Global Heavy-duty Autonomous Vehicles Market Forecast

- The Heavy-Duty Autonomous Vehicles Market is valued at USD 34.5 Bn in 2026 and is projected to reach USD 159.1 Bn, growing at a CAGR of 24% by 2033.

Market Analysis in Brief

Heavy-duty autonomous vehicles are self-driving vehicles made for tasks that call for a large load-carrying capacity and the ability to negotiate difficult terrains, such as transporting materials and cargo across construction sites and mines. LiDAR sensors, GPS, and sophisticated algorithms are just a few of the technology that heavy-duty autonomous vehicles employ to navigate their surroundings and decide how to operate safely and effectively. With limited commercial deployment and fewer market participants, the heavy-duty autonomous vehicle market is still in its early stages of development and adoption. The market is primarily centered on industrial applications including mining, construction, and logistics where there is a high need for big, strong vehicles that can drive themselves in difficult terrain. Although the market for heavy-duty autonomous vehicles is now smaller than that for all autonomous vehicles, it is anticipated to expand quickly over the next several years as technology develops and the advantages of autonomous operation are better understood.

Key Report Findings

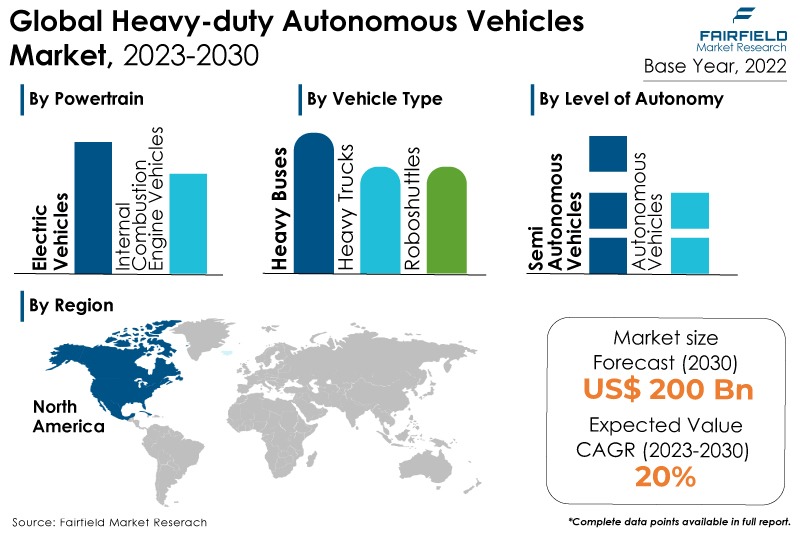

- The heavy-duty autonomous cars market will see revenue growth of 5x during the forecast period. i.e. between 2023 and 2030.

- Rising demand for autonomous driving increased technological advancements, and integration of heavy-duty driverless vehicles in public transportation are all predicted to contribute to the growth of the market for heavy-duty autonomous vehicles.

- Electric vehicles held the highest heavy-duty autonomous vehicles market revenue share in 2022.

- The heavy buses category is anticipated to dominate the market over the forecast period.

- Semi-autonomous vehicles are more in demand in the heavy-duty autonomous vehicle sector.

- North America will maintain its dominance, while the Asia Pacific heavy-duty autonomous vehicle industry will develop the fastest until 2030.

Growth Drivers

Improved Safety Features

The rise in demand for vehicles with autonomous driving capabilities and the development of cutting-edge autonomous commercial vehicle solutions, are propelling the market for heavy-duty autonomous vehicles. Furthermore, due to advantages including improved driver and vehicle safety features and fuel/battery power efficiency, the demand for heavy-duty autonomous cars is on the rise. Additionally, the development of heavy-duty autonomous vehicles is the subject of intense interest and funding, and numerous businesses are vying for a piece of this growing industry.

Growing Efforts for Road Safety Measures

Road accidents are becoming more frequent every day. More than a million individuals every year lose their lives in traffic accidents, according to the Association for Safe International Road Travel (ASIRT). Human error, which happens when there is uncertainty in the course of events, such as head-on collisions caused by a driver's misunderstanding, is the main factor in accidents. Accidents may also happen as a result of equipment or component failure, such as brake or axle failure.

Many governments are tightening the laws that can address concerns about road safety. Because heavy-duty autonomous vehicles are more technologically advanced and equipped with a variety of driving assistance systems, including navigation systems, lane management systems, and anti-collision systems, among others, and are connected to a central processing and decision-making system, they are safer than traditional heavy vehicles.

Furthermore, it may be possible to reduce traffic congestion with the help of heavy-duty autonomous vehicles. Autonomous vehicles can communicate with other vehicles to reduce traffic jams. Additionally, with the growth of the sharing economy, self-driving cars can provide travelers with a simple, practical, and efficient point-to-point journey with the least amount of traffic congestion.

Increased Adoption of Commercial Vehicle Electrification

The current global megatrend of commercial vehicle electrification is also having an impact on the heavy-duty autonomous cars market's expansion. The market is expected to expand as a result of rising demand for commercial vehicles free of emissions and equipped with enhanced safety and driver assistance features for effective supply chain, logistics, and trucking operations across key sectors.

Automotive pollution control is subject to strict laws in developed economies like China, the European Union, and the United States. For instance, in November 2022, the European Union unveiled the Euro VII emission standard. According to the new standard, buses, and lorries will emit 56% less nitric oxide (NOx) by 2035 compared to Euro VI, and cars, vans, and pickup trucks would emit 35% less NOx.

It is thus projected that the heavy-duty autonomous cars market growth in the years to come would be boosted by booming new-generation electric trucks and bus sales with a substantial level of autonomy. Moreover, it is projected that in the upcoming years, demand for self-driving trucks and buses will increase due to fleet managers' focus on deploying an emission-free autonomous fleet of trucks to save operating costs and increase efficiency.

Growth Challenges

Security Concerns

Data, such as current position data and sensor information, is crucial for heavy-duty autonomous vehicles. It is essential to ensure the security and privacy of this data to guard against potential breaches and abuse. As a result, the market for heavy-duty autonomous vehicles is faced with growing worries about cybersecurity and data privacy.

According to a report on issues in autonomous vehicle testing and deployment released by the Congressional Research Service, the USA's policy institute, in February 2020, concerns for data security and the defense of the onboard system against intrusion are growing as a result of technological advancements. A lot of data is produced on heavy vehicles, their performance, the behavior of the driver, and their precise location by the built-in automated components.

Governments at the state and federal levels, as well as service providers, manufacturers, and consumers, are extremely concerned about safeguarding heavy-duty autonomous vehicles from hackers. Therefore, as technology develops, worries about data security and privacy emerge, which is anticipated to significantly slow the growth of the market for heavy-duty autonomous vehicles.

Overview of Key Segments

Electric Vehicles Powertrain Segment Surges Ahead

The electric vehicles category in application-for electronics led the market in 2022. In comparison to vehicles powered by internal combustion engines (ICEs), electric vehicles (EVs) require more sophisticated equipment. When compared to internal combustion cars, electric vehicles are dominating the market for heavy-duty autonomous vehicles for several reasons.

Since they have no exhaust emissions and a smaller carbon footprint than internal combustion cars, electric vehicles are seen as being more environmentally friendly and sustainable. This fits with the expanding trend across businesses to cut carbon emissions and promote sustainability.

Additionally, compared to internal combustion vehicles, electric vehicles are typically quieter and provide a smoother ride, which can be advantageous in some sectors, like public transportation, where noise and vibration might be an issue.

Electric cars have also become more useful and convenient for heavy-duty applications as a result of developments in battery technology and charging infrastructure. Electric vehicles can already compete with internal combustion vehicles in terms of performance and usability thanks to quickly expanding charging infrastructures and longer driving range capabilities.

Growth Opportunities Across Regions

North America Spearheads

The heavy-duty autonomous vehicles market will continue to see dominance of North America due to the existence of numerous reputable manufacturers. Additionally, there are several legislative and policy measures in the region that promote the creation and use of autonomous vehicles, particularly heavy-duty vehicles. The sector has witnessed significant investment from both established automakers and tech firms, which has sped up the creation of autonomous heavy-duty vehicle technologies.

Furthermore, in North America, the legislative framework for autonomous vehicles differs between states and provinces. While some places have accepted testing and pilot projects, others have stricter laws that could affect rollout. The size and weight of heavy-duty trucks make safety a top priority. The potential reduction of accidents brought on by human mistakes is what motivates the deployment of autonomous technology.

In North America, it is typical for technology firms, automakers, and logistical service providers to work together. This strategy integrates knowledge of transportation operations, software, and hardware.

Asia Pacific Presents an Influx of Opportunities

The market for heavy-duty autonomous vehicles across the Asia Pacific will display a significant CAGR over the forecast period. Asia Pacific nations like China, Japan, and South Korea are at the forefront of technological advancement. As a result, there has been a significant advancement in the creation of autonomous technology for heavy-duty autonomous vehicles.

Additionally, the need for effective freight and logistics solutions is being driven by dense urban populations and expanding e-commerce sectors in nations like China, and India, making autonomous heavy-duty vehicles a desirable alternative. Furthermore, several regional governments are actively funding, regulating, and investing in the research and testing of autonomous vehicles. These programs are designed to make their nations the world leaders in autonomous technology.

Heavy-duty Autonomous Vehicles Market: Competitive Landscape

Some of the leading players at the forefront in the heavy-duty autonomous vehicles market space

• AB Volvo

• General Motors

• Mercedes-Benz Group AG

• BMW Group

• Volkswagen AG

• PACCAR Inc.

• Renault Trucks

• Traton Group

• Shanghai Newrizon Technology Co., Ltd.

• New Flyer (NFI Group)

• Karsan

• Proterra

• 2getthere B.V.

• Apollo (Baidu)

• Magna International Inc.

• ZF Friedrichshafen AG

• Zoox, Inc.

• Cruise LLC

• Schaeffler AG

• Waymo LLC

Recent Notable Developments

In May 2022, Kodiak Robotics, Inc. and Ambarella, Inc., a company that makes AI semiconductors, formed a cooperation to integrate Ambarella's CV2AQ AI perception system-on-chip (SoC) for all camera data processing into Kodiak's self-driving trucks.

In March 2023, ZF Friedrichshafen AG Group announced a $194.0 million investment to assist the expansion of eMobility while also expanding activities in Juarez, Mexico.

In February 2023, an agreement for Torc Robotics to purchase Algolux Inc. was reached. For its highly acclaimed intellectual property and expertise in computer vision and machine learning, Torc acquired Algolux.

Global Heavy-duty Autonomous Vehicles Market is Segmented as Below:

By Powertrain

- Internal Combustion Engine Vehicles

- Electric Vehicles

By Vehicle Type

- Heavy Trucks

- Heavy Buses

- Roboshuttles

By Level of Autonomy

- Semi-Autonomous Vehicles

- Autonomous Vehicles

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

- Rest of the World

- Latin America

- Middle East and Africa

- Executive Summary

- Global Heavy-Duty Autonomous Vehicles Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Heavy-Duty Autonomous Vehicles Market Outlook, 2020 - 2033

- Global Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Internal Combustion Engine Vehicles

- Electric Vehicles

- Global Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Heavy Trucks

- Heavy Buses

- Roboshuttles

- Global Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, Value (US$ Bn), 2020-2033

- Semi-Autonomous Vehicles

- Autonomous Vehicles

- 350 to 650 Volts

- Global Heavy-Duty Autonomous Vehicles Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- North America Heavy-Duty Autonomous Vehicles Market Outlook, 2020 - 2033

- North America Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Internal Combustion Engine Vehicles

- Electric Vehicles

- North America Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Heavy Trucks

- Heavy Buses

- Roboshuttles

- North America Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, Value (US$ Bn), 2020-2033

- Semi-Autonomous Vehicles

- Autonomous Vehicles

- 350 to 650 Volts

- North America Heavy-Duty Autonomous Vehicles Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- S. Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- S. Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Canada Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Canada Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Canada Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Europe Heavy-Duty Autonomous Vehicles Market Outlook, 2020 - 2033

- Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Internal Combustion Engine Vehicles

- Electric Vehicles

- Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Heavy Trucks

- Heavy Buses

- Roboshuttles

- Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, Value (US$ Bn), 2020-2033

- Semi-Autonomous Vehicles

- Autonomous Vehicles

- 350 to 650 Volts

- Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Germany Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Germany Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Italy Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Italy Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Italy Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- France Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- France Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- France Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- K. Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- K. Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- K. Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Spain Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Spain Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Spain Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Russia Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Russia Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Russia Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Rest of Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Rest of Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Asia Pacific Heavy-Duty Autonomous Vehicles Market Outlook, 2020 - 2033

- Asia Pacific Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Internal Combustion Engine Vehicles

- Electric Vehicles

- Asia Pacific Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Heavy Trucks

- Heavy Buses

- Roboshuttles

- Asia Pacific Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, Value (US$ Bn), 2020-2033

- Semi-Autonomous Vehicles

- Autonomous Vehicles

- 350 to 650 Volts

- Asia Pacific Heavy-Duty Autonomous Vehicles Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- China Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- China Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Japan Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Japan Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Japan Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- South Korea Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- South Korea Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- South Korea Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- India Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- India Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- India Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Southeast Asia Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Southeast Asia Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Rest of SAO Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Rest of SAO Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Latin America Heavy-Duty Autonomous Vehicles Market Outlook, 2020 - 2033

- Latin America Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Internal Combustion Engine Vehicles

- Electric Vehicles

- Latin America Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Heavy Trucks

- Heavy Buses

- Roboshuttles

- Latin America Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, Value (US$ Bn), 2020-2033

- Semi-Autonomous Vehicles

- Autonomous Vehicles

- 350 to 650 Volts

- Latin America Heavy-Duty Autonomous Vehicles Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Brazil Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Brazil Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Mexico Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Mexico Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Mexico Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Argentina Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Argentina Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Argentina Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Rest of LATAM Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Rest of LATAM Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Middle East & Africa Heavy-Duty Autonomous Vehicles Market Outlook, 2020 - 2033

- Middle East & Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Internal Combustion Engine Vehicles

- Electric Vehicles

- Middle East & Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Heavy Trucks

- Heavy Buses

- Roboshuttles

- Middle East & Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, Value (US$ Bn), 2020-2033

- Semi-Autonomous Vehicles

- Autonomous Vehicles

- 350 to 650 Volts

- Middle East & Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- GCC Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- GCC Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- South Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- South Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- South Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Egypt Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Egypt Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Egypt Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Nigeria Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Nigeria Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Nigeria Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- Rest of Middle East Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, 2020-2033

- Rest of Middle East Heavy-Duty Autonomous Vehicles Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East Heavy-Duty Autonomous Vehicles Market Outlook, by Level of Autonomy, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Heavy-Duty Autonomous Vehicles Market Outlook, by Powertrain, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- AB Volvo

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- General Motors

- Mercedes-Benz Group AG

- BMW Group

- Volkswagen AG

- PACCAR Inc.

- Renault Trucks

- Traton Group

- Shanghai Newrizon Technology Co., Ltd.

- New Flyer (NFI Group)

- AB Volvo

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Powertrain Coverage |

|

|

Vehicle Type Coverage |

|

|

Level of Autonomy Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |