Global Gene Expression Market Forecast

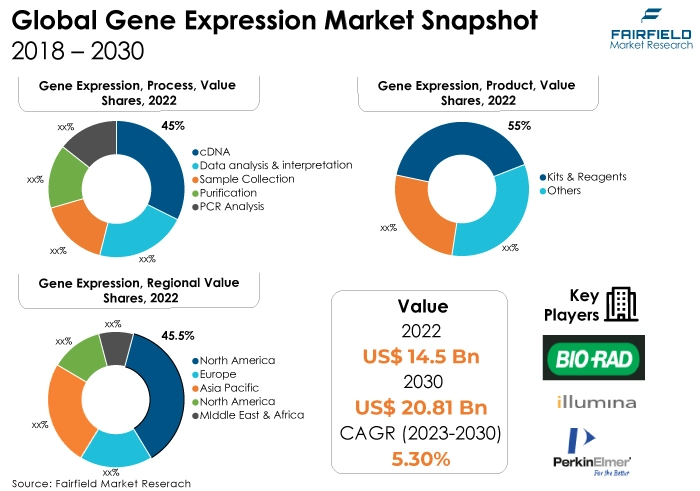

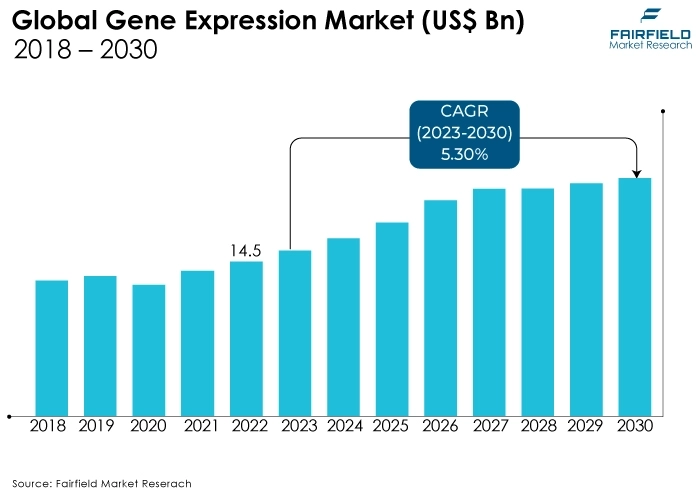

- Global gene expression market worth US$14.5 Bn (2022) poised to reach US$20.8 Bn by 2030

- Market size projected to observe a CAGR of 5.3% during 2023 - 2030

Quick Report Digest

- The main trend expected to drive the market growth for gene expression is the increasing demand for cancer diagnostics and treatment. Furthermore, the analysis of gene expression is essential for cancer early detection. To determine the cancer risk, abnormal gene expression patterns can act as biomarkers, enabling earlier intervention and possibly better treatment results.

- Another major market trend expected to drive the gene expression market growth is the rapidly expanding liquid biopsies. Making treatment decisions is made easier with the use of liquid biopsies. Oncologists can find possible therapeutic targets and choose the best treatment plans for specific patients by analysing the gene expression in liquid biopsy samples.

- In 2022, the cDNA synthesis & conversion category dominated the industry. The first step in the procedure is the extraction of total RNA from the target biological sample. This sample may be drawn from blood, tissues, cells, or any other source that contains RNA molecules. Successful cDNA synthesis depends on the quantity and quality of the isolated RNA.

- The kits & reagents category dominated the market in 2022. Reagents and tests are included in these kits to judge the calibre and reliability of RNA samples. Gel electrophoresis and spectrophotometry are frequent test techniques.

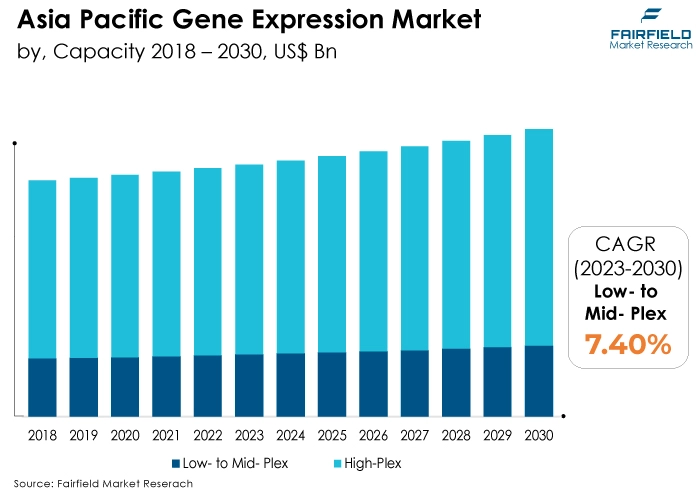

- In 2022, the high-plex category dominated the industry. Advanced multiplexing technologies that enable the simultaneous detection and quantification of multiple genes or targets in a single sample are used to achieve high-plex capacity.

- In 2022, the drug discovery & development segment dominated the market. Gene expression research can find potential new applications for already available drugs by identifying gene expression patterns that indicate therapeutic efficacy in a variety of illnesses.

- The RNA expression category dominated the market in 2022. A high-throughput technique called RNA-seq enables thorough and unbiased profiling of the whole transcriptome. Following RNA to cDNA conversion, next-generation sequencing is used.

- In the market for gene expression, Asia Pacific is anticipated to grow at the fastest rate. Due to their diversified patient populations, Asia-Pacific nations become desirable destinations for clinical studies. These studies heavily rely on gene expression analysis, which encourages the growth of gene expression services.

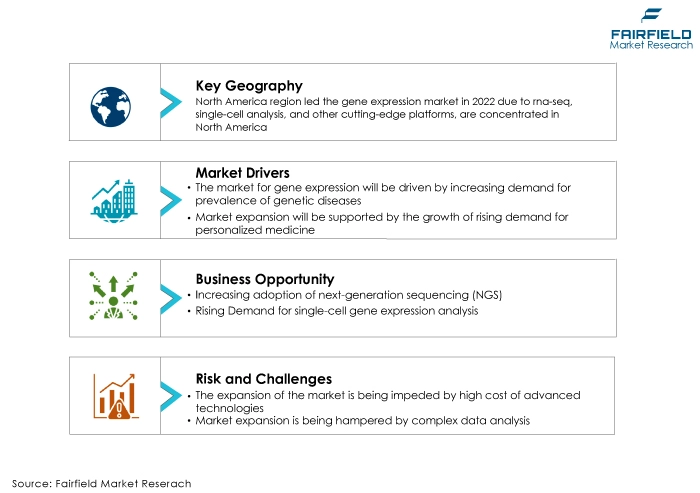

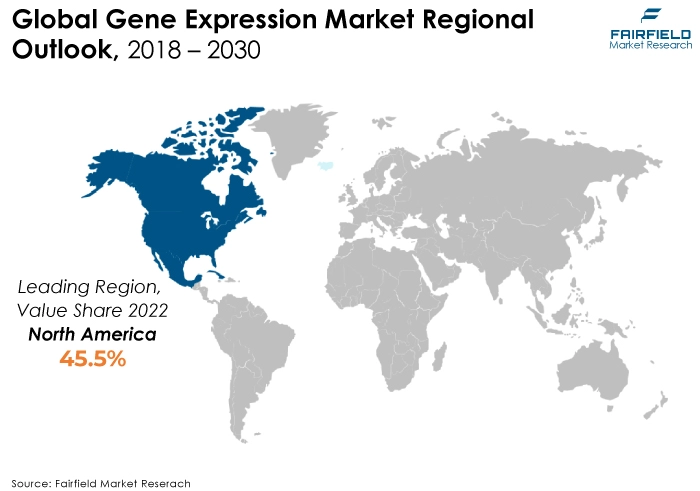

- The North America region will dominate the gene expression market throughout the forecast period. Innovative biotech startups and companies with a focus on gene expression technologies, such as RNA-seq, single-cell analysis, and other cutting-edge platforms, are concentrated in North America.

A Look Back and a Look Forward - Comparative Analysis

The identification and verification of prospective therapeutic targets is done using gene expression analysis. Researchers can identify genes and pathways that might make good targets for the creation of new drugs by examining the patterns of gene expression in disease tissues.

Pharmacogenomic research aims to understand how genetic variants affect drug reactions, and gene expression analysis helps with this. According to each patient's genetic makeup, this information is used to customise medicine dosages and therapies.

The market witnessed staggered growth during the historical period 2018 – 2022. Researchers were able to analyse gene expression at the molecular level because of developments in molecular biology tools, including the polymerase chain reaction (PCR), DNA sequencing, and microarray technologies.

With the aid of these technologies, it was feasible to examine the patterns of gene expression in diverse tissues and environments. Discussions about the ethical and social ramifications of gene expression, such as concerns about genetic privacy, genetic testing, and genetic prejudice, were also prompted by the increased public knowledge of gene expression.

Based on gene expression profiles, AI may create prediction models for disease diagnosis, prognosis, and therapy response. The development of diagnostic tests and personalised medicine strategies will be made possible by these models in the coming years. Additionally, reducing dimensionality, enhancing the quality of downstream analysis, and choosing the most pertinent genes or features from gene expression data are all made possible by AI techniques.

Furthermore, in-situ hybridisation and immunohistochemistry are two techniques that use AI-driven image analysis to measure the amount of gene expression in tissue samples. It quickens data processing and minimizes human error during the next five years.

Key Growth Determinants

- Mounting Prevalence of Genetic Diseases

The need for understanding the molecular mechanisms causing hereditary illnesses is increasing as their frequency rises. Through gene expression analysis, researchers may determine which genes are overexpressed or under-expressed in patients, offering important insights into disease processes.

For the proper classification and diagnosis of genetic illnesses, this information may be vital. The identification of biomarkers associated with genetic illnesses can be aided by gene expression profiling.

Early disease detection, disease monitoring, and gauging therapy effectiveness all depend on biomarkers. The creation of accurate biomarkers may facilitate the development of diagnostic procedures and individualised therapeutic strategies.

- Rising Demand for Personalised Medicine

Analysis of a person's genetic information, including gene expression patterns, is a key component of personalised medicine. Through the identification of certain genes that are overexpressed or under-expressed, gene expression profiling can shed light on a patient's particular medical issues and suggest prospective therapeutic approaches.

Based on a patient's genetic profile, gene expression analysis helps healthcare professionals in making the best treatment decisions. This may result in more efficient therapies, fewer negative effects, and better patient outcomes.

Personalised medicine is particularly important in oncology. Based on the genetic features of the tumour, gene expression profiling can assist in identifying the most efficient cancer treatments, such as targeted medicines and immunotherapies.

- Increasing Demand for Technological Advancements to Drive Market Growth

Gene expression analysis has undergone a revolutionary change drive by the next-generation sequencing (NGS) technologies, including RNA sequencing (RNA-seq), which provide high-resolution data on gene expression levels. Researchers now have easier access to gene expression profiling because of ongoing advancements in NGS technologies that increase their efficiency, speed, and accuracy.

The development of scRNA-seq technology has made it possible for researchers to examine single-cell gene expression. This makes it possible to identify rare cell types, comprehend cellular heterogeneity, and thoroughly examine the dynamics of gene expression.

Major Growth Barriers

- High Costs of Advanced Technologies

Research organisations, especially smaller academic labs, and organisations with tighter resources, may find the price of modern gene expression methods, such as single-cell RNA sequencing and next-generation sequencing (NGS), to be prohibitive. Access to innovative instruments and methods is constrained, which hinders the advancement of research.

Research projects and organisations may need financial assistance to meet the high initial costs of high-end sequencing machines as well as the continuous expenditures associated with reagents and data analysis. Budget restrictions and a slower pace of research advancement may result from this.

- Complex Data Analysis

Bioinformatics and computational biology specialists are frequently needed for gene expression data analysis. The analysis of gene expression databases by researchers and laboratories without access to bioinformatics specialists may be challenging, which might impede the advancement of research.

Gene expression data is typically combined with other omics data (such as genomes, and proteomics), or clinical data. Due to varying data formats platforms and the requirement for advanced data integration methodologies, this integration can take time and effort.

Key Trends and Opportunities to Look at

- Increasing Adoption of Next-Generation Sequencing (NGS)

The simultaneous sequencing of millions to billions of DNA or RNA fragments in a single run is made possible by NGS platforms. To investigate more genes and samples in less time, this high throughput radically accelerates gene expression analysis.

NGS offers quantitative data on gene expression levels, which is essential for precisely determining the amount of RNA transcripts. For an understanding of gene regulation and for locating genes that are differentially expressed in diverse biological settings, this quantitative data is crucial.

- Rising Demand for Single-Cell Gene Expression Analysis

The diversity of gene expression profiles within complex tissues and cell populations can be discovered by researchers using single-cell gene expression analysis. This provides a deeper understanding of tissue composition and function because it exposes cellular heterogeneity that may have been hidden in bulk analysis.

Studying diseases characterised by cellular heterogeneity, such as cancer and neurological disorders, requires an understanding of gene expression at the single-cell level. Rare cell forms, cell states associated with disease, and possible therapeutic targets can all be found by researchers.

- Growing Prominence of Precision Oncology

The identification of specific genes and pathways that are dysregulated in cancer is helped by gene expression profiling. Identification of prospective therapeutic targets for drug development depends on these insights.

The most appropriate type of treatment for each cancer patient can be chosen using gene expression data. Based on the molecular profile of the patient, it enables oncologists to select targeted medicines that are more likely to be beneficial.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, regulation of the gene expression market has been required to guarantee the security, precision, and dependability of gene expression analysis goods and services, particularly when utilised in clinical and diagnostic applications.

Gene expression-based diagnoses and treatments are heavily regulated in the US by the Food and Drug Administration (FDA). To ensure that gene expression tests used in clinical settings comply with safety and efficacy criteria, they supervise their approval and clearance. Gene expression tests that have received FDA approval have a big commercial influence as medical professionals start to trust and embrace them.

The European Medicines Agency (EMA) holds control over the gene expression-based medicines and diagnostics in Europe. For usage in the European Union, they assess and give their approval for new gene expression tests and therapies.

EMA approvals can significantly influence the acceptance of gene expression products in European markets. Gene expression test reimbursement decisions in the US are influenced by the Centers for Medicare & Medicaid Services (CMS). Their choices over whether to pay for specific tests can have a big impact on whether they are used in clinical practice.

Fairfield’s Ranking Board

Top Segments

- cDNA Synthesis & Conversion Preferred Process

In 2022, the segment of cDNA synthesis & conversion dominated the market. Because there is a large variety of kits available to meet different research needs, such as the ideal reaction temperature, the number of reactions, and the sample size. Additionally, the ongoing introduction of new cDNA synthesis & conversion synthesis and library preparation kits is anticipated to drive the segment's growth.

Furthermore, data analysis & interpretation category is anticipated to grow significantly throughout the forecast period. The considerable investments made in cancer research and the rising need for sophisticated software for cancer gene expression investigations are both responsible for this expansion. To analyse gene expression in complicated disorders like cancer, several methodologies and algorithms are being developed.

- Kits & Reagents Top-selling

In 2022, the kits & reagents segment dominated the industry. The presence of a significant number of businesses selling various kits and reagents for gene expression is responsible for the segment's large market share. For instance, Agilent Technologies, Inc. provides a wide selection of kits and reagents for gene expression microarrays. The development of cutting-edge items created for specific applications is another factor in the growth of the market.

The DNA chips category is expected to grow significantly during the forecast period. Microscope slides are used for DNA microarrays, which have thousands of tiny dots printed in precise places; each dot corresponds to a known DNA sequence or gene. Many people refer to these slides as DNA or gene chips.

In the domains of molecular biology, biomedical research, and genomics, these chips are often employed in the study of gene expression profiles to find illnesses, biomarkers, and therapeutic responses.

- The High-Plex Category Leads by Capacity

The high-plex segment dominated the market in 2022. It typically involves the evaluation of thousands of genes or a significant number of gene targets. RNA sequencing and microarrays are two examples of high-plex technologies used in gene expression investigation.

Furthermore, compared to qPCR and other traditional technologies, high-plex analysis requires less hands-on time. The method is also very straightforward and accurate because it does not require prior probe validation.

The low- to mid-plex category is expected to grow the fastest. Low-level plex measurements entail the examination of a small subset of genes, typically 5–500 targets. These cost-effective, low- to medium-complexity solutions are doable. For hypothesis-driven research, specialised studies, or more general exploratory analysis, researchers use low to mid-plex approaches.

- Application Highest in Drug Discovery & Development Sector

The drug discovery & development category dominated the industry in 2022. Pharma companies now use gene-expression profiling as a powerful tool for drug discovery. Pharmaceuticals' potency, toxicity, and other characteristics are assessed by seeing their effects on a cell's gene activity. Conventional profiling methods can be extremely expensive, often costing millions of dollars.

The clinical diagnostics segment is expected to rise the fastest. This is because gene expression analysis and profiling are being used more frequently to diagnose genetic illnesses quickly and accurately, comprehend disease pathophysiology, and track the evolution of diseases and how they respond to treatments.

- RNA Expression Remains Sought-after than Other Techniques

In 2022, the RNA expression segment dominated the industry. Analysing cDNA transcripts is done using the high-throughput sequencing (HTS) method known as RNA-sequencing (RNA-seq). A lot of clinical investigations have made use of this relatively new technology.

RNA-seq is most frequently used in a differential gene expression (DGE) analysis to compare the expression levels of genes and transcripts between two or more situations (i.e., comparison groups). DGE has been crucial in cancer research for analysing biological function, etiology, and biomarker development.

The promoter analysis category is anticipated to grow the fastest. It is essential for understanding the regulation of gene expression and figuring out the main variables that control gene activity. The computer study's first phase, which predicts regulatory variables, is promoter identification. This is a relatively straightforward issue in lower eukaryotes because of the relatively high gene density in comparison to genome size.

Regional Frontrunners

North America Represents the Lion’s Share

North America is expected to lead the gene expression market during the forecast period. Rising funding and expanding R&D efforts, particularly in the US, are responsible for this expansion of the gene therapy market. Additionally, the market for gene expression analysis is expanding in North America due to elements such as the rising importance of gene expression studies, government initiatives, and the availability of financing for NGS research.

The market in the area is expanding on the back of the increasing financing for next-generation sequencing from research institutions, businesses, and universities. For instance, the Department of Health and Human Services announced funding in August 2022 for novel studies and research on structural congenital disabilities using human translational/clinical approaches (genomics, metabolomics, proteomics, etc.) and animal models.

Asia Pacific to Take a Sprint Through 2030

Asia Pacific is expected to be the fastest-growing gene expression market region. Due to rising R&D investments and the vast populations in nations like China, and India, which offer individualised and cutting-edge healthcare.

Several services and goods linked to gene expression analysis, RNA sequencing, and expression microarrays are offered by key businesses. Japan is a significant market for gene expression analysis, too. The nation's top universities, cutting-edge research facilities, and well-established biotech industry are driving the market's expansion.

Fairfield’s Competitive Landscape Analysis

The gene expression market, which is highly competitive, has several well-known manufacturers. Big corporations are expanding their distribution networks, introducing new products, and taking other measures to increase their market share globally. According to Fairfield Market Research, additional market consolidation is also anticipated in the upcoming years.

Who are the Leaders in the Global Gene Expression Space?

- Illumina, Inc.

- PerkinElmer, Inc.

- Bio-Rad Laboratories

- Thermo Fisher Scientific, Inc.

- Catalent Inc.

- QIAGEN

- Quest Diagnostics, Inc.

- Hoffmann-La Roche Ltd

- Agilent Technologies

- GE Healthcare

- Promega Corp.

- Luminex Corp.

- Takara Bio, Inc.

- Danaher Corp.

- Oxford Nanopore Technologies

Key Company Developments

New Product Launches

- August 2023: The MinION MK1C, a new sequencer designed to be more reasonably priced and available to researchers, has been launched, according to an announcement from Oxford Nanopore Technologies. Gene expression analysis and RNA and DNA sequencing can both be done using the MinION MK1C.

- January 2023: The bioinformatics division of QIAGEN, QIAGEN Digital Insights (QDI), has just launched the QIAGEN CLC Genomics Workbench Premium, which eliminates the data-analysis bottleneck of next-generation sequencing. By incorporating high analysis speed into the analysis and interpretation of the whole exome sequencing (WES), whole genome sequencing (WGS), and large panel sequencing data, the bottleneck of the NGS data analysis is provided.

- November 2022: Singleton Biotechnologies, a pioneer in the creation of single-cell sequencing analysis systems, has expanded access to sophisticated high-throughput single-cell multimodal analysis with the launch of the ProMoSCOPE kit.

Distribution Agreements

- August 2023: A new distribution arrangement for Qiagen's GeneGlobe gene expression analysis platform was announced by Qiagen and Thermo Fisher Scientific. In accordance with the conditions of the agreement, Thermo Fisher Scientific will make the GeneGlobe platform available to its international clientele.

- June 2022: A new distribution agreement between 10x Genomics and QIAGEN was announced. In accordance with the terms of the agreement, QIAGEN will provide its global clientele with single-cell gene expression sequencing products from 10x Genomics.

An Expert’s Eye

Demand and Future Growth

Developing nations are making investments to improve their healthcare systems and services. A better knowledge of diseases, the development of diagnostics, and the customisation of treatments are all made possible through gene expression analysis.

Furthermore, research efforts in oncology have expanded due to the rising incidence of cancer in developing economies. The diagnosis, categorisation, and choice of cancer treatment all depend on gene expression analyses. However, the gene expression market is expected to face considerable challenges because of the high cost of advanced technologies.

Supply Side of the Market

According to our analysis, North America has the largest market for products and services related to gene expression, accounting for more than 40% of global sales. This is a result of several significant and well-known companies operating nearby, including Illumina, Thermo Fisher Scientific, and Qiagen. These companies offer a wide range of products and services for gene expression research, including NGS systems, microarrays, qPCR, and single-cell gene expression analysis.

Boasting a market share of more than 30%, Europe is the second-largest market for gene expression products and services. Small and medium-sized businesses (SMEs) and huge international corporations both make up the European market.

The US is the largest country in the North American gene expression market, with a consumption share of over 30%. Other key countries in this market include Canada, and Mexico. This is due to the presence of several large and well-funded research institutions and pharmaceutical companies in the region. These institutions and companies are investing heavily in gene expression research and are using gene expression analysis to develop new drugs and diagnostics.

Global Gene Expression Market is Segmented as Below:

By Process:

- Sample Collection

- Purification

- cDNA synthesis & conversion

- PCR Analysis

- Data analysis & interpretation

By Product:

- Kits & Reagents

- DNA Chips

- Others

By Capacity:

- Low- to Mid-Plex

- High-Plex

By Application:

- Drug Discovery & Development

- Clinical Diagnostics

- Biotech & Microbiology

- Others

By Technique:

- RNA Expression

- Promoter Analysis

- Posttranslational Modification Analysis

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Gene Expression Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Gene Expression Market Outlook, 2018 - 2030

3.1. Global Gene Expression Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Sample Collection

3.1.1.2. Purification

3.1.1.3. cDNA synthesis & conversion

3.1.1.4. PCR Analysis

3.1.1.5. Data analysis & interpretation

3.2. Global Gene Expression Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Kits & Reagents

3.2.1.2. DNA Chips

3.2.1.3. Others

3.3. Global Gene Expression Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Low- to Mid-Plex

3.3.1.2. High-Plex

3.4. Global Gene Expression Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Drug Discovery & Development

3.4.1.2. Clinical Diagnostics

3.4.1.3. Biotech & Microbiology

3.4.1.4. Others

3.5. Global Gene Expression Market Outlook, by Technique, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights Snacks

3.5.1.1. RNA Expression

3.5.1.2. Promoter Analysis

3.5.1.3. Posttranslational Modification Analysis

3.6. Global Gene Expression Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America Gene Expression Market Outlook, 2018 - 2030

4.1. North America Gene Expression Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Sample Collection

4.1.1.2. Purification

4.1.1.3. cDNA synthesis & conversion

4.1.1.4. PCR Analysis

4.1.1.5. Data analysis & interpretation

4.2. North America Gene Expression Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Kits & Reagents

4.2.1.2. DNA Chips

4.2.1.3. Others

4.3. North America Gene Expression Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Low- to Mid-Plex

4.3.1.2. High-Plex

4.4. North America Gene Expression Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Drug Discovery & Development

4.4.1.2. Clinical Diagnostics

4.4.1.3. Biotech & Microbiology

4.4.1.4. Others

4.5. Global Gene Expression Market Outlook, by Technique, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights Snacks

4.5.1.1. RNA Expression

4.5.1.2. Promoter Analysis

4.5.1.3. Posttranslational Modification Analysis

4.5.2. BPS Analysis/Market Attractiveness Analysis

4.6. North America Gene Expression Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.6.1. Key Highlights

4.6.1.1. U.S. Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

4.6.1.2. U.S. Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

4.6.1.3. U.S. Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

4.6.1.4. U.S. Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

4.6.1.5. U.S. Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

4.6.1.6. Canada Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

4.6.1.7. Canada Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

4.6.1.8. Canada Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

4.6.1.9. Canada Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

4.6.1.10. Canada Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Gene Expression Market Outlook, 2018 - 2030

5.1. Europe Gene Expression Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Sample Collection

5.1.1.2. Purification

5.1.1.3. cDNA synthesis & conversion

5.1.1.4. PCR Analysis

5.1.1.5. Data analysis & interpretation

5.2. Europe Gene Expression Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Kits & Reagents

5.2.1.2. DNA Chips

5.2.1.3. Others

5.3. Europe Gene Expression Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Low- to Mid-Plex

5.3.1.2. High-Plex

5.4. Europe Gene Expression Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Drug Discovery & Development

5.4.1.2. Clinical Diagnostics

5.4.1.3. Biotech & Microbiology

5.4.1.4. Others

5.5. Global Gene Expression Market Outlook, by Technique, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights Snacks

5.5.1.1. RNA Expression

5.5.1.2. Promoter Analysis

5.5.1.3. Posttranslational Modification Analysis

5.5.2. BPS Analysis/Market Attractiveness Analysis

5.6. Europe Gene Expression Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.6.1. Key Highlights

5.6.1.1. Germany Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

5.6.1.2. Germany Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

5.6.1.3. Germany Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

5.6.1.4. Germany Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

5.6.1.5. Germany Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

5.6.1.6. U.K. Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

5.6.1.7. U.K. Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

5.6.1.8. U.K. Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

5.6.1.9. U.K. Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

5.6.1.10. U.K. Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

5.6.1.11. France Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

5.6.1.12. France Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

5.6.1.13. France Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

5.6.1.14. France Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

5.6.1.15. France Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

5.6.1.16. Italy Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

5.6.1.17. Italy Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

5.6.1.18. Italy Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

5.6.1.19. Italy Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

5.6.1.20. Italy Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

5.6.1.21. Turkey Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

5.6.1.22. Turkey Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

5.6.1.23. Turkey Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

5.6.1.24. Turkey Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

5.6.1.25. Turkey Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

5.6.1.26. Russia Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

5.6.1.27. Russia Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

5.6.1.28. Russia Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

5.6.1.29. Russia Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

5.6.1.30. Russia Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

5.6.1.31. Rest of Europe Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

5.6.1.32. Rest of Europe Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

5.6.1.33. Rest of Europe Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

5.6.1.34. Rest of Europe Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

5.6.1.35. Rest of Europe Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Gene Expression Market Outlook, 2018 - 2030

6.1. Asia Pacific Gene Expression Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Sample Collection

6.1.1.2. Purification

6.1.1.3. cDNA synthesis & conversion

6.1.1.4. PCR Analysis

6.1.1.5. Data analysis & interpretation

6.2. Asia Pacific Gene Expression Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Kits & Reagents

6.2.1.2. DNA Chips

6.2.1.3. Others

6.3. Asia Pacific Gene Expression Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Low- to Mid-Plex

6.3.1.2. High-Plex

6.4. Asia Pacific Gene Expression Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Drug Discovery & Development

6.4.1.2. Clinical Diagnostics

6.4.1.3. Biotech & Microbiology

6.4.1.4. Others

6.5. Global Gene Expression Market Outlook, by Technique, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights Snacks

6.5.1.1. RNA Expression

6.5.1.2. Promoter Analysis

6.5.1.3. Posttranslational Modification Analysis

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Asia Pacific Gene Expression Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.6.1. Key Highlights

6.6.1.1. China Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

6.6.1.2. China Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

6.6.1.3. China Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

6.6.1.4. China Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

6.6.1.5. China Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

6.6.1.6. Japan Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

6.6.1.7. Japan Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

6.6.1.8. Japan Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

6.6.1.9. Japan Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

6.6.1.10. Japan Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

6.6.1.11. South Korea Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

6.6.1.12. South Korea Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

6.6.1.13. South Korea Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

6.6.1.14. South Korea Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

6.6.1.15. South Korea Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

6.6.1.16. India Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

6.6.1.17. India Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

6.6.1.18. India Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

6.6.1.19. India Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

6.6.1.20. India Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

6.6.1.21. Southeast Asia Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

6.6.1.22. Southeast Asia Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

6.6.1.23. Southeast Asia Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

6.6.1.24. Southeast Asia Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

6.6.1.25. Southeast Asia Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

6.6.1.26. Rest of Asia Pacific Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

6.6.1.27. Rest of Asia Pacific Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

6.6.1.28. Rest of Asia Pacific Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

6.6.1.29. Rest of Asia Pacific Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

6.6.1.30. Rest of Asia Pacific Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Gene Expression Market Outlook, 2018 - 2030

7.1. Latin America Gene Expression Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Sample Collection

7.1.1.2. Purification

7.1.1.3. cDNA synthesis & conversion

7.1.1.4. PCR Analysis

7.1.1.5. Data analysis & interpretation

7.2. Latin America Gene Expression Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Kits & Reagents

7.2.1.2. DNA Chips

7.2.1.3. Others

7.3. Latin America Gene Expression Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Low- to Mid-Plex

7.3.1.2. High-Plex

7.4. Latin America Gene Expression Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Drug Discovery & Development

7.4.1.2. Clinical Diagnostics

7.4.1.3. Biotech & Microbiology

7.4.1.4. Others

7.5. Global Gene Expression Market Outlook, by Technique, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights Snacks

7.5.1.1. RNA Expression

7.5.1.2. Promoter Analysis

7.5.1.3. Posttranslational Modification Analysis

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Latin America Gene Expression Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.6.1. Key Highlights

7.6.1.1. Brazil Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

7.6.1.2. Brazil Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

7.6.1.3. Brazil Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

7.6.1.4. Brazil Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

7.6.1.5. Brazil Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

7.6.1.6. Mexico Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

7.6.1.7. Mexico Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

7.6.1.8. Mexico Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

7.6.1.9. Mexico Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

7.6.1.10. Mexico Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

7.6.1.11. Argentina Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

7.6.1.12. Argentina Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

7.6.1.13. Argentina Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

7.6.1.14. Argentina Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

7.6.1.15. Argentina Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

7.6.1.16. Rest of Latin America Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

7.6.1.17. Rest of Latin America Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

7.6.1.18. Rest of Latin America Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

7.6.1.19. Rest of Latin America Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

7.6.1.20. Rest of Latin America Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Gene Expression Market Outlook, 2018 - 2030

8.1. Middle East & Africa Gene Expression Market Outlook, by Process, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Sample Collection

8.1.1.2. Purification

8.1.1.3. cDNA synthesis & conversion

8.1.1.4. PCR Analysis

8.1.1.5. Data analysis & interpretation

8.2. Middle East & Africa Gene Expression Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Kits & Reagents

8.2.1.2. DNA Chips

8.2.1.3. Others

8.3. Middle East & Africa Gene Expression Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Low- to Mid-Plex

8.3.1.2. High-Plex

8.4. Middle East & Africa Gene Expression Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Drug Discovery & Development

8.4.1.2. Clinical Diagnostics

8.4.1.3. Biotech & Microbiology

8.4.1.4. Others

8.5. Global Gene Expression Market Outlook, by Technique, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights Snacks

8.5.1.1. RNA Expression

8.5.1.2. Promoter Analysis

8.5.1.3. Posttranslational Modification Analysis

8.5.2. BPS Analysis/Market Attractiveness Analysis

8.6. Middle East & Africa Gene Expression Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.6.1. Key Highlights

8.6.1.1. GCC Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

8.6.1.2. GCC Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

8.6.1.3. GCC Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

8.6.1.4. GCC Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

8.6.1.5. GCC Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

8.6.1.6. South Africa Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

8.6.1.7. South Africa Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

8.6.1.8. South Africa Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

8.6.1.9. South Africa Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

8.6.1.10. South Africa Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

8.6.1.11. Egypt Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

8.6.1.12. Egypt Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

8.6.1.13. Egypt Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

8.6.1.14. Egypt Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

8.6.1.15. Egypt Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

8.6.1.16. Nigeria Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

8.6.1.17. Nigeria Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

8.6.1.18. Nigeria Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

8.6.1.19. Nigeria Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

8.6.1.20. Nigeria Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

8.6.1.21. Rest of Middle East & Africa Gene Expression Market by Process, Value (US$ Bn), 2018 - 2030

8.6.1.22. Rest of Middle East & Africa Gene Expression Market, by Product, Value (US$ Bn), 2018 - 2030

8.6.1.23. Rest of Middle East & Africa Gene Expression Market, by Capacity, Value (US$ Bn), 2018 - 2030

8.6.1.24. Rest of Middle East & Africa Gene Expression Market, by Application, Value (US$ Bn), 2018 - 2030

8.6.1.25. Rest of Middle East & Africa Gene Expression Market, by Technique, Value (US$ Bn), 2018 - 2030

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Illumina, Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. PerkinElmer, Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Bio-Rad Laboratories

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Thermo Fisher Scientific, Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Catalent Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. QIAGEN

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Quest Diagnostics, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. F. Hoffmann-La Roche Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Agilent Technologies

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. GE Healthcare

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Promega Corp.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Luminex Corp.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Takara Bio, Inc.

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Danaher Corp.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Oxford Nanopore Technologies

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Process Coverage |

|

|

Product Coverage |

|

|

Capacity Coverage |

|

|

Application Coverage |

|

|

Technique Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |