Global Adhesives and Sealants Market Forecast

- The Adhesives and Sealants Market is valued at USD 70.4 Bn in 2026 and is projected to reach USD 95.8 Bn, growing at a CAGR of 5% by 2033

Quick Report Digest

- The key trend anticipated to fuel the adhesives and sealants market growth is an increase in the development of adhesive and sealant technologies, such as novel formulas, greater bonding properties, quicker cure periods, and improved durability, which is what propels the industry.

- Another major market trend expected to fuel the adhesives and sealants market growth is the increasing demand for adhesives and sealants in sectors such as construction, automotive, packaging, aerospace, healthcare, electronics, and consumer goods drives market growth.

- In 2022, the water-borne adhesives category dominated the industry. Due to its low volatile organic compound (VOC) content, environmental compliance, and eco-friendliness, water-borne adhesives have been gaining popularity. In many different industries, such as packaging, woodworking, and paper and packaging, water-borne adhesives are frequently preferred.

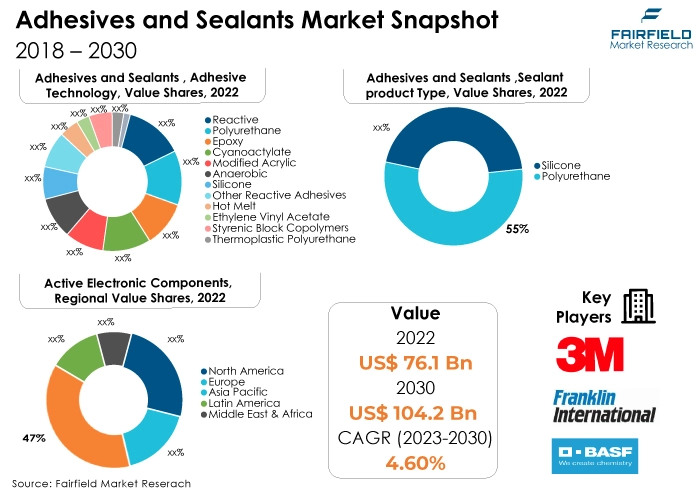

- In terms of market share for adhesives technology globally, the reactive adhesives segment is anticipated to dominate. Due to their adaptability, powerful bonding capabilities, and suitability for a variety of applications, reactive adhesives, particularly polyurethane and epoxy, have dominated the market. Epoxy adhesives are utilised in manufacturing, electronics, and aerospace, while polyurethane adhesives are frequently employed in the automotive, construction, and aerospace industries.

- In 2022, the silicone sealants category controlled the market. Due to its exceptional toughness, resistance to the elements, and adaptability, silicone sealants have maintained their leading position. Construction, automotive, aerospace, and electronics applications all often use silicone sealants.

- The solvent-borne adhesives category is highly prevalent in the market for adhesives and sealants market. Due to their extensive use, superior bonding abilities, and adaptability in a variety of applications. It's crucial to remember that the popularity of solvent-borne adhesives has been steadily waning as a result of worries about their use of volatile organic compounds (VOCs), which raises both environmental and health issues.

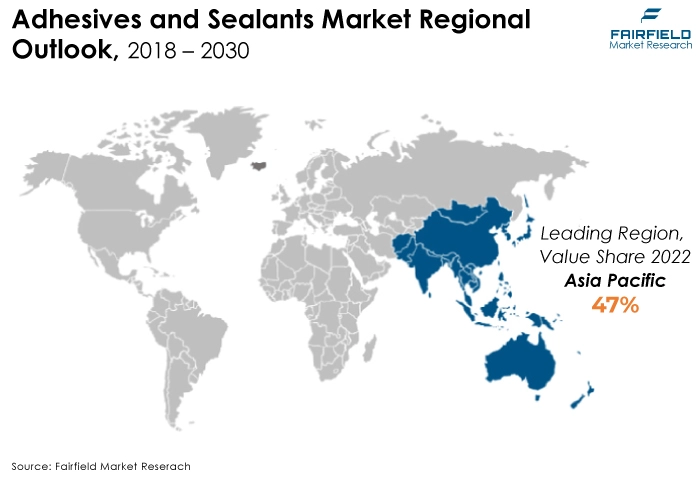

- The Asia Pacific region is anticipated to account for the largest share of the global adhesives and sealants market, owing to various technological factors such as economic conditions. The Asia Pacific region had been firmly establishing its position as the largest market across a range of industries. This standing was greatly influenced by its economic strength, size, growing urbanisation, and industrialisation. The expansion of the middle class in countries in the Asia Pacific region also increased consumer demand and fuelled the market for a wide variety of goods and services.

- The market for adhesives and sealants is expanding in North America due to the rapid economic growth and technological advancements. The steady rise in industrial and construction activities, driven by a burgeoning economy, has significantly heightened the demand for these versatile bonding solutions. Technological advancements in adhesive formulations and manufacturing processes have led to enhanced product performance, promoting their adoption across diverse industries. Innovations in eco-friendly and sustainable adhesives align with the growing focus on environmental consciousness in the region.

A Look Back and a Look Forward - Comparative Analysis

The market for adhesives and sealants has been experiencing significant growth, primarily driven by advancements in adhesives technology, such as water-borne and reactive adhesives. The market is driven by the booming construction and automotive sectors, where adhesives and sealants are critical for lightweighting, structural integrity, and enhanced performance.

Additionally, a growing emphasis on sustainability and compliance with environmental regulations is shaping product development and market strategies.

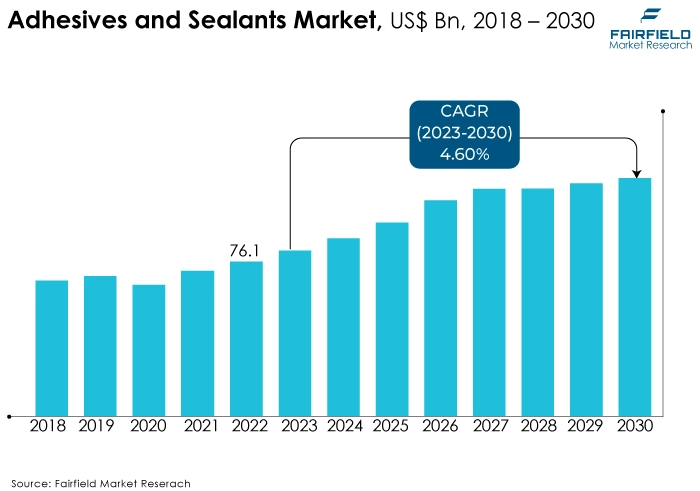

The market witnessed staggered growth during the historical period 2018 – 2022. the adhesives and sealants industry has evolved from traditional solvent-based adhesives to more environmentally friendly alternatives like water-borne, hot melt, and reactive adhesives.

Historically, solvent-based adhesives were dominant, but concerns about VOC emissions shifted the focus towards water-borne and other low-VOC adhesive technologies. The market has witnessed continuous advancements in formulations, application methods, and efficiency, aligning with changing industry requirements and consumer preferences.

The adhesives and sealants market is poised for substantial growth with a strong focus on sustainability, performance, and versatility. Future developments are expected in bio-based adhesives, smart adhesives with self-healing properties, and adhesives for advanced materials like composites and nanomaterials.

IoT integration, and rapid digitalisation in adhesive application processes for monitoring and quality control is anticipated. Moreover, increasing research and development investments will drive breakthroughs, offering adhesives and sealants with improved functionalities, higher efficiency, and enhanced environmental profiles.

Key Growth Determinants

- Increased Demand for Water-Borne Adhesives Across Industries

The global adhesives and sealants market is experiencing a substantial surge, driven primarily by the escalating demand for water-borne adhesives across diverse industries. Water-borne adhesives, known for their eco-friendly nature and low volatile organic compound (VOC) content, have become a preferred choice for various applications.

Industries such as packaging, construction, automotive, textiles, and healthcare are increasingly adopting water-borne adhesives due to stringent environmental regulations and a heightened focus on sustainability. Their versatile bonding properties, compatibility with different substrates, and excellent adhesion characteristics are fueling their popularity.

In addition, a shift towards water-borne adhesives aligns with the global efforts to reduce the carbon footprint and promote greener technologies. As a result, the market for adhesives and sealants is witnessing a significant boost, and this trend is expected to continue in the foreseeable future.

- Soaring Popularity of Silicone Sealants

The silicone sealants are poised to drive substantial market expansion within the adhesives and sealants industry. Recognised for their outstanding durability, flexibility, and resistance to extreme temperatures, UV radiation, and moisture, silicone sealants find wide-ranging applications across numerous sectors.

Industries such as construction, automotive, electronics, healthcare, and consumer goods rely on silicone sealants for sealing and bonding purposes, ensuring structural integrity and preventing leakages.

Moreover, the increasing emphasis on energy efficiency and sustainability has propelled the demand for silicone sealants, which aid in minimising energy consumption by providing effective insulation. Their versatility, longevity, and ability to adhere to a variety of substrates make them indispensable in modern construction practices and manufacturing processes.

- Technological Advancements, and Innovations

Technological advancements and continuous innovation are expected to be key drivers fuelling the growth of the adhesives and sealants market. Emerging technologies are leading to the development of novel adhesive formulations and sealant products with enhanced properties and functionalities.

Such innovations include eco-friendly and sustainable adhesive solutions, bio-based adhesives, smart adhesives with self-healing capabilities, and adhesives compatible with advanced materials like composites and nanomaterials.

In addition, advancements in application methods, curing processes, and the integration of digital technologies are streamlining the use of adhesives and sealants, making them more efficient and cost-effective. The ability to tailor adhesives and sealants to specific industry needs, such as aerospace, automotive, and electronics, is further driving their adoption.

Major Growth Barriers

- Volatile Raw Material Prices

Volatile raw material prices present a notable obstacle to the expansion of the adhesives and sealants market. Fluctuations in prices of key raw materials, such as petrochemical-based compounds, resins, and solvents, significantly impact production costs for adhesive and sealant manufacturers. These cost fluctuations can disrupt profit margins and pricing strategies, making it challenging to maintain stability and competitiveness in the market.

Moreover, sudden price hikes can strain the budgets of businesses, especially smaller manufacturers, leading to a ripple effect across the industry. The uncertainty and unpredictability associated with raw material prices create an environment where companies must constantly adjust strategies and formulations to mitigate cost impacts. Ultimately, this volatility hinders long-term planning, investments, and market expansion efforts within the adhesives and sealants sector.

- Lengthy Curing and Drying Time

Curing and drying times represent a notable hindrance to the expansion of the adhesives and sealants market. Certain adhesives and sealants require extended periods for curing or drying, leading to longer production cycles and potentially hampering operational efficiency. Industries often demand rapid processes to meet high production quotas and maintain competitiveness, making lengthy curing times a significant drawback.

Moreover, in sectors where quick assembly or repair is critical, such as automotive or electronics, prolonged curing or drying can disrupt workflow and impact overall productivity. As a result, adhesives and sealants with faster curing times or even instant-bonding capabilities are gaining traction in the market.

Key Trends and Opportunities to Look at

- Sustainability and Eco-friendly Solutions

Sustainability stands as a paramount trend in the adhesives and sealants market, dictating a shift towards eco-friendly solutions. Manufacturers are significantly investing in the development and widespread adoption of adhesives and sealants that are bio-based, water-borne, and have lower volatile organic compound (VOC) content.

Bio-based adhesives, derived from renewable sources, are gaining prominence for their reduced environmental impact. Water-borne formulations, recognised for their lower emissions and environmental sustainability, are increasingly preferred. The concerted efforts to reduce VOC content align with stringent environmental regulations and growing consumer preferences for greener, more sustainable alternatives.

Manufacturers recognise the importance of sustainable practices not only to meet regulatory requirements but also to align with corporate social responsibility and address the pressing need for environmentally conscious solutions. The future of the adhesives and sealants market is intrinsically linked to sustainability, where eco-friendly options are set to drive growth and meet the evolving needs of industries and consumers alike.

- High-Performance Adhesives for Advanced Materials

The adhesives and sealants market is experiencing a notable surge in demand for adhesives designed to effectively bond advanced materials such as composites, plastics, and nanomaterials. With industries like aerospace, automotive, and electronics constantly evolving and demanding lighter, stronger, and more efficient materials, high-performance adhesives have become crucial. These specialised adhesives offer strong bonding properties and exceptional durability, addressing the unique challenges posed by these advanced materials.

In the aerospace sector, where reducing weight without compromising structural integrity is paramount, high-performance adhesives play a critical role in bonding lightweight composites. Similarly, in the automotive industry, adhesives are indispensable for joining diverse materials, enhancing fuel efficiency, and contributing to vehicle safety.

- Adhesives for EV Manufacturing

The rapid growth of the electric vehicle (EV) market has sparked a notable demand for specialised adhesives and sealants designed to meet the unique requirements of this burgeoning industry. These specialised adhesive solutions are engineered to offer thermal conductivity, efficient electrical insulation, and lightweight properties, addressing the specific needs of EVs.

Adhesives especially play a critical role in the assembly of EV batteries, providing robust bonding for various components within the battery pack. This not only enhances the structural integrity of the battery but also ensures efficient thermal management, crucial for maintaining optimal operating temperatures.

Furthermore, adhesives contribute to the reduction of overall vehicle weight, promoting energy efficiency and extending driving range. As the electric vehicle market continues its expansion to meet sustainability goals and reduce reliance on fossil fuels, the demand for advanced adhesives and sealants will surge, underlining their importance in improving EV performance and safety.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the regulatory environment has a significant impact on how the adhesives and sealants market develops. The regulatory scenario significantly shapes the adhesives and sealants industry, influencing everything from product formulation to manufacturing processes and market competitiveness.

Governments and international bodies impose regulations to ensure product safety, environmental sustainability, and consumer protection. For instance, regulations often govern the use of volatile organic compounds (VOCs), hazardous chemicals, and emissions from adhesives and sealants. Manufacturers must comply with these regulations by producing low-VOC or VOC-free products, driving the development and adoption of eco-friendly formulations.

Additionally, regulatory standards regarding health and safety in workplaces impact production practices and necessitate adherence to specific guidelines for employee well-being. The industry also faces regulations related to labeling, packaging, transportation, and waste management. Staying compliant with these regulations is crucial for market access, maintaining consumer trust, and mitigating legal risks.

Fairfield’s Ranking Board

- Water-Borne Category Wins Preference over PVA Emulsion Segment

In the adhesives sector, the water-borne category continues to dominate over the polyvinyl acetate (PVA) emulsion category. Water-borne adhesives, known for their environmentally friendly properties, low VOC content, and compliance with stringent regulations, have garnered widespread preference across a multitude of industries. Their versatility in bonding various substrates, easy cleanup, and relatively quick curing times have made them a preferred choice for applications ranging from packaging to construction.

On the other hand, while PVA emulsion adhesives also have their merits, such as being cost-effective and versatile, they face challenges related to their relatively weaker water resistance and lower bonding strength compared to water-borne adhesives. As sustainability and environmental consciousness continue to drive industry trends, the water-borne category's dominance is expected to persist and even grow, further fuelled by ongoing advancements and innovations in water-borne adhesive technologies.

Furthermore, the PVA emulsion category is projected to experience the fastest market growth. PVA emulsions are valued for their versatility, cost-effectiveness, and eco-friendly nature, positioning them as a preferred choice across diverse applications.

PVA emulsions are being used more and more in industries including building, woodworking, packaging, paper and packaging, and glue because of their superior adhesive qualities and capacity to effectively adhere to a variety of substrates.

The need for PVA emulsions in wall coverings, laminates, and carpentry is rising due in large part to the construction industry's expansion, especially in emerging nations. Moreover, the shift towards eco-friendly and low-VOC adhesives is amplifying the appeal of PVA emulsions.

- Reactive Segment to Surge Ahead

In 2022, the reactive category dominated the industry. Reactive adhesives, including polyurethane, epoxy, cyanoacrylate, and modified acrylics, are highly versatile and offer superior bonding capabilities across diverse applications and industries. Polyurethane adhesives, known for their excellent adhesion, impact resistance, and durability, are extensively used in automotive, aerospace, and construction.

Epoxy adhesives find application in various industries due to their exceptional bonding and structural properties. Cyanoacrylate adhesives, often referred to as instant adhesives, are valued for their quick curing and strong bonding on a wide array of substrates.

The epoxy category is anticipated to grow substantially throughout the projected period. Epoxy adhesives are highly versatile and valued for their exceptional bonding properties, strength, durability, and resistance to various environmental factors. These adhesives find extensive applications across multiple industries, including aerospace, automotive, construction, electronics, and consumer goods.

In the aerospace and automotive sectors, epoxy adhesives play a critical role in lightweighting and enhancing fuel efficiency, given their ability to bond dissimilar materials efficiently. The robust demand for lightweight and high-strength materials in modern construction practices further amplifies the need for epoxy adhesives.

Additionally, the growth of the electronics industry, driven by technological advancements and the demand for compact and durable electronic devices, is expected to propel the demand for epoxy-based adhesives.

- Silicone Retains the Leading Position

The silicone segment dominated the market in 2022. Silicone-based adhesives and sealants have gained widespread favour across various industries due to their exceptional characteristics, including excellent durability, flexibility, and resistance to extreme temperatures, UV radiation, and moisture.

Industries such as construction, automotive, electronics, healthcare, and consumer goods rely heavily on silicone sealants for their versatile applications. Particularly in the construction sector, silicone sealants are indispensable for weatherproofing, sealing, and bonding, ensuring structural integrity and longevity of buildings.

The automotive industry extensively employs silicone-based adhesives and sealants in gasketing, bonding, and sealing applications, contributing to enhanced vehicle performance and safety. Moreover, the healthcare sector relies on silicone sealants for medical-grade bonding and sealing due to their biocompatibility and durability.

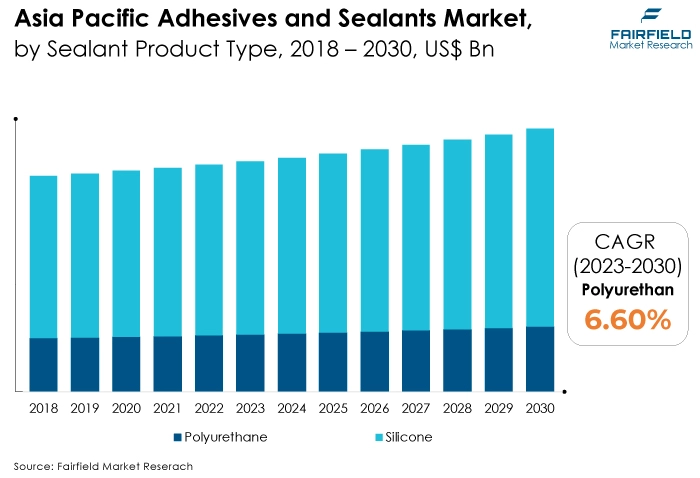

The polyurethane category is expected to experience the fastest growth within the forecast time frame. Polyurethane adhesives are highly sought after for their exceptional versatility, robust bonding capabilities, and superior performance across various applications.

Due to its superior flexibility, durability, and resistance to environmental variables, polyurethane adhesives are becoming more and more used in industries including electronics, automotive, construction, aerospace, and packaging. These adhesives are essential for lightweight vehicle designs and improved structural integrity in the automobile industry.

Furthermore, because polyurethane adhesives can survive harsh outdoor conditions and attach a broad variety of substrates, the building sector loves them. The burgeoning demand for eco-friendly and sustainable adhesive solutions has further propelled the adoption of water-borne polyurethane adhesives, contributing to the category's rapid growth.

Regional Frontrunners

The Largest Revenue Share Comes from Asia Pacific

Asia Pacific indeed continues to be a dominant and largest revenue-contributing region in the global adhesives and sealants market. This is driven by various factors, including the region's robust industrialisation, expanding manufacturing sector, rapid urbanisation, and significant economic growth.

Countries like China, Japan, India, and South Korea are major contributors to the market, boasting a thriving automotive industry, a burgeoning construction sector, and a growing demand for consumer goods. The use of adhesives and sealants is integral in these industries for applications ranging from automotive assembly, packaging, and construction bonding to consumer electronics.

Additionally, the rise in infrastructural projects and the adoption of advanced technologies further fuel the demand for adhesives and sealants in the region. As Asia Pacific continues to witness substantial economic development and industrial expansion, the demand for adhesives and sealants is expected to maintain a strong growth trajectory, solidifying the region's position as a vital player in the global market.

North America Awaits Significant Gains from Water-Borne Variants

North America is anticipated to witness significant growth in the water-borne adhesive category during the forecast period in the adhesives and sealants market. This growth is propelled by several factors, including a growing emphasis on sustainability, stringent environmental regulations, and the increasing awareness of reducing volatile organic compounds (VOCs).

Water-borne adhesives are recognised for their eco-friendly nature and low VOC content, aligning well with environmental sustainability goals. Industries in North America, such as packaging, construction, automotive, and textiles, are increasingly opting for water-borne adhesives due to their compliance with strict regulatory standards and their ability to provide strong and durable bonding.

The region's commitment to reducing its carbon footprint and adopting greener technologies further drives the adoption of water-borne adhesives. As sustainability continues to be a key focus, the water-borne adhesive category is expected to experience substantial growth in North America, making it a significant player in the global adhesives and sealants market.

Fairfield’s Competitive Landscape Analysis

The global adhesives and sealants market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Adhesives and Sealants Space?

- Dow Inc.

- 3M Company

- Sika AG

- Henkel AG & Co. KGaA

- BASF SE

- B. Fuller Company

- Arkema Group

- Saint-Gobain S.A.

- Illinois Tool Works Inc.

- PPG Industries, Inc.

- Franklin International

- KCC Corporation

- Weicon GmbH & Co. KG

- Mapei SpA

- RPM International Inc.

Key Company Developments

New Product Launches

- June 2022: ZF has consistently been at the forefront of developing advanced automotive technologies. They launched the "Tri-cam" camera system, an innovative 3D camera technology, which enhances safety and supports various advanced driver-assistance systems (ADAS) in vehicles.

- September 2021: Ficosa has been actively involved in developing automotive vision systems. One of their notable product launches was the "e-Mirror," a camera-based digital mirror system that enhances visibility and safety by replacing traditional side-view mirrors with high-resolution displays.

- November 2019: Curtiss-Wright Corporation announced the launch of the "Exlar FT Series Actuators," an advanced electromechanical actuator technology that can be integrated into various applications, including automotive systems for precise control.

Distribution Agreements

- May 2021: For the markets in Australia, New Zealand, and the Pacific Islands, a collaboration between J.L. Lennard and Cama Group was established. J.L. Lennard is an exclusive distributor of tools, accessories, and life cycle services.

- February 2020: CT Pack grew its market share in Latin America. It has also developed solid client relationships and a potent sales team. Customers' ideal solutions have been its complete packaging systems for the food industry.

An Expert’s Eye

Demand and Future Growth

The market demand for adhesives and sealants is expected to expand significantly. The demand for precise and effective gear-shifting systems is greater than ever as the automotive industry shifts more and more toward electric and driverless vehicles.

In line with the ongoing electrification and automation of the automobile industry, shift-by-wire systems provide a smooth and intelligent solution. The growing worries about fuel efficiency, safety improvements, and changing consumer preferences for cutting-edge and smart driving experiences all serve to support demand.

The adhesives and sealants market appears to be on a solid growth trajectory in the future as technology develops, with an emphasis on boosting cybersecurity, incorporating artificial intelligence, and improving user interfaces.

Supply Side of the Market

According to our analysis, the supply side of the adhesives and sealants market reflects a dynamic landscape characterised by fierce competition and rapid technological advancements.

Key market players, including established automotive technology firms and emerging startups, are heavily investing in research and development to innovate and offer cutting-edge shift-by-wire solutions. This entails a continuous quest for refining electronic control units, sensors, and interface designs to enhance user experience, safety, and efficiency.

Moreover, manufacturers are forging strategic partnerships and collaborations to access specialised expertise and expand their product portfolios. The trend leans towards tailoring solutions for electric and autonomous vehicles, aligning with the evolving automotive industry paradigm.

Global Adhesives and Sealants Market is Segmented as Below:

By Adhesive Type:

- Water-borne

- Acrylic

- Polyvinyl Acetate (PVA) Emulsion

- Ethylene Vinyl Acetate (EVA) Emulsion

- Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- Other Water-borne Adhesives

- Solvent-borne

- Chloroprene Rubber

- Poly Acrylate (PA)

- Styrenic Block Copolymers

- Other Solvent-borne Adhesives

By Adhesive Technology:

- Reactive

- Polyurethane

- Epoxy

- Cyanoacrylate

- Modified Acrylic

- Anaerobic

- Silicone

- Other

- Hot Melt

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Thermoplastic Polyurethane

- Other

By Sealant Product Type:

- Silicone

- Polyurethane

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

- Executive Summary

- Global Adhesives and Sealants Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Adhesives and Sealants Market Outlook, 2020 - 2033

- Global Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Water-borne

- Acrylic

- Polyvinyl Acetate (PVA) Emulsion

- Ethylene Vinyl Acetate (EVA) Emulsion

- Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- Other Water-borne Adhesives

- Solvent-borne

- Chloroprene Rubber

- Poly Acrylate (PA)

- Styrenic Block Copolymers

- Other Solvent-borne Adhesives

- Global Adhesives and Sealants Market Outlook, by Adhesive Technology, Value (US$ Mn), 2020-2033

- Reactive

- Reactive

- Polyurethane

- Epoxy

- Cyanoacrylate

- Modified Acrylic

- Anaerobic

- Hot Melt

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Thermoplastic Polyurethane

- Other

- Global Adhesives and Sealants Market Outlook, by Sealant Product Type, Value (US$ Mn), 2020-2033

- Silicone

- Polyurethane

- Global Adhesives and Sealants Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Reactive

- Water-borne

- Global Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- North America Adhesives and Sealants Market Outlook, 2020 - 2033

- North America Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Water-borne

- Acrylic

- Polyvinyl Acetate (PVA) Emulsion

- Ethylene Vinyl Acetate (EVA) Emulsion

- Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- Other Water-borne Adhesives

- Solvent-borne

- Chloroprene Rubber

- Poly Acrylate (PA)

- Styrenic Block Copolymers

- Other Solvent-borne Adhesives

- North America Adhesives and Sealants Market Outlook, by Adhesive Technology, Value (US$ Mn), 2020-2033

- Reactive

- Reactive

- Polyurethane

- Epoxy

- Cyanoacrylate

- Modified Acrylic

- Anaerobic

- Hot Melt

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Thermoplastic Polyurethane

- Other

- North America Adhesives and Sealants Market Outlook, by Sealant Product Type, Value (US$ Mn), 2020-2033

- Silicone

- Polyurethane

- North America Adhesives and Sealants Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- S. Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- S. Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Canada Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Canada Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Canada Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Reactive

- Water-borne

- North America Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Europe Adhesives and Sealants Market Outlook, 2020 - 2033

- Europe Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Water-borne

- Acrylic

- Polyvinyl Acetate (PVA) Emulsion

- Ethylene Vinyl Acetate (EVA) Emulsion

- Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- Other Water-borne Adhesives

- Solvent-borne

- Chloroprene Rubber

- Poly Acrylate (PA)

- Styrenic Block Copolymers

- Other Solvent-borne Adhesives

- Europe Adhesives and Sealants Market Outlook, by Adhesive Technology, Value (US$ Mn), 2020-2033

- Reactive

- Reactive

- Polyurethane

- Epoxy

- Cyanoacrylate

- Modified Acrylic

- Anaerobic

- Hot Melt

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Thermoplastic Polyurethane

- Other

- Europe Adhesives and Sealants Market Outlook, by Sealant Product Type, Value (US$ Mn), 2020-2033

- Silicone

- Polyurethane

- Europe Adhesives and Sealants Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Germany Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Germany Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Italy Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Italy Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Italy Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- France Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- France Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- France Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- K. Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- K. Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- K. Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Spain Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Spain Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Spain Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Russia Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Russia Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Russia Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Rest of Europe Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Rest of Europe Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Rest of Europe Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Reactive

- Water-borne

- Europe Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Asia Pacific Adhesives and Sealants Market Outlook, 2020 - 2033

- Asia Pacific Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Water-borne

- Acrylic

- Polyvinyl Acetate (PVA) Emulsion

- Ethylene Vinyl Acetate (EVA) Emulsion

- Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- Other Water-borne Adhesives

- Solvent-borne

- Chloroprene Rubber

- Poly Acrylate (PA)

- Styrenic Block Copolymers

- Other Solvent-borne Adhesives

- Asia Pacific Adhesives and Sealants Market Outlook, by Adhesive Technology, Value (US$ Mn), 2020-2033

- Reactive

- Reactive

- Polyurethane

- Epoxy

- Cyanoacrylate

- Modified Acrylic

- Anaerobic

- Hot Melt

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Thermoplastic Polyurethane

- Other

- Asia Pacific Adhesives and Sealants Market Outlook, by Sealant Product Type, Value (US$ Mn), 2020-2033

- Silicone

- Polyurethane

- Asia Pacific Adhesives and Sealants Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- China Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- China Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Japan Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Japan Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Japan Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- South Korea Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- South Korea Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- South Korea Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- India Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- India Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- India Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Southeast Asia Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Southeast Asia Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Southeast Asia Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Rest of SAO Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Rest of SAO Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Rest of SAO Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Reactive

- Water-borne

- Asia Pacific Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Latin America Adhesives and Sealants Market Outlook, 2020 - 2033

- Latin America Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Water-borne

- Acrylic

- Polyvinyl Acetate (PVA) Emulsion

- Ethylene Vinyl Acetate (EVA) Emulsion

- Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- Other Water-borne Adhesives

- Solvent-borne

- Chloroprene Rubber

- Poly Acrylate (PA)

- Styrenic Block Copolymers

- Other Solvent-borne Adhesives

- Latin America Adhesives and Sealants Market Outlook, by Adhesive Technology, Value (US$ Mn), 2020-2033

- Reactive

- Reactive

- Polyurethane

- Epoxy

- Cyanoacrylate

- Modified Acrylic

- Anaerobic

- Hot Melt

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Thermoplastic Polyurethane

- Other

- Latin America Adhesives and Sealants Market Outlook, by Sealant Product Type, Value (US$ Mn), 2020-2033

- Silicone

- Polyurethane

- Latin America Adhesives and Sealants Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Brazil Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Brazil Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Mexico Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Mexico Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Mexico Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Argentina Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Argentina Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Argentina Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Rest of LATAM Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Rest of LATAM Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Rest of LATAM Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Reactive

- Water-borne

- Latin America Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Adhesives and Sealants Market Outlook, 2020 - 2033

- Middle East & Africa Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Water-borne

- Acrylic

- Polyvinyl Acetate (PVA) Emulsion

- Ethylene Vinyl Acetate (EVA) Emulsion

- Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- Other Water-borne Adhesives

- Solvent-borne

- Chloroprene Rubber

- Poly Acrylate (PA)

- Styrenic Block Copolymers

- Other Solvent-borne Adhesives

- Middle East & Africa Adhesives and Sealants Market Outlook, by Adhesive Technology, Value (US$ Mn), 2020-2033

- Reactive

- Reactive

- Polyurethane

- Epoxy

- Cyanoacrylate

- Modified Acrylic

- Anaerobic

- Hot Melt

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Thermoplastic Polyurethane

- Other

- Middle East & Africa Adhesives and Sealants Market Outlook, by Sealant Product Type, Value (US$ Mn), 2020-2033

- Silicone

- Polyurethane

- Middle East & Africa Adhesives and Sealants Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- GCC Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- GCC Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- South Africa Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- South Africa Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- South Africa Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Egypt Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Egypt Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Egypt Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Nigeria Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Nigeria Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Nigeria Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- Rest of Middle East Adhesives and Sealants Market Outlook, by Adhesive Type, 2020-2033

- Rest of Middle East Adhesives and Sealants Market Outlook, by Adhesive Technology, 2020-2033

- Rest of Middle East Adhesives and Sealants Market Outlook, by Sealant Product Type, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Reactive

- Water-borne

- Middle East & Africa Adhesives and Sealants Market Outlook, by Adhesive Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Dow Inc.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- 3M Company

- Sika AG

- Henkel AG & Co. KGaA

- BASF SE

- Fuller Company

- Arkema Group

- Saint-Gobain S.A.

- Illinois Tool Works Inc.

- PPG Industries, Inc.

- Dow Inc.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Adhesive Type Coverage |

|

|

Adhesive Technology Coverage |

|

|

Sealant Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |