Global Handloom Product Market: Comprehensive Strategic Analysis

Executive Summary & Key Highlights

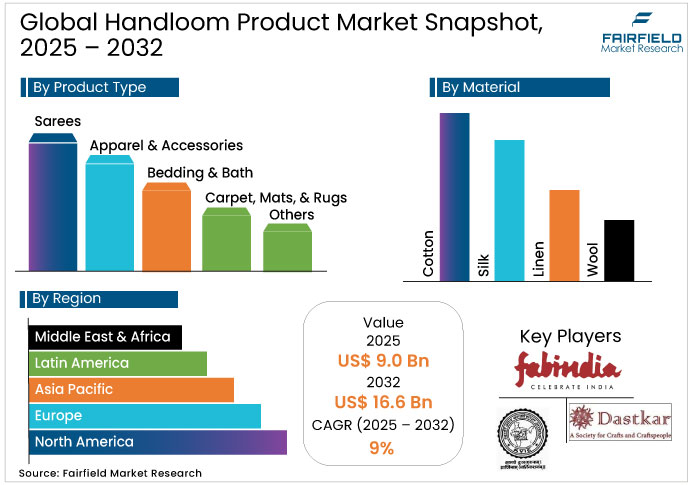

- The global handloom product market reached approximately USD 9.0 billion in 2025, with projections indicating expansion to USD 16.6 billion by 2032, reflecting market maturation with 9% CAGR dynamics.

- Asia-Pacific dominates the Global Handloom Product Market with a 70% share, led by India’s 64.66 lakh artisans and strong domestic and export demand for authentic, sustainable textiles.

- Europe holds 14% of the market, driven by ethically sourced, premium handloom products, with Germany and the UK contributing 50–60% of regional consumption

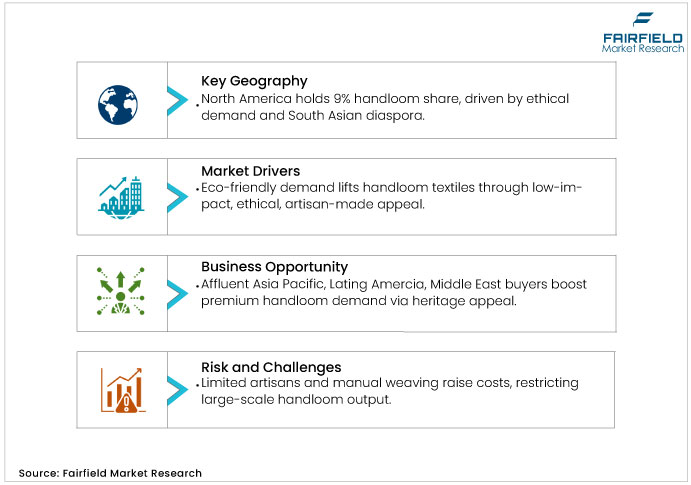

- North America accounts for 9% of global demand, supported by eco-conscious consumers, institutional purchasing, and a strong South Asian diaspora.

- Apparel & accessories lead the segment, representing ~45% of the market, with sarees alone contributing 32%, fueled by cultural heritage and diaspora demand.

- Cotton sarees dominate the material mix (~60%), while silk and linen are gaining premium and sustainable positioning, reflecting shifts toward eco-friendly and contemporary fabrics.

- E-commerce and direct-to-consumer channels capture 25–30% of global sales, enabling artisans to reach international buyers across North America, Europe, and Asia-Pacific.

- Sustainability and technology integration including upgraded looms, blockchain traceability, and AI-assisted design are key drivers, enhancing transparency, productivity, and premium market appeal.

Market Dynamics: Drivers, Restraints, and Opportunities Analysis

Market Drivers

- Sustainability and Eco-Conscious Consumer Positioning

Growing global preference for environmentally responsible products is becoming a major catalyst for the global Handloom Product Market, as consumers increasingly shift toward low-impact, ethically produced goods. This trend strengthens demand for handloom textiles because their production is naturally resource-efficient and supports rural artisan livelihoods. Studies indicate that handloom textiles made from natural fibres use 40–60% less energy and water than mechanised alternatives, giving them a clear sustainability advantage. This is particularly relevant in North America and Europe, where about 65% of consumers are willing to pay premium prices for certified sustainable products, boosting the appeal of handmade goods.

Sustainability adoption is also expanding demand for handloom items across emerging categories such as bedding, bath, and home décor, helping these products enter mainstream retail. The presence of 318 GI-tagged handicraft products and a skilled artisan base of over 64.66 lakh workers enhances authenticity and strengthens the market positioning of eco-friendly handloom goods. Companies that communicate supply chain transparency, fair labour practices, and certifications such as GOTS and Fair Trade are more likely to gain market share. With regulatory enforcement increasing and consumers maintaining a willingness to pay sustainably, this driver is expected to remain a strong long-term growth pillar.

- E-Commerce Channel Integration and Direct-to-Consumer Distribution Models

Digital distribution is reshaping the global Handloom Product Market by enabling producers to reach consumers without reliance on traditional retail networks. This shift reduces barriers such as geographic limitations and high inventory costs, giving small artisans and cooperatives easier market entry. Industry data from 2024–2025 shows that e-commerce platforms now account for 25–30% of global handloom sales, growing 2–3x faster than offline retail. Platforms such as Etsy, Amazon Handmade, Flipkart, and regional marketplaces have become critical growth engines supporting this expansion.

Direct-to-consumer digital channels further boost international reach, allowing Indian producers to cater directly to buyers in North America and Europe. India’s strong export capability reflected in USD 37.75 billion textile and apparel exports across 200+ global markets supports this transition by enhancing brand visibility. Government initiatives such as the Export Promotion Mission and FTAs also help artisans participate more effectively in global e-commerce. As digital adoption deepens and logistics systems strengthen, e-commerce is expected to remain a central driver of market growth while platform-dependent sellers must guard against commoditization.

Market Restraints

- Production Scale Limitations and Artisan Labour Fragmentation

Handloom production faces inherent structural limits due to the small and shrinking pool of skilled artisans, most of whom are based in India. Manual weaving delivers far lower output than mechanised systems, creating high unit costs because labour represents the largest share of production expenses. These constraints make large-scale expansion difficult, especially for high-volume orders.

Demographic pressures worsen the challenge: the artisan workforce is ageing, younger generations show limited interest, and rural-to-urban migration reduces the available labour base. Even with government efforts such as Pehchan ID, skill development, and design support through Weavers’ Service Centres, supply remains fragmented. As a result, organisations must balance maintaining authentic handcrafted production for premium segments while integrating hybrid or semi-mechanised processes to serve broader market demand.

- Supply Chain Transparency and Compliance Cost Burdens

Regulatory demands in developed markets now require strict supply-chain transparency, labour-standard compliance, and environmental reporting, creating heavy cost pressures for small handloom producers. New EU regulations (2024–2025) mandate detailed sourcing and labour disclosures, while certifications like Fair Trade and GOTS add annual auditing costs of USD 5,000–25,000, often beyond the reach of artisan cooperatives with limited financial capacity.

Regulatory complexity differs across export destinations, forcing producers to adopt market-specific compliance systems and digital traceability tools that many artisan communities cannot afford. Compliance can support premium positioning, but smaller enterprises risk exclusion from institutional procurement, driving consolidation toward larger organisations and widening competitive disparities within the handloom sector.

Market Opportunities

- Emerging Consumer Demographics and Geographic Market Expansion

Growing affluent consumer groups across Asia-Pacific, Latin America, and the Middle East are driving increased demand for premium, artisan-made handloom products, presenting a significant opportunity in the Global Handloom Product Market. This trend expands market potential as heritage textiles gain recognition among new-age buyers seeking authenticity and cultural value. Rising incomes in India, Vietnam, Indonesia, and Mexico further broaden the addressable consumer base, supported by traditional weaving cultures and rising middle-class spending across Southeast Asia.

Institutional channels such as corporate gifting, hospitality, luxury retail, and government procurement are opening high-volume opportunities, as sustainability-focused purchasing gains momentum worldwide. Tourism-linked retail, international exhibitions, and digital platforms like indiahandmade.com enhance global access, benefiting over 16 lakh weavers through marketing assistance under NHDP. With India’s handloom exports already reaching ₹2,417 crore and supported by initiatives across nine states through EU-backed sustainability programs, organisations that prioritise targeted market expansion and strong supply partnerships are well-positioned to capture disproportionate growth in the sector.

- Technology Integration and Supply Chain Modernisation

Technology adoption is emerging as a key opportunity by enhancing transparency, improving productivity, and opening new market pathways for the handloom sector. Digital traceability systems, including blockchain-led EU–India collaborations, are strengthening authenticity in premium categories. Under NHDP, more than 22 lakh weavers have gained from upgraded looms, solar units, and design-development tools, showcasing how modernisation improves cluster-level efficiency and sustainability.

E-commerce, digital marketing, and AI-assisted design already used in EU-supported programs for silk artisans remain largely untapped but offer strong potential for market expansion. Platforms like indiahandmade.com have already supported over 16 lakh weavers, while EU-backed initiatives across nine states focus on branding, resource efficiency, and modern production practices. Organisations that invest early in digital infrastructure and visibility tools will be best positioned to build trust, scale responsibly, and maintain artisan-centred value creation.

Regional Market Assessment: Strategic Geography Analysis

- North America Market Dynamics

North America holds 9% of the global handloom product market, supported by strong demand for artisanal, culturally rooted, and sustainably produced textiles. Growth is shaped by shifting consumer preferences toward ethical craftsmanship and rising institutional buying across corporate gifting, hospitality, and premium retail. The presence of a 6–7 million South Asian diaspora further strengthens product familiarity and sustained category adoption.

E-commerce platforms enhance accessibility, while FTC sustainability rules, textile labelling norms, and Fair Trade or organic certifications influence market entry and brand positioning. The region remains fragmented, with direct-to-consumer labels and speciality retailers competing through transparency, certification, and cultural authenticity. Brands that target diaspora-driven demand, younger conscious consumers, and institutional channels are positioned to achieve long-term, defensible growth.

- Europe Market Assessment

Europe accounts for 14% of the global handloom product market, supported by strong demand for ethically sourced, culturally authentic textiles across premium and mainstream retail. Growth is propelled by diaspora buyers, luxury retail interest, and rising fashion-industry integration, with Germany and the UK together making up 50–60% of regional consumption.

Strict EU regulations under the 2024 Textile Strategy and Green Deal require detailed supply-chain and labour compliance, shaping market participation. The February 2025 EU-India programme, allocating €9.5 million for sustainability and blockchain-based traceability for 35,000 artisans, strengthens premium positioning. Long-term success relies on adapting to country-specific rules while maintaining authenticity and transparency.

- Asia-Pacific Region Analysis

Asia-Pacific dominates the global handloom product market with a 70% share, driven by rising domestic consumption, export-focused manufacturing, and growing demand for authentic, sustainable textiles. India, home to over 64.66 lakh artisans and 2.8 million handloom weavers, emerges as the fastest-growing market, while ASEAN countries like Vietnam, Thailand, Indonesia, Cambodia, and the Philippines benefit from rising middle-class spending and established weaving traditions. Strong cultural heritage and artisan-led production provide premium positioning for handloom products.

Government initiatives such as the Pehchan Artisan Identification programme, NHDP support for 356 clusters, and e-commerce platforms like indiahandmade.com enhance skill development, productivity, and market access. E-commerce adoption further expands urban and international reach, enabling artisans to sell directly to consumers. Long-term growth in Asia-Pacific depends on strengthening supply chain partnerships, leveraging digital tools, and supporting sustainable, artisan-centric production models.

Segmentation Analysis: Category-Wise Strategic Assessment

- Apparel & Accessories Segment Analysis

Apparel and accessories dominate the global handloom product market, accounting for approximately 45% share in 2025, driven by traditional sarees and expanding categories like casual wear, fashion accessories, and fusion apparel. Growth is strong in India and South Asia and accelerating in developed markets, supported by e-commerce expansion, designer-artisan collaborations, and diversification into kurtas, dhotis, shawls, stoles, and contemporary fashion.

The segment remains highly fragmented, with the top 5–10 players holding under 20% combined market share, reflecting strong artisan, cooperative, and emerging direct-to-consumer participation. Government support through initiatives such as the National Handloom Development Programme, Raw Material Supply Scheme, and Weavers’ MUDRA Loans, alongside marketing support via India Handloom brand registrations and international fairs, strengthens competitiveness. Sustaining premium positioning depends on verifiable authenticity, design innovation, and transparent supply chains

- Sarees and Material Type Cross-Analysis

The sarees segment represents the highest-growth category within the global handloom product market, accounting for 32% of the total market in 2025, driven by strong cultural relevance in India and South Asia, rising diaspora demand, and growing interest from developed markets seeking heritage textiles. Cotton sarees dominate with around 60% share, silk sarees occupy premium positioning, and linen sarees emerge as the fastest-growing variant, reflecting shifts toward sustainable and contemporary fabrics.

Government initiatives such as the National Handloom Development Programme, Handloom Marketing Assistance, and cluster-based support have benefited over 22 lakh weavers, improving productivity, infrastructure, and market access. Programs like FabIndia’s Beautiful Imperfections campaign and GI recognitions for traditional sarees, including Woraiyur cotton, enhance visibility and export potential. Sustained growth in this segment relies on promoting authenticity, skilled craftsmanship, and direct-to-consumer access while ensuring economic empowerment for rural artisans, especially women.

Competitive Landscape: Market Structure and Strategic Positioning

The global handloom product market is highly fragmented, with numerous small to medium players deeply rooted in local craft traditions. Artisans and cooperatives dominate production across categories like sarees, shawls, home textiles, and accessories, creating a vibrant yet decentralized market that blends cultural heritage with contemporary demand.

Key players such as Fabindia, Khadi Gramodyog, and Dastkar have established leadership in India through strong branding, retail presence, and sustainable product offerings. Organizations like Dastkari Haat Samiti, Bharat Handloom, and Varanasi Weaves support artisans collectively, enhancing market access and international recognition, while online-focused players like Jaypore and Nandini Handlooms extend reach to global consumers without compromising traditional craftsmanship.

Key Players

- Fabindia

- Dastkar

- Khadi Gramodyog

- Barefoot College

- Bharat Handloom

- Varanasi Weaves

- Jaypore

- Nandini Handlooms

- Assam Handloom

- Dastkari Haat Samiti

- The India Handloom Brand

- Ranganayaki Handlooms

- Anokhi

- Looms & Weaves

- Sanganeri Textiles

Recent Developments

- May 22, 2025, FabIndia launched its ‘Beautiful Imperfections’ campaign to strengthen its focus on handicrafts and artisanal handloom traditions, highlighting the uniqueness of handmade products. The campaign showcases traditional techniques such as Dabu, Ajrakh, Bagru, Bagh, handblock printing, and tie-dye, emphasizing the value of craftsmanship and human touch in every piece. This initiative reinforces FabIndia’s commitment to promoting authentic handloom-based apparel, accessories, and home décor while celebrating natural dyes, handcrafted processes, and the individuality found in artisan-made products.

- 13 September 2024 FabIndia collaborated with the Ministry of Micro, Small, and Medium Enterprises (MoMSME) under the PM Vishwakarma Scheme to support and uplift India’s traditional artisans, including weavers, by integrating their handcrafted products into its national retail network. The initiative enhances market access, strengthens marketing capabilities, and provides training for artisans to refine skills and adopt modern design approaches, promoting wider visibility and sustainable livelihoods within the handloom and handicraft ecosystem.

Global Handloom Product Market Segmentation-

By Product Type

- Sarees

- Apparel & Accessories

- Bedding & Bath

- Carpet, Mats, & Rugs

- Others

By Material

- Cotton

- Silk

- Linen

- Wool

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Executive Summary

- Global Handloom Product Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2025

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2024-2032

- Price Impact Factors

- Global Handloom Product Market Outlook, 2019 - 2032

- Global Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Sarees

- Apparel & Accessories

- Bedding & Bath

- Carpet, Mats, & Rugs

- Others

- Global Handloom Product Market Outlook, by Material, Value (US$ Bn), 2019-2032

- Cotton

- Silk

- Linen

- Wool

- Global Handloom Product Market Outlook, by Region, Value (US$ Bn), 2019-2032

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- North America Handloom Product Market Outlook, 2019 - 2032

- North America Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Sarees

- Apparel & Accessories

- Bedding & Bath

- Carpet, Mats, & Rugs

- Others

- North America Handloom Product Market Outlook, by Material, Value (US$ Bn), 2019-2032

- Cotton

- Silk

- Linen

- Wool

- North America Handloom Product Market Outlook, by Country, Value (US$ Bn), 2019-2032

- S. Handloom Product Market Outlook, by Product Type, 2019-2032

- S. Handloom Product Market Outlook, by Material, 2019-2032

- Canada Handloom Product Market Outlook, by Product Type, 2019-2032

- Canada Handloom Product Market Outlook, by Material, 2019-2032

- BPS Analysis/Market Attractiveness Analysis

- North America Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Europe Handloom Product Market Outlook, 2019 - 2032

- Europe Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Sarees

- Apparel & Accessories

- Bedding & Bath

- Carpet, Mats, & Rugs

- Others

- Europe Handloom Product Market Outlook, by Material, Value (US$ Bn), 2019-2032

- Cotton

- Silk

- Linen

- Wool

- Europe Handloom Product Market Outlook, by Country, Value (US$ Bn), 2019-2032

- Germany Handloom Product Market Outlook, by Product Type, 2019-2032

- Germany Handloom Product Market Outlook, by Material, 2019-2032

- Italy Handloom Product Market Outlook, by Product Type, 2019-2032

- Italy Handloom Product Market Outlook, by Material, 2019-2032

- France Handloom Product Market Outlook, by Product Type, 2019-2032

- France Handloom Product Market Outlook, by Material, 2019-2032

- K. Handloom Product Market Outlook, by Product Type, 2019-2032

- K. Handloom Product Market Outlook, by Material, 2019-2032

- Spain Handloom Product Market Outlook, by Product Type, 2019-2032

- Spain Handloom Product Market Outlook, by Material, 2019-2032

- Russia Handloom Product Market Outlook, by Product Type, 2019-2032

- Russia Handloom Product Market Outlook, by Material, 2019-2032

- Rest of Europe Handloom Product Market Outlook, by Product Type, 2019-2032

- Rest of Europe Handloom Product Market Outlook, by Material, 2019-2032

- BPS Analysis/Market Attractiveness Analysis

- Europe Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Asia Pacific Handloom Product Market Outlook, 2019 - 2032

- Asia Pacific Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Sarees

- Apparel & Accessories

- Bedding & Bath

- Carpet, Mats, & Rugs

- Others

- Asia Pacific Handloom Product Market Outlook, by Material, Value (US$ Bn), 2019-2032

- Cotton

- Silk

- Linen

- Wool

- Asia Pacific Handloom Product Market Outlook, by Country, Value (US$ Bn), 2019-2032

- China Handloom Product Market Outlook, by Product Type, 2019-2032

- China Handloom Product Market Outlook, by Material, 2019-2032

- Japan Handloom Product Market Outlook, by Product Type, 2019-2032

- Japan Handloom Product Market Outlook, by Material, 2019-2032

- South Korea Handloom Product Market Outlook, by Product Type, 2019-2032

- South Korea Handloom Product Market Outlook, by Material, 2019-2032

- India Handloom Product Market Outlook, by Product Type, 2019-2032

- India Handloom Product Market Outlook, by Material, 2019-2032

- Southeast Asia Handloom Product Market Outlook, by Product Type, 2019-2032

- Southeast Asia Handloom Product Market Outlook, by Material, 2019-2032

- Rest of SAO Handloom Product Market Outlook, by Product Type, 2019-2032

- Rest of SAO Handloom Product Market Outlook, by Material, 2019-2032

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Latin America Handloom Product Market Outlook, 2019 - 2032

- Latin America Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Sarees

- Apparel & Accessories

- Bedding & Bath

- Carpet, Mats, & Rugs

- Others

- Latin America Handloom Product Market Outlook, by Material, Value (US$ Bn), 2019-2032

- Cotton

- Silk

- Linen

- Wool

- Latin America Handloom Product Market Outlook, by Country, Value (US$ Bn), 2019-2032

- Brazil Handloom Product Market Outlook, by Product Type, 2019-2032

- Brazil Handloom Product Market Outlook, by Material, 2019-2032

- Mexico Handloom Product Market Outlook, by Product Type, 2019-2032

- Mexico Handloom Product Market Outlook, by Material, 2019-2032

- Argentina Handloom Product Market Outlook, by Product Type, 2019-2032

- Argentina Handloom Product Market Outlook, by Material, 2019-2032

- Rest of LATAM Handloom Product Market Outlook, by Product Type, 2019-2032

- Rest of LATAM Handloom Product Market Outlook, by Material, 2019-2032

- BPS Analysis/Market Attractiveness Analysis

- Latin America Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Middle East & Africa Handloom Product Market Outlook, 2019 - 2032

- Middle East & Africa Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Sarees

- Apparel & Accessories

- Bedding & Bath

- Carpet, Mats, & Rugs

- Others

- Middle East & Africa Handloom Product Market Outlook, by Material, Value (US$ Bn), 2019-2032

- Cotton

- Silk

- Linen

- Wool

- Middle East & Africa Handloom Product Market Outlook, by Country, Value (US$ Bn), 2019-2032

- GCC Handloom Product Market Outlook, by Product Type, 2019-2032

- GCC Handloom Product Market Outlook, by Material, 2019-2032

- South Africa Handloom Product Market Outlook, by Product Type, 2019-2032

- South Africa Handloom Product Market Outlook, by Material, 2019-2032

- Egypt Handloom Product Market Outlook, by Product Type, 2019-2032

- Egypt Handloom Product Market Outlook, by Material, 2019-2032

- Nigeria Handloom Product Market Outlook, by Product Type, 2019-2032

- Nigeria Handloom Product Market Outlook, by Material, 2019-2032

- Rest of Middle East Handloom Product Market Outlook, by Product Type, 2019-2032

- Rest of Middle East Handloom Product Market Outlook, by Material, 2019-2032

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Handloom Product Market Outlook, by Product Type, Value (US$ Bn), 2019-2032

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2024

- Competitive Dashboard

- Company Profiles

- Fabindia

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Dastkar

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Khadi Gramodyog

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Barefoot College

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Bharat Handloom

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Varanasi Weaves

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Jaypore

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Nandini Handlooms

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Assam Handloom

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Dastkari Haat Samiti

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Fabindia

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Product Type Coverage |

|

|

By Material Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |