Global Physical Security Market Forecast

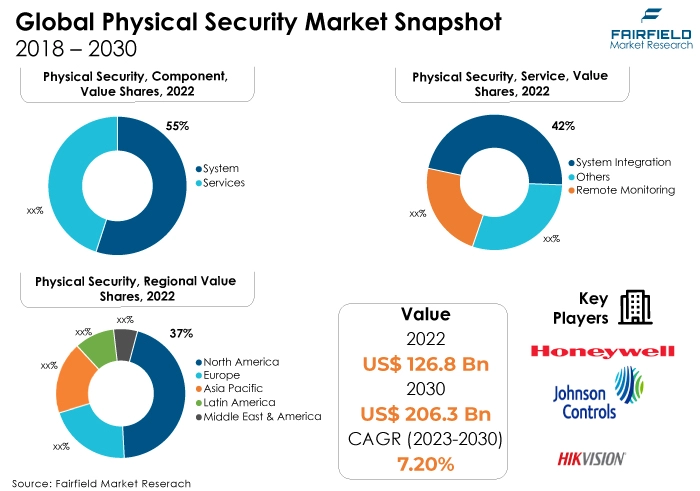

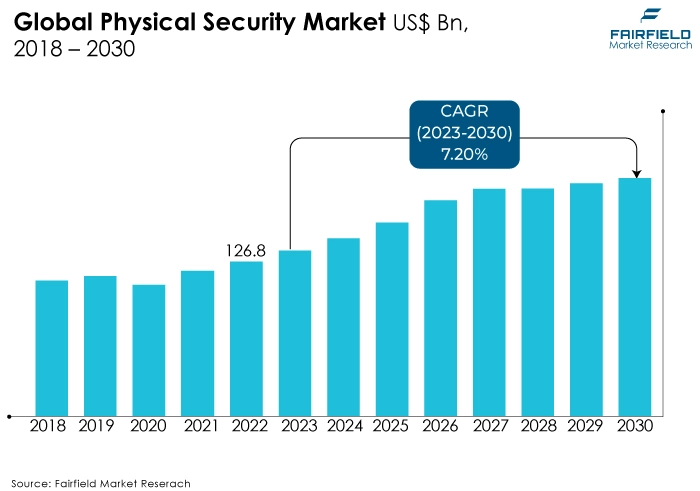

- The US$126.8 Bn market for physical security (2022) will reach US$206.3 Bn valuation in 2030

- Physical security market size projected to exhibit a CAGR of 7.2% during 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the physical security market growth is due to the increasing convergence of physical and cybersecurity.

- Another major market trend expected to fuel the physical security market growth is the rapidly expanding global retail industry. The market is also predicted to profit from the expanding worldwide banking & finance industries.

- System components, including surveillance cameras, access control devices, and alarms, dominate the physical security market due to their pivotal role in security infrastructure. These components form the core of security systems, ensuring effective monitoring, access management, and intrusion detection, driving their largest market share.

- Video surveillance systems hold the largest market share in the physical security market due to their versatile applications, effectiveness in threat detection, real-time monitoring, and forensic evidence gathering. These systems are integral to security across various sectors, cementing their dominant position.

- System Integration as a Service (SIaaS) dominates the physical security market because it streamlines complex security infrastructure, ensuring interoperability, and efficiency. SIaaS providers offer expertise, reducing organisations' burdens in managing diverse security technologies, leading to its largest market share.

- The retail sector secured the largest market share in the physical security market because it prioritises asset protection, theft prevention, and customer and employee safety. Extensive adoption of surveillance cameras, access control, and intrusion detection solutions in retail establishments solidifies its leading position.

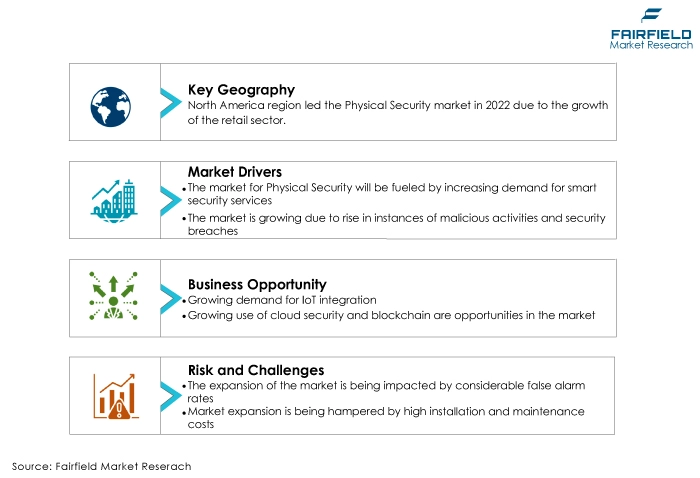

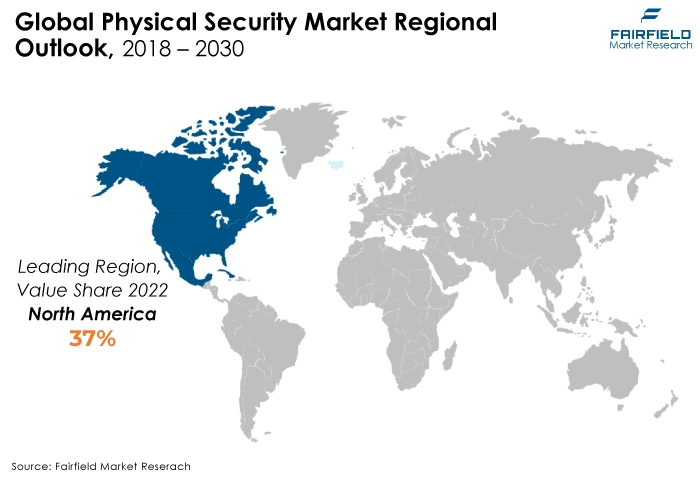

- North America leads the physical security market due to substantial security expenditure, technological advancements, and stringent regulations. It boasts high market penetration and demand for security solutions across industries, cementing its position with the largest market share.

- With rapid urbanisation, industrialisation, and infrastructure development. The growing middle-class population and increasing security concerns are driving substantial demand for advanced security solutions, propelling its growth.

A Look Back and a Look Forward - Comparative Analysis

The physical security market is growing due to increasing concerns about safety and security across various sectors. Factors such as rising crime rates, terrorism threats, and the need for safeguarding critical infrastructure drive demand. Technological advancements in surveillance, access control, and biometrics, along with the emergence of smart cities and the Internet of Things (IoT), further accelerate market growth as organisations and governments invest in modern security solutions to protect assets, and data.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as retail, transportation, and utility and energy. However, in some applications, the demand for physical security has increased, such as banking & finance.

The future of the physical security market looks promising, driven by ongoing technological innovations, such as AI and analytics, enhancing threat detection and response capabilities. As urbanisation continues, smart city initiatives will boost demand for integrated security systems. Additionally, increasing cybersecurity threats will drive the convergence of physical and digital security. The market's growth will be fueled by the need to protect critical infrastructure, public spaces, and digital assets.

Key Growth Determinants

- Increasing Demand for Smart Security Services

The increasing demand for smart security services is a significant driver in the physical security market. Businesses and consumers are seeking integrated, intelligent security solutions that leverage technologies like AI, IoT, and cloud computing for proactive threat detection and real-time monitoring.

The services offer enhanced situational awareness, scalability, and remote accessibility, making them crucial in safeguarding assets, personnel, and data. As smart cities and IoT adoption expand, the need for interconnected security systems will further drive the market, fostering innovation in the field of physical security services.

- Integration of Cutting-edge Technologies Like ML, AI, and Analytics

The integration of technologies like Machine Learning (ML), Artificial Intelligence (AI), and advanced analytics is propelling the physical security market. These innovations enable proactive threat detection, predictive analysis, and automation of security systems.

ML and AI algorithms can identify unusual patterns, while analytics provide insights for informed decision-making. This results in more effective security measures, and reduced false alarms. They improved overall situational awareness, making these technologies a driving force in meeting the evolving security needs of businesses and organisations, thus fueling market growth.

- Rise in Instances of Malicious Activities, and Security Breaches

The increase in instances of malicious activities and security breaches targeting physical systems is a primary driver of the physical security market. As threats escalate, organisations seek robust security solutions to protect assets, facilities, and people. This has led to greater investments in access control, surveillance, and intrusion detection systems.

The imperative drives the market to mitigate risks, enhance situational awareness, and respond effectively to security incidents, making physical security solutions a critical component of comprehensive security strategies.

Major Growth Barriers

- Considerable False Alarm Rates

Considerable false alarm rates pose a significant challenge to the physical security market. High false alarms not only strain resources but also undermine the effectiveness of security systems, leading to complacency and reduced trust in security measures.

Addressing false alarms requires advancements in AI and analytics for accurate threat detection, which can be costly and time-consuming. Reducing false alarms is crucial to maintaining the integrity and reliability of physical security systems, making it a persistent challenge in the industry.

- High Installation and Maintenance Costs for SMEs

Installation and maintenance costs pose challenges for SMEs in the physical security market. SMEs often have limited budgets and may need help to afford sophisticated security systems and ongoing maintenance. This cost barrier can leave them vulnerable to security threats.

To address this challenge, the industry must focus on providing affordable, scalable solutions tailored to the needs of SMEs and offer cost-effective maintenance plans to ensure the security of these businesses without excessive financial burden.

Key Trends and Opportunities to Look at

- IoT Integration

IoT Integration in the physical security market involves the incorporation of Internet of Things devices and sensors into security systems. This technology enables real-time data collection and analysis, allowing for proactive threat detection and automated responses.

IoT devices can include cameras, access control systems, and sensors, all connected to a central platform for improved surveillance, access management, and overall security effectiveness.

- Cloud-Based Security

Cloud-Based Security in the physical security market involves utilizing cloud computing infrastructure and services to store, manage, and monitor security data and devices remotely. This technology offers scalability, flexibility, and cost efficiency.

Users can access surveillance footage, manage access control, and analyse data from any location with an internet connection. It also enables easier integration with other cloud-based solutions and provides redundancy for enhanced security system reliability.

- Blockchain

Blockchain technology in the physical security market enhances data integrity and access control. By providing an immutable and decentralised ledger, it ensures the authenticity of security data, such as access logs and video footage.

Blockchain-based solutions enhance trust in security systems, prevent tampering of critical information, and facilitate secure access management. This technology contributes to more reliable and transparent security measures.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly shapes the physical security market by setting standards and requirements that influence technology adoption and business practices. Regulations often mandate specific security measures for industries like finance, healthcare, and critical infrastructure, driving demand for advanced security solutions.

Data protection and privacy regulations also impact the storage and handling of security data, encouraging the use of encryption and secure access control. Furthermore, cybersecurity regulations affect the integration of physical and digital security, promoting the convergence of both domains.

Compliance with these regulations is essential for businesses to avoid legal penalties, data breaches, and reputation damage. As regulatory requirements evolve and become more stringent, they drive innovation and investment in physical security technologies and services to meet the ever-changing security landscape.

Fairfield’s Ranking Board

Top Segments

- System Components Maintain Leadership Position

System components, such as surveillance cameras, access control devices, and alarms, capture the largest market share in the physical security market due to their fundamental role in security infrastructure. These components form the backbone of security systems, ensuring effective monitoring, access management, and intrusion detection.

As security concerns continue to grow, organisations prioritise investments in these components to safeguard assets and personnel. Additionally, advancements like AI and IoT integration have enhanced the capabilities of these components, further driving their demand and market dominance in meeting the evolving security needs across various industries.

As organisations increasingly recognise the value of comprehensive security solutions, and are seeking expert guidance for system design, installation, and ongoing maintenance, the services segment will receive a strong impetus for the years to come.

The rise of cloud-based and managed security services, including remote monitoring and threat response, has fueled this growth. The complexity of modern security systems and the need for specialised expertise are driving organisations to invest in security services to ensure the effectiveness and reliability of their security infrastructure.

- Video Surveillance to be the Prime Category

Video surveillance systems have captured the largest market share in the physical security market due to their versatile applications and effectiveness in threat detection. They provide real-time monitoring and forensic evidence, making them integral for security across various sectors, including commercial, industrial, and residential.

Advancements in camera technology, such as high-resolution and smart analytics, have enhanced their capabilities. Additionally, the growing demand for remote surveillance and cloud-based storage has further propelled the adoption of video surveillance systems, solidifying their dominant market position.

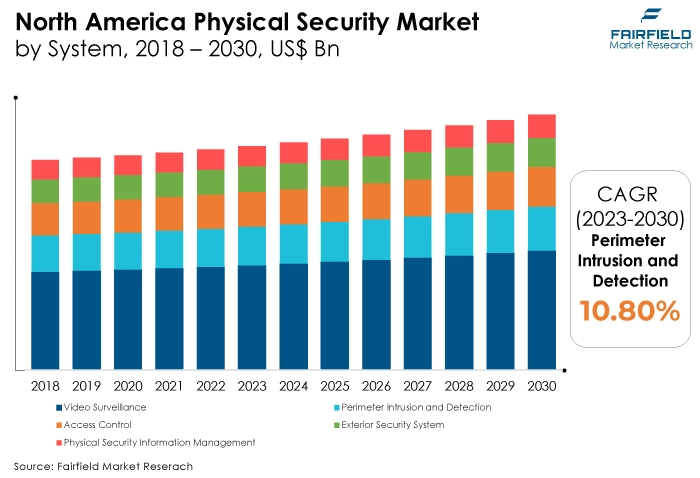

On the other han, the perimeter intrusion and detection systems segment is likely to be displaying the highest rate of growth in adoption through the end of forecast year, in the wake of an increasing need for protecting critical infrastructure and property. These systems provide proactive security measures by detecting unauthorised access attempts at the earliest stage, preventing potential threats.

As security concerns continue to rise, organisations invest significantly in perimeter security to safeguard assets and sensitive areas, driving the demand for advanced intrusion detection technologies and driving the high growth rate in this segment of the market.

- Demand for System Integration Services Maximum

System Integration has secured the largest market share in the physical security market due to its role in streamlining complex security infrastructure. The providers offer expertise in integrating various security components into a cohesive system, ensuring interoperability and efficiency.

This service reduces the burden on organisations to manage diverse security technologies and allows them to focus on core operations. As security systems become more sophisticated and interconnected, SIaaS becomes invaluable, making it a dominant segment in the market for integrated and comprehensive security solutions.

- Retail Hold a Command over Global Space

The retail sector has secured the largest market share in the physical security market due to several reasons. Retailers prioritise physical security to protect merchandise, prevent robbery, and ensure the safety of customers and employees. The adoption of surveillance cameras, access control systems, and intrusion detection solutions is widespread in retail establishments.

Moreover, advancements in video analytics and integration with inventory management systems have further enhanced security and operational efficiencies. Retail's emphasis on loss prevention and customer safety drives investments in comprehensive physical security solutions, solidifying its position as a leading segment in the market.

Meanwhile, with heightened security concerns, and stringent compliance regulations, the banking and finance sector is projected to demonstrate noteworthy adoption over the years to come. Financial institutions prioritise physical security to protect assets, sensitive data, and customer privacy.

Rising cyber threats have led to increased investment in integrated security systems, including access control, surveillance, and intrusion detection. Compliance requirements, such as PCI DSS, and GDPR, further drive demand for robust security measures. As financial organisations continually invest in security to mitigate risks, this sector is witnessing rapid growth in the physical security market.

Regional Frotrunners

North America Remains at the Forefront as Physical Security Measures Gain Spotlight Across Industries

North America captured the largest share in the physical security market for several reasons. The region places a high emphasis on security and safety across various industries, including government, commercial, and critical infrastructure. North America has a strong presence of leading security solution providers and technological innovators, fostering growth and innovation in the market.

The region faces persistent security threats, driving investments in advanced physical security systems. Additionally, stringent regulatory frameworks, and compliance requirements, especially in the financial and healthcare sectors, promote the adoption of comprehensive security solutions. These factors collectively contribute to North America's dominant market share in the evolving field of physical security.

Emphasis of Governments on Public Security Elevates Asia Pacific’s Position in Global Market

The Asia Pacific region is all set for the fastest CAGR in terms of revenue, majorly attributing to rapid urbanisation, and industrialisation. While this raises the security concerns, it is expected to drive investments in comprehensive physical security solutions. The emergence of smart cities, infrastructural developments, and a growing middle-class population further propel demand.

Additionally, government initiatives for safe and secure public spaces contribute to market growth. As businesses and governments prioritise security in this dynamic region, it fosters opportunities for technological innovation and integration, resulting in the highest CAGR in the Asia Pacific physical security market.

Fairfield’s Competitive Landscape Analysis

The global physical security market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Physical Security Space?

- Honeywell International Inc.

- Johnson Controls International PLC

- Bosch Security Systems

- Hikvision

- Dahua Technology

- Tyco International

- Cisco Systems Inc.

- Siemens AG

- ADT

- Axis Communications AB

- Genetec

- Hanwha Techwin Co. Ltd.

- Panasonic

- Stanley Security

- Veriant Systems Inc.

Significant Company Developments

New Product Launch

- May 2022: SureView Systems, a company specializing in open response platforms, and ShotSpotter, a provider of police technology solutions, have announced their integration. This collaboration aims to enhance law enforcement's response time to incidents, potentially contributing to crime prevention. The integration combines ShotSpotter's gunshot alerts with SureView's Physical Security Information Management (PSIM) system, offering security operations teams the necessary tactical information for efficient response and a comprehensive understanding of unfolding events.

- September 2021: Johnson Controls has expanded its innovation capabilities by introducing body-worn cameras, autonomous robotics, and mail inspection solutions into its security offerings. These cutting-edge solutions were developed in collaboration with the Johnson Controls OpenBlue Innovation Center. When integrated with the OpenBlue platform and Johnson Controls' security solutions, these innovations empower customers to respond effectively to evolving threats while enhancing building safety and productivity.

Distribution Agreement

- September 2021: Hexagon AB has launched its Physical Security & Surveillance Management portfolio designed for railway applications. This comprehensive solution integrates a proven set of solutions from railway operations globally. The portfolio incorporates 3D surveillance systems alongside security, dispatching, and collaboration software to enhance railway security and management.

An Expert’s Eye

Demand and Future Growth

An increase in retail facilities demand is driving the market. The physical security market is witnessing substantial demand and is poised for future growth. Increasing security concerns, rising incidents of cyberattacks, and stringent regulations are driving investments in advanced security solutions.

The integration of AI, IoT, and cloud technologies is reshaping the market, enabling real-time monitoring and proactive threat detection. As businesses and governments prioritise safety and asset protection, the physical security market is expected to experience sustained growth, with a focus on innovation and comprehensive security solutions to meet evolving security challenges.

Supply Side of the Market

Major countries in the physical security market include the US, China, Japan, Germany, and the UK. The US leads in market size due to high-security expenditure, while China, and Japan are prominent due to their technological advancements.

Germany is influential in Europe and known for stringent security regulations, and the UK is a key player with a strong focus on video surveillance and access control systems. These countries drive market growth and innovation in the ever-evolving field of physical security.

The physical security market relies on various raw materials, including metals (for enclosures and components), plastics (for housing and parts), electronic components (such as sensors and cameras), and wiring.

Manufacturers of these raw materials include Aurubis, and Rio Tinto for metals, BASF, and Dow for plastics, and leading electronics manufacturers like Sony and Panasonic for electronic components. These suppliers play a crucial role in the supply chain, ensuring the availability of essential materials for the production of physical security equipment and solutions.

The Physical Security Market Segmented as Below:

By Component:

- System

- Services

By System:

- Video Surveillance

- Perimeter Intrusion and Detection

- Access Control

- Exterior Security System

- Physical Security Information Management

By Service:

- System Integration

- Remote Monitoring

- Others

By End-use Sector:

- Retail

- Transportation

- Commercial

- Utility & Energy

- Government

- Banking & Finance

- Industrial

- Residential

- Hospitality

- Manufacturing & Industrial

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Physical Security Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Physical Security Market Outlook, 2018 - 2030

3.1. Global Physical Security Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. System

3.1.1.2. Services

3.2. Global Physical Security Market Outlook, by System, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Video Surveillance

3.2.1.2. Perimeter Intrusion and Detection

3.2.1.3. Access Control

3.2.1.4. Exterior Security System

3.2.1.5. Physical Security Information Management

3.3. Global Physical Security Market Outlook, by Service, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. System Integration

3.3.1.2. Remote Monitoring

3.3.1.3. Others

3.4. Global Physical Security Market Outlook, by End-User, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Retail

3.4.1.2. Transportation

3.4.1.3. Commercial

3.4.1.4. Utility & Energy

3.4.1.5. Government

3.4.1.6. Banking & Finance

3.4.1.7. Industrial

3.4.1.8. Residential

3.4.1.9. Hospitality

3.4.1.10. Manufacturing & Industrial

3.5. Global Physical Security Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Physical Security Market Outlook, 2018 - 2030

4.1. North America Physical Security Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. System

4.1.1.2. Services

4.2. North America Physical Security Market Outlook, by System, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Video Surveillance

4.2.1.2. Perimeter Intrusion and Detection

4.2.1.3. Access Control

4.2.1.4. Exterior Security System

4.2.1.5. Physical Security Information Management

4.3. North America Physical Security Market Outlook, by Service, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. System Integration

4.3.1.2. Remote Monitoring

4.3.1.3. Others

4.4. North America Physical Security Market Outlook, by End-User, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Retail

4.4.1.2. Transportation

4.4.1.3. Commercial

4.4.1.4. Utility & Energy

4.4.1.5. Government

4.4.1.6. Banking & Finance

4.4.1.7. Industrial

4.4.1.8. Residential

4.4.1.9. Hospitality

4.4.1.10. Manufacturing & Industrial

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Physical Security Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Physical Security Market System, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Physical Security Market Service, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Physical Security Market System, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Physical Security Market Service, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Physical Security Market Outlook, 2018 - 2030

5.1. Europe Physical Security Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. System

5.1.1.2. Services

5.2. Europe Physical Security Market Outlook, by System, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Video Surveillance

5.2.1.2. Perimeter Intrusion and Detection

5.2.1.3. Access Control

5.2.1.4. Exterior Security System

5.2.1.5. Physical Security Information Management

5.3. Europe Physical Security Market Outlook, by Service, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. System Integration

5.3.1.2. Remote Monitoring

5.3.1.3. Others

5.4. Europe Physical Security Market Outlook, by End-User, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Retail

5.4.1.2. Transportation

5.4.1.3. Commercial

5.4.1.4. Utility & Energy

5.4.1.5. Government

5.4.1.6. Banking & Finance

5.4.1.7. Industrial

5.4.1.8. Residential

5.4.1.9. Hospitality

5.4.1.10. Manufacturing & Industrial

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Physical Security Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Physical Security Market System, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Physical Security Market Service, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Physical Security Market System, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Physical Security Market Service, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Physical Security Market System, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Physical Security Market Service, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Physical Security Market System, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Physical Security Market Service, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Physical Security Market System, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Physical Security Market Service, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Physical Security Market System, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Physical Security Market Service, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Physical Security Market System, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Physical Security Market Service, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Physical Security Market Outlook, 2018 - 2030

6.1. Asia Pacific Physical Security Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. System

6.1.1.2. Services

6.2. Asia Pacific Physical Security Market Outlook, by System, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Video Surveillance

6.2.1.2. Perimeter Intrusion and Detection

6.2.1.3. Access Control

6.2.1.4. Exterior Security System

6.2.1.5. Physical Security Information Management

6.3. Asia Pacific Physical Security Market Outlook, by Service, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. System Integration

6.3.1.2. Remote Monitoring

6.3.1.3. Others

6.4. Asia Pacific Physical Security Market Outlook, by End-User, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Retail

6.4.1.2. Transportation

6.4.1.3. Commercial

6.4.1.4. Utility & Energy

6.4.1.5. Government

6.4.1.6. Banking & Finance

6.4.1.7. Industrial

6.4.1.8. Residential

6.4.1.9. Hospitality

6.4.1.10. Manufacturing & Industrial

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Physical Security Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Physical Security Market System, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Physical Security Market Service, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Physical Security Market System, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Physical Security Market Service, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Physical Security Market System, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Physical Security Market Service, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Physical Security Market System, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Physical Security Market Service, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Physical Security Market System, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Physical Security Market Service, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Physical Security Market System, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Physical Security Market Service, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Physical Security Market Outlook, 2018 - 2030

7.1. Latin America Physical Security Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. System

7.1.1.2. Services

7.2. Latin America Physical Security Market Outlook, by System, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Video Surveillance

7.2.1.2. Perimeter Intrusion and Detection

7.2.1.3. Access Control

7.2.1.4. Exterior Security System

7.2.1.5. Physical Security Information Management

7.3. Latin America Physical Security Market Outlook, by Service, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. System Integration

7.3.1.2. Remote Monitoring

7.3.1.3. Others

7.4. Latin America Physical Security Market Outlook, by End-User, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Retail

7.4.1.2. Transportation

7.4.1.3. Commercial

7.4.1.4. Utility & Energy

7.4.1.5. Government

7.4.1.6. Banking & Finance

7.4.1.7. Industrial

7.4.1.8. Residential

7.4.1.9. Hospitality

7.4.1.10. Manufacturing & Industrial

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Physical Security Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Physical Security Market System, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Physical Security Market Service, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Physical Security Market System, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Physical Security Market Service, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Physical Security Market System, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Physical Security Market Service, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Physical Security Market System, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Physical Security Market Service, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Physical Security Market Outlook, 2018 - 2030

8.1. Middle East & Africa Physical Security Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. System

8.1.1.2. Services

8.2. Middle East & Africa Physical Security Market Outlook, by System, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Video Surveillance

8.2.1.2. Perimeter Intrusion and Detection

8.2.1.3. Access Control

8.2.1.4. Exterior Security System

8.2.1.5. Physical Security Information Management

8.3. Middle East & Africa Physical Security Market Outlook, by Service, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. System Integration

8.3.1.2. Remote Monitoring

8.3.1.3. Others

8.4. Middle East & Africa Physical Security Market Outlook, by End-User, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Retail

8.4.1.2. Transportation

8.4.1.3. Commercial

8.4.1.4. Utility & Energy

8.4.1.5. Government

8.4.1.6. Banking & Finance

8.4.1.7. Industrial

8.4.1.8. Residential

8.4.1.9. Hospitality

8.4.1.10. Manufacturing & Industrial

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Physical Security Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Physical Security Market System, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Physical Security Market Service, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Physical Security Market System, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Physical Security Market Service, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Physical Security Market System, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Physical Security Market Service, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Physical Security Market System, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Physical Security Market Service, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Physical Security Market by Component, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Physical Security Market System, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Physical Security Market Service, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Physical Security Market End-User, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Service vs System Heatmap

9.2. Manufacturer vs System Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Honeywell International Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Johnson Controls International PLC

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Bosch Security Systems

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Hikvision

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Dahua Technology

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Tyco International

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Cisco Systems, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Siemens AG

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. ADT Inc.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Axis Communications AB

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Genetec Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Hanwha Techwin Co., Ltd.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Panasonic Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Stanley Security

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Verint Systems Inc.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

System Coverage |

|

|

Service Coverage |

|

|

End-use Sector Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |