Liquid Biopsy Market Growth and Industry Forecast

The Liquid Biopsy Market is valued at USD 4.1 Bn in 2026 and is projected to reach USD 8.7 Bn, growing at a CAGR of 11% by 2033

Liquid Biopsy Market Summary: Key Insights & Trends

- Circulating Tumour DNA leads the biomarker segment with over 35% share, driven by its superior mutation detection accuracy and real-time tumor tracking capabilities.

- Blood dominates the source segment with around 80% share, while urine emerges as the fastest-growing non-invasive alternative supported by new cfDNA stabilization methods.

- Treatment monitoring holds over 30% share, remaining the leading clinical application as clinicians increasingly use it for real-time therapy response evaluation.

- Lung cancer accounts for about 20% share, sustaining its leadership among indications due to strong adoption of mutation-specific diagnostics and targeted therapies.

- Multi-cancer early detection and non-oncology applications gain strong momentum, diversifying diagnostic use cases beyond traditional oncology and expanding clinical adoption.

- AI-integrated NGS technologies enhance test accuracy and reliability, reinforcing biomarker-based diagnostics as a preferred approach in precision medicine worldwide.

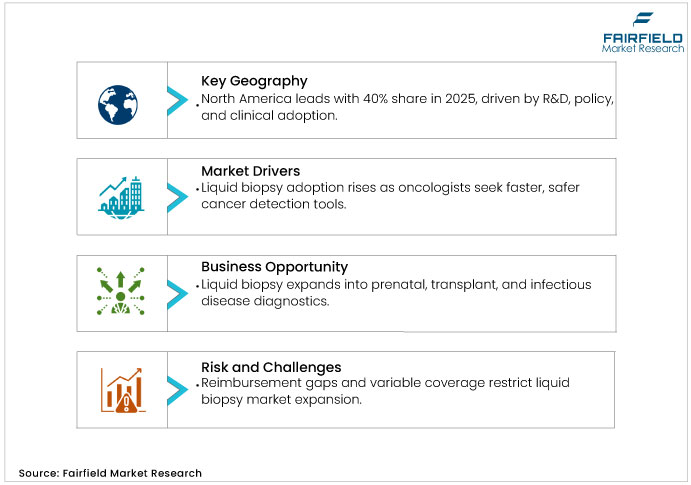

- North America commands roughly 40% share, supported by advanced healthcare infrastructure, R&D investments, and favorable reimbursement frameworks for biomarker testing.

- Asia Pacific shows rapid expansion, propelled by rising cancer incidence, government healthcare initiatives, and cross-border collaborations improving diagnostic access.

Key Growth Drivers

- Global Cancer Surge Accelerates Demand for Non-Invasive and Early Detection Tools

Oncologists increasingly rely on liquid biopsy techniques to address the escalating global cancer burden, which demands non-invasive tools for timely intervention. The World Health Organization (WHO) reports that cancer caused nearly 10 million deaths in 2020, representing one in six global fatalities, with projections from the International Agency for Research on Cancer (IARC) estimating 27.5 million new cases by 2040. This surge stems from aging populations and lifestyle risk factors such as smoking and poor diet, amplifying the urgency for scalable diagnostics. Liquid biopsy excels here by analyzing circulating biomarkers without surgical risks, offering cost efficiencies—up to 30% lower than tissue biopsies according to U.S. National Cancer Institute (NCI) filings—and enabling real-time tumor profiling. Consequently, healthcare providers integrate these tests into routine screenings, boosting Liquid Biopsy Market penetration as evidence from clinical trials links early detection to 20-30% improved survival rates in lung and breast cancers.

- NGS and AI Technologies Revolutionize Precision and Efficiency in Liquid Biopsy

Next-generation sequencing (NGS) and artificial intelligence (AI) propel the Liquid Biopsy Market by enhancing biomarker sensitivity and data interpretation, allowing clinicians to detect mutations at ultra-low frequencies. Industry association data from the American Society of Clinical Oncology (ASCO) highlights that NGS-based liquid biopsies achieve over 90% concordance with tissue results, a leap from earlier methods, driven by AI algorithms that reduce false positives by 40%. These innovations stem from collaborative R&D efforts, as seen in company filings from firms such as Guardant Health, where AI-driven platforms process vast genomic datasets in hours rather than weeks. This efficiency supports personalized medicine, where treatment decisions align with dynamic tumor evolution, fostering Liquid Biopsy Market growth amid rising demands for precision therapies. Ultimately, such technological synergies lower barriers to adoption, positioning liquid biopsy as a standard in oncology workflows.

Key Restraints

- Reimbursement Uncertainties Hinder Widespread Adoption in Liquid Biopsy Growth

Payers impose varying coverage criteria for molecular tests, complicating cost predictability and limiting access in the market. In the U.S., Medicare reimburses select biomarkers only for specific indications, leaving 30-40% of advanced tests uncovered per payer analyses. This variability burdens providers with administrative overhead, delaying integration into standard protocols. Patients face out-of-pocket expenses averaging USD 1,000-5,000 per test, deterring utilization in resource-constrained settings. Without standardized guidelines, the Liquid Biopsy Market struggles to achieve volume thresholds for economies of scale, potentially capping growth at 8-10% in under-reimbursed regions.

- Analytical Validation Challenges Limit Reliability in Liquid Biopsy Market

Standardizing protocols for biomarker extraction remains complex, as variability in pre-analytical factors such as sample handling affects accuracy in the liquid biopsy industry. Studies report 10-20% false negatives in ctDNA detection due to low tumor shedding, per clinical trial data from oncology associations. Regulatory scrutiny demands rigorous validation, extending time-to-market by 12-18 months and inflating costs. This restraint particularly impacts emerging applications, where insufficient longitudinal data undermines clinician confidence.

Liquid Biopsy Market Trends and Opportunities

- Non-Oncology Innovations Expand Diagnostic Potential Across Diverse Medical Applications

Non-oncology applications present significant opportunities extending to prenatal testing, organ transplants, and infectious diseases. Circulating biomarkers enable non-invasive monitoring of fetal health or transplant rejection, reducing risks associated with invasive procedures. Theoretical frameworks in regenerative medicine underscore how liquid biopsy facilitates real-time assessments, improving outcomes in diverse fields. Industry associations such as the American Society of Transplantation advocate for its use in graft surveillance. As research expands, integrations with AI enhance predictive capabilities, opening new revenue streams. This diversification mitigates oncology-centric risks, attracting investments from biotech firms. Strategic implications include broader market accessibility, particularly in developing regions where infrastructure supports liquid-based diagnostics over traditional methods.

- Early Multi-Cancer Detection Technologies Transform Preventive and Population Health Screening

Multi-cancer early detection tests unlock opportunities in the liquid biopsy market by screening multiple cancers from a single sample. Advances in NGS and machine learning identify shared signals, revolutionizing preventive care. Epidemiology theories emphasize population-level benefits, reducing mortality through timely interventions. Regulatory approvals, such as those from the European Medicines Agency, validate these tests for clinical use. Opportunities arise in public health programs, integrating liquid biopsy into routine screenings. This fosters partnerships with governments and insurers, scaling adoption. Business models evolve toward subscription-based monitoring, ensuring sustained growth and positioning liquid biopsy as a cornerstone of proactive healthcare.

Segment-wise Trends & Analysis

- Circulating Tumour DNA Leads Market as Genomic Profiling Gains Precision and Scale

Circulating Tumour DNA holds current market leadership by commanding over 40% share in 2025 due to its high sensitivity in detecting genetic mutations. This dominance stems from its ability to reflect real-time tumor evolution, aiding precise diagnostics. Growth trajectory remains strong, driven by NGS advancements that lower costs and improve accuracy. Competitive positioning favors companies specializing in ctDNA assays, as they capture oncology demand.

Emerging segments such as exomes show fast growth, emerging as key for comprehensive genomic profiling. Drivers include expanding research in rare mutations, supported by theoretical models in genomics emphasizing holistic analysis. Competitors invest in integrated platforms, enhancing differentiation and market entry for broader applications beyond cancer.

- Blood Remains Primary Diagnostic Medium While Urine Testing Gains Rapid Traction

Blood leads the market with over 80% share in 2025, attributed to its abundance of circulating biomarkers and ease of collection. This segment's growth follows a steady upward path, propelled by standardized protocols and regulatory endorsements. Competitive dynamics see leaders optimizing blood-based kits for scalability, securing positions in clinical labs.

Urine emerges as a fast-growing source, gaining traction for non-invasive urological applications. Underlying drivers involve patient preference for simplicity, aligned with health behavior theories promoting compliance. Positioning involves niche players developing urine-specific assays, challenging blood dominance through specialized innovations.

- Treatment Monitoring Dominates as Screening Applications Accelerate in Early Detection

Treatment Monitoring dominates by holding over 30% share in 2025 for its role in assessing therapy response dynamically. Growth accelerates with integration into personalized medicine, driven by real-world evidence from clinical trials. Competitors strengthen through data analytics tools, solidifying leadership in oncology workflows.

Diagnosis & Screening emerges rapidly, fueled by early detection initiatives. Drivers encompass public health policies emphasizing prevention, theoretically reducing healthcare burdens. Positioning strategies focus on multi-marker panels, enabling new entrants to disrupt established monitoring-focused firms.

- Lung Cancer Drives Growth While Non-Oncology Uses Expand Diagnostic Horizons

Lung Cancer led with over 20% share in 2025, due to high prevalence and biomarker richness. Its trajectory involves robust growth from targeted therapies, supported by epidemiological data. Competitive edges arise from specialized panels, positioning firms at the forefront of respiratory oncology.

Non-Oncology segments grow fast, emerging in areas such as prenatal testing. Drivers include diversifying applications, grounded in molecular diagnostic theories. Players position through cross-disciplinary collaborations, expanding beyond cancer to capture untapped markets.

Regional Trends & Analysis

Strong Infrastructure and Research Investment Sustain North America’s Diagnostic Leadership

North America maintains dominant market position with approximately 40% market share in 2025, driven by advanced healthcare infrastructure, substantial R&D investments, and favorable regulatory environment. The region benefits from established reimbursement frameworks for select liquid biopsy applications and strong clinical adoption rates among leading cancer centers. Continued market expansion is supported by ongoing clinical trials, FDA breakthrough device designations, and increasing healthcare spending on precision medicine initiatives.

U.S. Liquid Biopsy Market – 2025 Snapshot & Outlook

The U.S. represents the largest single market for liquid biopsy applications, with over 1.8 million new cancer cases annually creating substantial diagnostic testing demand. The market benefits from world-class clinical research infrastructure, with numerous academic medical centers conducting liquid biopsy validation studies and clinical trials. Recent FDA breakthrough device designations for multi-cancer detection tests signal regulatory support for innovative applications, while expanding Medicare coverage for select biomarker testing creates favorable reimbursement conditions.

Healthcare policy trends favor precision medicine adoption, with the Cancer Moonshot initiative and National Cancer Institute funding supporting liquid biopsy research and clinical implementation. Consumer surveys indicate growing awareness of liquid biopsy benefits among cancer patients, with 73% expressing preference for non-invasive testing options when clinically appropriate.

Rising Cancer Burden and Healthcare Investments Accelerate Growth Across Asia Pacific

Asia Pacific demonstrates exceptional growth potential with projected CAGR through 2033, driven by rising cancer incidence, improving healthcare infrastructure, and increasing government healthcare investments. The region benefits from growing medical tourism, expanding diagnostic capabilities, and increasing awareness of advanced cancer detection methods among healthcare providers and patients.

China Liquid Biopsy Market – 2025 Snapshot & Outlook

China reported over 4.5 million additional cancer cases in 2020, creating substantial market opportunity for liquid biopsy applications. The market benefits from government initiatives promoting precision medicine adoption, including the National Health Commission's support for innovative diagnostic technologies. Strategic partnerships between international liquid biopsy companies and domestic healthcare providers are accelerating market penetration and technology transfer.

Healthcare system reforms emphasize early cancer detection and prevention, aligning with liquid biopsy's clinical strengths. Recent regulatory approvals for liquid biopsy tests by the National Medical Products Administration demonstrate growing acceptance of these technologies within China's healthcare framework.

India Liquid Biopsy Market – 2025 Snapshot & Outlook

India's market is experiencing rapid growth driven by increasing cancer awareness campaigns, expanding private healthcare sector, and growing middle-class population seeking advanced healthcare services. The market benefits from government initiatives under the National Cancer Control Programme promoting early detection and screening programs. Cost-effective liquid biopsy solutions are gaining traction among healthcare providers seeking to improve patient outcomes while managing healthcare expenditures.

Medical tourism contributes significantly to market expansion, with international patients seeking advanced diagnostic services in major metropolitan areas. Partnerships between global diagnostic companies and Indian healthcare providers are establishing local testing capabilities and reducing costs through economies of scale.

Aging Demographics and Unified Regulations Boost Europe’s Precision Medicine Growth

Europe represents a fast-growing regional market driven by aging population demographics, increasing cancer incidence, and supportive healthcare policies promoting precision medicine adoption. The market benefits from harmonized regulatory frameworks under the In Vitro Diagnostic Regulation, though compliance requirements present implementation challenges for smaller companies.

Germany Liquid Biopsy Market – 2025 Snapshot & Outlook

Germany leads European market adoption with strong healthcare infrastructure and established cancer care networks supporting liquid biopsy implementation. The market benefits from robust public health insurance coverage and growing private healthcare spending on advanced diagnostic technologies. Recent healthcare digitization initiatives are improving laboratory information systems and supporting bioinformatics capabilities essential for liquid biopsy analysis.

Clinical research collaboration between university medical centers and biotechnology companies drives innovation and clinical validation studies. Patient advocacy organizations increasingly support liquid biopsy adoption through educational programs and policy advocacy efforts.

U.K. Liquid Biopsy Market – 2025 Snapshot & Outlook

The U.K.'s liquid biopsy market expansion is supported by National Health Service initiatives promoting early cancer detection and precision medicine adoption. The market benefits from world-class cancer research institutions and clinical trial networks validating liquid biopsy applications. Recent government investments in genomics and precision medicine create favorable conditions for liquid biopsy technology adoption.

Healthcare policy emphasis on cancer survival improvement and cost-effective diagnostic solutions aligns with liquid biopsy's clinical and economic value propositions. Industry surveys indicate growing acceptance among oncologists, with 68% reporting increased confidence in liquid biopsy results for clinical decision-making.

Competitive Landscape Analysis

The players in the Liquid Biopsy Market are focusing on strategic partnerships and R&D investments to accelerate innovation and expand global reach. This approach enables access to diverse biomarkers, as seen in Illumina's acquisition of Grail, enhancing multi-cancer detection capabilities with $8 billion valuation impact. Backed by over 125 funding instances totaling $7.3 billion in nine years, companies prioritize scalable platforms to meet rising demand. Such collaborations theoretically foster knowledge sharing, reducing development timelines.

M&A activities, such as recent consolidations, impact costs by achieving economies of scale, while new FDA regulations on LDTs increase compliance burdens, potentially raising entry barriers. Early movers will benefit from established reimbursement pathways, while latecomers may face intensified competition and higher acquisition costs.

Key Companies

- Guardant Health, Inc.

- Grail (Illumina, Inc.)

- ANGLE plc

- Hoffmann-La Roche Ltd.

- Invitae Corporation

- Myriad Genetics, Inc.

- Qiagen N.V.

- Exact Sciences Corporation

- MDxHealth SA

- Sysmex Inostics

- Biocept, Inc.

- NeoGenomics, Inc.

- Exosome Diagnostics, Inc.

- Personal Genome Diagnostics, Inc.

- Menarini-Silicon Biosystems

- Agena Bioscience, Inc.

- MedGenome Inc.

- Epigenomics AG

- Natera, Inc.

- Vortex Biosciences, Inc.

Recent Developments:

- May 2025, Guardant Health presented multiple studies at ASCO 2025 showcasing advances in liquid biopsy technologies. Highlights include the SERENA-6 Phase 3 trial using Guardant360® CDx to detect ESR1 mutations early in HR+/HER2– breast cancer, and new data validating Guardant Reveal™ for MRD detection in colon cancer and epigenomic classifiers for tumor origin and mutation prediction, underscoring the expanding clinical role of liquid biopsy in precision oncology.

- May 2025, Exact Sciences announced ten presentations at ASCO 2025, highlighting advances in its oncology portfolio, including the Oncodetect™ MRD, Oncotype DX®, Cologuard®, and multi-cancer early detection (MCED) tests. New data reinforce the Oncodetect test’s role in cancer recurrence monitoring and showcase the potential of the Cancerguard™ EX MCED test to reduce late-stage cancer incidence, underscoring Exact Sciences’ leadership in precision oncology and early cancer detection.

- September 2024, QIAGEN and PreAnalytiX have launched the PAXgene® Urine Liquid Biopsy Set, the first standardized solution for stabilizing cell-free DNA (cfDNA) from urine for molecular analysis. This innovation enables non-invasive sampling for genetic testing, improving data quality and complementing blood-based liquid biopsy in cancer and disease research.

Global Liquid Biopsy Market Segmentation-

By Biomarker

- Circulating Tumour Cells

- Circulating Tumour DNA

- Circulating free DNA

- Circulating Cell free RNA

- Exomes

- Other

By Source

- Blood

- Urine

- Other

By Clinical Application

- Diagnosis & Screening

- Treatment Selection

- Treatment Monitoring

- Recurrence Monitoring

By Indication

- Lung Cancer

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Other Cancers

- Non-Oncology

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Liquid Biopsy Market Outlook, 2020 - 2033 (US$ Billion)

1.2. Global Liquid Biopsy Market Incremental Opportunity, 2025 - 2033 (US$ Billion)

1.3. Key Industry Trends

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Market Drivers

2.2.2. Market Threats

2.2.3. Market Opportunities

2.3. Regulatory Framework

2.4. COVID-19 Impact Analysis

3. Global Liquid Biopsy Market Outlook, 2020 - 2033

3.1. Global Liquid Biopsy Market Outlook, By Biomarker, 2020 - 2033

3.1.1. Key Highlights

3.1.2. Global Liquid Biopsy Market Outlook, by Biomarker, Value (US$ Billion), 2020 - 2033

3.1.2.1. Circulating Tumor Cells

3.1.2.2. Circulating Tumor DNA (ctDNA) Cells

3.1.2.3. Circulating free DNA (cfDNA)

3.1.2.4. Circulating cell free RNA (cfRNA)

3.1.2.5. Exomes

3.1.2.6. Others

3.1.3. Global Liquid Biopsy Market Share and BPS Analysis, by Biomarker, Value, 2025 and 2033

3.1.4. Global Liquid Biopsy Market Attractiveness Analysis, by Biomarker, Value, 2025 - 2033

3.2. Global Liquid Biopsy Market Outlook, By Source, 2020 - 2033

3.2.1. Key Highlights

3.2.2. Global Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

3.2.2.1. Blood

3.2.2.2. Urine

3.2.2.3. Other

3.2.3. Global Liquid Biopsy Market Share and BPS Analysis, by Source, Value, 2025 and 2033

3.2.4. Global Liquid Biopsy Market Attractiveness Analysis, by Source, Value, 2025 - 2033

3.3. Global Liquid Biopsy Market Outlook, By Clinical Application, 2020 - 2033

3.3.1. Key Highlights

3.3.2. Global Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

3.3.2.1. Diagnosis & Screening

3.3.2.2. Treatment Selection

3.3.2.3. Treatment Monitoring

3.3.2.4. Recurrence Monitoring

3.3.3. Global Liquid Biopsy Market Share and BPS Analysis, by Clinical Application, Value, 2025 and 2033

3.3.4. Global Liquid Biopsy Market Attractiveness Analysis, by Clinical Application, Value, 2025 - 2033

3.4. Global Liquid Biopsy Market Outlook, By Indication, 2020 - 2033

3.4.1. Key Highlights

3.4.2. Global Liquid Biopsy Market Outlook, by Indication, Value (US$ Billion), 2020 - 2033

3.4.2.1. Lung Cancer

3.4.2.2. Breast Cancer

3.4.2.3. Prostate Cancer

3.4.2.4. Colorectal Cancer

3.4.2.5. Other Cancers

3.4.2.6. Non-Oncology

3.4.3. Global Liquid Biopsy Market Share and BPS Analysis, by Indication, Value, 2025 and 2033

3.4.4. Global Liquid Biopsy Market Attractiveness Analysis, by Indication, Value, 2025 - 2033

3.5. Global Liquid Biopsy Market Outlook, By Region, 2020 - 2033

3.5.1. Key Highlights

3.5.2. Global Liquid Biopsy Market Outlook, by Region, Value (US$ Billion), 2020 - 2033

3.5.2.1. North America

3.5.2.2. Europe

3.5.2.3. Asia Pacific

3.5.2.4. Rest of the World

3.5.3. Global Liquid Biopsy Market Share and BPS Analysis, by Region, Value, 2025 and 2033

3.5.4. Global Liquid Biopsy Market Attractiveness Analysis, by Region, Value, 2025 - 2033

4. North America Liquid Biopsy Market Outlook, 2020 - 2033

4.1. North America Liquid Biopsy Market Outlook, By Country, 2020 - 2033

4.1.1. Key Highlights

4.1.2. North America Liquid Biopsy Market Outlook, by Country, Value (US$ Billion), 2020 - 2033

4.1.2.1. U.S.

4.1.2.2. Canada

4.1.3. North America Liquid Biopsy Market Share and BPS Analysis, by Country, Value, 2025 and 2033

4.1.4. North America Liquid Biopsy Market Attractiveness Analysis, by Country, Value, 2025 - 2033

4.2. North America Liquid Biopsy Market Outlook, by Biomarker, 2020 - 2033

4.2.1. Key Highlights

4.2.2. North America Liquid Biopsy Market Outlook, by Biomarker, Value (US$ Billion), 2020 - 2033

4.2.2.1. Circulating Tumor Cells

4.2.2.2. Circulating Tumor DNA (ctDNA) Cells

4.2.2.3. Circulating free DNA (cfDNA)

4.2.2.4. Circulating cell free RNA (cfRNA)

4.2.2.5. Exomes

4.2.2.6. Others

4.2.3. North America Liquid Biopsy Market Share and BPS Analysis, by Biomarker, Value, 2025 and 2033

4.2.4. North America Liquid Biopsy Market Attractiveness Analysis, by Biomarker, Value, 2025 - 2033

4.3. North America Liquid Biopsy Market Outlook, by Source, 2020 - 2033

4.3.1. Key Highlights

4.3.2. North America Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

4.3.2.1. Blood

4.3.2.2. Urine

4.3.2.3. Other

4.3.3. North America Liquid Biopsy Market Share and BPS Analysis, by Source, Value, 2025 and 2033

4.3.4. North America Liquid Biopsy Market Attractiveness Analysis, by Source, Value, 2025 - 2033

4.4. North America Liquid Biopsy Market Outlook, By Clinical Application, 2020 - 2033

4.4.1. Key Highlights

4.4.2. North America Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

4.4.2.1. Diagnosis & Screening

4.4.2.2. Treatment Selection

4.4.2.3. Treatment Monitoring

4.4.2.4. Recurrence Monitoring

4.4.3. North America Liquid Biopsy Market Share and BPS Analysis, by Clinical Application, Value, 2025 and 2033

4.4.4. North America Liquid Biopsy Market Attractiveness Analysis, by Clinical Application, Value, 2025 - 2033

4.5. North America Liquid Biopsy Market Outlook, By Indication, 2020 - 2033

4.5.1. Key Highlights

4.5.2. North America Liquid Biopsy Market Outlook, by Indication, Value (US$ Billion), 2020 - 2033

4.5.2.1. Lung Cancer

4.5.2.2. Breast Cancer

4.5.2.3. Prostate Cancer

4.5.2.4. Colorectal Cancer

4.5.2.5. Other Cancers

4.5.2.6. Non-Oncology

4.5.3. North America Liquid Biopsy Market Share and BPS Analysis, by Indication, Value, 2025 and 2033

4.5.4. North America Liquid Biopsy Market Attractiveness Analysis, by Indication, Value, 2025 - 2033

5. Europe Liquid Biopsy Market Outlook, 2020 - 2033

5.1. Europe Liquid Biopsy Market Outlook, By Country, 2020 - 2033

5.1.1. Key Highlights

5.1.2. Europe Liquid Biopsy Market Outlook, by Country, Value (US$ Billion), 2020 - 2033

5.1.2.1. U.K.

5.1.2.2. France

5.1.2.3. Germany

5.1.2.4. Italy

5.1.2.5. Spain

5.1.2.6. Rest of Europe

5.1.3. Europe Liquid Biopsy Market Share and BPS Analysis, by Country, Value, 2025 and 2033

5.1.4. Europe Liquid Biopsy Market Attractiveness Analysis, by Country, Value, 2025 - 2033

5.2. Europe Liquid Biopsy Market Outlook, by Biomarker, Value (US$ Billion), 2020 - 2033

5.2.1. Key Highlights

5.2.2. Europe Liquid Biopsy Market Outlook, by Biomarker, Value (US$ Billion), 2020 - 2033

5.2.2.1. Circulating Tumor Cells

5.2.2.2. Circulating Tumor DNA (ctDNA) Cells

5.2.2.3. Circulating free DNA (cfDNA)

5.2.2.4. Circulating cell free RNA (cfRNA)

5.2.2.5. Exomes

5.2.2.6. Others

5.2.3. Europe Liquid Biopsy Market Share and BPS Analysis, by Biomarker, Value, 2025 and 2033

5.2.4. Europe Liquid Biopsy Market Attractiveness Analysis, by Biomarker, Value, 2025 - 2033

5.3. Europe Liquid Biopsy Market Outlook, By Source, 2020 - 2033

5.3.1. Key Highlights

5.3.2. Europe Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

5.3.2.1. Blood

5.3.2.2. Urine

5.3.2.3. Other

5.3.3. Europe Liquid Biopsy Market Share and BPS Analysis, by Source, Value, 2025 and 2033

5.3.4. Europe Liquid Biopsy Market Attractiveness Analysis, by Source, Value, 2025 - 2033

5.4. Europe Liquid Biopsy Market Outlook, By Clinical Application, 2020 - 2033

5.4.1. Key Highlights

5.4.2. Europe Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

5.4.2.1. Diagnosis & Screening

5.4.2.2. Treatment Selection

5.4.2.3. Treatment Monitoring

5.4.2.4. Recurrence Monitoring

5.4.3. Europe Liquid Biopsy Market Share and BPS Analysis, by Clinical Application, Value, 2025 and 2033

5.4.4. Europe Liquid Biopsy Market Attractiveness Analysis, by Clinical Application, Value, 2025 - 2033

5.5. Europe Liquid Biopsy Market Outlook, By Indication, 2020 - 2033

5.5.1. Key Highlights

5.5.2. Europe Liquid Biopsy Market Outlook, by Indication, Value (US$ Billion), 2020 - 2033

5.5.2.1. Lung Cancer

5.5.2.2. Breast Cancer

5.5.2.3. Prostate Cancer

5.5.2.4. Colorectal Cancer

5.5.2.5. Other Cancers

5.5.2.6. Non-Oncology

5.5.3. Europe Liquid Biopsy Market Share and BPS Analysis, by Indication, Value, 2025 and 2033

5.5.4. Europe Liquid Biopsy Market Attractiveness Analysis, by Indication, Value, 2025 - 2033

6. Asia Pacific Liquid Biopsy Market Outlook, 2020 - 2033

6.1. Asia Pacific Liquid Biopsy Market Outlook, By Country, 2020 - 2033

6.1.1. Key Highlights

6.1.2. Asia Pacific Liquid Biopsy Market Outlook, by Country, Value (US$ Billion), 2020 - 2033

6.1.2.1. India

6.1.2.2. Japan

6.1.2.3. China

6.1.2.4. Australia

6.1.2.5. Rest of Asia Pacific

6.1.3. Asia Pacific Liquid Biopsy Market Share and BPS Analysis, by Country, Value, 2025 and 2033

6.1.4. Asia Pacific Liquid Biopsy Market Attractiveness Analysis, by Country, Value, 2025 - 2033

6.2. Asia Pacific Liquid Biopsy Market Outlook, by Biomarker, Value (US$ Billion), 2020 - 2033

6.2.1. Key Highlights

6.2.2. Asia Pacific Liquid Biopsy Market Outlook, by Biomarker, Value (US$ Billion), 2020 - 2033

6.2.2.1. Circulating Tumor Cells

6.2.2.2. Circulating Tumor DNA (ctDNA) Cells

6.2.2.3. Circulating free DNA (cfDNA)

6.2.2.4. Circulating cell free RNA (cfRNA)

6.2.2.5. Exomes

6.2.2.6. Others

6.2.3. Asia Pacific Liquid Biopsy Market Share and BPS Analysis, by Biomarker, Value, 2025 and 2033

6.2.4. Asia Pacific Liquid Biopsy Market Attractiveness Analysis, by Biomarker, Value, 2025 - 2033

6.3. Asia Pacific Liquid Biopsy Market Outlook, By Source, 2020 - 2033

6.3.1. Key Highlights

6.3.2. Asia Pacific Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

6.3.2.1. Blood

6.3.2.2. Urine

6.3.2.3. Other

6.3.3. Asia Pacific Liquid Biopsy Market Share and BPS Analysis, by Source, Value, 2025 and 2033

6.3.4. Asia Pacific Liquid Biopsy Market Attractiveness Analysis, by Source, Value, 2025 - 2033

6.4. Asia Pacific Liquid Biopsy Market Outlook, By Clinical Application, 2020 - 2033

6.4.1. Key Highlights

6.4.2. Asia Pacific Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

6.4.2.1. Diagnosis & Screening

6.4.2.2. Treatment Selection

6.4.2.3. Treatment Monitoring

6.4.2.4. Recurrence Monitoring

6.4.3. Asia Pacific Liquid Biopsy Market Share and BPS Analysis, by Clinical Application, Value, 2025 and 2033

6.4.4. Asia Pacific Liquid Biopsy Market Attractiveness Analysis, by Clinical Application, Value, 2025 - 2033

6.5. Asia Pacific Liquid Biopsy Market Outlook, By Indication, 2020 - 2033

6.5.1. Key Highlights

6.5.2. Asia Pacific Liquid Biopsy Market Outlook, by Indication, Value (US$ Billion), 2020 - 2033

6.5.2.1. Lung Cancer

6.5.2.2. Breast Cancer

6.5.2.3. Prostate Cancer

6.5.2.4. Colorectal Cancer

6.5.2.5. Other Cancers

6.5.2.6. Non-Oncology

6.5.3. Asia Pacific Liquid Biopsy Market Share and BPS Analysis, by Indication, Value, 2025 and 2033

6.5.4. Asia Pacific Liquid Biopsy Market Attractiveness Analysis, by Indication, Value, 2025 - 2033

7. Rest of the World Liquid Biopsy Market Outlook, 2020 - 2033

7.1. Rest of the World Liquid Biopsy Market Outlook, By Country, 2020 - 2033

7.1.1. Key Highlights

7.1.2. Rest of the World Liquid Biopsy Market Outlook, by Country, Value (US$ Billion), 2020 - 2033

7.1.2.1. Latin America

7.1.2.2. Middle East & Africa

7.1.3. Rest of the World Liquid Biopsy Market Share and BPS Analysis, by Country, Value, 2025 and 2033

7.1.4. Rest of the World Liquid Biopsy Market Attractiveness Analysis, by Country, Value, 2025 - 2033

7.2. Rest of the World Liquid Biopsy Market Outlook, by Biomarker, 2020 - 2033

7.2.1. Key Highlights

7.2.2. Rest of the World Liquid Biopsy Market Outlook, by Biomarker, Value (US$ Billion), 2020 - 2033

7.2.2.1. Circulating Tumor Cells

7.2.2.2. Circulating Tumor DNA (ctDNA) Cells

7.2.2.3. Circulating free DNA (cfDNA)

7.2.2.4. Circulating cell free RNA (cfRNA)

7.2.2.5. Exomes

7.2.2.6. Others

7.2.3. Rest of the World Liquid Biopsy Market Share and BPS Analysis, by Biomarker, Value, 2025 and 2033

7.2.4. Rest of the World Liquid Biopsy Market Attractiveness Analysis, by Biomarker, Value, 2025 - 2033

7.3. Rest of the World Liquid Biopsy Market Outlook, By Source, 2020 - 2033

7.3.1. Key Highlights

7.3.2. Rest of the World Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

7.3.2.1. Blood

7.3.2.2. Urine

7.3.2.3. Other

7.3.3. Rest of the World Liquid Biopsy Market Share and BPS Analysis, by Source, Value, 2025 and 2033

7.3.4. Rest of the World Liquid Biopsy Market Attractiveness Analysis, by Source, Value, 2025 - 2033

7.4. Rest of the World Liquid Biopsy Market Outlook, By Clinical Application, 2020 - 2033

7.4.1. Key Highlights

7.4.2. Rest of the World Liquid Biopsy Market Outlook, by Source, Value (US$ Billion), 2020 - 2033

7.4.2.1. Diagnosis & Screening

7.4.2.2. Treatment Selection

7.4.2.3. Treatment Monitoring

7.4.2.4. Recurrence Monitoring

7.4.3. Rest of the World Liquid Biopsy Market Share and BPS Analysis, by Clinical Application, Value, 2025 and 2033

7.4.4. Rest of the World Liquid Biopsy Market Attractiveness Analysis, by Clinical Application, Value, 2025 - 2033

7.5. Rest of the World Liquid Biopsy Market Outlook, By Indication, 2020 - 2033

7.5.1. Key Highlights

7.5.2. Rest of the World Liquid Biopsy Market Outlook, by Indication, Value (US$ Billion), 2020 - 2033

7.5.2.1. Lung Cancer

7.5.2.2. Breast Cancer

7.5.2.3. Prostate Cancer

7.5.2.4. Colorectal Cancer

7.5.2.5. Other Cancers

7.5.2.6. Non-Oncology

7.5.3. Rest of the World Liquid Biopsy Market Share and BPS Analysis, by Indication, Value, 2025 and 2033

7.5.4. Rest of the World Liquid Biopsy Market Attractiveness Analysis, by Indication, Value, 2025 - 2033

8. Competitive Landscape

8.1. Heat Map Analysis

8.2. Company Profiles

8.2.1. Guardant Health, Inc.

8.2.1.1. Company Overview

8.2.1.2. Financial Performance

8.2.1.3. Product Portfolio

8.2.1.4. Pipeline Analysis

Above details will include, but not be limited to below list of companies based on availability

8.2.2. ANGLE plc

8.2.3. Grail LLC (subsidiary of Illumina)

8.2.4. Invitae Corporation

8.2.5. Biocept, Inc.

8.2.6. F. Hoffman La Roche

8.2.7. Vortex Biosciences

8.2.8. Natera, Inc.

8.2.9. Others

9. Appendix

9.1. Research Methodology

9.2. Report Specific Research Approach

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Biomarker |

|

|

By Source |

|

|

By Clinical Application |

|

|

By Indication |

|

|

Geographic Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Market Estimates and Forecast (Value), Market Dynamics, Regulatory Guidelines, Technological Advancements, COVID-19 Impact Analysis, Biomarker Insights, Source Insights, Clinical Application Insights, Indications, Regional and Country Insights, Competitive Landscape, Company Profiles |