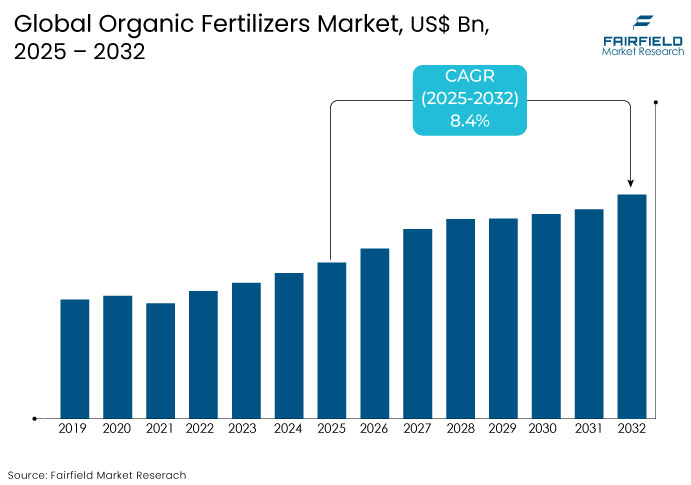

Global Organic Fertilizers Market Forecast

- The Organic Fertilizers Market is valued at USD 7.5 Bn in 2026 and is projected to reach USD 13.2 Bn, growing at a CAGR of 8% by 2033.

Organic Fertilizers Market Insights

- Organic farming expands across 72.3 million hectares in 187 countries, boosting demand for sustainable agricultural solutions.

- Australia, Argentina, and Spain drive organic farming momentum, increasing the need for organic fertilizers to enhance soil health and crop yields.

- Organic food and beverage sales exceeded 106 billion euros in 2019, reflecting strong market potential.

- Global agricultural areas increasingly adopt organic practices in livestock, beekeeping, and aquaculture, fueling demand for eco-friendly farming inputs.

- India cultivates organic crops on 2.30 million hectares, with Madhya Pradesh leading at 0.76 million hectares, representing 27% of India’s total organic farming area.

- The top 10 Indian states account for about 80% of the country's organic farming area, strengthening market opportunities for organic inputs.

A Look Back and a Look Forward - Comparative Analysis

The organic farming sector has seen consistent growth, with over 72.3 million hectares dedicated to organic practices across 187 countries. Countries such as Australia, Argentina, and Spain have been at the forefront, increasing demand for sustainable farming solutions to enhance soil health and boost crop yields. In India, states such as Madhya Pradesh have significantly contributed to the growth in organic farming, accounting for a substantial portion of the country's total organic cultivation. The organic food market, valued at over 106 billion euros in 2019, highlighted the rising demand for chemical-free produce.

The future for sustainable farming inputs looks bright, as consumers continue to favor natural, eco-friendly food products. Innovations in plant-based solutions, integrated pest management, and soil health practices will play a pivotal role in market expansion. Governments around the world are increasingly supporting sustainable agriculture, creating policies and incentives that foster growth. With the global rise in organic farming and an emphasis on environmental sustainability, the market for eco-friendly agricultural solutions will continue to grow.

Key Growth Determinants

- Rising Demand for healthier, chemical-free food options drives market growth

The increasing consumer demand for healthier and chemical-free food options is one of the key drivers of growth in the organic fertilizer market. As more consumers shift toward organic produce, they drive agricultural sectors to adopt more sustainable and eco-friendly farming practices. This change has been especially amplified in the post-COVID-19 pandemic, highlighting the awareness of harmful effects of chemicals used in conventional farming. The demand for organic food is rising globally leading to a significant push for farming methods that helps maintain soil health and produce food without using harmful chemicals. As a result, there is a growing reliance on fertilizers that enhances soil vitality while keeping environmental sustainability intact.

In countries such as India, where over 2.3 million hectares of land is dedicated to organic farming the shift toward healthier food is particularly evident. As the demand for organic products continues to surge there is an increased need for solutions that promote sustainable agriculture.

The rising adoption of organic farming in India, driven by consumer preferences and ecological awareness is expected to increase the market demand for fertilizers that help maintain soil health. The need for these sustainable farming inputs driven by consumer trends is likely to grow as organic food consumption increases further fueling the market.

Key Growth Barriers

- Limited adoption of sustainable agriculture practices poses challenges

Despite the growing awareness about the benefits of sustainable farming, the adoption of such practices remains limited, presenting a significant restraint to the market. While organic farming has garnered attention in many regions only a small percentage of the land is dedicated to it. Many farmers hesitate to transition due to challenges such as high labor intensity, a lack of mechanization, and insufficient financial resources.

The difficulty in shifting away from conventional farming practices makes it hard to increase the demand for fertilizers designed for organic methods. As a result, the market faces constraints in expanding to its full potential, particularly in regions where farming methods have been deeply rooted in traditional practices.

In India, while the central government has introduced policies to promote organic farming, such as the Paramparagat Krishi Vikas Yojana (PKVY), the actual implementation remains slow.

Financial constraints and the lack of strong incentives for farmers to switch to organic methods hinder the progress. This limited adoption of sustainable agriculture practices reduces the overall demand for organic farming inputs. Despite the growing awareness of environmental and health benefits, the market faces challenges in expanding its reach and achieving widespread adoption.

Market Opportunity

- Government investment in sustainable agriculture opens new opportunities

Governments worldwide are increasingly recognizing the need to support sustainable farming practices, which presents a significant opportunity for the market. In India, government initiatives such as the PM-PRANAM program and subsidies for organic farming offer financial support and capacity building for farmers. With more governments focusing on sustainable agriculture and offering incentives for eco-friendly practices, the demand for alternative farming inputs is expected to rise.

These efforts are designed to help farmers transition to organic farming methods by easing the financial burden and providing access to resources that make the switch easier. As more governments prioritize sustainable agriculture, it will further boost the demand for fertilizers that align with these green initiatives.

In Europe, the growing interest in organic products, including wine and olive oil is influencing the farming industry for sustainable inputs. As demand for high-quality organic goods increase governments are adapting their policies to ensure that farmers have access to the necessary inputs to meet the standards.

Countries such as France and Italy have ramped up their consumption of organic products, driving a need for fertilizers that promote organic farming and sustainability. The government support for sustainable agriculture offers ripe opportunity for companies to expand their reach in the organic farming sector catering to the growing demand for eco-friendly agricultural solutions.

Market Trend

- Shift toward high-value processed organic products creates demand for sustainable inputs

A significant trend influencing the organic farming sector is the shift toward high-value processed organic products. Consumers increasingly seek premium organic products, such as organic wine and olive oil, which require high-quality crops and specialized farming practices to meet market standards.

As demand for processed organic goods rises, farmers must adopt methods that ensure high yields and high-quality produce, thus driving the need for fertilizers that maintain soil health and support crop productivity. This trend reflects a broader consumer preference for high-quality, environmentally sustainable products, which is reshaping farming practices and creating demand for advanced farming inputs.

The European Union, in particular, has witnessed a surge in the demand for organic olive oil and other processed products. To meet these growing consumer preferences, farmers need to adopt practices that ensure higher yields and better-quality crops, driving the demand for fertilizers that can enhance soil health and crop quality.

The increasing interest in high-value processed organic products indicates a growing need for farming practices that go beyond basic organic standards, further elevating the role of sustainable inputs in ensuring product quality. This trend highlights the critical role that fertilizers play in supporting the market growth for premium organic goods.

Segments Covered in the Report

- Agriculture sector's growth fueled by expansion of organic farming

The agriculture sector is set to dominate driven by the rapid global expansion of organic farming. Over 96.4 million hectares of land are now dedicated to organic cultivation, marking a 26.6% increase since 2021.

Countries like Australia and India have been key contributors, adding 17.3 million hectares and 2.1 million hectares, respectively. As the demand for chemical-free food continues to rise, more regions are adopting organic farming practices, creating a significant need for sustainable agricultural inputs. Government policies and subsidies have further accelerated this growth, making organic farming more accessible to farmers.

As this shift towards sustainable farming practices gains momentum, the demand for natural, chemical-free solutions will continue to drive market growth.

- Plant-based fertilizers rise as the preferred sustainable input

The plant-based segment is experiencing significant growth, expected to hold a dominant share of 45.5% in 2024. This increase is driven by a growing preference among consumers and farmers for sustainable agricultural inputs that prioritize eco-friendly practices. Plant-based solutions have become popular for their ability to enhance soil health and support sustainable farming, without relying on synthetic chemicals.

With consumers increasingly seeking chemical-free produce, there has been a notable shift towards plant-derived agricultural solutions. As a result, the plant-based segment is positioned as a key driver of market growth, making it central to the future of agricultural sustainability.

Regional Analysis

- Expanding organic farming and policy support in Europe

The European organic fertilizer sector has contributed 28.1% to the global market in 2024. In 2022, the total area under organic production increased to 16.9 million hectares, with 419,112 producers. Despite production growth, the EU's organic retail market declined by 3%, reaching 45.1 billion EUR. This indicates a disconnect between production and retail growth.

To bridge this gap, the European Commission's Farm to Fork Strategy and the Organic Action Plan 2021-2027 aim to strengthen the demand and supply of organic products. The EU's target to have 25% of agricultural land under organic farming by 2030 is expected to drive further growth in the sector.

In Germany, organic farming shows a slight dip in growth, with 36,680 farms operating according to organic standards as of the end of 2023, covering 1.89 million hectares. While the share of organic farmland reached 11.4% of the total agricultural area, the number of organic farms fell by 232, marking the first decrease in 30 years. The increase in organically farmed land in 2023 was modest at 1.6%, reflecting a slower pace in the region's transition.

Despite these challenges, the focus remains on strengthening the market with national strategies aimed at enhancing sustainability and meeting the broader EU targets for organic farming expansion.

- North America's robust organic agriculture market growth drives global sustainability trends

North America is commanded by a dominant 32.5% share of the global organic fertilizer market, with significant expansions in organic farmland and related sectors.

Over 3.5 million hectares of organic land were managed in 2022, with the U.S. leading at 2,060,741 hectares, while Canada contributed over 1.5 million hectares, showing a remarkable 23% growth in its organic farmland. A slight decline in organic acreage was seen in the U.S., but the overall trend continues to be reflected in a commitment to sustainable farming practices.

Despite organic farmland, still representing only 0.8% of the continent's agricultural land, resilience in the sector is maintained, driven by increasing consumer demand for organic products.

The organic food and beverage market in Canada reached US$7.943 billion in 2024. A surge in exports was experienced by these countries with the U.S. expanding its global presence despite challenges such as Brexit and the Russia-Ukraine war. This steady demand continues to drive the region's organic market including the use of organic fertilizers, establishing it as a key player in the global sustainable farming landscape.

Competitive Landscape

The organic fertilizers market is fragmented with major players such as IFFCO, Yara, The Scotts Company LLC, and Coromandel International leading growth through innovations and strategic expansions. IFFCO introduced Nano DAP Liquid Fertilizer, supporting sustainable farming, while Coromandel expanded its operations with a new Nano Fertilizer plant and launched products targeting improved agricultural practices. Yara strengthened its presence by acquiring Ecolan Oy and Agribios Italiana, focusing on enhancing nutrient efficiency and regenerative farming.

Companies actively respond to the increasing demand for sustainable solutions through advanced technologies and strategic partnerships. Yara collaborated with PepsiCo Europe to reduce carbon emissions in the food value chain, and Syngenta Group China reported significant growth in microbial fertilizer sales, enhancing crop yields and soil health. Manufacturers like ICL, Multiplex Group of Companies, and Fertoz continue to advance their product lines to meet growing consumer demand. The industry remains competitive, with both large corporations and smaller innovators shaping market dynamics, especially in key regions such as Europe and Asia.

Key Companies

- IFFCO

- Yara

- The Scotts Company LLC

- Southern Petrochemical Industries Corporation Ltd (SPIC)

- Multiplex Group Of Companies

- uståne Natural Fertilizer, Inc.

- ICL

- Coromandel International Limited

- T.Stanes and Company Limited

- TerraLink Horticulture Inc.

- Queensland Organics

- K+S Aktiengesellschaft

- Darling Ingredients

- Fertoz

- Midwestern Bio Ag Holdings, LLC

- California Organic Fertilizers, Inc.

Recent Industry Developments

- In May 2024 ,Air Liquide has adopted a sustainability charter in collaboration with WWF France to advance sustainable biomethane production. By leveraging anaerobic digestion of organic waste, it aims to produce biomethane and biogenic CO2, along with organic fertilizers. The company plans to quadruple biogas production by 2030, reinforcing its commitment to renewable energy, agroecological methods, and reduced reliance on chemical fertilizers.

- In July 2023, the Indian Council of Agricultural Research (ICAR) introduced advanced composting technologies, including phosphor-nitro and phosphor-sulpho compost, to enhance organic fertilizer production. These innovations, along with bio-fertilizers like Zinc and Potassium Solubilizing Bio-fertilizers, have been shown to boost crop yields by 10-25% while reducing chemical fertilizer use. Government initiatives such as PKVY and MOVCDNER further support organic farming across India.

Expert Opinion

- Health-conscious consumers are increasingly opting for organic food, leading to a surge in demand for organic farming inputs.

- Growing awareness about the detrimental effects of synthetic fertilizers on the environment is prompting a shift towards eco-friendly agricultural practices.

- Government initiatives, such as subsidies and incentives, are encouraging farmers to adopt sustainable farming methods, thereby boosting the organic fertilizer sector.

- Innovations in organic fertilizer formulations and application techniques are enhancing their effectiveness and appeal to farmers.

- Emphasis on sustainable agriculture practices is leading to increased use of organic inputs to improve soil fertility.

- Organic farming has shown higher profitability compared to conventional methods, incentivizing farmers to adopt organic practices and inputs.

Global Organic Fertilizers Market is Segmented as-

By Source

- Animal-Based

- Plant-Based

- Mineral-Based

By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Turf and Ornamentals

By Form

- Granules

- Powder

- Liquid

By End-use

- Agriculture

- Horticulture

- Residential and Gardens

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

- Executive Summary

- Global Organic Fertilizers Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Organic Fertilizers Market Outlook, 2020 - 2033

- Global Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Animal-Based

- Plant-Based

- Mineral-Based

- Global Organic Fertilizers Market Outlook, by Crop Type, Value (US$ Bn), 2020-2033

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Turf and Ornamentals

- Global Organic Fertilizers Market Outlook, by Form, Value (US$ Bn), 2020-2033

- Granules

- Powder

- Liquid

- Global Organic Fertilizers Market Outlook, by End-use, Value (US$ Bn), 2020-2033

- Agriculture

- Horticulture

- Residential and Gardens

- Global Organic Fertilizers Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- North America Organic Fertilizers Market Outlook, 2020 - 2033

- North America Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Animal-Based

- Plant-Based

- Mineral-Based

- North America Organic Fertilizers Market Outlook, by Crop Type, Value (US$ Bn), 2020-2033

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Turf and Ornamentals

- North America Organic Fertilizers Market Outlook, by Form, Value (US$ Bn), 2020-2033

- Granules

- Powder

- Liquid

- North America Organic Fertilizers Market Outlook, by End-use, Value (US$ Bn), 2020-2033

- Agriculture

- Horticulture

- Residential and Gardens

- North America Organic Fertilizers Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Organic Fertilizers Market Outlook, by Source, 2020-2033

- S. Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- S. Organic Fertilizers Market Outlook, by Form, 2020-2033

- S. Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Canada Organic Fertilizers Market Outlook, by Source, 2020-2033

- Canada Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Canada Organic Fertilizers Market Outlook, by Form, 2020-2033

- Canada Organic Fertilizers Market Outlook, by End-use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Europe Organic Fertilizers Market Outlook, 2020 - 2033

- Europe Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Animal-Based

- Plant-Based

- Mineral-Based

- Europe Organic Fertilizers Market Outlook, by Crop Type, Value (US$ Bn), 2020-2033

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Turf and Ornamentals

- Europe Organic Fertilizers Market Outlook, by Form, Value (US$ Bn), 2020-2033

- Granules

- Powder

- Liquid

- Europe Organic Fertilizers Market Outlook, by End-use, Value (US$ Bn), 2020-2033

- Agriculture

- Horticulture

- Residential and Gardens

- Europe Organic Fertilizers Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Organic Fertilizers Market Outlook, by Source, 2020-2033

- Germany Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Germany Organic Fertilizers Market Outlook, by Form, 2020-2033

- Germany Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Italy Organic Fertilizers Market Outlook, by Source, 2020-2033

- Italy Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Italy Organic Fertilizers Market Outlook, by Form, 2020-2033

- Italy Organic Fertilizers Market Outlook, by End-use, 2020-2033

- France Organic Fertilizers Market Outlook, by Source, 2020-2033

- France Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- France Organic Fertilizers Market Outlook, by Form, 2020-2033

- France Organic Fertilizers Market Outlook, by End-use, 2020-2033

- K. Organic Fertilizers Market Outlook, by Source, 2020-2033

- K. Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- K. Organic Fertilizers Market Outlook, by Form, 2020-2033

- K. Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Spain Organic Fertilizers Market Outlook, by Source, 2020-2033

- Spain Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Spain Organic Fertilizers Market Outlook, by Form, 2020-2033

- Spain Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Russia Organic Fertilizers Market Outlook, by Source, 2020-2033

- Russia Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Russia Organic Fertilizers Market Outlook, by Form, 2020-2033

- Russia Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Rest of Europe Organic Fertilizers Market Outlook, by Source, 2020-2033

- Rest of Europe Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Rest of Europe Organic Fertilizers Market Outlook, by Form, 2020-2033

- Rest of Europe Organic Fertilizers Market Outlook, by End-use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Asia Pacific Organic Fertilizers Market Outlook, 2020 - 2033

- Asia Pacific Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Animal-Based

- Plant-Based

- Mineral-Based

- Asia Pacific Organic Fertilizers Market Outlook, by Crop Type, Value (US$ Bn), 2020-2033

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Turf and Ornamentals

- Asia Pacific Organic Fertilizers Market Outlook, by Form, Value (US$ Bn), 2020-2033

- Granules

- Powder

- Liquid

- Asia Pacific Organic Fertilizers Market Outlook, by End-use, Value (US$ Bn), 2020-2033

- Agriculture

- Horticulture

- Residential and Gardens

- Asia Pacific Organic Fertilizers Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Organic Fertilizers Market Outlook, by Source, 2020-2033

- China Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- China Organic Fertilizers Market Outlook, by Form, 2020-2033

- China Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Japan Organic Fertilizers Market Outlook, by Source, 2020-2033

- Japan Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Japan Organic Fertilizers Market Outlook, by Form, 2020-2033

- Japan Organic Fertilizers Market Outlook, by End-use, 2020-2033

- South Korea Organic Fertilizers Market Outlook, by Source, 2020-2033

- South Korea Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- South Korea Organic Fertilizers Market Outlook, by Form, 2020-2033

- South Korea Organic Fertilizers Market Outlook, by End-use, 2020-2033

- India Organic Fertilizers Market Outlook, by Source, 2020-2033

- India Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- India Organic Fertilizers Market Outlook, by Form, 2020-2033

- India Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Southeast Asia Organic Fertilizers Market Outlook, by Source, 2020-2033

- Southeast Asia Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Southeast Asia Organic Fertilizers Market Outlook, by Form, 2020-2033

- Southeast Asia Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Rest of SAO Organic Fertilizers Market Outlook, by Source, 2020-2033

- Rest of SAO Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Rest of SAO Organic Fertilizers Market Outlook, by Form, 2020-2033

- Rest of SAO Organic Fertilizers Market Outlook, by End-use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Latin America Organic Fertilizers Market Outlook, 2020 - 2033

- Latin America Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Animal-Based

- Plant-Based

- Mineral-Based

- Latin America Organic Fertilizers Market Outlook, by Crop Type, Value (US$ Bn), 2020-2033

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Turf and Ornamentals

- Latin America Organic Fertilizers Market Outlook, by Form, Value (US$ Bn), 2020-2033

- Granules

- Powder

- Liquid

- Latin America Organic Fertilizers Market Outlook, by End-use, Value (US$ Bn), 2020-2033

- Agriculture

- Horticulture

- Residential and Gardens

- Latin America Organic Fertilizers Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Organic Fertilizers Market Outlook, by Source, 2020-2033

- Brazil Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Brazil Organic Fertilizers Market Outlook, by Form, 2020-2033

- Brazil Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Mexico Organic Fertilizers Market Outlook, by Source, 2020-2033

- Mexico Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Mexico Organic Fertilizers Market Outlook, by Form, 2020-2033

- Mexico Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Argentina Organic Fertilizers Market Outlook, by Source, 2020-2033

- Argentina Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Argentina Organic Fertilizers Market Outlook, by Form, 2020-2033

- Argentina Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Rest of LATAM Organic Fertilizers Market Outlook, by Source, 2020-2033

- Rest of LATAM Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Rest of LATAM Organic Fertilizers Market Outlook, by Form, 2020-2033

- Rest of LATAM Organic Fertilizers Market Outlook, by End-use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Middle East & Africa Organic Fertilizers Market Outlook, 2020 - 2033

- Middle East & Africa Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Animal-Based

- Plant-Based

- Mineral-Based

- Middle East & Africa Organic Fertilizers Market Outlook, by Crop Type, Value (US$ Bn), 2020-2033

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Turf and Ornamentals

- Middle East & Africa Organic Fertilizers Market Outlook, by Form, Value (US$ Bn), 2020-2033

- Granules

- Powder

- Liquid

- Middle East & Africa Organic Fertilizers Market Outlook, by End-use, Value (US$ Bn), 2020-2033

- Agriculture

- Horticulture

- Residential and Gardens

- Middle East & Africa Organic Fertilizers Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Organic Fertilizers Market Outlook, by Source, 2020-2033

- GCC Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- GCC Organic Fertilizers Market Outlook, by Form, 2020-2033

- GCC Organic Fertilizers Market Outlook, by End-use, 2020-2033

- South Africa Organic Fertilizers Market Outlook, by Source, 2020-2033

- South Africa Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- South Africa Organic Fertilizers Market Outlook, by Form, 2020-2033

- South Africa Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Egypt Organic Fertilizers Market Outlook, by Source, 2020-2033

- Egypt Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Egypt Organic Fertilizers Market Outlook, by Form, 2020-2033

- Egypt Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Nigeria Organic Fertilizers Market Outlook, by Source, 2020-2033

- Nigeria Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Nigeria Organic Fertilizers Market Outlook, by Form, 2020-2033

- Nigeria Organic Fertilizers Market Outlook, by End-use, 2020-2033

- Rest of Middle East Organic Fertilizers Market Outlook, by Source, 2020-2033

- Rest of Middle East Organic Fertilizers Market Outlook, by Crop Type, 2020-2033

- Rest of Middle East Organic Fertilizers Market Outlook, by Form, 2020-2033

- Rest of Middle East Organic Fertilizers Market Outlook, by End-use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Organic Fertilizers Market Outlook, by Source, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- IFFCO

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Yara

- The Scotts Company LLC

- Southern Petrochemical Industries Corporation Ltd (SPIC)

- Multiplex Group Of Companies

- ICL

- Coromandel International Limited

- TerraLink Horticulture Inc.

- Queensland Organics

- Darling Ingredients

- IFFCO

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Source Coverage |

|

|

Crop Type Coverage |

|

|

Form Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |