellaneous

- Middle East & Africa Electric Construction Vehicles Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- GCC Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- GCC Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- South Africa Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- South Africa Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- South Africa Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Egypt Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Egypt Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Egypt Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Nigeria Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Nigeria Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Nigeria Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- Rest of Middle East Electric Construction Vehicles Market Outlook, by Propulsion Type, 2020-2033

- Rest of Middle East Electric Construction Vehicles Market Outlook, by Charging Type, 2020-2033

- Rest of Middle East Electric Construction Vehicles Market Outlook, by Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Electric Construction Vehicles Market Outlook, by Propulsion Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Hitachi

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Caterpillar

- John Deere

- Volvo CE

- XCMG

- CNH Industrial N.V.

- Komatsu

- SANY Group

- Liebherr

- Sandvik AB

- Hitachi

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Bn |

||

|

REPORT FEATURES |

DETAILS |

|

Propulsion Type Coverage |

|

|

Charging Type Coverage |

|

|

Product Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Production Output, Trade Statistics, Price Trend Analysis, Competition Landscape, Grade-, Application-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply), Key Market Trends |