Electrodeposited Copper Foils Market Growth and Industry Forecast

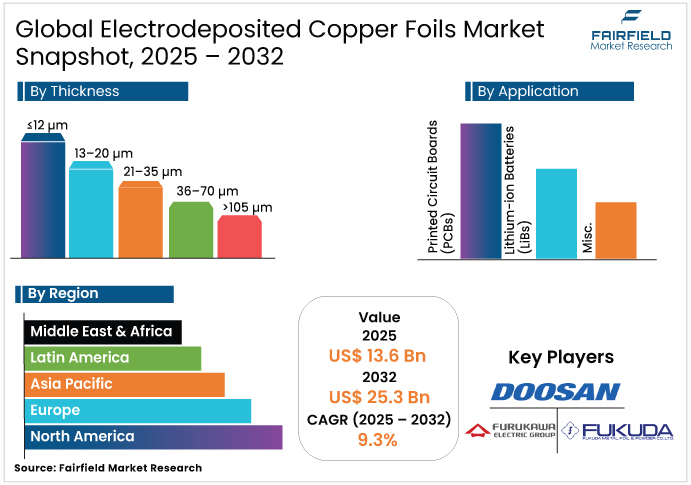

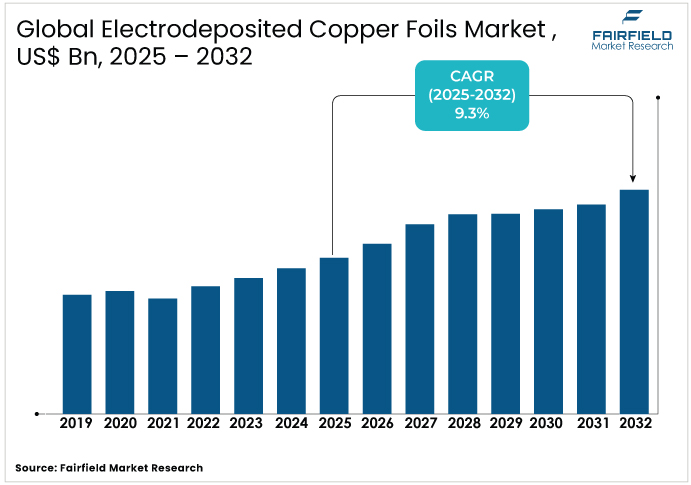

- The global electrodeposited copper foils market is projected to reach US$ 13.6 Bn in 2025 and is expected to expand at a CAGR of 9.3% from 2025 to 2032.

- This growth trajectory is anticipated to drive the market size to approximately US$ 25.3 Bn by 2032.

Electrodeposited Copper Foils Market Summary Key Insights & Trends

- PCBs lead the market with over 62% share, while lithium-ion batteries are expanding rapidly due to EV growth and renewable energy storage needs, with miscellaneous applications holding a smaller portion.

- The 13–20 µm thickness segment dominates with 27.5% share in 2025, preferred for high-density interconnect PCBs, flexible electronics, and emerging wearable devices.

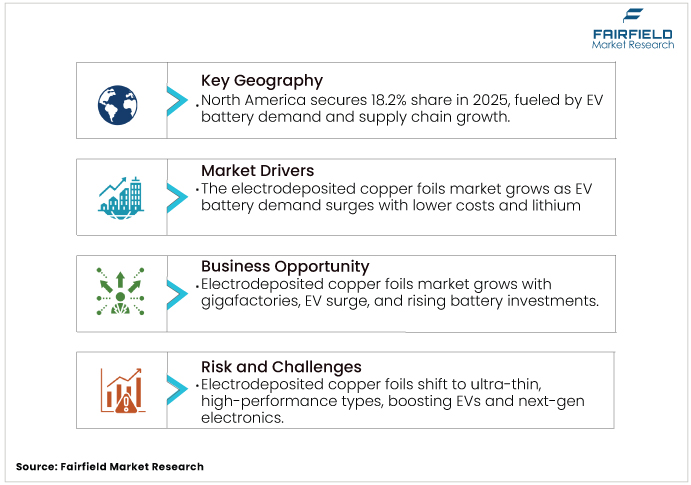

- Rising lithium-ion battery adoption in EVs and energy storage, combined with declining battery prices, drives strong demand for high-quality anode copper foils.

- The global expansion of gigafactories and battery manufacturing plants is creating significant opportunities, with industry capacity increasing over 67% between 2020 and 2025.

- Asia Pacific is expected to account for the largest market share at 44.8% in 2025, driven by China’s dominant battery production, rapid EV adoption, and well-integrated supply chains.

- North America is poised to capture 18.2% of the electrodeposited copper foils market in 2025, fueled by expanding lithium-ion battery production, growing EV adoption, and investments in gigafactories.

- Europe accounts for 13.8% market share in 2025, supported by local LFP battery production, EV incentives, and the development of renewable energy storage infrastructure.

A Look Back and a Look Forward - Comparative Analysis

From 2019 to 2024, the electrodeposited copper foils market experienced robust growth, driven by the rapid expansion of printed circuit boards (PCBs), rising adoption of lithium-ion batteries, and increasing demand from consumer electronics and telecommunication sectors. The proliferation of 5G infrastructure and smartphones further fueled the need for high-performance copper foils. Technological advancements in ultra-thin and reverse-treated foils enhanced product efficiency, while Asia Pacific, particularly China, dominated production and consumption, leveraging cost advantages and mature supply chains.

The electrodeposited copper foils industry is poised for accelerated growth from 2025 to 2032, driven by the surge in electric vehicle (EV) production, expansion of gigafactories, and increasing demand for renewable energy storage systems. Manufacturers are investing in sustainable and recycled copper foils to meet environmental standards, while technological innovations in high-conductivity, high-adhesion foils enable improved battery efficiency. North America and Europe are emerging as key growth regions due to domestic battery manufacturing expansion and policy support, reflecting a shift toward a more geographically diverse and resilient market.

Key Growth Drivers

- Demand for Lithium-Ion Batteries in Electric Vehicles and Energy Storage Systems

The electrodeposited copper foils market is gaining strong traction as lithium-ion battery adoption in electric vehicles (EVs) and energy storage systems continues to surge. With EV sales climbing by 25% in 2024 to reach nearly 17 million units, global battery demand has crossed the 1 TWh mark for the first time. The drop in battery pack prices below the USD 100/kWh threshold has made EVs more competitive with conventional vehicles, directly driving demand for high-quality anode current collectors. A steep 85% fall in lithium prices since 2022 has further boosted affordability, enabling faster battery production growth.

Global battery manufacturing capacity stood at 3 TWh in 2024, with projections to triple within five years, opening a major window for ED copper foil suppliers to expand capacity and secure long-term supply agreements across automotive, renewable energy, and electronics applications.

- Penetration of High-Density Interconnect and Flexible Printed Circuit Boards

The electrodeposited copper foils market is witnessing strong growth with the rising adoption of high-density interconnect (HDI) and flexible printed circuit boards (FPCBs) in advanced electronics. These applications demand ultra-thin, high-performance copper foils with excellent conductivity and adhesion properties to support miniaturized, high-layer-count PCB designs. Growing use of 5G smartphones, wearables, automotive electronics, and high-speed data servers is accelerating HDI and FPCB production, particularly in Asia, leading the global PCB manufacturing.

Players like Industrie De Nora are expanding production capacity in China to meet this demand, serving sectors such as lithium-ion batteries, copper foil for PCBs, and electronics components, ensuring a stable supply chain for PCB manufacturers. This trend is positioning electrodeposited copper foils as a critical enabler of next-generation consumer electronics, automotive systems, and IoT devices.

Key Growth Restraints

- Volatility in Copper Prices Impacting Manufacturing Costs and Profit Margins

The market faces notable cost pressures due to fluctuations in copper prices, which are a direct driver of manufacturing expenses. In 2023, global copper prices witnessed significant volatility as weak demand from China, a sluggish manufacturing sector in Western economies, and a stronger U.S. dollar pushed commodity costs higher for importers.

Rising borrowing costs further discouraged stockpiling, leading manufacturers to reduce copper inventories and creating instability in raw material procurement. Since copper accounts for a major share of production costs in electrodeposited copper foils, such price swings can sharply impact profit margins, particularly for producers supplying HDI PCBs, FPCBs, and lithium-ion battery components.

With copper demand projected to potentially double by 2035 but supply growth constrained by long mine development timelines, the electrodeposited copper foils market will likely continue to face raw material price instability, challenging cost management for foil manufacturers.

- High Capital and Energy Requirements for Electro-Deposition Processes

The electrodeposited copper foils market is significantly affected by the high capital and energy demands of the electro-deposition process. Manufacturing high-quality copper foils involves multiple surface treatment steps, including washing to deposit copper nodules, corrosion prevention to avoid oxidation, and chemical and heat protection to maintain conductivity and durability. Each anode must be customized to match specific application requirements, which raises both initial investment and operational costs.

Companies such as De Nora offer DSA® anodes that reduce energy consumption and extend anode life, but the process overall remains energy-intensive and capital-heavy. These high costs limit production scaling and impact profitability, particularly as demand grows in automotive electronics, lithium-ion batteries, and high-performance electronic components.

Electrodeposited Copper Foils Market Trends and Opportunities

- Scaling of Gigafactories and Battery Manufacturing Plants Worldwide

The electrodeposited copper foils market is gaining significant opportunities from the rapid expansion of gigafactories and battery production plants worldwide. With EV sales projected at 13.3 million units globally in 2024 and the U.S. share growing by 66.4% year-on-year, manufacturers are aggressively investing in lithium-ion battery supply chains, driving demand for high-quality copper foils as anode current collectors.

Companies like Volta Energy Solutions are building new plants in Quebec, Canada, while Denkai America is investing over US$430 million in a North American production facility to serve EV battery makers. Global expansion of foil capacity, including over a 67% increase between 2020 and 2025, ensures a stable supply of thin, conductive copper layers critical for electric vehicles, energy storage systems, and grid-scale applications. This trend positions electrodeposited copper foils as a central material enabling the energy transition and next-generation battery technologies.

- Technological Advancements in Ultra-Thin and Reverse-Treated Copper Foils

The electrodeposited copper foils market is moving toward ultra-thin and reverse-treated foils, focusing on improving adhesion, conductivity, and performance in advanced electronic applications. This trend is exemplified by CU4000 and CU4000 LoPro foils, which feature a high mechanical bonding area and a thin adhesive layer to reduce conductor loss and enhance multilayer board integration.

Developments like De Nora’s Suzhou plant expansion in 2023, which tripled electrode production capacity, support the growing demand for high-performance foils in electronics. These innovations allow manufacturers to simplify multi-layer board assembly, reduce prepreg usage, and strengthen HDI and build-up technologies, positioning electrodeposited copper foils as a critical material for next-generation electronics.

Segment-wise Trends & Analysis

- Strong Growth in 13–20 µm Electrodeposited Copper Foil Segment

By thickness, 13–20 µm holds the highest market share of 27.5% in 2025, driven by strong adoption in high-density interconnect (HDI) PCBs and flexible electronics. Manufacturers increasingly prefer this range for its balance of conductivity and durability, which suits consumer electronics and emerging wearable devices. Rising demand for compact, high-performance electronic components fuels growth in this segment, positioning it as the fastest-growing thickness range in the electrodeposited copper foils market.

- PCBs Lead Applications While Lithium-Ion Batteries Expand Rapidly

PCBs lead the electrodeposited copper foils market, accounting for over 62% of the share, fueled by their extensive use in smart devices, computing systems, and 5G infrastructure. The LiB segment is expanding rapidly, supported by the accelerating EV adoption and increasing demand for renewable energy storage solutions. Growth in battery manufacturing and technological improvements in copper foil anodes further enhance the segment’s market potential. Miscellaneous applications hold a smaller share but benefit from diverse uses across electronics and industrial sectors.

Regional Analysis

- North America Growth Driven by Electronics, EV Adoption, and 5G Expansion

North America holds an estimated market share of 18.2% in 2025, driven by rising demand for lithium-ion batteries, especially for electric vehicles and energy storage applications. Local production capacity still depends heavily on imports of key components, creating opportunities for electrodeposited copper foil manufacturers to supply the growing EV and stationary energy storage sectors. Strategic collaborations between battery makers and automakers are further enhancing supply chain integration, boosting demand for high-quality copper foils.

North America’s growth is fueled by rapid expansion in EV adoption and significant investment in battery manufacturing plants. The United States has doubled its battery production capacity since 2022, reaching over 200 GWh in 2024, supported by tax incentives for battery producers.

- Europe Boosted by Renewable Energy, EV Production, and Sustainability Goals

Europe is expanding its battery manufacturing ecosystem to reduce reliance on imports, particularly from China, with projects such as the Stellantis-CATL joint venture increasing local production of LFP batteries. Europe holds an estimated market share of 13.8% in 2025, driven by demand from electric vehicles and the energy storage sector.

Local battery production remains more expensive than in Asia, but investments in domestic battery plants, along with policy support for EV adoption, are gradually strengthening the region’s supply chain. European battery makers are focusing on cheaper LFP chemistries, while Korean and Japanese companies are investing in European facilities, further stimulating demand for lithium battery copper foils.

- Asia Pacific Leads with Strong EV Production and Electronics Manufacturing

Asia Pacific continues to dominate the global electrodeposited copper foils market, primarily due to China’s stronghold on battery production and large-scale EV adoption. Asia Pacific is expected to account for an estimated share of 44.8% in 2025, driven by China producing over three-quarters of batteries sold globally, with EV battery demand in China growing 30% in 2024.

The region benefits from integrated supply chains, extensive manufacturing know-how, and widespread use of LFP batteries, which are now nearly 30% cheaper than NMC alternatives. Rapid expansion of battery gigafactories in Southeast Asia, along with emerging hubs in Indonesia and Morocco for component production, further strengthens demand for electrodeposited copper foils in lithium-ion batteries and other electronics applications.

Competitive Landscape

The global electrodeposited copper foils market is moderately consolidated, with leading players holding a significant but not overwhelming share of the global market. Doosan Corporation Electro, Furukawa Electric Co., Ltd., Mitsui Mining & Smelting Co., Ltd., JX Nippon Mining & Metals Corporation, and Rogers Corporation are among the top competitors driving technological innovation and production scale in the market. These manufacturers focus on expanding production capacities, developing ultra-thin and high-performance copper foils, and enhancing product quality for applications in lithium-ion batteries, printed electronics, and advanced multilayer boards.

Companies are also investing in R&D, forming strategic partnerships, and entering new regional markets to strengthen their presence, improve supply chain efficiency, and address the growing demand from electric vehicles, renewable energy storage, and electronics sectors. The competitive intensity is rising due to innovation in electrodeposition processes and the increasing emphasis on high-conductivity and low-loss copper foils.

Key Companies

- Doosan Corporation Electro

- Furukawa Electric Co., Ltd.

- Fukuda Metal Foil & Powder Co., Ltd.

- Circuit Foil

- Chang Chun Group

- LS Mtron Ltd.

- Mitsui Mining & Smelting Co., Ltd.

- JX Nippon Mining & Metals Corporation

- ILJIN Materials Co., Ltd.

- Targray Technology International, Inc.

- Nippon Denkai, Ltd.

- All Foils, Inc.

- Oak-Mitsui Technologies LLC

- Rogers Corporation

Recent Key Industry Developments

- On January 9, 2025, Fukuda Metal Foil & Powder Co., Ltd. announced that UL Solutions validated several of its electrodeposited copper foil types (SV, HD, UN, HS, HTE, and STD) as made from 100% recycled copper, following ISO 14021 standards. This third-party validation strengthens the company’s sustainability credentials and positions it to meet the rising demand for eco-friendly copper foils in lithium-ion batteries, PCBs, and other electronics applications, reflecting the market’s growing emphasis on green materials and circular economy practices.

- On April 17, 2025, Industrie De Nora inaugurated its Innovation Center in Mentor, Ohio, boosting production of DSA® electrodes and gas diffusion electrodes (GDEs), which support copper foil manufacturing for lithium-ion batteries. With a production capacity of up to 30,000 m²/year of DSA® electrodes, the facility strengthens De Nora’s ability to deliver high-performance, high-conductivity materials, supporting battery production, electronics applications, and the energy transition, while reinforcing its global leadership in electrochemical technologies.

Global Electrodeposited Copper Foils Market Segmentation

By Thickness

- ≤12 µm

- 13–20 µm

- 21–35 µm

- 36–70 µm

- >105 µm

Application

- Printed Circuit Boards (PCBs)

- Lithium-ion Batteries (LiBs)

- Misc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Electrodeposited Copper Foils Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Electrodeposited Copper Foils Market Outlook, 2019 - 2032

3.1. Global Electrodeposited Copper Foils Market Outlook, by Thickness, Value (US$ Bn), 2019-2032

3.1.1. ≤12 µm

3.1.2. 13–20 µm

3.1.3. 21–35 µm

3.1.4. 36–70 µm

3.1.5. >105 µm

3.2. Global Electrodeposited Copper Foils Market Outlook, by Application, Value (US$ Bn), 2019-2032

3.2.1. Printed Circuit Boards (PCBs)

3.2.2. Lithium-ion Batteries (LiBs)

3.2.3. Misc.

3.3. Global Electrodeposited Copper Foils Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Electrodeposited Copper Foils Market Outlook, 2019 - 2032

4.1. North America Electrodeposited Copper Foils Market Outlook, by Thickness, Value (US$ Bn), 2019-2032

4.1.1. ≤12 µm

4.1.2. 13–20 µm

4.1.3. 21–35 µm

4.1.4. 36–70 µm

4.1.5. >105 µm

4.2. North America Electrodeposited Copper Foils Market Outlook, by Application, Value (US$ Bn), 2019-2032

4.2.1. Printed Circuit Boards (PCBs)

4.2.2. Lithium-ion Batteries (LiBs)

4.2.3. Misc.

4.3. North America Electrodeposited Copper Foils Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.3.1. U.S. Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

4.3.2. U.S. Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

4.3.3. Canada Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

4.3.4. Canada Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Electrodeposited Copper Foils Market Outlook, 2019 - 2032

5.1. Europe Electrodeposited Copper Foils Market Outlook, by Thickness, Value (US$ Bn), 2019-2032

5.1.1. ≤12 µm

5.1.2. 13–20 µm

5.1.3. 21–35 µm

5.1.4. 36–70 µm

5.1.5. >105 µm

5.2. Europe Electrodeposited Copper Foils Market Outlook, by Application, Value (US$ Bn), 2019-2032

5.2.1. Printed Circuit Boards (PCBs)

5.2.2. Lithium-ion Batteries (LiBs)

5.2.3. Misc.

5.3. Europe Electrodeposited Copper Foils Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.3.1. Germany Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

5.3.2. Germany Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

5.3.3. Italy Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

5.3.4. Italy Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

5.3.5. France Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

5.3.6. France Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

5.3.7. U.K. Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

5.3.8. U.K. Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

5.3.9. Spain Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

5.3.10. Spain Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

5.3.11. Russia Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

5.3.12. Russia Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

5.3.13. Rest of Europe Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

5.3.14. Rest of Europe Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Electrodeposited Copper Foils Market Outlook, 2019 - 2032

6.1. Asia Pacific Electrodeposited Copper Foils Market Outlook, by Thickness, Value (US$ Bn), 2019-2032

6.1.1. ≤12 µm

6.1.2. 13–20 µm

6.1.3. 21–35 µm

6.1.4. 36–70 µm

6.1.5. >105 µm

6.2. Asia Pacific Electrodeposited Copper Foils Market Outlook, by Application, Value (US$ Bn), 2019-2032

6.2.1. Printed Circuit Boards (PCBs)

6.2.2. Lithium-ion Batteries (LiBs)

6.2.3. Misc.

6.3. Asia Pacific Electrodeposited Copper Foils Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.3.1. China Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

6.3.2. China Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

6.3.3. Japan Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

6.3.4. Japan Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

6.3.5. South Korea Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

6.3.6. South Korea Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

6.3.7. India Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

6.3.8. India Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

6.3.9. Southeast Asia Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

6.3.10. Southeast Asia Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

6.3.11. Rest of SAO Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

6.3.12. Rest of SAO Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Electrodeposited Copper Foils Market Outlook, 2019 - 2032

7.1. Latin America Electrodeposited Copper Foils Market Outlook, by Thickness, Value (US$ Bn), 2019-2032

7.1.1. ≤12 µm

7.1.2. 13–20 µm

7.1.3. 21–35 µm

7.1.4. 36–70 µm

7.1.5. >105 µm

7.2. Latin America Electrodeposited Copper Foils Market Outlook, by Application, Value (US$ Bn), 2019-2032

7.2.1. Printed Circuit Boards (PCBs)

7.2.2. Lithium-ion Batteries (LiBs)

7.2.3. Misc.

7.3. Latin America Electrodeposited Copper Foils Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.3.1. Brazil Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

7.3.2. Brazil Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

7.3.3. Mexico Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

7.3.4. Mexico Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

7.3.5. Argentina Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

7.3.6. Argentina Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

7.3.7. Rest of LATAM Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

7.3.8. Rest of LATAM Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Electrodeposited Copper Foils Market Outlook, 2019 - 2032

8.1. Middle East & Africa Electrodeposited Copper Foils Market Outlook, by Thickness, Value (US$ Bn), 2019-2032

8.1.1. ≤12 µm

8.1.2. 13–20 µm

8.1.3. 21–35 µm

8.1.4. 36–70 µm

8.1.5. >105 µm

8.2. Middle East & Africa Electrodeposited Copper Foils Market Outlook, by Application, Value (US$ Bn), 2019-2032

8.2.1. Printed Circuit Boards (PCBs)

8.2.2. Lithium-ion Batteries (LiBs)

8.2.3. Misc.

8.3. Middle East & Africa Electrodeposited Copper Foils Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.3.1. GCC Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

8.3.2. GCC Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

8.3.3. South Africa Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

8.3.4. South Africa Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

8.3.5. Egypt Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

8.3.6. Egypt Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

8.3.7. Nigeria Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

8.3.8. Nigeria Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

8.3.9. Rest of Middle East Electrodeposited Copper Foils Market Outlook, by Thickness, 2019-2032

8.3.10. Rest of Middle East Electrodeposited Copper Foils Market Outlook, by Application, 2019-2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Doosan Corporation Electro

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Furukawa Electric Co., Ltd.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Fukuda Metal Foil & Powder Co., Ltd.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Circuit Foil

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Chang Chun Group

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. LS Mtron Ltd.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Mitsui Mining & Smelting Co., Ltd.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. JX Nippon Mining & Metals Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. ILJIN Materials Co., Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Targray Technology International, Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Thickness Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |