Global PLGA Market Forecast

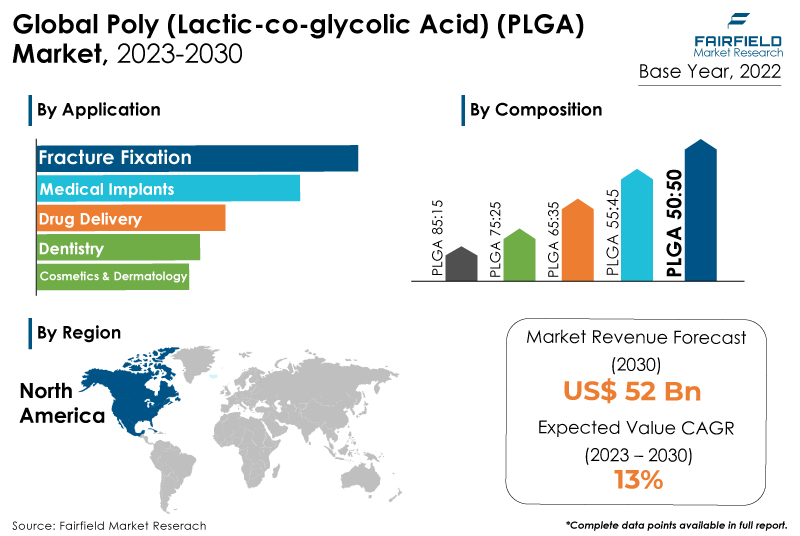

- Global poly lactic-co-glycolic acid (PLGA) market will rise at a significant pace of 13% CAGR during the period of assessment, 2023 - 2030

- The market value of PLGA will approach US$2 Bn by the end of 2030

Market Analysis in Brief

The increased focus on biodegradable and bioresorbable materials in the medical and pharmaceutical industries is one of the main motivators. Since PLGA is a biocompatible polymer and may break down within the body over time without producing negative side effects, it is widely used in tissue engineering, surgical sutures, and drug delivery systems. Additionally, the development of PLGA-based microspheres and nanoparticles has been spurred by the increased desire for sustained and controlled drug release, enabling accurate medication dosing and better therapeutic results. The material may be tailored to fit certain applications thanks to its adjustable features, which include deterioration rate and mechanical strength. The demand for PLGA in encapsulating active chemicals for skincare products has also increased due to the expansion of the cosmetics and personal care industries. Utilising PLGA microspheres increases the product's effectiveness by gradually releasing vitamins, antioxidants, and other useful ingredients.

Key Report Findings

- The market for poly (lactic-co-glycolic acid) (PLGA) will demonstrate more than 3x expansion in revenue over the decade, i.e., between 2023 and 2030.

- Fracture fixation was one of the key segment in 2022. As PLGA sutures are biocompatible and biodegradable, the rising number of surgical procedures is fueling the expansion of this market.

- PLGA 50:50 is the most preferred compostion, with a more than 42.6% market share in 2022.

- North America will hold the market share in 2022, with approximately 35.9%.

Growth Drivers

Biomedical Advancements, and Growing Demand for Drug Delivery Systems

Current biological developments and the rising demand for effective drug delivery methods considerably contribute to the poly (lactic-co-glycolic acid) (PLGA) market growth. PLGA, a biodegradable and biocompatible polymer, is widely used in the medical industry, notably in drug encapsulation and controlled release applications.

The need for improved therapeutic results and patient compliance is one of the main forces driving this trend. PLGA is a prime choice for creating continuous and regulated drug delivery platforms because of its exceptional capacity to deteriorate slowly and safely within the body.

The quest for personalised medicine has accelerated the usage of PLGA-based microspheres and nanoparticles and targeted therapeutics. With these systems, pharmaceutical compounds can be dosed precisely and released over an extended period, improving treatment effectiveness and minimising unwanted effects.

Additionally, customisation following the desired drug release profile is possible thanks to the customizable PLGA features, such as degradation rate and mechanical strength. This adaptability fits with the changing environment of medical therapy, as patients are increasingly looking for customised remedies for their unique conditions and demands.

The use of PLGA goes beyond conventional medication delivery to include tissue engineering and regenerative medicine. It is a desirable material for scaffold creation in tissue regeneration due to its biocompatibility and capacity to support cell development.

The rising popularity of regenerative therapies such as tissue repair and organ transplants further fuels the demand for PLGA-based solutions. The need for PLGA is anticipated to increase as biomedical research and development progress, making it a crucial factor in the market growth.

Popularity of Eco-friendly and Sustainable Material Solutions

The biodegradability and biocompatibility of PLGA have drawn much interest as consumer demands for products with lower environmental consequences increase and environmental concerns become more pressing. This factor is especially noticeable in industries like agriculture and packaging, where conventional materials increase waste and contamination.

In the packaging field, PLGA-based materials are being investigated as substitutes for traditional plastics, infamous for their environmental persistence and lack of biodegradability. The circular economy's principles align with the biodegradable properties of PLGA, which provides a remedy for the plastic waste dilemma. The demand for sustainable packaging materials pushes the adoption of PLGA-based solutions as governments and companies impose stricter restrictions and look for greener alternatives.

The agricultural industry also utilises the properties of PLGA for controlled-release fertilizers and pesticides. Because of their increased effectiveness and less environmental pollution due to their regulated release, PLGA-based formulations are an eco-friendly choice for sustainable agriculture. The desire for such cutting-edge solutions is anticipated to fuel the expansion of the PLGA Market within the agriculture industry as sustainable farming methods gain traction.

Expansion of Nanotechnology

The development of nanotechnology, which made it possible to create PLGA nanoparticles with exact sizes for targeted medication delivery and imaging applications, is another important driving force. The ability of these nanoparticles to cross biological barriers and deliver medications to particular tissues or cells on a targeted basis would revolutionise medical therapies.

Because PLGA is environmentally friendly and sustainable, it is increasingly being used in various applications as the world places more emphasis on minimising environmental consequences. Beyond the medical and cosmetic industries, PLGA is useful in various industries, including agriculture, food packaging, and electronics.

Overview of Key Segments

Growing Application in Medical Industry to Aid Demand

Fracture fixation is one of the major application segment in the poly (lactic-co-glycolic acid) (PLGA) market. This importance can be due to PLGA's inherent properties, which make it ideal for applications like medical sutures and wound closure. Sutures must hold tissues together throughout the crucial healing phase and disintegrate as the tissue heals. PLGA's biocompatibility, biodegradability, and programmable degradation rates fit these needs.

Since PLGA sutures do not need to be removed, there is less chance of infection and discomfort for the patient. This simplicity has helped PLGA sutures become widely used in various surgical procedures, fueling the segment's expansion.

Cosmetics and dermatology application is expanding at one of the quickest rate. Several strong reasons fuel this expansion. The primary way that PLGA is used in this market is to encapsulate active chemicals for cosmetics products. The effectiveness of skincare formulas is increased by the controlled and prolonged release of vitamins, antioxidants, and other useful substances made possible by PLGA microspheres.

Brands increasingly use cutting-edge delivery technologies, such as PLGA microspheres, to treat certain skin conditions as customers become more aware of the contents of their personal care products and seek tangible results. The growing need for PLGA in the personal care and dermatology industries is also fueled by the emergence of individualised skincare solutions and the pursuit of innovative and potent formulations.

Consumer preferences for cutting-edge skincare products and PLGA's ability to enhance ingredient delivery for better skin health are at odds, fuelling the expansion of this market sector.

Overview of Key Segments

PLGA 50:50 Bestseller

The PLGA market is split into several varieties, with PLGA 50:50 being the largest category. This predominance is due to the balanced ratio of polyglycolic acid (PGA) and polylactic acid (PLA) in PLGA 50:50, resulting in a versatile polymer with various capabilities. The formulation's equal ratio of PLA and PGA strikes a compromise between mechanical strength, rate of degradation, and biocompatibility.

On the back of its versatility, PLGA 50:50 can be used for various purposes, including tissue engineering and medication delivery. The requirement for a standard PLGA composition that can be used in various sectors and provides a balance between degradation kinetics and material performance is fueling the segment's expansion.

The PLGA market category with the quickest growth rate is PLGA 75:25. Several strong reasons fuel this expansion. Compared to other PLGA varieties, the composition of PLGA 75:25, which has a higher PLA-to-PGA ratio, causes a slower rate of deterioration. The applications that call for sustained medication release over a lengthy time are compatible with this prolonged degradation. The pharmaceutical and medical sectors particularly value the capacity of PLGA 75:25 to produce regulated drug delivery systems that maintain therapeutic amounts of drugs within the body for longer durations.

The rising need for individualised and patient-centered treatment regimens amplifies the use of PLGA 75:25 to create long-acting drug delivery platforms. The demand for PLGA 75:25 is anticipated to fuel the segment's strong growth as pharmaceutical research & development continues to concentrate on enhanced therapeutic outcomes and patient comfort.

Growth Opportunities Across Regions

Developed Pharmaceutical and Biomedical Infrastructure Secures Leadership Position for North American

North America is the largest poly (lactic-co-glycolic acid) (PLGA) market section. This significance can be traced to several factors supporting the region's high demand for PLGA together. First, North America's pharmaceutical and biotechnology industries are strong and continually promote advancements in regenerative medicine, medical devices, and drug delivery systems.

The ability to encapsulate and release therapeutic compounds, controlled degradation, and biocompatibility of PLGA align with the region's search for cutting-edge medical solutions. Using PLGA-based technologies has stimulated the development of personalised medicine, targeted therapeutics, and less invasive procedures, driving market expansion.

Additionally, with considerable investments in clinical trials and scientific research, North America prioritises research and development. Collaboration between academic institutions, research centers, and businesses has helped PLGA become more widely used in pharmaceutical and medical applications. The region's strict regulatory structure and commitment to quality standards also influence the increasing use of PLGA in authorised medical items and equipment.

Asia Pacific Emerges Highly Profitable

Asia Pacific has the poly (lactic-co-glycolic acid) (PLGA) market's fastest-growing segment. Several strong reasons fuel this expansion. First, the region's booming healthcare and pharmaceutical industries are quickly growing due to a combination of factors including a growing population, rising healthcare costs, and an increase in the prevalence of chronic diseases.

The need for innovative drug delivery systems and medical technologies, particularly PLGA-based products, significantly increases as Asia Pacific countries invest in healthcare infrastructure and research. The demand for adaptable materials like PLGA is further fueled by Asia Pacific's dominance in contract manufacturing and research organisations (CMOs and CROs). To develop and produce cutting-edge healthcare goods, these organisations partner with major pharmaceutical and medical device corporations worldwide.

For CMOs and CROs looking for flexible materials for their client's projects, PLGA is an appealing option due to its adaptability and suitability for various medical and research applications.

Growth Challenges

Complexity of Formulation and Manufacturing

The complexity of the formulation and manufacturing processes for PLGA-based products is one of the major factors limiting the growth of the poly (lactic-co-glycolic acid) (PLGA) market. Although PLGA is used widely for its adaptability and special qualities, producing it can be difficult due to its complex formulation.

The properties of PLGA, including its molecular weight, lactic acid to glycolic acid ratio, and rate of degradation, are important variables that affect how well it performs in diverse applications. Thorough knowledge of material science and polymer engineering is required to precisely select these parameters during the formulation stage to achieve the desired qualities.

Additionally, the production procedures for items made from PLGA can be complex and call for specialised tools and knowledge. Temperature, pressure, and solvent interactions must all be precisely controlled for creating microspheres, nanoparticles, films, or scaffolds made of PLGA.

The complexity is further increased by the need to ensure homogeneous particle size distribution, regulated drug release kinetics, and mechanical qualities. Any production variance can result in inconsistent product performance and quality.

Poly (Lactic-Co-Glycolic Acid) (PLGA) Market: Competitive Landscape

Some of the leading players at the forefront in the poly (lactic-co-glycolic acid) (PLGA) market space include Evonik Industries, Polysciences, Inc., DSM, Mitsui Chemicals, Ashland Inc., Creative PEGWorks, Corbion, and Poly-Med Incorporated.

Recent Notable Developments

In June 2023, Evonik Industries launched a new PLGA product called Purac PLGA Bioresorbable Polymer. This product is designed for various applications, including sutures, drug delivery, and tissue engineering.

In May 2023, Mitsui Chemicals launched a new PLGA product called CosmoPLGA Biomaterials. This product is designed for various applications, including sutures, implants, and drug delivery.

In April 2023, PCAS launched a new PLGA product called Biosorb PLGA. This product is designed for various applications, including sutures, implants, and drug delivery.

Global Poly (Lactic-Co-Glycolic Acid) (PLGA) Market is Segmented as Below:

By Composition

- PLGA 50:50

- PLGA 55:45

- PLGA 65:35

- PLGA 75:25

- PLGA 85:15

By Application

- Medical Implants

- Drug Delivery

- Fracture Fixation

- Dentistry

- Cosmetics and Dermatology

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, 2018 - 2030

3.1. Global Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. PLGA 50:50

3.1.1.2. PLGA 55:45

3.1.1.3. PLGA 65:35

3.1.1.4. PLGA 75:25

3.1.1.5. PLGA 85:15

3.2. Global Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Medical Implants

3.2.1.2. Drug Delivery

3.2.1.3. Fracture Fixation

3.2.1.4. Dentistry

3.2.1.5. Cosmetics and Dermatology

3.2.1.6. Misc.

3.3. Global Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, 2018 - 2030

4.1. North America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. PLGA 50:50

4.1.1.2. PLGA 55:45

4.1.1.3. PLGA 65:35

4.1.1.4. PLGA 75:25

4.1.1.5. PLGA 85:15

4.2. North America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Medical Implants

4.2.1.2. Drug Delivery

4.2.1.3. Fracture Fixation

4.2.1.4. Dentistry

4.2.1.5. Cosmetics and Dermatology

4.2.1.6. Misc.

4.2.2. Market Attractiveness Analysis

4.3. North America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, 2018 - 2030

5.1. Europe Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. PLGA 50:50

5.1.1.2. PLGA 55:45

5.1.1.3. PLGA 65:35

5.1.1.4. PLGA 75:25

5.1.1.5. PLGA 85:15

5.2. Europe Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Medical Implants

5.2.1.2. Drug Delivery

5.2.1.3. Fracture Fixation

5.2.1.4. Dentistry

5.2.1.5. Cosmetics and Dermatology

5.2.1.6. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Russia Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

5.3.1.10. Russia Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Rest of Europe Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

5.3.1.12. Rest of Europe Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, 2018 - 2030

6.1. Asia Pacific Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. PLGA 50:50

6.1.1.2. PLGA 55:45

6.1.1.3. PLGA 65:35

6.1.1.4. PLGA 75:25

6.1.1.5. PLGA 85:15

6.2. Asia Pacific Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Medical Implants

6.2.1.2. Drug Delivery

6.2.1.3. Fracture Fixation

6.2.1.4. Dentistry

6.2.1.5. Cosmetics and Dermatology

6.2.1.6. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, 2018 - 2030

7.1. Latin America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. PLGA 50:50

7.1.1.2. PLGA 55:45

7.1.1.3. PLGA 65:35

7.1.1.4. PLGA 75:25

7.1.1.5. PLGA 85:15

7.2. Latin America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Medical Implants

7.2.1.2. Drug Delivery

7.2.1.3. Fracture Fixation

7.2.1.4. Dentistry

7.2.1.5. Cosmetics and Dermatology

7.2.1.6. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Rest of Latin America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

7.3.1.6. Rest of Latin America Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, 2018 - 2030

8.1. Middle East & Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. PLGA 50:50

8.1.1.2. PLGA 55:45

8.1.1.3. PLGA 65:35

8.1.1.4. PLGA 75:25

8.1.1.5. PLGA 85:15

8.2. Middle East & Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Composition, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Medical Implants

8.2.1.2. Drug Delivery

8.2.1.3. Fracture Fixation

8.2.1.4. Dentistry

8.2.1.5. Cosmetics and Dermatology

8.2.1.6. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Rest of Middle East & Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Composition, Value (US$ Mn), 2018 - 2030

8.3.1.6. Rest of Middle East & Africa Poly (Lactic-Co-Glycolic Acid) (PLGA) Market, by Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Composition vs Application Heatmap

9.2. Manufacturer vs Composition Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Evonik Industries

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Polysciences, Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Ashland Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. DSM

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Mitsui Chemicals

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Corbion NV

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Creative PEGWorks

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Foster Corp.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Haihang Industry

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Koninklijke DSM NV

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Nomisma Healthcare Pvt. Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Poly-Med Incorporated

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Nanosoft Polymers

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Specific Polymers

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. BMG Inc.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Composition Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |