Global Post-Consumer Recycled Plastic Packaging Market Forecast

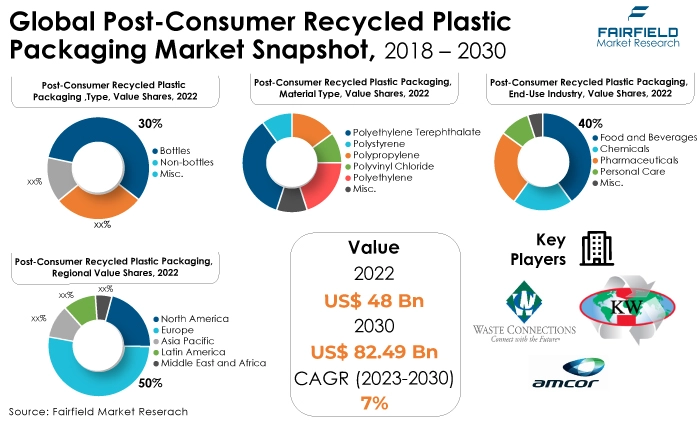

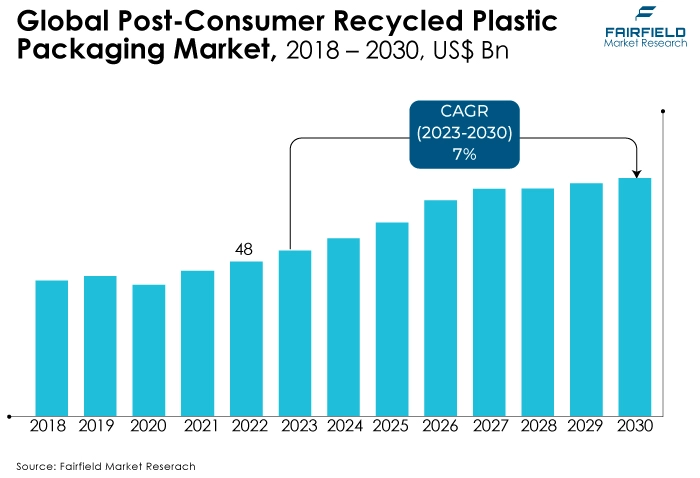

- The approximately US$48 Bn market for post-consumer recycled plastic packaging poised to rise high by 2030, reaching US$82.49 Bn

- Market size likely to witness an impressive CAGR of 7% over 2023 - 2030

Quick Report Digest

- The key trend expected to drive growth in the post-consumer recycled plastic packaging market is a growing focus on the conservation of nature, reduced cost, and sustainability.

- Another major market trend expected to fuel the post-consumer recycled plastic packaging market growth is government regulations. Government policies and regulations at the local, state, and national levels play a crucial role in promoting recycling. Legislation such as recycling mandates, landfill diversion goals, and extended producer responsibility (EPR) programs incentivise recycling efforts.

- In 2022, the bottles category dominated the Type segment as the focus on sustainability became the driving force.

- In terms of market share for the post-consumer recycled plastic packaging market globally, polyethylene terephthalate is anticipated to dominate.

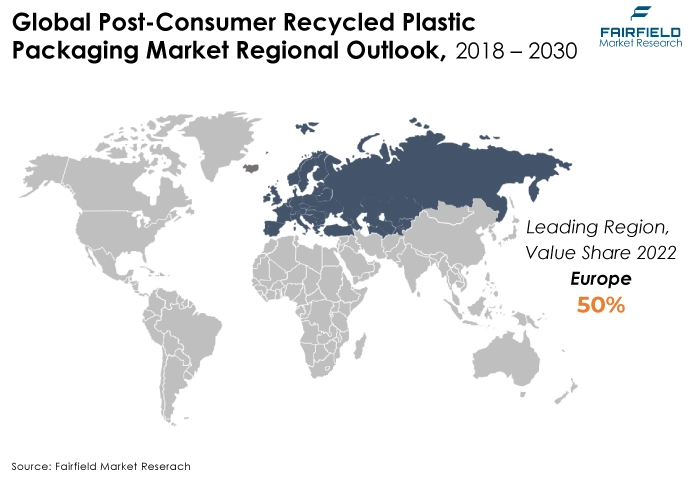

- The Europe region is anticipated to account for the largest share of the global post-consumer recycled plastic packaging market, owing to various factors such as robust recycling infrastructure, and a consumer base increasingly inclined toward eco-friendly choices.

- The market for post-consumer recycled plastic packaging market is expanding in the Asia Pacific region due to a focus on awareness of environmental issues and a shift towards eco-friendly consumer choices.

A Look Back and a Look Forward - Comparative Analysis

The post-consumer recycled plastic packaging in 2023 is characterised by a heightened focus on sustainability and resource conservation. Environmental awareness has grown significantly among consumers and businesses, driving an increased demand for recycling solutions.

Government regulations and waste reduction goals have spurred investments in recycling infrastructure and programs. Circular economy principles are gaining traction, emphasizing the importance of recycling in reducing waste and conserving resources.

Advancements in recycling technologies and processes have improved efficiency, and businesses increasingly incorporate recycled content into their products. Sustainable packaging and products with recycled materials are in high demand, promoting a more circular and eco-friendly economy. Challenges persist, including contamination issues, limited recycling infrastructure, and fluctuating commodity prices.

The historical evolution of post-consumer recycled plastic packaging reveals a gradual shift towards sustainability and responsible waste management. Over the years, government regulations and mandates have played a pivotal role in shaping recycling practices, setting the stage for increased awareness and participation.

Technological advancements have improved recycling processes, making them more cost-effective and efficient. The market has witnessed an expanding array of materials being recycled, from traditional paper and cardboard to plastics and electronics. However, challenges such as contamination, market volatility, and infrastructure gaps have persisted.

The future of post-consumer recycled plastic packaging holds promises and challenges. Sustainability will remain at the forefront, with the adoption of circular economy principles becoming more widespread. Innovations in recycling technology, including advanced sorting, and cleaning processes, will enhance the quality of recycled materials.

Smart waste management systems will revolutionise collection and sorting, improving efficiency and reducing contamination. Increasing collaboration among stakeholders, including governments, businesses, and consumers, will drive recycling rates higher. The market is expected to see further expansion into new materials, such as textiles and organic waste.

However, addressing challenges like contamination, economic viability, and regulatory consistency will require concerted efforts. The recycling market will continue to evolve, aligning with global environmental goals and striving for a more sustainable future.

Key Growth Determinants

- Growing Demand on the Back of a Favourable Environmental Impact

The positive environmental impact of post-consumer recycled plastic packaging materials serves as a compelling driver for the growth of this market. As awareness of environmental sustainability and plastic waste reduction intensifies, consumers and businesses are seeking eco-friendly alternatives to conventional packaging.

Recycled packaging materials, made from post-consumer plastics, significantly reduce the demand for new plastic production, conserve valuable natural resources, and divert plastic waste from landfills and oceans. By choosing recycled packaging, industries contribute to lower greenhouse gas emissions, decreased energy consumption, and decreased dependence on fossil fuels.

Moreover, recycled packaging promotes a circular economy, where materials are reused, recycled, and repurposed, aligning with global efforts to mitigate climate change and reduce environmental harm. This positive environmental impact resonates with consumers and drives market growth as companies strive to meet sustainability goals and address the pressing need for responsible packaging solutions.

- Supportive Government Regulations

Government regulations have emerged as a potent driver for post-consumer recycled plastic packaging. Across the globe, policymakers are recognising the urgent need to combat plastic pollution and reduce the environmental impact of packaging materials. To achieve these goals, many governments are implementing stringent regulations mandating the incorporation of post-consumer recycled plastic content in packaging.

Regulations are pushing industries to adopt sustainability by using recycled materials and reducing reliance on new plastics. This aligns with global efforts to reduce plastic waste and environmental impact while meeting consumer preferences for eco-friendly products.

The result significantly boosts the post-consumer recycled plastic packaging market as manufacturers, retailers, and packaging companies invest in technologies and processes to comply with these regulations.

As sustainability becomes a top priority on the legislative agenda, government regulations are shaping the packaging landscape, fostering innovation, and driving growth within the post-consumer recycled plastic packaging market.

Major Growth Barriers

- High Processing Costs

High processing costs pose a notable restraint for the post-consumer recycled plastic packaging. While the environmental benefits of using recycled materials are evident, the cost of collecting, sorting, cleaning, and processing post-consumer plastics into high-quality post-consumer recycled plastic can be substantial. These expenses encompass investments in advanced recycling technologies and machinery, as well as labour and energy costs.

Additionally, the diversity of plastics in the waste stream makes sorting and processing a complex and resource-intensive task. As a result, post-consumer recycled plastic materials can sometimes be less cost-competitive than virgin plastics, which can deter some industries from adopting recycled packaging solutions.

To address this restraint, ongoing innovations in recycling technologies and economies of scale are crucial to making post-consumer recycled plastic more economically viable and ensuring the continued growth of the post-consumer recycled plastic packaging market.

- Recyclable Contamination

The contamination of recyclables stands as a significant restraint for post-consumer recycled plastic packaging. Contamination occurs when non-recyclable materials, such as food waste, hazardous substances, or incompatible plastics, are mixed with recyclable materials. This not only compromises the quality and safety of the recycled materials but also increases processing costs and complexity.

Contaminated post-consumer recycled plastic may not meet the stringent standards required for packaging applications, leading to reduced market acceptance and value. To mitigate this restraint, education, and awareness campaigns are essential to inform consumers and businesses about proper recycling practices.

Furthermore, investments in advanced sorting and cleaning technologies are crucial to enhancing the purity and quality of post-consumer recycled plastic materials, ensuring their suitability for packaging, and addressing the contamination challenge in the post-consumer recycled plastic packaging market.

Key Trends and Opportunities to Look at

- Beverage Industry’s Expansion Offers a Prime Opportunity

The tremendous growth of the beverage industry presents a significant opportunity for post-consumer recycled plastic packaging. As the global demand for food and beverages, including bottled water, soft drinks, and alcoholic food and beverages, continues to rise, beverage companies are actively seeking sustainable packaging solutions to align with consumer expectations and environmental goals.

Post-consumer recycled plastic packaging, with its eco-friendly credentials and reduced carbon footprint, is poised to meet this demand. Many beverage manufacturers are transitioning to post-consumer recycled plastic materials to reduce their dependency on virgin plastics and demonstrate their commitment to sustainability.

This industry-wide shift toward sustainable packaging not only fosters innovation but also unlocks new avenues for post-consumer recycled plastic packaging suppliers, positioning them to capitalise on the beverage sector's growth and sustainability efforts.

- Economic Incentives

Economic incentives represent a promising opportunity for post-consumer recycled plastic packaging. Businesses across various industries are increasingly recognising the financial benefits of embracing sustainable practices, including the use of recycled materials.

Recycling and adopting post-consumer recycled plastic can lead to reduced waste disposal costs, lower raw material expenses, and even potential revenue streams from selling recycled materials. Governments and organisations are also offering financial incentives, grants, and tax breaks to encourage the adoption of post-consumer recycled plastic and sustainable packaging solutions.

The economic incentives not only make post-consumer recycled plastic more financially attractive but also incentivise industries to proactively invest in sustainable packaging options.

As businesses seek to improve their bottom lines while demonstrating environmental responsibility, the post-consumer recycled plastic packaging market stands to benefit from these economic drivers, further solidifying its growth and sustainability in the market landscape.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario for the post-consumer recycled plastic packaging market is marked by a global emphasis on sustainability and waste management. Packaging-waste management is subjected to a substantial number of regulatory measures worldwide, highlighting the growing concern for environmental sustainability.

Notably, a significant portion of these measures, approximately 83%, is directed toward sustainable packaging, with plastic packaging being the primary focus. Regions like the European Union, and Asia are particularly active in implementing regulations targeting plastics, with countries like France and India taking the lead.

Beverage packaging also garners substantial regulatory attention, especially in Europe, and North America, although regional variations exist, with Latin America, and the Middle East showing a preference for food packaging.

Furthermore, an emerging trend in Europe and Asia involves a holistic approach, encompassing a broader range of end-use areas beyond Food and Beverages. Regarding the types of packaging, primary packaging takes the forefront globally, accounting for nearly 90% of regulations.

However, Asia, particularly China, India, Vietnam, and the Philippines is increasingly addressing secondary and tertiary packaging, with a notable focus on e-commerce packaging to minimise waste.

Financial penalties, such as taxes, fines, and fees, represent the primary regulatory mechanism for driving sustainability change, with France standing out for its use of incentives to encourage positive changes in packaging sustainability.

The regulatory landscape underscores the growing importance of sustainable packaging practices and the need for industry players to stay informed and adapt to evolving regulations to meet both environmental and consumer demands effectively.

Fairfield’s Ranking Board

Top Segments

- Bottles Remain the Dominant Source

Bottles have emerged as the dominant source in the post-consumer recycled plastic packaging market. This predominance is driven by several factors, including the widespread use of plastic bottles in various industries such as food and beverages, personal care, and household products.

The recycling of plastic bottles is well-established and efficient, making them a readily available source of post-consumer recycled plastic materials. Additionally, consumers and manufacturers alike are increasingly recognising the importance of recycling plastic bottles to reduce environmental impact and promote sustainability.

The heightened awareness, combined with regulatory incentives and industry initiatives, has propelled bottles to the forefront of post-consumer recycled plastic packaging sources, making them a dominant and sustainable choice in the market.

- Polyethylene Terephthalate Most Sought-after Material Type

The polyethylene terephthalate category emerged as the dominant segment in the market. This leadership position can be attributed to its remarkable properties, including its strong resistance to a wide range of chemicals like solvents, alcohols, alkalis, and weak acids. Polyethylene terephthalate is predominantly employed in manufacturing items such as bottles, films, tubes, laminates, and plastic parts, all of which find applications across diverse sectors like packaging, electrical and electronics, and the automotive industry.

Regional Frontrunners

- Europe Takes the Lead with over Half Revenue Share

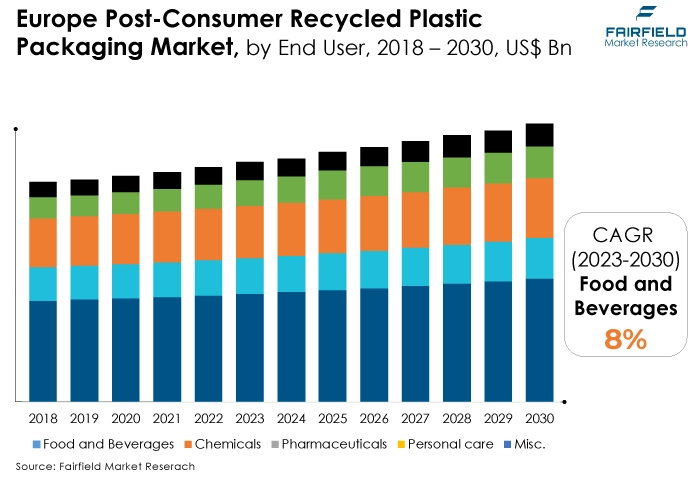

Europe's prominence in post-consumer recycled plastic packaging, capturing a substantial 53% share, is driven by a multifaceted approach to sustainability. The region boasts stringent environmental regulations, robust recycling infrastructure, and a consumer base increasingly inclined toward eco-friendly choices.

The European Union's ambitious recycling targets and policies have set the stage for the widespread adoption of post-consumer recycled plastic materials in packaging. Consumers in Europe exhibit a strong preference for sustainable products, amplifying the demand for post-consumer recycled plastic packaging.

With advanced recycling technologies and a commitment to circular economy principles, Europe continues to lead the way in promoting environmentally responsible packaging solutions.

- Asia Pacific Gains from an Improving Plastic Recycling Infrastructure

Asia Pacific is emerging as a rapidly growing region in post-consumer recycled plastic packaging due to several key factors. Firstly, the region's substantial population and expanding middle-class consumer base are driving increased demand for packaged goods, particularly in the food and beverages sector.

Escalating consumption has prompted both local and multinational companies to prioritise sustainable packaging solutions to meet environmental concerns and regulatory requirements.

Additionally, several Asian countries have been focusing on enhancing their recycling infrastructure and waste management practices, facilitating the availability of high-quality post-consumer recycled plastic materials.

Furthermore, growing awareness of environmental issues and a shift towards eco-friendly consumer choices are fortifying the adoption of post-consumer recycled plastic packaging in Asia, making it a burgeoning market with immense growth potential.

Fairfield’s Competitive Landscape Analysis

The global post-consumer recycled plastic packaging market is characterised by a concentrated landscape, with a select group of major players dominating the industry on a global scale. These leading companies are actively introducing innovative products and focusing on expanding their distribution channels to bolster their international presence. Fairfield Market Research predicts that further consolidation within the market is on the horizon.

Who Are the Leaders in the Global Post-Consumer Recycled Plastic Packaging Market Space?

- Berry Global Inc

- Amcor plc.

- KW Plastics

- ePac Holdings LLC

- Mondi plc

- Transcontinental Inc

- Republic Services Inc

- Veolia

- Shell International B.V.

- Waste Connections

- Clean Harbors Inc

- Klockner Pentaplast

- Placon

- Coveris

- Henkel Corporation

- Premium Packagings

- Rose Plastic AG

- Borealis AG

- Berk Company

Significant Company Developments

Partnerships, and Acquisitions

- August 2023: Berry Global established a closed loop system in partnership with its customer, leading French water treatment specialist Ocedis, for the supply of Berry’s 20-litre Optimum stacking containers manufactured from recycled polyethylene (rPE). Berry’s technical expertise has ensured that the rPE containers retain the same levels of performance in terms of their durability and functionality as those made from virgin polymer.

- August 2023: Mondi, a global leader in sustainable packaging and paper, has collaborated with Fressnapf, Europe’s market leader for pet supplies, to switch their packaging to a new range of premium mono-material recyclable solutions using process colour printing technology.

- July 2023: In collaboration with Dow, Klöckner Pentaplast launched a specially formulated fully recyclable vacuum film which is one of the most sustainable solutions of its type available. Dow’s FUSABOND™ technology, incorporated into kp FlexiVac®R allows the film to be recyclable without compromising on performance and aesthetics.

An Expert’s Eye

Demand and Future Growth

The market demand for post-consumer recycled plastic packaging continues to surge, reflecting a global shift toward sustainability and environmental responsibility. Consumers, now more than ever, are actively seeking products packaged in eco-friendly materials, driving a substantial demand for post-consumer recycled plastic packaging solutions.

The demand extends across various industries, including food and beverage, personal care, pharmaceuticals, and more, as companies recognise the importance of meeting consumer preferences and regulatory requirements for sustainable packaging.

Furthermore, government initiatives and regulations mandating the use of recycled materials in packaging further bolster the market demand for post-consumer recycled plastic packaging.

As businesses strive to reduce their carbon footprint and embrace circular economy principles, the demand for post-consumer recycled plastic packaging materials remains robust, positioning it as a vital component of the packaging industry's future landscape.

Supply Side of the Market

The supply side of the post-consumer recycled plastic market is marked by a complex interplay of factors that collectively drive the production and availability of recycled plastic materials. Recycling facilities serve as the heart of this supply chain, where post-consumer plastics are collected, sorted, cleaned, and processed into post-consumer recycled plastic pellets or flakes.

The abundance and quality of post-consumer plastic feedstock directly impact the supply of post-consumer recycled plastic materials. Technological advancements play a pivotal role, with innovations in sorting, cleaning, and extrusion processes enhancing the efficiency and quality of post-consumer recycled plastic production.

As demand for sustainable materials grows across various industries, capacity expansion becomes a priority for post-consumer recycled plastic producers, while stringent quality control measures ensure the consistent supply of high-quality post-consumer recycled plastic. Collaborations and partnerships in the market optimise the supply chain, streamlining production and distribution.

Adherence to environmental regulations is vital, and the ever-evolving consumer preference for eco-friendly products further shapes the supply landscape. The cost and availability of post-consumer plastic feedstock, influenced by market dynamics, competition, and global supply networks, add complexity to the post-consumer recycled plastic supply chain.

In this dynamic landscape, market trends and competitive pressures are expected to continue influencing the production and availability of post-consumer recycled plastic materials to meet the growing demand for sustainable alternatives to virgin plastics.

Global Post-Consumer Recycled Plastic Packaging Market is Segmented as Below:

Type:

- Bottles

- Non-bottle Rigid

- Trays

- Containers

- Clamshells

- Blister Packs

- Pouches and Bags

- Miscellaneous

- Miscellaneous

Material Type:

- Polypropylene

- Polystyrene

- Polyethylene

- High-density Polyethylene

- Low-density Polyethylene

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Miscellaneous

End-use Industry:

- Food and Beverages

- Chemicals

- Pharmaceuticals

- Personal Care

- Miscellaneous

By Geographic Coverage:

- North America

- United States

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Post-Consumer Recycled Plastic Packaging Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Post-Consumer Recycled Plastic Packaging Market Outlook, 2018 - 2030

3.1. Global Post-Consumer Recycled Plastic Packaging Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Bottles

3.1.1.2. Non-bottles

3.1.1.2.1. Trays

3.1.1.2.2. Containers

3.1.1.2.3. Clamshells

3.1.1.2.4. Blister Packs

3.1.1.2.5. Pouches and Bags

3.1.1.2.6. Misc.

3.1.1.3. Misc.

3.2. Global Post-Consumer Recycled Plastic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Polypropylene

3.2.1.2. Polystyrene

3.2.1.3. Polyethylene

3.2.1.3.1. High-density Polyethylene

3.2.1.3.2. Low-density Polyethylene

3.2.1.4. Polyvinyl Chloride

3.2.1.5. Polyethylene Terephthalate

3.2.1.6. Misc.

3.3. Global Post-Consumer Recycled Plastic Packaging Market Outlook, by End-Use Industry, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Food and Beverages

3.3.1.2. Chemicals

3.3.1.3. Pharmaceuticals

3.3.1.4. Personal Care

3.3.1.5. Misc.

3.4. Global Post-Consumer Recycled Plastic Packaging Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Post-Consumer Recycled Plastic Packaging Market Outlook, 2018 - 2030

4.1. North America Post-Consumer Recycled Plastic Packaging Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Bottles

4.1.1.2. Non-bottles

4.1.1.2.1. Trays

4.1.1.2.2. Containers

4.1.1.2.3. Clamshells

4.1.1.2.4. Blister Packs

4.1.1.2.5. Pouches and Bags

4.1.1.2.6. Misc.

4.1.1.3. Misc.

4.2. North America Post-Consumer Recycled Plastic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Polypropylene

4.2.1.2. Polystyrene

4.2.1.3. Polyethylene

4.2.1.3.1. High-density Polyethylene

4.2.1.3.2. Low-density Polyethylene

4.2.1.4. Polyvinyl Chloride

4.2.1.5. Polyethylene Terephthalate

4.3. Misc. North America Post-Consumer Recycled Plastic Packaging Market Outlook, by End-Use Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Food and Beverages

4.3.1.2. Chemicals

4.3.1.3. Pharmaceuticals

4.3.1.4. Personal Care

4.3.1.5. Misc.

4.4. North America Post-Consumer Recycled Plastic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

5. Europe Post-Consumer Recycled Plastic Packaging Market Outlook, 2018 - 2030

5.1. Europe Post-Consumer Recycled Plastic Packaging Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Bottles

5.1.1.2. Non-bottles

5.1.1.2.1. Trays

5.1.1.2.2. Containers

5.1.1.2.3. Clamshells

5.1.1.2.4. Blister Packs

5.1.1.2.5. Pouches and Bags

5.1.1.2.6. Misc.

5.1.1.3. Misc.

5.2. Europe Post-Consumer Recycled Plastic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Polypropylene

5.2.1.2. Polystyrene

5.2.1.3. Polyethylene

5.2.1.3.1. High-density Polyethylene

5.2.1.3.2. Low-density Polyethylene

5.2.1.4. Polyvinyl Chloride

5.2.1.5. Polyethylene Terephthalate

5.2.1.6. Misc.

5.3. Europe Post-Consumer Recycled Plastic Packaging Market Outlook, by End-Use Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Food and Beverages

5.3.1.2. Chemicals

5.3.1.3. Pharmaceuticals

5.3.1.4. Personal Care

5.3.1.5. Misc.

5.4. Europe Post-Consumer Recycled Plastic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

6. Asia Pacific Post-Consumer Recycled Plastic Packaging Market Outlook, 2018 - 2030

6.1. Asia Pacific Post-Consumer Recycled Plastic Packaging Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Bottles

6.1.1.2. Non-bottles

6.1.1.2.1. Trays

6.1.1.2.2. Containers

6.1.1.2.3. Clamshells

6.1.1.2.4. Blister Packs

6.1.1.2.5. Pouches and Bags

6.1.1.2.6. Misc.

6.1.1.3. Misc.

6.2. Asia Pacific Post-Consumer Recycled Plastic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Polypropylene

6.2.1.2. Polystyrene

6.2.1.3. Polyethylene

6.2.1.3.1. High-density Polyethylene

6.2.1.3.2. Low-density Polyethylene

6.2.1.4. Polyvinyl Chloride

6.2.1.5. Polyethylene Terephthalate

6.2.1.6. Misc.

6.3. Asia Pacific Post-Consumer Recycled Plastic Packaging Market Outlook, by End-Use Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Food and Beverages

6.3.1.2. Chemicals

6.3.1.3. Pharmaceuticals

6.3.1.4. Personal Care

6.3.1.5. Misc.

6.4. Asia Pacific Post-Consumer Recycled Plastic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

7. Latin America Post-Consumer Recycled Plastic Packaging Market Outlook, 2018 - 2030

7.1. Latin America Post-Consumer Recycled Plastic Packaging Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Bottles

7.1.1.2. Non-bottles

7.1.1.2.1. Trays

7.1.1.2.2. Containers

7.1.1.2.3. Clamshells

7.1.1.2.4. Blister Packs

7.1.1.2.5. Pouches and Bags

7.1.1.2.6. Misc.

7.1.1.3. Misc.

7.2. Latin America Post-Consumer Recycled Plastic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Polypropylene

7.2.1.2. Polystyrene

7.2.1.3. Polyethylene

7.2.1.3.1. High-density Polyethylene

7.2.1.3.2. Low-density Polyethylene

7.2.1.4. Polyvinyl Chloride

7.2.1.5. Polyethylene Terephthalate

7.2.1.6. Misc.

7.3. Latin America Post-Consumer Recycled Plastic Packaging Market Outlook, by End-Use Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Food and Beverages

7.3.1.2. Chemicals

7.3.1.3. Pharmaceuticals

7.3.1.4. Personal Care

7.3.1.5. Misc.

7.4. Latin America Post-Consumer Recycled Plastic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

8. Middle East & Africa Post-Consumer Recycled Plastic Packaging Market Outlook, 2018 - 2030

8.1. Middle East & Africa Post-Consumer Recycled Plastic Packaging Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Bottles

8.1.1.2. Non-bottles

8.1.1.2.1. Trays

8.1.1.2.2. Containers

8.1.1.2.3. Clamshells

8.1.1.2.4. Blister Packs

8.1.1.2.5. Pouches and Bags

8.1.1.2.6. Misc.

8.1.1.3. Misc.

8.2. Middle East & Africa Post-Consumer Recycled Plastic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Polypropylene

8.2.1.2. Polystyrene

8.2.1.3. Polyethylene

8.2.1.3.1. High-density Polyethylene

8.2.1.3.2. Low-density Polyethylene

8.2.1.4. Polyvinyl Chloride

8.2.1.5. Polyethylene Terephthalate

8.2.1.6. Misc.

8.3. Middle East & Africa Post-Consumer Recycled Plastic Packaging Market Outlook, by End-Use Industry, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Food and Beverages

8.3.1.2. Chemicals

8.3.1.3. Pharmaceuticals

8.3.1.4. Personal Care

8.3.1.5. Misc.

8.4. Middle East & Africa Post-Consumer Recycled Plastic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Post-Consumer Recycled Plastic Packaging Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Post-Consumer Recycled Plastic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Post-Consumer Recycled Plastic Packaging Market by End-Use Industry, Value (US$ Bn), 2018 - 2030

9. Competitive Landscape

9.1. Type vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Berry Global Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Amcor plc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. KW Plastics

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. ePac Holdings LLC

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Mondi plc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Transcontinental Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Republic Services Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Veolia

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Shell International B.V.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Waste Connections

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Clean Harbours Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Klokner Pentaplast

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Placon

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Coveris

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Henkel Corporation

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Premium Packaging

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. Rose Plastic AG

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

9.5.18. Borealis AG

9.5.18.1. Company Overview

9.5.18.2. Product Portfolio

9.5.18.3. Financial Overview

9.5.18.4. Business Strategies and Development

9.5.19. Berk Company

9.5.19.1. Company Overview

9.5.19.2. Product Portfolio

9.5.19.3. Financial Overview

9.5.19.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Material Type Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |