Global High Energy Lasers Market Forecast

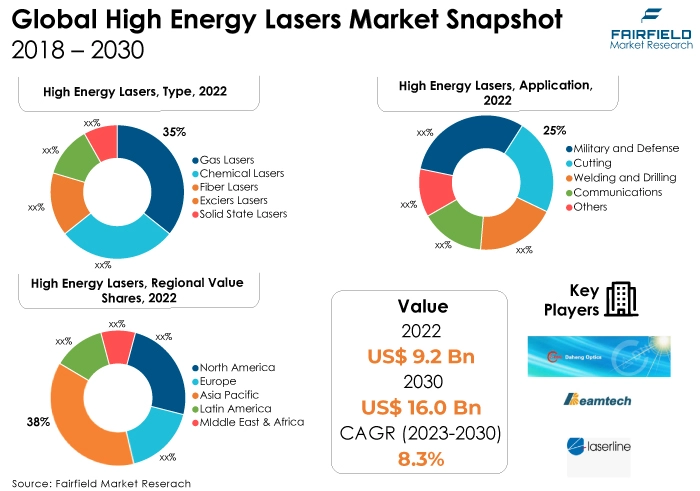

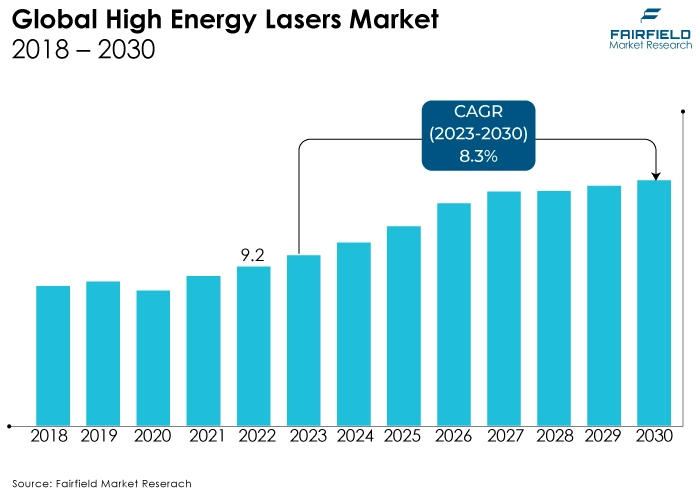

- High energy lasers market size poised to jump from US$9.2 Bn in 2022 to US$16 Bn by 2030-end

- High energy lasers market valuation expects a CAGR of 8.3% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel defence budgets globally, especially in countries like the US, and China, is driving the demand for high energy lasers (HEL) in military applications. The rising focus on advanced defence technologies and missile defence systems presents a significant market driver.

- Another major market trend expected to be rapid advancements in laser technology, including improved beam quality, increased power outputs, and enhanced reliability, are creating new opportunities in various sectors.

- HEL technology is finding novel applications in high-speed data transmission and secure communications. As the demand for high bandwidth and secure communication networks grows, high-energy lasers are becoming pivotal in revolutionising data transmission technologies.

- Gas lasers are leading the market due to their versatility in cutting, welding, and engraving, which has cemented their position. Their long-standing reputation and proven performance maintain their dominance.

- In 2022, fibre lasers are witnessing high adoption rates in industrial sectors, especially in cutting, welding, and drilling applications. Their precision and versatility are fuelling their demand among manufacturers.

- Military and defence applications, including missile defence systems and directed-energy weapons, are the primary drivers in this segment. High-energy lasers are crucial for countering aerial threats and enhancing national security.

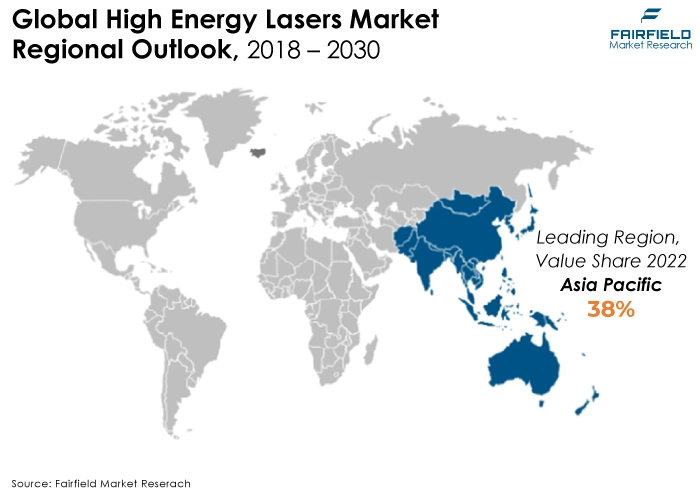

- The Asia Pacific region is anticipated to account for the largest share of the global high energy lasers market, owing to the region's significant investments in defence and military modernization. These countries have been consistently increasing their defence budgets to enhance their military capabilities, including the development and deployment of high-energy laser systems.

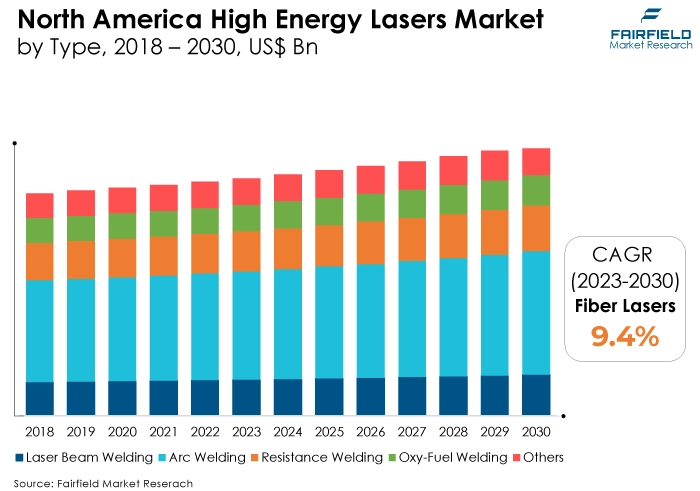

- The market for high energy lasers is expanding in North America due to the substantial investments in research and development within the defence sector. The US Department of Defence (DoD) has been actively funding HEL research programs, leading to technological advancements and the development of cutting-edge laser systems.

A Look Back and a Look Forward - Comparative Analysis

The HEL sector is witnessing robust growth, primarily driven by increasing defence investments, technological innovations, and expanding applications across various industries. Major economies like the US, China, and several countries in Europe, and Asia Pacific are investing substantially in directed-energy weapon systems and advanced military technologies, fuelling the demand for HEL.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to escalating geopolitical tensions, leading to increased defence spending globally. During this period, notable advancements in laser technologies occurred, enhancing beam quality, power outputs, and operational efficiency. Military applications, including missile defence systems and anti-drone technologies, drove substantial market growth.

The integration of AI and automation will further expand their applications in the military, healthcare, manufacturing, and communication sectors. With ongoing research and development, HEL systems are likely to become more compact, versatile, and cost-effective, increasing their adoption across diverse industries. Additionally, the increasing emphasis on renewable energy and environmental applications is expected to create new avenues for HEL, paving the way for a transformative future market scenario.

Key Growth Determinants

- Increasing Defence Expenditure, and Directed-Energy Weaponisation

The escalating global security concerns and evolving warfare tactics have spurred a substantial increase in defence budgets worldwide. Nations are investing significantly in advanced military technologies, including HEL for directed-energy weapons (DEWs).

HEL systems offer precision, speed, and the ability to engage multiple threats, making them integral to modern defence strategies. As governments prioritise military modernization, the demand for HEL systems as counter-drone weapons, missile defence systems, and anti-satellite solutions continues to grow.

- Technological Advancements, and Miniaturisation

Rapid technological innovations have revolutionised high energy lasers, making them more efficient, powerful, and versatile. Advances in fibre optic and solid-state laser technologies have significantly enhanced beam quality and power output.

Moreover, miniaturisation efforts have led to the development of compact, portable HEL systems suitable for various applications, including military, industrial, and medical sectors. These advancements not only expand the operational capabilities of HEL systems but also reduce costs, driving their adoption across a diverse range of industries.

- Increasing Civilian Applications, and Research Initiatives

High energy lasers are finding diverse applications beyond military uses. In the civilian sector, HEL systems are increasingly employed in precision manufacturing, healthcare, telecommunications, and research. In manufacturing, HEL technology enables precise cutting and welding, enhancing productivity and product quality. In healthcare, it facilitates non-invasive surgeries and medical research.

Research initiatives in universities, and institutions further drive innovation, exploring new applications and pushing the boundaries of HEL technology. The expanding scope of civilian applications and ongoing research initiatives contribute significantly to the growth of the HEL market.

Major Growth Barriers

- Regulatory Challenges, and Export Control Policies

Stringent regulations and export control policies in various countries pose significant hurdles for the high energy lasers market. Export restrictions limit the international trade of advanced laser technologies, hindering market expansion. Companies often face complex compliance processes, delays, and increased operational costs, impacting their ability to reach global markets seamlessly.

- Government-imposed Restrictions

High energy lasers are extensively used across the manufacturing sector. The industry that manufactures food and beverages is the largest portion of users, followed by the pharmaceutical sector. The Health and Safety Executive (HSE) has concluded from an analysis of packing machinery accidents examined in the F&B industry that injuries resulting from using, maintaining, or removing blockages at packaging machines can be severe or even dangerous (as with palletizers). These laws may prevent the market from expanding.

Key Trends and Opportunities to Look at

- Integration of AI and Automation

The market witnesses a surge in AI-driven HEL systems, enhancing accuracy and real-time response capabilities. This trend is prevalent globally, with companies in North America, and Europe leading. Key players like Lockheed Martin, and Northrop Grumman invest in AI research to optimise HEL systems, while smaller brands leverage partnerships for technology integration.

- Rise in Medical and Healthcare Applications

HEL technology gains traction in medical fields globally, especially for precision surgeries and medical research. Companies like IPG Photonics, and Coherent focus on diversifying applications. This trend sees significant growth in Asia Pacific, with companies in Japan, and South Korea innovating compact HEL systems for medical purposes.

- Development of Compact and Portable HEL Systems

Demand surges for portable High Energy Lasers, driving innovations globally. North American companies pioneer in miniaturization efforts, making compact HEL systems popular. Key brands like Raytheon, and Boeing leverage these trends by developing lightweight, mobile HEL solutions. In Europe, collaborative efforts focus on creating portable HEL systems for defence and industrial applications.

How Does the Regulatory Scenario Shape this Industry?

The market for high energy lasers is greatly impacted by an intricate network of global and local rules that govern the progress, commerce, and implementation of laser technologies. The FDA is responsible for overseeing the regulation of medical laser devices in the US, ensuring their efficacy and safety.

From a military perspective, the Arms Export Control Act (AECA), and the International Traffic in Arms Regulations (ITAR) regulate the export of defence-related technology, such sophisticated laser systems, and have a big impact on global markets.

In the EU, laser products must adhere to the European CE Marking standards, ensuring compliance with safety and performance requirements. Additionally, regional entities like the European Laser Association (ELA) play a vital role in setting industry standards and promoting research collaborations.

Asia Pacific, the hub of technological advancements, witnesses varying regulations. China's State Administration for Market Regulation (SAMR) oversees laser product standards, aligning with international benchmarks. In Japan, the Ministry of Health, Labour and Welfare (MHLW) ensures laser safety in medical applications.

Fairfield’s Ranking Board

Top Segments

- Gas Lasers Category Accounts for 35% Market Share

The gas lasers segment dominated the market in 2022. due to their high power output and reliability, making them essential in industrial and scientific applications. Their versatility in cutting, welding, and engraving has cemented their position, contributing to a substantial 35% market share. Their long-standing reputation and proven performance maintain their dominance.

Furthermore, the fibre lasers category is projected to experience the fastest market growth, expanding at 12% annually. Their compact size, energy efficiency, and superior beam quality drive their adoption in various industries.

Increasing demand for high-speed, precision cutting, especially in automotive and electronics manufacturing, propels their rapid growth, contributing significantly to the market with a 28% share. Ongoing technological advancements fuel this growth trajectory.

- Rocketing Adoption Expected in Military and Defence

In 2022, the military and defence category dominated the industry due to increasing global security concerns. High energy lasers are integral to missile defence systems and directed-energy weapons, securing their dominance with a 40% market share. Governments worldwide invest heavily in advanced military technologies, sustaining this dominance.

The cutting category is anticipated to grow substantially throughout the projected period, expanding at 10% annually. High demand in the automotive, aerospace, and electronics industries propels this growth.

High-energy lasers offer precision and efficiency, making them vital for intricate cutting tasks. Their adoption of high-speed, precise cutting technologies drives this segment, contributing significantly with a 25% market share.

Regional Frontrunners

Substantial Defence Investments by China, and India Sustain Global Leadership of Asia Pacific

Asia Pacific commands the largest share in the high energy lasers market, accounting for 38% of the global revenue. Significant defence investments in countries like China, and India drive this growth. Asia Pacific's robust manufacturing sector further fuels demand, particularly in laser materials processing. Technological advancements, and the growing awareness of HEL applications in healthcare solidify its dominance.

In addition, the Asia Pacific region benefits from a strong network of R&D institutions, fostering innovation in the high energy lasers market. Furthermore, the increasing adoption of high-energy lasers in key industries like aerospace, and automotive is expected to contribute to the region's continued growth in this market.

North America Gears up for the Fastest Yearly Growth

North America emerges as the fastest-growing region, will experience an average annual growth rate of 12% over the upcoming years. The US especially dominates this growth due to extensive research and development initiatives in military HEL applications. High demand for precision cutting and welding in the manufacturing sector propels HEL adoption. Favourable government policies and partnerships with leading technology companies bolster North America's rapid market expansion.

The region benefits from a strong infrastructure, and advanced manufacturing capabilities, which further support the growth of HEL applications. Additionally, the increasing focus on defence modernisation and the need for advanced weaponry systems contribute to the surge in HEL adoption in North America.

Fairfield’s Competitive Landscape Analysis

In the competitive landscape of the high energy lasers market, several key players dominate, driving innovation and shaping industry standards. Major companies such as Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company, and Boeing are at the forefront of developing cutting-edge HEL systems. These industry giants invest heavily in research and development, focusing on enhancing HEL technology for military and industrial applications.

Who are the Leaders in Global High Energy Lasers Space?

- TRUMPF Pvt. Ltd.

- EI EN Group

- MPB

- Coherent Dilas

- REO

- Daheng Optics

- IPG Photonics

- Laserline

- Beamtech Optronics

- nLight Inc

- BAE Systems Plc

- Northrop Grumman Corporation

- Moog Inc

- Rheinmetall AG

- Textron Inc

Significant Company Developments

New Product Launch

- May 2021: The US Army began testing a prototype laser weapon for close-range air defence; the weapon is a 50-kilowatt high-energy laser attached to a Stryker A1 vehicle that can locate, lock on, track, and destroy airborne threats.

- March 2021: The Israeli Defence Ministry showed interest by seeking U.S. funding and expertise for their air and missile defence lasers; Israel's current prototypes have achieved an output beam of nearly 100 kilowatts, whereas the United States has been exploring 300-kW weapons capable of killing cruise missiles.

- September 2020: Basel, Switzerland, will host the European Conference on Optical Communication (ECOC). Several thought leaders from Lumentum Holdings Inc. ("Lumentum"), a market-leading designer and producer of cutting-edge optical and photonic technologies, have been invited to speak in order to foster diversity, inclusivity, and a sense of belonging in the workplace.

Distribution Agreement

- March 2021: European missile maker MBDA, and French firm CILAS agreed to collaborate with electronic warfare and intelligence specialist SIGN4L to explore co-development opportunities in high-energy laser weapons systems to destroy drones.

- September 2022: To expand the production of Precision Strike Missiles (PrSM) with Early Operational Capability (EOC), the US Army granted Lockheed Martin a contract worth US$158 Mn. After a fruitful Manufacturing Readiness Assessment visit with the Army, a crucial stage in the development program that brought PrSM closer to fielding, this is the natural next step.

An Expert’s Eye

Demand and Future Growth

The high energy lasers market is poised for remarkable growth, driven by an escalating demand across various sectors. Military applications, particularly in missile defence systems and directed-energy weapons, continue to fuel substantial market demand, bolstered by rising global security concerns. Additionally, the HEL market is witnessing a surge in demand from industrial sectors, notably in precision cutting, welding, and drilling, owing to the laser's superior efficiency and accuracy.

Supply Side of the Market

According to our analysis, the supply side of the High energy lasers market is robust and innovative, with Asia Pacific emerging as a key hub for production and technological advancements. Asia Pacific-based manufacturers, especially in countries like China, Japan, and South Korea, play a pivotal role in the global HEL supply chain. These nations boast extensive manufacturing capabilities, enabling them to produce a wide array of HEL systems.

Asia Pacific is a hotbed for research and development in laser technologies, fostering innovation and driving the industry forward. Collaborations between Asian manufacturers and research institutions contribute to the region's reputation for cutting-edge HEL solutions. The region's strategic focus on HEL production and innovation positions Asia Pacific as a significant player in meeting the escalating global demand for advanced laser technologies.

The demand here is driven by various industries such as defence, aerospace, healthcare, and manufacturing, all of which rely on high-performance HEL systems for their operations. With its strong emphasis on research and development, Asia Pacific is well-positioned to continue leading the way in the advancement of laser technologies and meet the evolving needs of these industries.

Global High Energy Lasers Market is Segmented as Below:

By Type:

- Gas Lasers

- Chemical Lasers

- Excimer Lasers

- Fibre Lasers

- Solid State Lasers

By Application:

- Cutting

- Welding and Drilling

- Military and Defence

- Communications

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global High Energy Lasers Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global High Energy Lasers Market Outlook, 2018 - 2030

3.1. Global High Energy Lasers Market Outlook, by Type ,Value (US$ Bn ), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Gas Lasers

3.1.1.2. Chemical Lasers

3.1.1.3. Excimer Lasers

3.1.1.4. Fiber Lasers

3.1.1.5. Solid State Lasers

3.2. Global High Energy Lasers Market Outlook, by Application , Value (US$ Bn ), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cutting

3.2.1.2. Welding and Drilling

3.2.1.3. Military and Defense

3.2.1.4. Communications

3.2.1.5. Others

3.3. Global High Energy Lasers Market Outlook, by Region, Value (US$ Bn ), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America High Energy Lasers Market Outlook, 2018 - 2030

4.1. North America High Energy Lasers Market Outlook, by Type , Value (US$ Bn ), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Gas Lasers

4.1.1.2. Chemical Lasers

4.1.1.3. Excimer Lasers

4.1.1.4. Fiber Lasers

4.1.1.5. Solid State Lasers

4.2. North America High Energy Lasers Market Outlook, by Application , Value (US$ Bn ), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Cutting

4.2.1.2. Welding and Drilling

4.2.1.3. Military and Defense

4.2.1.4. Communications

4.2.1.5. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America High Energy Lasers Market Outlook, by Country, Value (US$ Bn ), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

4.3.1.2. U.S. High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

4.3.1.3. Canada High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

4.3.1.4. Canada High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe High Energy Lasers Market Outlook, 2018 - 2030

5.1. Europe High Energy Lasers Market Outlook, by Type , Value (US$ Bn ), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Gas Lasers

5.1.1.2. Chemical Lasers

5.1.1.3. Excimer Lasers

5.1.1.4. Fiber Lasers

5.1.1.5. Solid State Lasers

5.2. Europe High Energy Lasers Market Outlook, by Application , Value (US$ Bn ), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Cutting

5.2.1.2. Welding and Drilling

5.2.1.3. Military and Defense

5.2.1.4. Communications

5.2.1.5. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe High Energy Lasers Market Outlook, by Country, Value (US$ Bn ), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

5.3.1.2. Germany High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

5.3.1.3. U.K.High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

5.3.1.4. U.K.High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

5.3.1.5. France High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

5.3.1.6. France High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

5.3.1.7. ItalyHigh Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

5.3.1.8. Italy High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

5.3.1.9. Turkey High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

5.3.1.10. Turkey High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

5.3.1.11. Russia High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

5.3.1.12. Russia High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

5.3.1.13. Rest of Europe High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

5.3.1.14. Rest of Europe High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific High Energy Lasers Market Outlook, 2018 - 2030

6.1. Asia Pacific High Energy Lasers Market Outlook, by Type , Value (US$ Bn ), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Gas Lasers

6.1.1.2. Chemical Lasers

6.1.1.3. Excimer Lasers

6.1.1.4. Fiber Lasers

6.1.1.5. Solid State Lasers

6.2. Asia Pacific High Energy Lasers Market Outlook, by Application , Value (US$ Bn ), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Cutting

6.2.1.2. Welding and Drilling

6.2.1.3. Military and Defense

6.2.1.4. Communications

6.2.1.5. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific High Energy Lasers Market Outlook, by Country, Value (US$ Bn ), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

6.3.1.2. China High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

6.3.1.3. Japan High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

6.3.1.4. Japan High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

6.3.1.5. South Korea High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

6.3.1.6. South Korea High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

6.3.1.7. India High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

6.3.1.8. India High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

6.3.1.9. Southeast Asia High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

6.3.1.10. Southeast Asia High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

6.3.1.11. Rest of Asia Pacific High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

6.3.1.12. Rest of Asia Pacific High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America High Energy Lasers Market Outlook, 2018 - 2030

7.1. Latin America High Energy Lasers Market Outlook, by Type , Value (US$ Bn ), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Gas Lasers

7.1.1.2. Chemical Lasers

7.1.1.3. Excimer Lasers

7.1.1.4. Fiber Lasers

7.1.1.5. Solid State Lasers

7.2. Latin America High Energy Lasers Market Outlook, by Application , Value (US$ Bn ), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Cutting

7.2.1.2. Welding and Drilling

7.2.1.3. Military and Defense

7.2.1.4. Communications

7.2.1.5. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America High Energy Lasers Market Outlook, by Country, Value (US$ Bn ), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

7.3.1.2. Brazil High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

7.3.1.3. Mexico High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

7.3.1.4. Mexico High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

7.3.1.5. Argentina High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

7.3.1.6. Argentina High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

7.3.1.7. Rest of Latin America High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

7.3.1.8. Rest of Latin America High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa High Energy Lasers Market Outlook, 2018 - 2030

8.1. Middle East & Africa High Energy Lasers Market Outlook, by Type , Value (US$ Bn ), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Gas Lasers

8.1.1.2. Chemical Lasers

8.1.1.3. Excimer Lasers

8.1.1.4. Fiber Lasers

8.1.1.5. Solid State Lasers

8.2. Middle East & Africa High Energy Lasers Market Outlook, by Application , Value (US$ Bn ), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Cutting

8.2.1.2. Welding and Drilling

8.2.1.3. Military and Defense

8.2.1.4. Communications

8.2.1.5. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa High Energy Lasers Market Outlook, by Country, Value (US$ Bn ), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

8.3.1.2. GCC High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

8.3.1.3. South Africa High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

8.3.1.4. South AfricaH igh Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

8.3.1.5. Egypt High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

8.3.1.6. Egypt High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

8.3.1.7. Nigeria High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

8.3.1.8. Nigeria High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa High Energy Lasers Market by Type , Value (US$ Bn ), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa High Energy Lasers Market Application , Value (US$ Bn ), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs ApplicationHeatmap

9.2. Manufacturer vsApplicationHeatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Moog Inc

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Laserline

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. IPG Photonics

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Daheng Optics

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. REO

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. COHERENT DILAS

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. MPB

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. EI EN Group

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. NLight Inc

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. TRUMPF Pvt. Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. BAE Systems Plc

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Northrop Grumman Corporation

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Moog Inc

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. RHEINMETALL AG

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Textron Inc

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |