Global Lime Market Forecast

- Lime market size to reach from US$48.2 Bn (2026) to US$58.5 Bn by the end of 2033

- Global lime market size poised to see 3% CAGR between 2026 and 2033

Major Report Findings - Fairfield's Perspective

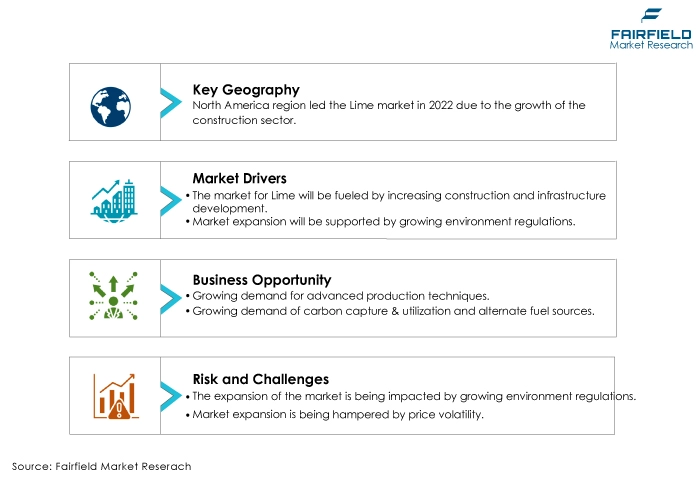

- The key trend anticipated to fuel the growth of lime market is the increasing demand from the construction industry.

- Another major market trend expected to fuel the growth is the lime market, a rapidly expanding global agriculture industry. The market is also predicted to profit from the growing worldwide agriculture industry.

- The lime market is driven by chemical intermediates such as lime, specifically quicklime and slaked. Lime is a fundamental raw material in the production of various mediators used in a wide range of industrial processes, making it a pivotal component in the chemical industry's supply chain.

- Quicklime is experiencing growth due to its rapid reactivity and versatility. It is vital in applications like construction, steel manufacturing, and flue gas desulfurisation. Quicklime's ability to quickly adjust pH levels and neutralise pollutants drives its increasing demand in various industries, contributing to its growth.

- Chemical intermediates capture the largest market share in the lime market because Lime, particularly quicklime and slaked lime, is an essential raw material in the production of various mediators used in diverse industrial processes, including chemicals, textiles, and metallurgy. Its versatile role makes it a dominant player in this segment.

- North America leads the lime market due to robust construction and industrial sectors, stringent environmental regulations necessitating lime use, and a thriving agriculture industry. The region's diverse applications and focus on sustainability contribute to its dominant market position.

- Asia Pacific is experiencing the highest CAGR in the lime market due to rapid urbanisation, infrastructure development, and increasing agricultural activities. These factors drive strong demand for construction materials, environmental control solutions, and soil improvement, making the region a high-growth market for lime products.

- Price volatility poses a challenge to the lime market due to fluctuations in energy and transportation costs, impacting production and distribution expenses. Such unpredictability can affect profitability for both producers and consumers, necessitating strategies to manage and mitigate these price swings effectively.

A Look Back and a Look Forward - Comparative Analysis

The lime market is growing due to its versatile applications in construction, environmental control, agriculture, and industry. Increasing construction projects, ecological regulations requiring emission control, and the need for soil improvement in agriculture are driving demand. Lime's role in sustainable construction materials and its contribution to addressing environmental challenges further boosts its growth in the market.

The market witnessed staggered growth during the historical period 2019 - 2024. This is due to the substantial growth of the major end-use application sectors such as construction and agriculture. The construction sector is a key driver of the lime market due to its extensive use of lime-based materials, including mortar, concrete, and plaster.

Lime enhances the durability and workability of construction materials, making them essential for building infrastructure residential, and commercial projects. The global construction boom, driven by urbanisation and infrastructure development, significantly fuels the demand for Lime, making the construction sector a dominant force in the lime market.

The prospects for the lime market are promising. It is anticipated to continue growing due to increasing urbanisation, infrastructure development, and environmental regulations. Lime's role in sustainable construction materials and emission control technologies positions it favourably for further expansion. Additionally, growing awareness of soil improvement's importance in agriculture and its contribution to food security ensures a positive outlook for the lime market.

Key Growth Determinants

- Pacing Construction Projects, and Infrastructural Developments

Construction and infrastructure development play a pivotal role in driving the lime market's growth. Lime is a fundamental component in construction materials like mortar, plaster, and concrete, essential for building roads, bridges, buildings, and other infrastructure projects. As urbanisation trends and population growth continue, the demand for construction materials, and subsequently, lime, remains strong.

Lime's ability to provide durability, strength, and long-lasting properties to construction materials makes it indispensable in the industry. Additionally, lime is used in soil stabilisation for foundations, reducing settlement, and enhancing the load-bearing capacity of soil, all critical aspects of construction projects.

With increased investments in infrastructure, particularly in emerging economies, the construction sector's expansion is expected to drive sustained demand for lime in the foreseeable future, positioning it as a vital player in the global construction and development landscape.

- Growing Environment Remediation

Environmental remediation drives the lime market as Lime is used to treat contaminated soils and mitigate hazardous waste sites. Lime's unique ability to stabilise heavy metals, neutralise acidic soils, and immobilise contaminants makes it a valuable tool in soil remediation efforts.

As awareness of environmental issues and regulations concerning contaminated sites grows, the demand for Lime in ecological cleanup projects increases. This positions lime as a crucial component in sustainable solutions for addressing soil pollution, contributing to the market's growth.

- Growing Innovations to Drive Market Growth

Innovations in lime products are propelling the lime market forward by expanding its range of applications and enhancing product performance. These innovations include the development of specialty lime products tailored to specific industry needs, such as high-purity lime for water treatment and advanced lime formulations for construction materials.

Additionally, research into more efficient production processes and sustainable sourcing methods is making Lime a more environmentally friendly choice. These innovations not only meet evolving industry requirements but also unlock new market segments, driving the overall growth and adoption of lime-based solutions.

Major Growth Barriers

- Growing Stringency of Environment Regulations

Increasing environmental regulations challenge the lime market by imposing stringent emission standards and compliance requirements on industries that rely on lime for processes like flue gas desulfurisation. Meeting these regulations often requires substantial investments in pollution control technologies, raising operational costs.

Furthermore, regulations may drive a shift toward cleaner alternatives, reducing demand for lime in certain applications. As environmental concerns continue to grow, lime producers must navigate evolving regulatory landscapes to maintain competitiveness while minimising their ecological impact, posing a significant challenge to the industry.

- Price Volatility

Price volatility presents a challenge to the lime market due to factors like energy costs and transportation expenses, which influence lime production and distribution costs. These fluctuations can affect the profitability of lime producers and create uncertainty for consumers.

Sudden price spikes may also impact budget planning for industries reliant on lime, such as construction and water treatment. Managing and mitigating price volatility is essential for both suppliers and users of lime to ensure cost-effective and stable operations in the market.

Key Trends and Opportunities to Look at

- Advanced Production Techniques

Advanced production techniques in the lime market encompass innovations in kiln design, automation, and process control. These techniques aim to enhance energy efficiency, reduce emissions, and improve product quality.

High-efficiency kilns and sophisticated control systems allow lime producers to optimise production processes, minimise environmental impact, and meet evolving industry standards, making lime production more sustainable and cost-effective.

- Carbon Capture and Utilisation (CCU)

Carbon capture and utilisation (CCU) technologies in the lime market focus on capturing carbon dioxide (CO2) emissions from lime production and converting them into valuable products. This approach mitigates the environmental impact of lime production while creating economic opportunities.

CCU can involve utilising captured CO2 in chemical processes, carbonation reactions, or even storing CO2 safely underground, aligning with carbon reduction and sustainability goals in the lime industry.

- Alternative Fuel Sources

Alternative fuel sources are gaining traction in the lime market as producers seek to reduce greenhouse gas emissions and dependence on traditional fossil fuels. Biomass, waste-derived fuels, and other sustainable alternatives are being explored to power lime kilns. These sources not only lower environmental impact but also promote energy efficiency, aligning with the industry's commitment to sustainable and eco-friendly practices.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario exerts a profound influence on the lime market, shaping its production practices, environmental impact, and market dynamics. Environmental regulations, such as emissions limits and pollution control requirements, are central to lime production. Compliance with these standards necessitates substantial investments in emission-reducing technologies and process optimisation to minimise the environmental footprint.

As governments worldwide intensify their focus on reducing industrial emissions and promoting sustainable practices, lime producers are compelled to adapt, often leading to more eco-friendly and efficient production processes. Furthermore, regulatory bodies often establish stringent product quality standards for lime, ensuring it meets specific purity and chemical composition criteria. These quality standards are critical for various industries, including construction and water treatment, which rely on consistent and reliable lime products.

Regulatory oversight fosters consumer confidence by guaranteeing that lime products are safe and suitable for their intended applications. Moreover, regulations extend to land use and permitting for limestone quarrying and lime production sites. Stringent requirements for responsible land management and reclamation practices aim to minimise ecological disruption and promote the restoration of quarry sites.

Compliance with these regulations underscores the lime industry's commitment to sustainable and ethical practices, aligning with broader environmental and societal goals. In essence, the regulatory landscape shapes the lime market by emphasizing environmental responsibility, product quality, and sustainability, ultimately driving the industry toward more eco-friendly and responsible practices.

Fairfield’s Ranking Board

Top Segments

- Quicklime Maintains Dominance

Quicklime, or calcium oxide (CaO), has captured the largest market share in the lime industry due to its versatility and widespread use. It serves as a fundamental raw material in various sectors, including construction, steel manufacturing, water treatment, and agriculture. Quicklime's ability to react quickly with water, making it a vital component in applications like mortar and pH control in water treatment, has solidified its dominance.

Additionally, its role in environmental solutions like flue gas desulfurisation further contributes to its significant market share. Slaked lime, or calcium hydroxide (Ca(OH)2), is anticipated to have the highest CAGR in the lime market due to its expanding applications in various sectors.

Slaked Lime is preferred in industries like water treatment for its exceptional ability to adjust pH levels, treat drinking water, and neutralise acidic effluents. It is also gaining traction in the construction sector for its role in soil stabilisation and as a building material. Moreover, its use in food processing, pharmaceuticals, and chemical manufacturing is driving its growth as these industries expand and prioritise sustainability.

- Chemical Intermediates Continue to Lead

Chemical intermediates have secured the largest market share in the lime market due to their pivotal role in diverse industrial processes. Lime, particularly quicklime (CaO) and slaked Lime (Ca(OH)2), is used as a key chemical reactant in the production of various intermediates, such as calcium-based salts and compounds. These intermediates find applications in a wide range of industries, including chemicals, textiles, and metallurgy.

The versatility of Lime as a precursor in chemical synthesis processes and its contributions to multiple value chains have led to its dominant position in this segment. Agriculture is experiencing the fastest CAGR in the lime market due to its critical role in soil health and crop productivity. Lime, particularly agricultural lime or aglime, is used to correct soil acidity and improve nutrient uptake by plants.

As global food demand rises, farmers increasingly recognise the importance of soil amendment with Lime to enhance yields and ensure sustainable agriculture. This growing awareness, coupled with government support and adoption of modern farming practices, is propelling the agricultural segment's rapid expansion in the lime market.

Regional Frontrunners

North America at the Forefront

North America has captured the largest market share in the lime industry due to several key factors. Firstly, the region boasts a robust construction sector driven by residential, commercial, and infrastructure projects, all of which require lime-based materials like concrete and mortar.

Stringent environmental regulations have led to increased lime consumption in flue gas desulfurisation systems, a crucial component in reducing emissions from power plants. Additionally, the agriculture sector benefits from lime applications to enhance soil quality and boost crop yields, contributing to significant lime demand.

The region's industrial base, including steel production and mining, relies on lime for various processes. These factors, coupled with a strong focus on sustainability and product quality, have solidified North America's position as the leading market for lime products.

Asia Pacific All Set for an Exceptional Pace of Growth

Asia Pacific will be experiencing the fastest CAGR in terms of value in the lime market due to several compelling factors. Rapid urbanisation, population growth, and infrastructure development in countries like China, and India are driving increased demand for construction materials like lime-based products.

Moreover, the agriculture sector is expanding to meet the food needs of growing populations, leading to rising lime usage for soil improvement. Additionally, industrial growth, including steel production and water treatment, relies heavily on lime.

The region's evolving regulatory environment, coupled with efforts to promote sustainability, further fuel lime market growth, making Asia Pacific a dynamic and high-growth market for lime products.

Fairfield’s Competitive Landscape Analysis

The global lime market is consolidated, with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Lime space?

- Lhoist Group

- Graymont

- Mississippi Lime Company

- Carmeuse

- United States Lime & Minerals

- HID Global

- Minerals Technologies

- Nordkalk Corporation

- Pete Lien & sons

- Linwood Mining & Minerals Corporation

- Valley Minerals

- Sigma Minerals

- Cheney Lime & Cement Company

- Chememan Co

- Atlantic Minerals Limited

Global Lime Market is Segmented as Below:

By Product Type:

- Quicklime

- Slaked Lime

By End Use:

- Chemical Intermediates

- Metallurgical

- Building & Construction

- Agriculture

- Glass

- Paper & Pulp

- Others

By Geographic Coverage:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Lime Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Five Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Lime Market Outlook, 2020 - 2033

- Global Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Quicklime

- Slaked Lime

- Global Lime Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Chemical Intermediates

- Metallurgical

- Building & Construction

- Agriculture

- Glass

- Paper & Pulp

- Others

- Global Lime Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- North America Lime Market Outlook, 2020 - 2033

- North America Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Quicklime

- Slaked Lime

- North America Lime Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Chemical Intermediates

- Metallurgical

- Building & Construction

- Agriculture

- Glass

- Paper & Pulp

- Others

- North America Lime Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Lime Market Outlook, by Product Type, 2020-2033

- S. Lime Market Outlook, by End Use, 2020-2033

- Canada Lime Market Outlook, by Product Type, 2020-2033

- Canada Lime Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Europe Lime Market Outlook, 2020 - 2033

- Europe Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Quicklime

- Slaked Lime

- Europe Lime Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Chemical Intermediates

- Metallurgical

- Building & Construction

- Agriculture

- Glass

- Paper & Pulp

- Others

- Europe Lime Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Lime Market Outlook, by Product Type, 2020-2033

- Germany Lime Market Outlook, by End Use, 2020-2033

- Italy Lime Market Outlook, by Product Type, 2020-2033

- Italy Lime Market Outlook, by End Use, 2020-2033

- France Lime Market Outlook, by Product Type, 2020-2033

- France Lime Market Outlook, by End Use, 2020-2033

- K. Lime Market Outlook, by Product Type, 2020-2033

- K. Lime Market Outlook, by End Use, 2020-2033

- Spain Lime Market Outlook, by Product Type, 2020-2033

- Spain Lime Market Outlook, by End Use, 2020-2033

- Russia Lime Market Outlook, by Product Type, 2020-2033

- Russia Lime Market Outlook, by End Use, 2020-2033

- Rest of Europe Lime Market Outlook, by Product Type, 2020-2033

- Rest of Europe Lime Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Asia Pacific Lime Market Outlook, 2020 - 2033

- Asia Pacific Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Quicklime

- Slaked Lime

- Asia Pacific Lime Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Chemical Intermediates

- Metallurgical

- Building & Construction

- Agriculture

- Glass

- Paper & Pulp

- Others

- Asia Pacific Lime Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Lime Market Outlook, by Product Type, 2020-2033

- China Lime Market Outlook, by End Use, 2020-2033

- Japan Lime Market Outlook, by Product Type, 2020-2033

- Japan Lime Market Outlook, by End Use, 2020-2033

- South Korea Lime Market Outlook, by Product Type, 2020-2033

- South Korea Lime Market Outlook, by End Use, 2020-2033

- India Lime Market Outlook, by Product Type, 2020-2033

- India Lime Market Outlook, by End Use, 2020-2033

- Southeast Asia Lime Market Outlook, by Product Type, 2020-2033

- Southeast Asia Lime Market Outlook, by End Use, 2020-2033

- Rest of SAO Lime Market Outlook, by Product Type, 2020-2033

- Rest of SAO Lime Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Latin America Lime Market Outlook, 2020 - 2033

- Latin America Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Quicklime

- Slaked Lime

- Latin America Lime Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Chemical Intermediates

- Metallurgical

- Building & Construction

- Agriculture

- Glass

- Paper & Pulp

- Others

- Latin America Lime Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Lime Market Outlook, by Product Type, 2020-2033

- Brazil Lime Market Outlook, by End Use, 2020-2033

- Mexico Lime Market Outlook, by Product Type, 2020-2033

- Mexico Lime Market Outlook, by End Use, 2020-2033

- Argentina Lime Market Outlook, by Product Type, 2020-2033

- Argentina Lime Market Outlook, by End Use, 2020-2033

- Rest of LATAM Lime Market Outlook, by Product Type, 2020-2033

- Rest of LATAM Lime Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Lime Market Outlook, 2020 - 2033

- Middle East & Africa Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Quicklime

- Slaked Lime

- Middle East & Africa Lime Market Outlook, by End Use, Value (US$ Mn), 2020-2033

- Chemical Intermediates

- Metallurgical

- Building & Construction

- Agriculture

- Glass

- Paper & Pulp

- Others

- Middle East & Africa Lime Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Lime Market Outlook, by Product Type, 2020-2033

- GCC Lime Market Outlook, by End Use, 2020-2033

- South Africa Lime Market Outlook, by Product Type, 2020-2033

- South Africa Lime Market Outlook, by End Use, 2020-2033

- Egypt Lime Market Outlook, by Product Type, 2020-2033

- Egypt Lime Market Outlook, by End Use, 2020-2033

- Nigeria Lime Market Outlook, by Product Type, 2020-2033

- Nigeria Lime Market Outlook, by End Use, 2020-2033

- Rest of Middle East Lime Market Outlook, by Product Type, 2020-2033

- Rest of Middle East Lime Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Lime Market Outlook, by Product Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Lhoist Group

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Graymont

- Mississippi Lime Company

- Carmeuse

- United States Lime & Minerals

- HID Global

- Minerals Technologies

- Nordkalk Corporation

- Pete Lien & sons

- Linwood Mining & Minerals Corporation

- Lhoist Group

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |