Global Payment Security Market Forecast

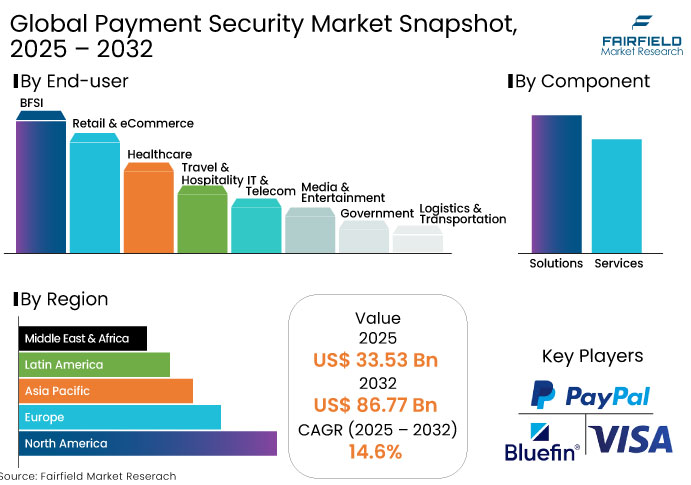

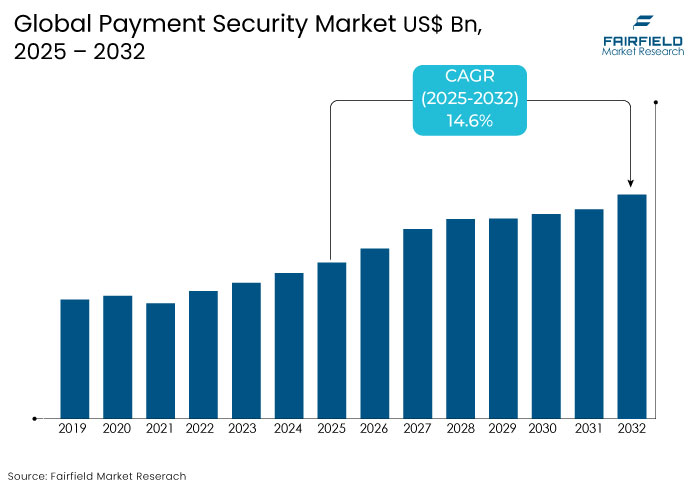

- The global payment security market size is expected to reach a market size of US$ 86.77 Bn by 2032 from its current market size of US$ 33.53 Bn in 2025, resembling strong growth with 14.6% CAGR by 2032.

- The payment security market is anticipated to benefit from strong demand due to increasing concerns over cybersecurity and digital transaction fraud.

Payment Security Market Insights

- The shift towards contactless, online, and mobile payments accelerates the need for robust security mechanisms to ensure safe transactions.

- The expansion of cross-border payments creates the need for enhanced security protocols to handle international transactions safely.

- The fraud detection & prevention segment is projected to account for over 30% of market revenue in 2025, driven by the increasing demand for advanced technologies to combat rising cyber threats and secure digital transactions.

- Asia Pacific is expected to witness the highest growth rate due to rapid digital transformation, increasing mobile payment adoption, and a rising demand for secure online transactions.

- The adoption of alternative payment methods such as cryptocurrencies and QR code-based payments adds complexity to payment security, creating new opportunities for solutions.

- AI and ML are being utilized to identify suspicious patterns, enhance fraud detection, and improve the accuracy of security systems in payment processing.

- Growing concerns about cyberattacks and data breaches drives demand for secure payment systems to protect sensitive financial data.

A Look Back and a Look Forward-Comparative Analysis

The historical growth of the payment security market has been primarily driven by the rapid expansion of e-commerce and the increasing demand for digital payment solutions. As online shopping, mobile wallets, and peer-to-peer (P2P) payments gained popularity, businesses faced heightened pressure to protect customer data and financial transactions. The rise in data breaches, cyberattacks, and identity theft incidents further emphasizes the need for robust payment security. Consequently, the demand for secure, seamless payment solutions surged as consumer behavior increasingly shifted toward online and mobile platforms.

Looking ahead, the payment security market is expected to experience robust year-over-year growth due to the increasing adoption of advanced technologies such as blockchain, biometrics, and quantum computing. Blockchain has revolutionized payment security by offering decentralized, transparent, and tamper-proof transaction records reducing fraud and data breaches. The integration of biometrics, such as facial recognition and fingerprint scanning, enhances user authentication, making transactions more secure and seamless. These advancements are expected to fuel continued market expansion.

Key Growth Determinants

- E-Commerce and digital payments expand attack surface, driving payment security needs

The rapid adoption of e-commerce, digital banking, and mobile payments has significantly amplified exposure to cyber risks, driving the demand for advanced payment security solutions worldwide. Hackers exploit vulnerabilities across software, networks, and point-of-sale (POS) devices, while fraudsters leverage phishing, identity theft, and account takeovers to steal sensitive financial information. The rapid adoption of digital payment modes such as mobile wallets, contactless cards, buy-now-pay-later platforms, and cryptocurrencies has expanded the attack surface, each bringing unique security challenges demanding specialized risk management strategies.

In 2024, the Federal Bureau of Investigation (FBI) reported cyber and scam-related crime losses reached a record $16.6 billion, a 33% increase from the previous year, with cryptocurrency frauds surging by 66% to US$9.3 billion. In Australia, the Australian Bureau of Statistics revealed that over two million Australians fell victim to card fraud in FY 2023-2024, while 675,000 individuals responded to scam messages. Additionally, 269 million card records and 1.9 million stolen U.S. bank checks were posted on dark and clear web platforms, highlighting the alarming rise in payment fraud activities.

Key Growth Barriers

- User resistance and regulatory hurdles

User resistance to advanced security protocols, such as multi-factor authentication (MFA) and biometric verification, remains a significant challenge. Many users find these technologies inconvenient, leading to reluctance to adopt them. This resistance delays the implementation of vital security features, leaving systems vulnerable to cyber threats. The 2024 UK Cyber Security Breaches Survey found that while half of businesses experienced cyberattacks, only a few adopted advanced security measures such as MFA or encryption due to perceived inconvenience and costs. Similarly, a 2025 OECD report revealed that 32% of SMEs faced digital security breaches, relying mostly on basic measures such as secure passwords and two-factor authentication.

The market also faces challenges due to a fragmented regulatory environment, where varying standards across countries create compliance difficulties for businesses. For instance, the European Union's General Data Protection Regulation (GDPR) and the United States Payment Card Industry Data Security Standard (PCI DSS) create compliance complexities for companies operating internationally. Adhering to these diverse regulations incurs significant costs, with companies needing to invest in legal counsel, compliance officers, and technology solutions.

Payment Security Market Trends and Opportunities

- Shift to open banking and zero-trustt cybersecurity

Open banking, which enables the secure sharing of financial data via APIs, is driving innovation in the financial services sector, particularly in India. The Reserve Bank of India (RBI) has set up a technical framework to support open banking, fostering financial inclusion while ensuring the protection of customer data. This shift is complemented by the rapid adoption of digital payment methods such as mobile wallets, contactless cards, and online banking. Notably, India's Unified Payments Interface (UPI) has transformed digital transactions, processing INR 23.49 lakh crore across 16.58 billion transactions by October 2024, marking a 45% year-on-year growth.

The Zero Trust cybersecurity framework is gaining prominence in safeguarding payment infrastructures from evolving cyber threats. Unlike traditional models, Zero Trust assumes that threats could be internal or external, requiring continuous identity verification and strict access controls for every user and device. This approach is essential in securing payment systems and ensuring compliance with regulatory requirements. Governments globally are prioritizing Zero Trust architectures, with initiatives such as the U.S. Department of Homeland Security's Cybersecurity and Infrastructure Security Agency (CISA) allocating US$3.0 billion in FY 2025 to enhance cybersecurity efforts, including Zero Trust implementation across federal networks.

- Rise of Contactless Payments

The adoption of contactless payment methods, including QR codes and Near Field Communication (NFC)-enabled cards, has surged due to their ease of use, speed, and hygiene considerations, particularly in the post-pandemic era. The increasing prevalence of smartphones and internet access has further fueled this trend, making digital payments accessible to a broader population. Traditional methods such as PINs or signatures are often seen as slow or inconvenient in contactless transactions, prompting businesses and financial institutions to turn to advanced authentication technologies.

Tokenization has become a critical component of secure digital transactions by replacing sensitive card information with a unique, encrypted token, reducing the risks of data breaches and fraud. Companies such as Apple Pay and Google Pay have successfully implemented tokenization, setting a precedent for other players in the payment ecosystem to adopt similar technologies. To address the increased risks of data interception and hacking, payment systems now use end-to-end encryption (E2EE) to protect payment data throughout the transaction process, ensuring data integrity and security as the volume of contactless payments continues to rise.

Leading Segment Overview

- Rise in digital payment ecosystem fuels demand for fraud detection solutions

Fraud detection & prevention is expected to hold over 30% share of the payment security market in 2025, driven by the growing sophistication of cyber threats and the expanding digital payment ecosystem. As online transactions become more complex and frequent, the risk of payment fraud escalates. Companies such as PayPal and Visa are investing significantly in advanced FDP solutions to safeguard both their operations and customers, addressing the increasing challenges posed by e-commerce, mobile wallets, and online banking.

Tokenization solutions are expected to grow significantly due to their ability to reduce fraud and enhance data protection by replacing sensitive payment information with unique identifiers, or tokens. It offers a cost-effective way to minimize the risks of data breaches, driving its adoption across various industries.

- Large enterprises lead the payment security with scalable, advanced solutions

Large enterprises are expected to account for 64.8% share of the payment security market in 2025, due to handling substantial transaction volumes and requiring advanced, scalable solutions to protect sensitive payment data. These enterprises face a higher risk of cyberattacks due to their size, making them prioritize robust security measures. Their complex payment systems across multiple regions and channels demand customized security solutions to ensure compliance with regulations and mitigate fraud risks.

Regional Analysis

- North America is the largest market for payment security

In the U.S. and Canada, cybersecurity threats are becoming increasingly sophisticated, with financial transactions emerging as prime targets. The surge in online payments, mobile banking, and card-not-present (CNP) transactions has amplified vulnerabilities, prompting organizations to invest heavily in secure payment gateways, multi-factor authentication (MFA), tokenization, and end-to-end encryption solutions. High-profile breaches, such as those at Target and Home Depot, accelerated the adoption of EMV chip cards and stricter network security protocols, highlighting the urgency of payment security investments.

The rapid growth of contactless payments and mobile wallets such as Apple Pay, Google Pay, and Samsung Pay has introduced new security challenges, driving demand for robust tokenization, biometric authentication (FaceID, TouchID), and device-level encryption. The boom in embedded finance and BNPL solutions across North America has blurred the lines between banking and commerce, requiring advanced fraud detection and customer verification tools. Recognizing these shifts, the U.S. Consumer Financial Protection Bureau (CFPB) finalized a rule in November 2024 to supervise major tech firms processing over 13 billion transactions annually, ensuring consumer data privacy and fraud prevention across digital payment ecosystems.

- Rise of cashless transactions in Asia and the push for safer payments

China's digital payment landscape is rapidly evolving, supported by its vast internet user base, which reached 1.1 billion by December 2024. The government's push for a cashless society and the widespread adoption of mobile payment platforms have made payment security a top priority. Initiatives such as the Digital Currency Electronic Payment (DCEP) project are aimed at enhancing the security and efficiency of digital transactions, ensuring safer and more reliable payment systems.

In Japan, the cashless payment ratio reached 42.8% in 2024, surpassing the government's target of 40%. The Ministry of Economy, Trade, and Industry (METI) aims to increase this ratio to 80%, further emphasizing the need for secure payment systems. South Korea and Japan have embraced NFC-based contactless payments, which, while convenient, introduce new security risks, such as unauthorized access to payment information. As a result, fintech startups in countries like Singapore are introducing innovative solutions, such as blockchain-based payments and AI-driven fraud detection systems, to bolster payment security and meet the growing demand for secure digital financial services.

- E-Commerce expansion and instant transfers drive demand for safer digital payments in Europe

Germany has witnessed a substantial increase in digital payment transactions, with Deutsche Bundesbank reporting a consistent rise in cashless payments. This shift towards electronic methods has heightened the need for robust security protocols to counter potential fraud and cyber threats. Similarly, in France, the adoption of instant credit transfers has accelerated, accounting for 9% of issued transfers in the first half of 2024 and totaling EUR 113.2 billion, driven further by the European regulation on instant payments effective from January 9, 2025.

In Italy, the rapid growth of the e-commerce sector, particularly in fashion, food, and electronics, has been accompanied by consumer concerns over online fraud, prompting businesses to enhance payment gateways, encryption, and two-factor authentication, with companies like Nexi Payments leading the effort. Meanwhile, the U.K., as one of Europe's most developed digital economies, is focusing on advanced security measures such as AI-based fraud detection, blockchain verification, and real-time transaction monitoring, with fintech leaders such as Revolut and Monzo innovating in biometric and token-based authentication to safeguard digital financial activities.

Competitive Landscape

Key players are continually investing in research and development (R&D) to create cutting-edge technologies that address emerging security threats. This includes advanced encryption algorithms, biometric authentication, tokenization, and multi-factor authentication (MFA). By forming alliances with major payment processors, financial institutions, and e-commerce platforms, providers gain access to a larger customer base and enhancing their market reach.

- In April 2025, Bluefin introduced network tokenization capabilities to its ShieldConex Tokenization as a Service and Orchestration platforms, allowing merchants to securely provision network-issued payment tokens from card brands such as Visa, Mastercard, American Express, and Discover.

- In March 2025, Yooz launched YoozProtect, an advanced fraud prevention solution for accounts payable (AP) operations in North America. The AI-powered tool uses machine learning to detect fraud, authenticate vendors, and secure payment workflows, addressing the rising risks of payment fraud. YoozProtect enhances transaction security with features such as fake detection, vendor verification, and user authentication.

Key Companies

- Visa Inc.

- PayPal

- Bluefin Payment Systems LLC

- Mastercard

- Elavon, Inc.

- Thales

- Entrust Corporation

- Ingenico

- TokenEx, LLC

- Razorpay

- Block, Inc.

- Stripe, Inc.

Expert Opinion

- Biometric technologies, including fingerprint scanning, facial recognition, and voice authentication, are gaining prominence in payment security. These technologies enhance user convenience while offering a higher level of protection than traditional password-based systems.

- Tokenization which replaces sensitive data with a non-sensitive placeholder, and encryption, which secures data through algorithms, are crucial in minimizing the risk of payment data theft.

- As more businesses shift to cloud-based payment platforms, ensuring the security of cloud storage and transaction processing becomes essential.

- Governments and regulatory bodies are enforcing stricter payment security guidelines, such as the EU’s PSD2 and PCI-DSS standards. These regulations compel businesses to strengthen security measures to avoid penalties and maintain consumer trust.

Global Payment Security Market is Segmented as-

By Component

- Solutions

- Encryption

- Tokenization

- Fraud Detection & Prevention

- Authentication

- Payment Gateway

- Misc.

- Services

- Professional Services

- Integration & Implementation

- Consulting

- Support & Maintenance

- Managed Services

By Deployment

- On-premises

- Cloud-based

- Hybrid

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End-user

- BFSI

- Retail & eCommerce

- Healthcare

- Travel & Hospitality

- IT & Telecom

- Media & Entertainment

- Government

- Logistics & Transportation

- Misc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Payment Security Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024 - 2032

2.9.2. Price Impact Factors

3. Global Payment Security Market Outlook, 2019 - 2032

3.1. Global Payment Security Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

3.1.1. Solutions

3.1.1.1. Encryption

3.1.1.2. Tokenization

3.1.1.3. Fraud Detection & Prevention

3.1.1.4. Authentication

3.1.1.5. Payment Gateway

3.1.1.6. Misc.

3.1.2. Services

3.1.2.1. Professional Services

3.1.2.1.1. Integration & Implementation

3.1.2.1.2. Consulting

3.1.2.1.3. Support & maintenance

3.1.2.2. Managed Services

3.2. Global Payment Security Market Outlook, by Deployment, Value (US$ Mn), 2019 - 2032

3.2.1. On-premise

3.2.2. Cloud-based

3.2.3. Hybrid

3.3. Global Payment Security Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

3.3.1. Small and Medium-sized Enterprises (SMEs)

3.3.2. Large Enterprises

3.4. Global Payment Security Market Outlook, by End-User, Value (US$ Mn), 2019 - 2032

3.4.1. BFSI

3.4.2. Retail & eCommerce

3.4.3. Healthcare

3.4.4. Travel & Hospitality

3.4.5. IT & Telecom

3.4.6. Media & Entertainment

3.4.7. Government

3.4.8. Logistics & Transportation

3.4.9. Misc.

3.5. Global Payment Security Market Outlook, by Region, Value (US$ Mn), 2019 - 2032

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Latin America

3.5.5. Middle East & Africa

4. North America Payment Security Market Outlook, 2019 - 2032

4.1. North America Payment Security Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

4.1.1. Solutions

4.1.1.1. Encryption

4.1.1.2. Tokenization

4.1.1.3. Fraud Detection & Prevention

4.1.1.4. Authentication

4.1.1.5. Payment Gateway

4.1.1.6. Misc.

4.1.2. Services

4.1.2.1. Professional Services

4.1.2.1.1. Integration & Implementation

4.1.2.1.2. Consulting

4.1.2.1.3. Support & maintenance

4.1.2.2. Managed Services

4.2. North America Payment Security Market Outlook, by Deployment, Value (US$ Mn), 2019 - 2032

4.2.1. On-premise

4.2.2. Cloud-based

4.2.3. Hybrid

4.3. North America Payment Security Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

4.3.1. Small and Medium-sized Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. North America Payment Security Market Outlook, by End-User, Value (US$ Mn), 2019 - 2032

4.4.1. BFSI

4.4.2. Retail & eCommerce

4.4.3. Healthcare

4.4.4. Travel & Hospitality

4.4.5. IT & Telecom

4.4.6. Media & Entertainment

4.4.7. Government

4.4.8. Logistics & Transportation

4.4.9. Misc.

4.5. North America Payment Security Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

4.5.1. U.S. Payment Security Market Outlook, by Component, 2019 - 2032

4.5.2. U.S. Payment Security Market Outlook, by Deployment, 2019 - 2032

4.5.3. U.S. Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

4.5.4. U.S. Payment Security Market Outlook, by End-User, 2019 - 2032

4.5.5. Canada Payment Security Market Outlook, by Component, 2019 - 2032

4.5.6. Canada Payment Security Market Outlook, by Deployment, 2019 - 2032

4.5.7. Canada Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

4.5.8. Canada Payment Security Market Outlook, by End-User, 2019 - 2032

4.6. BPS Analysis/Market Attractiveness Analysis

5. Europe Payment Security Market Outlook, 2019 - 2032

5.1. Europe Payment Security Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

5.1.1. Solutions

5.1.1.1. Encryption

5.1.1.2. Tokenization

5.1.1.3. Fraud Detection & Prevention

5.1.1.4. Authentication

5.1.1.5. Payment Gateway

5.1.1.6. Misc.

5.1.2. Services

5.1.2.1. Professional Services

5.1.2.1.1. Integration & Implementation

5.1.2.1.2. Consulting

5.1.2.1.3. Support & maintenance

5.1.2.2. Managed Services

5.2. Europe Payment Security Market Outlook, by Deployment, Value (US$ Mn), 2019 - 2032

5.2.1. On-premise

5.2.2. Cloud-based

5.2.3. Hybrid

5.3. Europe Payment Security Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

5.3.1. Small and Medium-sized Enterprises (SMEs)

5.3.2. Large Enterprises

5.4. Europe Payment Security Market Outlook, by End-User, Value (US$ Mn), 2019 - 2032

5.4.1. BFSI

5.4.2. Retail & eCommerce

5.4.3. Healthcare

5.4.4. Travel & Hospitality

5.4.5. IT & Telecom

5.4.6. Media & Entertainment

5.4.7. Government

5.4.8. Logistics & Transportation

5.4.9. Misc.

5.5. Europe Payment Security Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

5.5.1. Germany Payment Security Market Outlook, by Component, 2019 - 2032

5.5.2. Germany Payment Security Market Outlook, by Deployment, 2019 - 2032

5.5.3. Germany Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

5.5.4. Germany Payment Security Market Outlook, by End-User, 2019 - 2032

5.5.5. Italy Payment Security Market Outlook, by Component, 2019 - 2032

5.5.6. Italy Payment Security Market Outlook, by Deployment, 2019 - 2032

5.5.7. Italy Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

5.5.8. Italy Payment Security Market Outlook, by End-User, 2019 - 2032

5.5.9. France Payment Security Market Outlook, by Component, 2019 - 2032

5.5.10. France Payment Security Market Outlook, by Deployment, 2019 - 2032

5.5.11. France Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

5.5.12. France Payment Security Market Outlook, by End-User, 2019 - 2032

5.5.13. U.K. Payment Security Market Outlook, by Component, 2019 - 2032

5.5.14. U.K. Payment Security Market Outlook, by Deployment, 2019 - 2032

5.5.15. U.K. Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

5.5.16. U.K. Payment Security Market Outlook, by End-User, 2019 - 2032

5.5.17. Spain Payment Security Market Outlook, by Component, 2019 - 2032

5.5.18. Spain Payment Security Market Outlook, by Deployment, 2019 - 2032

5.5.19. Spain Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

5.5.20. Spain Payment Security Market Outlook, by End-User, 2019 - 2032

5.5.21. Russia Payment Security Market Outlook, by Component, 2019 - 2032

5.5.22. Russia Payment Security Market Outlook, by Deployment, 2019 - 2032

5.5.23. Russia Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

5.5.24. Russia Payment Security Market Outlook, by End-User, 2019 - 2032

5.5.25. Rest of Europe Payment Security Market Outlook, by Component, 2019 - 2032

5.5.26. Rest of Europe Payment Security Market Outlook, by Deployment, 2019 - 2032

5.5.27. Rest of Europe Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

5.5.28. Rest of Europe Payment Security Market Outlook, by End-User, 2019 - 2032

5.6. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Payment Security Market Outlook, 2019 - 2032

6.1. Asia Pacific Payment Security Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

6.1.1. Solutions

6.1.1.1. Encryption

6.1.1.2. Tokenization

6.1.1.3. Fraud Detection & Prevention

6.1.1.4. Authentication

6.1.1.5. Payment Gateway

6.1.1.6. Misc.

6.1.2. Services

6.1.2.1. Professional Services

6.1.2.1.1. Integration & Implementation

6.1.2.1.2. Consulting

6.1.2.1.3. Support & maintenance

6.1.2.2. Managed Services

6.2. Asia Pacific Payment Security Market Outlook, by Deployment, Value (US$ Mn), 2019 - 2032

6.2.1. On-premise

6.2.2. Cloud-based

6.2.3. Hybrid

6.3. Asia Pacific Payment Security Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.3.1. Small and Medium-sized Enterprises (SMEs)

6.3.2. Large Enterprises

6.4. Asia Pacific Payment Security Market Outlook, by End-User, Value (US$ Mn), 2019 - 2032

6.4.1. BFSI

6.4.2. Retail & eCommerce

6.4.3. Healthcare

6.4.4. Travel & Hospitality

6.4.5. IT & Telecom

6.4.6. Media & Entertainment

6.4.7. Government

6.4.8. Logistics & Transportation

6.4.9. Misc.

6.5. Asia Pacific Payment Security Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

6.5.1. China Payment Security Market Outlook, by Component, 2019 - 2032

6.5.2. China Payment Security Market Outlook, by Deployment, 2019 - 2032

6.5.3. China Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

6.5.4. China Payment Security Market Outlook, by End-User, 2019 - 2032

6.5.5. Japan Payment Security Market Outlook, by Component, 2019 - 2032

6.5.6. Japan Payment Security Market Outlook, by Deployment, 2019 - 2032

6.5.7. Japan Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

6.5.8. Japan Payment Security Market Outlook, by End-User, 2019 - 2032

6.5.9. South Korea Payment Security Market Outlook, by Component, 2019 - 2032

6.5.10. South Korea Payment Security Market Outlook, by Deployment, 2019 - 2032

6.5.11. South Korea Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

6.5.12. South Korea Payment Security Market Outlook, by End-User, 2019 - 2032

6.5.13. India Payment Security Market Outlook, by Component, 2019 - 2032

6.5.14. India Payment Security Market Outlook, by Deployment, 2019 - 2032

6.5.15. India Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

6.5.16. India Payment Security Market Outlook, by End-User, 2019 - 2032

6.5.17. Southeast Asia Payment Security Market Outlook, by Component, 2019 - 2032

6.5.18. Southeast Asia Payment Security Market Outlook, by Deployment, 2019 - 2032

6.5.19. Southeast Asia Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

6.5.20. Southeast Asia Payment Security Market Outlook, by End-User, 2019 - 2032

6.5.21. Rest of SAO Payment Security Market Outlook, by Component, 2019 - 2032

6.5.22. Rest of SAO Payment Security Market Outlook, by Deployment, 2019 - 2032

6.5.23. Rest of SAO Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

6.5.24. Rest of SAO Payment Security Market Outlook, by End-User, 2019 - 2032

6.6. BPS Analysis/Market Attractiveness Analysis

7. Latin America Payment Security Market Outlook, 2019 - 2032

7.1. Latin America Payment Security Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

7.1.1. Solutions

7.1.1.1. Encryption

7.1.1.2. Tokenization

7.1.1.3. Fraud Detection & Prevention

7.1.1.4. Authentication

7.1.1.5. Payment Gateway

7.1.1.6. Misc.

7.1.2. Services

7.1.2.1. Professional Services

7.1.2.1.1. Integration & Implementation

7.1.2.1.2. Consulting

7.1.2.1.3. Support & maintenance

7.1.2.2. Managed Services

7.2. Latin America Payment Security Market Outlook, by Deployment, Value (US$ Mn), 2019 - 2032

7.2.1. On-premise

7.2.2. Cloud-based

7.2.3. Hybrid

7.3. Latin America Payment Security Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.3.1. Small and Medium-sized Enterprises (SMEs)

7.3.2. Large Enterprises

7.4. Latin America Payment Security Market Outlook, by End-User, Value (US$ Mn), 2019 - 2032

7.4.1. BFSI

7.4.2. Retail & eCommerce

7.4.3. Healthcare

7.4.4. Travel & Hospitality

7.4.5. IT & Telecom

7.4.6. Media & Entertainment

7.4.7. Government

7.4.8. Logistics & Transportation

7.4.9. Misc.

7.5. Latin America Payment Security Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

7.5.1. Brazil Payment Security Market Outlook, by Component, 2019 - 2032

7.5.2. Brazil Payment Security Market Outlook, by Deployment, 2019 - 2032

7.5.3. Brazil Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

7.5.4. Brazil Payment Security Market Outlook, by End-User, 2019 - 2032

7.5.5. Mexico Payment Security Market Outlook, by Component, 2019 - 2032

7.5.6. Mexico Payment Security Market Outlook, by Deployment, 2019 - 2032

7.5.7. Mexico Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

7.5.8. Mexico Payment Security Market Outlook, by End-User, 2019 - 2032

7.5.9. Argentina Payment Security Market Outlook, by Component, 2019 - 2032

7.5.10. Argentina Payment Security Market Outlook, by Deployment, 2019 - 2032

7.5.11. Argentina Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

7.5.12. Argentina Payment Security Market Outlook, by End-User, 2019 - 2032

7.5.13. Rest of LATAM Payment Security Market Outlook, by Component, 2019 - 2032

7.5.14. Rest of LATAM Payment Security Market Outlook, by Deployment, 2019 - 2032

7.5.15. Rest of LATAM Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

7.5.16. Rest of LATAM Payment Security Market Outlook, by End-User, 2019 - 2032

7.6. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Payment Security Market Outlook, 2019 - 2032

8.1. Middle East & Africa Payment Security Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

8.1.1. Solutions

8.1.1.1. Encryption

8.1.1.2. Tokenization

8.1.1.3. Fraud Detection & Prevention

8.1.1.4. Authentication

8.1.1.5. Payment Gateway

8.1.1.6. Misc.

8.1.2. Services

8.1.2.1. Professional Services

8.1.2.1.1. Integration & Implementation

8.1.2.1.2. Consulting

8.1.2.1.3. Support & maintenance

8.1.2.2. Managed Services

8.2. Middle East & Africa Payment Security Market Outlook, by Deployment, Value (US$ Mn), 2019 - 2032

8.2.1. On-premise

8.2.2. Cloud-based

8.2.3. Hybrid

8.3. Middle East & Africa Payment Security Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

8.3.1. Small and Medium-sized Enterprises (SMEs)

8.3.2. Large Enterprises

8.4. Middle East & Africa Payment Security Market Outlook, by End-User, Value (US$ Mn), 2019 - 2032

8.4.1. BFSI

8.4.2. Retail & eCommerce

8.4.3. Healthcare

8.4.4. Travel & Hospitality

8.4.5. IT & Telecom

8.4.6. Media & Entertainment

8.4.7. Government

8.4.8. Logistics & Transportation

8.4.9. Misc.

8.5. Middle East & Africa Payment Security Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

8.5.1. GCC Payment Security Market Outlook, by Component, 2019 - 2032

8.5.2. GCC Payment Security Market Outlook, by Deployment, 2019 - 2032

8.5.3. GCC Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

8.5.4. GCC Payment Security Market Outlook, by End-User, 2019 - 2032

8.5.5. South Africa Payment Security Market Outlook, by Component, 2019 - 2032

8.5.6. South Africa Payment Security Market Outlook, by Deployment, 2019 - 2032

8.5.7. South Africa Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

8.5.8. South Africa Payment Security Market Outlook, by End-User, 2019 - 2032

8.5.9. Egypt Payment Security Market Outlook, by Component, 2019 - 2032

8.5.10. Egypt Payment Security Market Outlook, by Deployment, 2019 - 2032

8.5.11. Egypt Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

8.5.12. Egypt Payment Security Market Outlook, by End-User, 2019 - 2032

8.5.13. Nigeria Payment Security Market Outlook, by Component, 2019 - 2032

8.5.14. Nigeria Payment Security Market Outlook, by Deployment, 2019 - 2032

8.5.15. Nigeria Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

8.5.16. Nigeria Payment Security Market Outlook, by End-User, 2019 - 2032

8.5.17. Rest of Middle East Payment Security Market Outlook, by Component, 2019 - 2032

8.5.18. Rest of Middle East Payment Security Market Outlook, by Deployment, 2019 - 2032

8.5.19. Rest of Middle East Payment Security Market Outlook, by Enterprise Size, 2019 - 2032

8.5.20. Rest of Middle East Payment Security Market Outlook, by End-User, 2019 - 2032

8.6. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Visa Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. PayPal

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Bluefin Payment Systems LLC

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Mastercard

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Elavon, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Thales

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Entrust Corporation

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Ingenico

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. TokenEx, LLC

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Razorpay

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Deployment Coverage |

|

|

Enterprise Size Coverage |

|

|

End-User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |