The Exhaust Manifold Market is valued at USD 10.7 Bn in 2026 and is projected to reach USD 13.2 Bn, growing at a CAGR of 3% by 2033

Market Analysis in Brief

The automotive exhaust manifold market is rapidly emerging as a key industry sector in the automotive industry's landscape. Playing a pivotal role in ensuring the smooth operation of automobile engines, the exhaust manifold efficiently gathers exhaust gases from an engine's cylinders and directs them into the exhaust system. Several factors are playing out the major driving factors propelling the expansion of this market. The surge in demand for high-performance vehicles, coupled with stringent government regulations surrounding emission control, and an intensified focus on fuel efficiency, collectively contribute to the burgeoning demand for the automotive exhaust manifold worldwide.

The market is likely to witness rapid development of advanced exhaust manifolds boasting integrated catalytic converters, and lightweight materials. Focus on enhancing product durability and reliability to cater to the upswing in demand for high-performance vehicles is crucial. Efficient manufacturing processes that curtail the overall costs and drive adoption of advanced exhaust manifolds will most likely be prioritized in the years to come.

Key Report Findings

- Escalating demand for high-performance vehicles, stringent emission control regulations, and an augmented focus on fuel efficiency are the primary drivers of this market.

- The cast iron segment is predicted to secure the largest share in the automotive exhaust manifold market during the forecast period.

- The Asia Pacific region is poised to assert dominance in the global market throughout the forecast period.

- Increasing deployment of new auto production facilities, especially SEA countries will drive sales.

- Key players such as are Tenneco Inc (US)., Katcon (Mexico), Wescast, Sango Co (Japan), Faurecia SA (France), Friedrich Boysen, and SPM Autocomp are focusing on capacity expansion to maintain their market share and to sustain in highly competitive exhaust manifold market.

- Increasing stringency of emission regulations to curb pollution and promote environmental sustainability will lead to sustained opportunity for advanced and efficient exhaust manifold designs.

- Advanced light materials like high strength steel alloys, and advanced composites mark the top trending technology shaping this market as such materials promote improved strength-to-weight ratios, making lightweight exhaust manifold.

Growth Drivers

Swift Growth in Demand for High-performance Vehicles

An automotive exhaust manifold stands as a critical component within an engine's exhaust system. It diligently collects exhaust gases from the cylinders of an engine and directs their flow into the exhaust system. Constructed primarily from materials like cast iron or stainless steel, these manifolds are affixed to the engine's cylinder head, allowing them to effectively channel exhaust gases. The global automotive exhaust manifold market is poised to achieve remarkable growth at a notable CAGR during the forecast period.

This growth trajectory is predominantly powered by escalating demand for high-performance vehicles. The burgeoning desire for high-performance vehicles serves as a pivotal driver for the automotive exhaust manifold market. These vehicles necessitate top-tier exhaust manifolds to ensure optimal engine performance and durability.

Rigorous Emission Control Regulations, and Greater Emphasis on Fuel Efficiency

Stringent governmental mandates aimed at curbing vehicular emissions are propelling the growth of the exhaust manifold market revenue. Governments globally are imposing rigorous regulations to diminish vehicle emissions, consequently elevating the demand for efficient exhaust manifolds.

Moreover, the relentless pursuit of enhanced fuel efficiency by automotive manufacturers is another potent driver. This drive is steering the demand for lightweight and efficient exhaust manifolds, contributing to significant improvements in the fuel economy.

Growth Challenges

High Costs Associated with Advanced Manifolds

Expensive price points of advanced exhaust manifolds that are equipped with features like integrated catalytic converters and lightweight materials, will continue to pose a considerable restraint to the growth of exhaust manifold market revenue. This cost factor limits the rate of adoption to a large extent, shows research.

On the other hand, the presence of inferior alternatives across the market is expected to account for the growing prevalence of low-cost, low-quality exhaust manifolds in the global industry. Crafted from subpar materials, these widely available alternatives hold the potential to negatively impact engine performance, and durability.

Impact of COVID-19 Pandemic

The COVID-19 pandemic has wielded a substantial impact on the automotive exhaust manifold market. The disruptions in the global supply chain have resulted in hiccups in the production and distribution of automotive components, including exhaust manifolds. The pandemic-induced slump in automobile demand has also translated into reduced appetite for automotive exhaust manifolds. However, post-pandemic recovery is on the horizon, with the revival pinned on surging demand for high-performance vehicles and stringent emission control regulations.

Market Opportunity

The Swelling EV Market

The rise of electric vehicles (EVs) is now all set to present the automotive exhaust manifold market with significant growth opportunities over the upcoming decades. Despite lacking internal combustion engines, EVs still require exhaust manifolds for noise reduction, and cooling.

The demand for lightweight, and more efficient exhaust manifolds is poised to harness opportunities. The growing appetite of the auto industry for lightweight, efficient exhaust manifolds has stemmed from the incessant drive among the automakers to enhance vehicle fuel efficiency.

Overview of Key Segments

The cast iron segment is projected to dominate the automotive exhaust manifold market on the back of excellent thermal conductivity and durability. The segment currently makes up for approximately 73% share of the total market size.

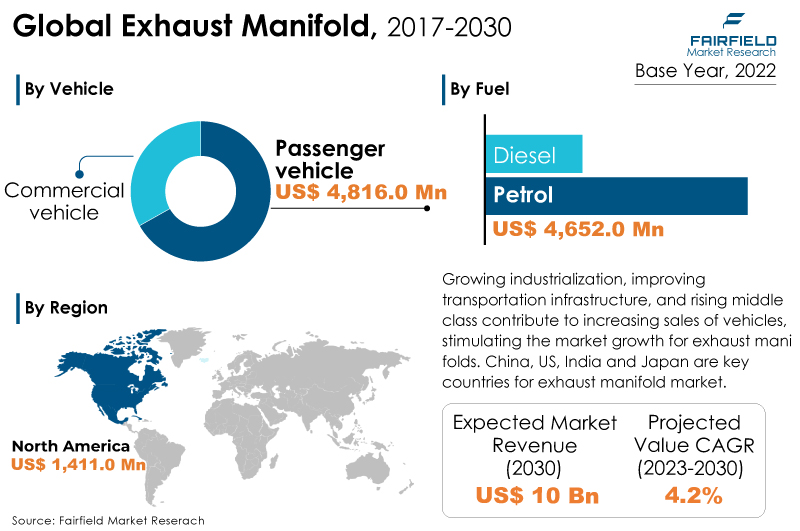

By the type of fuel, petrol remains preferred, accounting for nearly 65% of the total market revenue by 2022. Continued prevalence in both passenger cars, and light commercial vehicles will drive the dominance of this segment over its diesel counterpart.

In terms of the type of vehicle demanding exhaust manifold, passenger cars are set to claim the largest share of the market valuation. With heightening demand for high-performance variants across the auto industry, the passenger vehicles segment accounts for nearly 67% of the total exhaust manifold market revenue.

Growth Opportunities Across Regions

Asia Pacific Maintains Hegemony with over 50% Market Share

The Asia Pacific region is positioned to dominate the automotive exhaust manifold market in the foreseeable future. This dominance can be attributed to the strongest presence of automotive manufacturing giants like China, and India, which are instrumental in driving market expansion here. The region currently accounts for more than 50% share of the overall market revenue and will continue to represent the largest revenue share throughout the end of the forecast year. The Asia Pacific region's ascendancy is anticipated in the long run, given the thriving automotive markets in China, and India.

The next key markets, i.e., North America, and Europe also play substantial roles in shaping this market. The rigorous emission control regulations established within these regions are propelling the demand for efficient exhaust manifolds. Both the regions hold a collective revenue share of more than 1/3rd of the global market size.

Competitive Landscape Analysis – Exhaust Manifold Market

The automotive exhaust manifold market is fiercely competitive and witnesses the participation of both established industry players, and fresh entrants. Manufacturers of advanced exhaust manifolds stand to gain from the surging demand for high-performance vehicles.

The market's competitiveness is palpable, with established players and newcomers vying for market share. A concentrated effort on innovating advanced exhaust manifolds, incorporating features like integrated catalytic converters and lightweight materials, is essential to meet the mounting demand for high-performance vehicles.

Some of the prominent players steering the competition landscape of the exhaust manifold market are Faurecia, Futaba Industrial, Denso Corp, Benteler International AG, Katcon SA, Sango Co, Ltd, SPM Autocmp, Tenneco, Yutaka Giken co., and Friedrich Boysen Holding Gmbh.

Key Industry Developments

- In 2020, Faurecia SA unveiled a novel gasoline engine exhaust manifold that promised improved fuel efficiency, and reduced emissions.

- In 2019, Tenneco Inc. introduced a lightweight diesel engine exhaust manifold that was specifically designed to enhance durability and lower emissions.

- In 2018, Eberspaecher Group's acquisition of Climate Control Systems Inc. made major waves in the industry.

The Global Exhaust Manifold Market is Categorized as:

By Product Type

- Cast Iron

- Stainless Steel

- Other Materials

By Fuel Type

- Petrol

- Diesel

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Sales Channel

- OEM

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

- Executive Summary

- Global Exhaust Manifold Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Exhaust Manifold Market Outlook, 2020 - 2033

- Global Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Cast Iron

- Stainless Steel

- Other Materials

- Global Exhaust Manifold Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Global Exhaust Manifold Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Commercial Vehicles

- Global Exhaust Manifold Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Global Exhaust Manifold Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- North America Exhaust Manifold Market Outlook, 2020 - 2033

- North America Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Cast Iron

- Stainless Steel

- Other Materials

- North America Exhaust Manifold Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- North America Exhaust Manifold Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Commercial Vehicles

- North America Exhaust Manifold Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- North America Exhaust Manifold Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- S. Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- S. Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- S. Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Canada Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Canada Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Canada Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Canada Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Europe Exhaust Manifold Market Outlook, 2020 - 2033

- Europe Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Cast Iron

- Stainless Steel

- Other Materials

- Europe Exhaust Manifold Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Europe Exhaust Manifold Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Commercial Vehicles

- Europe Exhaust Manifold Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Europe Exhaust Manifold Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Germany Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Germany Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Germany Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Italy Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Italy Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Italy Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Italy Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- France Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- France Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- France Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- France Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- K. Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- K. Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- K. Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- K. Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Spain Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Spain Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Spain Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Spain Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Russia Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Russia Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Russia Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Russia Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Rest of Europe Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Rest of Europe Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Rest of Europe Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Asia Pacific Exhaust Manifold Market Outlook, 2020 - 2033

- Asia Pacific Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Cast Iron

- Stainless Steel

- Other Materials

- Asia Pacific Exhaust Manifold Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Asia Pacific Exhaust Manifold Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Commercial Vehicles

- Asia Pacific Exhaust Manifold Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Asia Pacific Exhaust Manifold Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- China Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- China Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- China Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Japan Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Japan Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Japan Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Japan Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- South Korea Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- South Korea Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- South Korea Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- South Korea Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- India Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- India Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- India Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- India Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Southeast Asia Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Southeast Asia Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Southeast Asia Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Rest of SAO Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Rest of SAO Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Rest of SAO Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Latin America Exhaust Manifold Market Outlook, 2020 - 2033

- Latin America Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Cast Iron

- Stainless Steel

- Other Materials

- Latin America Exhaust Manifold Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Latin America Exhaust Manifold Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Commercial Vehicles

- Latin America Exhaust Manifold Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Latin America Exhaust Manifold Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Brazil Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Brazil Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Brazil Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Mexico Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Mexico Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Mexico Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Mexico Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Argentina Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Argentina Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Argentina Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Argentina Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Rest of LATAM Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Rest of LATAM Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Rest of LATAM Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Middle East & Africa Exhaust Manifold Market Outlook, 2020 - 2033

- Middle East & Africa Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Cast Iron

- Stainless Steel

- Other Materials

- Middle East & Africa Exhaust Manifold Market Outlook, by Fuel Type, Value (US$ Bn), 2020-2033

- Petrol

- Diesel

- Middle East & Africa Exhaust Manifold Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Cars

- Commercial Vehicles

- Middle East & Africa Exhaust Manifold Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Middle East & Africa Exhaust Manifold Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- GCC Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- GCC Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- GCC Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- South Africa Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- South Africa Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- South Africa Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- South Africa Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Egypt Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Egypt Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Egypt Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Egypt Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Nigeria Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Nigeria Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Nigeria Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Nigeria Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- Rest of Middle East Exhaust Manifold Market Outlook, by Product Type, 2020-2033

- Rest of Middle East Exhaust Manifold Market Outlook, by Fuel Type, 2020-2033

- Rest of Middle East Exhaust Manifold Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East Exhaust Manifold Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Exhaust Manifold Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Faurecia

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Futaba Industrial

- Benteler International AG

- Denso Corp

- Katcon SA

- Mahle GMBH

- Sango Co, Ltd

- Tenneco

- SPM Autocomp

- Friedrich Boysen Holding Gmbh

- Faurecia

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Vehicle Coverage |

|

|

Fuel Type Coverage |

|

|

Product Type Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |