Global Fleet Management Market Forecast

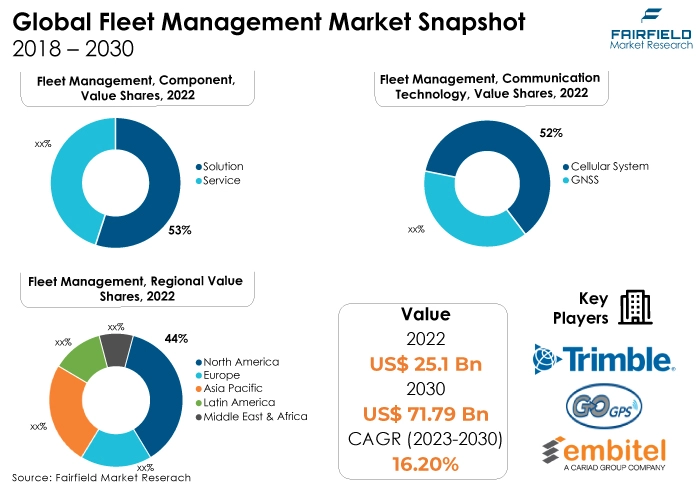

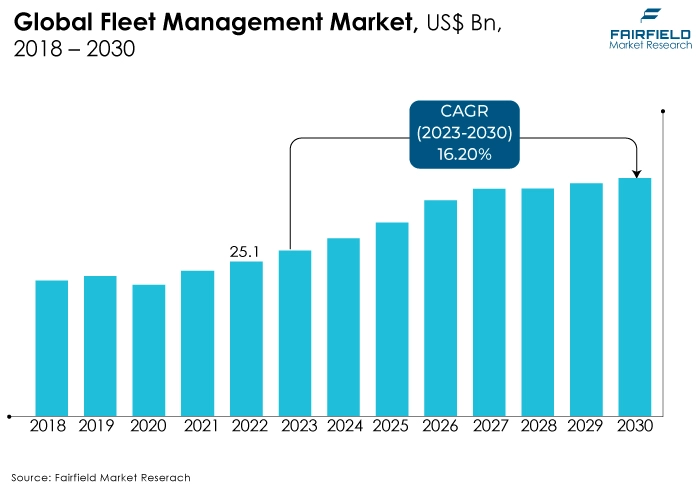

- Global fleet management market valuation poised to reach US$71.7 Bn in 2030, up from US$25.1 Bn attained in 2022

- Market expansion projected at a CAGR of 16.2% during 2023 - 2030

Quick Report Digest

- The worldwide fleet management sector is anticipated to rise as consumer awareness of affordable shared mobility options increases. The widespread use of remote sensing technologies is also to blame for the increase in market income.

- Globally expanding urbanisation and industrialisation, particularly in developing and underdeveloped nations, are projected to have a beneficial effect on the trajectory of the fleet management market's growth.

- In 2022, the light commercial vehicle category led the market. Light commercial vehicle (LCV) fleet management is becoming increasingly popular. For several uses, including last-mile deliveries, logistics, and transportation, LCVs are becoming more and more common.

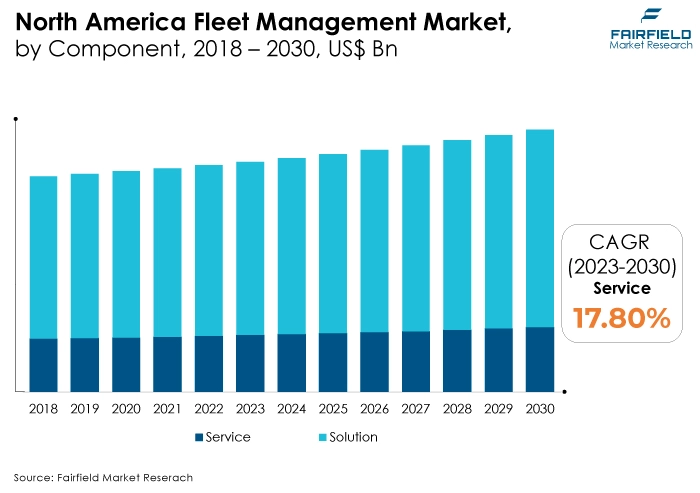

- Due to growing concerns about fleet safety, the solutions category accounted for a sizable portion of the market in 2022. One of the biggest problems fleet operators have at work is safety. The demand for fleet management systems is therefore anticipated to increase as a result of the catastrophic effects of accidents and other situations.

- The majority of the market was occupied by the cellular sustem category. Cellular connectivity is necessary for real-time communication and data transmission from cars to fleet management software platforms.

- In the upcoming years, it's anticipated that fleet management systems use in the government sector would increase. Government organisations should think about using a fleet management solution if they want to increase productivity, cut expenses, and increase the safety of their fleets.

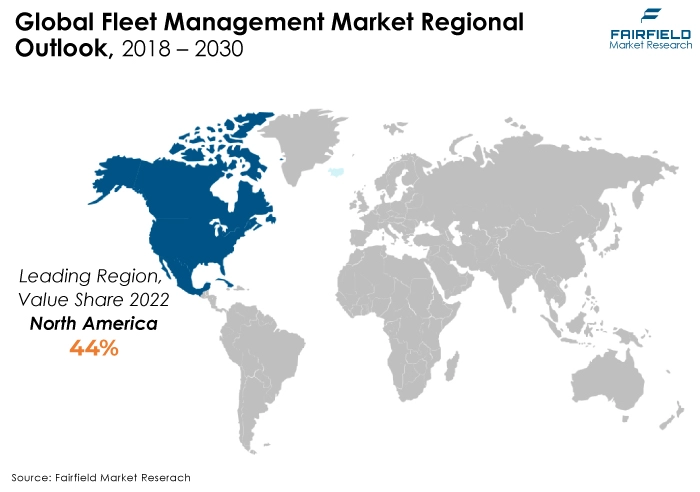

- North America region is anticipated to account for the highest share of the global fleet management market. The recent growth of the fleet management market is directly attributable to the government of this region.

- Europe will have the significant rate of growth in the fleet management market during the forecast period because of a rise in hydraulic control system research and development activities as well as technological improvements.

A Look Back and a Look Forward - Comparative Analysis

The fleet management market expansion will be fueled by the rising need for improved operational effectiveness and cost optimisation across sectors including logistics, transportation, and delivery services throughout the course of the forecast period. Additionally, businesses are being forced to invest in these systems to maintain compliance and lower their carbon footprint, which will help the market grow. This is due to the introduction of strict government regulations and a greater focus on safety and environmental issues.

Throughout the historical period of 2018-2022, the market had staggered growth. The rise in numerous industrial applications, including as aerospace, steel, power, chemical, and others, is one of the key factors propelling the growth of the fleet management market over the forecast period. Fleet management also has the advantage of enhancing resistance to load changes, which is expected to further fuel the market for fleet management's expansion.

The requirement for real-time monitoring and data-driven decision-making, which is assisted by GPS-based tracking and advanced analytics inside fleet management systems, is expected to rise significantly in the upcoming years. Additionally, as it enables smooth communication between vehicles and centralised administration systems, the fast spread of connected vehicles and Internet of Things (IoT) technology is fueling market expansion.

Key Growth Detrminants

- The Flourishing Development of Cold Chain Sectior

One of the major factors driving the market for fleet management software is the rising acceptance of cold chain transportation. Over the course of the projection period, market development is anticipated to be boosted by the increasing global usage of connected devices, and cold storage automation.

The demand for cold chain solutions is rising as organised retail outlets proliferate in developing nations. Additionally, industry growth is anticipated to be aided by trade liberalisation, government initiatives to reduce food waste, and MNCs' expansion of retail chains.

The cold chain is increasingly using monitoring components, in particular. Technology advancements and the increased demand for cargo integrity, effectiveness, and safety are the main drivers of this rise.

- e-Commerce Expansion

In order to maximise efficiency and cut costs, businesses can control and coordinate their fleets of delivery vehicles. Fleet management is a technique used to track and oversee messengers and delivery workers. Fleet management can be used to manage it easily. It requires a system of technologies that make it simpler for the fleet manager to coordinate the tasks, from fuel management to route planning.

The growth of the e-Commerce sector has had a profound effect on the logistics sector. Since it has an immediate impact on planned operations, stockrooms, and production network organisations, logistics has long been regarded as the foundation of the e-commerce sector.

To meet the increasing demands for internet business part development, they will increasingly rely on re-evaluating. As a result, this may play a significant role in both managing and increasing the pressure brought on by the anticipated rise of the e-commerce business sector.

- Proliferation of Mobility-as-a-service (MaaS)

An important trend in the fleet management market is mobility-as-a-service (MaaS), which can offer new revenue streams. More transportation infrastructure and services are needed as a result of the increase in passenger and freight traffic around the world, notably internet-based platforms for the road, rail, and other modes of transportation. This market's progress is further fueled by the burgeoning smart city sector.

The growth of Mobility as a Service (MaaS) platforms for shared mobility is a result of demand on cities with dense populations to reduce pollution and alleviate traffic. To satisfy a wide range of consumer expectations, service providers in the worldwide fleet management market are putting a strong emphasis on innovation and quality. The market for fleet management software will expand favourably as MaaS gains in popularity.

Major Growth Barriers

- Lack of Consistent and Seamless Internet Connectivity

Fleet management operates by decoding signals received from several satellites. Large structures, storms, and other barriers have a significant likelihood of interfering with these signals. The software's components, such GPS, become unreliable and ineffective in this case.

If a driver moves to a new location and needs constant help from the service provider, this can cause chaos. Due to inadequate data management caused by a lack of consistent and seamless internet connectivity, the fleet management market may see challenges throughout the projected period.

- Lack of Awareness Regarding the Benefits of Fleet Management

Small fleet operators in the fleet management industry are less likely than large fleet operators to take advantage of cutting-edge fleet management technology solutions. The lack of knowledge, tight financial budgets, and rising operating costs will hinder small fleet owners' adoption of technology.

Small fleet operators are typically flexible in fleet operations because they own up to 100 fleet vehicles. They still lack operational efficiencies, though, while having sufficient agility. Small fleet owners' reluctance to accept new technology will also limit the market's expansion.

Key Trends and Opportunities to Look at

- Accelerating Integration of AI in Fleet Management

The use of AI in fleet management is expanding as a result of the growing demand to increase productivity and simplify fleet operations. AI in fleet management systems reduces the risks associated with human intervention, which streamlines fleet operations.

AI enables the creation of predictive analytics to reduce potential hazards using both historical and current data. Fleet managers can learn more about fleet operations in real time with the aid of AI-based fleet analytics.

- Increased Adoption Within Construction Sector

Real-time monitoring of heavy machinery, including combined machinery and vehicles like cranes, excavators, loaders, bulldozers, and trucks, is necessary. Construction businesses can identify heavy equipment in remote areas in real time with the use of fleet management systems.

Additionally, the companies can make use of real-time equipment data related to speeding, idling, and aggressive driving. Through the central systems, construction organisations are able to see performance and expenses associated with assets and equipment more clearly.

- Rising Demand for Vehicle Tracking Systems

Vehicle tracking systems provide fleet managers with a detailed report on the whereabouts, powertrains, fuel usage, and speeds of each vehicle.

Fleet managers can find their fleet vehicles instantly due to GPS-based vehicle tracking systems. Vehicle tracking systems offer detailed information about the stolen vehicle or assets in the event of a loss of cars or valuables.

How Does the Regulatory Scenario Shape this Industry?

The regulatory environment significantly affects the fleet management sector, influencing its procedures, tools, and regulatory standards. The use of electronic logging devices (ELDs) to track hours of service (HOS) digitally is now required for commercial drivers in many regions, including the US, and certain portions of Europe.

The objectives of these rules are to increase safety and ensure adherence to driving time restrictions. To aid fleets in complying with these regulations, fleet management systems frequently integrate ELD capabilities.

Additionally, fleet management systems are made to assist companies in adhering to safety laws. They offer resources for observing how drivers behave, performing vehicle inspections, and making sure cars are kept properly. Safety regulations violations may result in penalties and other legal repercussions.

Fairfield’s Ranking Board

Top Segments

- Fleet Management for LCVs Gains Traction

The light commercial vehicle segment dominated the market in 2022. Fleet management for light commercial vehicles (LCVs) is gaining popularity. LCVs are used for a variety of purposes, such as last-mile deliveries, logistics, and transportation.

Fleet management systems can aid companies that operate LCV fleets in their quest to increase productivity and safety. Businesses may increase the effectiveness and safety of their LCV fleets, lower expenses, and boost customer satisfaction by employing fleet management systems.

The heavy commercial vehicle category is expected to grow significantly over the forecast period. The growing usage of heavy trucks in a variety of applications, including mining, freight transportation, municipal facilities, industry, and other, is projected to lead to significant expansion in the heavy commercial vehicle category in the near future.

The necessity for these vehicles is growing, so manufacturers are concentrating on releasing cutting-edge large commercial vehicles. Over the course of the projected year, this is then anticipated to support segment growth.

- Fleet Management Solutions Poised for the Highest Demand

In 2022, the solution category dominated the market, and it is predicted to grow significantly over the course of the forecast period. Fuel management tools make it easier to monitor and control fuel usage, increasing fuel economy and cutting costs. They might have functions like integration with gasoline cards, analysis of fuel consumption, and fuel theft detection.

Real-time information on vehicle location, speed, fuel consumption, and driver behaviour is made available by telematics solutions. GPS tracking, auto diagnostics, and remote monitoring are frequently included.

Furthermore, the service category is expected to expand significantly. Due to end users' growing reliance on fleet management services, the services sector is also anticipated to experience rapid expansion in the near future.

These services provide preventative maintenance options to shorten engine downtime. As a result, the market for global fleet management is expected to develop over the forecast period due to the rising demand for this particular segment.

- Cellular System Category Leads by Communication Technology

The cellular system category held the majority of the market share. Real-time communication, and data transmission from vehicles to fleet management software systems require cellular connectivity. It enables the sharing of information about driver behaviour, vehicle diagnostics, and location data.

Additionally, several cellular technology generations—3G, 4G, and 5G—are utilised in fleet management solutions to offer various degrees of data speed, and coverage. More sophisticated applications can be supported by 5G thanks to its quicker data throughput and lower latency.

During the forecasted years, GNSS is the fastest-growing category in the market. Global Navigation Satellite System, or GNSS, is a class of technology utilised in many fields, including fleet management. Global positioning and navigation services are offered through a system of satellites and ground stations known as GNSS.

Vehicles, assets, and equipment may all be accurately located in real-time thanks to GNSS technology. It is essential to geofencing, route optimisation, tracking driver behaviour, and fleet efficiency as a whole.

- Government Sector Registers the Maximum Adoption

The adoption of fleet management systems in the government sector is predicted to rise over the next years. If government organisations want to boost output, reduce costs, and improve the safety of their fleets, they should consider employing a fleet management solution.

Government organisations can increase efficiency with the help of fleet management solutions that monitor vehicle location, fuel use, and driver conduct. This data can be used to spot drivers who are squandering fuel, locate vehicles where they should be at the right time, and put fuel-saving strategies into action.

The transportation and logistics category is growing at a significant rate in the forecast period. The planning and administration of dispatch schedules, cost optimisation, and real-time tracking to ensure efficient last-mile delivery are all parts of fleet management, which is crucial for both logistics and transportation.

The traditional fleet management approach, which depends on management and interpersonal communication, does not keep track of how goods are transported from their point of origin to their destination.

Regional Frontrunners

North America Remains the Largest Revenue Contributor

The region with the biggest market share for fleet management is expected to be North America during that forecast period. The recent growth of the fleet management market has been largely attributed to the government of this region.

The amount of emissions produced by using vehicles has successfully been decreased because of the tight laws and regulations in the North American region and the industry is being forced to follow the policies by the strict laws to lessen the pollution brought on by the automobiles. During the anticipated time frame, this area is anticipated to have a significant impact on the expansion of the fleet management market.

Europe’s Growing Commercial Vehicle Ownership Accelerates Expansion

The market for fleet management is expanding at the fastest rate in Europe, which presents a significant opportunity for the industry attributed to the rise in commercial vehicle ownership, widespread digitisation, and introduction of automotive leasing services.

The adoption of cloud-based fleet management solutions and services has been accelerated by the region's extensive digitisation across a variety of industrial verticals, including automotive, and IT & telecom.

Companies have been compelled to implement cloud-based fleet management tools, such as driver management and vehicle tracking tools, in order to manage and monitor client experience. Additionally, Germany is the market leader in Europe as a result of growing technological breakthroughs, and R&D efforts.

Fairfield’s Competitive Landscape Analysis

Most of market participants are concentrating on increasing their product portfolios through investments in cutting-edge research and software development techniques. To improve fleet management with cutting-edge tracking, precise GPS, and greater support for the drivers, these companies are working with cutting-edge technology developers.

Additionally, these businesses are forming strategic alliances, mergers, and acquisitions with other automakers to provide cutting-edge fleet management solutions.

Who are the Leaders in Global Fleet Management Space?

- TomTom N.V.

- Trimble Inc.

- Cisco Systems, Inc.

- GoFleet Corporation

- Geotab Inc.

- GPS Trackit

- Fleetmatics Group PLC

- GoGPS

- Wireless Links

- Embitel

- Gurtam

- Teletrac Navman

- Linxio

- Trakm8 Limited

- WebEye Telematics Group

Significant Company Developments

New Product Launch

- October 2022: FleetWave Technician and FleetWave Driver are two new applications that Chevin Fleet Solutions has launched for its fleet management platform.

- February 2022: Element Fleet Management Corp. announced the debut of the Arc by Element, an all-inclusive electric vehicle (EV) fleet service to assist clients in navigating and streamlining the challenging switch from internal combustion engine (ICE) vehicles to EVs.

- June 2022: Fleet Electrification Knowledge Center was made available by Geotab. It is a one-stop information center where fleet managers may get information about the electrification process, from the early adoption of Electric Vehicles (EVs) to streamlining and improving operations.

- May 2021: With a built-in GPS receiver for real-time position tracking and an embedded accelerometer to keep track of its movement and state, Verizon Connect has introduced a small, covert asset tracking solution. This combination of qualities makes it possible to identify any potential problems with the asset as well as to detect any tampering or theft.

Collaborations

- May 2022: Government fleets will benefit from real-time visibility, quick access to data, and the right to use all other Geotab technological innovations thanks to the partnership between Geotab and General Motors, which provides instant connectivity via OnStar-equipped vehicles without the need for additional hardware installation.

An Expert’s Eye

Demand and Future Growth

The increasing fleet safety concerns, government mandates for vehicle maintenance and tracking, the need for operational competency in fleet management, and an increase in the adoption of wireless technology because of its accessibility and low cost all contribute to the market's growth globally.

However, the market's expansion globally is hampered by elements including cost sensitivity among local firms and a lack of consistent and seamless internet connectivity.

Supply Side of the Market

The US is renowned for its technological innovation. To improve their fleet management solutions, several American businesses in the fleet management sector are constantly developing and implementing cutting-edge technologies like IoT, AI, and machine learning. The competitiveness of American service providers on the worldwide market is boosted by this innovation.

Several fleet management organisations with headquarters in the US have globalised their operations. This growth enables them to provide services to clients not just in the US but also in other countries, strengthening their position as important providers in the global fleet management market.

Global Fleet Management Market is Segmented as Below:

By Vehicle Type

- Heavy Commercial Vehicle

- Aircraft

- Railway

- Watercraft

- Light Commercial Vehicle

By Component

- Solution

- Service

By Communication Technology

- GNSS

- Cellular System

By Industry

- Retail

- Government

- Transportation and Logistics

- Automotive

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Fleet Management Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Fleet Management Market Outlook, 2018 - 2030

3.1. Global Fleet Management Market Outlook, by Vehicle Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Heavy Cellular System Vehicle

3.1.1.2. Aircraft

3.1.1.3. Railway

3.1.1.4. Watercraft

3.1.1.5. Light Cellular System Vehicle

3.2. Global Fleet Management Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Retail

3.2.1.2. Government

3.2.1.3. Transportation and Logistics

3.2.1.4. Automotive

3.2.1.5. Others

3.3. Global Fleet Management Market Outlook, by Communication Technology, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. GNSS

3.3.1.2. Cellular System

3.4. Global Fleet Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Solution

3.4.1.2. Service

3.5. Global Fleet Management Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Fleet Management Market Outlook, 2018 - 2030

4.1. North America Fleet Management Market Outlook, by Vehicle Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Heavy Cellular System Vehicle

4.1.1.2. Aircraft

4.1.1.3. Railway

4.1.1.4. Watercraft

4.1.1.5. Light Cellular System Vehicle

4.2. North America Fleet Management Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Retail

4.2.1.2. Government

4.2.1.3. Transportation and Logistics

4.2.1.4. Automotive

4.2.1.5. Others

4.3. North America Fleet Management Market Outlook, by Communication Technology, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. GNSS

4.3.1.2. Cellular System

4.3.1.3. Traditional Medicine Practitioners

4.4. North America Fleet Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Solution

4.4.1.2. Service

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Fleet Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Fleet Management Market Outlook, 2018 - 2030

5.1. Europe Fleet Management Market Outlook, by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Heavy Cellular System Vehicle

5.1.1.2. Aircraft

5.1.1.3. Railway

5.1.1.4. Watercraft

5.1.1.5. Light Cellular System Vehicle

5.2. Europe Fleet Management Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Retail

5.2.1.2. Government

5.2.1.3. Transportation and Logistics

5.2.1.4. Automotive

5.2.1.5. Others

5.3. Europe Fleet Management Market Outlook, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. GNSS

5.3.1.2. Cellular System

5.3.1.3. Traditional Medicine Practitioners

5.4. Europe Fleet Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Solution

5.4.1.2. Service

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Fleet Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Fleet Management Market Outlook, 2018 - 2030

6.1. Asia Pacific Fleet Management Market Outlook, by Vehicle Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Heavy Cellular System Vehicle

6.1.1.2. Aircraft

6.1.1.3. Railway

6.1.1.4. Watercraft

6.1.1.5. Light Cellular System Vehicle

6.2. Asia Pacific Fleet Management Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Retail

6.2.1.2. Government

6.2.1.3. Transportation and Logistics

6.2.1.4. Automotive

6.2.1.5. Others

6.3. Asia Pacific Fleet Management Market Outlook, by Communication Technology, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. GNSS

6.3.1.2. Cellular System

6.3.1.3. Traditional Medicine Practitioners

6.4. Asia Pacific Fleet Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Solution

6.4.1.2. Service

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Fleet Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Fleet Management Market Outlook, 2018 - 2030

7.1. Latin America Fleet Management Market Outlook, by Vehicle Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Heavy Cellular System Vehicle

7.1.1.2. Aircraft

7.1.1.3. Railway

7.1.1.4. Watercraft

7.1.1.5. Light Cellular System Vehicle

7.2. Latin America Fleet Management Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

7.2.1.1. Retail

7.2.1.2. Government

7.2.1.3. Transportation and Logistics

7.2.1.4. Automotive

7.2.1.5. Others

7.3. Latin America Fleet Management Market Outlook, by Communication Technology, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. GNSS

7.3.1.2. Cellular System

7.3.1.3. Traditional Medicine Practitioners

7.4. Latin America Fleet Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Solution

7.4.1.2. Service

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Fleet Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Fleet Management Market Outlook, 2018 - 2030

8.1. Middle East & Africa Fleet Management Market Outlook, by Vehicle Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Heavy Cellular System Vehicle

8.1.1.2. Aircraft

8.1.1.3. Railway

8.1.1.4. Watercraft

8.1.1.5. Light Cellular System Vehicle

8.2. Middle East & Africa Fleet Management Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Retail

8.2.1.2. Government

8.2.1.3. Transportation and Logistics

8.2.1.4. Automotive

8.2.1.5. Others

8.3. Middle East & Africa Fleet Management Market Outlook, by Communication Technology, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GNSS

8.3.1.2. Cellular System

8.3.1.3. Traditional Medicine Practitioners

8.4. Middle East & Africa Fleet Management Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Solution

8.4.1.2. Service

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Fleet Management Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Fleet Management Market by Vehicle Type, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Fleet Management Market, by Industry, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Fleet Management Market, by Communication Technology, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Fleet Management Market, by Component, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. TomTom N.V.

9.5.1.1. Company Overview

9.5.1.2. Products Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Trimble Inc.

9.5.2.1. Company Overview

9.5.2.2. Products Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Cisco Systems, Inc.

9.5.3.1. Company Overview

9.5.3.2. Products Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. GoFleet Corporation

9.5.4.1. Company Overview

9.5.4.2. Products Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Geotab Inc.

9.5.5.1. Company Overview

9.5.5.2. Products Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. GPS Trackit

9.5.6.1. Company Overview

9.5.6.2. Products Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Fleetmatics Group PLC

9.5.7.1. Company Overview

9.5.7.2. Products Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. GoGPS

9.5.8.1. Company Overview

9.5.8.2. Products Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Wireless Links

9.5.9.1. Company Overview

9.5.9.2. Products Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Embitel

9.5.10.1. Company Overview

9.5.10.2. Products Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Gurtam

9.5.11.1. Company Overview

9.5.11.2. Products Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Teletrac Navman

9.5.12.1. Company Overview

9.5.12.2. Products Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Linxio

9.5.13.1. Company Overview

9.5.13.2. Products Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. WebEye Telematics Group

9.5.14.1. Company Overview

9.5.14.2. Products Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Trakm8 Limited

9.5.15.1. Company Overview

9.5.15.2. Products Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Vehicle Type Coverage |

|

|

Component Coverage |

|

|

Communication Technology Coverage |

|

|

Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |