Global Poultry Feed Market Forecast

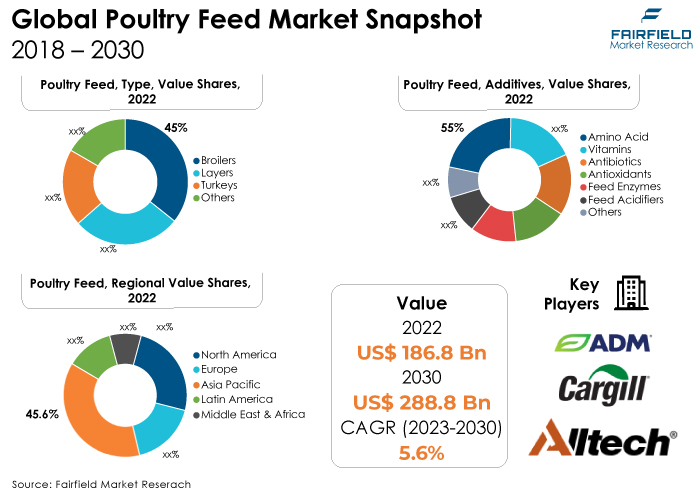

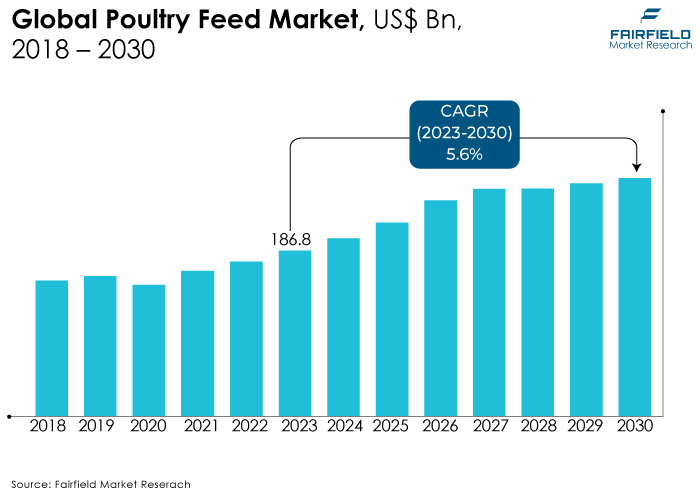

- Global market for poultry feed projected to reach US$288.8 Bn in 2030, up from US$186.8 Bn attained in 2022

- Poultry feed market size poised to expand at a CAGR of 5.6% during 2023 - 2030

Quick Report Digest

- The key trend anticipated to drive the poultry feed market growth is an increasing demand for precision feeding. Furthermore, Precision feeding prevents overfeeding and underfeeding by ensuring that each bird gets the precise nutrients it needs. Better feed conversion ratios result from this, which means more effective use of feed resources and lower costs for poultry producers.

- Another major market trend expected to drive the poultry feed market growth is the rapidly expanding sustainable feed production. Sustainable feed production prioritises the efficient use of resources, including water, energy, and land, to reduce any negative environmental effects. Effective resource management can lower production costs and increase feed makers' profitability.

- Traditional chicken products may face a competitive threat from the rising popularity of meat substitutes, such as plant-based and lab-grown proteins, which could result in reduced demand for poultry feed.

- In 2022, the broilers category dominated the industry. Renewable energy markets allow for the purchase and sale of solar Feeds for broilers, which must be designed to satisfy their specific nutritional requirements at various growth stages. These dietary needs include a well-balanced mix of proteins, carbs, fats, vitamins, and minerals.

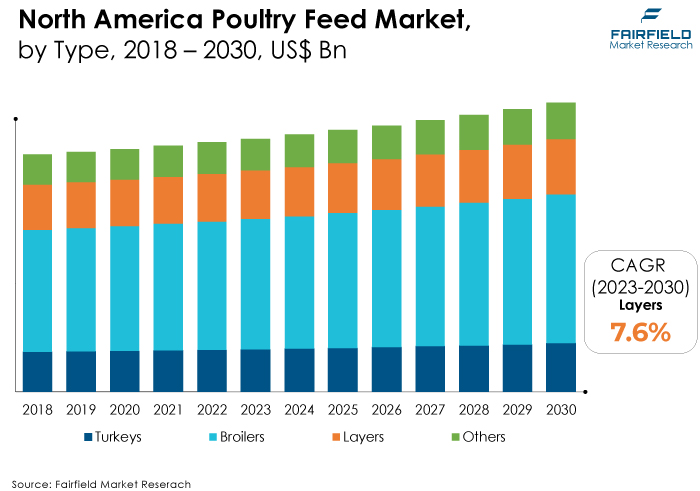

- During the forecast period, the layers category is expected to grow significantly. The nutrition of the laying hens must be balanced in order to maintain both egg production and general health. Their energy requirements should be met by the feed, which should also contain essential vitamins and minerals.

- In 2022, the amino acid category dominated the industry. Due to the increase in the amount of protein in chicken feed, amino acids are utilised. They help in ensuring that chickens obtain a proper supply of essential amino acids, which are necessary for protein synthesis, the growth of feathers, and the development of muscles in poultry.

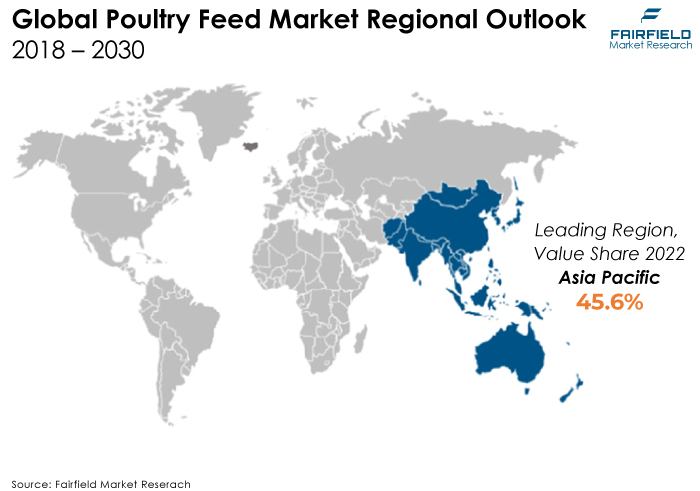

- The Asia Pacific region is expected to dominate the poultry feed market during the forecast period. The population of the Asia-Pacific area is expanding quickly, and urbanisation is accelerating. Increased demand for poultry products like chicken meat and eggs is being driven by this demographic shift, which also increases demand for poultry feed.

- North America is expected to be the fastest-growing poultry feed market region. The region's poultry industry frequently requires customised feed formulations to meet specific market demands, such as those for organic, non-GMO, and antibiotic-free poultry products.

A Look Back and a Look Forward - Comparative Analysis

Guidelines for providing adequate space and acceptable living conditions for chickens are frequently included in animal welfare regulations. It might be necessary to alter feed formulations and feeding procedures in order to meet these standards. Reduced stressors, such as nutritional stress, are a goal of practices centered on animal welfare.

The negative consequences of dietary stress can be reduced with the use of high-quality and reliable feeding. Customers may purchase items from companies and brands that are dedicated to the humane treatment of animals as they grow more conscious of and concerned about animal welfare. This consumer choice drives demand for poultry diets that promote animal welfare.

The market witnessed staggered growth during the historical period 2018 - 2022. The flow of poultry products and technologies across international borders was made possible by trade globalisation. By providing new markets and chances for chicken producers this helped the poultry business grow.

Many governments offered assistance, rewards, and rules to encourage the growth of the poultry industry. This assistance includes funds for research, the construction of infrastructure, and illness prevention strategies. The poultry industry expanded both domestically and internationally. Exports of poultry products to foreign markets increased, creating additional demand for poultry feed.

Products for chicken feed are easier for a larger audience to reach because of e-commerce platforms. Online feed shopping makes it easier for poultry producers, both small- and large-scale, to enter the market in the coming years. Additionally, poultry producers may compare costs and locate the best offers thanks to the pricing transparency offered by several online platforms. This promotes economical purchasing, which is advantageous to poultry companies of all sizes.

Furthermore, large commercial poultry farms benefit greatly from the ease with which bulk orders and deliveries of poultry feed are made possible by e-commerce platforms. It guarantees a steady flow of feed, minimising production interruptions during the next five years.

Key Growth Factors

- Increasing Demand for Poultry Meat and Eggs

The demand for poultry products is rising in direct proportion to the expanding world population. Poultry meat and eggs provide a reasonably priced and easily available choice as more people need sources of protein. More people are residing in cities and other urban regions due to urbanisation tendencies, where poultry products are easily accessible. This change in lifestyles increases the need for prepared and handy chicken products, which fuels the demand for poultry feed.

As earnings increase and diets change, there is a move towards meals high in protein. In comparison to some other meats, chicken is viewed as a better and more environmentally friendly source of protein, which increases demand for poultry feed through increased consumption.

- Growing Demand for Organic Poultry Products

Specialised organic feeds are needed because of the demand for organic poultry products. These feeds are manufactured in accordance with organic farming standards, include no synthetic pesticides or chemicals, and are created from organic and non-GMO components. Organic farming procedures must be followed by poultry farms that generate organic products.

Utilising organic feed is one aspect of this, which increases the demand for organic poultry feed. Sustainable and regenerative agriculture are the main focuses of organic farming practices, which are frequently more environmentally friendly. Indirectly driving up demand for organic chicken feed is the reality that environmentally conscious consumers are more likely to select organic poultry products.

- Rising Demand for Technological Advancements

Optimising feed formulas is made possible by advanced software and algorithms used by poultry nutritionists and feed producers. With the use of these tools, customised, affordable, and nutritionally sound feed recipes can be made for different bird species and life stages.

Technological advancements enable precision nutrition, where feed is tailored to meet the specific needs of individual birds or flocks. This results in improved feed efficiency, reduced waste, and better overall bird health. The use of genomics and molecular biology in poultry nutrition allows for a deeper understanding of how specific nutrients affect gene expression and bird performance. This knowledge informs the development of more targeted and effective feed formulations.

Major Growth Barriers

- Fluctuating Feed Ingredient Prices

The main components in poultry feed are grains like wheat, soybean meal, and maize. The price of producing feed is directly impacted when the prices of these commodities experience large fluctuations. Sudden price rises may erode profit margins for feed producers, and supply chains may be disturbed by erratic price changes. Uncertain profit margins for chicken producers might result from fluctuating component prices.

High feed costs can reduce profit margins, making it harder for farmers to maintain their competitiveness, and profitability. Producers of poultry may adjust their output levels in reaction to fluctuating feed prices. When feed prices are high, they can scale back output, which could result in supply shortages and price increases in the chicken market.

- Disease Outbreaks

A considerable percentage of chicken flocks may die as a result of disease outbreaks like avian influenza (bird flu), or Newcastle disease. Due to the decreased levels of meat and egg production, there is a corresponding decline in the demand for poultry feed. To stop the spread of infectious diseases, authorities frequently place concerned farms under quarantine. These actions may interfere with feed delivery schedules, cause delays, and incur extra costs.

Outbreaks of illness can make consumers less confident in chicken products. Reduced consumption of poultry can lower the demand for poultry products, which in turn reduces the need for poultry feed.

Key Trends and Opportunities to Look at

- Rising Functional Feeds

The performance of poultry, including growth rate, feed conversion efficiency, and egg production, is improved by functional feeds. The demand for these products is being driven by farmers' willingness to invest in these feeds in order to increase their earnings.

Additives, probiotics, prebiotics, and immune boosters are frequently found in functional diets, which improve the general health of chickens. In line with consumer desire for poultry products devoid of antibiotics, this can lower the prevalence of diseases and the demand for antibiotics.

- Increasing Focus on Food Safety

Consumer confidence is increased through food safety practices used in chicken farming, particularly the use of safe and clean feed. Demand for poultry feed is increased when consumers feel confident in the safety of chicken products. Poultry producers must follow stringent safety processes in order to comply with government agencies' severe food safety rules and requirements.

The usage of safe and high-quality feed is required to comply with these rules, which increases demand for certain feed products. Antibiotic use in poultry farming is declining due to worries about food safety. The use of antibiotics can be decreased as a result of safe feed practices, which is in line with consumer expectations for chicken products free of antibiotics.

- Growing Production of Alternative Protein Sources

Compared to conventional feed ingredients like soy and maize, alternative proteins frequently have a smaller impact on the environment. Because of this, they are a desirable option for chicken feed as concerns about sustainability and the environment are growing among consumers and the business community.

For instance, compared to conventional crops, insects and single-cell proteins can be produced with fewer resources like land and water. Producers of poultry who want to streamline their operations are drawn to their effective resource management.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the market for chicken feed has been subject to a number of regulatory frameworks and oversight by governmental and non-governmental organisations in order to preserve the security, efficacy, and quality of poultry feed products. In the US, the Food and Drug Administration (FDA) regulates animal feeds, including feed for poultry.

The FDA sets rules for labeling as well as guidelines for feed additives and ingredients. To ensure feed safety and adherence to good manufacturing practices (GMPs), the agency performs inspections and enforces regulations. FDA rules have an impact on the sourcing of feed ingredients, labeling, and safety precautions, forcing manufacturers to uphold high-quality standards.

The safety of feed additives used in the European Union, including those in the feed for poultry, is evaluated by the European Food Safety Authority (EFSA). It provides recommendations and scientific opinions regarding the approval of feed additives. The EFSA's evaluations direct the EU's approval procedure for feed additives, assuring their efficacy and safety. Animal feed and feed additive standards and recommendations are created by Codex, an international organisation. Global trade in chicken feed and feed ingredients is influenced by its standards. The Codex standards promote consistent feed quality and safety in global trading.

Fairfield’s Ranking Board

Top Segments

- Broilers Category Maintains Prime Position

The broilers segment dominated the market in 2022. This is due to the growing demand for chicken meat because of its high protein content, which emerged as a key factor in the segment's growth. Broilers are raised specifically to produce meat. Growing broiler farming is being driven by rising demand for chicken meat because of its availability at low cost and high protein content.

One of the key aspects of raising broilers is providing proper nutrition. For proper nutrition, the grill needs a source of energy - 13 vitamins, one vital fatty acid, 13 amino acids, and 14-16 minerals. Furthermore, the layers category is projected to experience the fastest market growth. Egg production is the primary reason layers are raised.

Global population growth is resulting in a rising need for food and energy sources, which is driving increased layer production. A higher calcium content is one of the critical components of layer feed that supports the formation of strong eggshells. For the purpose of preventing eggshell abnormalities and ensuring the quality of the eggs, adequate calcium is necessary.

- Amino Acid Segment Leads while Vitamins Grow Exceptionally

The amino acid segment dominated the market in 2022. The amino acid is one of the most significant sources of protein and is therefore, crucial to the nutrition of poultry. A monogastric animal's diet can contain less soybean meal because of amino acids' high protein concentration. A particular ratio of amino acids is necessary for the growth of poultry. For the best growth and performance, the amino acid profile of feeds is fine-tuned with amino acids to make sure that all necessary amino acids are present in the proper ratios.

The vitamins category is anticipated to grow substantially throughout the projected period. This is because the vitamins can be divided into two groups, viz., water-soluble vitamins and fat-soluble vitamins. Vitamins are a group of organic compounds that are required in minute amounts for feed. They are used to control normal body functions, reproduction, and growth, making them an important additive.

Regional Frontrunners

Rising Take-up of High-quality Poutry Products by QSR Keeps Asia Pacific at the Top

Asia Pacific is anticipated to lead the poultry feed market throughout the projection period. The poultry industries in China, and India have expanded quickly over the past 20 years, both in terms of production per bird and overall chicken numbers. As production levels rise, intensive systems with high food conversion ratios are becoming increasingly prevalent.

The increasing need for chicken feed in India has been considerably impacted by rising per capita income, quick-service restaurant expansion, and increased demand for high-quality poultry products. Future sales of chicken feed in the nation are likely to increase as a result. As a result, China, and India, two growing economies in the Asia Pacific, continue to have a high need for chicken feed. It results in the utilisation of more high-quality feed for more chickens. Additionally, Asia Pacific accounts for two-thirds of the rise in the global output of chicken meat.

North America Continues to Favour Eggs and Poultry Meat as a Staple Diet

The region with the fastest-growing market for poultry feeds is expected to be North America. The growing and processing of chicken is done by around thirty-five (federally inspected) companies in the US. Throughout the chicken value chain, these businesses are vertically integrated, helping to ensure the product's quality. Eggs and poultry meat are staple foods of the diet in North America.

There is a persistent and expanding demand for poultry products, which is pushing the need for high-quality poultry feed as consumer preferences shift towards healthier protein sources. The poultry production methods used in North America include those for broilers (chickens raised for meat), layers (hens raised for eggs), turkeys, and specialty birds. The market for poultry feed is broad since each industry has specific feed needs.

Fairfield’s Competitive Landscape Analysis

The consolidated global market for poultry feeds has a reduced number of well-known players participating. The major companies are introducing new products and enhancing their distribution networks in an effort to broaden their market reach. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Poultry Feed Space?

- Cargill Inc.

- Alltech, Inc.

- Archer Daniels Midland

- De Heus B.V.

- BASF SE

- Charoen Pokphand Foods PCL

- Anko Food Machine Co. Ltd.

- Berkshire Hathaway Inc.

- Hosokawa Micron Corp.

- Tetra Laval International S.A.

- Mallet & Company, Inc.

- Bucher Industries

- NICHIMO CO., LTD.

- SPX Corporation

- New Hope Group

Significant Company Developments

New Product Launch

- January 2022: Evonik launches a new range of chicken feed additives intended to enhance performance and gut health. Global producers and distributors of chicken feed have access to the new ingredients.

- December 2021: BASF SE launched sustainable feed enzymes for animal feed, including poultry.

- March 2019: SYNCRA, a supplement for chicken feed that DuPont de Nemours, Inc. launched to increase nutrient digestibility in poultry production.

Distribution Agreement

- January 2022: Nutreco announced the official ratification of a partnership with Unga Group Plc to set up two joint ventures there in order to provide the area with high-quality protein. The innovation increases market share for both Tunga Nutrition businesses in the animal nutrition sectors.

- January 2022: Cargill, and Charoen Pokphand Foods (CPF) collaborate to distribute chicken feed throughout Southeast Asia. The partnership will make use of CPF's local market expertise and distribution network, as well as Cargill's global expertise in chicken feed.

An Expert’s Eye

Demand and Future Growth

Greater awareness of the nutritional requirements of poultry at various life stages and for different types of production (e.g., broilers, layers, and breeders) is driving demand for specialised feeds designed to fulfill these particular needs. These diets guarantee ideal development, egg production, and general well-being.

Furthermore, Precision nutrition practices have emerged as a result of growing poultry nutrition knowledge. Feed formulas are becoming more exact as they take into account the genetics, age, and health of the birds. As a result, waste is decreased, and feed efficiency is increased. However, the poultry feed market is expected to face considerable challenges because of fluctuating feed ingredient prices.

Supply Side of the Market

According to our analysis, Asia Pacific is the largest producer of chicken feed in the world, accounting for approximately 40% of the global market share. The two main manufacturers of chicken feed in the Asia Pacific region are India, and China. The Asia Pacific poultry feed market is quite competitive due to the large number of domestic and international rivals.

North America is the second-largest producer of chicken feed, with a share of the market of around 20%. The US, and Canada are the main two producers of poultry feed in North America. The chicken feed market in North America is fiercely competitive due to the large number of domestic and international competitors. China is the largest poultry feed consumer in Asia Pacific, accounting for over 40% of the global market share.

Due to China's high demand for chicken meat, the consumption of feed is increasing. According to the Food and Agriculture Organisation (FAO), the output of chicken meat went from 14,373,315 metric tonnes in 2017 to 15,823,712 metric tonnes in 2020. Government incentives to help recovery and restocking also benefit the poultry sector. A number of the country's top grill companies have also made investments in new grill construction projects, with a potential investment of RMB 7.4 billion (US$1 billion) by 2020.

Global Poultry Feed Market is Segmented as Below:

By Type:

- Layers

- Broilers

- Turkeys

- Others

By Additive:

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Poultry Feed Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Poultry Feed Market Outlook, 2018 - 2030

3.1. Global Poultry Feed Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Layers

3.1.1.2. Broilers

3.1.1.3. Turkeys

3.1.1.4. Others

3.2. Global Poultry Feed Market Outlook, by Additives, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Antibiotics

3.2.1.2. Vitamins

3.2.1.3. Antioxidants

3.2.1.4. Amino Acid

3.2.1.5. Feed Enzymes

3.2.1.6. Feed Acidifiers

3.2.1.7. Others

3.3. Global Poultry Feed Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Poultry Feed Market Outlook, 2018 - 2030

4.1. North America Poultry Feed Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Layers

4.1.1.2. Broilers

4.1.1.3. Turkeys

4.1.1.4. Others

4.2. North America Poultry Feed Market Outlook, by Additives, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Antibiotics

4.2.1.2. Vitamins

4.2.1.3. Antioxidants

4.2.1.4. Amino Acid

4.2.1.5. Feed Enzymes

4.2.1.6. Feed Acidifiers

4.2.1.7. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Poultry Feed Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Poultry Feed Market Outlook, 2018 - 2030

5.1. Europe Poultry Feed Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Layers

5.1.1.2. Broilers

5.1.1.3. Turkeys

5.1.1.4. Others

5.2. Europe Poultry Feed Market Outlook, by Additives, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Antibiotics

5.2.1.2. Vitamins

5.2.1.3. Antioxidants

5.2.1.4. Amino Acid

5.2.1.5. Feed Enzymes

5.2.1.6. Feed Acidifiers

5.2.1.7. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Poultry Feed Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Poultry Feed Market Outlook, 2018 - 2030

6.1. Asia Pacific Poultry Feed Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Layers

6.1.1.2. Broilers

6.1.1.3. Turkeys

6.1.1.4. Others

6.2. Asia Pacific Poultry Feed Market Outlook, by Additives, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Antibiotics

6.2.1.2. Vitamins

6.2.1.3. Antioxidants

6.2.1.4. Amino Acid

6.2.1.5. Feed Enzymes

6.2.1.6. Feed Acidifiers

6.2.1.7. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Poultry Feed Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Poultry Feed Market Outlook, 2018 - 2030

7.1. Latin America Poultry Feed Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Layers

7.1.1.2. Broilers

7.1.1.3. Turkeys

7.1.1.4. Others

7.2. Latin America Poultry Feed Market Outlook, by Additives, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Antibiotics

7.2.1.2. Vitamins

7.2.1.3. Antioxidants

7.2.1.4. Amino Acid

7.2.1.5. Feed Enzymes

7.2.1.6. Feed Acidifiers

7.2.1.7. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Poultry Feed Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Poultry Feed Market Outlook, 2018 - 2030

8.1. Middle East & Africa Poultry Feed Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Layers

8.1.1.2. Broilers

8.1.1.3. Turkeys

8.1.1.4. Others

8.2. Middle East & Africa Poultry Feed Market Outlook, by Additives, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Antibiotics

8.2.1.2. Vitamins

8.2.1.3. Antioxidants

8.2.1.4. Amino Acid

8.2.1.5. Feed Enzymes

8.2.1.6. Feed Acidifiers

8.2.1.7. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Poultry Feed Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Poultry Feed Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Poultry Feed Market Additives, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Additives Heatmap

9.2. Manufacturer vs Additives Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Cargill Inc.

9.5.2. Alltech, Inc.

9.5.2.1. Company Overview

9.5.2.2. Products Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Archer Daniels Midland

9.5.3.1. Company Overview

9.5.3.2. Products Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. De Heus B.V.

9.5.4.1. Company Overview

9.5.4.2. Products Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. BASF SE

9.5.5.1. Company Overview

9.5.5.2. Products Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Charoen Pokphand Foods PCL

9.5.6.1. Company Overview

9.5.6.2. Products Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Anko Food Machine Co. Ltd.

9.5.7.1. Company Overview

9.5.7.2. Products Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Berkshire Hathaway Inc.

9.5.8.1. Company Overview

9.5.8.2. Products Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Hosokawa Micron Corp.

9.5.9.1. Company Overview

9.5.9.2. Products Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Tetra Laval International S.A.

9.5.10.1. Company Overview

9.5.10.2. Products Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Mallet & Company, Inc.

9.5.11.1. Company Overview

9.5.11.2. Products Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Bucher Industries

9.5.12.1. Company Overview

9.5.12.2. Products Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. NICHIMO CO., LTD.

9.5.13.1. Company Overview

9.5.13.2. Products Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. SPX Corporation

9.5.14.1. Company Overview

9.5.14.2. Products Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. New Hope Group

9.5.15.1. Company Overview

9.5.15.2. Products Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Additive Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |