In-car Audio System Market Forecast

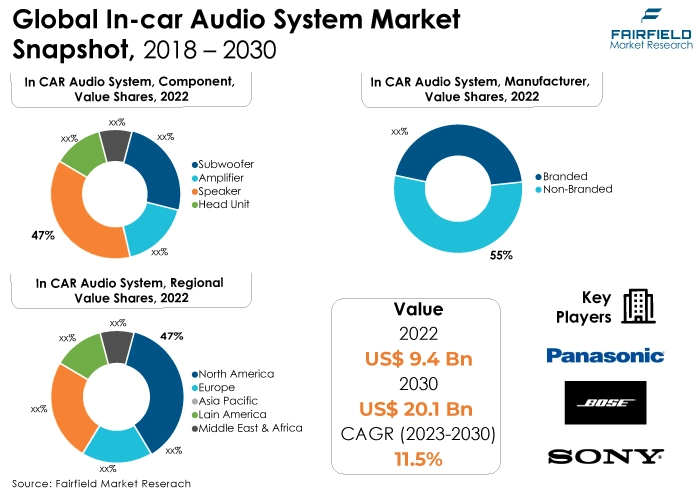

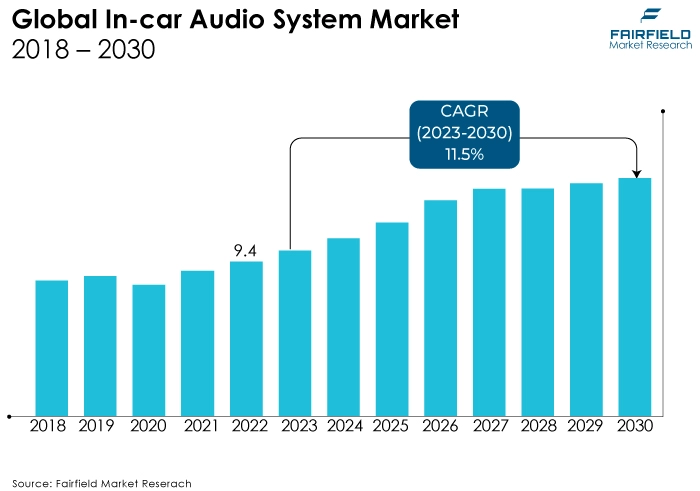

- The In-Car Audio System Market is valued at USD 9.6 Bn in 2026 and is projected to reach USD 20.3 Bn, growing at a CAGR of 11% by 2033

Quick Report Digest

- The key trend anticipated to fuel the in-car audio system market growth is ongoing advancements in audio technologies, including digital signal processing (DSP), surround sound, and high-resolution audio, driving the market as consumers seek enhanced audio experiences in their vehicles.

- Another major market trend expected to fuel the in-car audio system market growth is the rapid integration of smart features and connectivity options like Bluetooth, Wi-Fi, Apple CarPlay, Android Auto, and voice recognition systems, enhancing the user experience and influencing consumer purchasing decisions.

- In 2022, the speaker category dominated the industry due to their fundamental role in sound reproduction and the overall auditory experience. The demand for high-quality sound, advanced speakers and customisation options has increased the position of speakers in the market.

- Additionally, the market has seen constant innovation in speaker design, materials, and engineering, which has further cemented their position as a dominant component in-car audio industry.

- In terms of market share for in-car audio systems globally, the branded segment is anticipated to dominate. Branded have dominated the market, mostly because of an increase in demand brought on by engineers in research, development, and innovation into everyday life.

- Brand manufacturers also benefit from extensive marketing efforts, strong distribution networks and strategic partnerships with car manufacturers, strengthening their market presence.

- In 2022, the ICE category controlled the market. Due to its long-standing presence and extensive vehicle fleet, the ICE segment has established its supremacy in-car audio business. ICE vehicles, running on traditional gasoline or diesel engines, have been prevalent for many decades, constituting a significant majority of the global automotive market. As a result, the demand for car audio systems has primarily been driven by ICE vehicle installations.

- The OEM category is highly prevalent in the market for in-car audio system market. OEMs have a strong advantage in terms of distribution and market reach. They have direct access to vehicle assembly lines, enabling seamless integration of audio systems throughout the production process. This allows OEMs to offer factory-installed car audio systems that offer consumers a complete and cost-free audio solution when purchasing a vehicle.

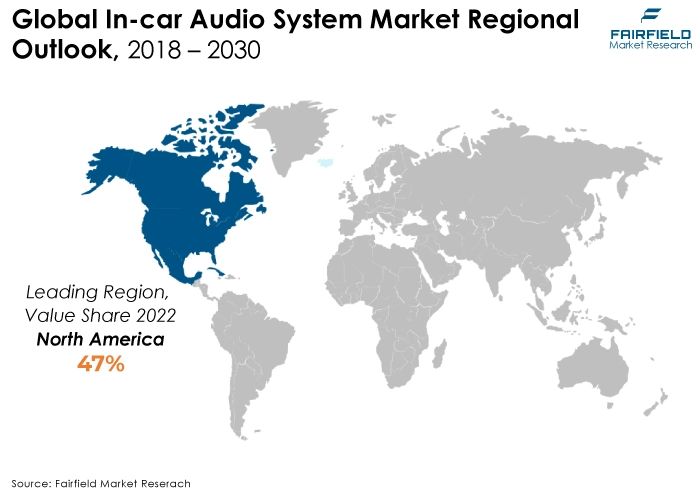

- The North American region is anticipated to account for the largest share of the global in-car audio system market, owing to various technological factors such as economic conditions.

- Consumer preferences and industry dynamics. North American consumers have shown a strong inclination towards sophisticated and high-quality car audio systems, valuing an enhanced audio experience in their vehicles.

- The market for in-car audio systems is expanding in Asia Pacific due to rapid economic growth and technological advancements. The Asia Pacific region is experiencing substantial economic growth, leading to an increase in disposable incomes among consumers. As people's purchasing power rises, there is a greater capacity to invest in vehicles, and, subsequently, in high-quality car audio systems to enhance their overall driving experience.

A Look Back and a Look Forward - Comparative Analysis

The market for in-car audio systems has been experiencing significant growth, primarily driven by advancements in audio technology, increased consumer demand, and a broadening range of applications. Technology developments are still being heavily prioritised in the business, especially in the fields of networking, smart features, and audio quality.

Customers are increasingly demanding seamless mobile device integration, voice control, cutting-edge audio processing, and improved user interfaces in their automobile audio systems. The automotive industry is seeing substantial growth in electric cars (EVs), which is having an impact on the market for car audio systems as well.

As EVs become more energy-efficient and have cabin acoustics that reduce the noise of the electric motor, there is an increasing demand for specialised audio solutions.

The market witnessed staggered growth during the historical period 2018 – 2022. There has been a significant transition from conventional analog systems to digital audio processing. High-resolution audio formats, smartphone integration (Apple CarPlay, Android Auto), and Bluetooth connectivity have all gained popularity.

Additionally, the aftermarket industry has experienced consistent expansion due to a rise in demand for improved and customised audio systems. The desire of consumers to customise their automobiles has fuelled the demand for high-end aftermarket audio components.

In-car audio systems will become incredibly clever thanks to technological developments, with features like artificial intelligence, augmented reality, and personalised sound profiles. An immersive in-car entertainment experience might be produced by these audio systems integrating smoothly with augmented reality (AR) displays.

The sustainability movement will persist, with a stronger emphasis on energy efficiency, recycling, and the use of environmentally friendly materials in manufacturing. Additionally, as electric and hybrid vehicles become more popular, audio systems will be developed to match their quieter interiors, guaranteeing the best sound quality and requiring less electricity.

Key Growth Factors

- Increased Demand for Speaker Across Industries

Due to their vital role in sound reproduction and the whole auditory experience, speakers have established their supremacy in the market for automobile audio systems. They are a crucial element that has an immediate impact on the clarity, quality, and immersion of the sound in a vehicle.

When purchasing a car audio system, consumers constantly place a premium on high audio quality, and speakers are essential in delivering on this expectation. The popularity of speakers on the market has been fuelled by consumer desire for high-fidelity audio, cutting-edge speaker technologies, and customizable options.

Further cementing its place as a prominent part of the automotive audio system business, the market has seen ongoing advances in speaker design, materials, and engineering.

- Rising Demand for Branded Products

Due to several important variables, the branded segment has become the market leader for automotive audio systems. Established brands have a history of trust, dependability, and reliable product quality, which gives consumers who want a better audio experience for their automobiles confidence. These companies make major investments in R&D, invention, and development, which produces cutting-edge products and advances in audio engineering.

Customers are frequently eager to spend money on well-known brands because they anticipate superior features, outstanding performance, and smooth vehicle integration. Additionally, strengthening their market presence are branded manufacturers' elaborate marketing campaigns, robust distribution systems, and strategic alliances with automobiles.

- Consumer Inclination for Customisation

In all facets of their life nowadays, including their cars, consumers seek out distinctive and personalised experiences. This also applies to in-car entertainment. Many times, auto owners want their cars to represent their personal style, preferences, and tastes. As a result, there is an increase in demand for individualised sound profiles and customised audio configurations that considers each person's listening tastes and style.

Because it offers a wide range of alternatives beyond what is included as standard in factory-installed systems, the aftermarket is frequently used by consumers to satisfy their customizing desires. Car owners can customise their audio systems with aftermarket goods to meet their unique needs, whether they want to achieve better sound quality, increase bass output, or include cutting-edge technology.

Major Growth Barriers

- High Costs of Advanced Technology

Car audio systems that incorporate cutting-edge audio technologies and advanced features improve the listening experience overall by providing better sound quality, connectivity options, and cutting-edge functionality. This improvement has a price, though.

The use of such advanced technologies greatly increases the production costs of automotive audio systems. The final retail cost of these sophisticated audio systems thus increases significantly as well.

Price-sensitive customers and some market groups with tight budgets may need help owing to this price increase. These customers could find it challenging to justify the higher cost connected with the newest audio technologies, possibly choosing more traditional or reasonably priced audio solutions instead.

- Space and Design Constraints

Due to the constrained interior space of these small and electric vehicles, the automobile industry's shift in this direction presents a special difficulty for the integration of audio equipment.

Compact and electric car audio component design and integration require meticulous planning and engineering know-how. These cars' small interiors necessitate creative approaches to the selection and arrangement of audio components. This restriction may affect the dimensions, display, and placement of speakers, amplifiers, subwoofers, and other important audio components.

Within these limitations, engineers must plan to maximise sound quality and performance, frequently choosing efficient, space-saving systems without sacrificing the audio experience.

Key Trends and Opportunities to Look at

- Innovations in Autonomous Vehicles

Innovative entertainment systems can flourish in autonomous vehicles, allowing passengers to watch films, play games, experience virtual reality, or listen to rich audio experiences while traveling. Automakers may gain a competitive edge by designing audio systems that produce high-quality sound and seamless integration with entertainment systems while improving passenger enjoyment.

The entertainment component of autonomous vehicles can be enhanced by designing audio systems that provide immersive 3D sound experiences. Passengers can become completely engaged in the audio environment by using technologies like object-based audio and spatial sound processing, making the experience more entertaining and interesting.

- EV Audio Solutions

A tempting opportunity to address the particular acoustic issues given by the quieter interiors of electric and hybrid vehicles is the development of specialised audio systems. In electric and hybrid cars, the traditional engine noise is greatly decreased, making previously undetectable sounds inside the car—like road noise or wind resistance—more audible.

To ensure a well-balanced and immersive audio experience, audio systems that can successfully counter or complement these sounds are required. Manufacturers have the chance to design audio components that are precisely tailored to the quirks of these cars, emphasizing excellent sound quality, effective power use, and cutting-edge noise-canceling technologies.

- Speaker Design and Material Innovations

The market for automobile audio systems is being completely transformed by developments in speaker design that make use of strong, lightweight materials. Innovative materials make it possible to create speakers that are not only strong and long-lasting but also lightweight, which maximises interior space. These innovations successfully blend improving interior aesthetics with providing improved audio performance.

Reduced weight makes it simpler to integrate and deploy speakers inside the car, increasing design and placement flexibility without sacrificing sound quality. Additionally, using strong materials assures endurance and dependability, giving customers a long-lasting and sustainable audio solution.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the regulatory environment has a significant impact on how the in-car audio system market develops. The regulatory environment has a substantial impact on the development of new products, safety regulations, how they affect the environment, and market dynamics.

The design, manufacture, and marketing of audio components are all impacted by the safety, emissions, noise levels, and energy efficiency rules and regulations set forth by the government. Furthermore, laws encouraging distraction-free driving have an impact on the incorporation of sophisticated control interfaces and voice-activated features to guarantee that drivers' attention is kept on the road.

Regulations governing the use of materials and energy efficiency also drive businesses to develop innovative, environmentally friendly audio solutions.

Fairfield’s Ranking Board

Top Segments

- Sales of Speakers Dominant over Amplifiers

In the component market, the speaker category still dominates the amplifier category. Within a car, speakers play a crucial role in sound reproduction, clarity, and overall acoustic enjoyment. Superior sound quality and strong audio output are priorities for consumers, who make speakers a key component of their purchase selections.

Additionally, improvements in speaker technology, such as new materials and innovative designs, have greatly improved their effectiveness and performance. A large variety of solutions are available in the speaker category to accommodate different preferences and price ranges, thereby enhancing its market domination.

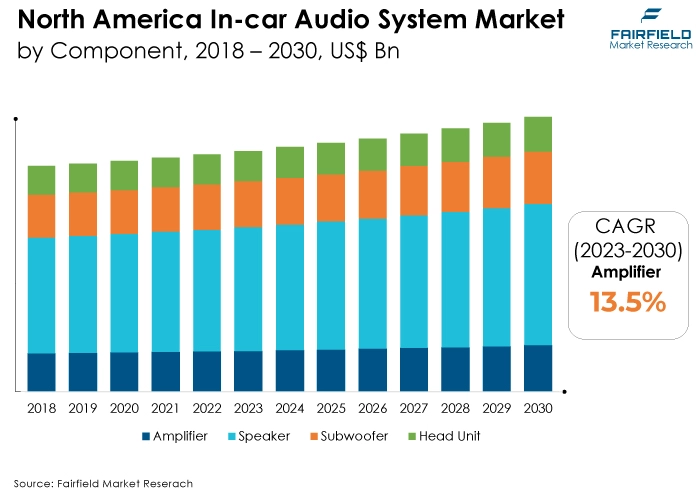

Furthermore, the amplifier category is projected to experience the fastest market growth. With the rising demand for high-fidelity audio and immersive in-car entertainment, consumers are increasingly seeking more powerful and efficient amplifiers.

Advancements in amplifier technologies, including class-D amplifiers and compact, high-efficiency designs, have resulted in improved power output while minimizing heat generation and energy consumption.

- Branded Systems Remain Favoured

In 2022, the branded category dominated the industry. There are a number of convincing reasons why branded automotive audio systems are expected to continue dominating during the projected period. Branded automobile audio systems are frequently linked to excellence, dependability, and a track record of providing outstanding sound experiences.

Reputable and established brands have a high level of consumer trust, making them the go-to options for those purchasing automotive audio systems. These companies are renowned for their dedication to research, development, and invention, which has led to the creation of cutting-edge technology and excellent audio quality.

The non-branded category is anticipated to grow substantially throughout the projected period. Non-branded audio systems, commonly referred to as generic or unbranded systems, frequently appeal to budget-conscious buyers searching for affordable substitutes without sacrificing vital audio features.

The growing demand for affordable solutions, particularly in emerging nations and among customers who are aware of their spending, is a major factor in the expansion of the non-branded sector.

- ICE Vehicles Prominent in Generating Demand

The ICE segment dominated the market in 2022. This is mostly because ICE vehicles are well-established and still predominate the automotive market, particularly in many parts of the world. The bulk of cars on the road are still ICEs, which use conventional fossil fuels. As a result, ICE vehicles continue to have a high demand for audio systems.

In addition, the inclusion of cutting-edge audio technologies, premium sound systems, and entertainment options in contemporary ICE vehicles draws customers seeking improved in-car experiences.

The EV category is expected to experience the fastest growth within the forecast time frame. The worldwide shift towards environmentally friendly and sustainable transportation options is responsible for this remarkable increase.

The use of electric vehicles is expanding as governments and consumers place more emphasis on lowering carbon footprints and embracing greener alternatives. Since electric cars tend to have quieter interiors than conventional internal combustion engine vehicles, there is an increasing demand for specialised audio systems designed for their specific acoustic environment.

- OEMs Take the Charge

In 2022, the OEM category led the market growth. OEMs, which are automakers who install factory-installed audio systems in vehicles, have a distinct advantage because of their close connection to the manufacturing process. Because it flawlessly accompanies the whole design, cosmetics, and usefulness of the car, consumers frequently give preference to the audio system offered by the OEM.

In addition, OEMs are skilled in creating and integrating audio systems that are acoustically tailored for specific car models, guaranteeing the end-users a superior audio experience.

Moreover, the aftermarket category is expected to grow fastest in the in-car audio system market during the forecast period. Numerous reasons contribute to this quick growth. People want more and more customised and advanced audio experiences in their cars.

The aftermarket industry provides a wide range of customisation choices, enabling customers to select audio components that suit their tastes, financial situation, and particular requirements. As cars get older or new audio technologies are developed, consumers frequently decide to replace their current audio systems will fuel the demand within aftermarket.

Regional Frontrunners

North America has the Largest Consumer Base for In-car Audio Systems

The dominant position of North America in the in-car audio market is the result of several reasons. A large percentage of consumers in North America, where the automotive industry is well-established, place a high value on cutting-edge in-car entertainment and audio experiences.

The region has a strong culture of car ownership, which increases the need for high-end audio products because long commutes and frequent travel are common.

North America is home to several well-known corporations that produce automobile audio systems and technological firms that consistently invent and launch cutting-edge audio technologies. These businesses make research and development investments, building high-quality audio systems and components that meet changing consumer tastes.

Asia Pacific Expects Gains from Speaker Sales

The region of Asia Pacific is expected to experience tremendous growth in the speaker sectors during the projection period, and this expectation is well-founded. This predicted a number of things influencing the rise. The automotive industry in Asia Pacific is expanding quickly, helped by a growing middle class and rising levels of disposable income.

Rising vehicle ownership across the area, especially in emerging nations, is increasing demand for automotive audio systems. The market for a greater in-car entertainment experience is being driven by the expanding urbanisation and shifting lifestyles in the Asia Pacific.

Customers in this region are placing a higher value on sound systems in their cars, which is driving up the need for cutting-edge speakers that can give them immersive audio experiences while they are driving.

Fairfield’s Competitive Landscape Analysis

The global car audio system market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global In-car Audio System Space?

- Focal-JMlab

- FORVIA Faurecia

- JVC KENWOOD Corporation

- ALPS ALPINE CO., LTD.

- Panasonic Industry Co., Ltd.

- Blaupunkt

- JLAudio

- HARMAN International

- Bose Corporation

- Clarion Co. Ltd.

- Pioneer Corporation

- Bang & Olufsen

- Yamaha Corporation

- Sonos, Inc.

- Sony group corporation

Significant Company Developments

New Product Launches

- June 2022: Sony's launch of the XAV-AX8100 in-car AV receiver with an 8.95-inch display and compatibility with Android Auto and Apple CarPlay is a notable addition to the In-Car Audio System Market. This product reflects the industry's emphasis on providing consumers with advanced connectivity options and larger, user-friendly displays for a seamless and enhanced in-car entertainment experience.

- September 2021: Bose's introduction of the Bose SoundLink Flex Bluetooth portable speaker highlights the company's commitment to offering versatile audio solutions for both in-car and on-the-go entertainment. This product caters to the growing demand for mobile. These high-quality audio devices can seamlessly transition between different environments, including being used within a vehicle or carried for outdoor activities.

- November 2019: Bang & Olufsen's launch of the BeoSound AMG, a high-end sound system tailored for specific Mercedes-AMG models, underscores the luxury audio segment's continuous pursuit of delivering exceptional sound experiences within premium automotive brands. The collaboration between Bang & Olufsen and Mercedes-AMG emphasises the significance of integrating top-notch audio technologies and design to match the high standards of luxury vehicles.

Distribution Agreements

- May 2021: US-based car audio system manufacturer Rockford Fosgate has partnered with Blaupunkt India to market and distribute its products in the country through an exclusive distribution agreement.

- February 2020: Amazon and Stellantis Collaborate to Introduce Customer-Centric Connected Experiences Across Millions of Vehicles, Helping Accelerate Stellantis’ Software Transformation.

From the Analyst's Perspective

Demand and Future Growth

The market demand for in-car audio systems is expected to expand significantly. In-car entertainment and audio quality are becoming increasingly important to consumers, and this trend, along with increased vehicle production and acceptance worldwide, is creating a solid base for market demand.

Consumers are looking for better audio systems for their automobiles because of developments in audio technologies, such as high-resolution audio formats and immersive sound experiences.

Additionally, the demand for specialised, effective audio solutions in quieter cabins is developing because of the growing popularity of electric vehicles. Market is also anticipated to be fuelled by the booming aftermarket industry, which offers bespoke audio solutions.

Supply Side of the Market

According to our analysis, extensive research of manufacturers, suppliers, and each of their manufacturing capacities, technological capabilities, and distribution networks is required to estimate the supply side of the in-car audio industry.

With their broad product portfolios, strong R&D skills, and strategic partnerships, leading manufacturers such as Bose Corporation, Harman International Industries, Sony Corporation, and Pioneer Corporation, among others exert a substantial amount of influence.

To keep up with changing consumer demands for high-fidelity audio experiences inside vehicles, these industry heavyweights continually innovate by introducing cutting-edge audio technologies, lightweight materials, and streamlined designs. Additionally, especially in the aftermarket sector, the market is seeing an increase in non-branded or generic audio system suppliers.

The Global Car Audio System Market is Segmented as Below:

By Component:

- Speaker

- Amplifier

- Subwoofer

- Others

- Head Unit

By Manufacturer:

- Branded

- Non-Branded

By Vehicle Type:

- ICE

- EV

By Sales Channel:

- OEM

- Aftermarket

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

- Executive Summary

- Global In-Car Audio System Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global In-Car Audio System Market Outlook, 2020 - 2033

- Global In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Speaker

- Amplifier

- Subwoofer

- Head Unit

- Others

- Global In-Car Audio System Market Outlook, by Manufacturer, Value (US$ Bn), 2020-2033

- Branded

- Non-Branded

- Global In-Car Audio System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- ICE

- EV

- Global In-Car Audio System Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Global In-Car Audio System Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- North America In-Car Audio System Market Outlook, 2020 - 2033

- North America In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Speaker

- Amplifier

- Subwoofer

- Head Unit

- Others

- North America In-Car Audio System Market Outlook, by Manufacturer, Value (US$ Bn), 2020-2033

- Branded

- Non-Branded

- North America In-Car Audio System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- ICE

- EV

- North America In-Car Audio System Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- North America In-Car Audio System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. In-Car Audio System Market Outlook, by Component, 2020-2033

- S. In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- S. In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- S. In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Canada In-Car Audio System Market Outlook, by Component, 2020-2033

- Canada In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Canada In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Canada In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Europe In-Car Audio System Market Outlook, 2020 - 2033

- Europe In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Speaker

- Amplifier

- Subwoofer

- Head Unit

- Others

- Europe In-Car Audio System Market Outlook, by Manufacturer, Value (US$ Bn), 2020-2033

- Branded

- Non-Branded

- Europe In-Car Audio System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- ICE

- EV

- Europe In-Car Audio System Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Europe In-Car Audio System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany In-Car Audio System Market Outlook, by Component, 2020-2033

- Germany In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Germany In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Germany In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Italy In-Car Audio System Market Outlook, by Component, 2020-2033

- Italy In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Italy In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Italy In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- France In-Car Audio System Market Outlook, by Component, 2020-2033

- France In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- France In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- France In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- K. In-Car Audio System Market Outlook, by Component, 2020-2033

- K. In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- K. In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- K. In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Spain In-Car Audio System Market Outlook, by Component, 2020-2033

- Spain In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Spain In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Spain In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Russia In-Car Audio System Market Outlook, by Component, 2020-2033

- Russia In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Russia In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Russia In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Rest of Europe In-Car Audio System Market Outlook, by Component, 2020-2033

- Rest of Europe In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Rest of Europe In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Asia Pacific In-Car Audio System Market Outlook, 2020 - 2033

- Asia Pacific In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Speaker

- Amplifier

- Subwoofer

- Head Unit

- Others

- Asia Pacific In-Car Audio System Market Outlook, by Manufacturer, Value (US$ Bn), 2020-2033

- Branded

- Non-Branded

- Asia Pacific In-Car Audio System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- ICE

- EV

- Asia Pacific In-Car Audio System Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Asia Pacific In-Car Audio System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China In-Car Audio System Market Outlook, by Component, 2020-2033

- China In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- China In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- China In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Japan In-Car Audio System Market Outlook, by Component, 2020-2033

- Japan In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Japan In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Japan In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- South Korea In-Car Audio System Market Outlook, by Component, 2020-2033

- South Korea In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- South Korea In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- South Korea In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- India In-Car Audio System Market Outlook, by Component, 2020-2033

- India In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- India In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- India In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Southeast Asia In-Car Audio System Market Outlook, by Component, 2020-2033

- Southeast Asia In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Southeast Asia In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Rest of SAO In-Car Audio System Market Outlook, by Component, 2020-2033

- Rest of SAO In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Rest of SAO In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Latin America In-Car Audio System Market Outlook, 2020 - 2033

- Latin America In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Speaker

- Amplifier

- Subwoofer

- Head Unit

- Others

- Latin America In-Car Audio System Market Outlook, by Manufacturer, Value (US$ Bn), 2020-2033

- Branded

- Non-Branded

- Latin America In-Car Audio System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- ICE

- EV

- Latin America In-Car Audio System Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Latin America In-Car Audio System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil In-Car Audio System Market Outlook, by Component, 2020-2033

- Brazil In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Brazil In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Brazil In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Mexico In-Car Audio System Market Outlook, by Component, 2020-2033

- Mexico In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Mexico In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Mexico In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Argentina In-Car Audio System Market Outlook, by Component, 2020-2033

- Argentina In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Argentina In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Argentina In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Rest of LATAM In-Car Audio System Market Outlook, by Component, 2020-2033

- Rest of LATAM In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Rest of LATAM In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Middle East & Africa In-Car Audio System Market Outlook, 2020 - 2033

- Middle East & Africa In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Speaker

- Amplifier

- Subwoofer

- Head Unit

- Others

- Middle East & Africa In-Car Audio System Market Outlook, by Manufacturer, Value (US$ Bn), 2020-2033

- Branded

- Non-Branded

- Middle East & Africa In-Car Audio System Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- ICE

- EV

- Middle East & Africa In-Car Audio System Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Middle East & Africa In-Car Audio System Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC In-Car Audio System Market Outlook, by Component, 2020-2033

- GCC In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- GCC In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- GCC In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- South Africa In-Car Audio System Market Outlook, by Component, 2020-2033

- South Africa In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- South Africa In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- South Africa In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Egypt In-Car Audio System Market Outlook, by Component, 2020-2033

- Egypt In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Egypt In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Egypt In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Nigeria In-Car Audio System Market Outlook, by Component, 2020-2033

- Nigeria In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Nigeria In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Nigeria In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- Rest of Middle East In-Car Audio System Market Outlook, by Component, 2020-2033

- Rest of Middle East In-Car Audio System Market Outlook, by Manufacturer, 2020-2033

- Rest of Middle East In-Car Audio System Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East In-Car Audio System Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa In-Car Audio System Market Outlook, by Component, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Focal-JMlab

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- FORVIA Faurecia

- JVC KENWOOD Corporation

- ALPS ALPINE CO., LTD.

- Panasonic Industry Co., Ltd.

- Blaupunkt

- JLAudio

- HARMAN International

- Bose Corporation

- Clarion Co. Ltd.

- Focal-JMlab

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Manufacturer Coverage |

|

|

Vehicle Type Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |