Global Industrial Robotics Market Forecast

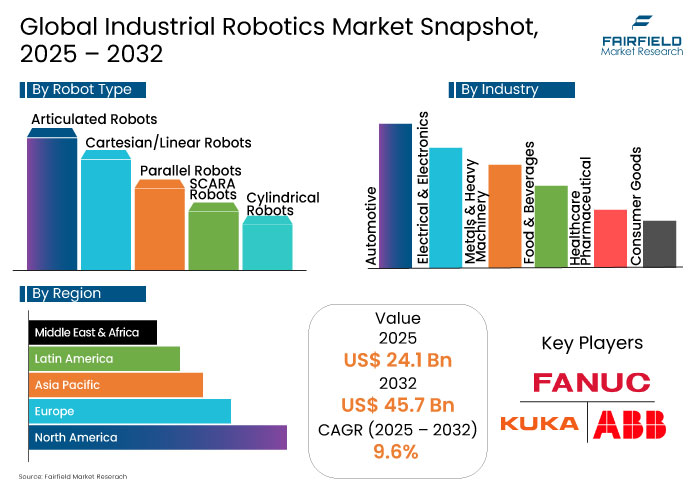

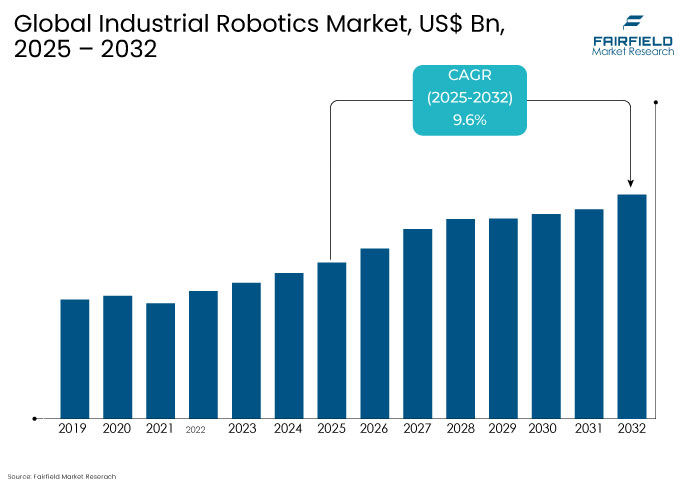

- The global Industrial Robotics Market size is projected to grow from US$ 24.1 Bn in 2025 to US$ 45.7 Bn by 2032 with a staggering CAGR of 9.6% during this period.

- Rising demand for automation across manufacturing sectors to enhance productivity, precision, and operational efficiency is the key driver for the global industrial robotics market.

Industrial Robotics Market Insights

- The increasing need for operational automation and cost optimization drives industrial robotics adoption globally.

- Growing labor shortages and rising wage costs across developed economies are accelerating the demand for industrial robots.

- Expansion of smart factories and Industry 4.0 initiatives is creating vast new deployment opportunities for industrial robotics.

- Surging investments in collaborative robots (cobots) offer significant growth potential, especially for SMEs.

- The integration of AI and machine learning technologies in robotics has transformed operational capabilities and flexibility.

- Adoption of modular and customizable robotic systems is gaining momentum across various manufacturing industries.

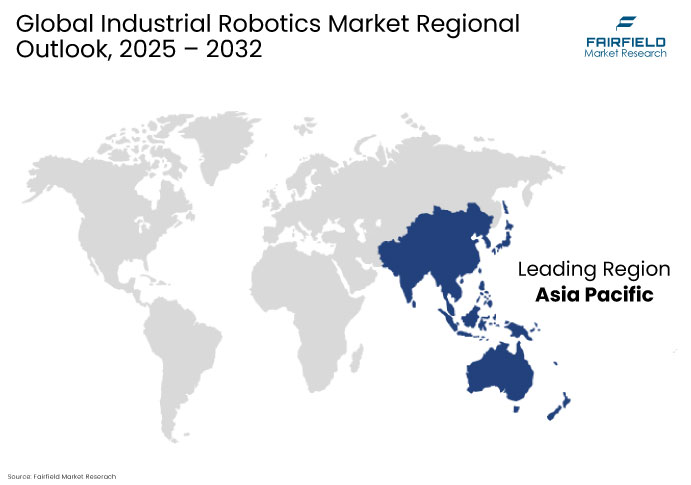

- Asia Pacific, led by China, remains the largest and fastest-growing region in the global industrial robotics market.

- Europe is witnessing significant growth fueled by strong automotive, electronics, and machinery industries.

- North America is advancing rapidly with the early adoption of collaborative and AI-enabled robotic solutions across sectors.

A Look Back and a Look Forward- Comparative Analysis

The global industrial robotics market witnessed moderate to accelerated growth during 2019–2024, driven by rising labor costs, industrial automation needs, and early Industry 4.0 initiatives. Traditional articulated robots dominated installations while collaborative solutions gained early traction. COVID-19 disruptions temporarily slowed deployments but later reinforced automation urgency. China led global installations, supported by strong performance in Japan, South Korea, Germany, and the United States. Large enterprises remained primary investors, while SME adoption grew cautiously, focusing on scalable, cost-effective solutions.

The forecast period 2025–2032 is expected to experience accelerated and sustained growth as robotics integrates AI, modular designs, and predictive maintenance capabilities. Electrification trends, smart factories, reshoring efforts, and green manufacturing priorities will further expand market opportunities beyond traditional sectors. Asia Pacific will maintain dominance, with stronger participation emerging from Vietnam, Thailand, and India, while Europe and North America advance smart automation strategies. SMEs will drive notable market expansion, supported by the growing popularity of Robot-as-a-Service models and accessible robotic technologies.

Key Growth Determinants

- Rising Automation Demand Accelerates Growth in the Global Industrial Robotics Market

The most prominent driver for the industrial robotics market is the surging demand for automation across manufacturing industries to enhance productivity, precision, and operational efficiency. Industries such as automotive, electronics, metals, and consumer goods are increasingly shifting towards automated solutions to combat rising labor costs, improve quality consistency, and meet accelerated production timelines. Manufacturers are actively integrating industrial robots to streamline workflows, minimize downtime, and maintain a competitive advantage amid evolving market dynamics. Furthermore, the post-pandemic emphasis on resilient and flexible production systems has intensified the role of robotics in achieving operational continuity and scalability.

As industries continue adopting smart manufacturing practices and digital transformation strategies, the need for advanced, intelligent robotic systems is expected to strengthen further, positioning automation demand as a foundational pillar of long-term market growth.

Key Growth Barriers

- Technical Complexity and Skilled Labor Gaps Restrain the Global Industrial Robotics Market

The increasing technical difficulty of integrating, programming, and maintaining sophisticated robotic systems is a major barrier affecting the global industrial robotics market. As robotics technologies evolve with AI, IoT, and machine learning capabilities, companies often face challenges in deploying these systems effectively within existing production environments. Inadequate internal technical expertise can lead to longer setup times, inefficient utilization, and higher operational risks. Small and mid-sized manufacturers, in particular, struggle to adapt quickly due to limited access to skilled professionals trained in robotics engineering, software integration, and system troubleshooting.

The shortage of highly skilled workers creates dependency on external integrators and lengthens project implementation cycles, ultimately slowing the broader adoption rate of industrial robotics across several industries and regions.

Industrial Robotics Market Trends and Opportunities

- Smart Factory Evolution Drives New Deployment Opportunities in the Industrial Robotics Market

The swift growth of smart factories and the broad use of Industry 4.0 frameworks present one of the biggest prospects for the global market. As manufacturers transition toward digitalized and interconnected production systems, the demand for intelligent, flexible, and autonomous robotic solutions is growing substantially. Robotics integrated with IoT, AI, and real-time data analytics is enabling highly adaptive manufacturing processes, minimizing errors, and enhancing operational agility. This evolution is not limited to traditional sectors but is also expanding across industries like food & beverage, pharmaceuticals, and consumer goods, broadening the market base.

The move toward smart factories will continue to create significant deployment opportunities for robotics manufacturers, particularly in areas requiring scalable, customizable, and interconnected robotic ecosystems.

- AI Integration Reshapes Operational Standards in the Global Industrial Robotics Market

The integration of artificial intelligence (AI) into robotic systems, which permits increased autonomy, flexibility, and predictive capacities, is a significant development influencing the global industrial robotics market. Manufacturers are increasingly deploying AI-powered robots that can learn, self-optimize, and adjust to dynamic production environments without constant human intervention. Machine vision, natural language processing, and predictive maintenance are becoming essential components of modern industrial robots, significantly enhancing their value proposition. This trend redefines the production lines by making them smarter, faster, and capable of handling more complex tasks with minimal errors.

The ongoing shift toward AI-enabled robotics is expected to drive widespread innovation and create new operational standards across industries seeking higher efficiency and operational intelligence.

Leading Segment Overview

- Articulated Robots Lead the Global Industrial Robotics Market with Versatility and Precision

The articulated robots segment is the leading category, driven by their versatility and ability to perform complex tasks in manufacturing environments. These robots, often equipped with 6 or more degrees of freedom, excel in applications like welding, material handling, and assembly lines. Their flexibility in performing multi-axis operations makes them the preferred choice in industries such as automotive, electronics, and metal fabrication.

Other significant categories include Cartesian/Linear robots, which are well-suited for high-precision tasks such as pick-and-place operations, and SCARA robots, popular for fast and repetitive tasks in assembly lines. Cylindrical and parallel robots are also used in specialized applications, such as packaging, food processing, and medical device manufacturing, while the "other robots" category covers emerging technologies in robotics.

In March 2024, KUKA Robotics announced the launch of a new line of lightweight articulated robots, specifically designed for collaborative manufacturing in industries such as automotive and electronics, emphasizing ease of integration and adaptability in dynamic production environments.

Regional Analysis

- Asia Pacific Dominates the Global Industrial Robotics Market with Rapid Manufacturing Automation

Asia Pacific remains the dominant region in the global market, driven by strong demand from manufacturing hubs such as China, Japan, South Korea, and increasingly, India. China continues to lead in both robotics production and consumption, with a growing number of factories automating production lines across industries such as automotive, electronics, and consumer goods. Government incentives and initiatives aimed at upgrading manufacturing capabilities further enhance the demand for industrial robots. Japan, home to global leaders like FANUC and Yaskawa, also continues to expand its robotic automation in advanced manufacturing sectors, reinforcing the region's leadership.

India and Southeast Asian countries, including Vietnam, Thailand, and Indonesia, are emerging as key contributors to the region’s growth. These countries have witnessed increased investments in robotics as they transition to smarter manufacturing practices. The rising labor costs, coupled with efforts to scale production and improve quality, make automation an attractive investment. Furthermore, the expansion of e-commerce, logistics, and the food & beverage sector in these nations creates a high demand for versatile robotic solutions.

- Europe Drives Industrial Robotics Market Growth with Smart Manufacturing and Sustainability Focus

Europe is a key region for the growth of global industry with countries such as Germany, Italy, and France leading the way in robotics integration. Germany, in particular, stands out as a global leader in industrial automation, driven by its strong automotive sector, precision engineering, and manufacturing excellence. The country's strategic push for Industry 4.0 and the increased demand for smart factories is fueling the growth of robotics adoption. Robotics applications are widespread in automotive assembly lines, machine tooling, and electronics manufacturing. The European Union's emphasis on digital transformation and technological innovation further supports the market's expansion.

Other countries, such as Italy and France, are also witnessing significant growth, particularly in industrial applications such as packaging, food processing, and pharmaceuticals. With increasing investments in R&D and manufacturing processes, the robotics market in these nations is thriving. Moreover, Europe’s proactive stance on sustainability and green manufacturing initiatives has led to the adoption of energy-efficient robots and eco-friendly automation solutions, offering long-term growth potential in diverse sectors.

- North America Enhances Industrial Robotics Growth with Strong Sectors and Smart Manufacturing Initiatives

North America plays a pivotal role in the growth of the global industrial robotics market with the United States as the key contributor. The country's high-tech industries, including automotive, electronics, and aerospace, are major adopters of robotics solutions. The shift towards automated manufacturing processes in these sectors is driven by the need for enhanced productivity, precision, and cost-efficiency. U.S. manufacturers, from large corporations to small and medium-sized enterprises, are increasingly implementing robotic systems to meet demand for higher quality and speed in production lines. Furthermore, the country’s focus on Industry 4.0 and smart manufacturing technologies has led to significant investments in robotics.

Canada and Mexico are also experiencing growth in the market, particularly in automotive manufacturing, food processing, and pharmaceuticals. While Canada’s adoption is driven by advancements in automation within its automotive sector, Mexico has become an attractive destination for robotics investments, largely due to its role as a manufacturing hub for North America. The region's strong economic foundation, alongwith continuous R&D efforts, positions North America to maintain a competitive edge in the global market.

Competitive Landscape

The global industrial robotics market is highly competitive, with leading players such as ABB Ltd., FANUC Corporation, KUKA AG, and Yaskawa Electric Corporation taking the lead. These companies dominate by offering advanced robotic systems across various industries, including automotive, electronics, healthcare, and food processing. The competition is driven by demand for efficient, flexible, and cost-effective robotic solutions, focusing on technological innovation and product diversification.

To stay ahead, these companies invest heavily in R&D, integrating AI, machine learning, and IoT capabilities into their robots. This allows them to provide autonomous systems capable of handling complex tasks. Strategic partnerships, collaborations, and acquisitions are key strategies to expand market share, access new customer segments, and enhance product offerings. Modular, scalable solutions are being developed to cater to large and small manufacturers.

The market offers numerous growth opportunities, particularly in emerging markets such as India, Southeast Asia, and Latin America, where industrial automation is on the rise. As companies in these regions look to increase efficiency and reduce costs, the demand for robotics is set to grow. Additionally, the push for smart manufacturing and energy-efficient robots presents new avenues for development.

- In May 2024, Mitsubishi Electric Corporation boosted its investment in Realtime Robotics, a U.S.-based startup known for motion-planning technology for factory automation, strengthening its role in agile manufacturing.

- In January 2024, ABB acquired Sevensense, a Swiss company specializing in AI-driven 3D visual navigation technology, to enhance its mobile robot capabilities, advancing its strategy in autonomous systems.

- In January 2024, ABB acquired a majority stake in Meshmind, a software company specializing in machine vision and IoT applications, expanding its footprint in smart automation and machine learning-based robotics.

Key Market Companies

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Universal Robots

- Stäubli Robotics

- Nachi-Fujikoshi Corporation

- Comau S.p.A.

- Omron Corporation

- Epson Robots

- Kawasaki Heavy Industries

- Denso Robotics

- Honda Robotics

- Siemens AG

Expert Opinion

- The integration of advanced technologies such as AI, machine learning, and IoT is a significant growth driver for the global market. These innovations allow for more flexible, autonomous systems capable of performing complex tasks, increasing efficiency, and reducing human labor in manufacturing processes. As industries continue to embrace digital transformation, the demand for smarter, more adaptable robotic systems will continue to rise.

- Industrial robotics adoption is expanding rapidly in emerging markets such as India, China, and Southeast Asia. These regions are investing heavily in automation to boost productivity and competitiveness. As local manufacturers aim to modernize their operations and meet global standards, the market for industrial robots in these regions is expected to grow significantly over the next decade.

- Collaborative robots (cobots) are revolutionizing the industrial robotics market by enabling robots to work safely alongside humans in various environments. This has opened up new possibilities, especially in small and medium-sized enterprises (SMEs), where flexible and cost-effective robotic solutions are crucial. The ease of programming and integration of cobots into existing workflows is fueling their demand across various sectors.

- The market is highly competitive, with industry giants like ABB, FANUC, and KUKA leading the way. However, new entrants and small players are making their mark by offering specialized robotic solutions and forming strategic partnerships. Companies are also focusing on acquisitions to enhance technological capabilities and expand their market presence, especially in emerging industries and regions. This competitive landscape fosters innovation and continues to drive market evolution.

Global Industrial Robotics Market is Segmented as

By Robot Type

- Articulated Robots

- Cartesian/Linear Robots

- Parallel Robots

- SCARA Robots

- Cylindrical Robots

- Other Robots

By Payload

- Upto 20kg

- 21 to 60kg

- 61 to 200kg

- Above 200kg

By Industry

- Automotive

- Electrical & Electronics

- Metals & Heavy Machinery

- Food & Beverages

- Healthcare & Pharmaceutical

- Consumer Goods

- Misc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Industrial Robotics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Industrial Robotics Market Outlook, 2019 - 2032

3.1. Global Industrial Robotics Market Outlook, by Robot Type, Value (US$ Bn) & Volume (Unit), 2019-2032

3.1.1. Articulated Robots

3.1.2. Cartesian/Linear Robots

3.1.3. Parallel Robots

3.1.4. SCARA Robots

3.1.5. Cylindrical Robots

3.1.6. Other Robots

3.2. Global Industrial Robotics Market Outlook, by Payload, Value (US$ Bn) & Volume (Unit), 2019-2032

3.2.1. Upto 20kg

3.2.2. 21 to 60kg

3.2.3. 61 to 200kg

3.2.4. Above 200kg

3.3. Global Industrial Robotics Market Outlook, by Industry, Value (US$ Bn) & Volume (Unit), 2019-2032

3.3.1. Automotive

3.3.2. Electrical & Electronics

3.3.3. Metals & Heavy Machinery

3.3.4. Food & Beverages

3.3.5. Healthcare & Pharmaceutical

3.3.6. Consumer Goods

3.3.7. Misc.

3.4. Global Industrial Robotics Market Outlook, by Region, Value (US$ Bn) & Volume (Unit), 2019-2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Industrial Robotics Market Outlook, 2019 - 2032

4.1. North America Industrial Robotics Market Outlook, by Robot Type, Value (US$ Bn) & Volume (Unit), 2019-2032

4.1.1. Articulated Robots

4.1.2. Cartesian/Linear Robots

4.1.3. Parallel Robots

4.1.4. SCARA Robots

4.1.5. Cylindrical Robots

4.1.6. Other Robots

4.2. North America Industrial Robotics Market Outlook, by Payload, Value (US$ Bn) & Volume (Unit), 2019-2032

4.2.1. Upto 20kg

4.2.2. 21 to 60kg

4.2.3. 61 to 200kg

4.2.4. Above 200kg

4.3. North America Industrial Robotics Market Outlook, by Industry, Value (US$ Bn) & Volume (Unit), 2019-2032

4.3.1. Automotive

4.3.2. Electrical & Electronics

4.3.3. Metals & Heavy Machinery

4.3.4. Food & Beverages

4.3.5. Healthcare & Pharmaceutical

4.3.6. Consumer Goods

4.3.7. Misc.

4.4. North America Industrial Robotics Market Outlook, by Country, Value (US$ Bn) & Volume (Unit), 2019-2032

4.4.1. U.S. Industrial Robotics Market Outlook, by Robot Type, 2019-2032

4.4.2. U.S. Industrial Robotics Market Outlook, by Payload, 2019-2032

4.4.3. U.S. Industrial Robotics Market Outlook, by Industry, 2019-2032

4.4.4. Canada Industrial Robotics Market Outlook, by Robot Type, 2019-2032

4.4.5. Canada Industrial Robotics Market Outlook, by Payload, 2019-2032

4.4.6. Canada Industrial Robotics Market Outlook, by Industry, 2019-2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Industrial Robotics Market Outlook, 2019 - 2032

5.1. Europe Industrial Robotics Market Outlook, by Robot Type, Value (US$ Bn) & Volume (Unit), 2019-2032

5.1.1. Articulated Robots

5.1.2. Cartesian/Linear Robots

5.1.3. Parallel Robots

5.1.4. SCARA Robots

5.1.5. Cylindrical Robots

5.1.6. Other Robots

5.2. Europe Industrial Robotics Market Outlook, by Payload, Value (US$ Bn) & Volume (Unit), 2019-2032

5.2.1. Upto 20kg

5.2.2. 21 to 60kg

5.2.3. 61 to 200kg

5.2.4. Above 200kg

5.3. Europe Industrial Robotics Market Outlook, by Industry, Value (US$ Bn) & Volume (Unit), 2019-2032

5.3.1. Automotive

5.3.2. Electrical & Electronics

5.3.3. Metals & Heavy Machinery

5.3.4. Food & Beverages

5.3.5. Healthcare & Pharmaceutical

5.3.6. Consumer Goods

5.3.7. Misc.

5.4. Europe Industrial Robotics Market Outlook, by Country, Value (US$ Bn) & Volume (Unit), 2019-2032

5.4.1. Germany Industrial Robotics Market Outlook, by Robot Type, 2019-2032

5.4.2. Germany Industrial Robotics Market Outlook, by Payload, 2019-2032

5.4.3. Germany Industrial Robotics Market Outlook, by Industry, 2019-2032

5.4.4. Italy Industrial Robotics Market Outlook, by Robot Type, 2019-2032

5.4.5. Italy Industrial Robotics Market Outlook, by Payload, 2019-2032

5.4.6. Italy Industrial Robotics Market Outlook, by Industry, 2019-2032

5.4.7. France Industrial Robotics Market Outlook, by Robot Type, 2019-2032

5.4.8. France Industrial Robotics Market Outlook, by Payload, 2019-2032

5.4.9. France Industrial Robotics Market Outlook, by Industry, 2019-2032

5.4.10. U.K. Industrial Robotics Market Outlook, by Robot Type, 2019-2032

5.4.11. U.K. Industrial Robotics Market Outlook, by Payload, 2019-2032

5.4.12. U.K. Industrial Robotics Market Outlook, by Industry, 2019-2032

5.4.13. Spain Industrial Robotics Market Outlook, by Robot Type, 2019-2032

5.4.14. Spain Industrial Robotics Market Outlook, by Payload, 2019-2032

5.4.15. Spain Industrial Robotics Market Outlook, by Industry, 2019-2032

5.4.16. Russia Industrial Robotics Market Outlook, by Robot Type, 2019-2032

5.4.17. Russia Industrial Robotics Market Outlook, by Payload, 2019-2032

5.4.18. Russia Industrial Robotics Market Outlook, by Industry, 2019-2032

5.4.19. Rest of Europe Industrial Robotics Market Outlook, by Robot Type, 2019-2032

5.4.20. Rest of Europe Industrial Robotics Market Outlook, by Payload, 2019-2032

5.4.21. Rest of Europe Industrial Robotics Market Outlook, by Industry, 2019-2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Industrial Robotics Market Outlook, 2019 - 2032

6.1. Asia Pacific Industrial Robotics Market Outlook, by Robot Type, Value (US$ Bn) & Volume (Unit), 2019-2032

6.1.1. Articulated Robots

6.1.2. Cartesian/Linear Robots

6.1.3. Parallel Robots

6.1.4. SCARA Robots

6.1.5. Cylindrical Robots

6.1.6. Other Robots

6.2. Asia Pacific Industrial Robotics Market Outlook, by Payload, Value (US$ Bn) & Volume (Unit), 2019-2032

6.2.1. Upto 20kg

6.2.2. 21 to 60kg

6.2.3. 61 to 200kg

6.2.4. Above 200kg

6.3. Asia Pacific Industrial Robotics Market Outlook, by Industry, Value (US$ Bn) & Volume (Unit), 2019-2032

6.3.1. Automotive

6.3.2. Electrical & Electronics

6.3.3. Metals & Heavy Machinery

6.3.4. Food & Beverages

6.3.5. Healthcare & Pharmaceutical

6.3.6. Consumer Goods

6.3.7. Misc.

6.4. Asia Pacific Industrial Robotics Market Outlook, by Country, Value (US$ Bn) & Volume (Unit), 2019-2032

6.4.1. China Industrial Robotics Market Outlook, by Robot Type, 2019-2032

6.4.2. China Industrial Robotics Market Outlook, by Payload, 2019-2032

6.4.3. China Industrial Robotics Market Outlook, by Industry, 2019-2032

6.4.4. Japan Industrial Robotics Market Outlook, by Robot Type, 2019-2032

6.4.5. Japan Industrial Robotics Market Outlook, by Payload, 2019-2032

6.4.6. Japan Industrial Robotics Market Outlook, by Industry, 2019-2032

6.4.7. South Korea Industrial Robotics Market Outlook, by Robot Type, 2019-2032

6.4.8. South Korea Industrial Robotics Market Outlook, by Payload, 2019-2032

6.4.9. South Korea Industrial Robotics Market Outlook, by Industry, 2019-2032

6.4.10. India Industrial Robotics Market Outlook, by Robot Type, 2019-2032

6.4.11. India Industrial Robotics Market Outlook, by Payload, 2019-2032

6.4.12. India Industrial Robotics Market Outlook, by Industry, 2019-2032

6.4.13. Southeast Asia Industrial Robotics Market Outlook, by Robot Type, 2019-2032

6.4.14. Southeast Asia Industrial Robotics Market Outlook, by Payload, 2019-2032

6.4.15. Southeast Asia Industrial Robotics Market Outlook, by Industry, 2019-2032

6.4.16. Rest of SAO Industrial Robotics Market Outlook, by Robot Type, 2019-2032

6.4.17. Rest of SAO Industrial Robotics Market Outlook, by Payload, 2019-2032

6.4.18. Rest of SAO Industrial Robotics Market Outlook, by Industry, 2019-2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Industrial Robotics Market Outlook, 2019 - 2032

7.1. Latin America Industrial Robotics Market Outlook, by Robot Type, Value (US$ Bn) & Volume (Unit), 2019-2032

7.1.1. Articulated Robots

7.1.2. Cartesian/Linear Robots

7.1.3. Parallel Robots

7.1.4. SCARA Robots

7.1.5. Cylindrical Robots

7.1.6. Other Robots

7.2. Latin America Industrial Robotics Market Outlook, by Payload, Value (US$ Bn) & Volume (Unit), 2019-2032

7.2.1. Upto 20kg

7.2.2. 21 to 60kg

7.2.3. 61 to 200kg

7.2.4. Above 200kg

7.3. Latin America Industrial Robotics Market Outlook, by Industry, Value (US$ Bn) & Volume (Unit), 2019-2032

7.3.1. Automotive

7.3.2. Electrical & Electronics

7.3.3. Metals & Heavy Machinery

7.3.4. Food & Beverages

7.3.5. Healthcare & Pharmaceutical

7.3.6. Consumer Goods

7.3.7. Misc.

7.4. Latin America Industrial Robotics Market Outlook, by Country, Value (US$ Bn) & Volume (Unit), 2019-2032

7.4.1. Brazil Industrial Robotics Market Outlook, by Robot Type, 2019-2032

7.4.2. Brazil Industrial Robotics Market Outlook, by Payload, 2019-2032

7.4.3. Brazil Industrial Robotics Market Outlook, by Industry, 2019-2032

7.4.4. Mexico Industrial Robotics Market Outlook, by Robot Type, 2019-2032

7.4.5. Mexico Industrial Robotics Market Outlook, by Payload, 2019-2032

7.4.6. Mexico Industrial Robotics Market Outlook, by Industry, 2019-2032

7.4.7. Argentina Industrial Robotics Market Outlook, by Robot Type, 2019-2032

7.4.8. Argentina Industrial Robotics Market Outlook, by Payload, 2019-2032

7.4.9. Argentina Industrial Robotics Market Outlook, by Industry, 2019-2032

7.4.10. Rest of LATAM Industrial Robotics Market Outlook, by Robot Type, 2019-2032

7.4.11. Rest of LATAM Industrial Robotics Market Outlook, by Payload, 2019-2032

7.4.12. Rest of LATAM Industrial Robotics Market Outlook, by Industry, 2019-2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Industrial Robotics Market Outlook, 2019 - 2032

8.1. Middle East & Africa Industrial Robotics Market Outlook, by Robot Type, Value (US$ Bn) & Volume (Unit), 2019-2032

8.1.1. Articulated Robots

8.1.2. Cartesian/Linear Robots

8.1.3. Parallel Robots

8.1.4. SCARA Robots

8.1.5. Cylindrical Robots

8.1.6. Other Robots

8.2. Middle East & Africa Industrial Robotics Market Outlook, by Payload, Value (US$ Bn) & Volume (Unit), 2019-2032

8.2.1. Upto 20kg

8.2.2. 21 to 60kg

8.2.3. 61 to 200kg

8.2.4. Above 200kg

8.3. Middle East & Africa Industrial Robotics Market Outlook, by Industry, Value (US$ Bn) & Volume (Unit), 2019-2032

8.3.1. Automotive

8.3.2. Electrical & Electronics

8.3.3. Metals & Heavy Machinery

8.3.4. Food & Beverages

8.3.5. Healthcare & Pharmaceutical

8.3.6. Consumer Goods

8.3.7. Misc.

8.4. Middle East & Africa Industrial Robotics Market Outlook, by Country, Value (US$ Bn) & Volume (Unit), 2019-2032

8.4.1. GCC Industrial Robotics Market Outlook, by Robot Type, 2019-2032

8.4.2. GCC Industrial Robotics Market Outlook, by Payload, 2019-2032

8.4.3. GCC Industrial Robotics Market Outlook, by Industry, 2019-2032

8.4.4. South Africa Industrial Robotics Market Outlook, by Robot Type, 2019-2032

8.4.5. South Africa Industrial Robotics Market Outlook, by Payload, 2019-2032

8.4.6. South Africa Industrial Robotics Market Outlook, by Industry, 2019-2032

8.4.7. Egypt Industrial Robotics Market Outlook, by Robot Type, 2019-2032

8.4.8. Egypt Industrial Robotics Market Outlook, by Payload, 2019-2032

8.4.9. Egypt Industrial Robotics Market Outlook, by Industry, 2019-2032

8.4.10. Nigeria Industrial Robotics Market Outlook, by Robot Type, 2019-2032

8.4.11. Nigeria Industrial Robotics Market Outlook, by Payload, 2019-2032

8.4.12. Nigeria Industrial Robotics Market Outlook, by Industry, 2019-2032

8.4.13. Rest of Middle East Industrial Robotics Market Outlook, by Robot Type, 2019-2032

8.4.14. Rest of Middle East Industrial Robotics Market Outlook, by Payload, 2019-2032

8.4.15. Rest of Middle East Industrial Robotics Market Outlook, by Industry, 2019-2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. ABB Ltd.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. FANUC Corporation

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. KUKA AG

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Yaskawa Electric Corporation

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Mitsubishi Electric Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Universal Robots

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Stäubli Robotics

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Nachi-Fujikoshi Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Comau S.p.A.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Omron Corporation

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. Epson Robots

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

9.4.12. Kawasaki Heavy Industries

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Developments

9.4.13. Denso Robotics

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Developments

9.4.14. Honda Robotics

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Developments

9.4.15. Siemens AG

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Robot Type |

|

|

Payload |

|

|

Industry |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |