Global Maritime Security Market Forecast

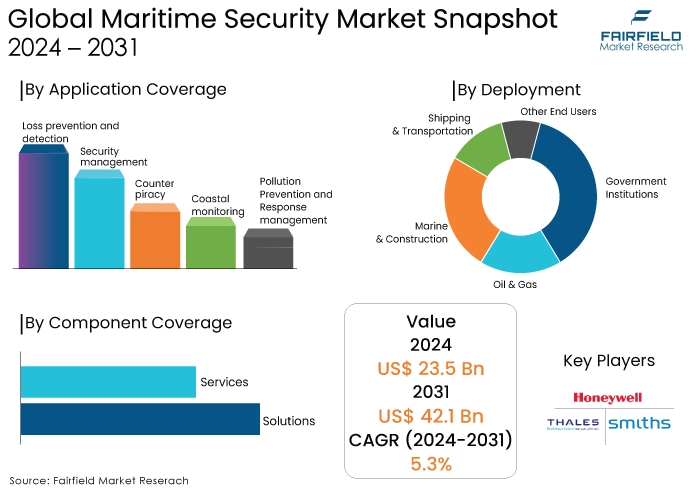

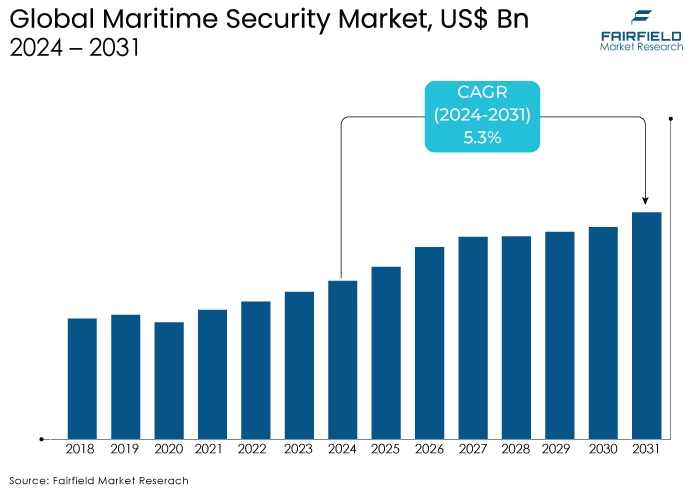

- Global maritime security market revenue projected to reach US$42.1 Bn in 2031, up from US$23.5 Bn estimated in 2024

- Maritime security market size poised to exhibit a CAGR of 5.3% between 2024 and 2031

Quick Report Digest

- The global maritime security market is expected to reach US$42.1 billion by 2031, growing at a CAGR of 5.3%.

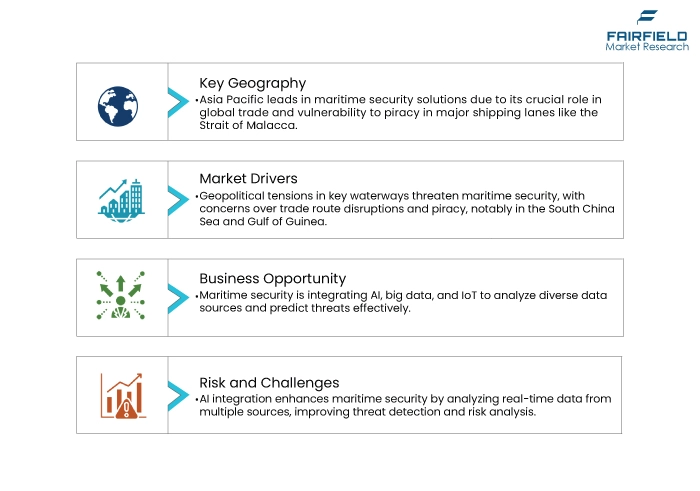

- Rising trade volumes, piracy threats, and geopolitical tensions are driving market growth.

- Regulations like ISPS Code mandate security measures for vessels and ports, influencing demand for security equipment and services.

- Advanced technologies like AI, autonomous vessels, and big data are transforming maritime security.

- Cybersecurity threats are a growing concern, necessitating robust solutions like intrusion detection and data encryption.

- High implementation costs and stringent environmental regulations can hinder market growth.

- Integration of AI, big data, and IoT is a key trend for enhanced threat detection and decision-making.

- Growing focus on border security creates opportunities for coastal surveillance systems, drones, and advanced vessel tracking.

- The rise of complex supply chains and growing environmental concerns necessitate efficient and sustainable maritime security solutions.

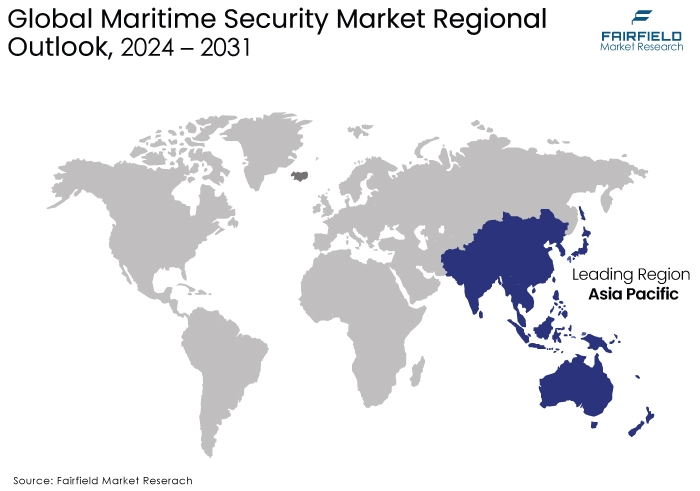

- Asia Pacific dominates the market due to high trade volume, piracy threats, and geopolitical tensions in the region.

A Look Back and a Look Forward - Comparative Analysis

Prior to 2023, the maritime security market experienced consistent growth fuelled by a combination of factors. The global trade volume witnessed a steady rise, creating a demand for secure transportation of goods. This, unfortunately, also coincided with an increase in piracy incidents, particularly in regions like West Africa. These incidents highlighted the vulnerability of vessels and crews, prompting investments in security measures.

However, the COVID-19 pandemic caused a temporary setback in 2020 as global trade contracted significantly. Despite the disruption, the market is expected to exhibit a strong rebound post-2024. Estimates project a CAGR of around 5.3% during the projection period with the market reaching a value between US$42.1 Bn by the end of forecast year. This growth is attributed to recovering trade volumes and a heightened focus on maritime security due to rising geopolitical tensions and the ever-present threat of piracy.

Key Growth Determinants

Rising Geopolitical Tensions and Piracy

Geopolitical instability in strategic waterways around the globe poses a major threat to maritime security. Tensions in regions like the South China Sea raise concerns about disruptions to trade routes and potential conflicts that could impede the flow of goods. Piracy also continues to be a significant threat, particularly in West Africa's Gulf of Guinea.

Such incidents not only result in financial losses due to stolen cargo but also endanger the lives of crew members. The need for advanced security solutions is thus on the rise. This includes investments in armed guards to deter pirate attacks, patrol vessels for increased surveillance, and sophisticated maritime surveillance systems that provide comprehensive monitoring capabilities.

Rapid Technological Advancements

Technological advancements are a key driver propelling the growth of the maritime security market. Integration of artificial intelligence (AI) into maritime security systems offers significant benefits. AI-powered solutions can analyse vast amounts of data from various sources in real-time, enabling them to detect threats more efficiently and improve risk analysis.

Additionally, advancements in drone technology and autonomous vehicles are transforming maritime surveillance and border patrol. Drones can be deployed for rapid aerial inspections of vessels and surrounding areas, while autonomous vehicles offer cost-effective and continuous surveillance capabilities in remote locations. These technological innovations are making security solutions more efficient, accurate, and cost-effective in the long run.

Growing Importance of Cybersecurity

Cybersecurity threats are a growing concern for the maritime industry. Increased reliance on digital technologies for navigation, communication, and cargo management makes vessels vulnerable to cyberattacks. Hackers could potentially gain control of critical systems, disrupt navigation, or steal sensitive data. This necessitates the implementation of robust cybersecurity solutions like intrusion detection systems that can identify and prevent unauthorized access to networks.

Data encryption is another crucial element, ensuring that even if a breach occurs, sensitive information remains protected. By prioritizing cybersecurity, companies can safeguard their critical infrastructure and prevent disruptions to their operations.

Investments in AI-Powered Platforms

Investments in AI-powered maritime domain awareness platforms boos market growth. These platforms leverage artificial intelligence to analyse vast amounts of data from various sources, including radar, AIS data, and satellite imagery, to provide real-time threat detection and improve situational awareness for security personnel.

Autonomous vessels offer a cost-effective and continuous surveillance solution for monitoring remote areas or strategic waterways. These vessels can be equipped with sensors and cameras to detect suspicious activity and transmit data back to security control centres.

Rising Collaboration Between Government and Private Sectors

Growing focus on cybersecurity solutions is accelerating the maritime security market growth. As cyber threats become more sophisticated, companies are investing in robust cybersecurity solutions to protect their vessels and critical infrastructure. This includes implementing measures like intrusion detection systems, data encryption, and vulnerability assessments.

Governments are increasingly collaborating with private security companies to enhance maritime security. This collaboration allows for the sharing of resources and expertise, leading to a more comprehensive approach to maritime security challenges.

Key Growth Barriers

High Costs of Implementation

Advanced maritime security solutions can be expensive to implement and maintain. The cost of acquiring sophisticated equipment like AI-powered surveillance systems or autonomous patrol vessels can be significant. Additionally, training personnel to operate and maintain these systems requires specialized expertise, further adding to the overall expense.

Furthermore, deploying security measures like armed guards or manned patrols incurs ongoing operational costs. These factors can be particularly prohibitive for smaller commercial entities with limited budgets. To address this challenge, the industry is witnessing a trend towards offering security solutions as a service. Managed security service providers can help companies optimize costs by delivering a comprehensive security package that includes equipment, personnel, and ongoing maintenance.

Stringent Environmental Regulations

Stringent environmental regulations can hinder the growth of certain maritime security solutions. For instance, stricter emission regulations aimed at reducing air and water pollution may limit the use of traditional patrol vessels that rely on fossil fuels. While these regulations are crucial for protecting the environment, they necessitate investment in cleaner technologies like electric or hybrid patrol vessels.

However, these alternative solutions often come with higher upfront costs. Balancing the need for robust maritime security with environmental sustainability remains a challenge. The industry is looking towards advancements in clean technology to develop cost-effective and environmentally friendly solutions.

Key Trends and Opportunities to Look at

Integration of Advanced Technologies

The maritime security industry is witnessing a growing trend of integrating advanced technologies into its operations. Artificial intelligence (AI), big data, and the Internet of Things (IoT) are playing a transformative role. AI-powered systems can analyse vast amounts of data collected from various sources, including satellite imagery, radar data, and Automatic Identification Systems (AIS), to identify suspicious activity and predict potential threats.

Big data analytics allows for the identification of patterns and trends that might be missed by traditional methods. Additionally, the integration of IoT devices on vessels and within ports can provide real-time data on everything from cargo status to equipment functionality. This comprehensive data collection and analysis empowers security personnel to make informed decisions and respond to threats more effectively.

Growing Focus on Border Security

The increasing focus on border security presents a significant opportunity for the maritime security market. Governments around the world are prioritizing the security of their coastlines to prevent illegal activities like smuggling and human trafficking. This is driving investments in advanced coastal surveillance systems that utilize radar, thermal imaging, and other technologies to monitor maritime activity in real-time.

Unmanned aerial vehicles (UAVs) or drones are also gaining traction due to their ability to provide aerial surveillance over vast areas. Additionally, advanced vessel tracking technologies that leverage Automatic Identification Systems (AIS) and satellite data are being implemented to track the movement of vessels and identify suspicious patterns. These investments in border security measures are creating a demand for sophisticated security solutions offered by the maritime security market.

Increasing Requirement for Handling Complicated Supply Chain Operations, and Improving Sustainability

To function efficiently and effectively, the marine industry must be able to handle complex procedures and changing market situations. The industry is embracing a spike in digital technology use for shipping logistics as a chance to improve efficiency, build smarter ships and fleets, and get ready to take advantage of global expansion. Maritime security market is likely to receive a strong impetus with the deepening penetration of advancing technologies. As consumer demand rises, global supply networks are expanding and growing more complex.

Increased environmental effect is a direct result of increased demand for goods, commodities, and raw materials. Marine businesses must immediately put new strategies into place to maximise efficiency and streamline their supply chains in today's fiercely competitive market.

Innovative technologies integrated into maritime and marine management software enable end users to easily arrange inventory data digitally, track and manage shipping and tracking information, and generate electronic invoicing. To save their business time and money, shipping businesses can cut down on the amount of time spent shipping, receiving, tracking, and gathering order data. All this is expected to subsequently firm up the growth of maritime security market.

Growing Significance of Digitalization

The importance of digitalization, and recent advancements in AI, blockchain, IoT, and automation technology are favouring the progress of marine industry as they aid in streamlining existing procedures, developing fresh commercial prospects, and transforming supply networks. End users can take advantage of capabilities like design and simulation tools, warehouse management, transportation and yard management, and end-to-end control of the logistics network provided by the marine and marine management software to manage supply chain activities successfully.

Additionally, stricter environmental regulations continue to influence the maritime transportation industry because transporters must keep up service standards, cut costs, and guarantee sustainability in operations. This naturally demands reliable safety and security measures for the entire system, which drives the growth of maritime security market.

Fairfield’s Ranking Board

Top Segments

Managed Security Services (MSS) Remain Most in Demand

Managed security services (MSS) are a dominant segment in the maritime security market due to their comprehensive approach. MSS providers offer a range of services tailored to the specific needs of their clients. These services can include threat detection and monitoring, vulnerability assessments to identify potential security weaknesses, incident response to address security breaches, and system maintenance to ensure the continued effectiveness of security measures.

By outsourcing their security needs to an MSS provider, companies can benefit from the expertise of specialized security professionals and access to advanced security technologies without the need for significant upfront investments. This makes MSS an attractive option for companies of all sizes looking to enhance their maritime security posture.

Maritime Patrol Services Continue to be Dominant

Maritime patrol services remain another dominant segment within the maritime security market. The need for physical security measures to deter piracy, theft, and other criminal activity necessitates the deployment of patrol vessels and personnel.

Maritime patrol services can include manned patrols with armed guards on board vessels to deter attacks, escort services for high-risk routes to ensure safe passage, and vessel boarding operations to conduct inspections and prevent illegal activity. These services play a crucial role in safeguarding vessels, crews, and cargo, making them a vital component of the maritime security industry.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape plays a crucial role in shaping the maritime security industry. The International Maritime Organization (IMO) establishes international regulations that mandate compliance with specific security measures for vessels and ports. These regulations, such as the International Ship and Port Facility Security (ISPS) Code, outline requirements for security assessments, development of security plans, and implementation of security measures onboard ships and at port facilities.

All this directly influences the demand for various security equipment and services like Automatic Identification Systems (AIS), which track vessel movements, and Vessel Monitoring Systems (VMS) that provide real-time location data. Additionally, regional regulations further influence the types of security solutions adopted. For instance, the European Union, and the United States have their own regulations that complement or expand upon IMO requirements, ensuring a multi-layered approach to maritime security.

Regional Frontrunners

Persistent Geopolitical Unrest Underpins Asia Pacific’s Global Dominance

The Asia Pacific region is the dominant market for maritime security solutions due to several key factors. This region accounts for a significant portion of global trade, with major shipping lanes like the Strait of Malacca carrying a vast amount of cargo. Unfortunately, these busy waterways are also vulnerable to piracy, making robust security measures essential.

Additionally, rising geopolitical tensions in the South China Sea, and the East China Sea further elevate security concerns, prompting governments and commercial entities to invest in advanced security solutions.

Furthermore, several emerging economies within the region, like China and India, are experiencing significant growth in their maritime sectors, leading to increased investments in port infrastructure and security measures. These factors combine to make the Asia Pacific region a leader in the maritime security market.

Fairfield’s Competitive Landscape Analysis

The maritime security market is a competitive landscape with a mix of established players and emerging technology companies. Leading companies offer a range of products and services, including security personnel, armed guards, patrol vessels, surveillance systems, and cybersecurity solutions.

Who are Leading Companies in Maritime Security Space?

- Honeywell

- Thales Group

- Smiths Group

- Elbit Systems

- Northrop Grumman

- Raytheon Anschutz

- Saab Group

- BAE Systems

- Airbus

- Rolta

- Armor Group

- GardaWorld

- Drydocks World Maritime Security

- Securitas Maritime

- International SOS

Recent Industry Developments

- In January 2022, Honeywell announced an innovative, new low-global-warming-potential (GWP) refrigerant for commercial and industrial refrigeration that is optimized for supermarkets. The product meets the needs of grocers and retailers who are seeking low-global-warming solutions ahead of likely regulatory changes.

- In January 2022, Elbit Systems Sweden agreed to supply combat management systems to the Royal Swedish Navy. It would enable underwater detection and surface tracks, based on real-time data, live video streaming, and imagery data, thereby expanding the operational envelope, increasing flexibility, and enabling effective decision making during MCM missions.

- In December 2021, Everbridge, has launched its next-generation Travel Risk Management (TRM) solution for new and existing customers. It helps businesses and organizations quickly locate and communicate with traveling employees, remote workers, and those returning to the office, who may be in harm’s way.

- In December 2021, Honeywell announced a new, user-friendly Transmission risk air monitor that alerts users when indoor air conditions may present an increased risk of potentially transmitting airborne viruses in schools, restaurants, and other spaces. It is an easy-to-deploy, portable device that measures carbon dioxide and features a proprietary risk alerting system based on user-selected activity levels within a room.

Global Maritime Security Market is Segmented as Below-

By Component Coverage

- Solutions

- Services

- Professional Services

- Training and Consulting

- Risk Assessment and Investigation

- Support and Maintenance

- Managed Services

- Professional Services

By Security Type Coverage

- Port and Critical infrastructure Security

- Coastal Surveillance

- Vessel Security

- Crew Security

- Cargoes and containers Safety

- Ship system and equipment (SSE) Safety

- Other Security Type (Yacht Security, Safety of marine installations, Shipyard security, and cyber security)

By System Coverage

- Ship Security Reporting System

- Automatic Identification System (AIS)

- Global Maritime Distress Safety System (GMDSS)

- Long Range Tracking and Identification (LRIT) System

- Vessel Monitoring and Management System

- Other Systems (Automated Manifest System (AMS), and Automated Mutual Assistance Vessel Rescue System (AMVER))

By End Use Coverage

- Government Institutions

- Oil & Gas

- Marine & Construction

- Shipping & Transportation

- Other End Users (Yachts, Boat Owners, and Ship Agencies)

By Application Coverage

- Loss prevention and detection

- Security management

- Counter piracy

- Coastal monitoring

- Pollution Prevention and Response (PPR) management

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of EU

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middles East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Maritime Security Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions

2.2. Market Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.4. Value Chain Analysis

2.5. Porter’s Five Forces Analysis

2.6. COVID-19 Impact Analysis

2.7. Key Patents

3. Global Maritime Security Market Outlook, 2019 - 2031

3.1. Global Maritime Security Market Outlook, by Components (US$ ‘000), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Solutions

3.1.1.2. Services

3.1.1.2.1. Professional Services

3.1.1.2.1.1. Training and Consulting

3.1.1.2.1.2. Risk Assessment and Investigation

3.1.1.2.1.3. Support and Maintenance

3.1.1.2.2. Managed Services

3.1.2. BPS Analysis/Market Attractiveness Analysis

3.2. Global Maritime Security Market Outlook, by Security Type, Value (US$ ‘000), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Port and Critical Infrastructure Security

3.2.1.2. Coastal Surveillance

3.2.1.3. Vessel Security

3.2.1.4. Crew Security

3.2.1.5. Cargoes and containers Safety

3.2.1.6. Ship system and equipment (SSE) Safety

3.2.1.7. Other Security Type (Yacht Security, Safety of marine installations, Shipyard security, and cyber security)

3.2.2. BPS Analysis/Market Attractiveness Analysis

3.3. Global Maritime Security Market Outlook, by System, Value (US$ ‘000), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Ship Security Reporting System

3.3.1.2. Automatic Identification System (AIS)

3.3.1.3. Global Maritime Distress Safety System (GMDSS)

3.3.1.4. Long Range Tracking and Identification (LRIT) System

3.3.1.5. Vessel Monitoring and Management System

3.3.1.6. Other Systems (Automated Manifest System (AMS), and Automated Mutual Assistance Vessel Rescue System (AMVER)

3.3.2. BPS Analysis/Market Attractiveness Analysis

3.4. Global Maritime Security Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Loss prevention and detection

3.4.1.2. Security management

3.4.1.3. Counter piracy

3.4.1.4. Coastal monitoring

3.4.1.5. Pollution Prevention and Response (PPR) management

3.4.2. BPS Analysis/Market Attractiveness Analysis

3.5. Global Maritime Security Market Outlook, by End User, Value (US$ ‘000), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. Government Institutions

3.5.1.2. Oil & Gas

3.5.1.3. Marine & construction

3.5.1.4. Shipping & Transportation

3.5.1.5. Other End-Users (Yachts, Boat Owners, and Ship Agencies)

3.5.2. BPS Analysis/Market Attractiveness Analysis

3.6. Global Maritime Security Market Outlook, by Region, Value (US$ ‘000), 2019 - 2031

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

3.6.2. BPS Analysis/Market Attractiveness Analysis

4. North America Maritime Security Market Outlook, 2019 - 2031

4.1. North America Maritime Security Market Outlook, by Components (US$ ‘000), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Solutions

4.1.1.2. Services

4.1.1.2.1. Professional Services

4.1.1.2.1.1. Training and Consulting

4.1.1.2.1.2. Risk Assessment and Investigation

4.1.1.2.1.3. Support and Maintenance

4.1.1.2.2. Managed Services

4.1.2. BPS Analysis/Market Attractiveness Analysis

4.2. North America Maritime Security Market Outlook, by Security Type, Value (US$ ‘000), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Port and Critical Infrastructure Security

4.2.1.2. Coastal Surveillance

4.2.1.3. Vessel Security

4.2.1.4. Crew Security

4.2.1.5. Cargoes and containers Safety

4.2.1.6. Ship system and equipment (SSE) Safety

4.2.1.7. Other Security Type (Yacht Security, Safety of marine installations, Shipyard security, and cyber security)

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Maritime Security Market Outlook, by System, Value (US$ ‘000), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Ship Security Reporting System

4.3.1.2. Automatic Identification System (AIS)

4.3.1.3. Global Maritime Distress Safety System (GMDSS)

4.3.1.4. Long Range Tracking and Identification (LRIT) System

4.3.1.5. Vessel Monitoring and Management System

4.3.1.6. Other Systems (Automated Manifest System (AMS), and Automated Mutual Assistance Vessel Rescue System (AMVER)

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Maritime Security Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Loss prevention and detection

4.4.1.2. Security management

4.4.1.3. Counter piracy

4.4.1.4. Coastal monitoring

4.4.1.5. Pollution Prevention and Response (PPR) management

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Maritime Security Market Outlook, by End User, Value (US$ ‘000), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. Government Institutions

4.5.1.2. Oil & Gas

4.5.1.3. Marine & construction

4.5.1.4. Shipping & Transportation

4.5.1.5. Other End-Users (Yachts, Boat Owners, and Ship Agencies)

4.6. North America Maritime Security Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

4.6.1. Key Highlights

4.6.1.1. U.S. Maritime Security Market by Value (US$ ‘000), 2019 - 2031

4.6.1.2. Canada Maritime Security Market by Value (US$ ‘000), 2019 - 2031

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Maritime Security Market Outlook, 2019 - 2031

5.1. Europe Maritime Security Market Outlook, by Components (US$ ‘000), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Solutions

5.1.1.2. Services

5.1.1.2.1. Professional Services

5.1.1.2.1.1. Training and Consulting

5.1.1.2.1.2. Risk Assessment and Investigation

5.1.1.2.1.3. Support and Maintenance

5.1.1.2.2. Managed Services

5.1.2. BPS Analysis/Market Attractiveness Analysis

5.2. Europe Maritime Security Market Outlook, by Security Type, Value (US$ ‘000), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Port and Critical Infrastructure Security

5.2.1.2. Coastal Surveillance

5.2.1.3. Vessel Security

5.2.1.4. Crew Security

5.2.1.5. Cargoes and containers Safety

5.2.1.6. Ship system and equipment (SSE) Safety

5.2.1.7. Other Security Type (Yacht Security, Safety of marine installations, Shipyard security, and cyber security)

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Maritime Security Market Outlook, by System, Value (US$ ‘000), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Ship Security Reporting System

5.3.1.2. Automatic Identification System (AIS)

5.3.1.3. Global Maritime Distress Safety System (GMDSS)

5.3.1.4. Long Range Tracking and Identification (LRIT) System

5.3.1.5. Vessel Monitoring and Management System

5.3.1.6. Other Systems (Automated Manifest System (AMS), and Automated Mutual Assistance Vessel Rescue System (AMVER)

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Maritime Security Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Loss prevention and detection

5.4.1.2. Security management

5.4.1.3. Counter piracy

5.4.1.4. Coastal monitoring

5.4.1.5. Pollution Prevention and Response (PPR) management

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Maritime Security Market Outlook, by End User, Value (US$ ‘000), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Government Institutions

5.5.1.2. Oil & Gas

5.5.1.3. Marine & construction

5.5.1.4. Shipping & Transportation

5.5.1.5. Other End-Users (Yachts, Boat Owners, and Ship Agencies)

5.5.2. BPS Analysis/Market Attractiveness Analysis

5.6. Europe Maritime Security Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

5.6.1. Key Highlights

5.6.1.1. Germany Maritime Security Market by Value (US$ ‘000), 2019 - 2031

5.6.1.2. France Maritime Security Market by Product, Value (US$ ‘000), 2019 - 2031

5.6.1.3. U.K. Maritime Security Market by Value (US$ ‘000), 2019 - 2031

5.6.1.4. Italy Maritime Security Market by Value (US$ ‘000), 2019 - 2031

5.6.1.5. Spain Maritime Security Market by Product, Value (US$ ‘000), 2019 - 2031

5.6.1.6. Rest of Europe Maritime Security Market Value (US$ ‘000), 2019 - 2031

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Maritime Security Market Outlook, 2019 - 2031

6.1. Asia Pacific Maritime Security Market Outlook, by Components (US$ ‘000), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Solutions

6.1.1.2. Services

6.1.1.2.1. Professional Services

6.1.1.2.1.1. Training and Consulting

6.1.1.2.1.2. Risk Assessment and Investigation

6.1.1.2.1.3. Support and Maintenance

6.1.1.2.2. Managed Services

6.1.2. BPS Analysis/Market Attractiveness Analysis

6.2. Asia Pacific Maritime Security Market Outlook, by Security Type, Value (US$ ‘000), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Port and Critical Infrastructure Security

6.2.1.2. Coastal Surveillance

6.2.1.3. Vessel Security

6.2.1.4. Crew Security

6.2.1.5. Cargoes and containers Safety

6.2.1.6. Ship system and equipment (SSE) Safety

6.2.1.7. Other Security Type (Yacht Security, Safety of marine installations, Shipyard security, and cyber security)

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Maritime Security Market Outlook, by System, Value (US$ ‘000), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Ship Security Reporting System

6.3.1.2. Automatic Identification System (AIS)

6.3.1.3. Global Maritime Distress Safety System (GMDSS)

6.3.1.4. Long Range Tracking and Identification (LRIT) System

6.3.1.5. Vessel Monitoring and Management System

6.3.1.6. Other Systems (Automated Manifest System (AMS), and Automated Mutual Assistance Vessel Rescue System (AMVER)

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Maritime Security Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Loss prevention and detection

6.4.1.2. Security management

6.4.1.3. Counter piracy

6.4.1.4. Coastal monitoring

6.4.1.5. Pollution Prevention and Response (PPR) management

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Maritime Security Market Outlook, by End User, Value (US$ ‘000), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. Government Institutions

6.5.1.2. Oil & Gas

6.5.1.3. Marine & construction

6.5.1.4. Shipping & Transportation

6.5.1.5. Other End-Users (Yachts, Boat Owners, and Ship Agencies)

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Asia Pacific Maritime Security Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

6.6.1. Key Highlights

6.6.1.1. India Maritime Security Market by Value (US$ ‘000), 2019 - 2031

6.6.1.2. China Maritime Security Market by Value (US$ ‘000), 2019 - 2031

6.6.1.3. Japan Maritime Security Market by Value (US$ ‘000), 2019 - 2031

6.6.1.4. Australia & New Zealand Maritime Security Market Value (US$ ‘000), 2019 - 2031

6.6.1.5. Rest of Asia Pacific Market by Value (US$ ‘000), 2019 - 2031

6.6.2. BPS Analysis/Market Attractiveness Analysis

6.7. Latin America Maritime Security Market Outlook, by Components (US$ ‘000), 2019 - 2031

6.7.1. Key Highlights

6.7.1.1. Solutions

6.7.1.2. Services

6.7.1.2.1. Professional Services

6.7.1.2.1.1. Training and Consulting

6.7.1.2.1.2. Risk Assessment and Investigation

6.7.1.2.1.3. Support and Maintenance

6.7.1.2.2. Managed Services

6.7.2. BPS Analysis/Market Attractiveness Analysis

6.8. Latin America Maritime Security Market Outlook, by Security Type, Value (US$ ‘000), 2019 - 2031

6.8.1. Key Highlights

6.8.1.1. Port and Critical Infrastructure Security

6.8.1.2. Coastal Surveillance

6.8.1.3. Vessel Security

6.8.1.4. Crew Security

6.8.1.5. Cargoes and containers Safety

6.8.1.6. Ship system and equipment (SSE) Safety

6.8.1.7. Other Security Type (Yacht Security, Safety of marine installations, Shipyard security, and cyber security)

6.8.2. BPS Analysis/Market Attractiveness Analysis

6.9. Latin America Maritime Security Market Outlook, by System, Value (US$ ‘000), 2019 - 2031

6.9.1. Key Highlights

6.9.1.1. Ship Security Reporting System

6.9.1.2. Automatic Identification System (AIS)

6.9.1.3. Global Maritime Distress Safety System (GMDSS)

6.9.1.4. Long Range Tracking and Identification (LRIT) System

6.9.1.5. Vessel Monitoring and Management System

6.9.1.6. Other Systems (Automated Manifest System (AMS), and Automated Mutual Assistance Vessel Rescue System (AMVER)

6.9.2. BPS Analysis/Market Attractiveness Analysis

6.10. Latin America Maritime Security Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

6.10.1. Key Highlights

6.10.1.1. Loss prevention and detection

6.10.1.2. Security management

6.10.1.3. Counter piracy

6.10.1.4. Coastal monitoring

6.10.1.5. Pollution Prevention and Response (PPR) management

6.10.2. BPS Analysis/Market Attractiveness Analysis

6.11. Latin America Maritime Security Market Outlook, by End User, Value (US$ ‘000), 2019 - 2031

6.11.1. Key Highlights

6.11.1.1. Government Institutions

6.11.1.2. Oil & Gas

6.11.1.3. Marine & construction

6.11.1.4. Shipping & Transportation

6.11.1.5. Other End-Users (Yachts, Boat Owners, and Ship Agencies)

6.11.2. BPS Analysis/Market Attractiveness Analysis

6.12. Latin America Maritime Security Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

6.12.1. Key Highlights

6.12.1.1. Brazil Maritime Security Market by Value (US$ ‘000), 2019 - 2031

6.12.1.2. Mexico Maritime Security Market by Value (US$ ‘000), 2019 - 2031

6.12.1.3. Rest of Latin America Maritime Security Market by Value (US$ ‘000), 2019 - 2031

6.12.2. BPS Analysis/Market Attractiveness Analysis

7. Middle East & Africa Maritime Security Market Outlook, 2019 - 2031

7.1. Global Maritime Security Market Outlook, by Components (US$ ‘000), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Solutions

7.1.1.2. Services

7.1.1.2.1. Professional Services

7.1.1.2.1.1. Training and Consulting

7.1.1.2.1.2. Risk Assessment and Investigation

7.1.1.2.1.3. Support and Maintenance

7.1.1.2.2. Managed Services

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Middle East & Africa Maritime Security Market Outlook, by Security Type, Value (US$ ‘000), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Port and Critical Infrastructure Security

7.2.1.2. Coastal Surveillance

7.2.1.3. Vessel Security

7.2.1.4. Crew Security

7.2.1.5. Cargoes and containers Safety

7.2.1.6. Ship system and equipment (SSE) Safety

7.2.1.7. Other Security Type (Yacht Security, Safety of marine installations, Shipyard security, and cyber security)

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Middle East & Africa Maritime Security Market Outlook, by System, Value (US$ ‘000), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Ship Security Reporting System

7.3.1.2. Automatic Identification System (AIS)

7.3.1.3. Global Maritime Distress Safety System (GMDSS)

7.3.1.4. Long Range Tracking and Identification (LRIT) System

7.3.1.5. Vessel Monitoring and Management System

7.3.1.6. Other Systems (Automated Manifest System (AMS), and Automated Mutual Assistance Vessel Rescue System (AMVER)

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Middle East & Africa Maritime Security Market Outlook, by Application, Value (US$ ‘000), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Loss prevention and detection

7.4.1.2. Security management

7.4.1.3. Counter piracy

7.4.1.4. Coastal monitoring

7.4.1.5. Pollution Prevention and Response (PPR) management

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Middle East & Africa Maritime Security Market Outlook, by End User, Value (US$ ‘000), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Government Institutions

7.5.1.2. Oil & Gas

7.5.1.3. Marine & construction

7.5.1.4. Shipping & Transportation

7.5.1.5. Other End-Users (Yachts, Boat Owners, and Ship Agencies)

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Middle East & Africa Maritime Security Market Outlook, by Country, Value (US$ ‘000), 2019 - 2031

7.6.1. Key Highlights

7.6.1.1. GCC Maritime Security Market by Value (US$ ‘000), 2019 - 2031

7.6.1.2. South Africa Maritime Security Market by Value (US$ ‘000), 2019 - 2031

7.6.1.3. Rest of Middle East & Africa Maritime Security Market by Value (US$ ‘000), 2019 - 2031

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Competitive Landscape

8.1. Company Market Share Analysis, 2019

8.2. Company Profiles

8.2.1. Honeywell

8.2.1.1. Company Overview

8.2.1.2. Key Retailing Partners

8.2.1.3. Business Segment Revenue

8.2.1.4. Ingredient Overview

8.2.1.5. Product Offering & its Presence

8.2.1.6. Certifications & Claims

8.2.2. Thales Group

8.2.3. Smiths Group

8.2.4. Elbit Systems

8.2.5. Northrop Grumman

8.2.6. Raytheon Anschutz

8.2.7. Saab Group

8.2.8. BAE Systems

8.2.9. Airbus

8.2.10. Rolta

9. Appendix

9.1. Research Methodology

9.2. Report Assumptions

9.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

|

||

|

REPORT FEATURES |

DETAILS |

|

Components Coverage |

|

|

Security Type Coverage |

|

|

System Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |