Global Ferrosilicon Market Forecast

- The Ferrosilicon Market is valued at USD 12.7 Bn in 2026 and is projected to reach USD 15.4 Bn, growing at a CAGR of 3% by 2033.

Quick Report Digest

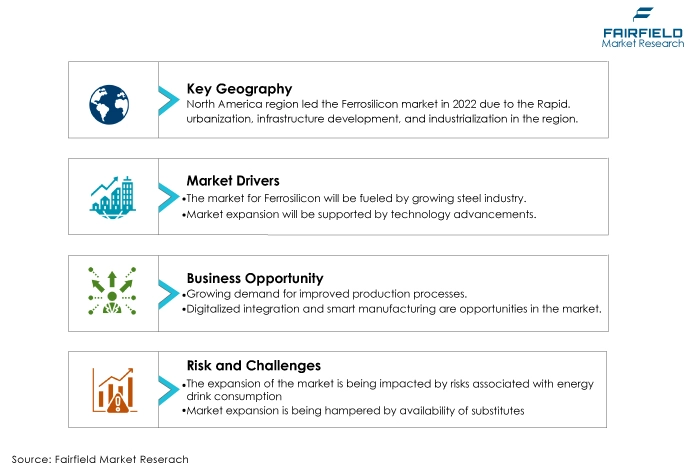

- The key trend anticipated to fuel the growth of ferrosilicon is the increasing demand from the steel industry.

- Technology trends are driving the ferrosilicon market through innovations in production processes, digitalisation, and advanced materials. These trends enhance efficiency, reduce environmental impact, and expand ferrosilicon's applications, aligning it with evolving industry demands and sustainability goals.

- Increasing alloy production drives the ferrosilicon market by raising demand for ferrosilicon in creating various specialty alloys. As industries like automotive and aerospace seek specific material properties, the requirement for ferrosilicon for alloy production grows, boosting market prospects.

- Atomized ferrosilicon has captured the largest market share in the Ferrosilicon market due to its superior characteristics. The atomisation process creates finely spherical particles with excellent fluidity and dispersion properties, making them highly effective in alloying and deoxidation processes and essential in steel production.

- Carbon and other ferrosilicon variants have secured the largest market share due to their versatility. Comprising silicon, carbon, and other alloying elements, they find applications in diverse industries, including steelmaking and foundry. Their adaptability to various processes and ability to fine-tune alloy compositions have solidified their dominance in the ferrosilicon market.

- Asia Pacific has secured the largest market share in the ferrosilicon market due to its robust manufacturing industries, particularly in China and India, which are major consumers. Rapid urbanisation, infrastructure development, and industrialisation in the region have fueled demand for ferrosilicon across various sectors, further solidifying its dominant position.

- North America is experiencing the fastest rate of growth in the Ferrosilicon market due to its growing demand for high-quality Ferrosilicon in steel and foundry applications, infrastructure development, and innovations in production processes, making it a high-CAGR region within the global ferrosilicon market.

- Volatility in raw material prices presents a significant challenge to the ferrosilicon market. Fluctuations in key inputs like silicon and iron ore can lead to unpredictable production costs, impacting profit margins and making pricing and supply chain management more complex for manufacturers.

A Look Back and a Look Forward - Comparative Analysis

The ferrosilicon market is experiencing growth due to its essential role in the steel and foundry industries. Ferrosilicon is a crucial additive for deoxidation and alloying, enhancing the quality and performance of Steel.

With increasing infrastructure development and industrialisation, particularly in emerging economies, there is a rising demand for high-quality steel products, driving the need for ferrosilicon. Additionally, its applications in the production of various alloys contribute to its sustained growth.

Several factors are contributing to the growth of the ferrosilicon market. These include the expanding steel and foundry industries, driven by infrastructure development and urbanisation. Ferrosilicon's critical role in deoxidizing and alloying steel enhances product quality, further fueling demand.

Additionally, its applications in the production of various alloys, such as nodular cast iron, support market growth. Rising demand for high-quality Steel in the construction, automotive, and manufacturing sectors is a key driver.

The future of the ferrosilicon market looks promising, driven by continued growth in the steel and foundry industries. Increasing urbanisation, infrastructure development, and industrialisation in emerging economies are expected to boost demand for high-quality Steel, sustaining the need for ferrosilicon.

Moreover, innovations in ferrosilicon production processes and the development of new alloys will likely expand its applications, ensuring a dynamic and evolving market landscape.

Key Growth Determinants

- Growing Demand from Steel Industry

Increasing steel industry demand is a primary driver of the ferrosilicon market. Ferrosilicon is a vital additive used for deoxidation and alloying in steel production, enhancing the quality and performance of steel. As global infrastructure development and urbanisation continue, the demand for high-quality steel products rises significantly.

Sustained need for steel, particularly in the construction, automotive, and manufacturing sectors, propels the requirement for ferrosilicon, making it a crucial component in meeting the escalating demands of the steel industry and driving market growth.

- Technology Advancements

Technology advancements are driving the ferrosilicon market through innovations in production processes. Modern manufacturing techniques have improved the efficiency, consistency, and quality of ferrosilicon production.

Enhanced process control, energy efficiency, and reduced environmental impact have been achieved, making ferrosilicon more competitive and sustainable.

Additionally, these advancements enable the development of specialised Ferrosilicon alloys tailored to meet specific industry requirements, expanding its applications beyond traditional uses and creating new growth opportunities in industries like steel, foundry, and electronics.

- Increasing Alloy Production

The increasing demand for alloy production is a key driver of the ferrosilicon market. The ferrosilicon is a critical component in the creation of various alloys, including nodular cast iron, stainless Steel, and other specialty alloys.

As industries such as automotive, aerospace, and electronics continue to grow and seek advanced materials with specific properties, the demand for Ferrosilicon for alloy production rises. This trend drives market growth by diversifying its applications and ensuring a steady and expanding demand for Ferrosilicon products.

Major Growth Barriers

- Volatility in Raw Material Prices

Volatility in raw material prices poses a significant challenge to the ferrosilicon market. Fluctuations in the costs of key ingredients like silicon and iron ore can lead to unpredictable production expenses, affecting profit margins and pricing competitiveness.

Manufacturers may need help to stabilize pricing and maintain profitability when raw material prices are erratic. This volatility also hampers long-term planning and investment decisions, making it challenging for businesses in the ferrosilicon market to navigate market dynamics and remain financially sustainable.

- Supply Chain Disruptions

Supply chain disruptions can significantly challenge the ferrosilicon market. Natural disasters, geopolitical issues, and transportation problems can interrupt the flow of raw materials and finished products. Such disorders can lead to production delays, increased costs, and supply shortages, affecting market stability and pricing.

Companies must implement robust supply chain management strategies, diversify sourcing options, and develop contingency plans to mitigate the impact of these disruptions and ensure a consistent supply of ferrosilicon to meet customer demand.

Key Trends and Opportunities to Look at

- Improved Production Processes

Improved production processes in the ferrosilicon market involve the adoption of advanced smelting and alloying technologies. These processes enhance energy efficiency, reduce carbon emissions, and minimise production costs.

Innovations in furnace design, temperature control, and automation result in higher-quality ferrosilicon products, contributing to the industry's competitiveness and environmental sustainability.

- Digitalisation Integration

Digitalisation integration in the ferrosilicon market entails the use of digital tools and data analytics to optimise production processes and enhance operational efficiency. This includes real-time monitoring of key parameters, predictive maintenance scheduling, supply chain optimisation, and quality control.

By leveraging digital technologies, ferrosilicon manufacturers can improve product consistency, reduce downtime, and make data-driven decisions, ultimately increasing competitiveness and sustainability in the market.

- Smart Manufacturing

Smart manufacturing in the ferrosilicon market involves the implementation of advanced technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and automation. These technologies enable real-time monitoring of production processes, predictive maintenance, and data-driven decision-making.

Smart manufacturing enhances efficiency, quality control, and safety in Ferrosilicon production, contributing to cost savings, improved product consistency, and overall competitiveness in the market.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the Ferrosilicon market. Environmental regulations are of particular significance, as Ferrosilicon production involves high-temperature processes and the potential release of emissions. Many countries have imposed stringent emissions standards, requiring Ferrosilicon manufacturers to invest in cleaner technologies and emissions control measures.

Compliance with these regulations not only mitigates environmental impact but also ensures market access and a positive public image. Additionally, trade policies and tariffs can impact the global Ferrosilicon market. Changes in trade agreements, import/export duties, and restrictions on the movement of raw materials can influence market dynamics. Companies must navigate evolving trade regulations to optimise their supply chains and remain competitive.

Safety regulations are another critical aspect. Ferrosilicon production facilities involve inherent risks due to high temperatures and reactive materials. Stringent safety measures and adherence to safety standards are necessary to protect workers and comply with regulatory requirements.

Failure to meet safety standards can result in operational disruptions and legal consequences, affecting market participants. Overall, the regulatory landscape in the Ferrosilicon market is multifaceted and has a substantial influence on production methods, environmental sustainability, market access, and safety practices, shaping the industry's evolution and competitiveness.

Fairfield’s Ranking Board

Top Segments

- Atomized Ferrosilicon Type Continues to Dominate

Atomized ferrosilicon has captured the largest market share in the Ferrosilicon market due to its superior qualities. It is produced through a specialised atomisation process, resulting in fine, spherical particles with excellent fluidity and dispersion properties. This makes it highly effective in steelmaking and other applications, where uniform alloying and deoxidation are crucial.

Atomized ferrosilicon's consistent quality and performance have solidified its dominance in the market. Milled ferrosilicon is experiencing the highest CAGR in the ferrosilicon market because it offers advantages in specific applications. Its fine particle size distribution and controlled milling process provide precise control over alloying and deoxidation, making it suitable for demanding industries like steel and foundry.

As these sectors grow and require high-performance ferrosilicon, the demand for milled variants rises, driving its exceptional growth in the market.

- Carbon and Other Variations to Lead Through 2030

Carbon and other variants of ferrosilicon have captured the largest market share due to their diverse applications. These variants contain a combination of silicon, carbon, and other alloying elements, making them versatile for use in various industries, including steelmaking and foundry.

The adaptability of these variations to different processes and the ability to fine-tune alloy compositions have solidified their dominance in the ferrosilicon market, meeting the wide-ranging need +

s of industrial applications.

Electrical steel is experiencing the highest growth rate in the ferrosilicon market due to the expanding demand for energy-efficient electrical transformers and motors. Electrical steel, containing specific silicon content, reduces energy loss and enhances electrical performance.

As industries and utilities worldwide seek more efficient electrical equipment, the demand for high-quality ferrosilicon for electrical steel production rises, driving its remarkable growth in the market.

Regional Frontrunners

Asia Pacific Brings in the Maximum Revenue

The Asia Pacific region has secured the largest market share in the ferrosilicon market for several compelling reasons. Firstly, it hosts robust manufacturing industries, particularly in China, and India, which are major consumers of ferrosilicon in steel and foundry applications.

Rapid urbanisation, infrastructure development, and industrialisation in the region have led to soaring steel demand. Additionally, favourable government policies, such as economic incentives and investment in infrastructure projects, stimulate market growth.

Furthermore, the availability of abundant raw materials and skilled labour, along with cost-effective production, contributes to Asia Pacific's dominant position in the global ferrosilicon market.

North America to Grow Highly Lucrative

North America is likely to be experiencing the highest value CAGR in the global ferrosilicon market due to several factors. Firstly, there is a growing demand for high-quality ferrosilicon in the region's steel and foundry industries, driven by infrastructure development and manufacturing sectors.

Innovations in production processes and environmental sustainability practices enhance the competitiveness of North American ferrosilicon producers. The region's focus on reducing dependence on imports and securing a stable supply chain for critical materials further drives market growth, positioning North America as a high-CAGR ferrosilicon market.

Fairfield’s Competitive Landscape Analysis

The global ferrosilicon market is consolidated, with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Ferrosilicon Space?

- Elkem A.S.A.

- Sinosteel Jilin Ferroalloy Co., Ltd.

- Huta Laziska S.A.

- L&M Group

- Gulf Ferroalloys Company

- China National Minerals Co., Ltd.

- FerroAtlántica Group

- TENOVA Pyromet

- Exxaro Resources Ltd.

- Wogen Resources Limited

- Kothari Metals Ltd.

- C. Feral S.R.L.

- Sinoferro

- Snam Alloys Pvt. Ltd.

- Mottram Mining and Resources

Significant Company Developments

New Product Launch

- July 2022: Ferroglobe P.L.C. embarked on an advanced phase of its silicon metal powder project, targeting applications in batteries and other advanced technologies. This project has achieved significant milestones, achieving high purity levels of up to 99.995% in micrometer and sub-micrometer sizes.

Distribution Agreement

- June 2022: Ferroglobe P.L.C. recently unveiled a Memorandum of Understanding (M.O.U.) with R.E.C. Silicon. This M.O.U. Outlines Ferroglobe's commitment to utilizing its US-based asset platform to provide R.E.C. Silicon with high-purity silicon metal. The joint goal is to establish an environmentally friendly and fully traceable solar supply chain within the United States.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, growth in metal is driving the market. The ferrosilicon market continues to experience robust demand due to its integral role in steel and alloy production across industries like construction, automotive, and electronics.

With increasing urbanisation, infrastructure development, and a focus on energy efficiency, the demand for high-quality ferrosilicon is expected to remain strong. Moreover, innovations in production processes and the development of specialised alloys are likely to create new growth opportunities.

The market's future growth prospects are anchored in its critical role within the broader industrial landscape and adaptability to evolving technological and environmental demands.

Supply Side of the Market

Several countries prominently lead the ferrosilicon market. China is a major player, with a robust steel industry and significant ferrosilicon production capacity. Other leading countries include Russia, Norway, and the United States, which have well-established ferrosilicon manufacturing sectors.

Additionally, India, Brazil, and South Africa are emerging as key contributors due to growing steel and foundry industries. These nations, driven by infrastructure development and industrialisation, are pivotal in shaping the global ferrosilicon market.

The primary raw materials required in the ferrosilicon market are silica (typically in the form of quartz), coke or coal, and iron ore. These materials are used to produce Ferrosilicon through a smelting process. Silica is commonly sourced from mining operations, while coke or coal and iron ore are obtained from various mining and metallurgical sources.

Companies like Vale, Rio Tinto, B.H.P. Billiton, and many others are major manufacturers and suppliers of iron ore. In contrast, coal and coke suppliers include companies like Peabody Energy, Arch Resources, and CONSOL Energy, among others. Silica suppliers can vary by region and often have local mining operations.

The Global Ferrosilicon Market is Segmented as Below:

By Type:

- Atomized Ferrosilicon

- Milled Ferrosilicon

By End Use:

- Carbon & Other

- Alloy Steel

- Stainless Steel

- Electrical Steel

- Cast Iron

- Magnesium

- Others

By Geographic Coverage:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Ferrosilicon Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Five Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Ferrosilicon Market Outlook, 2020 - 2033

- Global Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Atomized Ferrosilicon

- Milled Ferrosilicon

- Global Ferrosilicon Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Carbon & Other

- Alloy Steel

- Stainless Steel

- Electrical Steel

- Cast Iron

- Magnesium

- Others

- Global Ferrosilicon Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- North America Ferrosilicon Market Outlook, 2020 - 2033

- North America Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Atomized Ferrosilicon

- Milled Ferrosilicon

- North America Ferrosilicon Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Carbon & Other

- Alloy Steel

- Stainless Steel

- Electrical Steel

- Cast Iron

- Magnesium

- Others

- North America Ferrosilicon Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Ferrosilicon Market Outlook, by Type, 2020-2033

- S. Ferrosilicon Market Outlook, by End Use, 2020-2033

- Canada Ferrosilicon Market Outlook, by Type, 2020-2033

- Canada Ferrosilicon Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Europe Ferrosilicon Market Outlook, 2020 - 2033

- Europe Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Atomized Ferrosilicon

- Milled Ferrosilicon

- Europe Ferrosilicon Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Carbon & Other

- Alloy Steel

- Stainless Steel

- Electrical Steel

- Cast Iron

- Magnesium

- Others

- Europe Ferrosilicon Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Ferrosilicon Market Outlook, by Type, 2020-2033

- Germany Ferrosilicon Market Outlook, by End Use, 2020-2033

- Italy Ferrosilicon Market Outlook, by Type, 2020-2033

- Italy Ferrosilicon Market Outlook, by End Use, 2020-2033

- France Ferrosilicon Market Outlook, by Type, 2020-2033

- France Ferrosilicon Market Outlook, by End Use, 2020-2033

- K. Ferrosilicon Market Outlook, by Type, 2020-2033

- K. Ferrosilicon Market Outlook, by End Use, 2020-2033

- Spain Ferrosilicon Market Outlook, by Type, 2020-2033

- Spain Ferrosilicon Market Outlook, by End Use, 2020-2033

- Russia Ferrosilicon Market Outlook, by Type, 2020-2033

- Russia Ferrosilicon Market Outlook, by End Use, 2020-2033

- Rest of Europe Ferrosilicon Market Outlook, by Type, 2020-2033

- Rest of Europe Ferrosilicon Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Asia Pacific Ferrosilicon Market Outlook, 2020 - 2033

- Asia Pacific Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Atomized Ferrosilicon

- Milled Ferrosilicon

- Asia Pacific Ferrosilicon Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Carbon & Other

- Alloy Steel

- Stainless Steel

- Electrical Steel

- Cast Iron

- Magnesium

- Others

- Asia Pacific Ferrosilicon Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Ferrosilicon Market Outlook, by Type, 2020-2033

- China Ferrosilicon Market Outlook, by End Use, 2020-2033

- Japan Ferrosilicon Market Outlook, by Type, 2020-2033

- Japan Ferrosilicon Market Outlook, by End Use, 2020-2033

- South Korea Ferrosilicon Market Outlook, by Type, 2020-2033

- South Korea Ferrosilicon Market Outlook, by End Use, 2020-2033

- India Ferrosilicon Market Outlook, by Type, 2020-2033

- India Ferrosilicon Market Outlook, by End Use, 2020-2033

- Southeast Asia Ferrosilicon Market Outlook, by Type, 2020-2033

- Southeast Asia Ferrosilicon Market Outlook, by End Use, 2020-2033

- Rest of SAO Ferrosilicon Market Outlook, by Type, 2020-2033

- Rest of SAO Ferrosilicon Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Latin America Ferrosilicon Market Outlook, 2020 - 2033

- Latin America Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Atomized Ferrosilicon

- Milled Ferrosilicon

- Latin America Ferrosilicon Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Carbon & Other

- Alloy Steel

- Stainless Steel

- Electrical Steel

- Cast Iron

- Magnesium

- Others

- Latin America Ferrosilicon Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Ferrosilicon Market Outlook, by Type, 2020-2033

- Brazil Ferrosilicon Market Outlook, by End Use, 2020-2033

- Mexico Ferrosilicon Market Outlook, by Type, 2020-2033

- Mexico Ferrosilicon Market Outlook, by End Use, 2020-2033

- Argentina Ferrosilicon Market Outlook, by Type, 2020-2033

- Argentina Ferrosilicon Market Outlook, by End Use, 2020-2033

- Rest of LATAM Ferrosilicon Market Outlook, by Type, 2020-2033

- Rest of LATAM Ferrosilicon Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Ferrosilicon Market Outlook, 2020 - 2033

- Middle East & Africa Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Atomized Ferrosilicon

- Milled Ferrosilicon

- Middle East & Africa Ferrosilicon Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Carbon & Other

- Alloy Steel

- Stainless Steel

- Electrical Steel

- Cast Iron

- Magnesium

- Others

- Middle East & Africa Ferrosilicon Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Ferrosilicon Market Outlook, by Type, 2020-2033

- GCC Ferrosilicon Market Outlook, by End Use, 2020-2033

- South Africa Ferrosilicon Market Outlook, by Type, 2020-2033

- South Africa Ferrosilicon Market Outlook, by End Use, 2020-2033

- Egypt Ferrosilicon Market Outlook, by Type, 2020-2033

- Egypt Ferrosilicon Market Outlook, by End Use, 2020-2033

- Nigeria Ferrosilicon Market Outlook, by Type, 2020-2033

- Nigeria Ferrosilicon Market Outlook, by End Use, 2020-2033

- Rest of Middle East Ferrosilicon Market Outlook, by Type, 2020-2033

- Rest of Middle East Ferrosilicon Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Ferrosilicon Market Outlook, by Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Elkem A.S.A.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Huta Laziska S.A.

- L&M Group

- Gulf Ferroalloys Company

- FerroAtlántica Group

- TENOVA Pyromet

- Exxaro Resources Ltd.

- Wogen Resources Limited

- Kothari Metals Ltd.

- Feral S.R.L.

- Elkem A.S.A.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |