Global Hydrophobic Coatings Market Forecast

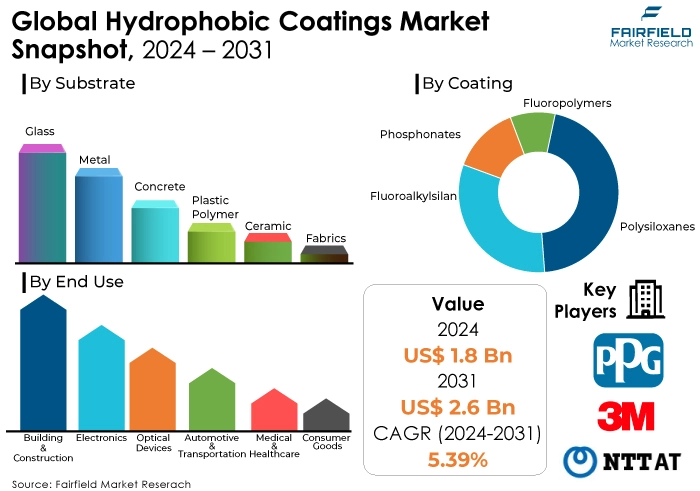

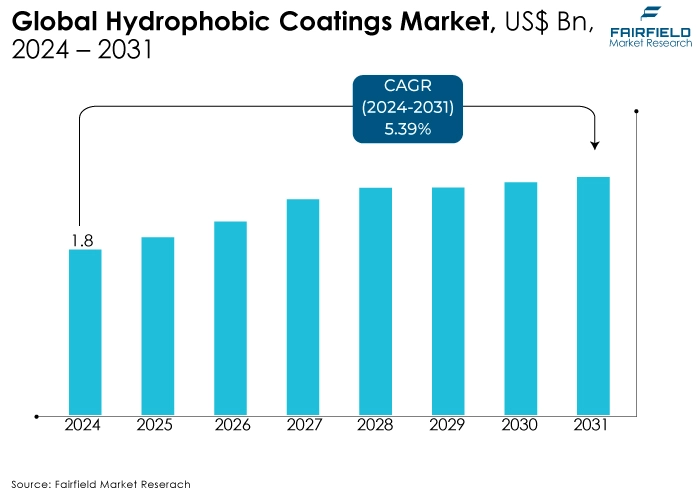

- Global hydrophobic coatings market size to reach US$2.6 Bn in 2031, up from US$1.8 Bn attained in 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 5.39% during 2024 - 2031

Quick Report Digest

- The global hydrophobic coatings market is forecasted to reach US$2.6 Bn by 2031, exhibiting a remarkable CAGR of 5.39% from 2024 to 2031

- Growth drivers include increased demand from automotive, construction, and electronics sectors due to enhanced durability and protection against water damage.

- Market expansion is further fuelled by rising urbanisation, infrastructure development, and advancements in nanotechnology, enabling more effective coatings.

- Challenges include limited versatility of hydrophobic coatings, environmental concerns regarding chemical composition, and higher manufacturing costs.

- Key trends emphasize sustainability, with a shift towards water-based and eco-friendly formulations, alongside advancements in nanotechnology enhancing coating effectiveness.

- Opportunities lie in expanding into emerging markets like Asia Pacific, Latin America, and Africa, driven by rapid industrialisation and urbanisation.

- Regulatory landscape influences market dynamics, with emphasis on compliance with VOC emissions, hazardous substances restrictions, and fire safety standards.

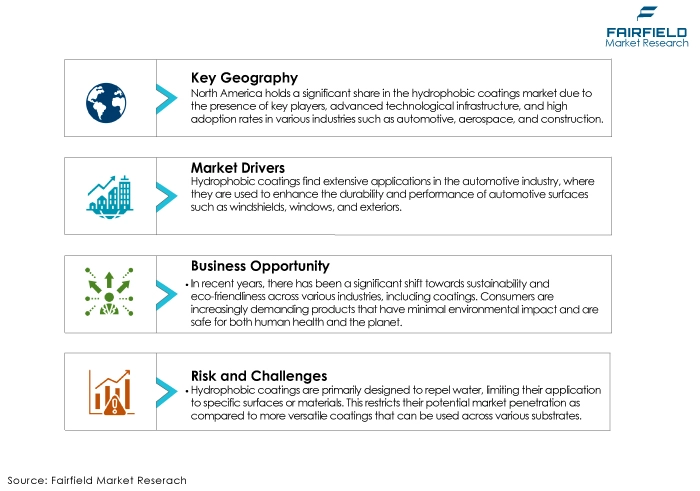

- North America dominates the market due to technological infrastructure, stringent regulations, and high adoption rates, led by the US.

- Europe follows suit, driven by strict environmental regulations, mature industrial landscape, and focus on sustainable development and innovation.

- Major players include 3M Company, PPG Industries, NTT Advanced Technologies, Master Builders Solution, and NeverWet, LLC, focusing on product innovation, strategic collaborations, and geographic expansions for market dominance.

A Look Back and a Look Forward - Comparative Analysis

The hydrophobic coatings market experienced steady growth from 2019 to 2023. While specific figures may vary by research firm, analysts generally predict a CAGR in the ballpark of 6.8% to 8.8% during this period. This expansion was driven by rising demand across various industries. In construction, for example, hydrophobic coatings improved building exteriors' water resistance, while in automotive applications, they enhanced visibility during rain.

Looking ahead, the forecast for 2024-2031 paints an even brighter picture. Market analysts predict a CAGR exceeding the previous period, potentially reaching a high of 8.8%. This accelerated growth is attributed to several factors. Increasing urbanisation and infrastructure development will fuel demand for protective coatings in construction. Additionally, rising environmental concerns are pushing for self-cleaning surfaces, a niche that hydrophobic coatings excel at.

Furthermore, advancements in nanotechnology are expected to lead to the development of even more effective and versatile coatings, opening doors for new applications. However, the market is not without challenges. Fluctuations in raw material prices and potential environmental regulations could hinder growth. Nevertheless, with continuous innovation and expanding applications, the hydrophobic coatings market is poised for a strong and sustained expansion in the coming years.

Key Growth Determinants

- Demand from Automotive Sector

Hydrophobic coatings find extensive applications in the automotive industry, where they are used to enhance the durability and performance of automotive surfaces such as windshields, windows, and exteriors. As consumers seek vehicles with superior water-repellent properties to improve visibility and maintain aesthetics, the demand for hydrophobic coatings continues to rise. Additionally, these coatings offer benefits like reduced maintenance requirements and protection against environmental factors, further driving their adoption in the automotive sector.

- Increasing Infrastructure Development

The construction industry is a significant consumer of hydrophobic coatings due to their ability to protect various building materials from water damage, corrosion, and staining. With rapid urbanisation and infrastructure development projects across the globe, there is a growing need for solutions that can prolong the lifespan of structures and reduce maintenance costs. Hydrophobic coatings fulfil these requirements by providing robust water-repellent properties to surfaces, thereby driving their demand in the construction sector.

- Expanding Electronics and Consumer Goods Markets

Hydrophobic coatings are increasingly utilised in electronics and consumer goods to protect sensitive components and surfaces from moisture-related damage. With the proliferation of electronic devices and consumer goods, there is a corresponding surge in demand for coatings that can safeguard these products from water intrusion, humidity, and corrosion. As technological advancements continue to drive innovation in electronics and consumer goods, the hydrophobic coatings market is expected to witness sustained growth.

Major Growth Barriers

- Limited Versatility

Hydrophobic coatings are primarily designed to repel water, limiting their application to specific surfaces or materials. This restricts their potential market penetration as compared to more versatile coatings that can be used across various substrates.

- Environmental Concerns

Some hydrophobic coatings contain chemicals that raise environmental concerns due to their persistence in ecosystems or potential toxicity. Regulatory restrictions on such chemicals can hinder market growth as companies must comply with stricter environmental standards, limiting their product offerings.

- Cost Considerations

Hydrophobic coatings often entail higher manufacturing costs due to the specialised materials and processes involved. This can make them less competitive compared to conventional coatings, particularly in price-sensitive markets. Additionally, the perceived value versus cost proposition may not always align with consumer expectations, leading to slower adoption rates, especially in industries where cost is a primary concern.

Key Trends and Opportunities to Look at

- Sustainability and Environmental Concerns

In recent years, there has been a significant shift towards sustainability and eco-friendliness across various industries, including coatings. Consumers are increasingly demanding products that have minimal environmental impact and are safe for both human health and the planet. This trend has led to the development of hydrophobic coatings that are water-based and free from harmful chemicals like volatile organic compounds (VOCs). Companies are investing in research and development to create coatings that offer superior water repellence while being environmentally friendly.

- Advancements in Nanotechnology

Nanotechnology has revolutionised the field of coatings, enabling the development of advanced hydrophobic coatings with remarkable properties. Nano-sized particles can be incorporated into coatings to enhance their water repellent capabilities, durability, and resistance to scratches and abrasion. As nanotechnology continues to advance, hydrophobic coatings are becoming more effective and versatile, finding applications in a wide range of industries such as automotive, aerospace, electronics, and construction.

- Expansion into Emerging Markets

One of the biggest opportunities for hydrophobic coatings market players lies in expanding into emerging markets. Countries in Asia Pacific, Latin America, and Africa are experiencing rapid industrialisation and urbanisation, driving the demand for advanced coatings to protect infrastructure, machinery, and consumer goods from water damage. By entering these markets early and establishing a strong presence, companies can capitalise on the growing demand for hydrophobic coatings and gain a competitive edge over their rivals.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly impacts the hydrophobic coatings market. Stringent regulations regarding volatile organic compounds (VOCs) emissions are driving the development of water-based and high-solids hydrophobic coatings. These regulations aim to improve air quality and reduce environmental pollution. As a result, manufacturers are focusing on developing innovative formulations that comply with VOC emission limitations.

Another crucial regulatory aspect is the restriction of certain chemicals used in traditional hydrophobic coatings. For instance, regulations like the Restriction of Hazardous Substances (RoHS) in Europe restrict the use of lead, mercury, cadmium, and other harmful substances. This pushes manufacturers to adopt alternative materials and chemistries that ensure product safety and regulatory compliance.

Furthermore, regulations concerning fire safety standards also influence the hydrophobic coatings market. These standards mandate the use of fire-retardant materials in specific applications like construction and building materials. This creates a demand for hydrophobic coatings that incorporate flame retardant properties, expanding the market for specialised solutions.

Overall, the regulatory scenario acts as a major driver for innovation and development in the hydrophobic coatings market. By adhering to environmental and safety regulations, manufacturers can ensure product sustainability and cater to the evolving needs of the industry. This focus on regulatory compliance fosters a market environment that prioritises both product performance and environmental responsibility.

Fairfield’s Ranking Board

Top Segments

- Automotive Sector Stands at the Forefront of Adoption

The automotive sector is a significant consumer of hydrophobic coatings due to their ability to protect vehicles from water damage, corrosion, and enhance aesthetics. With increasing consumer demand for high-performance vehicles, manufacturers are incorporating hydrophobic coatings in various automotive components like windshields, exteriors, and interior surfaces.

These coatings not only repel water but also offer self-cleaning properties, reducing maintenance costs. Moreover, in regions with extreme weather conditions, such as snow or heavy rainfall, hydrophobic coatings aid in improving visibility, and safety while driving. The growing trend of electric vehicles (EVs) also drives the demand for hydrophobic coatings to maintain the integrity and performance of sensitive electronic components.

- Aerospace Sector Remains a Key Consumer Industry

In the aerospace industry, hydrophobic coatings play a crucial role in enhancing the performance and durability of aircraft surfaces. These coatings are applied to aircraft exteriors, wings, engines, and critical components to repel water, prevent icing, and reduce drag. By minimising water accumulation on aircraft surfaces, hydrophobic coatings contribute to fuel efficiency and aerodynamic performance, ultimately reducing operating costs for airlines.

Additionally, these coatings provide protection against corrosion, prolonging the lifespan of aircraft and reducing maintenance requirements. As the aerospace sector continues to grow with increasing air travel demand, the adoption of hydrophobic coatings is expected to rise to meet stringent safety and efficiency standards.

- Application Broadens Across Building & Construction Sector

In the building and construction industry, hydrophobic coatings are utilised to protect various surfaces such as concrete, metal, and glass from water damage, mold, and corrosion. These coatings are applied to exterior walls, roofs, windows, and infrastructure to enhance durability and weather resistance.

By repelling water and moisture, hydrophobic coatings prevent cracks, deterioration, and structural damage, thereby extending the lifespan of buildings and reducing maintenance costs. Additionally, in urban areas prone to pollution, hydrophobic coatings help maintain the cleanliness and aesthetics of architectural surfaces by preventing dirt and stains from adhering.

Regional Frontrunners

North America's Market Dominance Prevails

North America holds a significant share in the hydrophobic coatings market due to the presence of key players, advanced technological infrastructure, and high adoption rates in various industries such as automotive, aerospace, and construction. The region's stringent regulations regarding environmental protection also drive the demand for eco-friendly hydrophobic coatings.

Additionally, the growing trend of self-cleaning surfaces in residential and commercial sectors further fuels market growth. The US dominates this market in North America, followed by Canada, and Mexico. Factors such as increased R&D activities, coupled with rising investments in nanotechnology, contribute to the continuous expansion of the hydrophobic coatings market in this region.

Europe's Strong Position Intact

Europe is a prominent regional market for hydrophobic coatings owing to strict environmental regulations and a mature industrial landscape. Countries like Germany, the UK, and France lead the market due to their well-established automotive, marine, and aerospace sectors. The growing demand for eco-friendly and durable coatings in construction and infrastructure development projects also boosts market growth.

Moreover, increasing investments in research and development activities to enhance coating efficiency and performance drive market expansion. Europe's focus on sustainable development and innovation in coating technologies further propels the adoption of hydrophobic coatings across various end-use industries, indicating promising growth prospects in the region.

Fairfield’s Competitive Landscape Analysis

The competition landscape in the hydrophobic coatings market is marked by intense rivalry among key players striving for market dominance. Leading companies such as PPG Industries, BASF SE, 3M Company, and The Sherwin-Williams Company are prominent players, leveraging their strong R&D capabilities and extensive product portfolios to maintain their competitive edge.

Major growth strategies adopted by these key companies include continuous product innovation and development, strategic collaborations, mergers and acquisitions, and geographic expansions. These strategies enable them to cater to diverse end-user industries such as automotive, aerospace, construction, and marine, meeting the growing demand for hydrophobic coatings.

Additionally, investments in advanced manufacturing technologies and sustainable solutions remain integral to their growth strategies, allowing them to address evolving market trends and consumer preferences while maintaining a competitive position in the global hydrophobic coatings market.

Who are the Leaders in the Hydrophobic Coatings Market Space?

- 3M Company

- PPG Industries

- NTT Advanced Technologies

- Master Builders Solution

- NeverWet, LLC

- Abrisa Technologies

- NEI Corporation

- Advanced NanoTech Lab

- Precision Coating

- COTEC GmbH

- Accucoat Inc.

- Nanokote

Significant Company Developments

New Product Launch

- March 2024: In March 2024, NanoTech introduced NanoShield Pro, a revolutionary hydrophobic coating designed for automotive surfaces. This advanced formula provides superior water repellency and durability, offering extended protection against environmental elements such as rain, mud, and road grime. NanoShield Pro's easy application and long-lasting effects make it a game-changer in the automotive detailing industry, enhancing both aesthetics and functionality.

Distribution Agreement

- November 2023: In November 2023, HydroGuard Technologies secured a strategic distribution agreement with Global Coatings Inc. This partnership aims to expand the market reach of HydroGuard's hydrophobic coatings across various industries, including construction, aerospace, and electronics. Global Coatings Inc.'s extensive distribution network and market expertise will facilitate broader accessibility to HydroGuard's innovative solutions, fostering growth opportunities and strengthening the company's position in the competitive coatings market.

- February 2023: February 2023 marked a significant milestone for AquaSeal Coatings as they inked a distribution agreement with AquaTech Distributors. This collaboration enables AquaSeal to penetrate new markets and reach a wider customer base with its range of hydrophobic coating solutions. AquaTech Distributors' established network and industry reputation will facilitate seamless distribution and provide customers with easy access to AquaSeal's high-performance coatings, driving further innovation and growth in the hydrophobic coatings market.

An Expert’s Eye

Growing Demand Across Industries

The expert analyst projects a promising growth outlook for the global Hydrophobic Coatings Market for two main reasons. Firstly, there's an increasing demand across various industries such as automotive, aerospace, and construction for hydrophobic coatings due to their exceptional water-repellent properties. As industries strive for enhanced durability and performance of their products, hydrophobic coatings offer a viable solution by preventing water damage and corrosion, thus extending the lifespan of the surfaces they protect. This growing awareness of the benefits of hydrophobic coatings is expected to drive market growth significantly.

Technological Advancements Driving Innovation

Technological advancements and innovations in coating formulations are further propelling market expansion. Manufacturers are continuously investing in research and development to introduce more efficient and eco-friendly hydrophobic coatings that meet evolving consumer demands and regulatory standards. These advancements not only enhance the performance of hydrophobic coatings but also contribute to expanding their application scope across various end-use industries, thereby fostering market growth.

The Global Hydrophobic Coatings Market is Segmented as Below:

By Type of Substrate:

- Glass

- Metal

- Concrete

- Plastic Polymer

- Ceramic

- Fabrics

- Others

By Type of Coating:

- Polysiloxanes

- Fluoroalkylsilane

- Phosphonates

- Fluoropolymers

- Other

By End Use:

- Building and Construction

- Electronics

- Optical Devices

- Automotive and Transportation

- Medical and Healthcare

- Consumer Goods

- Textiles

- Others

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middles East & Africa

1. Executive Summary

1.1. Global Hydrophobic Coatings Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, By Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Key Highlights

3.2. Global Hydrophobic Coatings Production, By Region

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Latin America

3.2.5. Middle East & Africa

4. Price Trends Analysis and Future Projects, 2019 - 2031

4.1. Global Average Price Analysis, By Coating Type

4.2. Prominent Factors Affecting Hydrophobic Coatings Prices

4.3. Global Average Price Analysis, By Region

5. Global Hydrophobic Coatings Market Outlook, 2019 - 2031

5.1. Global Hydrophobic Coatings Market Outlook, By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Polysiloxanes

5.1.1.2. Fluoropolymers

5.1.1.3. Fluoroalkylsilane

5.1.1.4. Phosphonates

5.1.1.5. Others

5.2. Global Hydrophobic Coatings Market Outlook, By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Glass

5.2.1.2. Metal

5.2.1.3. Concrete

5.2.1.4. Plastic Polymers

5.2.1.5. Ceramic

5.2.1.6. Fabrics

5.2.1.7. Others

5.3. Global Hydrophobic Coatings Market Outlook, By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Building & Construction

5.3.1.2. Electronics

5.3.1.3. Optical Devices

5.3.1.4. Automotive & Transportation

5.3.1.5. Medical & Health Care

5.3.1.6. Consumer Goods

5.3.1.7. Textiles

5.3.1.8. Others

5.4. Global Hydrophobic Coatings Market Outlook, By Region, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Hydrophobic Coatings Market Outlook, 2019 - 2031

6.1. North America Hydrophobic Coatings Market Outlook, By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Polysiloxanes

6.1.1.2. Fluoropolymers

6.1.1.3. Fluoroalkylsilane

6.1.1.4. Phosphonates

6.1.1.5. Others

6.2. North America Hydrophobic Coatings Market Outlook, By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Glass

6.2.1.2. Metal

6.2.1.3. Concrete

6.2.1.4. Plastic Polymers

6.2.1.5. Ceramic

6.2.1.6. Fabrics

6.2.1.7. Others

6.3. North America Hydrophobic Coatings Market Outlook, By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Building & Construction

6.3.1.2. Electronics

6.3.1.3. Optical Devices

6.3.1.4. Automotive & Transportation

6.3.1.5. Medical & Health Care

6.3.1.6. Consumer Goods

6.3.1.7. Textiles

6.3.1.8. Others

6.4. North America Hydrophobic Coatings Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.2. U.S. Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.3. U.S. Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.4. Canada Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.5. Canada Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.6. Canada Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Hydrophobic Coatings Market Outlook, 2019 - 2031

7.1. Europe Hydrophobic Coatings Market Outlook, By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Polysiloxanes

7.1.1.2. Fluoropolymers

7.1.1.3. Fluoroalkylsilane

7.1.1.4. Phosphonates

7.1.1.5. Others

7.2. Europe Hydrophobic Coatings Market Outlook, By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Glass

7.2.1.2. Metal

7.2.1.3. Concrete

7.2.1.4. Plastic Polymers

7.2.1.5. Ceramic

7.2.1.6. Fabrics

7.2.1.7. Others

7.3. Europe Hydrophobic Coatings Market Outlook, By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Building & Construction

7.3.1.2. Electronics

7.3.1.3. Optical Devices

7.3.1.4. Automotive & Transportation

7.3.1.5. Medical & Health Care

7.3.1.6. Consumer Goods

7.3.1.7. Textiles

7.3.1.8. Others

7.4. Europe Hydrophobic Coatings Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.2. Germany Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.3. Germany Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.4. U.K. Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.5. U.K. Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.6. U.K. Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.7. France Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.8. France Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.9. France Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.10. Italy Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.11. Italy Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.12. Italy Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.13. Russia Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.14. Russia Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.15. Russia Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.16. Rest of Europe Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.17. Rest of Europe Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.18. Rest of Europe Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Hydrophobic Coatings Market Outlook, 2019 - 2031

8.1. Asia Pacific Hydrophobic Coatings Market Outlook, By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Polysiloxanes

8.1.1.2. Fluoropolymers

8.1.1.3. Fluoroalkylsilane

8.1.1.4. Phosphonates

8.1.1.5. Others

8.2. Asia Pacific Hydrophobic Coatings Market Outlook, By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Glass

8.2.1.2. Metal

8.2.1.3. Concrete

8.2.1.4. Plastic Polymers

8.2.1.5. Ceramic

8.2.1.6. Fabrics

8.2.1.7. Others

8.3. Asia Pacific Hydrophobic Coatings Market Outlook, By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Building & Construction

8.3.1.2. Electronics

8.3.1.3. Optical Devices

8.3.1.4. Automotive & Transportation

8.3.1.5. Medical & Health Care

8.3.1.6. Consumer Goods

8.3.1.7. Textiles

8.3.1.8. Others

8.4. Asia Pacific Hydrophobic Coatings Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. China Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.2. China Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.3. China Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.4. Japan Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.5. Japan Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.6. Japan Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.7. South Korea Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.8. South Korea Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.9. South Korea Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.10. India Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.11. India Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.12. India Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.13. Southeast Asia Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.14. Southeast Asia Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.15. Southeast Asia Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.16. Rest of Asia Pacific Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.17. Rest of Asia Pacific Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.18. Rest of Asia Pacific Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Hydrophobic Coatings Market Outlook, 2019 - 2031

9.1. Latin America Hydrophobic Coatings Market Outlook, By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Polysiloxanes

9.1.1.2. Fluoropolymers

9.1.1.3. Fluoroalkylsilane

9.1.1.4. Phosphonates

9.1.1.5. Others

9.2. Latin America Hydrophobic Coatings Market Outlook, By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Glass

9.2.1.2. Metal

9.2.1.3. Concrete

9.2.1.4. Plastic Polymers

9.2.1.5. Ceramic

9.2.1.6. Fabrics

9.2.1.7. Others

9.3. Latin America Hydrophobic Coatings Market Outlook, By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Building & Construction

9.3.1.2. Electronics

9.3.1.3. Optical Devices

9.3.1.4. Automotive & Transportation

9.3.1.5. Medical & Health Care

9.3.1.6. Consumer Goods

9.3.1.7. Textiles

9.3.1.8. Others

9.4. Latin America Hydrophobic Coatings Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.2. Brazil Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.3. Brazil Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.4. Mexico Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.5. Mexico Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.6. Mexico Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.7. Rest of Latin America Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.8. Rest of Latin America Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.9. Rest of Latin America Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Hydrophobic Coatings Market Outlook, 2019 - 2031

10.1. Middle East & Africa Hydrophobic Coatings Market Outlook, By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Polysiloxanes

10.1.1.2. Fluoropolymers

10.1.1.3. Fluoroalkylsilane

10.1.1.4. Phosphonates

10.1.1.5. Others

10.2. Middle East & Africa Hydrophobic Coatings Market Outlook, By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Glass

10.2.1.2. Metal

10.2.1.3. Concrete

10.2.1.4. Plastic Polymers

10.2.1.5. Ceramic

10.2.1.6. Fabrics

10.2.1.7. Others

10.3. Middle East & Africa Hydrophobic Coatings Market Outlook, By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Building & Construction

10.3.1.2. Electronics

10.3.1.3. Optical Devices

10.3.1.4. Automotive & Transportation

10.3.1.5. Medical & Health Care

10.3.1.6. Consumer Goods

10.3.1.7. Textiles

10.3.1.8. Others

10.4. Middle East & Africa Hydrophobic Coatings Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.2. GCC Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.3. GCC Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.4. South Africa Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.5. South Africa Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.6. South Africa Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.7. Egypt Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.8. Egypt Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.9. Egypt Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.10. Rest of Middle East & Africa Hydrophobic Coatings Market By Coating Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.11. Rest of Middle East & Africa Hydrophobic Coatings Market By End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.1.12. Rest of Middle East & Africa Hydrophobic Coatings Market By Substrate Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2023

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Aculon, Inc.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Master Builders Solutions

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. NTT Advanced Technology Corporation

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. NeverWet, LLC

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. NEI Corporation

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. The 3M Company

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Abrisa Technologies

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Accucoat Inc.

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Business Strategies and Development

11.5.9. NANOKOTE

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Precision Coating

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Miller-Stephenson, Inc.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Lotus Leaf Coatings, Inc.

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Advanced NanoTech Lab

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. PPG Industries

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Nano-Care Deutschland AG

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

11.5.16. COTEC GmbH

11.5.16.1. Company Overview

11.5.16.2. Product Portfolio

11.5.16.3. Financial Overview

11.5.16.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion Volume: TONS |

||

|

REPORT FEATURES |

DETAILS |

|

Substrate Coverage |

|

|

Coating Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |