Global Enterprise Content Management Market Forecast

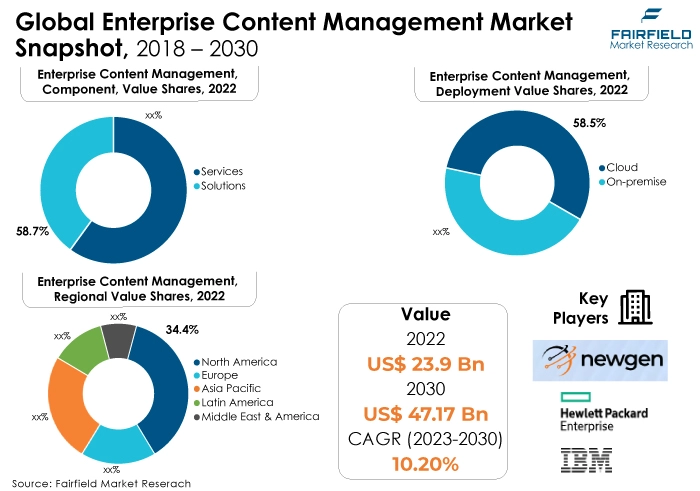

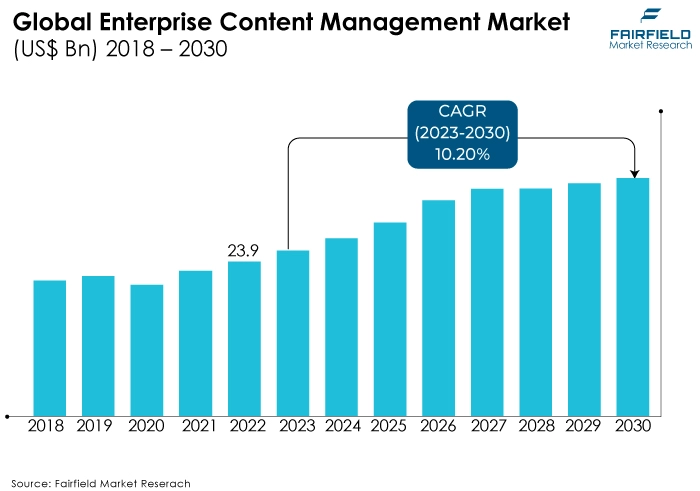

- The approximately US$23.9 Bn market for enterprise content management to be worth US$47.17 Bn by 2030-end

- Market expansion poised to witness a CAGR of 10.2% over 2023 - 2030

Quick Report Digest

- The main trend expected to drive market growth for enterprise content management is increased demand for hybrid ECM deployments. Furthermore, Multinational companies can benefit from hybrid ECM solutions. Through cloud deployments in several countries, they may keep centralised control over critical data while allowing local access to content.

- Another major market trend expected to drive the enterprise content management market growth is the rapidly expanding remote work enablement.

- Employees can access sensitive information while maintaining data security and compliance standards thanks to the secure remote access to content offered by ECM solutions. In fields with stringent regulatory standards, this is especially crucial.

- In 2022, the services category dominated the industry. Managed services include the routine application of patches, security updates, and software updates to ECM systems in order to safeguard against vulnerabilities and guarantee the most recent features are accessible.

- The cloud category dominated the market in 2022. ECM solutions in the cloud can be implemented more quickly than on-premises alternatives. Because of the quick deployment, businesses can use the technology more quickly and see benefits.

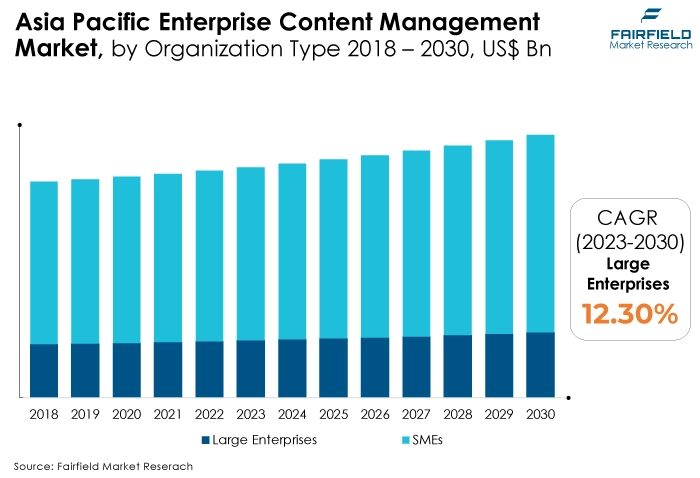

- In 2022, the SMEs category dominated the industry. SMEs can benefit from the expertise of ECM vendors and service providers who can assist with system configuration, security, and compliance, allowing SMEs to focus on core business objectives.

- The transportation & logistics category is expected to grow the fastest. ECM systems assist transportation and logistics companies in offering superior customer service by giving rapid access to order history, delivery status, and related documents.

- In the market for enterprise content management, Asia Pacific is anticipated to grow at the fastest rate. Due to their scalability, efficiency, and flexibility, cloud-based ECM systems are becoming more popular in the Asia Pacific area. To address their content management demands, businesses are increasingly choosing cloud-based ECM.

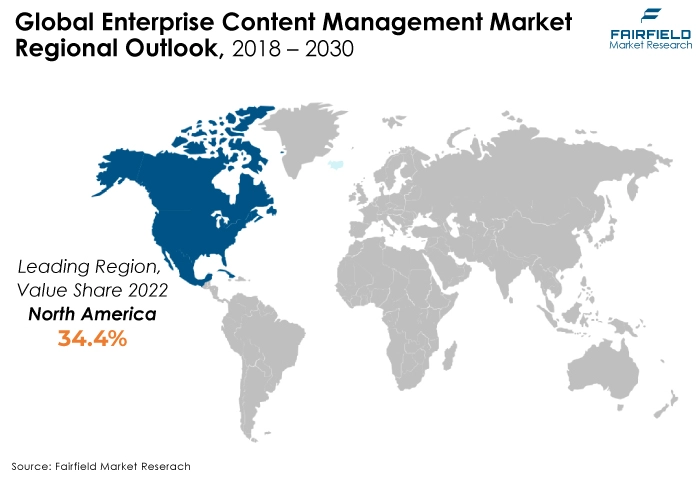

- The North American region will dominate the enterprise content management market throughout the forecast period. Because of the scalability, efficiency, and flexibility of cloud-based ECM systems, North American businesses are converting to them more frequently. This change drives the growth of cloud ECM service providers in the region.

A Look Back and a Look Forward - Comparative Analysis

Big data analytics improves content intelligence by extracting out insightful information from unstructured content, including papers, photos, and audio recordings. To make decisions based on data, organisations can better comprehend their content. ECM platforms that incorporate big data analytics can offer more effective and precise search capabilities. Natural language processing and semantic search algorithms enable users to find content, even in large libraries, easily.

Big data analytics helps automate content classification and tagging, making it easier to organise and categorise documents based on their content, context, and relevance. The market witnessed staggered growth during the historical period 2018 - 2022. Processes for managing content can be streamlined with an ECM system that is well-designed and has an easy-to-use interface. Users can find, access, and work together more rapidly on documents and data, which boosts productivity and efficiency within organisations.

Employee proficiency in the use of user-friendly ECM systems requires less training. As a result, companies may use ECM more affordably because onboarding and continuous training take less time and money. ECM systems include 3D printing capabilities for managing 3D models, designs, and related documents in sectors like engineering and manufacturing in the coming years.

Additionally, Blockchain technology improves data integrity and content security by offering a tamper-proof ledger for recording content modifications. For secure document management, ECM systems are implementing blockchain technology. Furthermore, Voice recognition technology allows users to interact with ECM systems using voice commands, making content retrieval and management hands-free and more accessible during the next five years.

Key Growth Determinants

- Rising Demand for Digital Transformation

Initiatives for digital transformation involve turning paper-based and analog data into digital representations. To make documents more accessible and searchable, ECM solutions offer capabilities for scanning, digitising, and organising paper documents.

Consolidating data and content from diverse sources into a single repository is a common step in the digital transformation process. The foundation of this centralisation is provided by ECM systems, which guarantee a single source of truth for all enterprise material.

ECM solutions provide features for workflow automation, which streamlines corporate procedures and minimises manual effort. For businesses trying to optimise their operations as part of their digital transformation initiatives, this is essential.

- Increasing Demand for Cloud Adoption

Comparing cloud-based ECM solutions to conventional on-premises systems, lower upfront costs are frequently found. ECM is more affordable for companies of all sizes since organisations can avoid making substantial capital expenditures on hardware and software licenses.

Scalability is a feature of cloud ECM systems that enables businesses to increase or decrease their processing and storage capacities in accordance with their requirements. This is especially helpful for companies whose workloads are shifting or growing.

Users can access their material and documents on cloud ECM solutions from any location with an internet connection. For remote and distributed teams to support contemporary work arrangements, this accessibility is essential.

- Increasing AI and Machine Learning Integration

AI and machine learning algorithms can automatically tag and categorise data, facilitating information organisation, search, and retrieval inside ECM systems. Accessibility and content discovery are so improved. AI-powered search engines can provide more accurate and context-aware search results, improving user experience and productivity when searching for specific content within ECM repositories.

Automating typical content-related processes like document routing, approval workflows, and content dissemination can be done by training machine learning models. This lessens manual labor requirements and accelerates business procedures. AI-driven customisation tools may adapt user interfaces and content to each user's preferences, improving the user experience and boosting engagement.

Major Growth Barriers

- High Initial Costs

The initial expenses of installing an ECM system can be high. These expenses cover the cost of hiring consultants, purchasing hardware infrastructure, and training employees. These costs can be a significant barrier to entry for start-ups, and small firms with tight finances.

ECM systems need constant upkeep, updates, and assistance. These expenses may include the equipment and staffing costs for on-premises systems as well as subscription fees for cloud-based solutions. These costs may add up over time and have an impact on the overall cost of ownership. It can be difficult and expensive to integrate an ECM system with already-in-use enterprise systems and applications, such as CRM, ERP, and HR software. Integration projects frequently need specialised expertise and materials.

- Resistance to Change

ECM adoption may be resisted by management and staff because they are reluctant to change their current procedures and workflows. Most people feel at ease using tried-and-true techniques; therefore, introducing ECM frequently throws off these patterns. Comprehending the advantages of ECM might lead to resistance to change.

Employees and decision-makers may be skeptical and reluctant because they need to understand how ECM might enhance productivity, cooperation, and decision-making. Employees may perceive ECM systems as overly complex or difficult to use, leading to resistance based on the assumption that the system will be too challenging to navigate.

Key Trends and Opportunities to Look at

- Rising Focus on Security and Compliance

Businesses handle a huge quantity of private data, including financial records, customer information, medical records, and intellectual property. This sensitive information is protected from unauthorised access and data breaches with the use of ECM solutions that include encryption, role-based access control, and audit trails.

ECM systems can automate compliance management procedures by making sure that information and documents abide by corporate guidelines and standards that are relevant to the industry. Organisations benefit from this automation by having a lower chance of compliance infractions.

- Rising Vertical-specific ECM

ECM systems designed for a given industry's vertical are frequently quite adaptable to fit with its particular workflows, document formats, and business processes. This degree of personalisation improves the effectiveness and productivity of businesses in that industry.

ECM systems created specifically for a given industry frequently include pre-built content templates and document types that are pertinent to that industry. This quickens the implementation process and makes sure the system is set up to handle industry-specific content right away.

- Increasing Adoption of Mobile ECM

Mobile ECM solutions are in high demand because of the trend towards remote work and the spread of mobile workforces. Mobile ECM is essential for organisations because it allows staff to access, manage, and collaborate on content from any location.

Mobile ECM empowers workers to be effective while on the road. Their smartphones or tablets allow them to access documents, check contracts, authorise invoices, and perform activities, which decreases downtime and boosts productivity.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, data privacy and protection have been governed by the General Data Protection Regulation (GDPR), a regulation of the European Union. It has an impact on ECM because it mandates secure personal data management and data control for persons. By offering tools for data encryption, access controls, and data subject rights management, ECM solutions must enable GDPR compliance.

The management of data relating to healthcare is regulated under the Health Insurance Portability and Accountability Act (HIPAA) in the US. ECM systems must adhere to HIPAA regulations in order for healthcare organisations to transmit and store patient health information (PHI) securely.

The American financial sector is governed by the Financial Industry Regulatory Authority (FINRA). Financial services companies are required to adopt ECM programs that abide by FINRA guidelines for electronic communications, recordkeeping, and document preservation. In the US, the National Archives and Records Administration (NARA) establishes records management guidelines for federal agencies. ECM solutions used by government organisations must adhere to NARA standards for records retention and management.

Fairfield’s Ranking Board

Top Segments

- Demand for Services Dominant

The services segment dominated the market in 2022. Due to the necessity of managed and professional services to guarantee the efficient operation of ECM solutions. These services help in developing, evaluating, and using ECM environments to prevent wasting time and energy on ineffective implementations.

Managed services help businesses move material to their ECM platforms from old systems or other sources. Data mapping, content transformation, and maintaining data integrity when migrating are all included in this. Furthermore, The solutions category is anticipated to grow significantly throughout the forecast period.

Organisations can operate more efficiently because of solutions like document management, web content management, records management, document collaboration, digital rights management, and content analytics. These tools help businesses provide better customer service and manage digital material more effectively.

- Cloud Category Continues to be at the Forefront

In 2022, the cloud segment dominated the industry. Enterprise content management powered by the cloud has advantages like flexibility and disaster recovery. Additionally, it provides advantages like reduced network traffic, which helps businesses improve user experience and operational efficiency.

The on-premise category is expected to grow significantly during the forecast period. Data security, data ownership, and storage capacity flexibility are further advantages provided by on-premise enterprise content management.

- SMEs Register the Maximum Adoption

The SMEs category dominated the industry in 2022. Enterprise content management (ECM) enables small and medium-sized businesses to reduce the cost of data storage by allowing them to store data from various data verticals in a single repository. It also enables them to comply with laws like Sarbanes Oxley, and HIPAA that require businesses to store and retain certain documents. The software helps them to lower the cost of regulatory compliance by providing features like automated retention and audible alerts.

The large enterprises category is expected to grow the fastest. Many large enterprises have a global presence with multiple offices and branches across different regions. ECM systems must support centralised content management while accommodating localised needs and compliance requirements.

- BFSI Takes up the Largest Share of Pie, Transport & Logistics to Pick Pace

The BFSI category dominated the market in 2022. Banks, and other financial institutions handle a large number of papers, such as account statements, contracts, loan applications, and more. ECM systems provide for effective document capture, indexing, storage, retrieval, and secure archiving.

The BFSI industry is rapidly embracing digital transformation to improve customer experiences, modernise processes, and cut costs. In order to digitise paper-based operations and enhance workflow automation, ECM solutions are essential. The fastest growth is however anticipated in the transportation & logistics category. Real-time supply chain visibility is made possible for fleet operators through ECM.

Large amounts of logistics and transportation data can be managed and stored by them in a single location. They are assisted in lowering their freight costs and gaining access to improved order processing capabilities through the real-time freight data and analysis provided.

Regional Frontrunners

North America’s Versatile ECM Takeup Sustains its Top Rank

During the projected period, North America is anticipated to dominate the enterprise content management market. Large companies from a variety of sectors, including banking and finance, healthcare, government, manufacturing, and retail, are responsible for driving the market size.

As businesses work to manage the volume of material they produce, increase operational effectiveness, and strengthen compliance, the market will likely continue to develop steadily. In North America, cloud-based ECM systems have significantly increased in popularity.

The advantages of cloud deployment, such as scalability, flexibility, and lower infrastructure costs, are acknowledged by organisations. Remote work and cooperation are made possible by cloud-based ECM, which proved essential during the COVID-19 epidemic. Additionally, cloud ECM solutions address organisations' worries about content protection by providing improved data security and disaster recovery capabilities.

Asia Pacific Gears up in Line with Widening Application Potential

Asia Pacific is expected to be the fastest-growing enterprise content management market region. Many countries in the Asia Pacific region have some of the highest urbanisation rates worldwide. In industries like real estate, construction, and infrastructure development, where document management and compliance are crucial, this trend fuels the demand for ECM solutions.

The economies of the Asia Pacific region are among the world's fastest-growing. This economic expansion leads to more company activity, which creates more digital content and records that need to be managed effectively. Asia Pacific's BFSI industry is growing quickly. To manage customer data, transaction records, compliance documents, and other data, this industry needs ECM solutions.

Fairfield’s Competitive Landscape Analysis

The market for enterprise content management is very competitive and home to a number of well-known manufacturers. Large corporations are expanding their distribution networks and releasing new products in an effort to increase their market share globally. According to Fairfield Market Research, additional market consolidation is also anticipated in the upcoming years.

Who are the Leaders in the Global Enterprise Content Management Space?

- IBM

- Hewlett Packard Enterprise (HPE) Company

- M-Files Corporation

- Microsoft Corporation

- Newgen Software

- OpenText Corporation

- Oracle Corporation

- Xerox Corporation

- SAP

- Micro Focus

- iManage

- Hyland

- Laserfiche

- DOMA Technologies

- Ascend Software

Significant Company Developments

New Product Launch

- April 2021: New content services platforms from OpenText, OpenText Core Content and OpenText Core Case Management were launched. This solution offers a single approach to managing an organisation's content lifecycle in the context of both formal and informal business processes by combining content management, case management, and integration into lead applications.

- March 2021: The launch of Laserfiche 11 and the addition of direct share for self-hosted systems, as well as the addition of Audit Trail 11, make it easier for users to locate, work with, and exchange documents. Along with several efficiency enhancements, this update also includes various bug fixes.

- March 2021: To improve customer experience and accelerate digital transformation, Hyland Software, Inc. launched new solutions and product upgrades. The following product enhancements are available: Brainware Foundation EP2, Perceptive Content Foundation Enhancement Pack (EP) 3, and Content Composer Foundation EP4. Priority Work Management and Alfresco Content Services 7.0, two brand-new solutions from Hyland, enable businesses to accommodate remote workers and provide superior customer service.

Distribution Agreement

- March 2023: Adobe Corporation and IBM Corporation have joined partners to help marketing and creative organisations optimise their content supply chain. Adobe's cutting-edge technologies for experience management are combined with IBM's expertise in enterprise content and digital asset management in this partnership.

- February 2022: By making its OpenText Core Content service available on Google Cloud, OpenText established a partnership with the company. The collaboration aims to provide customers with new possibilities by utilising Google Cloud features in safe software supply chains.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, companies may personalise content recommendations and experiences for customers due to content analytics and business intelligence (BI), which increases customer engagement and happiness.

Furthermore, By focusing on high-value content and processes, insights from content analytics and business intelligence (BI) can assist organisations in allocating resources, including employees and finance, more effectively. However, the enterprise content management market is expected to face considerable challenges because of high initial costs.

Supply Side of the Market

According to our analysis, North America is the largest product and service supplier in the world market for ECM solutions, accounting for over 40% of the global market share in 2023. This is due to a number of factors, including the high concentration of large enterprises in the region, the early adoption of ECM technologies, and the presence of a number of leading ECM vendors.

The largest market for ECM in North America is the United States. Hyland, OpenText, IBM, Xerox, and Microsoft are among the top ECM providers in the U.S. North America is the largest consumer of ECM products and services, accounting for over 42% of global consumption.

Consumption of ECM products and services is higher in industrialised nations like the US, Germany, and Japan than in less developed nations like India and Nigeria. This is due to industrialised countries spending more on IT and research and development. The major ECM vendors are investing heavily in research and development to develop new and innovative ECM products and services.

Global Enterprise Content Management Market is Segmented as Below:

By Component:

- Solutions

- Services

By Deployment:

- On-Premises

- Cloud

By Organisation Type:

- SMEs

- Large Enterprises

By Vertical:

- BFSI

- Communication Media & Services

- Retail

- Manufacturing & Natural Resources

- Transportation & Logistics

- Government & Utilities

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Enterprise Content Management Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Enterprise Content Management Market Outlook, 2018 - 2030

3.1. Global Enterprise Content Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Solutions

3.1.1.2. Services

3.2. Global Enterprise Content Management Market Outlook, by Deployment, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. On-Premise

3.2.1.2. Cloud

3.3. Global Enterprise Content Management Market Outlook, by Organization Type, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. SMEs

3.3.1.2. Large Enterprises

3.4. Global Enterprise Content Management Market Outlook, by Vertical, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. BFSI

3.4.1.2. Communication Media & Services

3.4.1.3. Retail

3.4.1.4. Manufacturing & Natural Resources

3.4.1.5. Transportation & Logistics

3.4.1.6. Government & Utilities

3.4.1.7. Others

3.5. Global Enterprise Content Management Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Enterprise Content Management Market Outlook, 2018 - 2030

4.1. North America Enterprise Content Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Solutions

4.1.1.2. Services

4.2. North America Enterprise Content Management Market Outlook, by Deployment, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. On-Premise

4.2.1.2. Cloud

4.3. North America Enterprise Content Management Market Outlook, by Organization Type, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. SMEs

4.3.1.2. Large Enterprises

4.4. North America Enterprise Content Management Market Outlook, by Vertical, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. BFSI

4.4.1.2. Communication Media & Services

4.4.1.3. Retail

4.4.1.4. Manufacturing & Natural Resources

4.4.1.5. Transportation & Logistics

4.4.1.6. Government & Utilities

4.4.1.7. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Enterprise Content Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Enterprise Content Management Market Outlook, 2018 - 2030

5.1. Europe Enterprise Content Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Solutions

5.1.1.2. Services

5.2. Europe Enterprise Content Management Market Outlook, by Deployment, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. On-Premise

5.2.1.2. Cloud

5.3. Europe Enterprise Content Management Market Outlook, by Organization Type, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. SMEs

5.3.1.2. Large Enterprises

5.4. Europe Enterprise Content Management Market Outlook, by Vertical, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. BFSI

5.4.1.2. Communication Media & Services

5.4.1.3. Retail

5.4.1.4. Manufacturing & Natural Resources

5.4.1.5. Transportation & Logistics

5.4.1.6. Government & Utilities

5.4.1.7. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Enterprise Content Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Enterprise Content Management Market Outlook, 2018 - 2030

6.1. Asia Pacific Enterprise Content Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Solutions

6.1.1.2. Services

6.2. Asia Pacific Enterprise Content Management Market Outlook, by Deployment, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. On-Premise

6.2.1.2. Cloud

6.3. Asia Pacific Enterprise Content Management Market Outlook, by Organization Type, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. SMEs

6.3.1.2. Large Enterprises

6.4. Asia Pacific Enterprise Content Management Market Outlook, by Vertical, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. BFSI

6.4.1.2. Communication Media & Services

6.4.1.3. Retail

6.4.1.4. Manufacturing & Natural Resources

6.4.1.5. Transportation & Logistics

6.4.1.6. Government & Utilities

6.4.1.7. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Enterprise Content Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Enterprise Content Management Market Outlook, 2018 - 2030

7.1. Latin America Enterprise Content Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Solutions

7.1.1.2. Services

7.2. Latin America Enterprise Content Management Market Outlook, by Deployment, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. On-Premise

7.2.1.2. Cloud

7.3. Latin America Enterprise Content Management Market Outlook, by Organization Type, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. SMEs

7.3.1.2. Large Enterprises

7.4. Latin America Enterprise Content Management Market Outlook, by Vertical, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. BFSI

7.4.1.2. Communication Media & Services

7.4.1.3. Retail

7.4.1.4. Manufacturing & Natural Resources

7.4.1.5. Transportation & Logistics

7.4.1.6. Government & Utilities

7.4.1.7. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Enterprise Content Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Enterprise Content Management Market Outlook, 2018 - 2030

8.1. Middle East & Africa Enterprise Content Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Solutions

8.1.1.2. Services

8.2. Middle East & Africa Enterprise Content Management Market Outlook, by Deployment, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. On-Premise

8.2.1.2. Cloud

8.3. Middle East & Africa Enterprise Content Management Market Outlook, by Organization Type, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. SMEs

8.3.1.2. Large Enterprises

8.4. Middle East & Africa Enterprise Content Management Market Outlook, by Vertical, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. BFSI

8.4.1.2. Communication Media & Services

8.4.1.3. Retail

8.4.1.4. Manufacturing & Natural Resources

8.4.1.5. Transportation & Logistics

8.4.1.6. Government & Utilities

8.4.1.7. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Enterprise Content Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Enterprise Content Management Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Enterprise Content Management Market Deployment, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Enterprise Content Management Market Organization Type, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Enterprise Content Management Market Vertical, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Organization Type vs Deployment Heatmap

9.2. Manufacturer vs Deployment Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. IBM

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Hewlett Packard Enterprise (HPE) Company

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. M-Files Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Microsoft Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Newgen Software

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. OpenText Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Oracle Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Xerox Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. SAP

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Micro Focus

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. iManage

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Hyland

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Laserfiche

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. DOMA Technologies

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Ascend Software

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Deployment Coverage |

|

|

Organisation Type Coverage |

|

|

Vertical Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |