Plastic Caps & Closures Market Growth and Industry Forecast

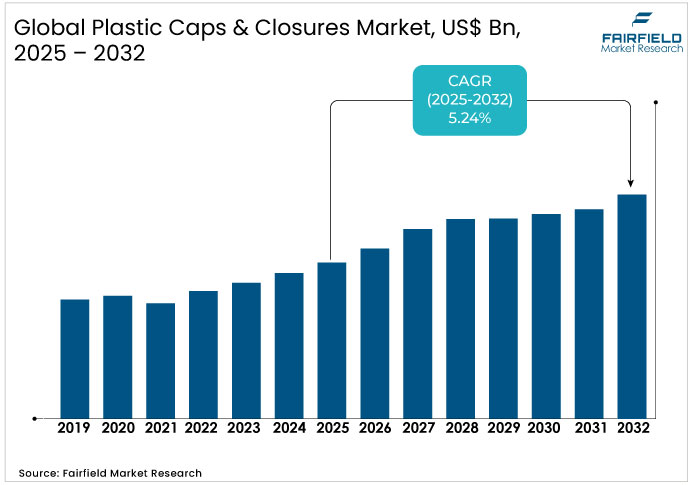

The Plastic Caps & Closures Market is valued at USD 52.3 Bn in 2026 and is projected to reach USD 77.6 Bn, growing at a CAGR of 6% by 2033.

Plastic Caps & Closures Market Summary: Key Insights & Trends

- Polypropylene leads with 57% share, driven by its versatility in beverages and food packaging.

- HDPE strengthens its share, supported by pharmaceutical demand and mono-material recyclability.

- Screw-on caps dominate with 45% share, sealing 70% of carbonated drinks globally.

- Dispensing caps gain share, reducing 20% product waste in personal care applications.

- Injection molding holds 42% share, while compression molding advances in tamper-evident closures.

- Beverages lead with 27% share, supported by 48% global bottling reliance on plastics.

- Pharmaceutical closures expand share, driven by aging populations and child-resistant mandates.

- Asia Pacific dominates with 35% share, led by China, India, and Japan’s PP adoption.

Key Growth Drivers

- Urban Migration Fuels Packaged Goods Growth and Expands Plastic Closures Adoption

Urban migration reshapes consumer behaviors, compelling food and beverage firms to adopt plastic caps and closures for their portability and seal integrity. The World Bank reports that 56% of the global population resides in urban areas, a figure projected to climb to 70% by 2050, directly correlating with a 15% annual increase in ready-to-eat product sales in emerging plastic caps & closures markets. This demographic shift amplifies demand for screw-on and dispensing variants, which ensure hygiene and extend shelf life by up to 30% compared to alternatives. Manufacturers leverage this trend through localized production, reducing logistics costs by 10-15% and enhancing market penetration. Regulatory endorsements from bodies such as the U.S. Food and Drug Administration (FDA) on child-resistant features further bolster adoption, mitigating contamination risks in high-volume bottling lines. Overall, these dynamics fortify supply chain resilience, positioning the sector for scalable growth amid macroeconomic stability.

- Innovations in Molding Technologies Accelerate Sustainable Packaging and Recycling Efficiency

Innovations in injection and compression molding technologies drive efficiency, enabling producers to incorporate up to 60% recycled content without compromising durability. The United Nations Environment Programme highlights that plastic production emits 0.9 metric tons of CO2 per ton processed, yet bio-based resins now mitigate this by 20-25% through lower energy inputs. This technological evolution responds to consumer preferences, where 78% favor recyclable packaging per industry surveys, fostering brand loyalty and premium pricing opportunities. Firms integrate AI-optimized molds to cut waste by 15%, aligning with Extended Producer Responsibility (EPR) frameworks in Europe and North America. Such progress not only curbs operational costs but also navigates regulatory landscapes, such as the EU's Single-Use Plastics Directive, promoting a transition to mono-material designs that streamline recycling streams. Consequently, these advancements yield competitive edges in cost structures and compliance, sustaining long-term viability.

Key Restraints

- Rising Plastic Waste and Regulatory Pressure Challenge Packaging Industry Growth

Persistent plastic pollution challenges growth, as annual global generation exceeds 430 million tons, with only 9% effectively recycled according to United Nations data. This scrutiny intensifies supply chain bottlenecks, with EPR fees escalating production costs by 5-8% in regulated regions. Competitors exploit alternatives such as metal or glass, eroding plastic's 57% material dominance and pressuring margins amid consumer backlash. Mitigation requires upstream investments in waste tracking, yet fragmented collection infrastructures in developing economies exacerbate non-compliance risks.

- Geopolitical Tensions and Price Fluctuations Disrupt Closure Manufacturing Profitability

Fluctuations in propylene and ethylene prices, driven by geopolitical tensions, inflate PP and PE costs by up to 15% quarterly, straining profitability for closure manufacturers. Supply chain disruptions, such as those from petrochemical shortages, delay deliveries and hike inventory holdings by 20%. This volatility favors larger incumbents with hedging capabilities, while smaller players face cash flow strains and reduced competitiveness in price-sensitive applications such as homecare products.

Plastic Caps & Closures Market Trends and Opportunities

- Bio-Based and Recyclable Resins Unlock Circular Growth in Sustainable Packaging

The shift toward bio-based resins presents a $10-15 billion addressable plastic caps & closures market by 2030, amid EPR modulations and consumer demands for circular solutions. Developing economies such as India and ASEAN nations, with urbanization rates surpassing 4% annually, offer unmet needs for affordable, lightweight closures in expanding dairy and personal care sectors. Policy subsidies, such as India's PLI scheme allocating $1.2 billion for sustainable packaging, lower entry barriers and enable 20% cost reductions via localized bio-feedstock sourcing. Stakeholders can capitalize by partnering with resin innovators, fostering mono-material designs that boost recyclability rates to 50% and align with global standards such as ISO 15270. This opportunity not only diversifies revenue streams but also mitigates regulatory risks, positioning early adopters for 15-20% premium margins in eco-conscious segments. Theoretical frameworks such as cradle-to-cradle design principles underscore the long-term value, emphasizing closed-loop systems that minimize virgin material dependency and enhance brand resilience against greenwashing accusations.

- Pharmaceutical Closures Market Expands with Aging Populations and Regulatory Support

Pharma closures command a $5-7 billion sub-market opportunity through 2030, propelled by robust CAGR from aging populations and stringent child-resistant laws in North America and Europe. Unmet demands in emerging markets, where pharmaceutical packaging penetration lags at 40%, arise from rising chronic disease prevalence, projected to affect 1.8 billion adults globally by 2030 per WHO estimates. Supportive policies, including U.S. FDA fast-track approvals for innovative tamper features, subsidize R&D to 30% of costs, enabling scalable production of dispensing caps for precise dosing. Companies can theorize value chain integration, from resin selection to end-use testing, to achieve 25% efficiency gains and reduce counterfeiting losses estimated at $200 billion annually. This avenue extends to homecare synergies, where hybrid designs blend pharma-grade seals with consumer aesthetics, capturing cross-segment spillovers and fortifying defensive moats against commoditization.

Segment-wise Trends & Analysis

Polypropylene Leads Market While HDPE Rises with Pharmaceutical Packaging Demand

Polypropylene (PP) commands over 57% of plastic caps & closures market share in 2025, valued at approximately USD 37.9 billion, due to its chemical resistance and cost-effectiveness in high-volume applications such as beverages. This leadership stems from PP's versatility in molding processes, supporting lightweight designs that cut transportation emissions by 15%.

High-density polyethylene (HDPE) emerges as the fast-growing segment, projected to expand at 6% CAGR, driven by demand for durable, recyclable options in pharmaceuticals where barrier properties prevent 99% moisture ingress. Underlying catalysts include regulatory preferences for mono-materials, enabling streamlined recycling and cost savings of 10-12% over composites.

Screw-On Caps Dominate as Dispensing Caps Gain in Personal Care

Screw-on caps dominate the plastic caps and closures market with over 45% share in 2025, valued at USD 29.9 billion, favored for their universal compatibility and tamper-evident security in food and beverage bottling, where they seal 70% of carbonated drinks. Dispensing caps are the fastest-growing segment, driven by precision requirements in personal care products, enabling 20% reduction in product waste through metered release mechanisms and supporting sustainable packaging initiatives.

Injection Molding Retains Lead While Compression Molding Accelerates Adoption

Injection molding dominates the plastic caps and closures market with over 42% share in 2025, valued at USD 28 billion, excelling in high-precision production for complex geometries that improve seal integrity by 25% in beverage applications. Compression molding is the fastest-growing technology, particularly suited for tamper-evident bands, reducing assembly times by 15% and enhancing production efficiency.

Beverages Lead Applications While Beauty and Personal Care Rapidly Expand

The beverage segment leads with over 27% share, valued at USD 18 billion, supported by 48% global bottling reliance on plastic to maintain carbonation. Beauty and personal care is expanding rapidly, driven by premium dispensing needs and 15% annual growth in skincare sales, highlighting emerging opportunities for innovation in closures.

Regional Trends & Analysis

North America Plastic Caps Market Strengthened by Food, Pharma, and E-Commerce

North America captures 25% of the global Plastic Caps & Closures Market in 2025, propelled by robust food and pharma sectors, with innovations in lightweight designs reducing freight costs by 12%. The U.S. exemplifies fastest growth in beauty and personal care, where e-commerce drives 20% CAGR for dispensing caps, supported by sustainable sourcing mandates.

U.S. Plastic Caps & Closures Market – 2025 Snapshot & Outlook

The U.S. plastic caps and closures market is projected for steady growth through 2032, driven by the beverage sector and strong regulatory focus on recyclables. Demand is rising among urban millennials, who favor portable packaging, while FDA-mandated child-resistant features increase pharmaceutical adoption by 15%. Retailers’ shift to omnichannel models enhances margins by 8%, and Buy American Act incentives subsidize domestic polypropylene production, providing 10% cost advantages and encouraging vertical integration to reduce tariff risks.

Europe Leads with Stringent Sustainability Mandates Driving Plastic Caps Transition

Europe holds 28% share in 2025, shaped by stringent sustainability regulations such as the Single-Use Plastics Directive, which mandates tethered caps and spurs 5% growth in pharma applications. Germany and the U.K. lead, with eco-innovations addressing 67% disposable plastic waste concerns.

Germany Plastic Caps & Closures Market – 2025 Snapshot & Outlook

Germany’s plastic caps and closures market is projected to grow steadily, driven by REACH-compliant cosmetic materials and compression molding, which reduces energy consumption by 20%. Export-focused beverage companies prioritize polypropylene (PP) due to its 56% recyclability, according to EU data. A Eurostat report shows that 55% of consumers prefer sustainable closures, shaping brand strategies. Tax incentives for green technology investments, offering up to 25% deductions, enhance margins and support energy transitions, accelerating the adoption of mono-material designs and promoting circularity.

U.K Plastic Caps & Closures Market – 2025 Snapshot & Outlook

The U.K. plastic caps and closures market is poised for steady growth, driven by post-Brexit trade agreements that boost beverage exports and increase demand for tamper-evident technologies. The personal care segment experiences a 22% uplift from vegan packaging trends. British Standards Institution data indicates that 60% of households prefer eco-friendly caps. Supportive VAT reductions on recyclable products improve accessibility by 12%, countering inflation, while encouraging supply chain localization and reducing reliance on imports from the EU.

Asia Pacific Dominates Market with Manufacturing Scale and Urbanization Growth

Asia Pacific leads the plastic caps & closures market with approximately 35% share in 2025, valued at USD 23.3 billion, dominated by China's manufacturing scale and India's urbanization, where bottled water consumption rises 10% yearly. Japan and South Korea innovate in precision closures, while India targets unmet homecare needs.

Japan Plastic Caps & Closures Market – 2025 Snapshot & Outlook

Japan’s plastic caps and closures market is expanding steadily, driven by high beverage consumption and JIS standards that encourage lightweight polypropylene designs, reducing material use by 18%. An aging population is boosting demand for pharmaceutical dispensing caps, with adoption growing 25%. A Ministry of Economy survey reports that 68% of consumers prioritize recyclable features in personal care products. Government support through the Green Innovation Fund, totaling ¥2 trillion, provides a 15% R&D boost and enhances export competitiveness, while AI-assisted molding optimizes production yields.

India Plastic Caps & Closures Market – 2025 Snapshot & Outlook

India’s plastic caps and closures market is projected to reach USD 7.5 billion in 2025, driven by PLI scheme investments in food packaging, where screw caps support a 30% growth in processed goods. The expanding urban middle class is boosting demand in beauty and personal care applications. FSSAI regulations mandate tamper-evident features, and a NITI Aayog study indicates that 58% of consumers prioritize hygiene seals. Tax incentives for eco-friendly projects, offering up to 100% deductions, enhance margins by 12%, while retail digitization via quick-commerce platforms accelerates volume throughput.

Competitive Landscape Analysis

The competitive landscape of the plastic caps and closures market is increasingly shaped by sustainability-driven innovation, as companies aim to capture 20% additional share in eco-friendly segments by 2030. Leading firms invest $1–2 billion annually in R&D to incorporate recycled content, achieving 15% cost reductions through economies of scale. M&A activity surged in Q1 2025, totalling US$ 9.4 billion, consolidating supply chains amid tariff uncertainties. Regulatory measures like EU tethering mandates accelerate capacity expansions, improving compliance and market access. Early movers gain 25% premium pricing on green products, while late entrants risk 10–15% market erosion from agile disruptors.

Key Companies

- Crown Holding

- Amcor plc

- Phoenix Closures

- Closure Systems International

- Ball Corporation

- Silgan Holdings Inc.

- Berry Global Inc.

- Guala Closures S.p.A

- AptarGroup, Inc.

- BERICAP

- Nippon Closures Co., Ltd.

- Sonoco Products Company

- Webpac Ltd

- UAB Elmoris

- CL Smith

- PELLICONI & C. SPA

- BERK

- UNITED CAPS

Recent Developments:

- In March 2025, Ayna.AI formed a joint venture with Ball Corporation called Oasis Venture Holdings, LLC. Ayna.AI, which is the majority investor, employs its "engaged operator model" to drive the growth of Ball's aluminum cup business within this new venture.

- In March 2025, Nippon Closures, a subsidiary of Toyo Seikan Group, won the Social Products Award 2025 for its innovative Smartphone Ring + Cap Opener. The product combines a PET bottle cap opener with a smartphone grip, improving accessibility for the elderly and those with weaker grip strength.

- July 2024, Silgan Holdings announced a €838 million agreement to acquire Weener Plastics, a global producer of dispensing solutions with 19 facilities and 4,000 employees. The deal expands Silgan’s dispensing and specialty closures business, with expected €20 million in synergies and accretive earnings in 2025, pending regulatory approvals and closing in late 2024.

Global Plastic Caps & Closures Market Segmentation-

By Material Tye

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Others

By Product Type

- Dispensing Caps

- Screw-on Caps

- Others

By Technology

- Post-mold TE Band

- Compression Molding

- Injection Molding

By Application

- Beverages

- Food

- Pharmaceuticals

- Beauty and Personal Care

- Homecare

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Plastic Caps & Closures Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Plastic Caps & Closures Market Outlook, 2020 - 2033

- Global Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Others

- Global Plastic Caps & Closures Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Dispensing Caps

- Screw-on Caps

- Others

- Global Plastic Caps & Closures Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- Post-mold TE Band

- Compression Molding

- Injection Molding

- Global Plastic Caps & Closures Market Outlook, by Application, Value (US$ Bn), 2020-2033

- Beverages

- Food

- Pharmaceuticals

- Beauty and Personal Care

- Homecare

- Others

- Global Plastic Caps & Closures Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- North America Plastic Caps & Closures Market Outlook, 2020 - 2033

- North America Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Others

- North America Plastic Caps & Closures Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Dispensing Caps

- Screw-on Caps

- Others

- North America Plastic Caps & Closures Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- Post-mold TE Band

- Compression Molding

- Injection Molding

- North America Plastic Caps & Closures Market Outlook, by Application, Value (US$ Bn), 2020-2033

- Beverages

- Food

- Pharmaceuticals

- Beauty and Personal Care

- Homecare

- Others

- North America Plastic Caps & Closures Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- S. Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- S. Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- S. Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Canada Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Canada Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Canada Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Canada Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Europe Plastic Caps & Closures Market Outlook, 2020 - 2033

- Europe Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Others

- Europe Plastic Caps & Closures Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Dispensing Caps

- Screw-on Caps

- Others

- Europe Plastic Caps & Closures Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- Post-mold TE Band

- Compression Molding

- Injection Molding

- Europe Plastic Caps & Closures Market Outlook, by Application, Value (US$ Bn), 2020-2033

- Beverages

- Food

- Pharmaceuticals

- Beauty and Personal Care

- Homecare

- Others

- Europe Plastic Caps & Closures Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Germany Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Germany Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Germany Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Italy Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Italy Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Italy Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Italy Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- France Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- France Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- France Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- France Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- K. Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- K. Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- K. Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- K. Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Spain Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Spain Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Spain Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Spain Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Russia Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Russia Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Russia Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Russia Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Rest of Europe Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Rest of Europe Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Rest of Europe Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Rest of Europe Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Asia Pacific Plastic Caps & Closures Market Outlook, 2020 - 2033

- Asia Pacific Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Others

- Asia Pacific Plastic Caps & Closures Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Dispensing Caps

- Screw-on Caps

- Others

- Asia Pacific Plastic Caps & Closures Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- Post-mold TE Band

- Compression Molding

- Injection Molding

- Asia Pacific Plastic Caps & Closures Market Outlook, by Application, Value (US$ Bn), 2020-2033

- Beverages

- Food

- Pharmaceuticals

- Beauty and Personal Care

- Homecare

- Others

- Asia Pacific Plastic Caps & Closures Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- China Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- China Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- China Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Japan Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Japan Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Japan Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Japan Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- South Korea Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- South Korea Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- South Korea Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- South Korea Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- India Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- India Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- India Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- India Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Southeast Asia Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Southeast Asia Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Southeast Asia Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Southeast Asia Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Rest of SAO Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Rest of SAO Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Rest of SAO Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Rest of SAO Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Latin America Plastic Caps & Closures Market Outlook, 2020 - 2033

- Latin America Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Others

- Latin America Plastic Caps & Closures Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Dispensing Caps

- Screw-on Caps

- Others

- Latin America Plastic Caps & Closures Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- Post-mold TE Band

- Compression Molding

- Injection Molding

- Latin America Plastic Caps & Closures Market Outlook, by Application, Value (US$ Bn), 2020-2033

- Beverages

- Food

- Pharmaceuticals

- Beauty and Personal Care

- Homecare

- Others

- Latin America Plastic Caps & Closures Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Brazil Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Brazil Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Brazil Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Mexico Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Mexico Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Mexico Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Mexico Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Argentina Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Argentina Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Argentina Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Argentina Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Rest of LATAM Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Rest of LATAM Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Rest of LATAM Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Rest of LATAM Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Middle East & Africa Plastic Caps & Closures Market Outlook, 2020 - 2033

- Middle East & Africa Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Others

- Middle East & Africa Plastic Caps & Closures Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Dispensing Caps

- Screw-on Caps

- Others

- Middle East & Africa Plastic Caps & Closures Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- Post-mold TE Band

- Compression Molding

- Injection Molding

- Middle East & Africa Plastic Caps & Closures Market Outlook, by Application, Value (US$ Bn), 2020-2033

- Beverages

- Food

- Pharmaceuticals

- Beauty and Personal Care

- Homecare

- Others

- Middle East & Africa Plastic Caps & Closures Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- GCC Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- GCC Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- GCC Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- South Africa Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- South Africa Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- South Africa Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- South Africa Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Egypt Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Egypt Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Egypt Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Egypt Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Nigeria Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Nigeria Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Nigeria Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Nigeria Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- Rest of Middle East Plastic Caps & Closures Market Outlook, by Material Tye, 2020-2033

- Rest of Middle East Plastic Caps & Closures Market Outlook, by Product Type, 2020-2033

- Rest of Middle East Plastic Caps & Closures Market Outlook, by Technology, 2020-2033

- Rest of Middle East Plastic Caps & Closures Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Plastic Caps & Closures Market Outlook, by Material Tye, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Crown Holding

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Amcor plc

- Phoenix Closures

- Closure Systems International

- Ball Corporation

- Silgan Holdings Inc.

- Berry Global Inc.

- Guala Closures S.p.A

- AptarGroup, Inc.

- BERICAP

- Crown Holding

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Material Type Coverage |

|

|

Product Type Coverage |

|

|

Technology Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |