Geophysical Services Market Growth and Industry Forecast

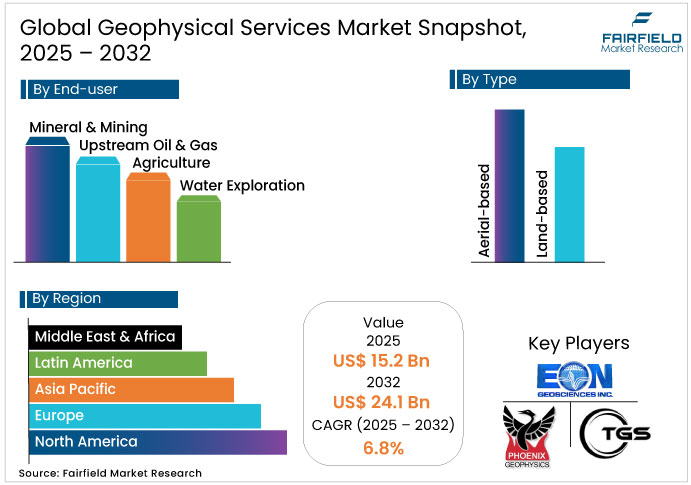

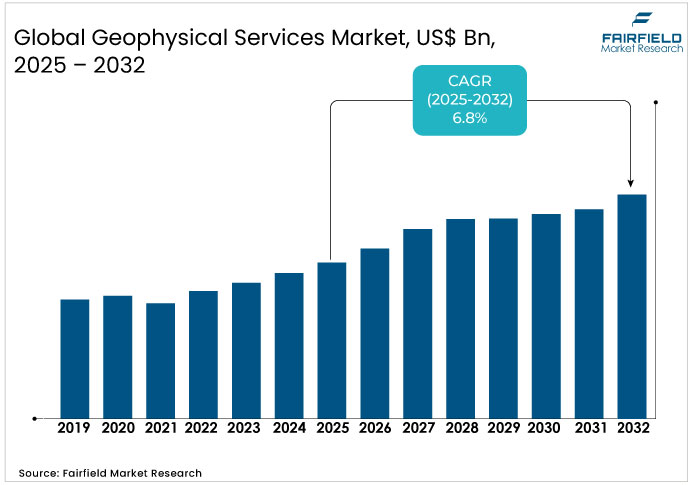

The Geophysical Services Market is valued at USD 15.2 billion in 2025 and is projected to reach USD 24.1 billion, growing at a CAGR of 6.8% by 2032.

Geophysical Services Market Summary: Key Insights & Trends

- Furnace black dominates the market with over 65% share, driven by its widespread use in tires and plastics.

- Specialty carbon black is the fastest-rising segment, expanding its share in coatings, batteries, and conductive polymers.

- The tire industry leads demand with more than 70% share, as carbon black remains essential in reinforcement.

- Conductive and battery applications are gaining share, creating new opportunities in energy storage and advanced electronics.

- Asia Pacific commands the market with over 45% share, anchored by China and India’s tire industries.

- North America is increasing its share of specialty carbon black, supported by electronics and clean energy growth.

- Recovered carbon black is steadily gaining share, fueled by recycling initiatives and circular economy adoption.

- Leading players collectively hold a dominant share through integrated production and global distribution networks.

Key Growth Drivers

- Growing energy exploration boosts adoption of advanced subsurface intelligence solutions

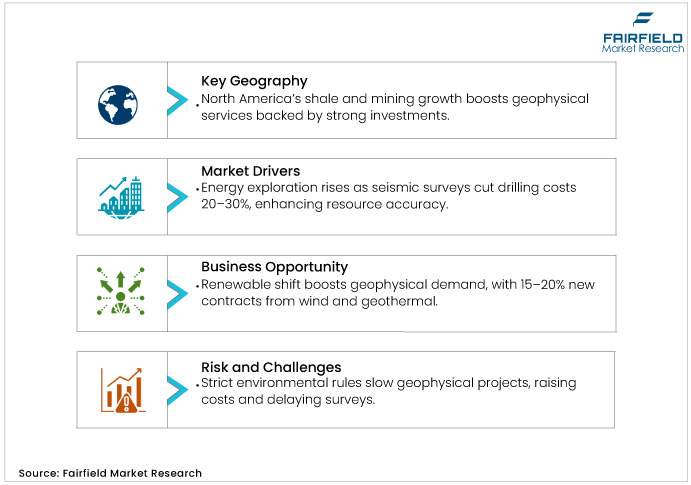

Exploration activities in the energy sector fundamentally drive as operators seek precise subsurface data to mitigate risks in resource extraction. Theoretical frameworks in geophysics emphasize how seismic and electromagnetic surveys enable non-invasive profiling, reducing exploratory drilling costs by up to 20-30% through targeted site selection. This aligns with global energy security imperatives, where governments prioritize domestic production to counter supply volatility.

In practice, upstream oil and gas firms integrate these services into decision-making pipelines, leveraging multi-client data libraries for scalable insights. The shift toward integrated basin modeling further amplifies adoption, as it combines geophysical inputs with geological simulations for holistic reservoir characterization.

- Growing Mineral Investments Fuel Demand for Geophysical Services in Mining Exploration

Investments in mineral exploration propel the geophysical services market by addressing raw material shortages for clean energy technologies, such as batteries and renewables. Grounded in resource economics theory, geophysical methods such as gravity and magnetic surveys optimize concession evaluations, minimizing environmental footprints while maximizing yield probabilities. Industry associations highlight how these tools support sustainable mining practices, aligning with circular economy principles that recycle geophysical data across project lifecycles.

Emerging applications in critical minerals—lithium, cobalt, and rare earths—underscore this trend, as explorers use hyperspectral imaging to delineate deposits with higher accuracy. This driver not only expands service demand but also encourages innovation in data analytics, where machine learning refines interpretations for faster permitting. By bridging geological uncertainty with investment confidence, geophysical services become indispensable for scaling supply chains in a decarbonizing world.

Key Restraints

- Strict environmental rules create delays and increase operational complexity worldwide

Stringent environmental regulations pose a significant restraint on the geophysical services market, as compliance requirements escalate operational complexities and timelines. Theories of regulatory economics illustrate how permitting delays—often exceeding six months for seismic surveys—erode project economics, particularly in sensitive ecosystems. Providers must navigate biodiversity offsets and emission caps, diverting resources from core innovations. This challenge disproportionately affects land-based operations, where stakeholder consultations add layers of scrutiny. Overall, these hurdles constrain market fluidity, compelling firms to invest in green certifications that inflate upfront costs without immediate returns.

- Expensive technologies and labor shortages restrict new entrants and innovation

The capital-intensive nature of geophysical equipment restrains market entry and scalability within the geophysical services market. Economic barrier models highlight how acquisition costs for advanced tools such as ground-penetrating radar exceed millions, sidelining SMEs from competitive bidding. Maintenance and skilled labor shortages compound this, as rapid tech obsolescence demands continuous upgrades. In volatile sectors such as mining, these factors amplify financial risks, leading to deferred surveys and fragmented service delivery. Consequently, consolidation trends emerge, limiting diversity and innovation at the fringes.

Geophysical Services Market Trends and Opportunities

- Renewable energy transition opens new avenues for advanced subsurface mapping

The geophysical services industry harbors substantial opportunities in renewable energy, where geophysical techniques map geothermal reservoirs and offshore wind sites with unprecedented precision. Transition theories in energy economics posit that as nations target net-zero emissions, demand for non-fossil surveys will surge, potentially capturing 15-20% of new service contracts by 2030. For instance, electromagnetic methods delineate subsurface heat flows, optimizing turbine placements and reducing exploratory failures.

Government subsidies for green infrastructure further catalyze this, as seen in EU directives mandating geophysical assessments for renewable bids. Providers can leverage multi-purpose data platforms to serve hybrid projects, blending oil/gas legacies with clean tech. This pivot not only diversifies revenue but also aligns with ESG imperatives, positioning early adopters as sustainability leaders in a US$1 trillion transition market. Strategic partnerships with energy majors will unlock these avenues, emphasizing scalable, low-emission survey protocols.

- Infrastructure expansion boosts demand for groundwater and land assessment technologies

Infrastructure booms in developing regions offer ripe opportunities for the Geophysical Services Market, particularly in groundwater exploration and urban planning. Development economics theory underscores how geophysical resistivity surveys mitigate water scarcity risks, supporting megaprojects such as smart cities. With global urbanization projected to add 2.5 billion residents by 2050, demand for site characterization will escalate, favoring aerial and LIDAR integrations for rapid assessments.

Policy incentives, such as India's National Water Mission, prioritize these services, fostering public-private collaborations. Providers can capitalize by developing localized models that incorporate cultural and topographic nuances, enhancing accuracy in diverse terrains. This opportunity extends to agriculture, where hyperspectral data informs precision farming, boosting yields amid climate pressures. By prioritizing capacity-building in local talent, firms can secure long-term footholds, transforming geophysical insights into tangible socioeconomic value.

Segment-wise Trends & Analysis

- Drone integration and AI tools strengthen aerial-based survey capabilities worldwide

Aerial-based surveys command leadership by capturing over 60% share in 2025 valued at approximately USD 9.1 billion. This dominance stems from their efficiency in covering expansive, inaccessible terrains, integral to initial reconnaissance phases. Fixed-wing and helicopter platforms deliver high-resolution datasets, reducing logistical hurdles compared to ground alternatives.

Growth trajectories for aerial-based services with sustainable CAGR through 2032, driven by drone integrations and AI-enhanced processing that amplify data throughput. Underlying factors include regulatory easing for unmanned operations and rising needs in environmental monitoring. Competitively, incumbents such as Fugro position through fleet modernizations, outpacing land-focused rivals in scalability.

- End-user diversification reshapes industry priorities across traditional and emerging sectors

Upstream oil and gas leads the geophysical services market end-users with over 45% share in 2025, equating to USD 6.8 billion, fueled by persistent E&P demands. Seismic integrations here optimize well placements, underpinning 70% of global drilling decisions.

Mineral and mining emerge as fast-growing, propelled by critical mineral hunts for EVs. Drivers encompass supply chain diversification and ESG mandates. Competitors differentiate via hyperspectral offerings, capturing niche premiums while challenging oil/gas hegemony through cross-segment data reuse.

- Electromagnetic approaches gain traction in mineral and geothermal exploration needs

Seismic technology dominates the geophysical services market at over 30% share in 2025, worth USD 4.6 billion, due to its reliability in hydrocarbon delineation. 3D/4D variants enable time-lapse monitoring, essential for mature fields.

Electromagnetic methods are gaining momentum as an emerging approach, driven by expanding applications in mineral and geothermal exploration. Innovations in broadband EM systems drive this, addressing blind spots in conductive terrains. Positioning-wise, seismic leaders such as PGS fortify via nodal tech, while EM upstarts gain via cost-effective airborne deployments, reshaping hybrid workflows.

Regional Trends & Analysis

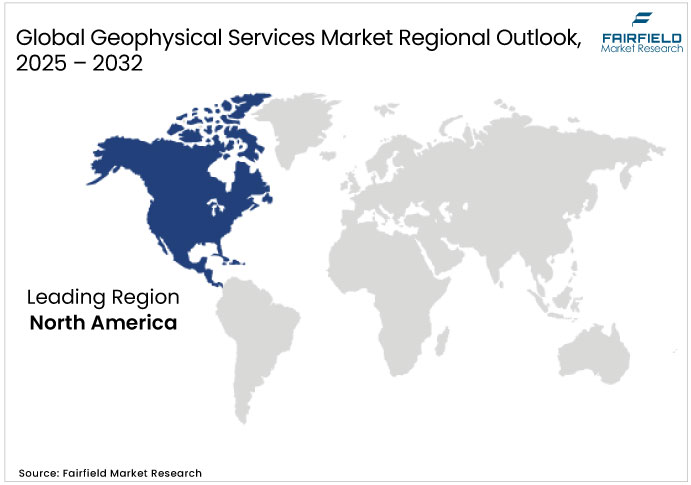

North America strengthened by shale activity and mining expansion, with steady flows

North America's geophysical services sector is buoyed by robust activity in shale gas exploits, mineral and mining expansion, and resilient investment flows. The prevalence of land-based and seismic survey modalities aligns with the region’s advanced resource management prerequisites, proactive regulatory oversight, and sophisticated analytical infrastructure.

U.S. Geophysical Services Market – 2025 Snapshot & Outlook

The U.S. market commands above 35% share in 2025, driven by major basin surveys in Oakland, Houston, Seattle, and Florida. The country’s leadership is underpinned by premium pricing for high-quality seismic data, agile adoption of digital analysis platforms, and strong governmental incentives for domestic exploration. Consumer trends reveal a marked preference for multi-client seismic reports; recent regulator surveys highlight a 20% year-on-year increase in demand for rapid, multi-modal data delivery. Supportive tax policies and expedited permitting procedures further accentuate the U.S. market’s competitive position.

Latin America advances through mineral diversification and oil basin development

Latin America's market is advancing through diversified mineral exploration and strategic oil basin development. Brazil and Chile stand out for targeted policy frameworks and innovation in survey techniques, which foster competitive advantages for early adopters.

Brazil Geophysical Services Market – 2025 Snapshot & Outlook

Brazil is leveraging supportive federal investment programs and innovation grants to accelerate geophysical survey deployments in pre-salt and onshore reserves. Policy-driven expansion has resulted in a 15% reduction in project procurement lead times since 2023. Trends indicate that Brazilian operators increasingly use aerial-based survey platforms to address vast, inaccessible regions, with industry data reporting a 25% increase in operational coverage year-on-year, supported by government-backed digital transformation initiatives.

Chile Geophysical Services Market – 2025 Snapshot & Outlook

Chile’s geophysical services landscape is shaped by copper and lithium mining expansion, environmental stewardship, and enhanced grid connectivity. Regulatory mandates require robust geophysical documentation for new resource concessions, prompting 30% more companies to invest in advanced electromagnetic and hyperspectral surveys compared to 2022. National mineral agency surveys reveal mounting consumer interest in sustainability-aligned, low-impact survey modalities—spurring both revenue and reputational benefits for operators.

Asia Pacific emerges fastest growing with mineral and energy discovery programs

Asia Pacific, the fastest-growing region, is catalyzed by large-scale mineral, oil, and gas discovery programs, especially in China, India, and Southeast Asia. Government infrastructure investments and modernization agendas drive segment momentum, with robust demand for advanced geophysical analytics and data services.

China Geophysical Services Market – 2025 Snapshot & Outlook

China leads regional market growth, focusing chiefly on scaling mineral and strategic oil exploration activities. National subsidies for emerging geophysical technologies and aggressive commercialization of multi-client survey projects have increased market penetration by 20% annually since 2022. Survey data highlight a notable consumer trend: over 50% of resource enterprises are shifting toward aerial-based modalities to secure operational efficiencies and expedited approvals.

India Geophysical Services Market – 2025 Snapshot & Outlook

India is championing expansion in water exploration and mineral mining, supported by regulatory streamlining and capacity enhancement initiatives. The pivot to land-based, ground-penetrating radar surveys is especially prominent in agricultural and urban water resource planning projects. Industry agency data indicate that multi-sector demand in India is growing at a sustainable CAGR, fueled by government mandates for detailed geophysical evaluations in public and private infrastructure projects. Consumer surveys illustrate increasing reliance on integrated, multi-modal data delivery for strategic decision-making.

Competitive Landscape Analysis

The players in the Geophysical Services Market are focusing on technological integrations to enhance data accuracy and operational efficiency. This strategy counters rising exploration complexities, as evidenced by a 2023 SEG conference where 40% of sessions addressed AI-geophysics hybrids. Firms pursue R&D alliances to scale hyperspectral capabilities, responding to mineral demand spikes that increased project bids by 22% per industry trackers. Such moves secure first-mover advantages in emerging segments such as water exploration.

Regulatory shifts and supply chain consolidations will impact costs and capacity in the market. Stricter ESG norms, such as those from the IFC, mandate emission audits, potentially hiking compliance expenses by 10-15%. Meanwhile, M&A activity, including recent consolidations in seismic fleets, expands coverage but strains capex. Early movers will benefit from proprietary datasets, while latecomers may face premium pricing pressures.

Key Companies

- TGS

- EON Geosciences

- Phoenix Geophysics

- New Resolution Geophysics

- SEA GEO SURVEYS PVT LTD

- Compagnie Générale de Géophysique (CGG)

- Dawson Geophysical Inc.

- GEOTEC SURVEYS

- Spectrum Geophysics

- GSSI Geophysical Survey Systems, Inc.

Recent Developments:

- September 2025, TGS has launched its Amendment West-1 multi-client OBN survey in the Gulf of America, covering 5,400 sq km in the Paleogene West play. The project, deploying Gemini™ sources and ZXPLRe™ nodes, aims to enhance seismic clarity using advanced imaging technologies, with data delivery expected in Q2 2026

- September 2025, Fission Uranium 3.0 has received 6.05 million shares of Traction Uranium Corp. as part of their JV agreement for the Hearty Bay and Lazy Edward projects in Saskatchewan’s Athabasca Basin. The Hearty Bay property, notable for historic radioactive boulder discoveries, is being advanced with exploration targeting potential uranium sources.

- July 2025, USGS is mapping the Atlantic Seaboard Fall Line to identify domestic sources of critical minerals such as titanium and improve earthquake hazard assessments. The project aims to boost U.S. self-reliance in vital resources while enhancing public safety and resilience across the Southeast.

Global Geophysical Services Market Segmentation-

By Type Coverage

- Aerial-based

- Land-based

By End-user Coverage

- Mineral & Mining

- Upstream Oil & Gas

- Agriculture

- Water Exploration

- Others

By Technology Coverage

- Magnetic

- Gradiometry

- Gravity

- Electromagnetic

- LIDAR

- Hyperspectral

- Ground Penetrating Radar

- Resistivity

- Seismic

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Geophysical Services Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact

2.5.1. Supply Chain

2.5.2. Technology Customer Impact Analysis

3. Price Trends Analysis

4. Global Geophysical Services Market Outlook, 2019 - 2032

4.1. Global Geophysical Services Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Aerial-based

4.1.1.2. Land-based

4.1.2. BPS Analysis/Market Attractiveness Analysis, by Type

4.2. Global Geophysical Services Market Outlook, by End-user, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Mineral & Mining

4.2.1.2. Upstream Oil & Gas

4.2.1.3. Agriculture

4.2.1.4. Water Exploration

4.2.1.5. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis, by End-user

4.3. Global Geophysical Services Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Magnetic

4.3.1.2. Gradiometry

4.3.1.3. Gravity

4.3.1.4. Electromagnetic

4.3.1.5. LIDAR

4.3.1.6. Hyperspectral

4.3.1.7. Ground Penetrating Radar

4.3.1.8. Resistivity

4.3.1.9. Seismic

4.3.1.10. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis, by Technology

4.4. Global Geophysical Services Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

4.4.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Geophysical Services Market Outlook, 2019 - 2032

5.1. North America Geophysical Services Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Aerial-based

5.1.1.2. Land-based

5.2. North America Geophysical Services Market Outlook, by End-user, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Mineral & Mining

5.2.1.2. Upstream Oil & Gas

5.2.1.3. Agriculture

5.2.1.4. Water Exploration

5.2.1.5. Others

5.3. North America Geophysical Services Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Magnetic

5.3.1.2. Gradiometry

5.3.1.3. Gravity

5.3.1.4. Electromagnetic

5.3.1.5. LIDAR

5.3.1.6. Hyperspectral

5.3.1.7. Ground Penetrating Radar

5.3.1.8. Resistivity

5.3.1.9. Seismic

5.3.1.10. Others

5.4. North America Geophysical Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. U.S. Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

5.4.1.2. Canada Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

6. Europe Geophysical Services Market Outlook, 2019 - 2032

6.1. Europe Geophysical Services Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Aerial-based

6.1.1.2. Land-based

6.2. Europe Geophysical Services Market Outlook, by End-user, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Mineral & Mining

6.2.1.2. Upstream Oil & Gas

6.2.1.3. Agriculture

6.2.1.4. Water Exploration

6.2.1.5. Others

6.3. Europe Geophysical Services Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Magnetic

6.3.1.2. Gradiometry

6.3.1.3. Gravity

6.3.1.4. Electromagnetic

6.3.1.5. LIDAR

6.3.1.6. Hyperspectral

6.3.1.7. Ground Penetrating Radar

6.3.1.8. Resistivity

6.3.1.9. Seismic

6.3.1.10. Others

6.4. Europe Geophysical Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Germany Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

6.4.1.2. U.K. Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

6.4.1.3. France Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

6.4.1.4. Russia & CIS Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

6.4.1.5. Rest of Europe Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

7. Asia Pacific Geophysical Services Market Outlook, 2019 - 2032

7.1. Asia Pacific Geophysical Services Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Aerial-based

7.1.1.2. Land-based

7.2. Asia Pacific Geophysical Services Market Outlook, by End-user, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Mineral & Mining

7.2.1.2. Upstream Oil & Gas

7.2.1.3. Agriculture

7.2.1.4. Water Exploration

7.2.1.5. Others

7.3. Asia Pacific Geophysical Services Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Magnetic

7.3.1.2. Gradiometry

7.3.1.3. Gravity

7.3.1.4. Electromagnetic

7.3.1.5. LIDAR

7.3.1.6. Hyperspectral

7.3.1.7. Ground Penetrating Radar

7.3.1.8. Resistivity

7.3.1.9. Seismic

7.3.1.10. Others

7.4. Asia Pacific Geophysical Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. China Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

7.4.1.2. India Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

7.4.1.3. Australia Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

7.4.1.4. ASEAN Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

7.4.1.5. Rest of Asia Pacific Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

8. Latin America Geophysical Services Market Outlook, 2019 - 2032

8.1. Latin America Geophysical Services Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Aerial-based

8.1.1.2. Land-based

8.2. Latin America Geophysical Services Market Outlook, by End-user, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Mineral & Mining

8.2.1.2. Upstream Oil & Gas

8.2.1.3. Agriculture

8.2.1.4. Water Exploration

8.2.1.5. Others

8.3. Latin America Geophysical Services Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Magnetic

8.3.1.2. Gradiometry

8.3.1.3. Gravity

8.3.1.4. Electromagnetic

8.3.1.5. LIDAR

8.3.1.6. Hyperspectral

8.3.1.7. Ground Penetrating Radar

8.3.1.8. Resistivity

8.3.1.9. Seismic

8.3.1.10. Others

8.4. Latin America Geophysical Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Brazil Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

8.4.1.2. Mexico Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

8.4.1.3. Rest of Latin America Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

9. Middle East & Africa Geophysical Services Market Outlook, 2019 - 2032

9.1. Middle East & Africa Geophysical Services Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Aerial-based

9.1.1.2. Land-based

9.2. Middle East & Africa Geophysical Services Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Mineral & Mining

9.2.1.2. Upstream Oil & Gas

9.2.1.3. Agriculture

9.2.1.4. Water Exploration

9.2.1.5. Others

9.3. Middle East & Africa Geophysical Services Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Magnetic

9.3.1.2. Gradiometry

9.3.1.3. Gravity

9.3.1.4. Electromagnetic

9.3.1.5. LIDAR

9.3.1.6. Hyperspectral

9.3.1.7. Ground Penetrating Radar

9.3.1.8. Resistivity

9.3.1.9. Seismic

9.3.1.10. Others

9.4. Middle East & Africa Geophysical Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. Saudi Arabia Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

9.4.1.2. Kuwait Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

9.4.1.3. Qatar Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

9.4.1.4. South Africa Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

9.4.1.5. Rest of Middle East & Africa Geophysical Services Market, Value (US$ Bn), by Type, End-user, Technology, 2019 - 2032

10. Competitive Landscape

10.1. Company Market Share Analysis, 2021

10.2. Strategic Collaborations

10.3. Company Profiles

10.3.1. TGS

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. EON Geosciences

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Phoenix Geophysics

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. New Resolution Geophysics

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. SEA GEO SURVEYS PVT LTD

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Compagnie Générale de Géophysique (CGG)

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Dawson Geophysical Inc.

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. GEOTEC SURVEYS

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Spectrum Geophysics

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. GSSI Geophysical Survey Systems, Inc.

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2024 |

|

2019 - 2024 |

|

2025 - 2032 |

Value: US$ Billion |

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End-user Coverage |

|

|

Technology Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2018-2021), Price Trend Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |