Global Fixed Mobile Convergence Market Forecast

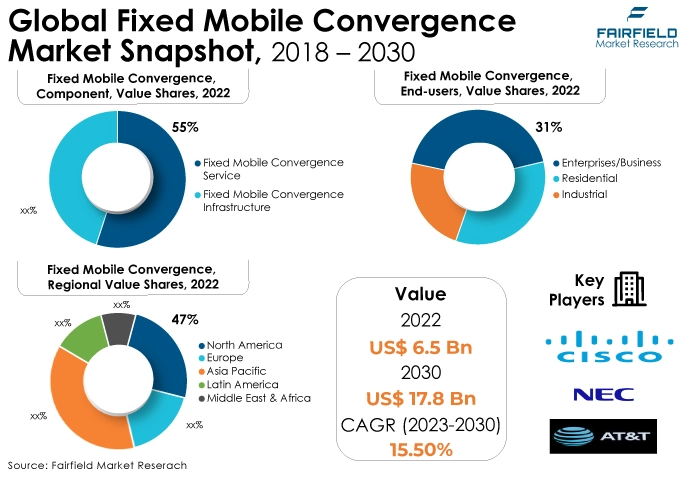

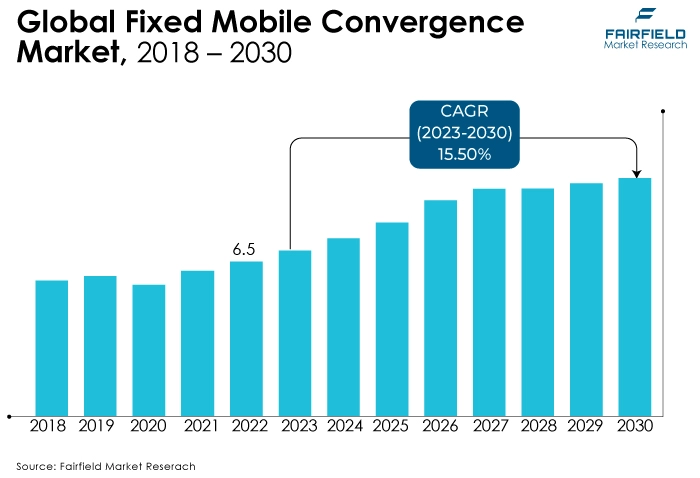

- Global market for fixed mobile convergence slated to jump from a valuation of US$6.5 Bn in 2022, to US$17.8 Bn by 2030-end

- Market valuation likely to exhibit a solid CAGR of 15.5% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the growth of fixed mobile convergence (FMC) is the increasing demand for integrated services such as communications, VPN, information and entertainment, voice mail, etc.

- Another major market trend expected to fuel the growth is the fixed Mobile convergence market, a rapidly expanding usage of 5G technology. The market is also predicted to profit from mobile transitions to 5G. Tier-1 operators are expected to drive fixed mobile convergence architecture deeper into 5G networks.

- FMC services have dominated the market because they are the core enablers of seamless communication, allowing users to unify voice, data, and multimedia services across fixed and mobile networks, thus streamlining operations, reducing costs, and enhancing productivity for businesses and individuals alike.

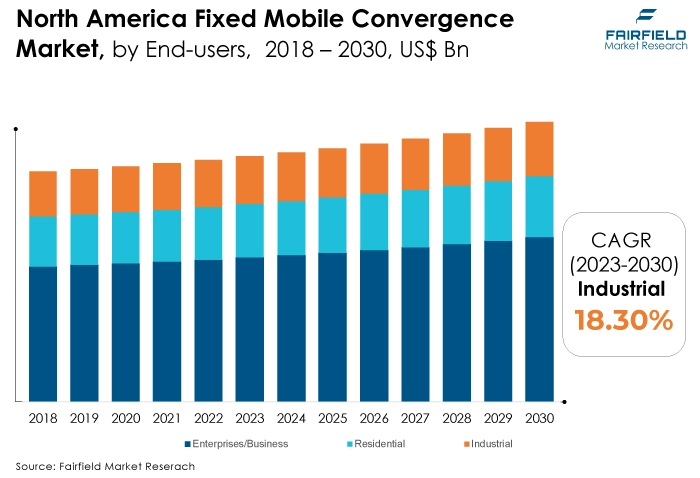

- Enterprises and businesses have dominated the FMC market due to their significant demand for unified communication solutions. Fixed mobile convergence streamlines operations, reduces costs, and simplifies management, making it particularly appealing to businesses seeking efficient communication solutions for their employees and customers.

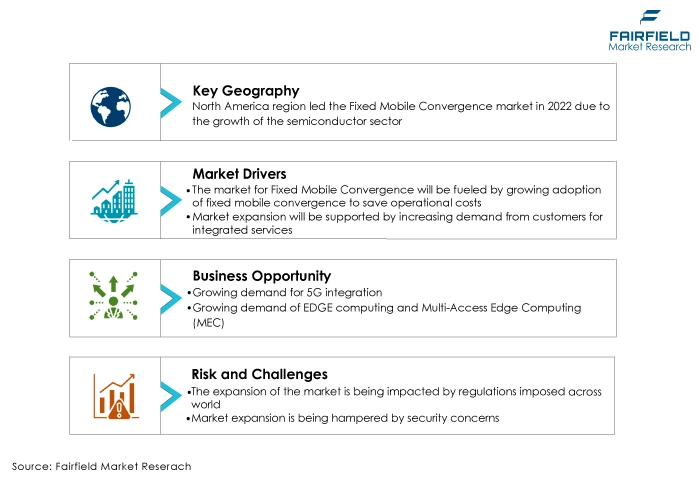

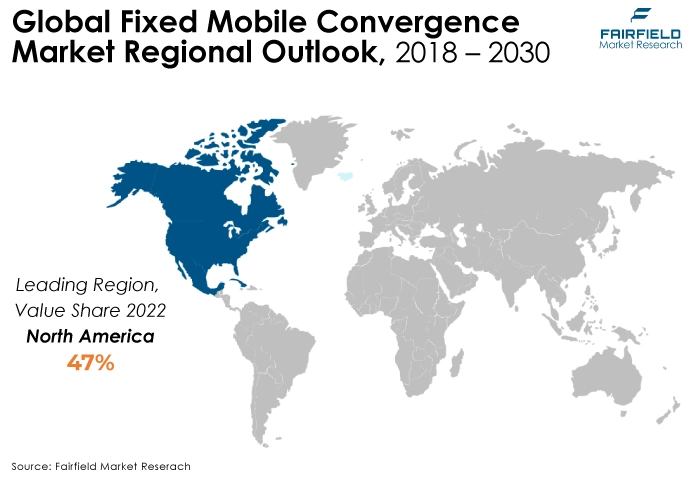

- North America has captured the largest market share in the FMC market due to its advanced telecommunications infrastructure, tech-savvy consumer base, and the presence of multinational corporations. These factors drive strong FMC adoption and market dominance in the region.

- Asia Pacific region is experiencing the fastest growth in the FMC industry due to its vast and diverse consumer base, rapid digital transformation, and increasing industrial adoption. The demand for integrated communication solutions in emerging markets is driving FMC growth at an accelerated pace.

- The regulatory scenario poses challenges in front of the market due to varying telecommunications regulations, compliance complexities, and evolving standards across regions. Navigating these legal landscapes can be complex and costly for FMC providers, impacting market dynamics and service deployment.

A Look Back and a Look Forward - Comparative Analysis

The FMC market is growing due to the increasing demand for seamless, unified communication experiences. FMC integrates fixed-line and mobile networks, enhancing mobility and productivity. Businesses and consumers benefit from cost savings, improved connectivity, and simplified management.

As the need for flexible and efficient communication solutions continues to rise, FMC adoption is expanding, contributing to the market's growth. The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of the major end-use application sectors such as enterprises/business.

Enterprises and business end-users are increasingly adopting fixed mobile convergence to streamline communication, reduce costs, and enhance productivity. FMC allows seamless integration of fixed and mobile networks, enabling efficient remote work, unified communications, and improved customer service, which are vital for modern businesses, driving its growth in this segment.

The future of this market looks promising. With the ongoing advancement of 5G technology, the integration of fixed and mobile networks will become even more seamless and efficient. This will lead to enhanced services, improved connectivity, and greater user mobility. As businesses and individuals seek integrated communication solutions, the FMC market is poised for continued growth and innovation.

Key Growth Determinants

- Growing Adoption for Operational Cost Saving

The growing adoption of fixed mobile convergence is driven by its ability to save operational costs significantly. FMC enables businesses to consolidate their communication infrastructure, reducing expenses related to managing separate fixed-line and mobile networks.

By integrating these networks, organisations can streamline their voice and data services, optimise resource allocation, and eliminate redundancy in infrastructure management. Additionally, FMC promotes efficient remote work, reducing office-related expenses. Moreover, it enables cost-effective international calling through Wi-Fi or data networks, leading to reduced roaming charges. These substantial cost-saving opportunities make FMC an attractive solution for businesses, thus driving the growth of the FMC market.

- Increasing Demand for Integrated Services

The fixed mobile convergence market is experiencing growth due to increasing customer demand for integrated services. Customers seek seamless and unified communication experiences that span fixed-line and mobile networks. FMC addresses this demand by providing a cohesive solution that enables integrated voice, data, and multimedia services.

Businesses and individuals benefit from improved connectivity, convenience, and cost-efficiency. As the desire for integrated services continues to rise, FMC adoption is expanding, driving market growth and innovation in response to evolving customer needs.

- Rising Adoption for a Unified Converged Communication Network

The fixed mobile convergence market is growing due to the rising adoption of FMC solutions that offer a unified and converged communication network. These solutions allow seamless integration of fixed and mobile communication services, providing users with a unified experience. This convergence enhances communication efficiency, reduces costs, and simplifies management for both businesses and individuals.

As the demand for integrated and streamlined communication networks increases, FMC adoption is on the rise, propelling the market's growth as it fulfills the need for unified and efficient communication solutions.

Major Growth Barriers

- Regulatory Challenges

Regulations imposed by various governments can present challenges to the market. Compliance with regulatory requirements, such as data privacy, security, and spectrum allocation, can be complex and costly.

Additionally, differing regulations across regions can hinder the seamless integration of fixed and mobile networks. Navigating these regulatory hurdles and ensuring FMC solutions meet compliance standards can be a barrier to market growth, requiring businesses to adapt and invest in solutions that align with the evolving legal landscape.

- Security Concerns

Security concerns pose a significant challenge to the F market. Integrating fixed-line and mobile networks for seamless communication increases the attack surface for potential cybersecurity threats.

Protecting sensitive data and voice communication is paramount. Ensuring robust security measures, compliance with regulations, and educating users on best practices becomes crucial. Any breach or vulnerability can erode trust among users and hinder the adoption of FMC solutions, making security a central challenge in the market's growth and success.

Key Trends and Opportunities to Look at

- 5G Integration

5G integration is a pivotal trend in the fixed mobile convergence market. It leverages the high-speed, low-latency capabilities of 5G networks to enable seamless communication between fixed and mobile devices.

This integration enhances the user experience, supports bandwidth-intensive applications, and expands the scope of FMC services, making it a critical driver of innovation and adoption in the FMC market.

- EDGE Computing

EDGE computing plays a significant role in the market. It reduces latency by processing data closer to the source, enhancing the performance of FMC applications.

With EDGE computing, FMC solutions can support real-time applications like augmented reality, IoT, and critical communications, making it a crucial technology trend to enable seamless and efficient convergence between fixed and mobile networks.

- Multi-access Edge Computing (MEC)

Multi-access edge computing (MEC) is a pivotal technology trend in the FMC market. It brings computing resources closer to the end-users, reducing latency and enhancing the performance of FMC applications.

MEC supports real-time processing for applications like augmented reality, virtual reality, and IoT, making it essential for delivering low-latency, high-quality converged communication experiences across fixed and mobile networks.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario significantly shapes the this market. Governments and regulatory bodies worldwide play a crucial role in determining the rules and standards governing telecom services, spectrum allocation, data privacy, and security. Compliance with these regulations is essential for FMC providers to operate legally and maintain consumer trust.

Moreover, regulations related to net neutrality and competition policies can impact how FMC services are priced and offered. The regulatory landscape can also influence mergers and acquisitions within the industry, affecting market dynamics and competition.

In addition to national regulations, international agreements and standards, such as those set by the International Telecommunication Union (ITU) and regional regulatory bodies, impact the global FMC market. Staying compliant with these evolving regulations while adapting to technological advancements is a challenge and a crucial factor in shaping the FMC market's future.

Fairfield’s Ranking Board

Top Segments

- Fixed Mobile Convergence Service Component Dominant

Fixed mobile convergence service components have captured the largest market share due to their central role in enabling seamless communication experiences. FMC services provide the vital bridge between fixed-line and mobile networks, allowing users to enjoy unified voice, data, and multimedia services. This convergence enhances productivity, reduces costs, and simplifies communication for both businesses and individuals.

As FMC solutions continue to evolve and expand, their service components remain at the forefront, meeting the growing demand for integrated and efficient communication solutions, hence securing the largest market share.

The FMC infrastructure will most likely be experiencing the fastest CAGR through the end of the forecast period because it forms the backbone of FMC solutions. As FMC adoption increases, the demand for robust, scalable, and adaptable infrastructure grows. This infrastructure includes components like network servers, gateways, and hardware that enable seamless communication between fixed and mobile networks.

With the rapid expansion of FMC services, the need for advanced infrastructure to support integrated voice, data, and multimedia services is driving its growth at the fastest CAGR in the FMC market.

- Enterprises and Businesses Surge Ahead in Demand Generation

Enterprises and businesses have captured the largest market share in the fixed mobile convergence market due to their substantial demand for unified communication solutions. FMC enhances productivity, reduces communication costs, and simplifies management for organisations of all sizes.

FMC enables seamless integration between fixed-line and mobile networks, making it particularly appealing to businesses seeking to streamline operations and offer flexible communication options to their employees and customers. This strong enterprise adoption and preference for FMC solutions have led to businesses dominating the market.

The industrial sector is all set to exhibit the fastest value CAGR in the FMC market space, in the years to come, because of the increasing need for efficient and integrated communication solutions.

Industries such as manufacturing, logistics, and energy require seamless connectivity between fixed and mobile networks to support mission-critical operations and IoT applications. FMC enhances operational efficiency, real-time monitoring, and decision-making, making it indispensable in the industrial sector, thereby driving its rapid growth at the fastest CAGR.

Regional Frontrunners

North America Holds the Lion’s Share

North America has captured the largest market share in the global market for FMC. Firstly, the region has a highly developed telecommunications infrastructure, making it fertile ground for FMC adoption. Secondly, the presence of numerous multinational corporations and enterprises drives the demand for unified communication solutions to streamline operations.

Moreover, North America's tech-savvy consumer base seeks seamless connectivity between fixed and mobile networks, promoting FMC services among individuals and businesses. Additionally, government initiatives and regulations often support FMC innovation. The combination of these factors has established North America as a dominant player in the FMC market, contributing to its largest market share.

Asia Pacific Awaits Impressive Growth Prospects Through 2030

Asia Pacific region is experiencing the fastest growth in the fixed mobile convergence market due to several factors. It has a vast and diverse consumer base seeking seamless and cost-effective communication solutions.

Rapid digital transformation, especially in emerging markets, is driving FMC adoption. Additionally, the region's growing industrial sectors, such as manufacturing and logistics, are embracing FMC to enhance operational efficiency.

The need for FMC services is rising as mobile networks in Asia Pacific continue to develop and flourish, which is helping to fuel the market's rapid expansion at the quickest CAGR.

Fairfield’s Competitive Landscape Analysis

The global fixed mobile convergence market is consolidated, with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Fixed Mobile Convergence Space?

- CISCO Systems

- Ericsson

- Nokia

- Huawei Technologies

- Samsung Electronics

- NEC Corporation

- Avaya

- Mitel Networks

- Mavenir

- Ribbon Communications

- T-Mobile USA

- Comcast Corporation

- AT&T

- Verizon Communications

- Orange SA

Significant Company Developments

New Product Launches

- December 2022: The fourth Indian business to do so is Nelco, a part of the Tata Group, which has submitted an application for a Global Mobile Personal Communication by Satellite (GMPCS) licence. This highlights the growing interest in an emerging market with significant growth prospects. The government has already issued licenses to SpaceX, owned by Elon Musk, and OneWeb, supported by the Bharti Group, along with the satellite division of Reliance Jio Infocomm.

- August 2022: Vodafone PNG and Kacific have partnered to extend the Mobile Backhaul services of the satellite operator to rural areas. This collaboration is focused on delivering Vodafone PNG's voice and 3G/4G data network to remote regions in Papua New Guinea, supporting the government, schools, businesses, and communities in their digital transformation efforts. Kacific currently provides services in the Asia Pacific region, covering New Zealand, Singapore, Australia, Fiji, PNG, and other Pacific Islands. The upcoming project will leverage Kacific's capabilities to enhance mobile connectivity and services in rural areas.

Distribution Agreement

- July 2022: The Combat Capabilities Development Command of the US Army has granted a contract to Kratos Defense & Security Solutions, Inc., a prominent provider of National Security Solutions. The contract is for the demonstration of a virtualised SATCOM ground system. This solution, built on Kratos' OpenSpace Platform, enables the government to implement SATCOM networks aligned with modernisation goals. These objectives encompass optimising gateway and remote terminal capabilities from various vendors, reducing life-cycle expenses, and supporting adaptive and dynamic space operations.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, growth in metal is driving the market. The demand for FMC services is driven by the increasing need for seamless and cost-effective communication solutions across fixed and mobile networks.

As businesses seek greater efficiency and consumers demand integrated services, the FMC market is poised for future growth. Advancements in 5G, IoT, and cloud technologies will further boost FMC adoption, meeting the rising expectations for unified communication experiences while addressing the evolving demands of both enterprises and individuals.

Supply Side of the Market

Leading countries in the fixed mobile convergence market include the United States, where advanced telecommunications infrastructure and tech-savvy consumers drive adoption. European countries like the Germany, United Kingdom, and France are significant players, with a focus on unified communication solutions.

Additionally, countries in the Asia Pacific region, particularly India, and China, are experiencing rapid FMC growth due to their large and digitally connected populations. These nations collectively shape the global FMC market landscape.

The market primarily relies on technology components and software solutions rather than traditional raw materials. However, the key components and infrastructure required include network servers, gateways, routers, switches, and software for seamless integration.

The major suppliers in this market are technology companies like Cisco, Nokia, Ericsson, and Huawei, providing the hardware and software solutions necessary for FMC infrastructure. These suppliers play a vital role in enabling the convergence of fixed and mobile networks in FMC solutions.

The Global Fixed Mobile Convergence Market is Segmented as Below:

By Component:

- Fixed Mobile Convergence Service

- Fixed Mobile Convergence Infrastructure

By End User:

- Enterprises/Business

- Residential

- Industrial

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Fixed Mobile Convergence Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Fixed Mobile Convergence Market Outlook, 2018 - 2030

3.1. Global Fixed Mobile Convergence Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Fixed Mobile Convergence Service

3.1.1.2. Fixed Mobile Convergence Infrastructure

3.2. Global Fixed Mobile Convergence Market Outlook, by End Users, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Enterprises/Business

3.2.1.2. Residential

3.2.1.3. Industrial

3.3. Global Fixed Mobile Convergence Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Fixed Mobile Convergence Market Outlook, 2018 - 2030

4.1. North America Fixed Mobile Convergence Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Fixed Mobile Convergence Service

4.1.1.2. Fixed Mobile Convergence Infrastructure

4.2. North America Fixed Mobile Convergence Market Outlook, by End Users, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Enterprises/Business

4.2.1.2. Residential

4.2.1.3. Industrial

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Fixed Mobile Convergence Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Fixed Mobile Convergence Market Outlook, 2018 - 2030

5.1. Europe Fixed Mobile Convergence Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Fixed Mobile Convergence Service

5.1.1.2. Fixed Mobile Convergence Infrastructure

5.2. Europe Fixed Mobile Convergence Market Outlook, by End Users, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Enterprises/Business

5.2.1.2. Residential

5.2.1.3. Industrial

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Fixed Mobile Convergence Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

5.3.1.9. Russia Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

5.3.1.10. Russia Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

5.3.1.11. Rest of Europe Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

5.3.1.12. Rest of Europe Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Fixed Mobile Convergence Market Outlook, 2018 - 2030

6.1. Asia Pacific Fixed Mobile Convergence Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Fixed Mobile Convergence Service

6.1.1.2. Fixed Mobile Convergence Infrastructure

6.2. Asia Pacific Fixed Mobile Convergence Market Outlook, by End Users, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Enterprises/Business

6.2.1.2. Residential

6.2.1.3. Industrial

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Fixed Mobile Convergence Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Fixed Mobile Convergence Market by End Users, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Fixed Mobile Convergence Market Outlook, 2018 - 2030

7.1. Latin America Fixed Mobile Convergence Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Fixed Mobile Convergence Service

7.1.1.2. Fixed Mobile Convergence Infrastructure

7.2. Latin America Fixed Mobile Convergence Market Outlook, by End Users, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Enterprises/Business

7.2.1.2. Residential

7.2.1.3. Industrial

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Fixed Mobile Convergence Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

7.3.1.5. Rest of Latin America Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

7.3.1.6. Rest of Latin America Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Fixed Mobile Convergence Market Outlook, 2018 - 2030

8.1. Middle East & Africa Fixed Mobile Convergence Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Fixed Mobile Convergence Service

8.1.1.2. Fixed Mobile Convergence Infrastructure

8.2. Middle East & Africa Fixed Mobile Convergence Market Outlook, by End Users, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Enterprises/Business

8.2.1.2. Residential

8.2.1.3. Industrial

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Fixed Mobile Convergence Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

8.3.1.5. Rest of Middle East & Africa Fixed Mobile Convergence Market Component, Value (US$ Bn), 2018 - 2030

8.3.1.6. Rest of Middle East & Africa Fixed Mobile Convergence Market End Users, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End Users vs End Users Heatmap

9.2. Manufacturer vs End Users Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. CISCO Systems

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Ericsson

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Nokia

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Huawei Technologies

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Samsung Electronics

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. NEC Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Avaya

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Mitel Networks

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Mavenir

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Ribbon Communications

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. T-Mobile USA

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Comcast Corporation

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. AT&T

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Verizon Communications

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Orange S.A.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |