Fire-Resistant Cable Market Forecast

- The Fire-Resistant Cable Market is valued at USD 2.6 Bn in 2026 and is projected to reach USD 3.3 Bn, growing at a CAGR of 4% by 2033.

Quick Report Digest

- The key trend anticipated to drive the fire-resistant cable market growth is an increasing demand for renewable energy. Furthermore, Cables are needed in solar PV installations to connect solar panels to inverters and the power grid. For these connections to be secure and reliable, particularly in rooftop and utility-scale solar installations, fire-resistant cables are needed.

- Another major market trend expected to drive the fire-resistant cable market growth is the rapidly expanding fire-resistant cables in the healthcare sector. Healthcare facilities house a huge variety of essential medical equipment, such as monitoring tools, life support systems, and diagnostic tools. Fire-resistant cables help in preventing fire-related damage to this equipment, providing ongoing patient care.

- The advantages of fire-resistant wires still need to be well-known in various regions and industries. A lack of understanding of the significance of fire safety and the function of fire-resistant cables may hamper the development of the market.

- In 2022, the XLPE category dominated the industry. High dielectric strength and low dielectric loss, among other excellent electrical properties, make XLPE insulation a great choice for applications requiring effective electrical performance.

- The LSZH segment is expected to be the fastest-growing in the fire-resistant cable market during the forecast period. LSZH insulation is designed to produce the least amount of smoke possible when exposed to fire. This feature, which improves visibility and permits safe escape in the event of a fire, makes LSZH cables ideal for use in confined areas like buildings, tunnels, and transportation systems.

- In 2022, the building & construction category dominated the industry. Building fire safety systems must have fire-resistant cables as essential parts. They are utilised for evacuation systems, emergency lighting and fire alarm systems to make sure that people inside the building are informed of a fire and can safely leave.

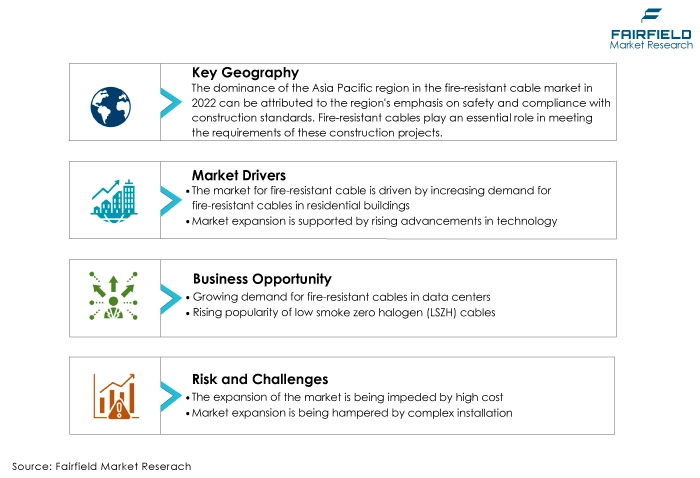

- Asia Pacific is expected to dominate the fire-resistant cable market during the forecast period. Many residential, commercial, and industrial projects are currently under construction in Asia Pacific, which is experiencing a construction boom. Because they provide safety and abide by construction requirements, fire-resistant cables are a crucial part of these projects.

- North America is expected to be the fastest-growing fire-resistant cable market region. The number of renewable energy initiatives in the area has increased, including wind and solar farms. For these projects to guarantee the security and dependability of electrical connections in difficult settings, fire-resistant cables are needed.

A Look Back and a Look Forward - Comparative Analysis

The construction of high-rise structures, skyscrapers, and urban infrastructure is a result of rapid urbanisation. In order to comply with fire safety regulations and save occupants and property, these buildings must be equipped with fire-resistant wires.

Emerging markets make significant investments in the construction of utilities, airports, and transportation networks. For the sake of safety and regulatory compliance, these projects must include fire-resistant cables. Emerging markets demand fire-resistant cables with improved features and performance to meet safety and reliability criteria as they adopt advanced technologies.

The market witnessed staggered growth during the historical period 2018 - 2022. The demand for automobiles increased globally, and the automotive sector experienced significant growth. The need for fire-resistant cables in numerous automotive applications grew along with the number of vehicles produced. Modern automobiles heavily rely on advanced electrical and electronic systems for a variety of purposes, such as engine control, navigation, entertainment, and safety.

To guarantee the security and dependability of these systems, fire-resistant cables were required. Automotive electrical systems become more advanced with the introduction of electric and hybrid automobiles. High-voltage parts and batteries were kept safe because, in large part fi, there were re-resistant wires.

The energy sector, which includes power plants, oil and gas facilities, and renewable energy installations, consumes a significant number of fire-resistant cables to protect against fire risks in complex and hazardous environments in the coming years.

Additionally, Fire-resistant wires are used in manufacturing facilities, heavy industries, and metallurgical facilities to safeguard production-critical equipment and procedures.

Furthermore, Data and control cables are necessary for industrial automation and control systems. To maintain communication and control during fire incidents, fire-resistant wires are essential during the next five years.

Key Growth Determinants

- Increasing Demand from Residential Buildings

The use of fire-resistant cables in residential construction is required by numerous countries and areas' stricter building rules and safety laws. In order to lower the danger of fire-related incidents and guarantee occupant safety, these standards have been put in place.

Homeowners and contractors are becoming more and more conscious of the significance of fire safety in residential structures. Due to this increased awareness, more people are now prepared to spend money on fire-resistant wires as a precaution.

Some insurance companies could demand that homeowners install fire-resistant cables in order to be eligible for coverage. Based on the theory that fire-resistant cables can assist in cutting insurance risks by minimising the possibility of fire damage, this policy was created.

- Advent of Technology

Advanced fire-retardant materials have been used to create fire-resistant cables as a result of ongoing research and development. The risk of electrical fires is decreased by these cables' ability to resist higher temperatures and extend their fire protection.

Halogen-free fire-resistant wires have been produced as a result of some technological advancements. Further improving safety in enclosed places, these wires burn with low harmful fume production. Superior cable insulation materials have been created as a result of technological breakthroughs. These materials contribute to greater electrical performance and durability in addition to increasing fire resistance.

Production of fire-resistant cables with reduced smoke emissions during a fire is now possible because of innovative technologies. In the event of a fire, this is crucial for the security of residents and first responders.

- Increasing Demand from Non-construction Sectors

Industrial situations, such as manufacturing factories, chemical facilities, and power production plants, need the use of fire-resistant cables. Fire-resistant cables are essential for maintaining the safety of employees and equipment in these locations since high-temperature processes are frequently present.

Due to the presence of flammable materials and extreme operating conditions during exploration, drilling, and refining activities, the oil and gas industry significantly relies on fire-resistant cables. During a fire emergency, these wires are used to sustain vital activities.

Fire-resistant cables are necessary in data centres, which store priceless and delicate electronic equipment, in order to protect crucial data infrastructure from disturbances caused by fire. Servers and networking hardware are always operational because of fire-resistant connections.

Major Growth Barriers

- Prohibitive Price Point

Consumers may be hesitant to buy fire-resistant cables due to their higher initial costs, especially in areas or enterprises that are price-sensitive. Purchases may be delayed or postponed as a result, which could limit the market's growth.

Manufacturers and suppliers of standard cables may have a competitive advantage in markets where cost is a key factor because they can provide less expensive alternatives. Manufacturers of fire-resistant cables may feel pressure from this to come up with affordable fixes.

Considerations for fire-resistant cables are frequently weighed against the ROI. Although the added safety that these cables offer may only sometimes be worth the higher initial cost, particularly in sectors with lower fire risk profiles, ROI analyses must be performed.

- Complex Installation

Fire-resistant cable installation frequently requires professional skills and expertise because the cables must be put properly to guarantee their fire-resistant properties are fully functional. Utilising experienced personnel may also be more expensive, which may turn away certain clients, especially for projects with limited funding.

Fire-resistant cables may require more installation time than conventional cables because of their special design and construction requirements. This could push up labour costs and even throw off project schedules, which might be critical for projects that must be completed quickly.

Key Trends and Opportunities to Look at

- Rising Popularity of LSZH Cables

Low smoke zero halogen (LSZH) cables are made to release the least amount of harmful fumes and smoke when exposed to fire. By lowering the risk of smoke inhalation and hazardous gases during a fire occurrence, this trait considerably enhances safety in confined places, such as buildings, data centres, and transportation systems.

Because they don't contain halogen-based compounds, LSZH cables are seen as being more environmentally friendly. LSZH cables are a recommended option for eco-conscious enterprises and regions because the lack of halogens minimises the release of hazardous gases and acids into the environment during a fire.

- Growing Demand Across Data Centres

Organisations store and handle enormous volumes of important data in data centres. Incidents involving fires may cause data loss and service outages, which could have very severe financial and reputational consequences. Fire-resistant cables reduce the risk of fire-related damage, helping to maintain data integrity and guarantee business continuity.

Critical infrastructure in data centres, such as power distribution systems, networking hardware, and backup power supplies, are safeguarded by fire-resistant cables. During a fire emergency, these wires guarantee that vital systems will continue to function.

- Growing Adoption by EV Industry

The main energy source for EVs is lithium-ion batteries. Thermal runaway events, which can cause flames or explosions, are possible with these batteries. The risks connected with these powerful batteries are reduced in part by fire-resistant wires.

High temperature resistance and limiting fire spread are the goals of fire-resistant cables. Fire-resistant cables can aid in keeping the fire under control and safeguarding other crucial components in the case of a thermal runaway in an EV's battery pack.

The infrastructure for EV charging depends on cables to provide electricity reliably and effectively. To guarantee the dependability and security of charging stations and the connections they make to EVs, fire-resistant wires are essential.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, various regulatory frameworks and standards that ensure the performance and safety of fire-resistant cables are applicable to the market for fire-resistant cables. International Electrotechnical Commission (IEC) is an international organization that creates standards for electrical and technological products, including lines that can withstand fire.

Standards like IEC 60331 and IEC 60332 provide the testing procedures and specifications for cables that are both fire-resistant and fire-retardant. The need for compliance with IEC standards in many areas influences the design and production of fire-resistant cables. The certification body Underwriters Laboratories (UL) is well-known both in the United States and abroad.

Fire-resistant cables are one of the many goods for which UL creates safety standards. Gaining market acceptance, particularly in North America, depends on products meeting UL standards, such as UL 2196 for fire-resistant cables.

In Europe, the European Committee for Electrotechnical Standardization (CENELEC) creates standards for electrical and technological products. The European Fire-resistant cable market is influenced by the European standards EN 50200 for fire-resistant cables and EN 60332 for fire performance.

Fairfield’s Ranking Board

Top Segments

- XLPE Remains the Most Preferred Insulating Material

The XLPE segment dominated the market in 2022. XLPE insulation material's high thermal short circuit rating, excellent electrical performance maintained across the entire temperature range, resistance to thermal deformation at high temperatures, excellent chemical resistance, high durability, excellent water resistance and low water permeability, and long operational life are some of the qualities propelling the market's expansion.

Furthermore, the low smoke zero halogens (LSZH) category is projected to experience the fastest market growth. Due to its low smoke and zero halogen emissions under fire and heat conditions, LSZH jacketing materials for fire-resistant cables are anticipated to gain popularity in the near future. In the upcoming years, demand for the material is also projected to rise due to its lower flammability and cost-effectiveness.

- Building & Construction Industry Leads Demand Generation

The building & construction segment dominated the market in 2022. This is due to the fact that both residential and non-residential regions can employ fire-resistant cables for wiring and connectivity needs. The wires provide human safety since they are simple to install, keep electrical circuits reliable, and can endure high temperatures during fires.

The general public's growing awareness of building safety has increased demand for fire-resistant cables. These cables are used in practically every commercial and residential facility for power distribution. The building and construction industry's need for fire-resistant cable is being driven by rising construction activity.

The automotive & transportation category is anticipated to grow substantially throughout the projected period. Due to the extremely hot climate, electrical wires used in automobiles and other vehicles require excellent insulation.

The demand for cables that can supply electricity without interruption is predicted to rise as electric cars become more and more popular around the world. This will also increase the need for jacketed wires.

Regional Frontrunners

Asia Pacific Secures Top Spot in Global Market

Throughout the forecast period, Asia Pacific is anticipated to dominate the market for fire-resistant cables. China, India, and ASEAN countries, which are seeing rapid growth in their end-use sectors, are the key drivers of the need for fire-resistant cables in the Asia Pacific region.

In the region, industry expansion is anticipated to be fueled by a number of significant reasons, including a growing population and expanding urbanisation.

The demand for fire-resistant cables in the region is being driven by expanding sectors in a number of Asian nations, including manufacturing, building & construction, and automotive & transportation.

North America Set to Display Exceptional Growth

The region with the fastest-growing fire-resistant cable market is expected to be North America. Fire-resistant cables must be used in a variety of applications due to North America's stringent fire safety laws and construction rules, particularly in the United States. The need for fire-resistant cables is fueled by these restrictions in order to satisfy safety standards.

North America has a robust building sector that includes residential, commercial, and industrial developments. To maintain compliance with safety norms and standards, fire-resistant cables are crucial in the construction industry.

Silicon Valley, the East Coast, and Canada are all significant technology hubs in North America, which also has a sizable data centre market. Data centres rely on fire-resistant cables to protect sensitive information and guarantee continuous operation.

Fairfield’s Competitive Landscape Analysis

The market for fire-resistant cable essentials is consolidating; there are fewer well-known firms in the sector. To increase their reach internationally, the major companies are launching new products and modernising their distribution systems. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Fire-Resistant Cable Space?

- Prysmian Group

- Nexans S.A.

- NKT Group

- Leoni AG

- LS Cable & System Limited

- Jiangnan Group Limited

- Tratos Limited

- EL Sewedy Electric Company

- Furukawa Electric Co., Ltd.

- Universal Cable (M) Berhad

- Panduit

- TPC Wire & Cable Corp.

- Belden Inc.

- Siemens AG

- Relemac Technologies Pvt. Ltd

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, building codes and fire safety requirements have been developed in numerous regions and nations, and they call for the usage of fire-resistant cables in certain applications. Obtaining building licenses and approvals depends on compliance with these rules. This forces contractors and project managers to use fire-resistant wires, which increases market demand.

Furthermore, Regulations for fire safety are constantly being updated to reflect new fire risks and hazards. The need for improved and approved fire-resistant cables rises as regulations become more strict and extensive. In response, manufacturers provide cutting-edge cable solutions that comply with these changing regulations. However, the fire-resistant cable market is expected to face considerable challenges because of high cost.

Supply Side of the Market

According to our analysis, the United States is the largest supplier market in the North Ameriaca region, accounting for more than 60% of the total supply there. 40% of the total comes from Canada. In the United States, the top vendors of fire-resistant cables are Belden, General Cable, Nexans, Prysmian Group, and Southwire.

Nearly 35% of the world's supply of fire-resistant cables is sold in the second-largest market, which is Asia Pacific. Approximately 30% of the world's usage of fire-resistant cables is consumed in North America. The United States is the leading consumer of fire-resistant wires in North America, followed by Canada.

Due to the high demand for building and construction applications, China accounted for the second largest share in the Asia pacific region's overall consumption of fire-resistant cable materials. The country's well-established electrical and electronic industry, together with an expanding number of production facilities, is further projected to boost demand for goods during the projection period.

The Global Fire-Resistant Cable Market is Segmented as Below:

By Insulation Material:

- XLPE

- PVC

- EPR

- LSZH

- Others

By End-use Industry:

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others

By Geographic Coverage:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Fire-Resistant Cable Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Fire-Resistant Cable Market Outlook, 2020 - 2033

- Global Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- XLPE

- PVC

- EPR

- LSZH

- Others

- Global Fire-Resistant Cable Market Outlook, by End-use Industry, Value (US$ Bn), 2020-2033

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others

- Global Fire-Resistant Cable Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- North America Fire-Resistant Cable Market Outlook, 2020 - 2033

- North America Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- XLPE

- PVC

- EPR

- LSZH

- Others

- North America Fire-Resistant Cable Market Outlook, by End-use Industry, Value (US$ Bn), 2020-2033

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others

- North America Fire-Resistant Cable Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- S. Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Canada Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Canada Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- Europe Fire-Resistant Cable Market Outlook, 2020 - 2033

- Europe Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- XLPE

- PVC

- EPR

- LSZH

- Others

- Europe Fire-Resistant Cable Market Outlook, by End-use Industry, Value (US$ Bn), 2020-2033

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others

- Europe Fire-Resistant Cable Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Germany Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Italy Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Italy Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- France Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- France Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- K. Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- K. Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Spain Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Spain Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Russia Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Russia Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Rest of Europe Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Rest of Europe Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- Asia Pacific Fire-Resistant Cable Market Outlook, 2020 - 2033

- Asia Pacific Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- XLPE

- PVC

- EPR

- LSZH

- Others

- Asia Pacific Fire-Resistant Cable Market Outlook, by End-use Industry, Value (US$ Bn), 2020-2033

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others

- Asia Pacific Fire-Resistant Cable Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- China Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Japan Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Japan Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- South Korea Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- South Korea Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- India Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- India Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Southeast Asia Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Southeast Asia Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Rest of SAO Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Rest of SAO Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- Latin America Fire-Resistant Cable Market Outlook, 2020 - 2033

- Latin America Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- XLPE

- PVC

- EPR

- LSZH

- Others

- Latin America Fire-Resistant Cable Market Outlook, by End-use Industry, Value (US$ Bn), 2020-2033

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others

- Latin America Fire-Resistant Cable Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Brazil Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Mexico Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Mexico Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Argentina Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Argentina Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Rest of LATAM Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Rest of LATAM Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- Middle East & Africa Fire-Resistant Cable Market Outlook, 2020 - 2033

- Middle East & Africa Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- XLPE

- PVC

- EPR

- LSZH

- Others

- Middle East & Africa Fire-Resistant Cable Market Outlook, by End-use Industry, Value (US$ Bn), 2020-2033

- Automotive & Transportation

- Building & Construction

- Energy

- Manufacturing

- Others

- Middle East & Africa Fire-Resistant Cable Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- GCC Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- South Africa Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- South Africa Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Egypt Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Egypt Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Nigeria Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Nigeria Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- Rest of Middle East Fire-Resistant Cable Market Outlook, by Insulation Material, 2020-2033

- Rest of Middle East Fire-Resistant Cable Market Outlook, by End-use Industry, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Fire-Resistant Cable Market Outlook, by Insulation Material, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Prysmian Group

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Nexans S.A.

- NKT Group

- Leoni AG

- LS Cable & System Limited

- Jiangnan Group Limited

- Tratos Limited

- EL Sewedy Electric Company

- Furukawa Electric Co., Ltd.

- Universal Cable (M) Berhad

- Prysmian Group

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Insulation Industry Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |