Global Network Switches Market Forecast

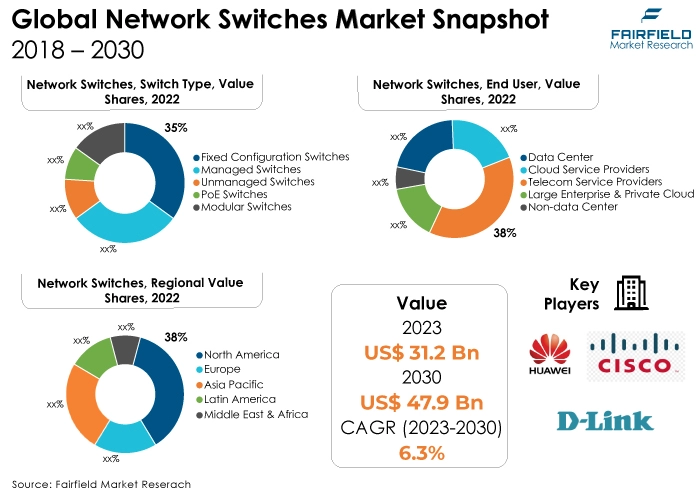

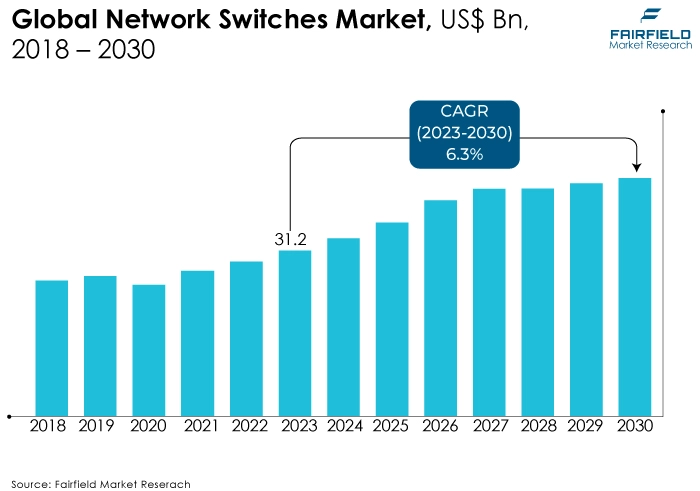

- The approximately US$31.2 Bn network switches market 2023 poised to reach US$47.9 Bn in 2030

- Network switches market revenue slated for a healthy CAGR of 6.3% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the network switches market. The increased need for data centres worldwide, the requirement for automated and streamlined networking communication management and automation, and rising investments in digital platforms are anticipated to drive the market for network switches.

- The number of data centres run by cloud service providers, government organisations, and telecommunications service providers is expected to rise, raising demand for network switches. Additionally, it is projected that the market will rise faster during the forecast period because of the increasing global need for efficient administration of telecom services and the growth in internet penetration.

- In 2022, the fixed configuration switches category dominated the industry. Fixed configuration switches offer ethernet switching solutions for various applications, including campus, midsize businesses, enterprise branch offices, and small and medium-sized businesses (SMBs). These switches also provide access security, sustainability, operations excellence, and improved work experience, which is the reason for the growth.

- In terms of market share for network switches globally, the 100 GBE segment is anticipated to dominate. The network switch market's shift to 100GbE as the most preferred network connection speed demonstrates the high customer acceptance of public cloud services.

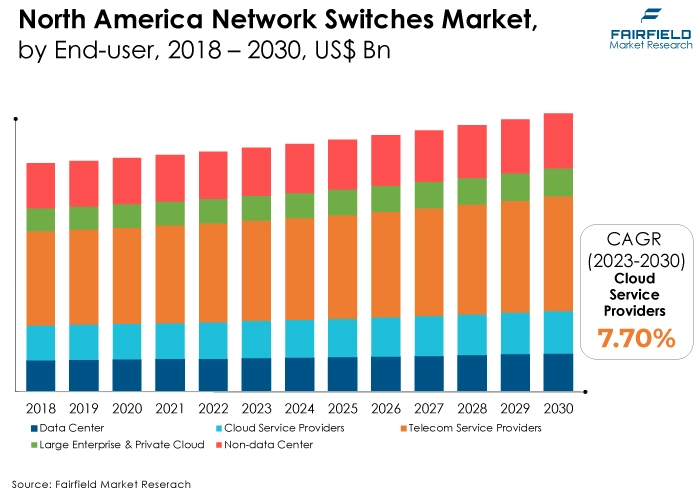

- In 2022, the telecom service providers category controlled the market. The increasing adoption of these switches may be attributed to their beneficial features by telecommunications carriers.

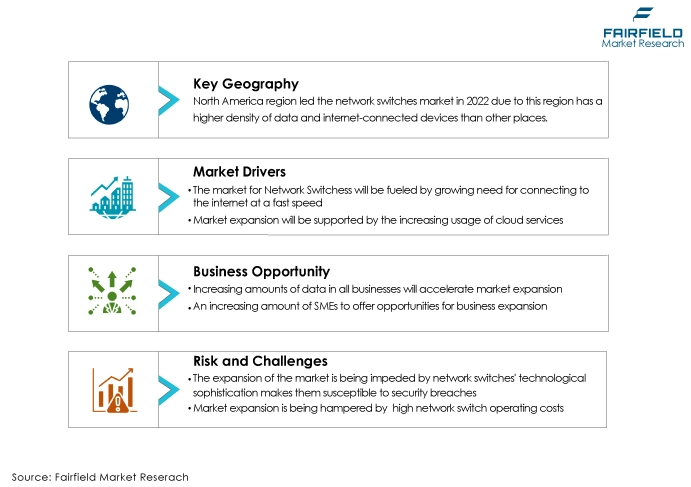

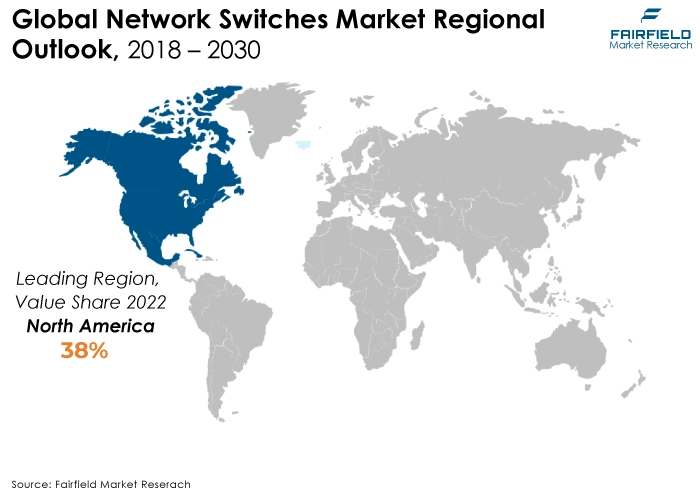

- The North American region is anticipated to account for the largest share of the global network switches market. This is due to the fact that this region has a higher density of data and internet-connected devices than other places. Apart from that, the region quickly absorbs new technologies. The market has also profited greatly from rising investments, another important aspect.

- The market for network switches is expanding in North America due to the growing government initiatives and investments from Asia Pacific's technologically advanced nations, such as China, Japan, and India, which are propelling the region's data centre deployments, which are anticipated to propel the market for network switches.

A Look Back and a Look Forward - Comparative Analysis

A network switch is the networking equipment used to connect multiple devices on a network. Expanding the usage of Ethernet-based operation for performance analysis, fault detection, and loopback testing increases network switch use. In addition, the network switch market is growing due to the increased requirement for effective management of telecom services.

The market witnessed staggered growth during the historical period 2018 - 2022. The market for network switches is expanding rapidly due to the increasing number of data centres run by government organisations, cloud-based solution providers, and telecom service providers. However, bandwidth fluctuations and device interoperability problems could limit the market growth for network switches. Additionally, the market for network switches has grown due to rising internet penetration and strict requirements for effective network administration.

The proliferation of IoT devices, cloud computing, and big data analytics has increased the need for robust network switches to handle the growing traffic. The advancement of software-defined networking (SDN), and virtualisation technologies also calls for deploying intelligent switches that adapt to these shifting topologies. The market for network switches is anticipated to develop due to this factor.

Key Growth Determinants

- Growing Need for Faster Internet Connection

The market for network switches is expanding due largely to the prevalence of high-speed Internet connectivity. As more data-intensive applications increase, there is an increasing need for additional bandwidth to accommodate the enormous amounts of data being transmitted between networks.

Additionally, to manage the increasing data traffic and guarantee low latency communication, the deployment of 5G networks necessitates the use of reliable, high-capacity network switches. More network switch products are available on the market due to the rising demand for them. One inexpensive switch that offers high-speed network access is the MGS-910X multigigabit ethernet switch from Planet, which has eight 10/100/1G/2.5GMbps ports and one 10GBASE-X SFP+ uplink port.

- Increasing Usage of Cloud Services

High levels of flexibility are required in cloud service systems to handle varying workloads and resource requirements. Network switches allow cloud providers to expand their networks vertically and horizontally. The market for network switches has grown considerably due to new product introductions and the increasing use of cloud services.

For example, Alibaba Cloud announced in November 2023 that Salesforce Sales Cloud, Service Cloud, and Salesforce Platform would be made available to the general public. These offerings are intended to assist businesses, especially multinational corporations, in meeting changing market demands, adhering to the most recent data residency laws and integrating with distinctive local app ecological systems.

- Rapid Advances in Technology

The spread of high-speed connectivity is anticipated to be driven by ongoing advancements in networking technology, including the creation of faster switches, software-defined networking (SDN), and intent-based networking (IBN). This enhances the general capabilities and performance of network switches. The business of network switches is supported by the tremendous demand for network switches brought forth by these technological breakthroughs.

Major Restraints

- Network Switches' Technological Sophistication Makes Them Susceptible to Security Breaches

The three most crucial components of every network are routers, switches, and firewalls, referred to as network infrastructure devices. They should be the most secure devices in terms of security. Still, because of their significance, administrators are rarely eager to upgrade them to ensure they don't unintentionally impact network uptime.

Businesses lose an average of 9% of their yearly income due to network misconfigurations. Research shows that 96% of organisations fail to audit their switches and routers, which leaves them vulnerable. The failure of some network experts to modify the routers' and switches' default configurations is one of the most prevalent security flaws in these devices. Security settings or administrator login credentials are examples of this.

- High Network Switch Operating Costs

Networking operations greatly benefit from the use of network switches. They never have to slow down since they can transfer massive volumes of data in milliseconds. Because of this, they are ideal for applications like video editors, cryptocurrency miners, and gamers who need high bandwidth and low latency. Network switches have a little high R&D expense.

When additional features like processors, memory, cabling, and connectors are added, the cost of the switch increases. The newest hardware from larger manufacturers like Broadcom and Intel often costs only $100 for tiny 5-port devices, while a 24-48 port switch can easily reach thousands of dollars.

Key Trends and Opportunities to Look at

- Increasing Amounts of Data in Businesses

Technology advancements, including edge computing, artificial intelligence, the Internet of Things, 5G, and machine learning applications, have drastically changed IT infrastructure. These technologies are used across various industrial verticals, including banking, manufacturing, retail, logistics, aviation, smart agriculture, healthcare & life sciences, and defense systems.

Furthermore, 5G's high-speed data transfer and ubiquitous internet coverage have expanded the client base and greatly boosted several industries. Applications and customer bases are expanding, which has resulted in a major increase in data volumes. Higher bandwidth transfers of these data volumes were required to servers and storage systems, necessitating sophisticated network switches.

- Increasing Amount of SMEs

The principles must also adapt to the changing times. Here, even small and medium-sized businesses (SMEs) are taking advantage of the internet's immense power and the great potential of collocation data hubs.

The Ethernet switch sector greatly benefits from the business changes implemented in SMEs. The number of SMEs is growing rapidly, far outweighing the business share held by the few major corporations in a given nation. Thus, the SME market's expansion has driven the consistent demand for ethernet switches.

- Constant Innovation in Technology

Technological innovations are occurring constantly. Artificial Intelligence (AI), machine learning, and the Internet of Things (IoT) are examples of complex new endeavors. The emergence of IoT, in particular, opens up a whole new realm for machine-to-machine (M2M) communication.

The market for integrated ethernet switches has much potential due to this M2M communication technology. The routers can create high-speed LANs, and Ethernet switches to function as internal servers for the company's computers and gadgets. This will significantly raise the facility's demand.

How Does the Regulatory Scenario Shape this Industry?

The market for network switches is dynamic and complicated, driven by regulations and technical improvements. Manufacturers and vendors must keep up with changing rules to guarantee product compliance and market access. They must also meet consumer concerns on sustainability, privacy, and security. Various international rules, including those pertaining to safety, pollution, and electromagnetic compatibility, apply to the network switches market.

Certain regional laws, such as cybersecurity and data privacy, may also apply. For instance, the Personal Data Protection Bill 2019 is being considered in India and may have effects on providers and makers of network equipment. Industry standards are essential to guarantee compatibility and interoperability among various network switches.

Fairfield’s Ranking Board

Top Segments

- Fixed Configuration Switches Category Continues to Dominate

The fixed configuration switches segment dominated the market in 2022. Managed, unmanaged, and PoE switches are examples of fixed-configuration switches. Fixed configuration switches offer ethernet switching solutions for various applications, including campus, midsize businesses, enterprise branch offices, and small and medium-sized businesses (SMBs). These switches also provide access security, sustainability, operations excellence, and improved work experience, which is the reason for the growth. The need for fixed configuration changes is largely fueled by these causes worldwide.

Furthermore, the PoE switches category is projected to experience the fastest market growth. One of the main factors driving the growth of the power over the Ethernet market is the spread of data centre and enterprise networking as well as power over automation. Users can save much money and effort on installation and maintenance when they utilise a PoE network switch instead of buying and installing extra electrical lines and outlets. These switches are, hence, economical. Consequently, there would be a big need for PoE switch adoption shortly.

- 100 GBE Segment to Surge Ahead

In 2022, the 100 GBE category dominated the industry. The network switch market's shift to 100GbE as the most preferred network connection speed demonstrates the high customer acceptance of public cloud services. Some of the biggest hyperscale cloud service provider data centre networks have made 100GbE the standard switch port speed for the past few years. 100 GbE networks began to be widely used as data centres transitioned away from 40 GbE and as the price of 100 GbE networking equipment declined.

The 200 GBE and 400 GBE category is anticipated to grow substantially throughout the projected period. Optimised and cost-effective switching solutions for both data centre and non-data centre applications are provided by the 200 GbE to 400 GbE network switches. Furthermore, in large-scale networks, reducing costs and boosting efficiency depend heavily on the switching speed between switches. These switching ports are engineered to deliver optimal performance in demanding storage and enterprise data centre environments.

- Telecom Service Providers at the Helm

The telecom service providers segment dominated the market in 2022. The increasing adoption of these switches may be attributed to their beneficial features by telecommunications carriers. Telecom companies also use these switches to manage services better and outperform competitors.

The cloud service providers category is expected to experience the fastest growth within the forecast time frame. Due to the anticipated expansion, businesses are gradually adopting cloud computing solutions to reduce infrastructure costs, enhance scalability, and streamline operations.

Regional Frontrunners

North America Continues to March Ahead

In order to boost the use of network switches in the industrial sector, several governments are investing in high-speed internet connectivity. They are concentrating on expanding their reach to rural residents. For instance, the USDA Secretary declared in February 2023 that the US Department of Agriculture had committed $63 million to give those who live and work in rural areas access to high-speed internet.

The Canadian government invested in the industrial sector's next-generation wireless technology innovation in April 2021. With the help of this financing, Redline will be able to build Industrial 5G, a 5G wireless solution that provides the speeds and bandwidth required to optimise the advantages of the Internet of Things. The project is valued at US$39.5 Mn.

Proliefartion of Data Centres to Bring in Profits to Asia Pacific

Growing government initiatives, and investments from Asia Pacific's technologically advanced nations, such as China, Japan, and India, are propelling the region's data centre deployments, which is anticipated to propel the market for network switches. The need for network switches is also fueled by the growth of small and medium-sized businesses and their integration of digital technology.

Furthermore, the demand for cloud-based services is driven by the region's growing internet penetration and number of internet users, which generate enormous amounts of data. The characteristics above need the installation of network switches throughout data centres' network infrastructure.

Fairfield’s Competitive Landscape Analysis

Several well-known players have a strong regional presence and substantial market domination in the worldwide network switches industry. These significant participants are committed to continuous R&D. They also actively participate in strategic growth activities like partnerships, joint ventures, product launches, and innovation. These companies want to gain a larger market share. Thus, they are trying to improve their standing in the market and grow their clientele.

Who are the Leaders in Global Network Switches Space?

- Huawei Technologies

- Arista Network

- D-Link Corporation

- NVIDIA Corporation

- Cisco Systems

- Linsys

- TP-Link

- Alcatel Lucent Enterprise

- NETGEAR

- HPE Aruba

- Juniper Networks

Significant Company Developments

New Product Launch

- January 2023: At ISC West 2023, TechLogix Networx announced the launching new networking solutions, including network switches. The TL-NS5R-POE, TL-NS5R1S-POE, TL-NS8R, and TL-NS8R2U POE unmanaged switches were among the new network switches.

- June 2022: High-performance 400GbE switches designed for demanding situations have been unveiled by HPE Aruba (US). A state-of-the-art 1U fixed configuration switch with a remarkable 12.8Tbps throughput is the Aruba CX 9300-32D. Its 32 400GbE ports can accommodate port breakouts at different speeds, including 25G, 100G, and 200 G. Thanks to its flexible and economical design, the switch enables dense and dependable 100/200/400GbE connectivity for servers, storage, and intra-fabric communication.

- March 2020: The pioneer of the networking business, TRENDnet, launches the first 2.5G switches globally and broadens its portfolio of high-performing multi-gigabit networking products. The 8-Port Unmanaged 2.5G Switch (TEG-S380) and the 5-Port Unmanaged 2.5G Switch (TEG-S350) are examples of TRENDnet's Multi-Gigabit Networking Systems.

An Expert’s Eye

Demand and Future Growth

An increase in consumer demand for food and beverages is driving the market. The growing need to connect to the internet quickly, the increasing usage of cloud services, and rapid technological advances increase the need for network switches. Furthermore, increasing amounts of data in all businesses, an increasing amount of SMEs, and constant innovation in the technology field will boost market growth soon. However, the technological sophistication of network switches makes them susceptible to security breaches, and high network switch operating costs limit the market.

Supply Side of the Market

According to our analysis, major data centre operators are expanding their footprints due to the acceleration of data centre growth and expansion brought about by the rise in cloud migration. The United States' customers consumed 500 megawatts (MW) of data space in 2021. Most of the absorption was propelled by hyperscalers, the biggest data centre occupants, consisting of cloud services companies like Microsoft, Google Cloud, and Amazon Web Services (AWS). For example, Google Cloud intended to construct new data centres in Texas, Nebraska, South Carolina, Virginia, and Nevada in 2019.

Similarly, Microsoft announced a bold ambition to construct 50-100 new data centres nationwide. The need for data centre network switches will increase due to these investments. In addition, the number of smart gadgets such as IoT-based devices, smart TVs, smartphones, driverless cars, and household appliances has increased. This increase is anticipated to accelerate the integration of chips into data centre servers, presenting profitable expansion prospects for the worldwide network switch industry.

Global Network Switches Market is Segmented as Below:

By Switch Type:

- Fixed Configuration Switches

- Managed Switches

- Unmanaged Switches

- PoE Switches

- Modular Switches

By Port Type:

- 10 MBE & 1 GBE

- 5 GBE & 5 GBE

- 10 GBE

- 25 GBE & 50 GBE

- 100 GBE

- 200 GBE & 400 GBE

By End User:

- Data Centre

- Cloud Service Providers

- Telecom Service Providers

- Large Enterprise & Private Cloud

- Non-data Centre

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Network Switches Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Network Switches Market Outlook, 2018 - 2030

3.1. Global Network Switches Market Outlook, by Switch Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Fixed Configuration Switches

3.1.1.2. Managed Switches

3.1.1.3. Unmanaged Switches

3.1.1.4. PoE Switches

3.1.1.5. Modular Switches

3.2. Global Network Switches Market Outlook, by Port Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. 10 MBE & 1 GBE

3.2.1.2. 2.5 GBE & 5 GBE

3.2.1.3. 10 GBE

3.2.1.4. 25 GBE & 50 GBE

3.2.1.5. 100 GBE

3.2.1.6. 200 GBE & 400 GBE

3.3. Global Network Switches Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Data Center

3.3.1.2. Cloud Service Providers

3.3.1.3. Telecom Service Providers

3.3.1.4. Large Enterprise & Private Cloud

3.3.1.5. Non-data Center

3.4. Global Network Switches Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Network Switches Market Outlook, 2018 - 2030

4.1. North America Network Switches Market Outlook, by Switch Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Fixed Configuration Switches

4.1.1.2. Managed Switches

4.1.1.3. Unmanaged Switches

4.1.1.4. PoE Switches

4.1.1.5. Modular Switches

4.2. North America Network Switches Market Outlook, by Port Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. 10 MBE & 1 GBE

4.2.1.2. 2.5 GBE & 5 GBE

4.2.1.3. 10 GBE

4.2.1.4. 25 GBE & 50 GBE

4.2.1.5. 100 GBE

4.2.1.6. 200 GBE & 400 GBE

4.3. North America Network Switches Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Data Center

4.3.1.2. Cloud Service Providers

4.3.1.3. Telecom Service Providers

4.3.1.4. Large Enterprise & Private Cloud

4.3.1.5. Non-data Center

4.4. North America Network Switches Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Network Switches Market End User, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Network Switches Market End User, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Network Switches Market Outlook, 2018 - 2030

5.1. Europe Network Switches Market Outlook, by Switch Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Fixed Configuration Switches

5.1.1.2. Managed Switches

5.1.1.3. Unmanaged Switches

5.1.1.4. PoE Switches

5.1.1.5. Modular Switches

5.2. Europe Network Switches Market Outlook, by Port Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. 10 MBE & 1 GBE

5.2.1.2. 2.5 GBE & 5 GBE

5.2.1.3. 10 GBE

5.2.1.4. 25 GBE & 50 GBE

5.2.1.5. 100 GBE

5.2.1.6. 200 GBE & 400 GBE

5.3. Europe Network Switches Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Data Center

5.3.1.2. Cloud Service Providers

5.3.1.3. Telecom Service Providers

5.3.1.4. Large Enterprise & Private Cloud

5.3.1.5. Non-data Center

5.4. Europe Network Switches Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Network Switches Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Network Switches Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Network Switches Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Network Switches Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Network Switches Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Network Switches Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Network Switches Market End User, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Network Switches Market Outlook, 2018 - 2030

6.1. Asia Pacific Network Switches Market Outlook, by Switch Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Fixed Configuration Switches

6.1.1.2. Managed Switches

6.1.1.3. Unmanaged Switches

6.1.1.4. PoE Switches

6.1.1.5. Modular Switches

6.2. Asia Pacific Network Switches Market Outlook, by Port Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. 10 MBE & 1 GBE

6.2.1.2. 2.5 GBE & 5 GBE

6.2.1.3. 10 GBE

6.2.1.4. 25 GBE & 50 GBE

6.2.1.5. 100 GBE

6.2.1.6. 200 GBE & 400 GBE

6.3. Asia Pacific Network Switches Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Data Center

6.3.1.2. Cloud Service Providers

6.3.1.3. Telecom Service Providers

6.3.1.4. Large Enterprise & Private Cloud

6.3.1.5. Non-data Center

6.4. Asia Pacific Network Switches Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Network Switches Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Network Switches Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Network Switches Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Network Switches Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Network Switches Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Network Switches Market End User, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Network Switches Market Outlook, 2018 - 2030

7.1. Latin America Network Switches Market Outlook, by Switch Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Fixed Configuration Switches

7.1.1.2. Managed Switches

7.1.1.3. Unmanaged Switches

7.1.1.4. PoE Switches

7.1.1.5. Modular Switches

7.2. Latin America Network Switches Market Outlook, by Port Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. 10 MBE & 1 GBE

7.2.1.2. 2.5 GBE & 5 GBE

7.2.1.3. 10 GBE

7.2.1.4. 25 GBE & 50 GBE

7.2.1.5. 100 GBE

7.2.1.6. 200 GBE & 400 GBE

7.3. Latin America Network Switches Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Data Center

7.3.1.2. Cloud Service Providers

7.3.1.3. Telecom Service Providers

7.3.1.4. Large Enterprise & Private Cloud

7.3.1.5. Non-data Center

7.4. Latin America Network Switches Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Network Switches Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Network Switches Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Network Switches Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Network Switches Market End User, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Network Switches Market Outlook, 2018 - 2030

8.1. Middle East & Africa Network Switches Market Outlook, by Switch Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Fixed Configuration Switches

8.1.1.2. Managed Switches

8.1.1.3. Unmanaged Switches

8.1.1.4. PoE Switches

8.1.1.5. Modular Switches

8.2. Middle East & Africa Network Switches Market Outlook, by Port Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. 10 MBE & 1 GBE

8.2.1.2. 2.5 GBE & 5 GBE

8.2.1.3. 10 GBE

8.2.1.4. 25 GBE & 50 GBE

8.2.1.5. 100 GBE

8.2.1.6. 200 GBE & 400 GBE

8.3. Middle East & Africa Network Switches Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Data Center

8.3.1.2. Cloud Service Providers

8.3.1.3. Telecom Service Providers

8.3.1.4. Large Enterprise & Private Cloud

8.3.1.5. Non-data Center

8.4. Middle East & Africa Network Switches Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Network Switches Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Network Switches Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Network Switches Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Network Switches Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Network Switches Market by Switch Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Network Switches Market Port Type, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Network Switches Market End User, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Huawei Technologies

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Arista Network

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. D-Link Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. NVIDIA Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Cisco Systems

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Linsys

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. TP Link

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Alcatel Lucent Enterprise

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. NETGEAR

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. HPE Aruba

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Juniper Networks

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Switch Type Coverage |

|

|

Port Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |