Global Paints and Coatings Market Forecast

- Global paints and coatings market revenue to jump from US$186.7 Bn in 2026, to US$284.5 Bn in 2033

- Market size slated for a modest CAGR of 6.20% over 2026 - 2033

Quick Report Digest

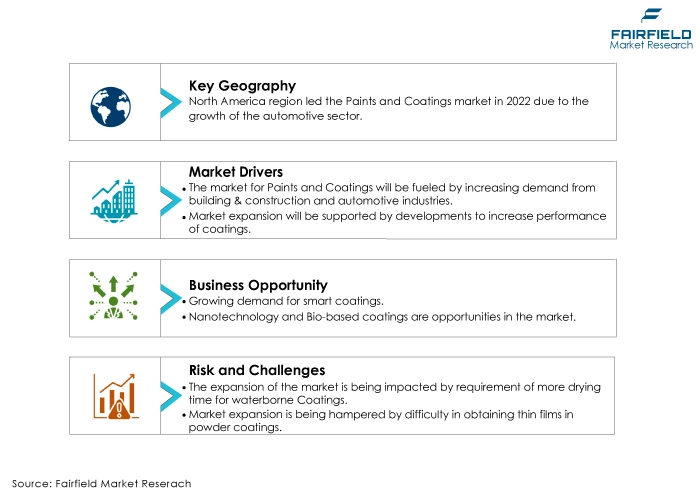

- The key trend anticipated to fuel the paints and coatings market growth is the increasing popularity of automotive applications.

- The paints and coatings market is growing due to increased demand from construction, automotive, and industrial sectors. Advancements in sustainable and high-performance coatings, coupled with rising urbanisation and infrastructure development, contribute to the market's expansion. Additionally, regulatory compliance and innovations drive growth in eco-friendly coatings.

- Acrylic resin types dominate the paints and coatings market due to their wide range of applications. They offer excellent adhesion, durability, and weather resistance, making them suitable for various industries, including construction, automotive, and industrial coatings. Additionally, acrylic resins are favoured for their low VOC content, aligning with environmental regulations.

- Powder coatings technology leads the paints and coatings market due to its eco-friendly attributes, superior durability, and resistance to corrosion, chemicals, and UV radiation. These properties make it ideal for various applications, including automotive, architectural, and industrial coatings, contributing to its dominant market share.

- Architectural end users dominate the paints and coatings market due to robust demand for coatings in residential and commercial construction. Coatings are essential to protect and enhance building aesthetics and durability, aligning with the construction industry's diverse needs and sustainability requirements.

- Asia Pacific leads the paints and coatings market due to rapid urbanisation, robust construction, and automotive sectors. Growing awareness of eco-friendly coatings and stringent regulations also contribute to its market dominance, reflecting diverse industry dynamics in the region.

- North America is likely to be witnessin the highest CAGR in the paints and coatings market due to a strong economy, technological innovations, and a revival in the construction and automotive sectors. Growing demand for eco-friendly and high-performance coatings drives its rapid growth.

- The requirement for extended drying time with waterborne coatings poses a challenge in the paints and coatings market. This limitation affects operational efficiency, as longer drying periods can slow down production processes and increase costs, hindering the market's overall expansion.

A Look Back and a Look Forward - Comparative Analysis

The paints and coatings market is growing due to increasing construction and infrastructure development globally. Rising demand for paints and coatings in the automotive industry, coupled with the expanding real estate and renovation sectors, fuels market growth. Additionally, the adoption of advanced coatings for corrosion protection and sustainability trends, such as low-VOC and eco-friendly coatings, contribute to its expansion.

The paints and coatings market is growing due to several key factors, including robust construction and infrastructure development, rising automotive production, and renovation activities worldwide. Additionally, the demand for eco-friendly and sustainable coatings, increased focus on corrosion protection, and innovations in high-performance coatings are contributing to market expansion. The adoption of advanced coatings to meet regulatory requirements and enhance durability further fuels this growth

The future of the paints and coatings market is promising, driven by innovations in eco-friendly and sustainable coatings, including low-VOC and high-performance formulations. Increasing focus on corrosion protection, fire resistance, and improved durability will continue to drive demand across industries. Furthermore, the market is expected to benefit from the growing emphasis on smart coatings with self-healing and anti-fouling properties, enhancing their longevity and performance.

Key Growth Determinants

- Environmental Regulations Around VOC-free Coatings

Environmental regulations aimed at reducing volatile organic compounds (VOCs) emissions are driving the paints and coatings market. VOC-free coatings, which have minimal or no harmful emissions, align with these regulations, making them highly desirable. They cater to the growing demand for eco-friendly and sustainable solutions in construction, automotive, and industrial applications.

As environmental awareness increases and regulations become stricter, the adoption of VOC-free coatings is set to grow, propelling the overall market forward.

- Increasing Demand from Building & Construction, and Automotive Industries

Increasing demand from the building and construction sector, driven by urbanisation and infrastructure development, is boosting the paints and coatings market. Additionally, the automotive industry's need for coatings for vehicle protection and aesthetics contributes to market growth.

Innovations in advanced coatings, such as anti-corrosion and high-performance formulations, cater to these industries' specific requirements. As construction and automotive activities continue to rise globally, the demand for paints and coatings is expected to see sustained growth.

- Increasing Effort Toward Improved Performance of Coatings

Developments aimed at enhancing coating performance are a significant driver of the paints and coatings market. Manufacturers are continuously innovating to improve properties like durability, corrosion resistance, and fire protection.

These advancements cater to industries such as aerospace, automotive, and industrial, where coatings play a crucial role in extending the lifespan and performance of products. As companies seek coatings with superior characteristics, the market continues to grow, driven by the demand for high-performance solutions.

Major Growth Barriers

- Requirement of More Drying Time for Waterborne Coatings

The paints and coatings market faces challenges with waterborne coatings due to their longer drying times compared to solvent-based counterparts. This extended drying period can disrupt production schedules and increase energy costs. Manufacturers are working on improving drying times and formulation efficiency to address this issue.

While waterborne coatings are eco-friendly and comply with regulations, overcoming the drying time challenge is essential to continue their competitiveness in the market and meet industry demands for faster production cycles.

- Difficulty in Obtaining Thin Films in Powder Coatings

Obtaining thin films in powder coatings poses a challenge in the paints and coatings market. Powder coatings are typically thicker than liquid coatings, making it challenging to achieve thin and uniform films. This limitation restricts their use in applications where precise thickness control is critical, such as electronics and aerospace.

Overcoming this challenge is crucial for expanding the application range of powder coatings and enhancing their competitiveness in markets requiring fine-tuned coating thicknesses.

Key Trends and Opportunities to Look at

- Smart Coatings

Smart coatings in the paints and coatings market incorporate advanced materials and technologies that enable them to respond to external stimuli, such as temperature changes, moisture, or light.

These coatings offer functionalities like self-healing, anti-corrosion, anti-fouling, and antimicrobial properties. They find applications in various industries, including aerospace, automotive, and healthcare, where their intelligent responses enhance performance and durability while reducing maintenance costs.

- Nanotechnology

Nanotechnology in the paints and coatings market involves the use of nanoscale materials and particles to enhance coating properties. It enables coatings to achieve superior performance characteristics like increased UV resistance, improved durability, enhanced barrier properties, and reduced friction.

By manipulating materials at the nanoscale, coatings become more efficient, allowing them to meet stringent industry requirements and deliver advanced solutions for various applications, including electronics, automotive, and construction.

- Bio-based Coatings

Bio-based coatings in the paints and coatings market are formulations made from renewable, plant-based, or biodegradable raw materials. These coatings are favoured for their eco-friendly and sustainable characteristics, as they reduce reliance on fossil fuels and minimise environmental impact.

Bio-based coatings are increasingly adopted to meet regulatory requirements and consumer demand for environmentally responsible products in applications such as architectural coatings, automotive coatings, and industrial coatings.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a pivotal role in shaping the paints and coatings market. Environmental regulations, especially concerning volatile organic compounds (VOCs) and hazardous materials, drive the industry toward eco-friendly formulations like low-VOC and waterborne coatings. These regulations aim to reduce air pollution and protect human health, fostering the development and adoption of sustainable coatings.

Additionally, regulations related to product safety, labeling, and quality standards influence manufacturers' practices and impact market dynamics. Compliance with international standards, such as ISO and ASTM, is crucial for market players to ensure product quality and gain consumer trust.

Overall, the regulatory landscape drives innovation, encourages sustainability, and promotes safer and more environmentally friendly coatings, shaping the market's direction toward eco-conscious and high-performance solutions.

Fairfield’s Ranking Board

Top Segments

- Acrylic Resin Type Continues to Dominate

Acrylic resin types dominate the paints and coatings market due to their diverse range of applications. They offer excellent adhesion, durability, and weather resistance, making them suitable for various industries, including construction, automotive, and industrial coatings.

Additionally, acrylic resins are favoured for their low VOC content, aligning with environmental regulations. Their ability to deliver high-performance coatings, coupled with their eco-friendliness, positions them as the preferred choice in the market, capturing the largest share.

Vinyl resin types will most likely experience the fastest CAGR in the paints and coatings market due to their unique properties. Vinyl coatings offer exceptional chemical resistance, corrosion protection, and versatility. They find increasing applications in automotive, industrial, and architectural coatings, driven by the need for robust and long-lasting solutions.

In addition, their cost-effectiveness and ability to adhere to various substrates contribute to their rapid growth. As industries seek high-performance and economical coatings, vinyl resins are emerging as a top choice, propelling their CAGR in the market.

- Powder Coatings Remain at the Forefront

Powder coatings technology dominates the paints and coatings market due to several advantages. Powder coatings are eco-friendly, as they produce minimal VOC emissions and waste. They offer superior durability, resistance to corrosion, chemicals, and UV radiation, making them ideal for various applications, including automotive, architectural, and industrial coatings.

Additionally, the cost-effectiveness of powder coatings and their ability to produce thin and uniform films contribute to their market leadership, capturing the largest share among coating technologies.

Solvent-borne technology on the other hand is expected to witness the highest rate of growth due to its unique attributes. Solvent-based coatings provide excellent adhesion, durability, and resistance to extreme conditions, making them ideal for demanding applications such as aerospace, and marine.

In addition, their fast drying characteristics and ability to produce high-gloss finishes contribute to their growth. Despite environmental concerns, innovations in low-VOC formulations and regulatory compliance measures are supporting the resurgence of solvent-borne coatings, driving their rapid CAGR in the Market.

- Architectural End Users Surge Ahead

Architectural end users lead the paints and coatings consumption owing to their substantial demand, especially for coatings, from residential and commercial construction sectors. The architectural sector relies on coatings to protect and beautify structures, enhancing aesthetics and longevity.

The growing construction and renovation activities globally, coupled with the need for environmentally friendly coatings, further boost this segment's dominance. As architects and builders prioritise aesthetics, durability, and sustainability, architectural coatings remain the largest market segment, catering to the diverse needs of the construction industry.

On the other side, the automotive sector reflects the highest growth potential during the forecast period, due to several factors. Rising automotive production and the demand for high-performance coatings to enhance vehicle aesthetics, durability, and corrosion resistance are key drivers.

In addition, the shift toward electric vehicles (EVs) and the need for specialised coatings for EV components, such as batteries, contribute to the segment's growth. As automotive manufacturers prioritise advanced coatings for innovation and sustainability, the sector is expected to continue its rapid expansion.

Regional Frontrunners

Asian Markets Contribute the Largest Revenue

Asia Pacific commands the largest share in the paints and coatings market due to several factors. The region's robust economic growth, rapid urbanisation, and expanding construction activities drive the demand for architectural and industrial coatings. The thriving automotive industry and increased manufacturing activities also bolster coatings consumption.

Moreover, Asia Pacific benefits from the presence of major manufacturers and a growing middle-class population with rising disposable income, boosting consumer demand for paints and coatings. The region's regulatory environment and the adoption of eco-friendly coatings align with global sustainability trends. As Asia Pacific continues to be a hub for manufacturing and construction, it retains its leadership position in the global paints and coatings industry.

North America Poised to Display Exceptional Growth Potential

North America will be witnessing noteworthy revenue growth through 2030 in the paints and coatings market due to several factors. The region's strong economy, technological advancements, and innovation in coatings, including smart and eco-friendly solutions, drive demand.

Additionally, the revival of the construction and real estate sectors, coupled with the thriving automotive industry, fuels coatings consumption.

As North America prioritises sustainability and regulatory compliance, the adoption of high-performance coatings continues to grow. These factors contribute to the region's rapid CAGR in the paints and coatings market.

Fairfield’s Competitive Landscape Analysis

The paints and coatings market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Paints and Coatings market space?

- Akzo Nobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd

- BASF SE

- Axalta Coating Systems, LLC

- Axalta Coating Systems, LLC

- RPM International Inc.

- Hempel A/S

- Jotun

- Asian Paints

- Berger Paints Limited

- Dunn-Edwards Corporation

- DAW SE

- Kelly-Moore Paints

Recent Company Developments

New Product Launch

- February 2022: The Sherwin-Williams Company has entered into an agreement with North Carolina, Iredell County, and the city of Statesville to expand its architectural paint and coatings manufacturing capacity and establish a larger distribution centre in Statesville, North Carolina. The project entails a minimum investment of USD 300 million by Sherwin-Williams.

Distribution Agreement

- February 2022: PPG has announced its acquisition of the Powder Coating Manufacturing Business from Arsonsisi, an industrial coating company headquartered in Milan, Italy. This strategic acquisition is aimed at enabling the company to achieve backward integration.

An Expert’s Eye

Demand and Future Growth

The paints and coatings market continues to experience robust demand driven by the construction and automotive sectors. Increasing construction activities, renovation projects, and infrastructure development fuel the Market. Additionally, growing awareness of eco-friendly and sustainable coatings, along with innovations in high-performance formulations, contribute to future growth.

The Market is expected to further expand with the rise of smart coatings, advancements in nanotechnology, and compliance with stringent environmental regulations, ensuring a promising future in meeting diverse industry needs.

Supply Side of the Market

The paints and coatings market is prominently led by several major countries worldwide. China, with its rapid urbanisation and massive construction projects, stands as a dominant force, driving substantial coatings demand. In the US, a robust construction sector and a thriving automotive industry contribute significantly to the market's growth.

India is experiencing a surge in coatings demand due to its booming construction and infrastructure development activities. Germany, renowned for its automotive and industrial coatings sectors, plays a pivotal role in the market. Japan's coatings industry thrives on its contributions to the automotive and electronics sectors.

In South America, Brazil stands out as a key player, with growing construction and renovation activities fueling coatings consumption. These countries collectively shape the global paints and coatings landscape, reflecting the industry's diverse market dynamics and applications.

The paints and coatings market relies on a variety of raw materials, including pigments, binders (resins), solvents, additives, and fillers. Pigments provide colour and opacity, while binders act as the film-forming component. Solvents help in application and film formation, while additives enhance properties like durability and flow. Fillers improve coating consistency and reduce costs.

Major manufacturers of raw materials for the paints and coatings market include BASF SE, AkzoNobel N.V., Dow Chemical Company, PPG Industries Inc., and Sherwin-Williams Company. These companies supply a wide range of raw materials, catering to the diverse needs of coating manufacturers worldwide.

The Global Paints and coatings market is Segmented as Below:

By Resin Type:

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Vinyl

- Polyester

- Silicone

- Miscellaneous

By Technology:

- Waterborne

- Solvent Borne

- Powder Coatings

- UV/EB Cured

By End Use:

- Architectural

- Automotive

- Marine

- Aerospace

- Oil & Gas

- General Industrial

- Wood Furniture

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Paints and Coatings Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Paints and Coatings Market Outlook, 2019 - 2033

3.1. Global Paints and Coatings Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2033

3.1.1. Key Highlights

3.1.1.1. Acrylic

3.1.1.2. Alkyd

3.1.1.3. Epoxy

3.1.1.4. Polyurethane

3.1.1.5. Vinyl

3.1.1.6. Polyester

3.1.1.7. Silicone

3.1.1.8. Misc.

3.2. Global Paints and Coatings Market Outlook, by Technology, Value (US$ Bn), 2019 - 2033

3.2.1. Key Highlights

3.2.1.1. Waterborne

3.2.1.2. Solvent Borne

3.2.1.3. Powder Coatings

3.2.1.4. UV/EB Cured

3.3. Global Paints and Coatings Market Outlook, by End User, Value (US$ Bn), 2019 - 2033

3.3.1. Key Highlights

3.3.1.1. Architectural

3.3.1.2. Automotive

3.3.1.3. Marine

3.3.1.4. Aerospace

3.3.1.5. Oil & Gas

3.3.1.6. General Industrial

3.3.1.7. Wood Furniture

3.3.1.8. Misc.

3.4. Global Paints and Coatings Market Outlook, by Region, Value (US$ Bn), 2019 - 2033

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Paints and Coatings Market Outlook, 2019 - 2033

4.1. North America Paints and Coatings Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2033

4.1.1. Key Highlights

4.1.1.1. Acrylic

4.1.1.2. Alkyd

4.1.1.3. Epoxy

4.1.1.4. Polyurethane

4.1.1.5. Vinyl

4.1.1.6. Polyester

4.1.1.7. Silicone

4.1.1.8. Misc.

4.2. North America Paints and Coatings Market Outlook, by Technology, Value (US$ Bn), 2019 - 2033

4.2.1. Key Highlights

4.2.1.1. Waterborne

4.2.1.2. Solvent Borne

4.2.1.3. Powder Coatings

4.2.1.4. UV/EB Cured

4.3. North America Paints and Coatings Market Outlook, by End User, Value (US$ Bn), 2019 - 2033

4.3.1. Key Highlights

4.3.1.1. Architectural

4.3.1.2. Automotive

4.3.1.3. Marine

4.3.1.4. Aerospace

4.3.1.5. Oil & Gas

4.3.1.6. General Industrial

4.3.1.7. Wood Furniture

4.3.1.8. Misc.

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Paints and Coatings Market Outlook, by Country, Value (US$ Bn), 2019 - 2033

4.4.1. Key Highlights

4.4.1.1. U.S. Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

4.4.1.2. U.S. Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

4.4.1.3. U.S. Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

4.4.1.4. U.S. Paints and Coatings Market End Use, Value (US$ Bn), 2019 - 2033

4.4.1.5. Canada Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

4.4.1.6. Canada Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

4.4.1.7. Canada Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

4.4.1.8. Canada Paints and Coatings Market End Use, Value (US$ Bn), 2019 - 2033

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Paints and Coatings Market Outlook, 2019 - 2033

5.1. Europe Paints and Coatings Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2033

5.1.1. Key Highlights

5.1.1.1. Acrylic

5.1.1.2. Alkyd

5.1.1.3. Epoxy

5.1.1.4. Polyurethane

5.1.1.5. Vinyl

5.1.1.6. Polyester

5.1.1.7. Silicone

5.1.1.8. Misc.

5.2. Europe Paints and Coatings Market Outlook, by Technology, Value (US$ Bn), 2019 - 2033

5.2.1. Key Highlights

5.2.1.1. Waterborne

5.2.1.2. Solvent Borne

5.2.1.3. Powder Coatings

5.2.1.4. UV/EB Cured

5.3. Europe Paints and Coatings Market Outlook, by End User, Value (US$ Bn), 2019 - 2033

5.3.1. Key Highlights

5.3.1.1. Architectural

5.3.1.2. Automotive

5.3.1.3. Marine

5.3.1.4. Aerospace

5.3.1.5. Oil & Gas

5.3.1.6. General Industrial

5.3.1.7. Wood Furniture

5.3.1.8. Misc.

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Paints and Coatings Market Outlook, by Country, Value (US$ Bn), 2019 - 2033

5.4.1. Key Highlights

5.4.1.1. Germany Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

5.4.1.2. Germany Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

5.4.1.3. Germany Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

5.4.1.4. U.K. Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

5.4.1.5. U.K. Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

5.4.1.6. U.K. Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

5.4.1.7. France Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

5.4.1.8. France Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

5.4.1.9. France Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

5.4.1.10. Italy Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

5.4.1.11. Italy Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

5.4.1.12. Italy Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

5.4.1.13. Turkey Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

5.4.1.14. Turkey Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

5.4.1.15. Turkey Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

5.4.1.16. Russia Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

5.4.1.17. Russia Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

5.4.1.18. Russia Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

5.4.1.19. Rest of Europe Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

5.4.1.20. Rest of Europe Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

5.4.1.21. Rest of Europe Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Paints and Coatings Market Outlook, 2019 - 2033

6.1. Asia Pacific Paints and Coatings Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2033

6.1.1. Key Highlights

6.1.1.1. Acrylic

6.1.1.2. Alkyd

6.1.1.3. Epoxy

6.1.1.4. Polyurethane

6.1.1.5. Vinyl

6.1.1.6. Polyester

6.1.1.7. Silicone

6.1.1.8. Misc.

6.2. Asia Pacific Paints and Coatings Market Outlook, by Technology, Value (US$ Bn), 2019 - 2033

6.2.1. Key Highlights

6.2.1.1. Waterborne

6.2.1.2. Solvent Borne

6.2.1.3. Powder Coatings

6.2.1.4. UV/EB Cured

6.3. Asia Pacific Paints and Coatings Market Outlook, by End User, Value (US$ Bn), 2019 - 2033

6.3.1. Key Highlights

6.3.1.1. Architectural

6.3.1.2. Automotive

6.3.1.3. Marine

6.3.1.4. Aerospace

6.3.1.5. Oil & Gas

6.3.1.6. General Industrial

6.3.1.7. Wood Furniture

6.3.1.8. Misc.

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Paints and Coatings Market Outlook, by Country, Value (US$ Bn), 2019 - 2033

6.4.1. Key Highlights

6.4.1.1. China Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

6.4.1.2. China Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

6.4.1.3. China Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

6.4.1.4. Japan Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

6.4.1.5. Japan Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

6.4.1.6. Japan Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

6.4.1.7. South Korea Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

6.4.1.8. South Korea Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

6.4.1.9. South Korea Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

6.4.1.10. India Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

6.4.1.11. India Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

6.4.1.12. India Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

6.4.1.13. Southeast Asia Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

6.4.1.14. Southeast Asia Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

6.4.1.15. Southeast Asia Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

6.4.1.16. Rest of Asia Pacific Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

6.4.1.17. Rest of Asia Pacific Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

6.4.1.18. Rest of Asia Pacific Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Paints and Coatings Market Outlook, 2019 - 2033

7.1. Latin America Paints and Coatings Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2033

7.1.1. Key Highlights

7.1.1.1. Acrylic

7.1.1.2. Alkyd

7.1.1.3. Epoxy

7.1.1.4. Polyurethane

7.1.1.5. Vinyl

7.1.1.6. Polyester

7.1.1.7. Silicone

7.1.1.8. Misc.

7.2. Latin America Paints and Coatings Market Outlook, by Technology, Value (US$ Bn), 2019 - 2033

7.2.1. Key Highlights

7.2.1.1. Waterborne

7.2.1.2. Solvent Borne

7.2.1.3. Powder Coatings

7.2.1.4. UV/EB Cured

7.3. Latin America Paints and Coatings Market Outlook, by End User, Value (US$ Bn), 2019 - 2033

7.3.1. Key Highlights

7.3.1.1. Architectural

7.3.1.2. Automotive

7.3.1.3. Marine

7.3.1.4. Aerospace

7.3.1.5. Oil & Gas

7.3.1.6. General Industrial

7.3.1.7. Wood Furniture

7.3.1.8. Misc.

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Paints and Coatings Market Outlook, by Country, Value (US$ Bn), 2019 - 2033

7.4.1. Key Highlights

7.4.1.1. Brazil Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

7.4.1.2. Brazil Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

7.4.1.3. Brazil Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

7.4.1.4. Mexico Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

7.4.1.5. Mexico Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

7.4.1.6. Mexico Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

7.4.1.7. Argentina Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

7.4.1.8. Argentina Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

7.4.1.9. Argentina Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

7.4.1.10. Rest of Latin America Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

7.4.1.11. Rest of Latin America Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

7.4.1.12. Rest of Latin America Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Paints and Coatings Market Outlook, 2019 - 2033

8.1. Middle East & Africa Paints and Coatings Market Outlook, by Resin Type, Value (US$ Bn), 2019 - 2033

8.1.1. Key Highlights

8.1.1.1. Acrylic

8.1.1.2. Alkyd

8.1.1.3. Epoxy

8.1.1.4. Polyurethane

8.1.1.5. Vinyl

8.1.1.6. Polyester

8.1.1.7. Silicone

8.1.1.8. Misc.

8.2. Middle East & Africa Paints and Coatings Market Outlook, by Technology, Value (US$ Bn), 2019 - 2033

8.2.1. Key Highlights

8.2.1.1. Waterborne

8.2.1.2. Solvent Borne

8.2.1.3. Powder Coatings

8.2.1.4. UV/EB Cured

8.3. Middle East & Africa Paints and Coatings Market Outlook, by End User, Value (US$ Bn), 2019 - 2033

8.3.1. Key Highlights

8.3.1.1. Architectural

8.3.1.2. Automotive

8.3.1.3. Marine

8.3.1.4. Aerospace

8.3.1.5. Oil & Gas

8.3.1.6. General Industrial

8.3.1.7. Wood Furniture

8.3.1.8. Misc.

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Paints and Coatings Market Outlook, by Country, Value (US$ Bn), 2019 - 2033

8.4.1. Key Highlights

8.4.1.1. GCC Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

8.4.1.2. GCC Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

8.4.1.3. GCC Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

8.4.1.4. South Africa Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

8.4.1.5. South Africa Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

8.4.1.6. South Africa Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

8.4.1.7. Egypt Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

8.4.1.8. Egypt Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

8.4.1.9. Egypt Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

8.4.1.10. Nigeria Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

8.4.1.11. Nigeria Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

8.4.1.12. Nigeria Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

8.4.1.13. Rest of Middle East & Africa Paints and Coatings Market by Resin Type, Value (US$ Bn), 2019 - 2033

8.4.1.14. Rest of Middle East & Africa Paints and Coatings Market Technology, Value (US$ Bn), 2019 - 2033

8.4.1.15. Rest of Middle East & Africa Paints and Coatings Market End User, Value (US$ Bn), 2019 - 2033

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Akzo Nobel N.V.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. PPG Industries, Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. The Sherwin-Williams Company

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Nippon Paint Holdings Co., Ltd

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. BASF SE

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Axalta Coating Systems, LLC

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Kansai Paint Co., Ltd.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. RPM International Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Hempel A/S

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Jotun

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Asian Paints Limited

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Berger Paints India Limited

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Dunn-Edwards Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. DAW SE

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Kelly-Moore Paints

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2025 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Resin Type Coverage |

|

|

Technology Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |