Micro-LED Displays Market Growth and Industry Forecast

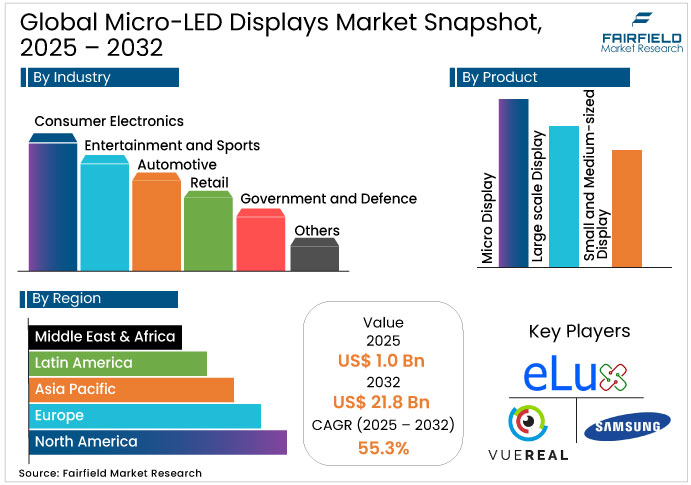

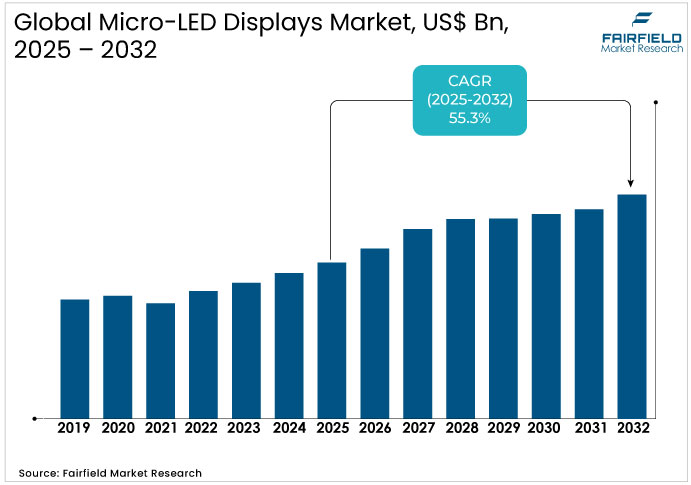

The Micro-LED Displays Market is valued at USD 1.0 billion in 2025 and is projected to reach USD 21.8 billion, growing at a CAGR of 55.3% by 2032.

Micro-LED Displays Market Summary: Key Insights & Trends

- Large-scale displays dominate the Micro-LED Displays Market with over half of total share due to wide use in commercial and public installations.

- Micro displays are expanding fastest, supported by AR/VR and smartwatch integration across wearable and automotive applications.

- AR/VR and other specialized applications lead with about 35% share, fueled by immersive content demand and low-latency visuals.

- Smartphones and tablets continue gaining share as high-brightness and foldable micro-LED screens enter premium device portfolios.

- Consumer electronics hold roughly 70% share, driven by strong adoption in TVs, laptops, and smart home devices.

- Automotive displays are rapidly increasing their share through heads-up, dashboard, and in-vehicle infotainment integrations.

- Asia Pacific accounts for about 42% of global share, anchored by China, Japan, and South Korea’s large-scale production capacity.

- North America strengthens its position with rising smart-device and home-automation demand, led by U.S. consumer adoption.

Key Growth Drivers

- Cutting-Edge Micro-LED Innovations Redefine Display Efficiency and Visual Performance Globally

Micro-LED technology revolutionizes visual experiences by delivering superior brightness, contrast ratios, and energy efficiency compared to traditional LCD and OLED displays. This innovation stems from self-emissive pixels that eliminate backlighting needs, enabling wider viewing angles and faster response times ideal for dynamic content. Governments worldwide support such progress through policies promoting electronic manufacturing, such as India's National Electronics Policy aiming for substantial domestic output. As consumer demand rises for immersive viewing in smart devices, manufacturers invest in R&D to miniaturize components and improve yield rates, fostering broader adoption across sectors. These advancements not only reduce power consumption but also extend device lifespans, aligning with sustainability goals and driving the Micro-LED Displays Market forward through enhanced user satisfaction and operational efficiencies.

- Growing Consumer Electronics Demand Accelerates Global Adoption of Micro-LED Displays

The surge in discretionary incomes and urban lifestyles propels as consumers seek high-end gadgets with vivid, burn-in-resistant screens. Integration with 5G, IoT, and AI amplifies this trend, enabling seamless connectivity in smart homes and wearables. Industry associations report increased adoption in premium smartphones and TVs, where micro-LED's color gamut outperforms competitors, supported by company filings showing expanded production capacities. This demand encourages alliances for technology sharing, reducing barriers to entry and accelerating market penetration. Ultimately, the focus on eco-friendly, durable displays positions micro-LED as a preferred choice, boosting revenue streams and encouraging innovation in application-specific designs.

Key Restraints

- Complex Production Processes and High Costs Challenge Micro-LED Display Scalability

The intricate manufacturing process of micro-LED displays, involving ultra-precise LED epitaxy, mass transfer, and defect repair, significantly elevates production costs and limits yield efficiency. These technical challenges make large-scale manufacturing difficult, particularly for high-resolution displays. Moreover, fluctuations in semiconductor industry cycles further aggravate the issue by creating supply bottlenecks and inventory imbalances. The lack of established, cost-effective supply chains and automation technologies exposes vendors to operational and financial risks, ultimately hindering the commercialization and mass adoption of micro-LED technology.

- Patent Gaps and Supply Chain Weaknesses Restrict Micro-LED Market Expansion

Incomplete patent landscapes and fragmented intellectual property ownership restrict collaboration and innovation within the micro-LED ecosystem. At the same time, weak integration across supply chain stages—such as wafer fabrication, chip transfer, and panel assembly—creates significant bottlenecks for mass production. Compared to mature LCD or OLED technologies, micro-LED manufacturing demands higher precision and specialized equipment, which amplifies production risks and costs. These inefficiencies not only delay time-to-market but also discourage investment, limiting the pace of market expansion and technology standardization.

Micro-LED Displays Market Trends and Opportunities

- Government Policies and Incentives Accelerate Global Micro-LED Display Development

Opportunities abound in the sector through global policies aimed at revitalizing manufacturing sectors. For instance, national electronics policies target ambitious turnover goals, integrating AI, IoT, and 5G to amplify demand for advanced displays. Justifications include subsidies that lower barriers for R&D, enabling faster prototyping and commercialization. This fosters alliances between governments and industry, creating ecosystems where micro-LEDs enhance smart infrastructure. Emerging trends in sustainable tech further justify expansions, as energy-efficient displays align with green agendas, opening doors to public-private partnerships for widespread deployment.

- Sustainable Innovations Drive New Micro-LED Opportunities Across Emerging Applications

The Micro-LED Displays Market capitalizes on rising preferences for sustainable tech, with low-power designs ideal for eco-conscious consumers in automotive and retail sectors. Opportunities arise from AR/VR expansions, where micro-LEDs' efficiency supports prolonged usage without environmental strain. Justifications encompass trade alliances forming flexible lighting solutions, broadening applications in smart homes and defense. Technological roadmaps predict integrations into VLC for niche areas such as marine exploration, justifying investments in durability enhancements that promise long-term returns.

Segment-wise Trends & Analysis

- Large-Scale Displays Lead Micro-LED Market as Micro Displays Gain Momentum

Large scale displays command over 50% market share in the Micro-LED Displays Market for 2025, reflecting their dominance in commercial installations. These segments lead due to scalability for public venues and advertising, where high brightness ensures visibility in ambient light. Competitors position large scale variants as premium solutions, leveraging modular assembly for custom sizes. Growth trajectory hinges on declining production costs, projected to accelerate adoption in retail and transportation hubs.

Emerging micro displays gain traction in the market as fast-growing segments, driven by AR/VR demands. Their compact size supports portable applications, with underlying drivers including miniaturization advancements. Competitive positioning favors innovators focusing on integration with optics, differentiating through energy efficiency and resolution. This segment's expansion underscores strategic shifts toward wearable tech.

- AR/VR and Smart Devices Drive Rapid Growth in Micro-LED Applications

Other applications hold approximately 35% market share in 2025, encompassing AR/VR and specialized uses. This leading segment thrives on immersive technology needs, where Micro-LEDs provide low latency and high fidelity. Players position these applications as innovative frontiers, capitalizing on consumer trends toward interactive content.

Smartphone and tablet segments emerge rapidly, fueled by demand for high-end devices. Growth drivers include rising disposable incomes and 5G integration, enabling superior visuals. Competitive analysis reveals tech giants leading through R&D, securing advantages in battery life and screen durability.

- Consumer Electronics Dominate While Automotive Emerges as Fast-Growing Micro-LED Vertical

Consumer electronics secured around 70% market share in 2025, dominating due to widespread adoption in home devices. This leading vertical benefits from preferences for energy-efficient screens, with TVs and laptops driving volume. Positioning emphasizes user experience enhancements, such as burn-in resistance.

Automotive emerges as a fast-growing vertical, propelled by electric vehicle trends. Drivers include safety regulations requiring clear interfaces, with competitors integrating displays for heads-up systems. This positions the segment for strategic gains in connected mobility.

Regional Trends & Analysis

North America Emerges as Fast-Growing Hub for Smart Micro-LED Adoption

North America positions itself as a fast-growing/emerging region in the Micro-LED Displays Market, driven by smartphone penetration and smart home ecosystems. Major corporations invest in alliances for automotive integrations, enhancing product features. Rising demand for new electronics fuels this expansion, with the United States accounting for the bulk of consumption.

U.S. Micro-LED Displays Market – 2025 Snapshot & Outlook

Trends in the U.S. market emphasize energy-efficient screens for consumer applications. Drivers include the rapid adoption of smart appliances, supported by government energy standards from the Department of Energy. Margin advantages arise from tax incentives for R&D, positively impacting costs by up to 20%. A consumer survey by Consumer Reports indicates 65% prefer high-brightness displays for TVs. Retail shifts toward online platforms amplify demand.

Policies such as supportive tax credits bolster the U.S. industry, encouraging local manufacturing. Trends show integration in XR devices, with shipments rising 6% in 2025. Government initiatives promote innovation, yielding margin gains through efficiency.

Asia Pacific Dominates Global Micro-LED Market with Strong Manufacturing Base

Asia Pacific holds approximately 42% share in the Micro-LED Displays Market for 2025, leading through technical advancements and investments. Japan, South Korea, and China drive trends with production expansions in smartphones and TVs. Government subsidies in China, such as the Hubei project, enhance capacity. South Korea leaps in IT convergence, while India targets electronics growth via policies.

Japan Micro-LED Displays Market – 2025 Snapshot & Outlook

Japan's market trends toward automotive and consumer integrations, driven by precision engineering. Government investments in next-generation displays provide margin advantages through subsidies, impacting R&D costs favorably. Consumer trends lean toward high-resolution screens, with industry data showing 70% preference for energy-efficient tech. Retail shifts to e-commerce boost accessibility.

Policies in Japan support Micro-LED Displays industry via funding for OLED alternatives, yielding positive tax effects. Trends include transparent displays for AR, enhancing demand. Regulator surveys indicate 60% consumer adoption in wearables. This framework drives sustainable growth.

India Micro-LED Displays Market – 2025 Snapshot & Outlook

India's market trends focus on e-commerce and consumer electronics boom. Drivers encompass national policies targeting US$400 Bn electronics turnover by 2025, offering tax incentives that reduce costs by 15%. Consumer surveys from IBEF reveal 50% favoring premium displays. Retail transitions to digital platforms accelerate adoption.

Government initiatives propel India's industry, with supportive policies enhancing margins. Trends show AV integration in events. Regulator data highlights a sustainable CAGR in e-commerce, driving display needs.

Europe Advances Micro-LED Displays Through Sustainability and Automotive Innovation

Europe advances the Micro-LED Displays Market through emphasis on eco-friendly technologies and automotive applications. Germany leads in precision manufacturing, while the U.K. excels in photonics. Trends include regulatory pushes for energy efficiency, with France contributing via innovation hubs.

Germany Micro-LED Displays Market – 2025 Snapshot & Outlook

Germany's market trends toward automotive displays, driven by EU sustainability mandates. Government policies offer tax rebates, improving margins by 10%. Consumer trends favor efficient lighting, with association data showing 80% preference for LED tech. Retail shifts to integrated systems enhance demand.

Supportive frameworks in Germany boost via R&D grants. Trends include photonics resurgence. Regulator surveys indicate 70% adoption in vehicles.

U.K. Micro-LED Displays Market – 2025 Snapshot & Outlook

U.K. trends in market highlight photonics growth, driven by £18.5 Bn industry contribution. Policies provide tax incentives, aiding margins. Consumer preferences shift to high-productivity tech, with 101,000 GBP per employee. Government support accelerates the U.K. market, with trends in AR displays. Association data shows resurgence in markets.

Competitive Landscape

Players in the Micro-LED Displays Market focus on R&D investments to reduce production costs and improve yields. This strategy aims to achieve commercialization in the AR/VR and automotive sectors. One key event includes partnerships formed in May 2025 for scalable manufacturing, enhancing supply chains. Another involves CES 2025 launches, where firms demonstrated innovative applications, boosting visibility.

M&A activities and new regulations impact costs by consolidating resources and enforcing efficiency standards. Capacity expansions through fabs entering production in 2025 address demand surges. Early movers will benefit from first-mover advantages in consumer adoption, while latecomers may face intensified competition.

Key Companies

- VueReal

- Samsung Electronics Co. Ltd.

- eLux Inc.

- Glo AB

- Aledia

- Sony Corporation

- LG Display

- Apple Inc.

- PlayNitride Inc.

- Rohinni LLC

Recent Developments:

- June 2025, VueReal Inc. expanded its micro-LED innovation with new Reference Design Kits (RDKs) for automotive and consumer-electronics applications, debuting those bundles at Display Week 2025. The company also announced a partnership with ACA TMetrix in Canada to enhance access to its MicroSolid Printing™ platform. VueReal disclosed that its patent portfolio has surpassed 130 granted patents globally, reinforcing its fab-free micro-LED manufacturing strategy.

- January 2024, Samsung Electronics Co., Ltd. unveiled its 2024 Neo QLED, MICRO LED, OLED and Lifestyle display line-ups ahead of CES 2024, introducing the NQ8 AI Gen3 processor (with a neural-processing unit twice as fast, and eight-fold neural-network capacity) to spearhead its “AI screen era”. Samsung also highlighted a transparent MICRO LED display with a modular design, allowing size/shape flexibility. The line-up emphasised AI-powered picture and sound quality, connected experiences via Tizen OS and SmartThings, and accessible features for modern users.

- June 2025, the micro-LED market is entering a “make-or-break” phase as first pilot fabs and consumer products move into production in 2025. Leading market-research firms highlight 2025 as the turning point for commercialization of micro-LED displays, mapping full landscapes of fabs/pilot lines, supply-chains, key players, and forecasts for 2022-2032 across applications, wafers, and substrates.

Global Micro-LED Displays Market Segmentation-

By Product

- Micro Display

- Large scale Display

- Small and Medium-sized Display

By Application

- Smartphone and Tablet

- PC and Laptop

- TV

- Smartwatch

- Others

By Industry

- Consumer Electronics

- Entertainment and Sports

- Automotive

- Retail

- Government and Defence

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Micro-LED Displays Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Micro-LED Displays Market Outlook, 2019 - 2032

3.1. Global Micro-LED Displays Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Micro Display

3.1.1.2. Large scale Display

3.1.1.3. Small and Medium-sized Display

3.2. Global Micro-LED Displays Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Smartphone and Tablet

3.2.1.2. PC and Laptop

3.2.1.3. TV

3.2.1.4. Smartwatch

3.2.1.5. Others

3.3. Global Micro-LED Displays Market Outlook, by Industry Vertical, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Consumer Electronics

3.3.1.2. Entertainment and Sports

3.3.1.3. Automotive

3.3.1.4. Retail

3.3.1.5. Government and Defence

3.3.1.6. Others

3.4. Global Micro-LED Displays Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Micro-LED Displays Market Outlook, 2019 - 2032

4.1. North America Micro-LED Displays Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Micro Display

4.1.1.2. Large scale Display

4.1.1.3. Small and Medium-sized Display

4.2. North America Micro-LED Displays Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Smartphone and Tablet

4.2.1.2. PC and Laptop

4.2.1.3. TV

4.2.1.4. Smartwatch

4.2.1.5. Others

4.3. North America Micro-LED Displays Market Outlook, by Industry Vertical, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Consumer Electronics

4.3.1.2. Entertainment and Sports

4.3.1.3. Automotive

4.3.1.4. Retail

4.3.1.5. Government and Defense

4.3.1.6. Others

4.3.2. Market Attractiveness Analysis

4.4. North America Micro-LED Displays Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

4.4.1.2. U.S. Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

4.4.1.3. U.S. Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

4.4.1.4. Canada Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

4.4.1.5. Canada Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

4.4.1.6. Canada Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Micro-LED Displays Market Outlook, 2019 - 2032

5.1. Europe Micro-LED Displays Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Micro Display

5.1.1.2. Large scale Display

5.1.1.3. Small and Medium-sized Display

5.2. Europe Micro-LED Displays Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Smartphone and Tablet

5.2.1.2. PC and Laptop

5.2.1.3. TV

5.2.1.4. Smartwatch

5.2.1.5. Others

5.3. Europe Micro-LED Displays Market Outlook, by Industry Vertical, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Consumer Electronics

5.3.1.2. Entertainment and Sports

5.3.1.3. Automotive

5.3.1.4. Retail

5.3.1.5. Government and Defence

5.3.1.6. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Micro-LED Displays Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

5.4.1.2. Germany Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

5.4.1.3. Germany Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

5.4.1.4. U.K. Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

5.4.1.5. U.K. Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

5.4.1.6. U.K. Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

5.4.1.7. France Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

5.4.1.8. France Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

5.4.1.9. France Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

5.4.1.10. Italy Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

5.4.1.11. Italy Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

5.4.1.12. Italy Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

5.4.1.13. Spain Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

5.4.1.14. Spain Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

5.4.1.15. Spain Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

5.4.1.16. Russia Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

5.4.1.17. Russia Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

5.4.1.18. Russia Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

5.4.1.19. Rest of Europe Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

5.4.1.20. Rest of Europe Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

5.4.1.21. Rest of Europe Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Micro-LED Displays Market Outlook, 2019 - 2032

6.1. Asia Pacific Micro-LED Displays Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Micro Display

6.1.1.2. Large scale Display

6.1.1.3. Small and Medium-sized Display

6.2. Asia Pacific Micro-LED Displays Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Smartphone and Tablet

6.2.1.2. PC and Laptop

6.2.1.3. TV

6.2.1.4. Smartwatch

6.2.1.5. Others

6.3. Asia Pacific Micro-LED Displays Market Outlook, by Industry Vertical, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Consumer Electronics

6.3.1.2. Entertainment and Sports

6.3.1.3. Automotive

6.3.1.4. Retail

6.3.1.5. Government and Defense

6.3.1.6. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Micro-LED Displays Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

6.4.1.2. China Micro-LED Displays Market Application, Value (US$ Bn), 2019 - 2032

6.4.1.3. China Micro-LED Displays Market Industry Vertical, Value (US$ Bn), 2019 - 2032

6.4.1.4. Japan Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

6.4.1.5. Japan Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.6. Japan Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

6.4.1.7. South Korea Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

6.4.1.8. South Korea Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.9. South Korea Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

6.4.1.10. India Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

6.4.1.11. India Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.12. India Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

6.4.1.13. Southeast Asia Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

6.4.1.14. Southeast Asia Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.15. Southeast Asia Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Micro-LED Displays Market Outlook, 2019 - 2032

7.1. Latin America Micro-LED Displays Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Micro Display

7.1.1.2. Large scale Display

7.1.1.3. Small and Medium-sized Display

7.2. Latin America Micro-LED Displays Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Smartphone and Tablet

7.2.1.2. PC and Laptop

7.2.1.3. TV

7.2.1.4. Smartwatch

7.2.1.5. Others

7.3. Latin America Micro-LED Displays Market Outlook, by Industry Vertical, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Consumer Electronics

7.3.1.2. Entertainment and Sports

7.3.1.3. Automotive

7.3.1.4. Retail

7.3.1.5. Government and Defense

7.3.1.6. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Micro-LED Displays Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

7.4.1.2. Brazil Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

7.4.1.3. Brazil Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

7.4.1.4. Mexico Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

7.4.1.5. Mexico Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

7.4.1.6. Mexico Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

7.4.1.7. Rest of Latin America Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

7.4.1.8. Rest of Latin America Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

7.4.1.9. Rest of Latin America Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Micro-LED Displays Market Outlook, 2019 - 2032

8.1. Middle East & Africa Micro-LED Displays Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Micro Display

8.1.1.2. Large scale Display

8.1.1.3. Small and Medium-sized Display

8.2. Middle East & Africa Micro-LED Displays Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Smartphone and Tablet

8.2.1.2. PC and Laptop

8.2.1.3. TV

8.2.1.4. Smartwatch

8.2.1.5. Others

8.3. Middle East & Africa Micro-LED Displays Market Outlook, by Industry Vertical, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Consumer Electronics

8.3.1.2. Entertainment and Sports

8.3.1.3. Automotive

8.3.1.4. Retail

8.3.1.5. Government and Defense

8.3.1.6. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Micro-LED Displays Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

8.4.1.2. GCC Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

8.4.1.3. GCC Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

8.4.1.4. South Africa Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

8.4.1.5. South Africa Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

8.4.1.6. South Africa Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

8.4.1.7. Rest of Middle East & Africa Micro-LED Displays Market by Product Type, Value (US$ Bn), 2019 - 2032

8.4.1.8. Rest of Middle East & Africa Micro-LED Displays Market by Application, Value (US$ Bn), 2019 - 2032

8.4.1.9. Rest of Middle East & Africa Micro-LED Displays Market by Industry Vertical, Value (US$ Bn), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Application Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. VueReal

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Samsung Electronics Co. Ltd.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. eLux Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Glo AB

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Aledia

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Sony Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. LG Display

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Apple Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. PlayNitride Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Rohinni LLC

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion Volume: Tons |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

Industry Vertical Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Price Trend Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |